The persistent challenge of student loan debt often clashes with the crucial goal of securing a comfortable retirement. Many young professionals face a difficult decision: prioritize aggressive student loan repayment, potentially sacrificing employer-matched 401(k) contributions, or maximize retirement savings while managing a potentially overwhelming student loan burden. This exploration delves into the complexities of this financial balancing act, examining the trade-offs, exploring alternative strategies, and offering insights to help navigate this critical juncture.

Understanding the tax implications of early 401(k) withdrawals, the potential loss of employer matching funds, and the long-term financial consequences of each choice is paramount. We will analyze various scenarios, comparing the interest rates on student loans to the potential returns on 401(k) investments, and offer practical strategies for managing both debt and retirement savings simultaneously. The psychological impact of this financial pressure will also be addressed, along with coping mechanisms and resources available to help alleviate stress and anxiety.

The 401(k) Match Dilemma

Choosing between using a 401(k) match to pay off student loans presents a significant financial decision. This requires careful consideration of the immediate benefits of debt reduction versus the long-term growth potential of retirement savings. Understanding the tax implications and potential financial consequences is crucial for making an informed choice.

Tax Implications of Early 401(k) Withdrawal

Withdrawing from a 401(k) before age 59 1/2 typically incurs a 10% early withdrawal penalty, in addition to income taxes on the withdrawn amount. This means a significant portion of your savings will be lost to penalties and taxes, diminishing the intended benefit of the withdrawal. For example, if you withdraw $10,000, you might pay $1,000 in penalties and an additional amount in income taxes, depending on your tax bracket. This effectively reduces the amount available to pay down your student loans. Furthermore, the income tax liability could push you into a higher tax bracket for the year, further increasing your overall tax burden.

Long-Term Financial Consequences of Early 401(k) Withdrawal

Early 401(k) withdrawals significantly impact long-term retirement savings. The lost principal and the missed opportunity for compounded growth can have a substantial effect on your retirement nest egg. Consider this example: Withdrawing $10,000 today might seem like a considerable sum to alleviate student loan debt, but that $10,000, invested and compounding over 30 years, could potentially grow to a much larger amount, depending on the investment returns. This lost potential growth is a significant long-term cost.

Comparison of Interest Rates: Student Loans vs. 401(k) Returns

Student loan interest rates vary, but generally fall within a specific range. However, the potential return on 401(k) investments is subject to market fluctuations and the specific investment choices within the plan. Historically, the stock market has shown a higher average return than most student loan interest rates over the long term. This means that, although it is risky, leaving your money in the 401(k) could potentially yield a higher return than paying off a loan with a fixed interest rate. However, guaranteeing a higher return is impossible, as market performance is unpredictable.

Withdrawal Penalty Scenarios

The following table illustrates various withdrawal penalty scenarios:

| Scenario | Penalty Percentage | Amount Withdrawn | Net Amount Received |

|---|---|---|---|

| Before age 59 1/2, no hardship exception | 10% + applicable income tax | $10,000 | (Example: Approximately $7,000-$8,000 after penalties and taxes, depending on tax bracket) |

| Before age 59 1/2, with hardship exception (check plan rules) | Applicable income tax (penalty may be waived) | $10,000 | (Example: Approximately $6,000-$9,000 after taxes, depending on tax bracket and specific plan rules) |

| After age 59 1/2 | Applicable income tax only | $10,000 | (Example: Approximately $6,000-$9,000 after taxes, depending on tax bracket) |

