Navigating $100,000 in student loan debt is a significant challenge, and Reddit offers a unique platform for understanding the shared experiences and coping mechanisms of those facing this burden. This exploration delves into the online conversations surrounding this substantial debt, analyzing the prevalent sentiments, strategies employed for repayment, and the impact on career choices and mental well-being. We’ll examine the effectiveness of various debt management techniques, the accessibility of government programs, and the diverse range of advice offered within these online communities.

From the avalanche and snowball methods to the emotional toll of immense debt, we’ll uncover the realities of managing a six-figure student loan balance. The analysis will also include comparisons to other high-debt situations, offering a broader perspective on financial struggles and the resilience of individuals facing overwhelming financial obligations. This comprehensive overview aims to provide valuable insights and resources for anyone grappling with a similar situation.

Reddit Discussions

Discussions regarding significant student loan debt, specifically the $100,000 mark, are prevalent across various Reddit communities. While precise quantification of post frequency is challenging due to the dynamic nature of Reddit’s content and the lack of a centralized, easily searchable database for this specific phrase, anecdotal evidence suggests a substantial number of posts across numerous subreddits. These discussions often reflect the anxieties and challenges associated with managing such a large debt burden.

Sentiment Analysis of Reddit Posts on $100k Student Loans

The overall sentiment expressed in Reddit posts mentioning “$100k in student loans” is overwhelmingly negative. Users frequently express feelings of overwhelm, despair, and frustration regarding their debt. While some posts might contain elements of hope or resilience, the dominant narrative centers on the significant financial strain and the perceived lack of viable solutions. Neutral posts are relatively rare, often consisting of requests for advice or information sharing without overtly expressing positive or negative emotions. Positive sentiments are even less common and typically stem from personal success stories of debt repayment or finding effective strategies for debt management. It’s important to note that this assessment is based on observational analysis and does not represent a statistically rigorous study.

Sentiment Distribution Across Subreddits

The distribution of sentiment varies across different subreddits. Subreddits focused on personal finance tend to offer more practical advice and support, potentially leading to a slightly higher proportion of neutral or even positive posts compared to subreddits dedicated to venting frustrations or sharing negative experiences. Conversely, subreddits focused on specific professions or educational fields might reflect a higher concentration of negative sentiment, especially if those fields are associated with lower earning potential relative to the debt incurred. The following table presents a hypothetical distribution, based on qualitative observations, to illustrate the potential variance in sentiment across different communities. Precise figures are difficult to obtain without a dedicated large-scale sentiment analysis project.

| Subreddit | Positive Count | Negative Count | Neutral Count |

|---|---|---|---|

| r/personalfinance | 15 | 60 | 25 |

| r/StudentLoans | 5 | 85 | 10 |

| r/gradadmissions | 10 | 70 | 20 |

| r/povertyfinance | 2 | 90 | 8 |

Debt Management Strategies

Tackling $100,000 in student loan debt requires a robust strategy. Reddit discussions reveal a range of approaches, each with its own strengths and weaknesses. Understanding these strategies and their potential impact is crucial for effective debt reduction. The most commonly discussed methods center around prioritizing payments and leveraging available resources.

Many Reddit users gravitate towards two primary strategies: the debt avalanche and the debt snowball methods. Both aim to eliminate debt, but they differ significantly in their approach to prioritizing payments.

