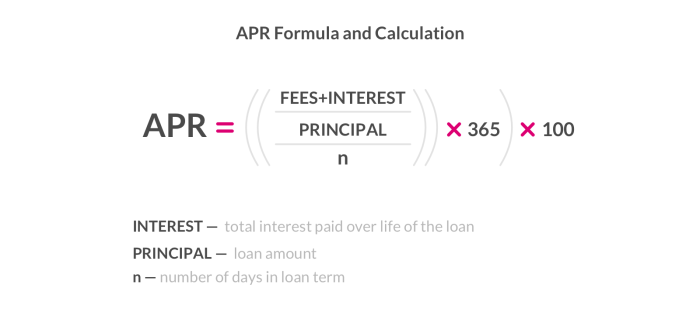

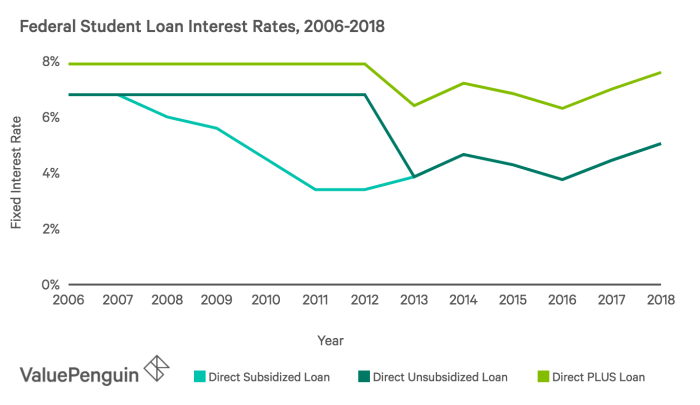

The weight of student loan debt in America is a significant concern, impacting millions and shaping the financial landscape for a generation. This exploration delves into the complexities of Americu student loans, examining their various forms, the factors contributing to the current crisis, and the long-term consequences for individuals and society. We’ll analyze the rising costs of higher education, government policies, and personal financial literacy’s role in navigating this challenging terrain. From understanding different repayment plans and interest rates to exploring potential solutions and reforms, this overview aims to provide a clear and insightful understanding of the Americu student loan Read More …