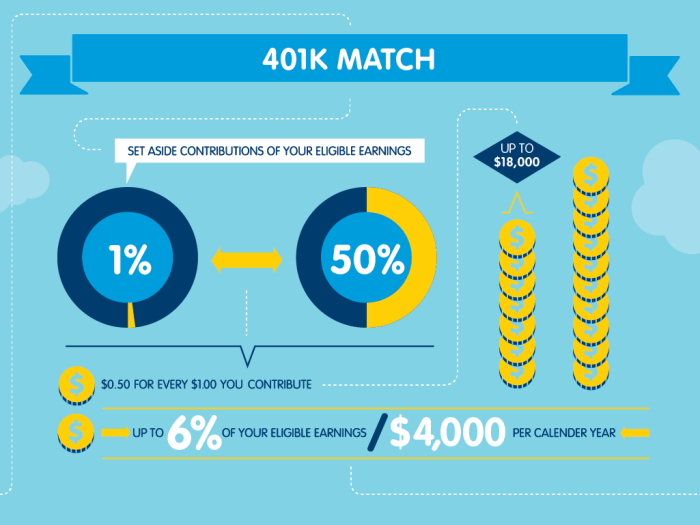

Employer Matching Contributions

Employer matching contributions represent a significant opportunity for wealth building, essentially offering free money to boost your retirement savings. However, the allure of aggressively paying down student loan debt can sometimes overshadow this valuable benefit. Weighing the pros and cons of prioritizing one over the other requires careful consideration of your individual financial situation and long-term goals.

The opportunity cost of foregoing employer matching contributions to accelerate student loan repayment is substantial. This is because you are essentially turning down free money that could significantly increase your retirement savings over time. While eliminating student loan debt offers immediate financial relief, neglecting the employer match can lead to a considerable shortfall in retirement funds.

Calculating Potential Loss of Employer Matching Funds

Understanding the potential loss requires a step-by-step calculation. First, determine your employer’s matching contribution percentage. Let’s assume your employer matches 50% of your contributions up to 6% of your salary. Next, calculate the amount of your salary that qualifies for the match. If your salary is $60,000, 6% is $3,600. Your employer will contribute $1,800 (50% of $3,600). Now, consider the time horizon. If you forgo this match for five years, your potential loss would be $9,000 ($1,800 x 5). This calculation demonstrates the compounding effect of missed contributions over time. The longer you delay maximizing your 401(k) contributions, the greater the potential loss. This calculation should be adjusted based on individual circumstances such as the specific match percentage, salary, and contribution limits.

Hypothetical Scenario: Long-Term Impact

Imagine Sarah, a recent graduate with $50,000 in student loan debt and a $60,000 annual salary. Her employer offers a 50% match on contributions up to 6% of her salary. If Sarah aggressively pays down her student loans and contributes minimally to her 401(k), she might pay off her debt in 5 years. However, over those five years, she would forgo $9,000 in employer matching contributions. Assuming an average annual return of 7%, that $9,000 could grow to significantly more by retirement. This illustrates how choosing immediate debt relief might compromise long-term financial security. Conversely, if Sarah contributed enough to receive the full match, while still making significant progress on her loans, she would be building a stronger financial foundation for both the short and long term. The compounding effect of even small contributions and employer matches over several decades is profound.

Examples of Successful Dual Management

Many individuals successfully manage both student loan repayment and 401(k) contributions. Consider John, who prioritized a higher percentage of his income towards student loan repayment while still contributing enough to his 401(k) to capture the full employer match. He meticulously budgeted and found areas to cut expenses, allowing him to achieve both goals. Similarly, Maria used a debt avalanche strategy, prioritizing her highest-interest loan while making the minimum payments on others, alongside consistent 401(k) contributions to secure the employer match. Both examples highlight the importance of budgeting, disciplined saving, and prioritizing employer matching contributions as a crucial component of a comprehensive financial strategy. These strategies demonstrate that with careful planning and resourcefulness, individuals can successfully balance both immediate and long-term financial obligations.

Alternative Strategies for Managing Student Loan Debt and Retirement Savings

Balancing student loan repayment with retirement savings can feel daunting, but several strategies can help individuals navigate this challenge effectively. Prioritizing both is crucial for long-term financial well-being, ensuring a secure future while managing existing debt. This section explores alternative approaches to help you manage both simultaneously.

Income-Driven Repayment Plans for Student Loans

Income-driven repayment (IDR) plans adjust your monthly student loan payments based on your income and family size. These plans typically offer lower monthly payments than standard repayment plans, making them more manageable, especially during early career stages when income may be lower. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). The specific plan and its terms vary, so it’s essential to compare them to find the most suitable option. For example, REPAYE often caps monthly payments at 10% of discretionary income, while IBR may have a slightly higher percentage. Choosing the right IDR plan can significantly impact your monthly budget and free up funds for retirement contributions.

