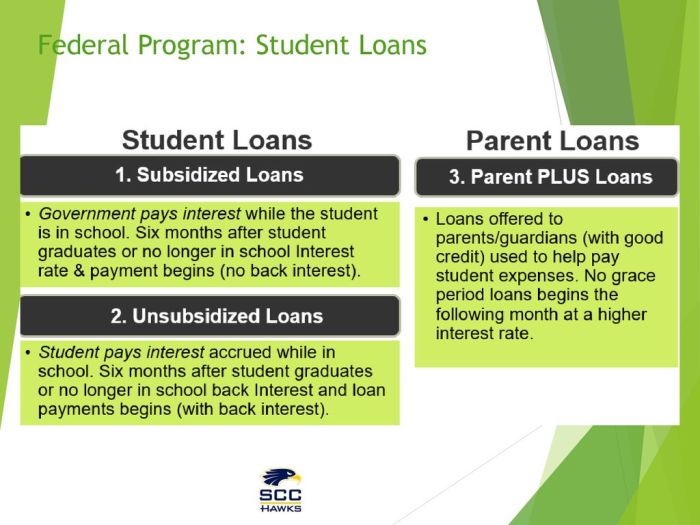

Navigating the complexities of student loan repayment can feel overwhelming. This guide provides a clear and concise path towards responsible borrowing and repayment, focusing on identifying safe and reputable programs to help students manage their debt effectively. We’ll explore various federal loan programs, highlighting their features and eligibility requirements, and equip you with the knowledge to avoid common scams and navigate the repayment process confidently. From understanding different repayment plans and identifying trustworthy loan servicers to building financial literacy and utilizing government resources, we aim to empower you with the tools and information necessary for a smooth and successful student Read More …