Navigating the complexities of student loan debt often feels like an uphill battle. While traditional repayment strategies exist, exploring alternative options can significantly impact your financial future. This exploration delves into the potential of utilizing 529 plans, typically associated with college savings, as a tool to manage and potentially reduce student loan burdens. We’ll examine the tax implications, legal considerations, and financial planning strategies involved in this unconventional approach.

This guide provides a comprehensive overview of using 529 plans for student loan repayment, covering the advantages and disadvantages, along with practical steps to determine its suitability for your individual circumstances. We’ll dissect the intricacies of 529 plan withdrawals for non-qualified expenses, compare this strategy against traditional repayment methods, and illustrate its impact on overall financial planning. Real-world examples will help clarify the financial implications and guide you toward making informed decisions.

Understanding 529 Plans

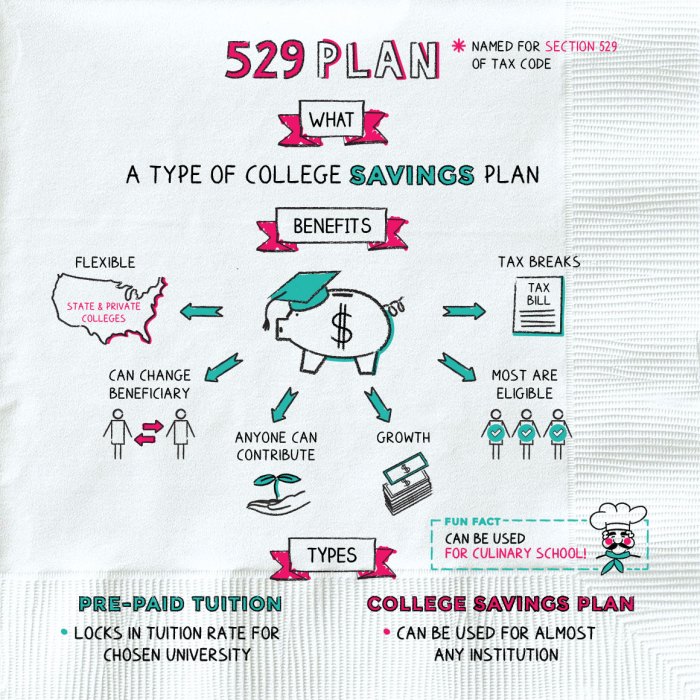

529 plans are tax-advantaged savings plans designed to encourage saving for future education expenses. They offer significant benefits for families looking to fund college or other qualified education costs, and understanding their mechanics is crucial for maximizing their potential. This section will delve into the key features and considerations of 529 plans.

Tax Advantages of 529 Plans

The primary advantage of a 529 plan lies in its tax benefits. Earnings grow tax-deferred, meaning you don’t pay taxes on investment gains until you withdraw the money for qualified education expenses. Furthermore, withdrawals used for qualified education expenses are generally tax-free at the federal level. This double tax advantage significantly boosts the long-term growth potential of your savings. State tax benefits also vary, with some states offering deductions or credits for contributions made to their state’s 529 plan. It’s important to check your state’s specific tax laws to determine any applicable deductions or credits.

Types of 529 Plans

There are two main types of 529 plans: state-sponsored and private. State-sponsored plans are offered by individual states and often come with in-state tax benefits. Private plans, managed by financial institutions, are not tied to a specific state and may offer a broader range of investment options. The choice between the two depends on individual circumstances, including state residency and investment preferences. State-sponsored plans may offer lower fees or specific benefits to residents of that state, while private plans often provide greater investment flexibility.

529 Plan Investment Options and Risks

529 plans typically offer a variety of investment options, ranging from age-based portfolios (which automatically adjust their risk profile over time) to individual stock and bond funds. Age-based portfolios are generally considered lower-risk, suitable for long-term savings, while individual funds allow for more customized investment strategies, potentially offering higher returns but also greater risk. The risk level of any investment option depends on the underlying assets. Investments in stocks, for example, carry more risk than investments in bonds, but also potentially offer higher returns. It’s essential to carefully consider your risk tolerance and time horizon when selecting investment options. Diversification across asset classes is a common strategy to mitigate risk.

529 Plan Fees

Fees associated with 529 plans can vary significantly depending on the plan provider and the specific investment options chosen. It is crucial to compare fees before selecting a plan. High fees can significantly impact long-term returns. The following table provides a simplified comparison, and it’s essential to consult each plan’s individual fee schedule for complete details.

| Plan Name | Annual Fee | Investment Management Fee | Transaction Fees |

|---|---|---|---|

| Example State Plan A | $0.10 per $1000 | 0.20% | Variable |

| Example State Plan B | $0.05 per $1000 | 0.15% | $10 per transaction |

| Example Private Plan C | $0.15 per $1000 | 0.25% | $5 per transaction |

| Example Private Plan D | $0.00 per $1000 | 0.30% | Variable |

Student Loan Repayment Strategies

Navigating student loan repayment can feel overwhelming, but understanding the available options and their implications is crucial for effective financial planning. Several repayment plans exist, each with its own set of advantages and disadvantages, impacting your monthly payments and overall repayment timeline. The strategic use of a 529 plan can sometimes offer an additional, albeit unconventional, approach.

