The crushing weight of a $100,000 student loan debt is a reality for many, and Reddit offers a unique platform to explore the shared experiences, anxieties, and strategies surrounding this significant financial burden. This analysis delves into the online conversations surrounding this level of debt, examining the prevalent sentiments, debt management approaches, and the impact on life choices.

From the emotional toll of overwhelming debt to the practical considerations of repayment plans and career choices, Reddit users openly share their journeys. This exploration uncovers common themes, offering insights into the challenges and potential solutions for individuals facing a six-figure student loan debt.

Reddit User Sentiment Regarding $100k Student Loan Debt

Reddit discussions surrounding $100,000 in student loan debt reveal a predominantly negative sentiment. Users overwhelmingly express feelings of overwhelming stress, anxiety, and hopelessness regarding the prospect of repaying such a significant amount. While some express a degree of resilience and determination, the overall tone is one of significant financial burden and emotional strain.

Sentiment Analysis Summary

Analysis of Reddit posts concerning $100,000 in student loan debt reveals a strong negative sentiment. s frequently associated with these discussions include “crushing,” “overwhelmed,” “hopeless,” “anxiety,” and “trapped.” While some users share strategies for repayment or express cautious optimism, the sheer magnitude of the debt overshadows these positive sentiments, resulting in a net negative overall feeling. The prevalence of posts detailing the emotional toll of this debt level significantly contributes to this negative sentiment.

Common Themes and Emotions

The following table summarizes common themes and associated emotions expressed by Reddit users regarding $100,000 in student loan debt:

| Theme | Emotion | Frequency |

|---|---|---|

| Financial Burden | Stress, Anxiety, Hopelessness, Despair | Very High |

| Career Prospects | Frustration, Uncertainty, Resentment | High |

| Lifestyle Limitations | Resentment, Regret, Depression | High |

| Repayment Strategies | Hope, Determination, Anxiety (regarding success) | Moderate |

| Regret over Educational Choices | Regret, Anger, Self-doubt | Moderate |

User Experiences with $100,000 in Student Loan Debt

Many users share experiences that illustrate the significant challenges associated with this level of debt. These experiences often include:

- Difficulty securing housing due to high debt-to-income ratios.

- Inability to save for retirement or other long-term financial goals.

- Significant limitations on lifestyle choices, including travel, entertainment, and even basic necessities.

- Mental health struggles related to financial stress and the overwhelming feeling of debt.

- Postponement or cancellation of major life events such as marriage, homeownership, or starting a family.

- Feelings of being trapped in a cycle of debt with little hope of escape.

- Regret over educational choices and the perceived lack of return on investment.

- Exploration of various repayment strategies, including income-driven repayment plans and loan refinancing.

- Seeking advice and support from fellow Reddit users facing similar challenges.

- Considering career changes to increase earning potential and accelerate debt repayment.

Strategies for Managing $100k in Student Loan Debt Mentioned on Reddit

Managing a $100,000 student loan debt is a significant financial challenge, but Reddit discussions reveal a range of strategies employed by individuals facing similar situations. These strategies often involve a combination of repayment plans, budgeting techniques, and lifestyle adjustments. Understanding the nuances of each approach is crucial for effective debt management.

Reddit-Discussed Strategies for $100,000 Student Loan Debt Management

Many Reddit users facing substantial student loan debt share various strategies. These approaches aren’t mutually exclusive and often complement each other. The effectiveness of each strategy depends on individual circumstances and financial discipline.

- Aggressive Repayment: Prioritizing high payments to reduce principal quickly, often involving additional payments beyond the minimum.

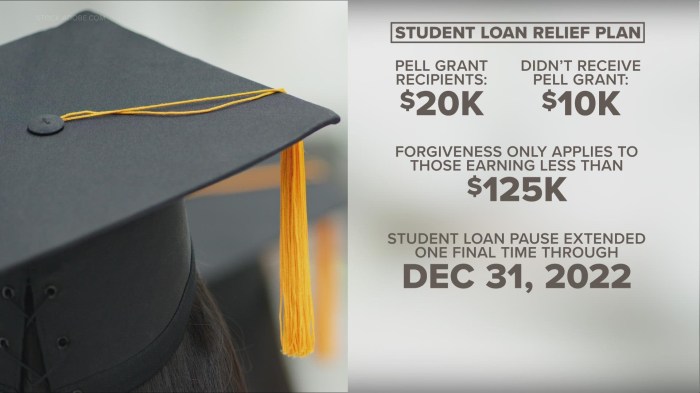

- Income-Driven Repayment (IDR) Plans: Utilizing government programs that adjust monthly payments based on income and family size.

