Navigating the complexities of student loan repayment can feel overwhelming, especially when unexpected circumstances arise. Understanding your options, such as student loan deferment, is crucial for managing your finances effectively. This guide provides a clear and concise overview of the process, helping you determine your eligibility and navigate the application procedure with confidence. We will explore various deferment types, their implications, and alternative solutions, equipping you with the knowledge to make informed decisions about your student loan repayment.

This guide covers the eligibility criteria for different federal student loan programs, detailing the specific requirements and documentation needed. We’ll walk you through the step-by-step application process, addressing common concerns and potential challenges. Furthermore, we’ll examine the long-term financial consequences of deferment and explore alternative strategies like forbearance and income-driven repayment plans, allowing you to choose the best approach for your unique situation.

Eligibility for Student Loan Deferment

Securing a student loan deferment can provide crucial financial relief during challenging times. Understanding the eligibility requirements is the first step in this process. Eligibility depends on several factors, including the type of loan you have and your current circumstances.

General Eligibility Criteria for Student Loan Deferment

Generally, you’re eligible for a deferment if you meet specific criteria demonstrating a temporary inability to repay your student loans. This often involves experiencing financial hardship or pursuing further education. The specific requirements vary depending on the type of federal student loan you hold. For example, deferment options for subsidized loans might differ from those available for unsubsidized or PLUS loans. It’s crucial to check the terms and conditions of your specific loan agreement for detailed information.

Specific Requirements for Different Federal Student Loan Types

Subsidized, unsubsidized, and PLUS loans each have their own eligibility criteria for deferment. Subsidized loans, for example, may offer deferments based on unemployment or enrollment in graduate school, while unsubsidized loans might have stricter requirements. PLUS loans, taken out by parents, also have specific deferment options, often linked to the student’s circumstances. The available deferment options and the required documentation may vary depending on the lender and the specific loan program.

Examples of Qualifying Situations for Deferment

Several situations can qualify you for a student loan deferment. Unemployment is a common reason, as is experiencing economic hardship, such as a significant reduction in income or unexpected medical expenses. Enrollment in graduate school is another qualifying event, allowing students to focus on their studies without the immediate pressure of loan repayment. Furthermore, certain types of military service may also qualify for deferment. It is important to note that each situation requires specific documentation to support the claim.

Comparison of Eligibility Requirements Across Loan Types

The following table summarizes the key differences in eligibility requirements for various federal student loan types. Remember that this is a general overview, and individual circumstances may affect eligibility. Always consult your loan servicer for the most accurate and up-to-date information.

| Loan Type | Required Documentation | Duration Limits | Income Limits |

|---|---|---|---|

| Subsidized Federal Stafford Loan | Proof of unemployment, enrollment in graduate school, or economic hardship (e.g., tax returns, pay stubs, documentation of medical expenses) | Varies depending on the reason for deferment; typically up to 3 years total. | Specific income limits may not apply, but the overall financial hardship must be demonstrated. |

| Unsubsidized Federal Stafford Loan | Similar to subsidized loans; proof of unemployment, enrollment in graduate school, or economic hardship. | Varies depending on the reason for deferment; typically up to 3 years total. | Specific income limits may not apply, but the overall financial hardship must be demonstrated. |

| Federal PLUS Loan | Documentation supporting the parent borrower’s or student’s economic hardship or unemployment, or the student’s enrollment in graduate school. | Varies depending on the reason for deferment; typically up to 3 years total. | Specific income limits may not apply, but the overall financial hardship must be demonstrated. |

Types of Deferment Options

Federal student loan deferment offers temporary pauses on loan repayment, preventing accruing interest in some cases. Several types of deferment exist, each with specific eligibility criteria and implications. Understanding these differences is crucial for borrowers seeking financial relief.

In-School Deferment

In-school deferment is available to undergraduate and graduate students enrolled at least half-time in a degree or certificate program at a school approved by the Department of Education. This deferment typically continues as long as the student maintains half-time enrollment. The primary benefit is the pause on repayment while pursuing education, allowing students to focus on their studies without the added financial burden of loan payments. A drawback is that interest may still accrue on unsubsidized loans during this period. For subsidized loans, the government pays the interest while the borrower is in school at least half-time.

