Balancing student loan repayment with maximizing 401(k) contributions is a significant financial challenge for many young professionals. The allure of immediate debt reduction often competes with the long-term benefits of employer-matched retirement savings. This exploration delves into effective strategies for navigating this crucial decision, examining the interplay between these two essential financial goals.

We’ll analyze the potential long-term financial implications of prioritizing one over the other, exploring various budgeting techniques and financial planning approaches that allow individuals to successfully manage both student loan debt and retirement savings simultaneously. We’ll also examine employer-sponsored programs designed to assist employees in achieving both objectives, highlighting the tax advantages and potential impact on employee retention.

The Relationship Between 401(k) Matching and Student Loan Repayment

The decision of whether to prioritize 401(k) contributions or aggressive student loan repayment is a crucial one for young professionals. Both represent significant financial commitments with differing long-term implications. Understanding the trade-offs involved is key to making informed choices that align with individual financial goals and risk tolerance.

Financial Implications of Prioritizing 401(k) Contributions vs. Aggressive Student Loan Repayment

Prioritizing 401(k) contributions, especially when employer matching is available, leverages the power of compounding returns over the long term. This strategy offers significant tax advantages and can lead to substantial wealth accumulation for retirement. However, delaying aggressive student loan repayment might result in higher interest payments over time, increasing the total debt burden. Conversely, prioritizing aggressive student loan repayment offers immediate debt reduction, reducing financial stress and potentially freeing up cash flow for other goals. However, this approach may limit the opportunity to benefit from employer matching and the long-term growth potential of 401(k) investments.

Long-Term Growth Potential of 401(k) Investments vs. Immediate Debt Reduction

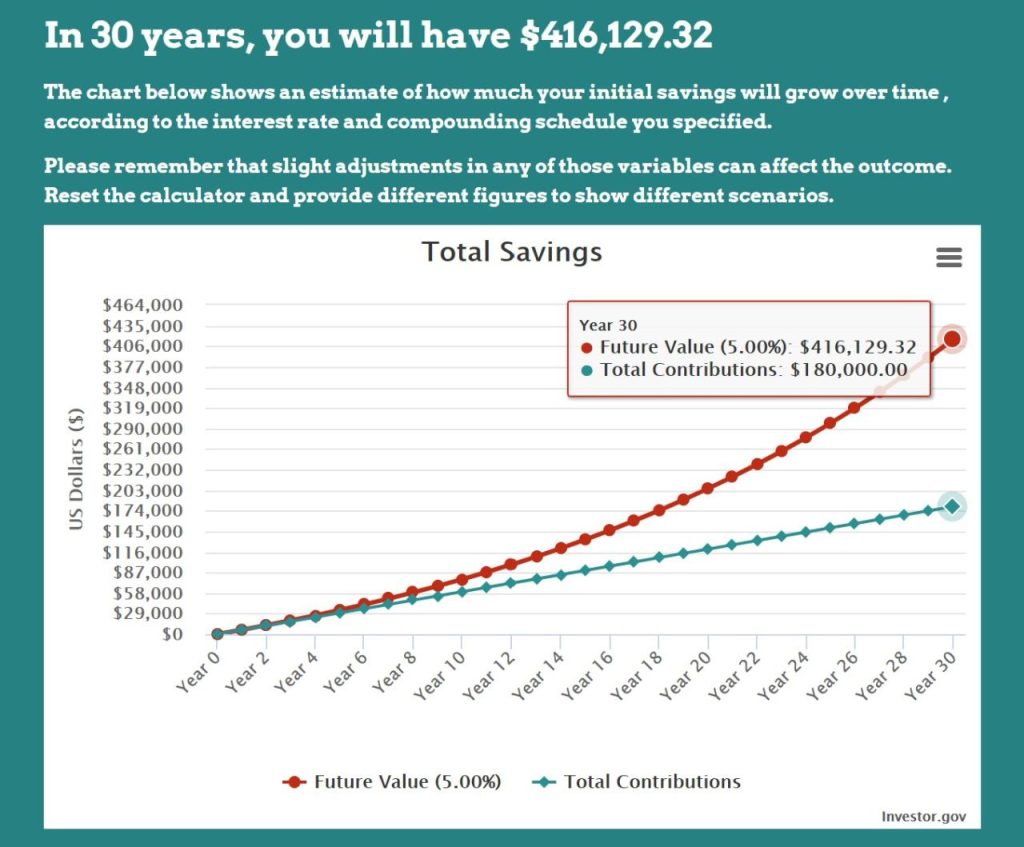

401(k) investments, particularly those in diversified portfolios, have historically shown significant long-term growth potential. The power of compounding, where investment returns generate further returns, can dramatically increase savings over decades. This contrasts with student loan repayment, where the primary benefit is the immediate reduction of debt. While eliminating debt provides peace of mind and improved credit scores, it doesn’t offer the same potential for exponential growth. For example, a consistent $500 monthly contribution to a 401(k) earning an average annual return of 7% over 30 years could grow to over $600,000, while the same amount applied to student loan repayment simply reduces the principal.

