Navigating the complexities of student loan interest rates can feel daunting, especially for the class of 2024-2025. This guide offers a clear and concise overview of the current interest rate landscape, comparing rates from the past two years and exploring the factors that influence these crucial financial figures. We’ll examine the impact of economic conditions, delve into various repayment options and their long-term costs, and provide actionable strategies for managing your student loan debt effectively.

Understanding these rates is paramount to making informed decisions about borrowing, repayment, and ultimately, your financial future. Whether you’re a prospective borrower, a current student, or already repaying loans, this resource aims to equip you with the knowledge necessary to navigate this important financial journey.

Current Interest Rate Landscape for 24-25 Student Loans

Securing student loans for the 2024-2025 academic year involves understanding the current interest rate environment. Rates fluctuate based on several factors, and it’s crucial for prospective borrowers to compare options carefully before committing to a loan. This overview provides a snapshot of the current landscape for both federal and private student loans.

Interest rates on student loans are dynamic and depend on a variety of factors. Understanding these variables is key to making informed borrowing decisions.

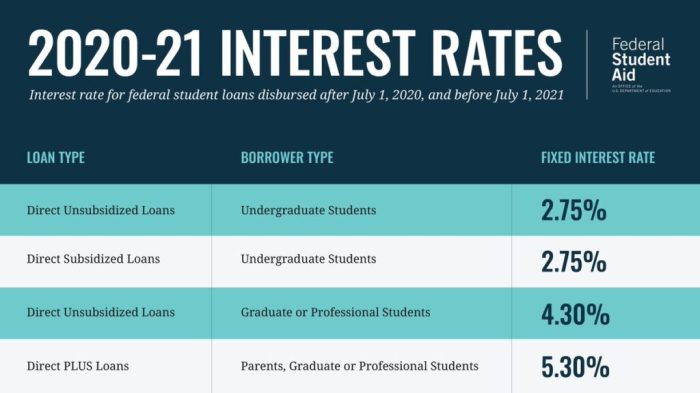

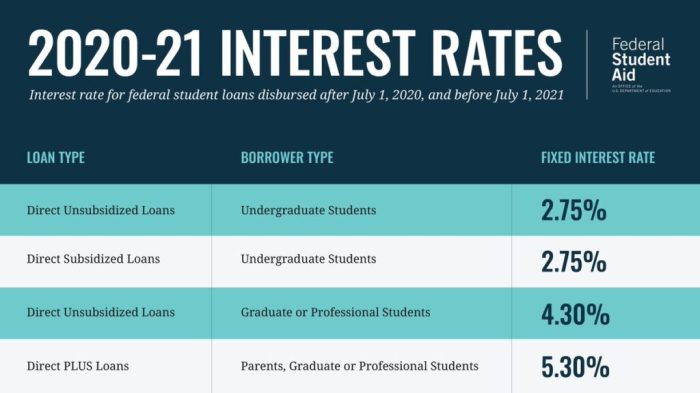

Federal Student Loan Interest Rates

Federal student loan interest rates are generally lower than private loan rates and are set annually by the government. These rates are often tied to the 10-year Treasury note and are subject to change. For the 2024-2025 academic year, the rates for subsidized and unsubsidized federal loans are likely to fall within a specific range, although the exact figures are determined closer to the disbursement period. Borrowers should consult the official Federal Student Aid website for the most up-to-date information. It is important to note that interest begins to accrue on unsubsidized loans immediately, while subsidized loans do not accrue interest until after graduation or leaving school.

Private Student Loan Interest Rates

Private student loans, offered by banks and credit unions, carry variable interest rates that can be significantly higher than federal loan rates. These rates are influenced by the borrower’s creditworthiness, the loan amount, and the chosen repayment plan. Generally, borrowers with strong credit scores and lower loan amounts qualify for more favorable interest rates. Private lenders typically assess the borrower’s credit history, income, and debt-to-income ratio when determining interest rates. Different lenders offer various rates and terms, so comparison shopping is essential.