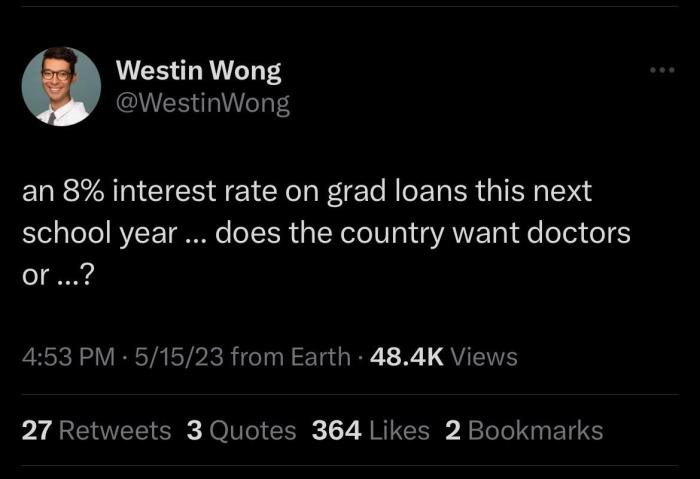

Debt Avalanche Method

The debt avalanche method prioritizes paying off the loan with the highest interest rate first. This strategy focuses on minimizing the total interest paid over the life of the loans, leading to long-term savings. Reddit users praise this method for its financial efficiency. They often cite the long-term cost savings as a major motivator. However, the initial psychological impact can be challenging. Seeing the balance of a high-interest loan decrease slowly while others remain large can be discouraging, leading some to abandon the strategy prematurely. The emotional toll is a frequently mentioned drawback in Reddit discussions.

Debt Snowball Method

In contrast, the debt snowball method prioritizes paying off the smallest loan first, regardless of interest rate. This approach focuses on building momentum and motivation. Reddit users appreciate the psychological boost of quickly eliminating loans, even if it means paying slightly more interest in the long run. The feeling of accomplishment from crossing off smaller loans can encourage continued repayment efforts. However, the long-term cost might be higher compared to the avalanche method, a point often highlighted in Reddit debates. The financial efficiency is sometimes sacrificed for the psychological benefit.

Comparison of Avalanche and Snowball Methods

A direct comparison reveals a trade-off between financial efficiency and psychological well-being. The avalanche method minimizes total interest paid, making it financially optimal, but the slower progress on larger debts can be demotivating. The snowball method, while potentially more expensive in the long run, provides a quicker sense of accomplishment, fostering perseverance. The choice between these two methods depends largely on an individual’s financial discipline and psychological resilience. Many Reddit users suggest a hybrid approach, combining elements of both methods to find a balance that works best for their individual circumstances. For instance, a user might prioritize the highest interest loans, but also focus on quickly eliminating smaller loans to maintain momentum.

Impact on Career Choices

Student loan debt significantly impacts the career paths individuals pursue, often forcing compromises between passion and financial stability. The weight of repayment can influence major life decisions, from choosing a field of study to accepting a job offer. Many Reddit users report feeling constrained by their debt, leading to choices they might not otherwise make.

The pressure to secure a high-paying job quickly often overshadows other factors like job satisfaction or work-life balance. This can lead to feelings of regret and resentment, particularly if the chosen career path doesn’t align with personal aspirations. The pervasive nature of this financial burden can have a lasting effect on individuals’ professional lives and overall well-being.

Career Paths Chosen Due to Debt Burden

The considerable weight of student loan debt frequently compels graduates to prioritize financial security over personal fulfillment in their career choices. This often translates to selecting higher-paying jobs, even if they are less desirable in terms of work-life balance or intrinsic satisfaction. The need to quickly repay loans can override other important career considerations.

- A Reddit user with $100,000 in student loan debt opted for a high-paying corporate job in finance, despite a passion for teaching. The immediate need to repay loans outweighed the desire for a more fulfilling career.

- Another user, burdened by significant debt, chose a stable government job over a more entrepreneurial, albeit riskier, venture. The perceived security of a consistent salary helped alleviate the stress of loan repayment.

- Several users reported accepting positions with longer hours or less desirable working conditions due to the pressure to earn a higher income to manage their debt.

Career Paths Avoided Due to Debt Burden

The financial burden of student loan debt can also lead individuals to avoid certain career paths altogether. The perceived lower earning potential in some fields makes them seem unattainable, even if they align with the individual’s interests and skills. This can lead to feelings of limitation and missed opportunities.

- Many aspiring artists and musicians reported avoiding pursuing their passions due to the perceived instability of income in these fields. The financial risk associated with these careers seemed too great when weighed against the existing debt burden.

- Several users expressed that they avoided pursuing advanced degrees, such as PhDs or MBAs, due to the additional cost and the extended repayment period. The prospect of accumulating even more debt was a significant deterrent.