Common Student Loan Repayment Plans

Different repayment plans cater to various financial situations. Standard repayment involves fixed monthly payments over a 10-year period. Income-driven repayment plans, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE), tie monthly payments to your income and family size, resulting in lower monthly payments but potentially extending the repayment period. Extended repayment plans stretch payments over a longer period (up to 25 years), lowering monthly payments but increasing the total interest paid. Finally, graduated repayment plans start with lower payments that gradually increase over time. The choice depends on your income, financial goals, and risk tolerance. Careful consideration of the long-term implications of each plan is essential.

Using a 529 Plan for Student Loan Repayment: Benefits and Drawbacks

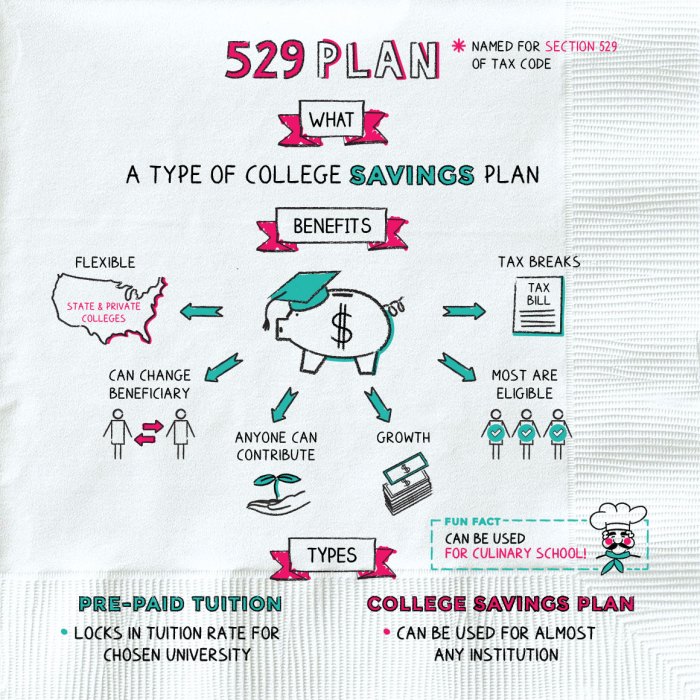

While primarily designed for qualified education expenses like tuition and fees, 529 plans can be used to pay off student loans, though this is generally not recommended. A potential benefit is the avoidance of federal student loan interest, which can significantly reduce the overall cost of borrowing. However, this comes with substantial drawbacks. The primary disadvantage is the 10% tax penalty on non-qualified withdrawals (those not used for qualified education expenses), plus the repayment of any earnings on the investment. This penalty significantly diminishes the potential savings and can make this strategy financially unviable in most cases. Furthermore, the funds in a 529 plan could potentially grow more efficiently if invested for future educational expenses for other family members.

Tax Consequences of Non-Qualified 529 Plan Withdrawals

Withdrawing funds from a 529 plan for non-qualified expenses, such as student loan repayment, incurs a 10% federal tax penalty on the earnings portion of the withdrawal. The original contributions are generally not taxed, but the investment gains are subject to this penalty. Additionally, the withdrawal may also be subject to state income tax, depending on your state’s regulations. For example, if you withdraw $10,000 from a 529 plan, with $2,000 representing earnings, you’ll owe a $200 penalty ($2,000 x 0.10) plus income tax on the $2,000 earnings. This underscores the importance of carefully weighing the potential tax implications before using a 529 plan for student loan repayment.

Determining the Financial Viability of Using a 529 Plan for Student Loan Repayment

A step-by-step approach is crucial to assess the financial viability of this strategy.

- Calculate the total amount of student loan debt: Determine the principal balance of all your student loans.

- Assess the 529 plan balance: Determine the current balance in your 529 plan, including both contributions and earnings.

- Estimate the tax penalty: Calculate the potential 10% tax penalty on the earnings portion of the withdrawal. This requires differentiating between contributions and earnings within the 529 plan.

- Compare the net amount available after taxes: Subtract the estimated tax penalty from the 529 plan balance to determine the net amount available for student loan repayment.

- Compare to alternative repayment strategies: Analyze the cost savings compared to standard student loan repayment plans, considering interest accrual and the extended repayment period.