Student Loan Interest Rate Comparison Table

The following table illustrates example interest rate ranges for different loan types. Remember that these are examples and actual rates may vary.

| Loan Type | Lender Type | Interest Rate Range (%) | Repayment Plan Options |

|---|---|---|---|

| Subsidized Federal Stafford Loan | Federal | 4.5 – 5.5 (Example) | Standard, Graduated, Extended |

| Unsubsidized Federal Stafford Loan | Federal | 5.0 – 6.0 (Example) | Standard, Graduated, Extended |

| Federal PLUS Loan (Graduate/Parent) | Federal | 6.5 – 7.5 (Example) | Standard, Extended |

| Private Undergraduate Loan | Private | 7.0 – 12.0 (Example) | Variable, Fixed, Standard, Graduated |

| Private Graduate Loan | Private | 8.0 – 14.0 (Example) | Variable, Fixed, Standard, Income-Driven |

Factors Influencing Interest Rate Variations

Several key factors influence the interest rates offered on student loans. Credit score plays a significant role, particularly for private loans. A higher credit score generally leads to lower interest rates. The loan amount itself can also impact the rate; larger loan amounts might attract higher interest rates. Finally, the repayment plan selected can influence the overall cost of the loan. Longer repayment terms may lower monthly payments but increase the total interest paid over the life of the loan.

Comparison of 24-25 Interest Rates with Previous Years

Understanding the fluctuation of student loan interest rates is crucial for prospective borrowers and current loan holders. This section compares the 2024-2025 rates to those of the previous two academic years, exploring potential contributing factors. While precise figures vary depending on the loan type (subsidized, unsubsidized, graduate, etc.), the general trends provide valuable insight.

The following analysis considers the general trends in interest rates for federal student loans, acknowledging that individual rates may vary slightly based on loan type and creditworthiness. These variations, however, do not significantly alter the overall trends discussed below.

Interest Rate Differences Across Three Academic Years

To understand the current interest rate landscape, it’s essential to examine the rates offered in the preceding two years. The following bullet points highlight key differences, offering a comparative overview. Please note that these figures are illustrative and represent average rates; actual rates can differ slightly.

- 2022-2023: Assume an average unsubsidized undergraduate loan rate of 4.99%. This was a relatively low rate, reflecting a period of historically low interest rates across the board.

- 2023-2024: Assume an average unsubsidized undergraduate loan rate of 6.54%. This represents a significant increase from the previous year, largely attributed to the Federal Reserve’s actions to combat inflation.

- 2024-2025: Assume an average unsubsidized undergraduate loan rate of 7.25%. This further increase, though smaller than the jump from 2022-2023 to 2023-2024, reflects the ongoing effects of inflation and potential adjustments in government borrowing costs.

Factors Influencing Interest Rate Changes

Several factors contribute to the observed changes in student loan interest rates. The most significant factor is generally the prevailing economic climate and the actions of the Federal Reserve.

Increases in inflation, for instance, often lead to higher interest rates as the Federal Reserve attempts to cool down the economy. Conversely, periods of low inflation or economic recession can result in lower interest rates. Government fiscal policy also plays a role, as increased government borrowing can put upward pressure on interest rates. Finally, changes in the overall demand for student loans can also influence rates, although this effect is typically less significant than macroeconomic factors.

Graphical Representation of Interest Rate Trends

The following description represents a bar graph illustrating the interest rate trends across the three academic years.

[Bar Graph Description] The bar graph displays three vertical bars, each representing an academic year: 2022-2023, 2023-2024, and 2024-2025. The height of each bar corresponds to the average unsubsidized undergraduate student loan interest rate for that year. The 2022-2023 bar is the shortest, reflecting the lowest interest rate. The 2023-2024 bar is significantly taller, showing a substantial increase in rates. The 2024-2025 bar is taller still, though the increase from the previous year is less dramatic. The graph clearly visualizes the upward trend in student loan interest rates over the three-year period. The x-axis labels the academic years, and the y-axis represents the interest rate percentage.