Resources Available to Help Borrowers Manage Student Loan Debt

Numerous resources can assist borrowers in managing their student loan debt effectively. The Federal Student Aid website (studentaid.gov) provides comprehensive information on repayment plans, loan forgiveness programs, and other relevant resources. Additionally, many non-profit organizations offer free financial counseling services, guiding borrowers through the complexities of loan repayment and budgeting. These organizations often provide personalized advice tailored to individual circumstances, helping borrowers create realistic repayment plans and avoid default. Furthermore, some employers offer student loan repayment assistance programs, either through direct contributions or matching programs, further alleviating the financial burden. Utilizing these resources can significantly improve your ability to manage your debt and prioritize retirement savings.

Student Loan Refinancing Options

Student loan refinancing involves replacing your existing federal or private student loans with a new loan from a private lender. This can potentially lower your interest rate, resulting in lower monthly payments and reduced total interest paid over the life of the loan. However, refinancing federal student loans means losing access to federal protections and benefits, such as income-driven repayment plans and loan forgiveness programs. Therefore, careful consideration is crucial before refinancing. When comparing refinancing options, it is essential to consider factors such as interest rates, fees, repayment terms, and the lender’s reputation. A lower interest rate might seem appealing, but hidden fees or unfavorable repayment terms could offset the benefits. Thoroughly researching different lenders and comparing their offers is essential to secure the most advantageous refinancing deal.

Budgeting Techniques for Managing Student Loan Payments and Retirement Savings

Effectively managing both student loan payments and retirement savings requires a well-structured budget. Prioritizing retirement contributions, even with a small amount, is crucial for long-term financial security. One effective technique is the 50/30/20 rule: allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. Within the 20%, prioritize allocating a portion towards retirement contributions before applying the remainder to student loan payments. Another approach involves using budgeting apps or spreadsheets to track income and expenses meticulously. This allows for identifying areas where expenses can be reduced to free up more funds for both student loan repayment and retirement savings. Regularly reviewing and adjusting the budget ensures it remains aligned with financial goals and changing circumstances. Consider automating retirement contributions to ensure consistent savings, even with fluctuating income.

The Psychological Impact of Student Loan Debt on Retirement Planning

The weight of significant student loan debt can cast a long shadow over retirement planning, creating a complex interplay between financial strain and emotional well-being. The constant pressure of repayment can lead to feelings of overwhelm, anxiety, and even despair, making it difficult to focus on long-term financial goals like saving for retirement. This psychological burden can manifest in various ways, impacting decision-making and potentially delaying or derailing retirement plans altogether.

The emotional and mental toll of substantial student loan debt significantly impacts retirement planning decisions. Individuals grappling with large monthly payments may prioritize immediate debt reduction over retirement savings, delaying the accumulation of funds needed for a comfortable retirement. This can lead to a feeling of being trapped in a cycle of debt, with little hope of achieving financial security in the future. The constant worry about loan repayments can also impair cognitive function, making it harder to make sound financial decisions and plan effectively for retirement. This anxiety can lead to procrastination, avoidance of financial planning, and even impulsive spending decisions that further complicate the situation.

Stress and Anxiety Management Techniques

Effective stress and anxiety management is crucial for individuals facing the dual challenges of student loan repayment and retirement savings. Strategies such as mindfulness meditation, regular exercise, and engaging in hobbies can help alleviate stress and improve mental well-being. Seeking support from friends, family, or a therapist can provide emotional relief and perspective. Furthermore, developing a realistic budget that incorporates both debt repayment and retirement savings can reduce financial anxiety by providing a clear plan and sense of control. Financial counseling can also offer valuable guidance and support in navigating this complex financial landscape.

Coping Mechanisms for Financial Burden

Developing effective coping mechanisms is essential for navigating the financial pressures of student loans and retirement planning. Creating a detailed budget that prioritizes both debt repayment and retirement contributions is a crucial first step. Exploring options for student loan repayment, such as income-driven repayment plans or refinancing, can alleviate some of the financial burden. Additionally, actively seeking opportunities to increase income, such as a side hustle or career advancement, can provide additional resources to allocate towards both debt reduction and retirement savings. Regularly reviewing and adjusting the budget as circumstances change is also important to ensure it remains a viable and effective tool.

