Navigating the world of student loans can be daunting, especially when faced with ambiguous terms like “5 3 Bank student loans.” This phrase, likely a misspelling or a shorthand reference, points to the broader challenge of securing funding for higher education. This guide will delve into the various types of student loans available, highlighting the differences between federal and private options, and examining the intricacies of interest rates, repayment plans, and the application process. We’ll also explore the potential risks and provide strategies for effectively managing student loan debt after graduation.

Understanding the nuances of bank student loans is crucial for prospective students and their families. Making informed decisions requires a thorough grasp of available options, associated costs, and long-term financial implications. This guide aims to empower you with the knowledge necessary to make sound choices and navigate the complexities of student loan financing successfully.

Understanding the “5 3 Bank Student Loans” Phrase

The phrase “5 3 Bank Student Loans” is ambiguous and likely a misspelling or a colloquialism. It doesn’t correspond to a known, established bank or a standard student loan program. Understanding its meaning requires exploring potential interpretations of “5 3 Bank” and how it might be used within the context of student loan searches or discussions.

The phrase likely arises from a misunderstanding or a typographical error. “5 3 Bank” could be a misremembered or incorrectly typed name of a financial institution. It’s possible the user intended to refer to a bank with a name similar to “5/3 Bank” (which is a regional bank, now known as Fifth Third Bank). Alternatively, “5 3” might be a completely unrelated element misinterpreted within the context of student loans.

Possible Interpretations of “5 3 Bank”

The most probable interpretation of “5 3 Bank” is a misspelling of “Fifth Third Bank,” a significant regional bank in the United States offering various financial products, potentially including student loans. Other possibilities, though less likely, involve a completely different financial institution whose name is similar, or even a completely unrelated phrase mistakenly associated with student loans. The numbers “5” and “3” might be unrelated to the bank’s name and instead represent something else entirely, such as a specific loan program code, a mistaken interest rate, or a part of a loan identifier.

Interpretations of “5 3” in the Context of Student Loans

The numerical portion “5 3” could be interpreted in several ways, none of which are definitively linked to a standard student loan program or feature. For example, it could represent:

A mistakenly recalled interest rate: Someone might remember a loan with an interest rate around 5.3% and misrepresent it in this form. For example, a student might recall, “I had a loan with a 5.3% interest rate from 5/3 Bank,” when they actually meant Fifth Third Bank.

A misremembered loan term: Perhaps the “5” refers to a five-year repayment plan, and the “3” is some other unrelated detail. This is purely speculative, as there’s no standard loan product using this combination.

Part of a loan identification number: The numbers could be a fragmented part of a much larger loan identification number, accidentally isolated and misinterpreted. This is more likely if the phrase appeared in an informal conversation.

Examples of the Phrase’s Use

The phrase “5 3 Bank Student Loans” might appear in online searches made by individuals who misremembered or misspelled the bank’s name. For instance, a student seeking information on their loan might type “5 3 bank student loan login” into a search engine. In online forums or social media discussions, someone might mention “I got my student loan from 5 3 Bank,” again due to a misspelling or misremembering of the actual bank name. These examples highlight the importance of accurate information when discussing financial matters, especially regarding student loans.

Types of Student Loans Offered by Banks

Banks offer a range of student loan products designed to help students finance their education. These loans differ significantly in their terms, eligibility requirements, and repayment options, making it crucial for prospective borrowers to understand the distinctions before applying. Choosing the right loan depends heavily on individual financial circumstances and the type of educational program being pursued.

While the specific offerings vary between banks, most commonly provide private student loans. These loans are distinct from federal student loans, which are offered by the government and typically have more favorable terms. Private loans are subject to the bank’s lending criteria and interest rates, which can fluctuate based on market conditions and the borrower’s creditworthiness. Subsidized and unsubsidized loans are categories within the federal student loan system, and are not generally offered directly by banks.

Private Student Loans

Private student loans are offered by banks and other private lenders. These loans are not backed by the government, meaning that the interest rates are usually higher and eligibility requirements are more stringent. Lenders assess applicants based on their credit history, income, and debt-to-income ratio. The interest rates on private loans are variable, meaning they can change over the life of the loan, or fixed, remaining consistent throughout the repayment period. Borrowers should carefully compare interest rates and fees from different lenders before selecting a private student loan. For example, a student with excellent credit might qualify for a lower interest rate than a student with limited credit history.

