Navigating the complexities of student loan repayment is a significant challenge for many. However, did you know that the IRS offers a potential tax break to ease the burden? The 2024 student loan interest deduction provides a valuable opportunity to reduce your tax liability, but understanding the eligibility requirements and calculation methods is crucial to maximizing its benefits. This guide will walk you through the process, ensuring you’re well-equipped to claim this deduction.

This comprehensive guide will delve into the intricacies of the 2024 student loan interest deduction, covering eligibility criteria, calculation procedures, necessary documentation, and potential pitfalls to avoid. We’ll explore how tax reforms might influence your deduction and provide practical examples to illustrate key concepts. By the end, you’ll have the knowledge to confidently navigate this aspect of your tax obligations.

Eligibility Requirements for the 2024 Student Loan Interest Deduction

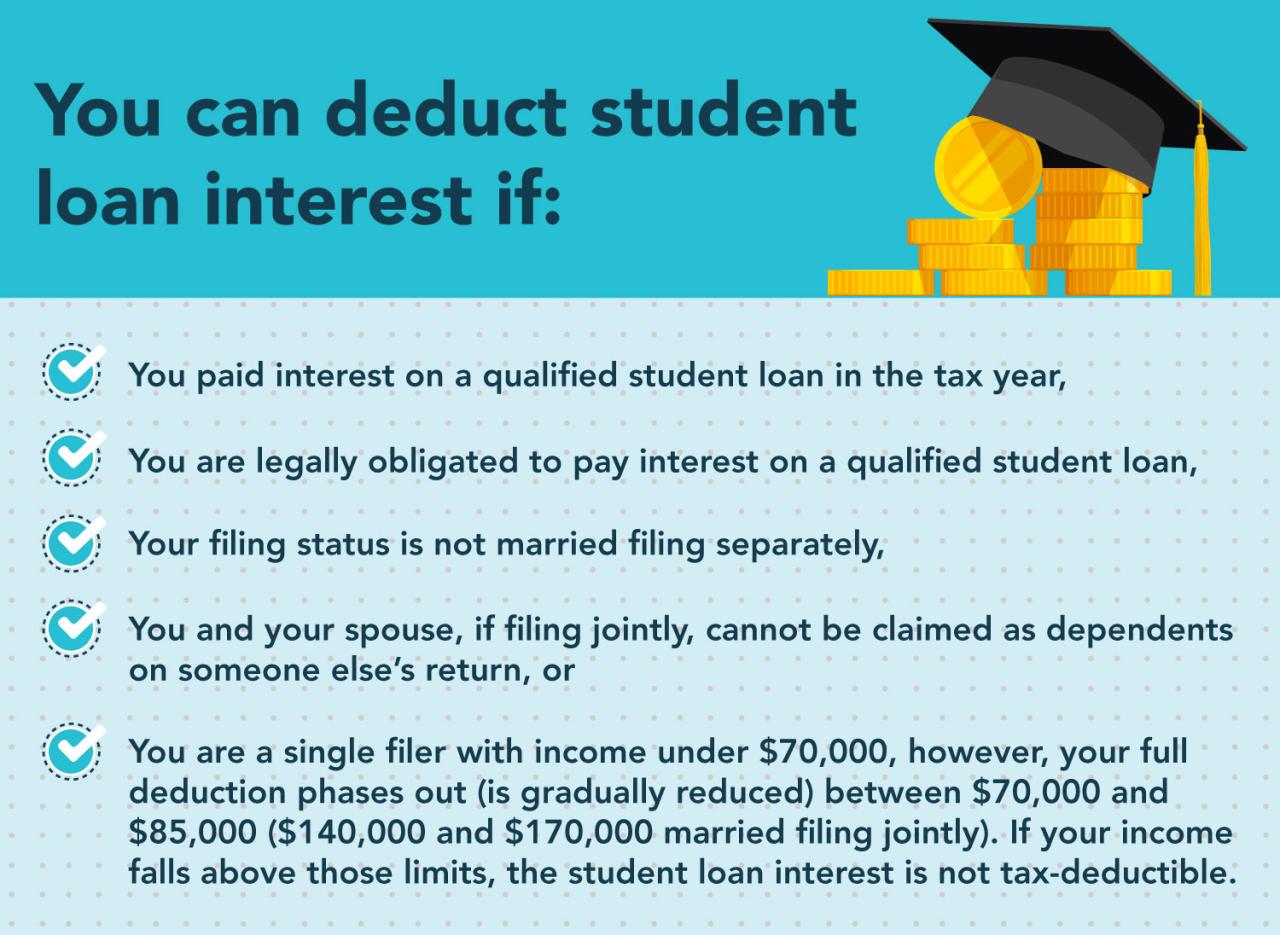

The student loan interest deduction allows eligible taxpayers to deduct the amount they paid in student loan interest during the tax year. However, claiming this deduction depends on meeting specific requirements regarding your adjusted gross income (AGI) and filing status. Understanding these limitations is crucial for accurately filing your taxes.