- Consider opportunity cost: Evaluate the potential for higher returns if the 529 plan funds remain invested for future qualified education expenses.

Only if the net amount available after taxes significantly offsets the interest accrued on the student loans and outperforms other repayment strategies should this approach be considered. In most cases, other strategies will be more financially advantageous.

Legal and Regulatory Considerations

Using a 529 plan to pay for student loans involves navigating specific IRS rules and regulations. Understanding these rules is crucial to avoid unexpected tax penalties and ensure the plan’s effectiveness. Misuse can lead to significant financial repercussions, so careful planning and awareness are paramount.

IRS Rules and Regulations Governing Non-Qualified Withdrawals

Withdrawals from a 529 plan for expenses other than qualified education expenses are considered non-qualified withdrawals. The IRS defines qualified education expenses as tuition, fees, books, supplies, and room and board for courses taken at an eligible educational institution. Student loan repayment is explicitly *not* considered a qualified education expense. Therefore, any funds withdrawn for this purpose are subject to income tax on the earnings portion of the withdrawal, plus a 10% penalty. This penalty applies to the earnings portion of the account, not the original contributions. For example, if you contribute $10,000 and the account grows to $12,000, only the $2,000 in earnings would be subject to the tax and penalty. Exceptions may exist for certain disabilities.

Penalties for Non-Qualified Withdrawals

The primary penalty for non-qualified withdrawals is the aforementioned 10% tax on earnings, in addition to the income tax owed on those earnings. This means the overall tax burden can be substantial. For instance, if the earnings portion is $5,000 and you are in a 22% tax bracket, you’d owe $1,100 in income tax ($5,000 * 0.22) plus $500 in penalty ($5,000 * 0.10), for a total of $1,600. It’s vital to consult a tax professional to understand the full tax implications in your specific situation. Furthermore, state tax implications may also exist, varying by state.

Legal Implications of Using a 529 Plan for Student Loan Repayment vs. Other Debt Repayment Strategies

Using a 529 plan for student loan repayment differs significantly from using it for qualified education expenses or other debt repayment strategies. While using 529 funds for qualified education expenses is tax-advantaged, using them for student loans incurs significant tax penalties. In contrast, repaying other types of debt, such as credit card debt or personal loans, generally doesn’t have the same tax consequences as a non-qualified 529 withdrawal. Strategically, paying down high-interest debt may be a more financially prudent approach than incurring penalties from a 529 withdrawal.

Potential Legal Ramifications of Using 529 Plan Funds for Student Loan Repayment

The potential legal ramifications primarily revolve around the tax consequences detailed above. These include:

- Income tax on the earnings portion of the withdrawal.

- A 10% additional tax penalty on the earnings portion of the withdrawal.

- Potential state income taxes on the earnings portion of the withdrawal (depending on the state).

- Increased overall tax liability compared to using the funds for qualified education expenses or other debt repayment strategies.

It’s crucial to weigh these potential tax liabilities against the benefits of using the 529 funds for student loan repayment before making a decision. Professional financial and tax advice is highly recommended.

Financial Planning Aspects

Integrating 529 plan withdrawals into a comprehensive financial plan for student loan repayment requires careful consideration of various factors, including the total loan amount, interest rates, repayment terms, and the available funds within the 529 plan. A well-structured plan will optimize the use of these resources to minimize the overall cost of borrowing and accelerate debt reduction.

Incorporating 529 plan withdrawals into a student loan repayment strategy requires a holistic approach that accounts for all financial resources and obligations. This involves analyzing the student’s current financial situation, including income, expenses, and existing debts, alongside the 529 plan’s balance and the terms of their student loans. Strategic withdrawal planning can significantly reduce the overall interest paid on loans, potentially saving thousands of dollars over the life of the debt.

Scenarios Where Using a 529 Plan for Student Loan Repayment Is Advantageous

Using a 529 plan for student loan repayment can be particularly beneficial in specific situations. For instance, if a student graduates with high-interest private loans, using 529 funds to pay them off quickly can substantially reduce the overall interest burden. Another scenario is when a student faces unexpected financial hardship and needs immediate assistance to avoid defaulting on their loans. In such cases, the 529 plan can serve as a crucial safety net. Finally, if the 529 plan has significantly more funds than needed for qualified education expenses, using the surplus to tackle student loans can be a fiscally responsible choice.

Impact of 529 Plan Usage on Financial Aid Eligibility

Using 529 plan funds to pay for qualified education expenses, including student loan repayment, generally does not affect future financial aid eligibility. However, it’s crucial to understand that withdrawing funds for non-qualified expenses, such as those unrelated to education, will result in tax penalties and may potentially affect financial aid eligibility in future years. It is always recommended to consult with a financial advisor to understand the potential implications before making any decisions.