Eligibility Criteria for Private Student Loans

Eligibility for private student loans typically involves meeting several key criteria. These often include having a credit history (though some lenders offer co-signer options for students without established credit), demonstrating sufficient income or having a co-signer with sufficient income, and maintaining satisfactory academic standing at an eligible educational institution. Lenders may also consider factors such as the length of the loan term, the total amount borrowed, and the type of degree being pursued. Meeting these criteria increases the likelihood of loan approval and potentially secures a more favorable interest rate. For example, a student applying with a parent as a co-signer who has a strong credit history and stable income will likely have a better chance of approval and a lower interest rate than a student applying without a co-signer and limited income.

Interest Rates and Repayment Options

Securing a student loan involves understanding the associated costs and repayment structures. Interest rates and repayment plans significantly impact the overall cost and manageability of your loan. Choosing the right loan and repayment plan is crucial for responsible financial planning.

Understanding the interest rate is paramount. It determines the additional cost you’ll pay above the principal loan amount. Repayment plans, conversely, dictate how you’ll pay back the loan over time, influencing your monthly payments and the total interest accrued. Let’s delve into these critical aspects.

Typical Interest Rates and Repayment Periods for Bank Student Loans

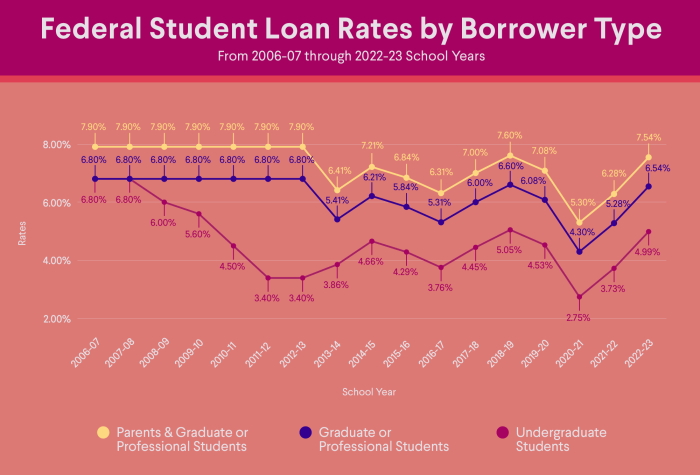

Interest rates for bank student loans vary depending on several factors, including creditworthiness, the type of loan, and prevailing market conditions. The following table provides a general overview. Note that these are illustrative ranges and actual rates may differ. Always check with the specific bank for the most up-to-date information.

| Loan Type | Interest Rate Range (Approximate) | Repayment Period Options | Additional Fees |

|---|---|---|---|

| Federal Subsidized Loan | 4.5% – 7.5% | 5-10 years, potentially longer with forbearance | Origination fees (typically 1% of loan amount) |

| Federal Unsubsidized Loan | 5% – 8% | 5-10 years, potentially longer with forbearance | Origination fees (typically 1% of loan amount) |

| Private Bank Loan (Variable) | 6% – 12% (Variable) | 5-15 years | Origination fees, late payment fees |

| Private Bank Loan (Fixed) | 7% – 10% (Fixed) | 5-15 years | Origination fees, prepayment penalties (in some cases) |

Bank Student Loan Repayment Plans

Banks offer various repayment plans to cater to different financial situations. Understanding these options is vital for selecting a plan that aligns with your post-graduation income and financial goals.

Common repayment plans include:

- Standard Repayment: Fixed monthly payments over a set period (typically 10 years).

- Graduated Repayment: Payments start low and gradually increase over time.

- Extended Repayment: Longer repayment period (potentially up to 25 years), resulting in lower monthly payments but higher total interest paid.

- Income-Driven Repayment (IDR): Monthly payments are calculated based on your income and family size. This option is often available for federal student loans, but some private lenders may offer similar programs. These plans usually involve forgiveness after 20-25 years of payments.