Adjusted Gross Income (AGI) Limitations

The amount of student loan interest you can deduct is limited by your adjusted gross income (AGI). The AGI is your gross income minus certain deductions. For 2024, the AGI limits for the student loan interest deduction vary depending on your filing status. Exceeding these limits will result in ineligibility for the deduction.

Filing Status Requirements

Your filing status significantly impacts your eligibility for the student loan interest deduction. The IRS recognizes several filing statuses, including single, married filing jointly, married filing separately, qualifying widow(er), and head of household. Each status has its own AGI limit for the deduction.

Determining Eligibility Based on Income Thresholds

To determine your eligibility, follow these steps:

1. Calculate your Adjusted Gross Income (AGI): This involves subtracting allowable deductions from your gross income. Consult IRS Publication 970 for a comprehensive guide on calculating your AGI.

2. Determine your filing status: Accurately identify your filing status as per IRS guidelines.

3. Compare your AGI to the applicable limit: Refer to the table below to find the AGI limit corresponding to your filing status. If your AGI is less than or equal to the limit, you may be eligible. If your AGI exceeds the limit, you are not eligible for the deduction.

Examples of Eligibility Scenarios

Let’s consider a few examples:

* Example 1 (Eligible): Sarah is single and paid $1,000 in student loan interest. Her AGI is $65,000. Since her AGI is below the $85,000 limit for single filers, she is eligible to deduct the $1,000.

* Example 2 (Not Eligible): John and Mary are married filing jointly and paid $2,000 in student loan interest. Their combined AGI is $175,000. Because their AGI exceeds the $170,000 limit for married filing jointly, they are not eligible for the deduction.

* Example 3 (Eligible): David is a head of household and paid $1,500 in student loan interest. His AGI is $120,000. Since his AGI is below the $130,000 limit for head of household filers, he is eligible for the deduction.

AGI Limits by Filing Status

| Filing Status | AGI Limit (Single) | AGI Limit (Married Filing Jointly) | AGI Limit (Head of Household) |

|---|---|---|---|

| Single | $85,000 | ||

| Married Filing Jointly | $170,000 | ||

| Head of Household | $130,000 |

Calculating the Student Loan Interest Deduction

The student loan interest deduction allows you to reduce your taxable income by the amount of interest you paid on qualified student loans during the tax year. This can result in a lower tax bill, providing some financial relief for those managing student loan debt. The calculation is straightforward, but understanding the limits is crucial.

The calculation of the student loan interest deduction involves determining the amount of interest you paid during the tax year and comparing it to the maximum allowable deduction. For the 2024 tax year, the maximum deduction is $2,500. This means that even if you paid more than $2,500 in student loan interest, you can only deduct up to this amount. The deduction is claimed on Form 1040, Schedule 1 (Additional Income and Adjustments to Income).

Maximum Deduction Amount

The maximum deduction for student loan interest is $2,500, regardless of the actual amount of interest paid. This limit applies to both single and married filing jointly statuses. If your total student loan interest exceeds $2,500, you will only be able to deduct the $2,500 maximum. This is a key factor to consider when planning your tax return.

Examples of Deduction Calculation

Let’s illustrate the calculation with a few examples. Remember, this deduction is for interest paid, not principal payments.

| Interest Paid | Deductible Amount | Tax Savings (Assuming 22% Tax Bracket) |

|---|---|---|

| $1,500 | $1,500 | $330 ($1,500 x 0.22) |

| $2,500 | $2,500 | $550 ($2,500 x 0.22) |

| $3,000 | $2,500 | $550 ($2,500 x 0.22) |

Handling Interest Paid Exceeding the Maximum

As shown in the table above, if you paid more than $2,500 in student loan interest, you can only deduct the maximum allowable $2,500. Any interest paid above this amount is not deductible. Keep accurate records of all your student loan interest payments to support your deduction.