Strategies for Balancing 401(k) Contributions and Student Loan Payments

A balanced approach involves maximizing employer 401(k) matching contributions while strategically managing student loan repayment. This often entails contributing at least enough to receive the full employer match, as this is essentially free money. Any additional funds can then be allocated towards student loans, focusing on higher-interest debt first. Refinancing student loans to a lower interest rate can also significantly reduce the overall cost of repayment. Budgeting and tracking expenses meticulously are crucial for determining how much can be allocated to both goals.

Sample Budget Illustrating a Balanced Approach

Let’s assume a monthly net income of $4,000. A balanced approach might look like this:

* Housing: $1,200

* Food: $500

* Transportation: $300

* Utilities: $200

* 401(k) (including employer match): $700

* Student Loan Payment: $500

* Savings/Emergency Fund: $300

* Other Expenses: $300

This budget demonstrates a commitment to both retirement savings and debt reduction, with sufficient funds allocated for essential living expenses and emergency savings. The specific allocation will vary depending on individual circumstances and debt levels.

Tax Advantages of 401(k) Contributions and Student Loan Interest Deductions

| Feature | 401(k) Contributions | Student Loan Interest Deduction |

|---|---|---|

| Tax Impact | Reduces taxable income, lowering current tax liability. | Reduces taxable income, lowering current tax liability (subject to income limits). |

| Maximum Contribution | Varies annually, set by the IRS. | Limited by IRS rules and adjusted gross income. |

| Tax Benefit Type | Pre-tax contributions; taxes paid upon withdrawal in retirement. | Itemized deduction; reduces taxable income directly. |

| Eligibility | Offered by many employers. | Available to taxpayers who meet specific income and loan criteria. |

Employer-Sponsored 401(k) Plans and Student Loan Debt Management Programs

Many forward-thinking companies recognize the significant financial burdens faced by employees juggling student loan debt and retirement savings. Offering both robust 401(k) matching programs and student loan repayment assistance demonstrates a commitment to employee well-being and can significantly impact employee retention and morale. This approach acknowledges the interconnectedness of these financial priorities and provides tangible support to employees.

The combination of these two benefits creates a powerful incentive for employees, fostering loyalty and productivity. By alleviating some of the financial stress associated with student loans, employees are better positioned to focus on their work and contribute more effectively to the company’s success. Furthermore, the 401(k) matching program encourages long-term financial planning, benefiting both the employee and the company in the long run.

Companies Offering Both 401(k) Matching and Student Loan Repayment Assistance

Several companies are leading the way in offering comprehensive employee benefits packages that include both generous 401(k) matching and student loan repayment assistance. These programs often vary in specifics, such as the matching contribution rate for 401(k) plans and the amount of student loan repayment assistance provided. However, the underlying principle remains consistent: to support employees’ financial well-being. For example, Fidelity Investments is known for its robust 401(k) program and has also incorporated student loan repayment assistance into its benefits package for some employees. Similarly, some tech companies, like Google, have implemented comprehensive financial wellness programs that include both generous 401(k) matching and student loan repayment assistance. While specific details are often confidential and vary based on employee roles and tenure, the trend toward integrating these benefits is evident.

Examples of Successful Employee Programs Combining 401(k) and Student Loan Repayment Benefits

Successful programs often integrate both benefits seamlessly. For instance, a company might offer a matching contribution to the employee’s 401(k) up to a certain percentage of their salary, while simultaneously contributing a fixed amount or a percentage of their student loan payments. This approach ensures that employees receive support for both their immediate debt relief and long-term retirement planning. Another successful model might involve a phased approach, where the student loan repayment assistance is offered for a specific period, perhaps until the loan is paid off, after which the focus shifts more heavily towards maximizing 401(k) contributions. These programs are often tailored to the specific needs and financial situations of the employees. A well-designed program will include clear communication and resources to help employees understand and maximize the benefits available to them.