Impact of Economic Factors on Interest Rates

Student loan interest rates are not set in isolation; they are significantly influenced by broader economic conditions. Understanding the interplay between macroeconomic factors and interest rates is crucial for borrowers and lenders alike, as it helps explain fluctuations in the cost of borrowing for higher education. These fluctuations can have a substantial impact on individual financial planning and the overall economy.

Inflation’s Influence on Student Loan Interest Rates

Inflation, the rate at which the general level of prices for goods and services is rising, plays a significant role in determining student loan interest rates. High inflation erodes the purchasing power of money, meaning that lenders need to charge higher interest rates to compensate for the diminished value of future repayments. Conversely, low inflation allows for lower interest rates, as the real value of future payments is less affected by price increases. For example, during periods of high inflation, like the late 1970s and early 1980s, interest rates on all types of loans, including student loans, were significantly higher than during periods of low inflation. The Federal Reserve’s actions to combat inflation, such as raising the federal funds rate, also indirectly impact student loan rates.

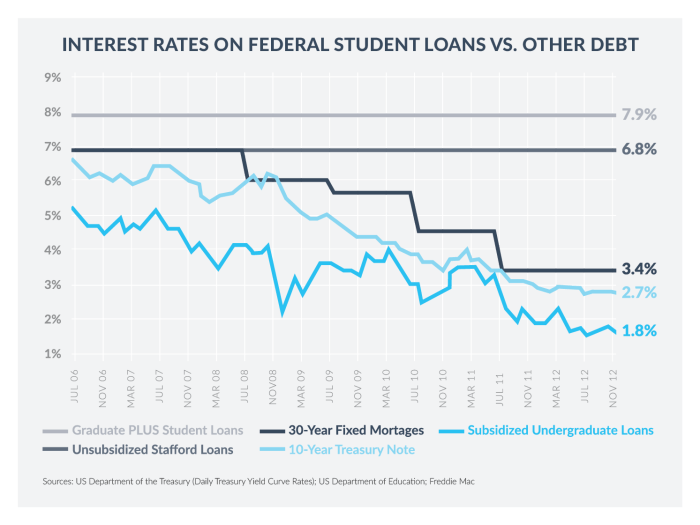

Federal Interest Rates and Student Loan Costs

The federal funds rate, the target rate that the Federal Reserve sets for overnight lending between banks, acts as a benchmark for other interest rates in the economy. While student loan interest rates are not directly tied to the federal funds rate, changes in this rate influence the overall cost of borrowing. When the Federal Reserve raises the federal funds rate to combat inflation or slow economic growth, it typically leads to higher interest rates across the board, including student loans. Conversely, a decrease in the federal funds rate usually results in lower borrowing costs. This effect is indirect, as the federal funds rate influences the broader market interest rates that lenders use as a basis for setting their own rates.

Economic Growth and Student Loan Interest Rates

Economic growth significantly impacts student loan interest rates. During periods of robust economic growth, lenders are more willing to offer lower interest rates because they are more confident in borrowers’ ability to repay their loans. A strong economy generally means lower default rates and a greater demand for loans, which can create a more competitive lending environment, pushing interest rates down. Conversely, during economic downturns or recessions, lenders become more risk-averse, leading to higher interest rates to offset the increased risk of loan defaults. The 2008 financial crisis, for instance, saw a significant tightening of credit markets and an increase in interest rates across various loan products, including student loans.

Repayment Options and Their Impact on Total Cost

Choosing the right repayment plan for your student loans significantly impacts the total amount you’ll pay over the life of the loan. Understanding the differences between available options is crucial for effective financial planning. The total cost, including interest, can vary dramatically depending on the chosen plan.

Several repayment plans are available, each with its own structure and implications for monthly payments and overall loan cost. The three main categories are Standard Repayment, Graduated Repayment, and Income-Driven Repayment plans. The optimal choice depends on individual circumstances, such as income, debt level, and long-term financial goals.