Interaction with Other Tax Deductions and Credits

The student loan interest deduction is an above-the-line deduction, meaning it reduces your adjusted gross income (AGI) before calculating your taxable income. This can make it beneficial even if you don’t itemize. However, it’s important to note that this deduction may interact with other tax benefits. For instance, it may affect the amount you can deduct for other items or the amount of certain tax credits you qualify for. Consult a tax professional for personalized advice.

Documentation and Record Keeping

Proper documentation is crucial for successfully claiming the student loan interest deduction. Failing to maintain adequate records could result in the IRS rejecting your claim, delaying your refund, or even leading to penalties. This section Artikels the necessary documentation and best practices for record-keeping to ensure a smooth and successful deduction process.

Keeping detailed and organized records not only simplifies the tax filing process but also provides a valuable audit trail should the IRS request further information. Accurate record-keeping demonstrates your compliance and minimizes the risk of errors or disputes.

Required Documents for the Student Loan Interest Deduction

To claim the student loan interest deduction, you’ll need to gather several key documents. These documents serve as proof of your student loan payments and the amount of interest paid during the tax year. The most important document is Form 1098-E, Student Loan Interest Statement. This form is issued by your lender and reports the total amount of student loan interest you paid during the year. If you don’t receive a Form 1098-E, you’ll need to obtain documentation directly from your lender, such as monthly statements or payment confirmations showing the interest paid. This documentation should clearly indicate the date of payment, the amount paid, and that the payment was specifically for student loan interest.

Information to Include in Supporting Documents

Each document supporting your student loan interest deduction should contain specific information. This includes the date of each payment, the amount paid, the name of the lender or institution, and a clear indication that the payment was specifically for student loan interest. For example, a bank statement should clearly show the payee (the lender) and a description indicating the payment is for student loan interest. If using multiple lenders, ensure each lender’s information is clearly separated and identified. Keep all original documents; copies are acceptable for your records, but retain the originals in case of an audit.

Best Practices for Organizing and Storing Records

Effective record-keeping involves more than just gathering documents; it’s about organizing and storing them in a way that ensures easy access and retrieval. A well-organized system prevents the frustration of searching through piles of papers when tax season arrives. Consider using a dedicated file folder, either physical or digital, specifically for student loan interest documentation. Within this file, organize documents chronologically, by lender, or by any method that makes sense to you and is easily retrievable.

Recommended Record-Keeping Methods

- Maintain a dedicated physical or digital file for all student loan documents.

- Use a spreadsheet or accounting software to track payments, dates, and amounts.

- Scan and save digital copies of all important documents.

- Consider cloud storage for secure backup of your digital records.

- Store original documents in a safe and organized location.

Impact of Tax Reform on the Student Loan Interest Deduction

The student loan interest deduction, while seemingly straightforward, has been subject to changes over the years due to various tax reform acts. Understanding these changes is crucial for taxpayers to accurately calculate their deductions and maximize their tax benefits. This section will compare the 2024 deduction to previous years, highlighting any modifications to the rules and their potential impact on eligible taxpayers.

The student loan interest deduction has not undergone significant structural changes in recent years. However, indirect impacts from broader tax reforms, such as changes to income thresholds or standard deduction amounts, can influence the overall benefit a taxpayer receives. For instance, an increase in the standard deduction could reduce the number of taxpayers who find the student loan interest deduction beneficial, as they might not itemize their deductions.

Adjusted Gross Income (AGI) Limits and Phaseouts

The student loan interest deduction is subject to an adjusted gross income (AGI) limitation. This means that the deduction may be reduced or eliminated entirely if your AGI exceeds a certain threshold. These thresholds have remained relatively consistent in recent years but are subject to annual inflation adjustments. For example, in 2023, a single filer could deduct the full amount of their student loan interest if their AGI was below $85,000. Above that threshold, the deduction began to phase out. Similar AGI limits exist for married couples filing jointly. Taxpayers should consult the most recent IRS publications for the exact AGI limits applicable to the 2024 tax year.

Comparison of Deduction Amounts Under Different Scenarios

Let’s consider two taxpayers, both with $1,000 in student loan interest paid in 2024. Taxpayer A has an AGI of $70,000, while Taxpayer B has an AGI of $100,000. Assuming the phase-out for 2024 remains similar to previous years (specific numbers would need to be verified with official IRS documentation), Taxpayer A would likely be able to deduct the full $1,000. Taxpayer B, however, due to exceeding the AGI threshold, might see their deduction reduced or completely eliminated depending on how far above the limit their AGI falls. The precise amount of the reduction would depend on the specific phase-out rules in effect for 2024. This illustrates how changes to the AGI limits, even without direct changes to the deduction itself, can significantly impact a taxpayer’s ability to claim the full benefit.