Economic Hardship Deferment

Economic hardship deferment provides a temporary reprieve from loan payments for borrowers experiencing significant financial difficulties. Eligibility usually requires documentation demonstrating an inability to meet basic living expenses due to unemployment, low income, or other financial setbacks. The deferment period is generally limited and requires periodic recertification of the borrower’s financial situation. The benefit is the immediate relief from loan payments during a period of economic stress. However, the process of obtaining and maintaining this deferment can be cumbersome, requiring extensive documentation and potentially impacting credit scores. Interest may accrue on both subsidized and unsubsidized loans during this period, increasing the total loan amount owed upon repayment resumption.

Other Deferment Options

Beyond in-school and economic hardship deferments, other options may exist depending on individual circumstances. These can include deferments for borrowers experiencing military service, those with certain disabilities, or those facing other extenuating circumstances. Specific eligibility requirements vary significantly. The benefits of these deferments are tailored to the specific situation, providing relief during challenging times. However, accessing these deferments often requires extensive documentation and navigating complex application processes. The accrual of interest during these deferments varies depending on the loan type and specific circumstances.

Choosing the Right Deferment Option: A Flowchart

Imagine a flowchart. It begins with a central question: “Are you currently enrolled at least half-time in an eligible educational program?” If yes, the path leads to “In-School Deferment.” If no, the path branches to a new question: “Are you experiencing significant economic hardship?” If yes, the path leads to “Economic Hardship Deferment.” If no, the path leads to “Explore other deferment options (military service, disability, etc.)” and then to “Contact your loan servicer for guidance.” Each option within the flowchart should include a brief description of the associated benefits and drawbacks to guide the decision-making process. This visual representation aids borrowers in navigating the available choices and selecting the most suitable deferment option based on their individual circumstances.

The Application Process

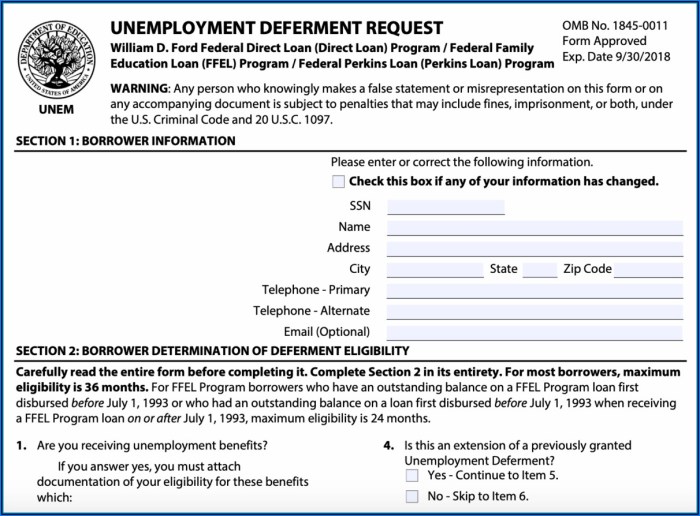

Applying for a student loan deferment involves several steps, and the specific requirements may vary depending on your loan servicer and the type of deferment you are seeking. It’s crucial to carefully review your loan servicer’s website for the most up-to-date and accurate information. This process generally involves gathering necessary documentation, completing an application form, and submitting your request.

Required Documentation

The documentation needed for a student loan deferment application depends heavily on the type of deferment you qualify for. Providing complete and accurate documentation is essential for a timely and successful application. Incomplete applications can lead to delays or rejection.

- For Unemployment Deferment: You will typically need to provide proof of unemployment, such as a recent pay stub showing zero income or a letter from your employer confirming your job loss. Some servicers may also require documentation of your active job search, such as a record of job applications or attendance at job placement services.

- For Economic Hardship Deferment: This often requires documentation demonstrating your financial difficulties. Examples include bank statements showing low balances, proof of medical expenses, or tax returns showing low income. The specific requirements vary greatly depending on the servicer and the severity of your financial situation. You might need to provide a detailed explanation of your hardship circumstances.

- For In-School Deferment: Proof of enrollment in a degree or certificate program is typically required. This usually involves an enrollment verification form from your school or a copy of your current student schedule. The specific documentation will depend on your school and loan servicer.