- Refinancing: Securing a new loan with a lower interest rate to reduce overall interest paid.

- Debt Consolidation: Combining multiple loans into a single loan, potentially simplifying repayment and lowering interest rates.

- Budgeting and Lifestyle Changes: Implementing strict budgeting to reduce expenses and free up more money for loan repayment.

- Side Hustles and Increased Income: Generating additional income through part-time jobs, freelance work, or starting a small business.

- Seeking Professional Financial Advice: Consulting with a financial advisor to create a personalized debt management plan.

Comparison of Repayment Plan Effectiveness

Different repayment plans offer varying advantages and disadvantages. Reddit users often discuss their experiences, highlighting both the benefits and drawbacks of each option.

| Plan Name | Pros | Cons | User Feedback (Examples) |

|---|---|---|---|

| Standard Repayment | Fixed payment amount, predictable timeline. | High monthly payments, potentially unaffordable for some. | “Paid off quickly, but it was a struggle.” “Too expensive for my starting salary.” |

| Income-Driven Repayment (IDR) | Lower monthly payments based on income, potential for loan forgiveness after 20-25 years. | Longer repayment period, potentially higher total interest paid. | “Manageable payments, but it’ll take forever to pay off.” “The forgiveness is a lifesaver, but the interest adds up.” |

| Extended Repayment | Lower monthly payments than standard repayment. | Longer repayment period, higher total interest paid. | “More manageable, but I’m paying way more in interest.” |

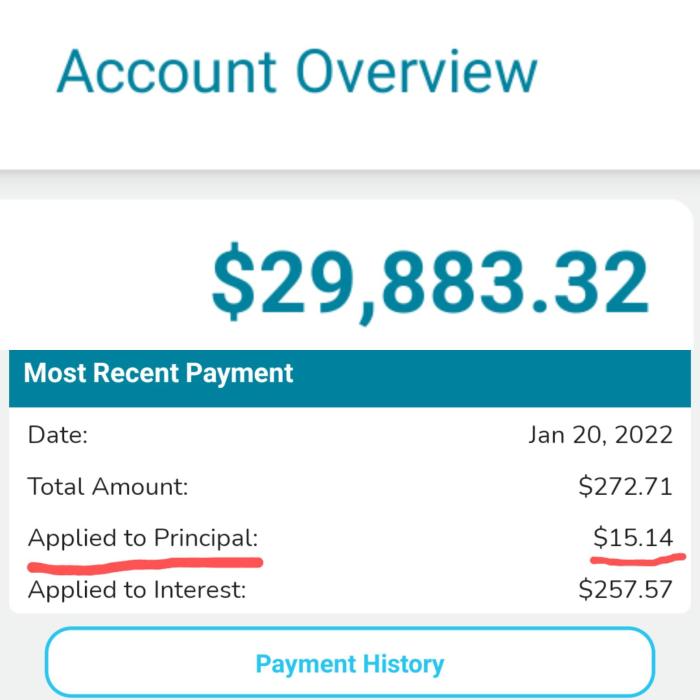

Long-Term Financial Implications of Debt Management Strategies

The long-term financial consequences of chosen debt management strategies are significant. For example, aggressive repayment, while leading to faster debt elimination, might require sacrifices in other areas of life. Conversely, opting for an IDR plan extends the repayment period, increasing the total interest paid but offering immediate affordability. Refinancing can lower monthly payments and the total interest paid, but it involves the risk of unforeseen fees and potential credit score impacts. Careful consideration of these factors is crucial for long-term financial well-being. Failing to address the debt effectively can lead to long-term financial stress, impacting credit scores, savings, and future financial opportunities. Conversely, a well-planned approach can free up resources for other financial goals, such as saving for a down payment on a house or investing for retirement.

Resources and Support Systems for $100k Student Loan Debt (Reddit Discussions)

Navigating a $100,000 student loan debt burden can feel overwhelming, but Reddit offers a valuable platform for individuals to share experiences, strategies, and resources. Many users find solace and practical advice within these online communities, fostering a sense of shared experience and reducing feelings of isolation. The following sections detail the resources and support systems frequently discussed on Reddit in relation to managing significant student loan debt.

