Navigating the complexities of student loan repayment can feel overwhelming, especially when considering potential tax benefits. Understanding the maximum student loan interest deduction is crucial for borrowers seeking to minimize their tax burden. This guide provides a clear and concise overview of eligibility requirements, calculation methods, and strategies for maximizing this valuable deduction. We’ll explore how recent tax reforms have impacted the deduction and compare it to other student loan assistance programs, empowering you to make informed financial decisions. This exploration delves into the intricacies of the maximum student loan deduction, covering everything from determining eligibility based on your Modified Read More …

Bulan: Maret 2025

Low-Interest Rate Student Loans Without Cosigner

Securing a higher education shouldn’t be financially crippling. The prospect of student loans often evokes anxiety, but navigating the landscape of low-interest options without needing a cosigner is entirely possible. This exploration delves into the strategies, programs, and considerations crucial for students aiming to achieve their academic goals without unnecessary financial burdens. We’ll examine eligibility criteria, explore available loan programs, and discuss strategies to improve your chances of securing favorable terms. Understanding the factors influencing interest rates, from credit history to academic performance, is paramount. We’ll equip you with the knowledge to make informed decisions, empowering you to confidently pursue Read More …

Lower Interest Rates Student Loans Financial Relief

The weight of student loan debt significantly impacts graduates’ financial futures. Lower interest rates offer a potential lifeline, easing the burden of monthly payments and ultimately reducing the total cost of repayment. This exploration delves into the multifaceted effects of reduced interest rates on borrowers, government policies, economic implications, and behavioral shifts. We’ll examine how these lower rates reshape financial landscapes for both individuals and the broader economy. From analyzing the immediate impact on monthly payments to exploring the long-term financial implications and comparing savings under various scenarios, we will uncover the true potential of lower interest rates to alleviate Read More …

Major Student Loan Companies A Comprehensive Guide

Navigating the complex world of student loans can feel overwhelming, especially with the sheer number of lenders and repayment options available. This guide provides a clear and concise overview of major student loan companies in the United States, examining their history, loan offerings, customer service, and the broader impact on borrowers’ financial well-being. Understanding these key players is crucial for prospective and current borrowers alike, empowering them to make informed decisions about their educational financing. From understanding interest rates and repayment plans to navigating government regulations and leveraging technological advancements, we aim to demystify the student loan process. We’ll explore Read More …

Maine Student Loans A Comprehensive Guide

Navigating the complexities of higher education financing can be daunting, especially when considering student loans. This guide provides a detailed overview of Maine student loan programs, offering insights into eligibility, repayment options, and the overall impact on students and the state’s economy. We’ll explore various programs, compare them to options in neighboring states, and address common concerns to empower you with the knowledge needed to make informed decisions about your financial future. Understanding Maine’s student loan landscape is crucial for prospective and current students, as well as for policymakers interested in the state’s economic well-being. This guide aims to demystify Read More …

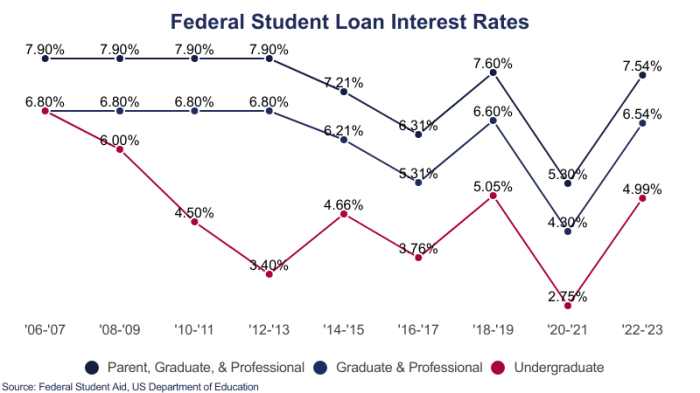

Low Interest Rates for Student Loans

Securing a low interest rate on student loans can significantly impact a borrower’s financial future. This impacts not only immediate repayment costs but also long-term financial stability. Understanding the factors influencing these rates—government policies, lender practices, and available repayment strategies—is crucial for navigating the complexities of student loan debt. This exploration delves into the multifaceted world of low-interest student loans, examining the interplay between government regulations, private sector involvement, and the various repayment options available to borrowers. We’ll analyze how these factors combine to shape both the immediate and long-term financial consequences for students and graduates. Impact of Low Student Read More …

Loans for International Students in USA Without Cosigner

Navigating the complexities of higher education in the USA as an international student often involves securing funding. Securing a loan without a cosigner presents unique challenges, requiring careful consideration of eligibility criteria, available loan types, and the overall application process. This guide provides a comprehensive overview of the landscape of loans available to international students in the US, specifically focusing on those options that don’t necessitate a cosigner. Understanding the various loan options, their associated interest rates and repayment terms, and the potential long-term financial implications is crucial for informed decision-making. We will explore both the advantages and disadvantages of Read More …

Student Loan Servicers A Comprehensive Guide

Navigating the complexities of student loan repayment can feel overwhelming, but understanding the role of loan servicers is crucial for a smooth and successful journey. These intermediaries act as the primary point of contact between borrowers and lenders, managing payments, providing account information, and offering various repayment options. This guide delves into the intricacies of student loan servicers, equipping you with the knowledge to effectively manage your student loan debt. From identifying the right servicer based on your individual needs and preferences to understanding different repayment plans and resolving common issues, this resource provides a comprehensive overview of the entire Read More …

Lower Student Loan Interest A Comprehensive Guide

Navigating the complex landscape of student loan debt can be daunting, especially with the ever-fluctuating interest rates. Understanding how these rates impact your overall repayment burden is crucial for long-term financial planning. This guide delves into the intricacies of lower student loan interest, exploring its effects on borrowers, government policies influencing rates, and strategies to minimize your costs. We’ll examine both federal and private loan options, offering a clear picture of your available choices and potential savings. From analyzing current interest rate trends and their historical context to outlining strategies for reducing your interest payments, we aim to equip you Read More …

Loan for International Students Without Cosigner

Securing higher education abroad is a significant achievement, but financing it can present considerable challenges, especially for international students who may lack a US-based cosigner. This guide navigates the complexities of obtaining a loan without a cosigner, exploring eligibility criteria, available loan types, reputable lenders, and effective repayment strategies. We aim to empower international students with the knowledge needed to confidently pursue their academic dreams. From understanding the nuances of credit history requirements to comparing various loan options—including federal loans, private loans, and alternative funding sources—we provide a comprehensive overview. This includes practical advice on navigating the application process, selecting Read More …