Hypothetical Repayment Schedule for a $20,000 Student Loan

The following table illustrates a simplified repayment schedule for a $20,000 loan at different interest rates, assuming a 10-year repayment period and standard repayment plan. Actual repayment amounts may vary based on the specific loan terms and repayment plan selected.

| Interest Rate | Monthly Payment (Approximate) | Total Interest Paid (Approximate) |

|---|---|---|

| 5% | $212 | $2,500 |

| 7% | $228 | $3,400 |

| 9% | $245 | $4,300 |

Note: These calculations are simplified and do not include potential fees or changes in interest rates. It is crucial to consult with your lender for precise repayment calculations.

Application Process and Required Documentation

Securing a student loan from 5/3 Bank involves a straightforward application process, but understanding the steps and required documentation is crucial for a smooth experience. Careful preparation will significantly expedite the loan approval process.

The application process typically consists of several key steps. It’s important to note that specific requirements may vary slightly depending on the type of loan and your individual circumstances.

Steps in the 5/3 Bank Student Loan Application Process

Applying for a student loan usually involves these steps: First, you’ll need to pre-qualify to understand your potential loan terms. Next, you’ll complete the formal application, providing all necessary documentation. Following this, the bank will review your application and supporting documents. Finally, once approved, you’ll receive your loan disbursement. Remember to carefully review all loan terms and conditions before accepting the loan.

- Pre-qualification: Determine your eligibility and potential loan terms.

- Complete the Application: Fill out the application form accurately and completely.

- Document Submission: Provide all necessary supporting documents.

- Application Review: The bank reviews your application and supporting documents.

- Loan Disbursement: Upon approval, funds are disbursed according to the loan agreement.

Required Documentation for a 5/3 Bank Student Loan Application

Gathering the necessary documents beforehand will streamline the application process. Missing documents can cause delays in processing your loan application. Ensure all documents are accurate and up-to-date.

- Completed Application Form: The official application form from 5/3 Bank.

- Proof of Identity: Government-issued photo identification (e.g., driver’s license, passport).

- Social Security Number (SSN): Required for verification and loan processing.

- Student Status Verification: Acceptance letter or enrollment confirmation from your educational institution.

- Financial Aid Award Letter (if applicable): Details of any financial aid received.

- Parent’s Financial Information (if applicable): Depending on the loan type, this may include tax returns and bank statements.

- Bank Statements: Proof of sufficient funds (if required for co-signer or other related financial obligations).

Verification Process for 5/3 Bank Student Loan Applications

5/3 Bank employs a rigorous verification process to assess the creditworthiness of applicants and ensure responsible lending practices. This involves checking the information provided in the application against external databases and reviewing supporting documentation.

The verification process typically involves: Firstly, confirming your identity and student status. Secondly, verifying your financial information, including income and credit history. Thirdly, assessing your ability to repay the loan based on your financial situation. Finally, reviewing any co-signer’s financial information, if applicable. This thorough process aims to minimize risk for both the borrower and the bank.

Comparing Bank Student Loans to Other Options

Choosing the right financing for your higher education is a crucial decision impacting your financial future. Understanding the differences between various funding options is key to making an informed choice. This section compares bank student loans with federal student loans and explores alternative funding sources, helping you determine the best path for your specific circumstances.

Bank student loans and federal student loans represent two distinct avenues for financing higher education, each with its own set of advantages and disadvantages. Understanding these differences is critical in selecting the most suitable option for your individual financial profile and educational goals. Additionally, exploring alternative options such as scholarships and grants can significantly reduce your reliance on loans.

Federal Student Loans versus Bank Student Loans

Federal student loans and bank student loans differ significantly in their eligibility criteria, interest rates, repayment options, and overall terms. Federal student loans, offered by the U.S. Department of Education, generally offer more favorable terms and greater borrower protections. They often come with lower interest rates and flexible repayment plans, including income-driven repayment options. However, eligibility is based on financial need and credit history may not be a factor for some programs. Bank student loans, on the other hand, are offered by private financial institutions and are typically subject to credit checks and higher interest rates. While they may offer larger loan amounts, they often lack the same borrower protections as federal loans. For example, federal loans often have deferment and forbearance options unavailable with private loans.