Frequently Recommended Resources for Managing Student Loan Debt

Reddit users often recommend a variety of resources to help manage substantial student loan debt. These resources range from websites offering budgeting tools and financial literacy information to organizations providing debt consolidation or repayment assistance. Access to reliable information is crucial in developing an effective debt management strategy.

- Websites: Many users cite websites like NerdWallet, Student Loan Hero, and the official websites of federal student loan servicers (like FedLoan Servicing or Navient, depending on the loan type) as valuable resources for understanding repayment options, calculating payments, and exploring refinancing possibilities. These sites often provide calculators and tools to help users model different repayment scenarios.

- Organizations: Non-profit organizations focused on financial literacy and student loan debt relief are frequently mentioned. These organizations often provide free or low-cost counseling services, workshops, and educational materials. Examples include the National Foundation for Credit Counseling (NFCC) and the Consumer Financial Protection Bureau (CFPB).

- Financial Advisors: While not always accessible due to cost, many Reddit users highlight the benefits of consulting with a financial advisor specializing in student loan debt management. A financial advisor can provide personalized guidance tailored to an individual’s specific financial situation and goals.

The Role of Community Support and Peer-to-Peer Advice

Reddit’s anonymous and supportive nature allows users to openly discuss their financial struggles without judgment. This peer-to-peer support is invaluable for many dealing with the psychological and emotional toll of high student loan debt. Users frequently share their personal experiences, offering encouragement and practical advice based on their own journeys. For example, a common thread involves users sharing their success stories with income-driven repayment plans, inspiring others to explore similar options. The sharing of budgeting tips, debt reduction strategies, and even emotional support creates a powerful sense of community and shared understanding.

Types of Support Systems Mentioned by Reddit Users

Coping with a significant debt burden often requires a multifaceted approach to support. Reddit discussions reveal that users rely on a range of support systems, both personal and professional.

- Family and Friends: Many users report seeking emotional and practical support from family and friends. This can involve discussing financial anxieties, seeking advice, or even requesting temporary financial assistance. However, it’s also important to note that some users express hesitation in disclosing their debt situation to loved ones due to potential stigma or embarrassment.

- Professional Counselors: Some Reddit users acknowledge the importance of seeking professional help to manage the stress and anxiety associated with high student loan debt. Financial therapists or counselors can provide tools and strategies to cope with the emotional impact of debt, and help develop healthy financial habits.

Impact of $100k Student Loan Debt on Life Choices (Reddit Perspectives)

Carrying a $100,000 student loan debt significantly impacts major life decisions for many Reddit users. The weight of this debt often forces difficult trade-offs and necessitates careful financial planning, affecting everything from housing choices to family planning. The pervasive theme across numerous Reddit threads is the feeling of being constrained by this significant financial burden.

The sheer size of the debt casts a long shadow over many aspects of life. Reddit discussions reveal a common struggle to balance the desire for a fulfilling life with the pressing need to repay loans. This often leads to difficult choices and compromises.

Homeownership and $100k Student Loan Debt

The dream of homeownership is frequently delayed or even abandoned entirely by Reddit users burdened with six-figure student loan debt. High monthly loan payments often leave little room in the budget for a mortgage, property taxes, and insurance. Many describe feeling trapped in a cycle of renting, with the prospect of homeownership seeming increasingly distant. Examples abound of users postponing home purchases indefinitely, opting instead to focus aggressively on debt repayment. The feeling of being financially locked out of the housing market is a recurring theme.

Marriage and Family Planning Decisions

The financial strain of $100,000 in student loans significantly impacts decisions about marriage and starting a family. Many Reddit users report delaying marriage until their debt is more manageable, or even forgoing marriage altogether. The added financial burden of raising children, coupled with existing loan payments, can seem insurmountable. Discussions frequently highlight the anxieties surrounding financial stability and the desire to provide a secure future for potential children. The need to prioritize debt repayment often overshadows other life goals, causing significant stress and impacting personal relationships.

Career Choices and Financial Sacrifices

The pressure to repay student loans often influences career choices. Reddit users frequently discuss accepting jobs that offer higher salaries, even if they lack personal fulfillment, to accelerate debt repayment. Opportunities for further education or career advancement may be forgone due to the financial constraints imposed by the debt. Some users report foregoing raises or promotions to maintain a lower tax bracket, thereby reducing their disposable income but potentially improving their long-term repayment strategy. These sacrifices represent the significant compromises many make to navigate the burden of their loans.

