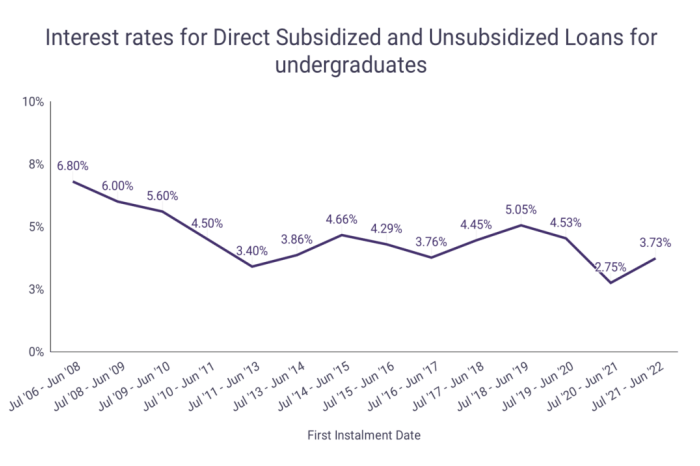

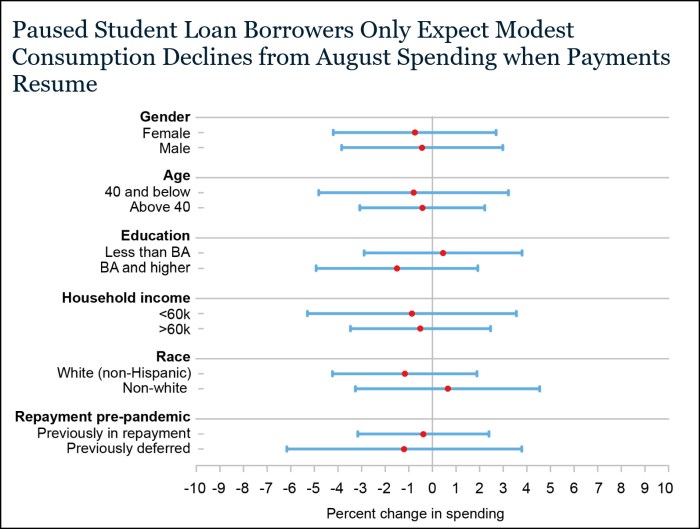

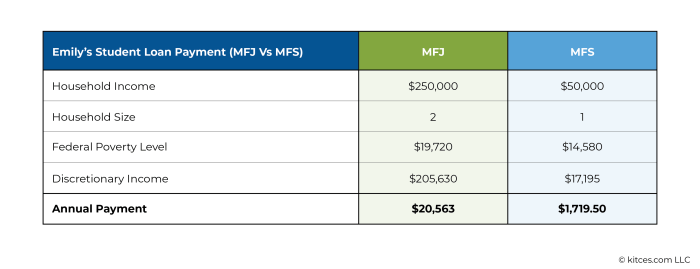

Navigating the complexities of student loan programs can feel overwhelming, but understanding the available options and employing effective strategies can significantly reduce the financial burden of higher education. This guide explores various federal and private student loan programs, outlining eligibility requirements, interest rates, and repayment plans. We’ll delve into practical strategies for minimizing debt accumulation, including maximizing scholarships and grants, and creating a responsible college budget. Beyond minimizing initial debt, we’ll examine repayment options, including income-driven plans and refinancing, along with the potential benefits and risks involved. We’ll also discuss the role of government initiatives and policies in shaping student Read More …