Potential Impact of Combined Programs on Employee Retention and Morale

Studies have shown a strong correlation between employee benefits and retention. By offering both 401(k) matching and student loan repayment assistance, companies can significantly improve employee satisfaction and loyalty. The reduction in financial stress associated with student loan debt can lead to increased productivity, improved morale, and reduced employee turnover. Employees who feel valued and supported by their employers are more likely to remain with the company for longer periods. This reduces recruitment and training costs for the company and fosters a more stable and experienced workforce.

Tax Implications for Employees Participating in Both Programs

The tax implications of participating in both programs are crucial to understand. Contributions to a 401(k) plan are typically tax-deferred, meaning that taxes are not paid on the contributions until retirement. However, the employer’s matching contributions are considered taxable income for the employee. Student loan repayment assistance, depending on the program structure, may also be considered taxable income. Some programs might structure the assistance as a non-taxable benefit, while others might treat it as supplemental income. It’s essential for employees to consult with a tax professional to understand the specific tax implications of their employer’s programs. Careful planning can help employees minimize their tax liability and maximize the benefits of both programs.

Resources Available to Employees Seeking Guidance on Managing Both 401(k)s and Student Loans

Employees seeking guidance on managing both 401(k)s and student loans have several resources available to them. Many employers offer financial wellness programs that include workshops, seminars, and one-on-one consultations with financial advisors. Independent financial advisors can also provide personalized guidance on developing a comprehensive financial plan that addresses both retirement savings and student loan repayment. Additionally, online resources, such as websites and articles from reputable financial institutions, can offer valuable information and tools to help employees manage their finances effectively. Government websites and non-profit organizations often provide free resources and educational materials related to student loan repayment and retirement planning. Utilizing these resources can empower employees to make informed decisions about their financial future.

The Impact of Student Loan Debt on 401(k) Contribution Rates

The burden of student loan debt significantly impacts an individual’s ability to save for retirement. High monthly payments often leave little room in a budget for additional savings, directly affecting 401(k) participation and contribution levels. This effect is particularly pronounced for younger generations who are simultaneously entering the workforce and grappling with substantial student loan balances. Understanding this interplay is crucial for both individuals navigating these financial challenges and employers seeking to support their employees’ long-term financial well-being.

The correlation between student loan debt and 401(k) participation is demonstrably negative. Studies consistently show that individuals with higher student loan debt are less likely to participate in employer-sponsored retirement plans. This is not simply a matter of choice; it’s a direct consequence of limited disposable income. Many find themselves prioritizing immediate debt repayment over long-term savings, even when faced with the potential loss of employer matching contributions. For example, a recent study by [Insert reputable source and specific findings here, e.g., the Federal Reserve] found that individuals with over $50,000 in student loan debt were [Insert percentage] less likely to contribute to a 401(k) than their debt-free counterparts.