Lifestyle Adaptations and Spending Habits

To manage their substantial student loan debt, many Reddit users have drastically altered their lifestyles and spending habits. Discussions detail meticulous budgeting, extreme frugality, and a significant reduction in discretionary spending. Examples include foregoing vacations, eating out less frequently, and minimizing non-essential purchases. Many describe living below their means, prioritizing debt repayment above all else. This often involves a significant reduction in quality of life in the short term, with the hope of achieving greater financial freedom in the future. The determination and resilience displayed by these individuals are noteworthy, highlighting their commitment to overcoming this significant financial challenge.

Prevalence of Specific Career Paths Among Redditors with $100k+ Student Loan Debt

Reddit discussions reveal a diverse range of career paths among individuals burdened with significant student loan debt exceeding $100,000. While precise data on average salaries and debt-to-income ratios for each profession is difficult to obtain directly from Reddit posts, analyzing common threads provides valuable insights into the relationship between career choice, earning potential, and debt management.

The correlation between chosen profession, income potential, and the ability to manage substantial student loan debt is complex and multifaceted. High-earning potential careers don’t automatically guarantee manageable debt; factors like the cost of living in the area of employment, lifestyle choices, and unexpected life events significantly influence an individual’s ability to repay loans. Conversely, individuals in lower-paying fields might find themselves struggling despite careful budgeting.

Career Paths and Associated Income

The following table presents some frequently mentioned career paths on Reddit among users with substantial student loan debt, along with estimated average salaries. It’s crucial to note that these salary figures are broad estimations and can vary considerably based on experience, location, and specific employer. Debt-to-income ratios are not included due to the inherent difficulty in obtaining reliable, anonymized data from Reddit posts.

| Career | Estimated Average Annual Salary (USD) |

|---|---|

| Medicine (Physician, Physician Assistant, etc.) | $150,000 – $300,000+ |

| Law (Attorney, Lawyer) | $80,000 – $200,000+ |

| Engineering (Software, Electrical, Mechanical, etc.) | $80,000 – $150,000+ |

| Business (Finance, Management, Consulting) | $70,000 – $180,000+ |

| Education (Higher Education, K-12) | $40,000 – $80,000 |

Visualization of Career Field Distribution

A bar chart would effectively illustrate the distribution of career fields among Reddit users with over $100,000 in student loan debt. The horizontal axis would represent the different career categories (e.g., Medicine, Law, Engineering, Business, Education, and “Other”), while the vertical axis would represent the number of Reddit users in each category. The length of each bar would correspond to the frequency of that specific career field mentioned in relevant Reddit discussions. The chart would visually highlight the most prevalent career paths among this group and could reveal potential imbalances or concentrations in certain professional sectors. For instance, the bar representing “Medicine” might be significantly taller than the bar representing “Education,” illustrating the disproportionate representation of medical professionals among this debt-burdened population.

Final Summary

Navigating a $100,000 student loan debt is a complex and often emotionally charged journey. Reddit provides a valuable space for individuals to connect, share experiences, and explore potential solutions. While the path to financial freedom may be challenging, the collective wisdom and support found within these online communities offer a beacon of hope and practical guidance for those facing this significant financial hurdle. The insights gleaned from these discussions underscore the importance of proactive planning, informed decision-making, and the power of community support in overcoming substantial student loan debt.

Commonly Asked Questions

What are the most common repayment plans mentioned on Reddit for $100k student loans?

Income-driven repayment (IDR) plans, standard repayment plans, and extended repayment plans are frequently discussed. The best option depends on individual income and financial circumstances.

Is bankruptcy an option for $100k in student loan debt?

Bankruptcy is difficult to achieve for student loans, requiring extreme hardship. Consult with a bankruptcy attorney to understand the specific requirements and limitations.

Are there any resources beyond Reddit for managing significant student loan debt?

Yes, many non-profit organizations, government websites (e.g., StudentAid.gov), and financial advisors specialize in student loan debt management. Seeking professional guidance is recommended.

How can I find support beyond online communities?

Consider reaching out to family, friends, financial counselors, or mental health professionals for support. Many resources are available to help you cope with the emotional and financial stress of significant debt.