Alternative Financing Options for Higher Education

Beyond federal and bank loans, several alternative financing options exist to help fund higher education. These options can significantly reduce the amount of debt students accumulate. Scholarships, grants, and work-study programs provide valuable financial assistance without requiring repayment.

Comparison of Key Features

The following table summarizes the key features of bank loans, federal loans, and scholarships, allowing for a direct comparison to aid in decision-making.

| Feature | Bank Student Loans | Federal Student Loans | Scholarships/Grants |

|---|---|---|---|

| Interest Rates | Generally higher, variable or fixed; dependent on creditworthiness. | Generally lower, fixed or variable; dependent on loan type and program. | None; no repayment required. |

| Eligibility | Credit check required; income and credit history considered. | Based on financial need and enrollment status; credit history may not be a factor for some programs. | Varies widely based on merit, need, and specific criteria of the awarding institution or organization. |

| Repayment Options | Typically standard repayment plans; may offer limited options. | Variety of repayment plans, including income-driven repayment. | No repayment required. |

| Borrower Protections | Fewer borrower protections than federal loans. | Strong borrower protections, including deferment and forbearance options. | N/A |

Potential Risks and Considerations

Taking out student loans, even from a reputable bank like 5/3 Bank, involves inherent risks that borrowers should carefully consider before signing on the dotted line. Failing to fully understand these risks can lead to significant financial hardship down the road. It’s crucial to weigh the benefits of higher education against the potential long-term consequences of accumulating student loan debt.

Understanding the loan terms and conditions is paramount. This isn’t simply about skimming the paperwork; it requires a thorough understanding of interest rates, repayment schedules, fees, and any potential penalties for late or missed payments. A seemingly small difference in interest rates can translate into thousands of dollars in extra costs over the life of the loan. Similarly, understanding the repayment options and their implications for your future financial stability is critical.

High Interest Rates and Debt Burden

High interest rates significantly increase the total cost of a student loan. For example, a $20,000 loan with a 7% interest rate will cost considerably more than the same loan with a 5% interest rate over the same repayment period. This difference compounds over time, potentially leading to a substantial debt burden that can impact major life decisions such as buying a home, starting a family, or investing in retirement. Careful consideration of the interest rate and its impact on the total repayment amount is essential.

Calculating the Total Cost of a Student Loan

Accurately calculating the total cost of a student loan requires understanding the loan’s principal amount, interest rate, and repayment terms. A simple calculation isn’t sufficient; using an amortization schedule (easily found online) provides a detailed breakdown of principal and interest payments over the loan’s lifespan.

Total Cost = Principal + (Principal x Interest Rate x Loan Term)

This formula provides a basic estimate. However, it’s important to factor in additional fees, such as origination fees, which are typically charged upfront and add to the overall cost. For a more precise calculation, online loan calculators or amortization schedules should be used. For instance, a $30,000 loan at 6% interest over 10 years would likely have a significantly higher total repayment amount than the same loan over 5 years, even though the monthly payments might be lower in the 10-year plan. The longer the repayment period, the more interest will accrue.

Importance of Understanding Loan Terms and Conditions

Before borrowing, carefully review all loan documents. This includes understanding the interest rate (fixed or variable), repayment schedule (e.g., standard, graduated, income-driven), deferment and forbearance options, and any prepayment penalties. Failure to understand these terms can result in unexpected costs and financial difficulties. For example, a variable interest rate can fluctuate, potentially increasing your monthly payments, while a prepayment penalty could discourage you from paying off your loan early, even if you have the means to do so. The consequences of not understanding these terms can be severe, potentially leading to default and damage to your credit score.

Managing Student Loan Debt

Graduating with student loan debt is a common experience, but effective management is crucial for long-term financial well-being. Understanding various strategies and available options can significantly impact your ability to repay your loans efficiently and minimize their overall financial burden. This section will explore practical strategies for managing your student loan debt, refinancing and consolidation options, and the importance of budgeting and financial planning.