Impact of Standard Deduction Changes

Another indirect impact stems from changes to the standard deduction. If the standard deduction increases significantly, more taxpayers may opt to take the standard deduction instead of itemizing, rendering the student loan interest deduction irrelevant for them. This is because the student loan interest deduction is an itemized deduction, and taxpayers can only claim it if they choose to itemize rather than take the standard deduction. For instance, if a taxpayer’s itemized deductions, including the student loan interest deduction, are less than the standard deduction amount, they will benefit more from claiming the standard deduction.

Resources and Further Information

Navigating the complexities of the student loan interest deduction can be challenging. Fortunately, several resources are available to help taxpayers understand their eligibility and accurately claim the deduction. These resources offer valuable information, ranging from official government guidelines to expert advice from tax professionals.

This section provides an overview of helpful resources and contact information to assist with any questions or concerns regarding the student loan interest deduction. It is crucial to utilize these resources to ensure accurate and timely filing.

Government Websites and Publications

The Internal Revenue Service (IRS) website is the primary source for information on tax deductions, including the student loan interest deduction. This website offers detailed publications, instructions, and frequently asked questions (FAQs) related to tax filing. You can find specific information on eligibility requirements, calculation methods, and documentation needed to support your claim. Additionally, the IRS provides various forms and publications that offer comprehensive guidance on all aspects of tax filing, including the student loan interest deduction. These resources are updated annually to reflect any changes in tax laws. The government also provides publications that explain the tax implications of student loans and provide examples to clarify the process. These publications often include scenarios illustrating how to calculate the deduction and what documentation is required.

Tax Professional Assistance

Seeking guidance from a qualified tax professional can significantly simplify the process of claiming the student loan interest deduction. Enrolled agents, certified public accountants (CPAs), and other tax professionals possess in-depth knowledge of tax laws and regulations. They can help you determine your eligibility, accurately calculate the deduction, and ensure your tax return is properly filed. Many tax professionals offer consultations to answer questions and provide personalized advice tailored to your specific circumstances. You can find qualified tax professionals through professional organizations or online directories. When choosing a tax professional, consider their experience, qualifications, and client reviews. A consultation with a tax professional can be especially beneficial for individuals with complex financial situations or those unsure about their eligibility for the deduction.

Contact Information for Tax Professionals

While specific contact information for individual tax professionals cannot be provided here due to privacy concerns and the constantly changing nature of business information, several avenues exist to locate qualified professionals. The National Association of Enrolled Agents (NAEA) and the American Institute of CPAs (AICPA) websites maintain directories of their members, allowing you to search for professionals in your area. Online directories, such as those offered by legal and financial websites, also provide listings of tax professionals with client reviews and ratings. It’s recommended to thoroughly research and compare different professionals before making a decision.

Ultimate Conclusion

Successfully claiming the 2024 student loan interest deduction can significantly impact your tax burden, providing welcome financial relief during student loan repayment. Remember, careful record-keeping and a thorough understanding of the eligibility requirements are key to maximizing this benefit. While this guide provides comprehensive information, consulting with a tax professional is always advisable for personalized guidance, especially if your financial situation is complex. Don’t let valuable tax savings slip through the cracks; take advantage of the resources available to you and ensure you receive the full deduction you deserve.

Query Resolution

What if I paid off my student loans early? Can I still claim the deduction?

Yes, you can still claim the deduction for the interest you paid, even if you paid off your loans before the tax filing deadline. You need to have paid the interest during the tax year.

Can I claim the deduction if I’m claimed as a dependent on someone else’s return?

Generally, no. You typically cannot claim the student loan interest deduction if you are claimed as a dependent on someone else’s tax return. There are some exceptions, depending on your income and filing status. Consult the IRS guidelines or a tax professional for clarification.

What happens if I don’t have all the necessary documentation?

It’s crucial to maintain accurate records of your student loan interest payments. Without proper documentation, you risk being unable to claim the deduction. Contact your loan servicer if you need copies of statements or payment confirmations.

My AGI is slightly above the limit. Are there any exceptions?

There are no exceptions based solely on exceeding the AGI limit. The limits are strictly defined. However, changes to your income or filing status in future years may make you eligible then.