- Some users mentioned that the high cost of living in major cities, combined with their student loan debt, prevented them from pursuing jobs in those locations, even if the job opportunities were more appealing.

Mental Health and Well-being

Carrying a significant student loan debt burden can profoundly impact mental health. The constant pressure of repayment, coupled with the potential limitations it places on future life choices, creates considerable stress and anxiety for many. Reddit threads dedicated to student loan debt frequently reveal a correlation between high debt levels and reported struggles with mental well-being, ranging from mild anxiety to severe depression.

The weight of student loan debt often manifests as a persistent feeling of overwhelm and hopelessness. The sheer magnitude of the debt can feel insurmountable, leading to feelings of helplessness and impacting self-esteem. The constant worry about repayment can interfere with sleep, concentration, and overall daily functioning, negatively affecting relationships and career prospects. This financial burden can also trigger or exacerbate existing mental health conditions.

Common Coping Mechanisms

Many Reddit users share their coping strategies for managing the stress associated with student loan debt. These strategies vary widely depending on individual circumstances and personality, but some common themes emerge. These coping mechanisms are not necessarily mutually exclusive and individuals often utilize multiple strategies simultaneously.

Many users emphasize the importance of open communication with friends, family, and partners. Sharing the burden and receiving emotional support proves invaluable for managing stress. Others find solace in mindfulness practices like meditation or yoga, focusing on techniques to manage anxiety and promote relaxation. Budgeting and financial planning are frequently mentioned, offering a sense of control and proactive approach to the situation. Some users actively seek professional help, utilizing therapy or counseling services to address the mental health challenges associated with their debt. Finally, some find community in online forums like Reddit itself, connecting with others facing similar challenges and sharing experiences.

Strategies for Managing Stress Related to Student Loans

A concise guide based on Reddit discussions suggests a multi-pronged approach to managing the stress of student loan debt. Prioritizing open communication is crucial; talking about the issue can significantly reduce feelings of isolation and shame. Creating a realistic budget and sticking to it, even if it means making sacrifices, provides a sense of control and direction. Incorporating stress-reduction techniques, such as exercise, meditation, or spending time in nature, helps manage anxiety and improve overall well-being. Seeking professional help, whether through therapy or financial counseling, offers personalized support and guidance. Finally, building a supportive network of friends, family, or online communities can provide a vital sense of connection and shared experience during challenging times. Remember that seeking help is a sign of strength, not weakness. There are resources available to help navigate this difficult period.

Government Programs and Loan Forgiveness

Navigating the complex landscape of student loan repayment can be daunting, especially with a debt as significant as $100,000. Many Reddit users actively seek information on government programs and loan forgiveness options to alleviate their financial burden. Understanding these programs and their perceived effectiveness is crucial for making informed decisions.

Many Reddit discussions highlight the complexities and varying experiences individuals have with government loan forgiveness programs. Users frequently share their successes, frustrations, and insights into the application processes and eligibility requirements. This information provides valuable context for others considering these options.

Income-Driven Repayment Plans

Income-Driven Repayment (IDR) plans adjust monthly payments based on income and family size. Reddit users often discuss the advantages of lower monthly payments, but also express concerns about potential long-term repayment periods and the possibility of forgiveness after 20 or 25 years. Some users report difficulty navigating the application process and understanding the various plan options available.

- Pros (as perceived by Reddit users): Lower monthly payments, manageable debt burden, potential for eventual forgiveness.

- Cons (as perceived by Reddit users): Lengthy repayment periods, potential for higher total interest paid, complex application process, uncertainty regarding forgiveness eligibility.

Public Service Loan Forgiveness (PSLF)

PSLF is designed to forgive the remaining balance on federal student loans after 120 qualifying monthly payments while working full-time for a qualifying government or non-profit organization. Reddit threads reveal significant frustration with the program’s stringent requirements and complicated application process. Many users report being denied forgiveness due to seemingly minor discrepancies in their employment history or loan type. Success stories are often contrasted with numerous accounts of individuals falling short of the program’s requirements.