Impact of Delayed Retirement

Delayed retirement due to student loan debt is a significant consequence of the financial strain many individuals face. The inability to save adequately for retirement necessitates working longer to accumulate sufficient funds, potentially impacting personal well-being and delaying life goals. This delay can have far-reaching implications, impacting individuals’ ability to enjoy leisure time, pursue personal interests, or spend quality time with loved ones during their later years. The financial implications of working longer can also be significant, as it may mean missing out on potential social security benefits or other retirement incentives. For example, an individual forced to work five extra years may experience a reduced standard of living during retirement, and this is compounded by the missed opportunity to invest those five years of savings.

Visualizing the Financial Trade-offs

Understanding the long-term impact of choosing between prioritizing student loan repayment and maximizing 401(k) contributions requires visualizing the potential financial outcomes. Data representation, through graphs and charts, provides a clear and concise way to compare these choices and inform decision-making.

401(k) Growth with and without Employer Matching Contributions

The following line graph illustrates the growth of a hypothetical 401(k) account over 20 years, comparing scenarios with and without employer matching contributions. We assume an initial investment of $5,000, annual contributions of $5,000, and a consistent 7% annual return. The employer match is assumed to be 50% of the employee’s contribution up to a maximum of $2,500 annually.

The x-axis represents the year (from Year 0 to Year 20), and the y-axis represents the account balance in US dollars. The graph shows two lines: one representing the growth of the 401(k) with the employer match (labeled “With Match”), and the other representing growth without the match (labeled “Without Match”). The “With Match” line will show significantly steeper growth, particularly in the early years due to the added employer contributions. For example, at year 5, the “With Match” line might show approximately $35,000 while the “Without Match” line might show around $28,000. This difference will widen over time, demonstrating the compounding effect of the employer match. At year 20, the “With Match” line would show a substantially larger balance than the “Without Match” line, highlighting the long-term financial benefits of taking advantage of employer matching contributions.

Student Loan Interest Paid Under Different Repayment Plans

This bar chart compares the total interest paid on a hypothetical $50,000 student loan under three common repayment plans: Standard, Extended, and Income-Driven. The x-axis lists the repayment plan type (Standard, Extended, Income-Driven), and the y-axis represents the total interest paid in US dollars. The height of each bar represents the total interest paid over the life of the loan under that specific plan.

The Standard repayment plan typically has a shorter repayment period (e.g., 10 years), resulting in higher monthly payments but lower overall interest paid. The Extended repayment plan stretches the repayment period (e.g., 25 years), leading to lower monthly payments but significantly higher total interest paid. An Income-Driven Repayment plan adjusts payments based on income, resulting in potentially lower monthly payments but potentially the highest total interest paid over the loan’s life, depending on income fluctuations and the specific plan terms. For instance, the Standard plan bar might show approximately $15,000 in total interest, the Extended plan bar might show around $40,000, and the Income-Driven plan bar might show approximately $45,000. This visual representation clearly shows the trade-off between monthly payment burden and total interest paid.

Outcome Summary

Successfully navigating the intersection of student loan repayment and 401(k) contributions requires careful planning, informed decision-making, and a proactive approach to managing both short-term and long-term financial goals. While prioritizing aggressive student loan repayment might seem appealing, the potential loss of employer matching contributions and the delayed growth of retirement savings can have significant long-term consequences. By understanding the trade-offs involved, exploring alternative strategies like income-driven repayment plans and refinancing options, and implementing effective budgeting techniques, individuals can build a solid financial foundation for both their present and future.

Clarifying Questions

Can I withdraw from my 401(k) to pay off student loans penalty-free?

Generally, no. Early withdrawals from a 401(k) before age 59 1/2 typically incur significant tax penalties and fees, unless specific exceptions apply (like hardship withdrawals, which have strict requirements).

What if my employer offers a 100% 401k match up to a certain percentage of my salary? Should I still prioritize student loans?

A 100% match is essentially free money. Missing out on this represents a significant lost opportunity cost. Weigh this against your student loan interest rate and repayment plan. It often makes financial sense to at least contribute enough to secure the full match before aggressively paying down student loans.

Are there any tax benefits to paying off student loans?

Unfortunately, student loan interest is generally not tax deductible for most taxpayers unless certain income limitations are met. However, there are income-driven repayment plans that can lower monthly payments and potentially reduce the total amount paid over time.

What are some budgeting apps that can help me manage both student loans and retirement savings?

Many budgeting apps are available, including Mint, YNAB (You Need A Budget), and Personal Capital. These apps can help you track income and expenses, create budgets, and monitor your progress towards your financial goals.