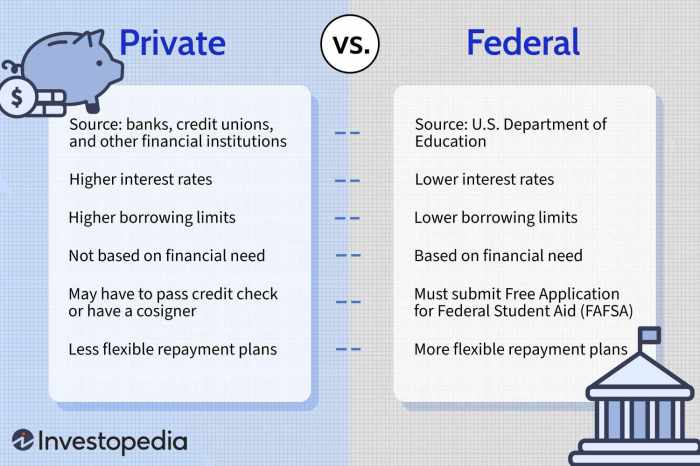

Navigating the world of private student loans can feel like deciphering a complex financial code. Understanding private student loan interest rates is crucial for responsible borrowing and avoiding potential financial pitfalls. This guide unravels the intricacies of interest rates, empowering you to make informed decisions and secure the best possible terms for your education financing. From the factors influencing your rate to effective repayment strategies and comparisons with federal loans, we’ll explore every aspect to help you manage your student loan debt effectively. We’ll also delve into the application process, potential risks, and the importance of understanding your loan agreement. Read More …