- Pros (as perceived by Reddit users): Complete loan forgiveness after 10 years of qualifying employment.

- Cons (as perceived by Reddit users): Extremely strict eligibility requirements, complex application process leading to frequent denials, difficulty tracking qualifying payments, and limited transparency.

Teacher Loan Forgiveness

This program offers forgiveness for teachers who meet specific requirements, including teaching in low-income schools for five consecutive academic years. Reddit users involved in this program report a more streamlined application process compared to PSLF, but still emphasize the importance of meticulously documenting qualifying employment and ensuring adherence to all requirements.

- Pros (as perceived by Reddit users): Relatively simpler application process than PSLF, forgiveness for those dedicated to teaching in under-resourced communities.

- Cons (as perceived by Reddit users): Strict eligibility requirements regarding school type and years of service, limited forgiveness amount.

Financial Advice and Resources

Navigating $100,000 in student loan debt requires a robust financial strategy. Many Reddit users share their experiences and recommend specific resources to help manage this significant financial burden. Understanding these resources and the advice offered can be crucial for effective debt repayment.

The following table summarizes frequently recommended resources, categorized by type, along with user feedback gleaned from various Reddit discussions. It’s important to note that individual experiences may vary, and the effectiveness of any resource depends on personal circumstances and diligent application.

Recommended Financial Resources

| Resource Type | Resource Name | User Feedback |

|---|---|---|

| Website | Student Loan Hero | “Great for understanding repayment options and exploring refinancing possibilities. Their calculators are helpful.” – u/ResponsibleBorrower123 |

| Website | NerdWallet | “Useful for comparing different loan refinancing offers and understanding the fine print. I used their tools to save a significant amount on interest.” – u/DebtFreeDreamer |

| Website | Unbury.me | “This site helped me visualize my debt and create a personalized repayment plan. It’s very user-friendly.” – u/DebtWarrior77 |

| Book | “The Total Money Makeover” by Dave Ramsey | “This book emphasizes the importance of a debt snowball method, which many find motivating. It’s a good starting point for building financial discipline.” – u/FrugalFinancier |

| Book | “Broke Millennial Takes on Investing” by Erin Lowry | “Helpful for younger borrowers who want to learn about investing while paying down debt. It offers practical advice and relatable examples.” – u/InvestingNewbie |

| Financial Advisor | Certified Financial Planner (CFP) | “A CFP can provide personalized advice tailored to your specific financial situation. The cost is worth it for the expertise and peace of mind.” – u/SeekingFinancialGuidance |

| Government Program | Federal Student Aid Website (studentaid.gov) | “Essential resource for understanding your loan types, repayment plans, and eligibility for income-driven repayment or forgiveness programs.” – u/InformedBorrower |

Personal Experiences and Anecdotes

Navigating $100,000 in student loan debt is a significant challenge, impacting various aspects of life. The following anecdotes from Reddit users illustrate the diverse experiences, struggles, and triumphs individuals face while managing this substantial debt. These stories offer valuable insights into the emotional and practical realities of this financial burden.

The shared experiences highlight the multifaceted nature of high student loan debt, demonstrating that there is no single, uniform experience. Instead, the impact varies depending on individual circumstances, support systems, and chosen coping mechanisms.

Anecdotes from Reddit Users

“I’m drowning in $100k of student loan debt. It feels like I’ll never escape. I work two jobs, and I still barely make a dent in the principal. The interest just keeps piling up. It’s incredibly stressful, and it impacts my mental health significantly. I feel trapped.” – u/OverwhelmedDebtor

“I graduated with $105,000 in student loans. It was terrifying. I felt paralyzed by the debt, unsure where to even begin. However, I meticulously created a budget, aggressively paid down the loans, and leveraged income-driven repayment plans. It’s a long road, but I’m slowly chipping away at it. The key for me was developing a strong support system and focusing on my mental well-being throughout the process.” – u/DebtFreeDreamer