Hypothetical Case Study: Comparing Student Loan Repayment Approaches

Let’s consider two scenarios for a student graduating with $50,000 in federal student loans at a 5% interest rate over a 10-year repayment period.

Scenario 1: Standard Repayment Plan. The student makes the standard monthly payments, resulting in a total repayment of approximately $65,000 over 10 years.

Scenario 2: 529 Plan Integration. The student has a 529 plan with $20,000. They use this amount to make a significant lump-sum payment towards their loans. This reduces the principal balance to $30,000. The remaining balance is then repaid over a shorter period (e.g., 7 years) using the standard repayment plan. This results in a lower total repayment amount and significantly reduces the total interest paid. The exact savings will depend on the interest rate and the repayment schedule.

Note: This is a simplified example. Actual savings may vary depending on several factors, including loan interest rates, repayment plans, and the amount available in the 529 plan. Consulting with a financial professional is always recommended for personalized advice.

Illustrative Examples

Understanding when a 529 plan is a suitable tool for student loan repayment requires careful consideration of individual financial circumstances. The tax advantages and potential penalties must be weighed against the specific loan terms and overall financial picture. Let’s examine scenarios where this strategy proves beneficial and where it falls short.

Using a 529 plan for student loan repayment is a complex financial decision with both potential benefits and drawbacks. The decision hinges on the individual’s financial situation, the specifics of their student loans, and the amount of funds available in the 529 plan.

Scenario: Financially Sound Decision

A high-income family with significant assets and a substantial 529 plan balance exceeding their child’s educational expenses might find using the 529 plan to repay high-interest student loans advantageous. The potential tax benefits of using the 529 plan to pay down debt could outweigh any penalties incurred, particularly if the loan interest rates are significantly higher than potential investment returns within the 529 plan. For example, a family with a $50,000 529 plan balance and a child carrying $40,000 in student loans with a 7% interest rate could realize substantial savings by using the 529 funds, even considering potential penalties. This assumes that the potential tax benefits and interest savings surpass the penalties for non-qualified withdrawals.

Scenario: Financially Unsound Decision

Conversely, a low-income family with limited assets and a modest 529 plan balance designed for a future child’s education should generally avoid using those funds for existing student loan repayment. The penalties for non-qualified withdrawals, coupled with the potential loss of future investment growth, could severely impact their long-term financial goals. For instance, a family relying on the 529 plan for a younger sibling’s future education should prioritize maintaining that fund rather than using it to address current student loan debt, especially if the loan interest rate is relatively low. The potential tax penalties would likely outweigh the benefits of paying off the loan early.

Hypothetical Family and 529 Plan Usage

Let’s consider the Miller family. They have a $30,000 balance in their 529 plan, originally intended for their daughter Sarah’s college education. Sarah unexpectedly received a full scholarship and did not need the funds for tuition. The Millers are also burdened with Sarah’s partner, Tom’s, $25,000 in student loan debt at a 6% interest rate.

- Existing 529 Plan: $30,000 balance.

- Student Loan Debt: $25,000 at 6% interest.

- Financial Situation: The Millers have a comfortable income but prefer to avoid incurring additional debt.

- 529 Plan Strategy: The Millers could strategically use a portion of the 529 plan funds to reduce Tom’s student loan debt. This could significantly reduce the total interest paid over the life of the loan.

- Tax Implications: They would need to carefully consider the tax implications of withdrawing funds from the 529 plan for non-qualified expenses. They should consult a financial advisor to determine the optimal strategy, balancing the tax penalties with the interest savings from reduced loan debt.

- Alternative Strategy: If the tax penalties are too high, they might explore refinancing the loan at a lower interest rate or making additional principal payments using other available funds.

Conclusion

Ultimately, the decision of whether to utilize a 529 plan for student loan repayment requires careful consideration of your unique financial situation and long-term goals. While offering potential tax advantages, it’s crucial to weigh these benefits against the potential penalties associated with non-qualified withdrawals. This guide has provided a framework for understanding the complexities involved, empowering you to make an informed decision that aligns with your financial aspirations. Remember to consult with a qualified financial advisor to personalize your strategy and ensure it aligns with your individual circumstances.

FAQs

Can I use 529 funds for graduate school loans?

Yes, provided the graduate program is considered eligible under 529 plan rules. However, always check the specific requirements of your plan.

What happens if I withdraw more from my 529 plan than needed for student loan repayment?

Any excess withdrawn funds will be subject to income tax and a 10% penalty, unless an exception applies.

Are there income limits for contributing to a 529 plan?

No, there are no income limits for contributing to a 529 plan.

Can I change the beneficiary of my 529 plan if I decide not to use it for student loans?

Yes, you can change the beneficiary to another qualifying family member.