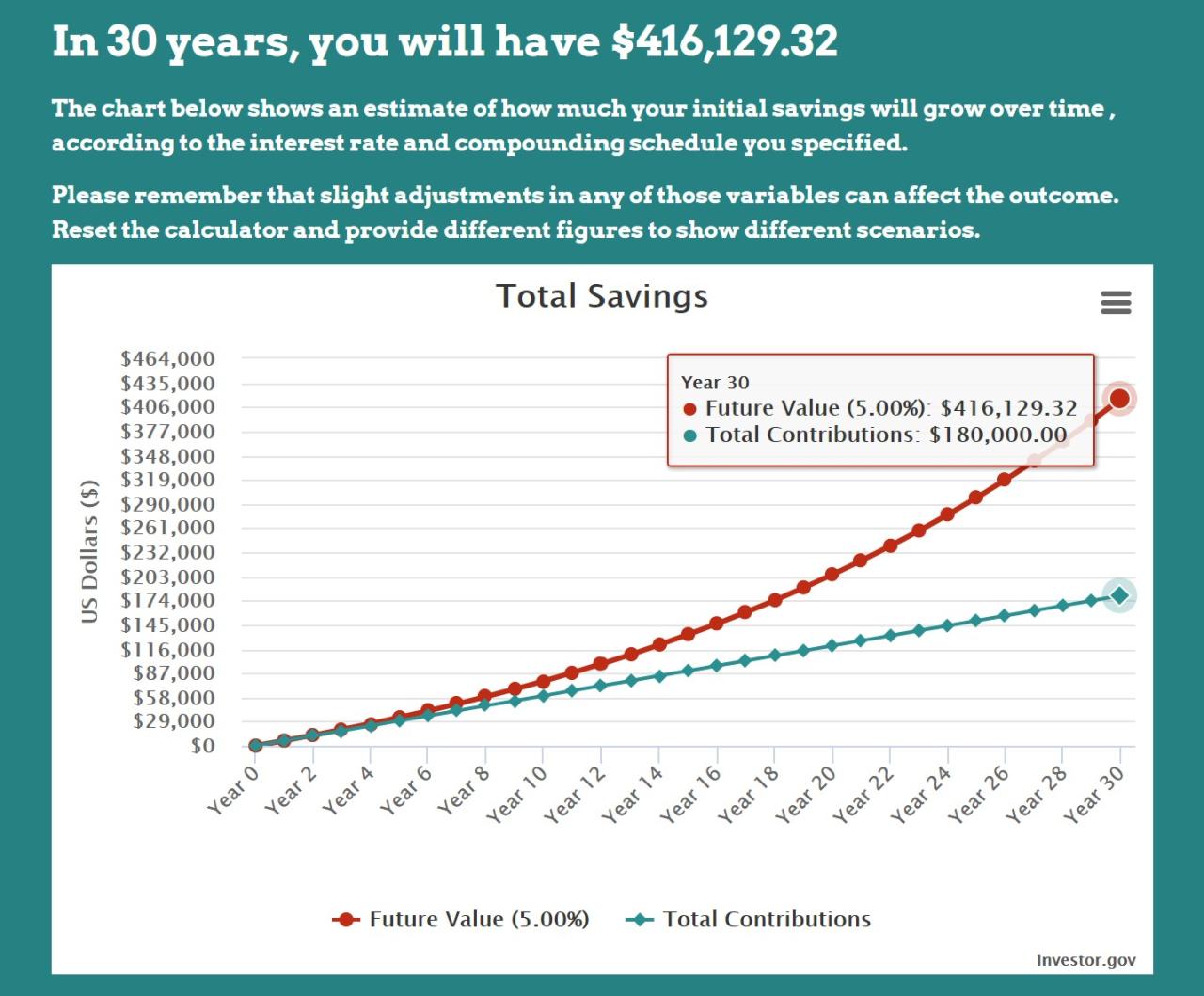

High Student Loan Payments and 401(k) Matching Contributions

High student loan payments directly constrain an individual’s ability to maximize 401(k) matching contributions. Employer matching is essentially free money, yet many individuals struggling with debt find themselves unable to contribute enough to fully capitalize on this benefit. Let’s say an employer offers a 50% match up to 6% of an employee’s salary. An individual earning $50,000 annually would need to contribute $3,000 to receive the full $1,500 employer match. However, if significant portions of their income are allocated to student loan repayments, reaching this contribution level might be financially impossible. This lost opportunity represents a substantial reduction in potential retirement savings.

Long-Term Consequences of Delayed or Reduced 401(k) Contributions

Delaying or reducing 401(k) contributions due to student loan debt carries significant long-term consequences. The power of compounding interest is crucial for retirement savings, and early contributions yield significantly higher returns over time. Missing out on employer matching and foregoing even small contributions can drastically reduce the final retirement nest egg. For instance, delaying contributions for even five years can significantly impact the overall retirement savings, potentially resulting in a shortfall of [Insert example calculation or reference to a study showing the impact of delayed contributions]. This shortfall can lead to a less comfortable retirement, necessitating continued work or a lower standard of living in later years.

Strategies for Contributing to a 401(k) with Significant Student Loan Debt

Individuals with substantial student loan debt can still make meaningful contributions to their 401(k) by implementing strategic financial planning. Prioritizing even small, consistent contributions can significantly impact long-term savings. One effective strategy involves gradually increasing contributions as student loan payments decrease or income increases. Another approach might involve refinancing student loans at a lower interest rate to reduce monthly payments, freeing up funds for retirement savings. Furthermore, exploring options like income-driven repayment plans for student loans can help manage monthly payments and increase the budget for 401(k) contributions.

Steps to Gradually Increase 401(k) Contributions While Managing Student Loan Debt

Individuals can effectively manage both student loan repayments and 401(k) contributions through a phased approach. It’s crucial to start small and gradually increase contributions as financial capacity allows.