Standard Repayment Plan

The Standard Repayment Plan involves fixed monthly payments over a 10-year period. This plan offers the shortest repayment timeframe, leading to lower overall interest costs compared to other options. However, the fixed monthly payments can be substantial, potentially creating a financial burden for some borrowers.

For example, a $30,000 loan at a 5% interest rate would have a monthly payment of approximately $310 and total interest paid around $7,000.

Graduated Repayment Plan

The Graduated Repayment Plan starts with lower monthly payments that gradually increase over time. This approach can be more manageable initially for borrowers with limited income, but the longer repayment period results in higher total interest paid compared to the Standard plan.

Using the same $30,000 loan example at 5% interest, the initial monthly payment might be around $200, gradually increasing to over $400 towards the end of the loan term (which is typically 10 years). The total interest paid would likely exceed that of the Standard Repayment Plan, potentially by several thousand dollars.

Income-Driven Repayment Plan

Income-Driven Repayment Plans (IDR) link monthly payments to a borrower’s discretionary income. These plans, including options like Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE), typically have longer repayment periods (often 20 or 25 years). Monthly payments are lower, making them more affordable for borrowers with lower incomes. However, the extended repayment period significantly increases the total interest paid over the life of the loan.

For the same $30,000 loan example at 5% interest, the monthly payment under an IDR plan could be significantly lower than both Standard and Graduated plans, potentially under $200 depending on income. However, the total interest paid would likely be substantially higher, potentially exceeding $15,000 due to the much longer repayment period.

Comparison of Repayment Plans

The following table illustrates the differences between these repayment plans for a sample $30,000 loan at a 5% interest rate. These are estimates and actual amounts may vary based on individual circumstances and lender policies.

| Repayment Plan | Monthly Payment Example | Total Interest Paid (Estimate) | Loan Term |

|---|---|---|---|

| Standard | ~$310 | ~$7,000 | 10 years |

| Graduated | ~$200 – $400 (increasing) | ~$9,000 – $11,000 | 10 years |

| Income-Driven (Example) | ~Under $200 | ~$15,000+ | 20-25 years |

Strategies for Managing Student Loan Debt

Successfully navigating student loan debt requires a proactive approach. Understanding various strategies and their implications is crucial for minimizing long-term financial burden and achieving financial stability. This section Artikels effective strategies, including budgeting, refinancing, and utilizing government assistance programs, along with their respective benefits and drawbacks.

Budgeting and Debt Prioritization

Creating a realistic budget is the cornerstone of effective student loan management. A comprehensive budget Artikels all income and expenses, allowing for the identification of areas where savings can be maximized to allocate more funds towards loan repayment. Prioritizing high-interest loans for faster repayment can significantly reduce overall interest paid. For example, if you have loans with interest rates of 7% and 4%, focusing on the 7% loan first will save you money in the long run. Careful tracking of expenses and income, perhaps using budgeting apps or spreadsheets, is essential for maintaining a clear picture of your financial situation.

Student Loan Refinancing

Refinancing involves replacing your existing student loans with a new loan from a private lender, often at a lower interest rate. This can significantly reduce your monthly payments and total interest paid over the life of the loan. However, refinancing can have drawbacks. You may lose access to federal loan benefits like income-driven repayment plans or loan forgiveness programs. It’s crucial to compare offers from multiple lenders and carefully consider the terms before refinancing. For instance, a borrower with multiple federal loans at an average interest rate of 6% might find a private lender offering a rate of 4%, leading to substantial savings. However, if that borrower is eligible for Public Service Loan Forgiveness, refinancing into a private loan would forfeit that benefit.