- For Deferment Due to Military Service: You will need official documentation confirming your active duty status in the military. This usually involves a copy of your military orders or a letter from your commanding officer. The specifics depend on your branch of service.

Step-by-Step Application Procedure

Following these steps will help ensure a smooth application process. Remember to always double-check the instructions provided by your loan servicer.

- Gather Required Documentation: Before starting the application, collect all necessary documents as Artikeld above. This will streamline the process and prevent delays.

- Locate the Application Form: Access the deferment application form through your loan servicer’s website. This is usually found in your online account dashboard or under the “Deferment” or “Forbearance” section.

- Complete the Application Form: Carefully fill out the application form, providing accurate and complete information. Any inconsistencies or missing information can delay the process.

- Submit the Application and Supporting Documents: Submit your completed application form and all supporting documentation through your loan servicer’s online portal or by mail, as instructed. Keep a copy of everything for your records.

- Track Your Application: After submitting your application, monitor its status online through your loan servicer’s website or by contacting them directly. This will allow you to address any issues promptly.

Application Checklist

A checklist can help ensure you’ve completed all necessary steps.

- Have you gathered all required documentation?

- Have you completed the application form accurately and completely?

- Have you submitted all documents through the correct channel (online or mail)?

- Have you kept copies of all submitted documents?

- Have you noted the application tracking number or method for checking the status?

Understanding the Implications of Deferment

Deferring your student loan payments can offer temporary relief, but it’s crucial to understand the long-term financial consequences. This section will clarify how deferment impacts interest accrual, the potential for increased loan balances, and the process of resuming payments. Careful consideration of these factors is essential before choosing to defer.

Interest Accrual During Deferment

The impact of deferment on interest accrual varies depending on your loan type. For subsidized federal loans, the government typically pays the interest during the deferment period, provided you meet specific eligibility requirements. However, for unsubsidized federal loans and most private student loans, interest continues to accrue during deferment, increasing your overall loan balance. This means you’ll owe more than your original loan amount once your deferment period ends. The longer the deferment, the more significant the impact on your total debt.

Long-Term Financial Implications of Deferment

Deferring student loan payments can lead to substantial long-term financial implications. The accumulation of interest during deferment can significantly increase the total amount you owe, extending the repayment period and ultimately increasing the overall cost of your education. This can affect your ability to save for other financial goals, such as buying a home or investing. Furthermore, a larger loan balance can impact your credit score, potentially making it more difficult to obtain loans or favorable interest rates in the future. For example, deferring a $30,000 loan for five years at a 6% interest rate could add thousands of dollars to the total amount owed.

Resuming Payments After Deferment

Once your deferment period ends, you’ll need to resume your student loan payments. Your loan servicer will typically notify you about 60 days before the end of your deferment. You’ll need to contact your servicer to confirm your repayment plan and ensure that payments are processed correctly. Failing to resume payments on time can result in late payment fees and negative impacts on your credit score. It is advisable to plan your budget and finances in advance to ensure a smooth transition back to regular payments.

Impact of Deferment on Loan Balance Growth

The following table illustrates how deferment can increase your loan balance over time, depending on the interest rate and deferment period. These figures represent simple interest calculations and do not include any potential fees. Actual results may vary based on your specific loan terms and the type of deferment.

| Interest Rate | Initial Loan Balance | Deferment Period (years) | Balance After Deferment |

|---|---|---|---|

| 3% | $10,000 | 2 | $10,615 |

| 6% | $10,000 | 2 | $11,236 |

| 3% | $20,000 | 5 | $23,186 |

| 6% | $20,000 | 5 | $26,262 |

Alternative Solutions to Deferment

Sometimes, deferment isn’t the best option for managing student loan repayments. Fortunately, several alternatives exist, each with its own set of benefits and drawbacks. Understanding these alternatives allows borrowers to choose the most suitable strategy based on their individual financial circumstances. This section will explore two key alternatives: forbearance and income-driven repayment plans.

Forbearance Compared to Deferment

Forbearance and deferment both temporarily postpone student loan payments, but they differ significantly in their implications. Deferment typically involves a pause in payments and may even suspend interest accrual (depending on the loan type and deferment reason), whereas forbearance generally means you’re still responsible for accruing interest, even though payments are temporarily halted. This crucial difference can lead to a substantially larger loan balance after the forbearance period ends.