- Assess your current budget: Carefully analyze your income and expenses to determine how much you can realistically allocate to your 401(k) without compromising essential needs.

- Start with a small contribution: Begin with a minimal contribution, even if it’s just a small percentage of your income. This establishes a savings habit and allows you to gradually increase contributions over time.

- Automate your contributions: Set up automatic deductions from your paycheck to ensure consistent contributions. This removes the temptation to skip contributions when faced with unexpected expenses.

- Increase contributions incrementally: Once comfortable with your initial contribution, gradually increase the amount by a small percentage each year or whenever your financial situation improves.

- Review and adjust regularly: Periodically review your budget and contribution levels to ensure they align with your financial goals and changing circumstances.

Financial Planning Strategies Considering Both 401(k) and Student Loans

Balancing 401(k) contributions and student loan repayment requires a strategic approach to financial planning. Many young professionals face the challenge of simultaneously building long-term savings for retirement while tackling substantial student loan debt. Effective strategies prioritize both goals, ensuring a secure financial future.

Repayment Strategies: A Comparison

Choosing the right student loan repayment strategy significantly impacts the available funds for 401(k) contributions. Income-driven repayment plans (IDR) like PAYE or REPAYE adjust monthly payments based on income and family size, making them more manageable in the short term. However, they often extend the repayment period, leading to higher overall interest payments. Accelerated repayment, conversely, involves paying more than the minimum monthly payment, shortening the repayment period and minimizing interest accrued. This strategy frees up more money for 401(k) contributions sooner, but requires a higher initial financial commitment. The optimal strategy depends on individual financial circumstances and risk tolerance.

The Role of Financial Advisors

Financial advisors provide invaluable guidance in navigating the complexities of managing both 401(k)s and student loans. They create personalized financial plans, considering factors like income, debt levels, risk tolerance, and retirement goals. Advisors help individuals prioritize debt repayment versus 401(k) contributions, taking into account employer matching contributions and the potential tax advantages of 401(k) investments. They also offer advice on budgeting, investment strategies, and overall financial health. A financial advisor acts as a crucial resource, ensuring a balanced approach that maximizes both short-term debt reduction and long-term retirement savings.

Realistic Financial Scenarios and Recommended Approaches

Consider two scenarios: Scenario A: A young professional earning $60,000 annually with $50,000 in student loan debt and a 401(k) with a 50% employer match up to 6% of salary. Scenario B: A similar professional but with $20,000 in student loan debt. In Scenario A, an initial focus on aggressive student loan repayment, possibly utilizing the avalanche method (prioritizing high-interest loans first), while maximizing the employer match in the 401(k) is advisable. Once a significant portion of the debt is repaid, the 401(k) contribution rate can be increased. In Scenario B, a more balanced approach might be suitable, allocating a larger percentage of income to both student loan repayment and 401(k) contributions from the outset, leveraging the employer match.

Infographic: Integrating 401(k) Planning and Student Loan Management

The infographic would visually represent the interplay between 401(k) contributions and student loan repayment. One section could depict a flowchart outlining the decision-making process, beginning with assessing income and debt levels, followed by choosing a repayment strategy (IDR vs. accelerated), and finally determining 401(k) contribution rates, considering employer matching. Another section would illustrate the potential long-term financial outcomes of different strategies, using a bar graph comparing total interest paid on student loans and accumulated 401(k) balances under various scenarios. A third section could display a pie chart illustrating a sample budget allocation, showing percentages dedicated to housing, food, transportation, student loan payments, 401(k) contributions, and other expenses. Finally, a table would summarize the advantages and disadvantages of different repayment strategies (IDR vs. accelerated), highlighting factors like monthly payment amounts, total interest paid, and time to repayment. The overall visual design would be clean and easily understandable, emphasizing the interconnectedness of short-term debt management and long-term retirement planning.

Government Policies and Initiatives Related to 401(k)s and Student Loan Debt

The interplay between retirement savings and student loan repayment is a significant concern for many Americans, prompting various government interventions. Understanding these policies is crucial for individuals navigating both financial responsibilities. This section will examine existing government policies, analyze their effectiveness, and explore potential future impacts on both 401(k)s and student loans.