Successfully navigating student loan repayment requires a proactive and organized approach. It’s essential to understand your loan terms, repayment options, and available resources to develop a personalized repayment plan that aligns with your financial situation and goals.

Strategies for Effective Student Loan Debt Management

Implementing these strategies can help you effectively manage your student loan debt and work towards becoming debt-free sooner.

- Create a Realistic Budget: Track your income and expenses meticulously to identify areas where you can reduce spending and allocate funds towards loan repayment. A detailed budget allows you to prioritize loan payments and avoid unnecessary debt accumulation.

- Prioritize High-Interest Loans: Focus on repaying loans with the highest interest rates first to minimize the total interest paid over the life of the loans. This strategy can save you significant money in the long run.

- Explore Repayment Plans: Investigate different repayment plans offered by your loan servicers, such as income-driven repayment (IDR) plans. IDR plans adjust your monthly payments based on your income and family size, potentially lowering your monthly payments but extending the repayment period.

- Make Extra Payments When Possible: Even small extra payments can significantly reduce the principal balance and shorten the repayment period. Consider making bi-weekly payments instead of monthly payments to make more frequent payments.

- Automate Payments: Set up automatic payments to ensure consistent and timely payments, avoiding late fees and negative impacts on your credit score.

Loan Refinancing and Consolidation Options

Refinancing and consolidation can simplify loan repayment and potentially lower your monthly payments or interest rate. However, it’s crucial to carefully evaluate the terms before making a decision.

Refinancing involves replacing your existing student loans with a new loan from a different lender, often at a lower interest rate. This can lead to lower monthly payments and faster repayment. However, refinancing might extend your repayment period, increasing the total interest paid if you don’t pay down the principal faster.

Consolidation combines multiple student loans into a single loan, simplifying repayment management. This can streamline the repayment process but might not always lower your interest rate. The interest rate on a consolidated loan is typically a weighted average of your existing loan interest rates.

Budgeting and Financial Planning for Student Loan Debt

A well-structured budget and financial plan are essential for effectively managing student loan debt and achieving long-term financial goals. These steps will help you navigate the complexities of student loan repayment and build a strong financial foundation.

- Develop a Comprehensive Budget: Create a detailed budget that tracks all income and expenses, allocating sufficient funds for loan repayments, essential living expenses, and savings.

- Prioritize Emergency Savings: Build an emergency fund to cover unexpected expenses, preventing you from falling behind on loan payments due to unforeseen circumstances. Aim for 3-6 months of living expenses in your emergency fund.

- Set Realistic Financial Goals: Define short-term and long-term financial goals, such as buying a house or investing, and integrate student loan repayment into your overall financial plan.

- Regularly Review and Adjust Your Plan: Your financial situation may change over time, so it’s essential to review and adjust your budget and repayment plan periodically to ensure it remains aligned with your current circumstances.

Last Point

Securing funding for higher education is a significant step, and understanding the intricacies of student loans is paramount. While the term “5 3 Bank student loans” might be unclear, the underlying principles of responsible borrowing remain consistent. By carefully considering your options, comparing interest rates and repayment plans, and diligently managing your debt, you can achieve your educational goals without undue financial strain. Remember to always read the fine print, seek professional advice if needed, and prioritize financial literacy to ensure a secure financial future.

Essential FAQs

What does “5 3 Bank” likely refer to in the context of student loans?

It’s probably a misspelling or an informal abbreviation, not a specific bank or loan program. It’s best to search using more precise terms like the name of a specific bank offering student loans.

Are bank student loans always more expensive than federal loans?

Generally, yes. Private bank loans often carry higher interest rates than federal loans, especially for borrowers with less-than-perfect credit. However, federal loan options may have limits on borrowing amounts.

What happens if I can’t repay my student loans?

Defaulting on student loans has serious consequences, including damage to your credit score, wage garnishment, and potential legal action. Explore options like deferment, forbearance, or income-driven repayment plans if you’re struggling.

Can I refinance my student loans to lower my interest rate?

Yes, refinancing can potentially lower your interest rate and monthly payments, but it’s crucial to compare offers carefully and ensure the new loan terms are beneficial. Refinancing often involves a new loan with a different lender.