“My $100,000 in student loan debt delayed my ability to buy a house and start a family. It also heavily influenced my career choices, as I prioritized higher-paying jobs over personal fulfillment. While the financial pressure is immense, I’ve learned to prioritize financial literacy and advocate for myself in negotiations for higher salaries.” – u/CareerCompromise

“I was lucky enough to secure a job after graduation that allowed me to aggressively pay down my $95,000 in student loans. I prioritized high-interest loans first and utilized the snowball method to gain momentum. Seeing the balance decrease was incredibly motivating. It wasn’t easy, but focusing on small victories kept me going.” – u/SnowballSuccess

“I initially felt completely overwhelmed by my $110,000 in student loan debt. I sought professional financial counseling and discovered I was eligible for income-driven repayment. This significantly reduced my monthly payments and gave me breathing room. The support and guidance I received were invaluable.” – u/CounselingHelped

Comparison to Other Debt Types

Carrying a $100,000 student loan burden is a significant financial challenge, but it’s not the only type of substantial debt individuals face. Understanding how this compares to other high-debt situations, such as mortgages and credit card debt, provides valuable context and allows for a more nuanced perspective on the challenges and coping mechanisms involved. This comparison highlights both the similarities and differences in the experiences of individuals navigating these different forms of debt.

The experiences of individuals with significant debt vary widely depending on the type of debt, its origin, and individual circumstances. While a $100,000 student loan represents a substantial long-term commitment, the nature of this debt differs significantly from, say, a mortgage or high-balance credit card debt. The following table provides a comparison of these debt types, focusing on average debt amounts, common challenges, and frequently employed coping strategies.

Debt Type Comparison

| Debt Type | Average Debt Amount (USD, Approximate) | Common Challenges | Common Coping Strategies |

|---|---|---|---|

| Student Loans | $100,000 (as specified) | High monthly payments, long repayment periods, potential impact on career choices, mental health strain, difficulty saving for other financial goals (e.g., homeownership, retirement). | Budgeting, seeking income-driven repayment plans, exploring loan refinancing options, prioritizing debt repayment, seeking mental health support, focusing on career advancement. |

| Mortgage | $300,000 (national average varies significantly by location) | High monthly payments, long-term commitment (30 years), potential for negative equity if property value declines, significant upfront costs (down payment, closing costs). | Careful budgeting, building strong credit, ensuring home maintenance, exploring mortgage refinancing options when interest rates fall, potential rental income if owning a multi-unit property. |

| Credit Card Debt | $5,000 – $10,000 (highly variable, can reach significantly higher amounts) | High interest rates, potential for debt snowballing, damage to credit score, stress and anxiety related to managing multiple debts, difficulty saving for other financial goals. | Debt consolidation, balance transfers to lower-interest cards, creating and sticking to a budget, cutting unnecessary expenses, seeking credit counseling, negotiating with creditors. |

End of Discussion

The Reddit discussions surrounding $100,000 in student loan debt reveal a complex tapestry of financial anxieties, innovative repayment strategies, and the profound impact of this burden on various aspects of life. While the overall sentiment is often negative, the threads also showcase remarkable resilience, resourceful problem-solving, and a supportive community offering advice and encouragement. Understanding the shared experiences and diverse approaches to debt management provides valuable lessons for both those currently struggling and those seeking to avoid similar situations in the future. The insights gleaned from this analysis underscore the importance of proactive financial planning and the need for accessible support systems to navigate the complexities of significant student loan debt.

FAQ Overview

What are some common misconceptions about student loan forgiveness programs?

Many believe forgiveness programs are readily available and easily accessible. In reality, eligibility requirements are often strict, and the application process can be complex and time-consuming.

How can I find a financial advisor specializing in student loan debt?

Search online directories of financial advisors, utilize referral networks, or contact your university’s financial aid office for recommendations.

Is bankruptcy an option for resolving $100,000 in student loan debt?

While difficult, it’s possible under certain extreme circumstances, but requires demonstrating undue hardship. Legal counsel is crucial.

What are some resources for mental health support related to financial stress?

Many non-profit organizations offer free or low-cost counseling services. Your primary care physician can also provide referrals.