Forbearance: Advantages and Disadvantages

Forbearance offers temporary relief from student loan payments, which can be beneficial during periods of unexpected financial hardship, such as job loss or medical emergencies. However, it’s crucial to understand that interest continues to accrue during forbearance, potentially increasing your overall loan balance significantly. This can lead to a longer repayment period and higher overall costs. Forbearance might be suitable for short-term financial setbacks where you anticipate being able to resume payments relatively quickly. For example, a borrower experiencing a temporary job loss might utilize forbearance until they secure new employment.

Income-Driven Repayment Plans: Advantages and Disadvantages

Income-driven repayment (IDR) plans adjust your monthly payments based on your income and family size. This can significantly lower your monthly payments, making them more manageable during periods of lower income. Several IDR plans exist, each with specific eligibility criteria and payment calculation methods. However, a key disadvantage is that IDR plans typically extend the repayment period, potentially leading to higher overall interest payments over the life of the loan. IDR plans are generally best suited for borrowers with lower incomes who struggle to make their standard monthly payments. A recent college graduate with a low-paying entry-level job could significantly benefit from an IDR plan, enabling them to manage their student loan debt while establishing their career.

Resources and Contact Information

Navigating the student loan deferment process can be complex, but accessing the right resources and contacting the appropriate agencies can significantly simplify the experience. This section provides information on contacting relevant government agencies and your loan servicer, along with links to helpful online resources.

Understanding which agency or servicer to contact is crucial for efficient resolution of your deferment request. The correct contact will depend on your specific loan type and servicer. Incorrect contact may result in delays or rejection of your application. Always verify the contact information through official government websites before reaching out.

Government Agencies

The federal government offers several resources to assist students with federal student loans. These agencies provide information on loan repayment, deferment options, and other financial aid programs. Contacting the appropriate agency is essential for accessing accurate and up-to-date information. Remember to verify contact details on official websites to ensure accuracy.

Student Loan Servicers

Your student loan servicer is the company responsible for managing your student loans. They handle loan payments, process deferment requests, and provide information on your loan status. Contacting your servicer directly is often the most efficient way to address questions or concerns regarding your deferment application. Each servicer has its own contact methods, including phone, email, and online portals.

Contacting Your Student Loan Servicer

Before contacting your servicer, gather your student loan information, including your loan numbers, and prepare a list of your questions. Most servicers offer multiple contact options, such as phone, email, and online portals. Check your loan servicer’s website for their preferred contact method and operating hours. Be prepared to provide identifying information to verify your identity. Keep records of all correspondence with your servicer.

Helpful Resources

A list of helpful resources, including government websites and organizations that offer guidance on student loan deferment, is provided below. These resources provide additional information and support throughout the process. Remember to verify the accuracy of any information found online with official sources.

- The Federal Student Aid website: This website provides comprehensive information on federal student loans, including eligibility requirements for deferment and the application process.

- Your Student Loan Servicer’s Website: This website provides specific information about your loans, including contact information, payment options, and deferment options.

- National Consumer Law Center: This organization provides legal assistance and resources for consumers, including information on student loan rights and protections.

- Student Loan Borrower Assistance Program: This program provides assistance to borrowers struggling to repay their student loans.

Last Point

Successfully navigating the student loan deferment process requires careful planning and a thorough understanding of your options. By carefully reviewing your eligibility, selecting the appropriate deferment type, and completing the application accurately, you can effectively manage your student loan debt during challenging times. Remember to explore alternative solutions if deferment isn’t the best fit for your circumstances. Proactive financial planning and informed decision-making are key to long-term financial well-being.

FAQ Resource

What happens to my interest during a deferment period?

For subsidized loans, the government may pay your interest during certain deferment periods. For unsubsidized loans, interest continues to accrue and is added to your principal balance.

Can I defer my student loans indefinitely?

No, deferments are typically limited to specific periods, often determined by the type of deferment and your circumstances. There are usually maximum time limits.

What if my application for deferment is denied?

If your application is denied, you’ll receive notification explaining the reasons. You can usually appeal the decision, providing additional documentation to support your claim.

How long does it take to process a deferment application?

Processing times vary, but it typically takes several weeks. It’s best to apply well in advance of when you need the deferment to begin.