Existing Government Policies Impacting 401(k) Contributions and Student Loan Repayment

Several federal policies directly or indirectly influence both 401(k) participation and student loan repayment. The Saver’s Credit, for example, offers a tax credit to low-to-moderate-income taxpayers who contribute to a retirement account, including 401(k)s. This incentivizes retirement savings, particularly for those who may be struggling with student loan debt. Conversely, income-driven repayment (IDR) plans for student loans adjust monthly payments based on income, potentially freeing up more funds for 401(k) contributions. However, the long repayment periods under IDR plans can lead to higher overall interest paid, impacting long-term financial health. Tax advantages associated with 401(k) contributions, such as pre-tax contributions and tax-deferred growth, also indirectly influence repayment strategies by providing a powerful incentive to prioritize retirement savings.

Effectiveness of Government Initiatives Addressing Student Loan Debt

The effectiveness of various government initiatives aimed at addressing student loan debt is a complex issue. Income-driven repayment plans, while providing short-term relief, can result in substantial interest accrual over the loan’s life. Loan forgiveness programs, such as the Public Service Loan Forgiveness (PSLF) program, have faced criticism due to stringent eligibility requirements and administrative challenges. While designed to incentivize public service, the program’s complexity has resulted in low success rates for many applicants. Conversely, initiatives focusing on preventative measures, such as increased financial literacy programs for prospective college students and streamlined loan application processes, could prove more effective in the long run by reducing the burden of student loan debt.

Potential Impact of Future Policy Changes on 401(k)s and Student Loans

Future policy changes could significantly alter the landscape of both 401(k)s and student loan repayment. Proposals for increased student loan forgiveness could free up significant disposable income, potentially leading to higher 401(k) contribution rates. However, such large-scale forgiveness programs would have significant budgetary implications. Conversely, changes to 401(k) regulations, such as increased matching contributions from employers or automatic enrollment features, could significantly boost retirement savings rates. These changes, however, may need to be carefully balanced with other economic considerations. For example, a hypothetical increase in the Saver’s Credit could stimulate retirement savings, but its effectiveness depends on factors like the credit’s magnitude and the overall economic climate. A significant economic downturn might render even generous credits less impactful.

Examples of Successful Government Programs Supporting Retirement Savings and Student Loan Repayment

While no single program perfectly addresses both retirement savings and student loan repayment, some initiatives have shown promise. The MyRA (My Retirement Account) program, while discontinued, provided a low-risk, low-fee retirement savings option for low-income individuals. Its success lay in its simplicity and accessibility. Similarly, state-sponsored programs offering financial literacy education to high school and college students can proactively address the challenges of student loan debt and responsible financial planning. These programs equip students with the knowledge and tools to make informed decisions about higher education financing and long-term financial goals. The success of such programs can be measured by increased student awareness of financial planning and reduced instances of excessive borrowing.

Resources for Individuals Seeking Information on Government Programs Related to 401(k)s and Student Loans

Individuals seeking information on government programs can access resources from several federal agencies. The Department of the Treasury offers information on tax credits and retirement savings plans, while the Department of Education provides details on student loan repayment options and forgiveness programs. The websites of these agencies, along with independent financial literacy organizations, offer valuable information and tools to assist individuals in navigating these complex financial matters. Additionally, many non-profit organizations provide free financial counseling and assistance.

Conclusive Thoughts

Successfully managing both student loan debt and 401(k) contributions requires careful planning and a clear understanding of the long-term financial implications of each. By strategically balancing immediate debt reduction with the power of compounding returns in a 401(k), individuals can build a strong financial foundation for both their present and future. Remember to leverage available resources, including financial advisors and employer-sponsored programs, to navigate this complex financial landscape effectively.

FAQ Compilation

Can I contribute to my 401(k) if I’m still paying off student loans?

Absolutely. Even small contributions to your 401(k), especially if matched by your employer, can significantly benefit your long-term financial health. Prioritize what you can afford while still making progress on your student loans.

What if my employer doesn’t offer student loan repayment assistance?

Explore options like income-driven repayment plans for your student loans, which can lower your monthly payments. Focus on maximizing your 401(k) contributions, especially if you have an employer match, as this is essentially free money.

Are there tax benefits to both 401(k) contributions and student loan interest?

Yes. 401(k) contributions are often tax-deductible, reducing your taxable income. Additionally, you may be able to deduct student loan interest payments on your tax return, though there are income limitations.

How can I balance both student loan payments and 401k contributions on a tight budget?

Create a detailed budget to track your income and expenses. Prioritize essential expenses and explore ways to reduce non-essential spending. Consider automating your 401(k) contributions and student loan payments to ensure consistent progress.