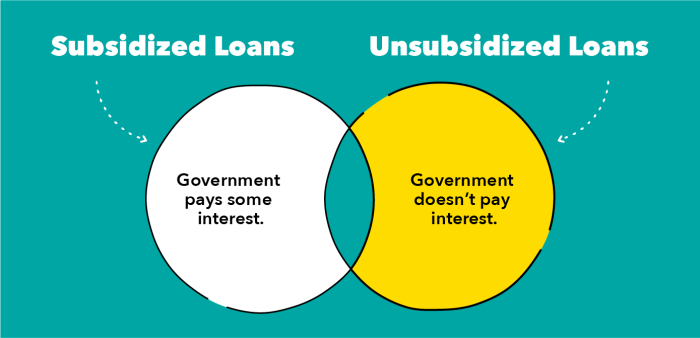

The decision between subsidized and unsubsidized student loans is a pivotal one for prospective college students and their families. Understanding the nuances of each loan type is crucial for responsible financial planning and avoiding the potential pitfalls of overwhelming debt. This guide will dissect the key differences, eligibility requirements, and long-term implications of choosing between these two common funding options for higher education. From interest accrual during your studies to repayment plans and their impact on your credit score, we will explore the financial landscape of subsidized and unsubsidized student loans, empowering you to make informed decisions that align with Read More …