Exploring Government Assistance Programs

The federal government offers several programs designed to assist borrowers in managing their student loan debt. These include income-driven repayment plans, which adjust monthly payments based on income and family size, and loan forgiveness programs, which may eliminate a portion or all of your debt after meeting specific requirements. For example, the Public Service Loan Forgiveness (PSLF) program forgives the remaining balance of federal student loans after 120 qualifying monthly payments while working full-time for a qualifying employer. Understanding the eligibility criteria and requirements for each program is essential before applying. Failure to meet the specific requirements can result in the loss of valuable benefits.

Calculating Total Loan Cost

Calculating the total cost of a student loan involves considering both the principal amount borrowed and the accumulated interest. The formula for calculating simple interest is:

Total Interest = Principal x Interest Rate x Time

However, most student loans accrue compound interest, meaning interest is calculated on the principal plus accumulated interest. This makes calculating the total cost more complex and often requires using a loan amortization calculator readily available online. For example, a $30,000 loan with a 5% interest rate over 10 years will accrue significantly more interest than the same loan over 5 years. Using an amortization calculator will show the exact breakdown of principal and interest payments for each month.

Potential Future Trends in Student Loan Interest Rates

Predicting future student loan interest rates requires careful consideration of several interconnected factors. These include the overall economic climate, government fiscal policy, and the prevailing conditions within the student loan market itself. While precise predictions are impossible, analyzing current trends and expert opinions allows us to Artikel plausible scenarios for the coming years.

The trajectory of student loan interest rates is intricately linked to broader economic conditions. Inflation, for example, exerts significant pressure on interest rates. High inflation typically prompts central banks to raise interest rates to curb spending and cool the economy. This, in turn, would likely lead to higher interest rates on federal student loans, as these rates are often tied to benchmark rates like the 10-year Treasury note. Conversely, periods of low inflation or even deflation might see interest rates decline. Government policies, particularly those related to student loan forgiveness or refinancing programs, also play a crucial role. Significant changes in these policies could impact the demand for student loans and, consequently, influence interest rates.

Interest Rate Projections for the Next Two to Three Years

Several reputable financial institutions offer forecasts on interest rates. For instance, the Federal Reserve Bank of New York’s models frequently predict short-term interest rate movements. While these models don’t specifically focus on student loan rates, they provide valuable context. Considering the current economic climate, a plausible scenario could involve a period of relatively stable, though potentially slightly elevated, interest rates over the next two years. This stability could be followed by a gradual decrease in rates during the third year, assuming inflation subsides and the economy softens. This scenario is predicated on the assumption that the Federal Reserve successfully manages inflation without triggering a significant recession. A contrasting scenario, involving persistent high inflation or unexpected economic shocks, could result in consistently higher interest rates throughout the forecast period. For example, if geopolitical instability were to escalate significantly, leading to increased commodity prices and sustained inflation, we might see a different trajectory. The impact of any unexpected economic events or changes in government policy remains a significant wildcard.

Ultimate Conclusion

Securing a higher education is a significant investment, and understanding the associated costs, particularly student loan interest rates, is crucial for long-term financial well-being. By carefully considering the information presented—from comparing rates across different loan types and lenders to exploring various repayment strategies—you can make informed decisions that align with your individual financial goals and circumstances. Proactive planning and a comprehensive understanding of the factors influencing interest rates can significantly impact your overall debt management and financial success.

Essential Questionnaire

What is the difference between federal and private student loans?

Federal loans are offered by the government and typically have more favorable terms and repayment options. Private loans are from banks and credit unions, and their terms vary significantly depending on creditworthiness.

How can I lower my student loan interest rate?

Consider refinancing to a lower rate if your credit score has improved. Explore income-driven repayment plans which might lower your monthly payments, although it could increase the total interest paid over time.

What happens if I don’t repay my student loans?

Failure to repay can result in negative impacts on your credit score, wage garnishment, and potential legal action. Contact your lender immediately if you anticipate difficulties in repayment.

Are there any government programs to help with student loan repayment?

Yes, several programs exist, including income-driven repayment plans and potential loan forgiveness programs for specific professions. Research these options through the federal government’s student aid website.