Navigating the complexities of student loan debt can feel overwhelming, but understanding your refinancing options is a crucial step towards financial freedom. This guide delves into the world of student loan refinancing, equipping you with the knowledge and tools to make informed decisions. We’ll explore various refinancing options, detail how refinancing calculators work, and highlight the factors influencing your eligibility and potential savings.

From understanding the key inputs of a student loan refinancing calculator to analyzing the impact of your credit score and income, this resource provides a clear and concise pathway to effectively manage your student loan debt. We’ll also address potential risks and considerations, empowering you to approach refinancing with confidence and a strategic plan.

Understanding Refinancing Options

Refinancing your student loans can be a smart way to save money and simplify your payments. However, understanding the different options available is crucial to making an informed decision. This section will Artikel the various types of refinancing, eligibility requirements, and a comparison of lenders to help you navigate this process.

Types of Student Loan Refinancing Options

Student loan refinancing primarily involves consolidating multiple federal and/or private loans into a single new loan with a private lender. This new loan typically offers a lower interest rate, potentially resulting in significant savings over the life of the loan. Some lenders also offer options to refinance only federal loans, or only private loans, depending on your specific circumstances. The choice depends on your individual financial situation and loan portfolio.

Eligibility Criteria for Refinancing

Eligibility requirements vary between lenders, but generally include factors such as credit score, debt-to-income ratio, and income level. A higher credit score typically qualifies you for better interest rates. Lenders also assess your income stability and employment history to gauge your ability to repay the loan. Some lenders may require a co-signer if your credit history is limited or your income is insufficient. Specific requirements for federal loan refinancing programs differ from private lender programs and are generally stricter.

Interest Rates and Repayment Terms

Interest rates offered by various lenders fluctuate based on market conditions and your individual creditworthiness. Generally, borrowers with excellent credit scores and stable incomes receive the most favorable interest rates. Repayment terms also vary, typically ranging from 5 to 20 years. Shorter repayment terms lead to higher monthly payments but lower overall interest paid, while longer terms result in lower monthly payments but higher overall interest paid. It’s important to carefully consider your financial situation and choose a repayment term that aligns with your budget and long-term financial goals.

Comparison of Lenders

The following table compares four hypothetical lenders, showcasing the variability in interest rates, fees, and repayment terms. Remember that these are examples, and actual rates and terms will vary depending on your individual circumstances and the current market conditions. Always check with the lender directly for the most up-to-date information.

| Lender | Interest Rate (Example – Variable) | Origination Fee (Example) | Repayment Terms (Example) |

|---|---|---|---|

| Lender A | 6.5% | 1% of loan amount | 5-15 years |

| Lender B | 7.0% | 0% | 7-20 years |

| Lender C | 6.0% | 0.5% of loan amount | 10-15 years |

| Lender D | 7.5% | 1.5% of loan amount | 5-10 years |

How Student Loan Refinancing Calculators Work

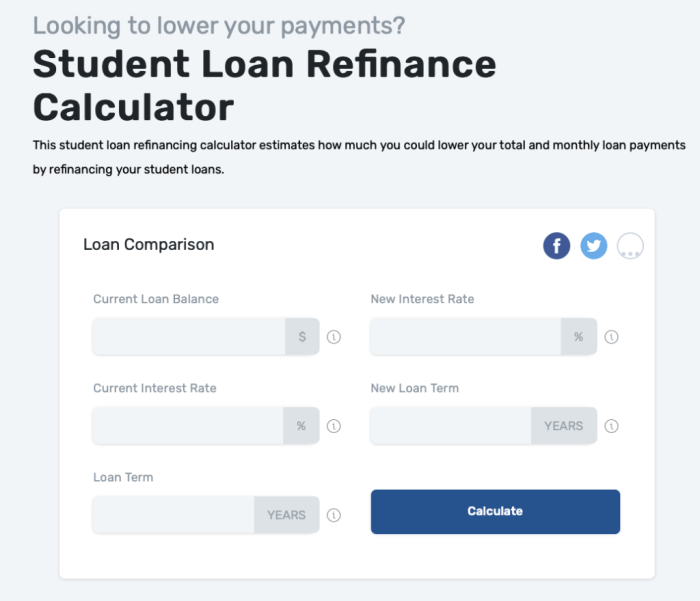

Student loan refinancing calculators are powerful tools that simplify the complex process of comparing refinancing options. By inputting key information about your current loans and desired refinancing terms, these calculators quickly estimate your potential monthly payments, total interest paid, and overall savings. This allows you to make informed decisions about whether refinancing is right for you and which offer is most beneficial.

Understanding the calculations behind these tools empowers you to use them effectively and confidently navigate the refinancing landscape.

Key Inputs for Student Loan Refinancing Calculators

These calculators require specific information to accurately estimate your refinancing outcomes. Providing accurate data ensures the results are reliable and reflect your unique financial situation. Inaccurate input will lead to inaccurate projections.

- Current Loan Amount: The total outstanding balance of all the student loans you intend to refinance.

- Current Interest Rate: The interest rate on each of your current student loans. This is usually expressed as a percentage (e.g., 6%).

- Loan Term: The length of time (in years) you have to repay your current loans.

- Proposed Interest Rate: The interest rate offered by the lender for your refinanced loan. This rate will vary based on your credit score and the lender’s criteria.

- Proposed Loan Term: The repayment period (in years) you choose for your refinanced loan. Shorter terms lead to higher monthly payments but lower overall interest paid, while longer terms result in lower monthly payments but higher overall interest.

Calculations Performed by Refinancing Calculators

The calculator uses the provided inputs to perform several calculations, ultimately providing you with a clear picture of your potential savings and monthly payments.

The core calculation is based on the standard formula for determining loan payments:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

M = Monthly Payment

P = Principal Loan Amount

i = Monthly Interest Rate (Annual Interest Rate / 12)

n = Number of Months (Loan Term in Years * 12)

Using this formula, the calculator determines your monthly payment for the proposed refinanced loan. It then compares this to your current monthly payments to show the potential difference. Furthermore, the calculator calculates the total interest you would pay over the life of the refinanced loan and compares this to the total interest you would pay on your current loans. This difference represents your potential savings.

Using a Student Loan Refinancing Calculator: A Step-by-Step Guide

Using a refinancing calculator is straightforward. Follow these steps for accurate results:

- Find a reputable calculator: Many financial websites and lenders offer these calculators. Choose one from a trusted source.

- Gather your loan information: Collect the necessary details about your current student loans (loan amount, interest rate, loan term for each loan).

- Input your loan details: Enter the required information into the calculator fields accurately.

- Specify refinancing terms: Enter the proposed interest rate and loan term offered by the lender.

- Review the results: Carefully examine the calculator’s output, which typically includes estimated monthly payments, total interest paid, and potential savings.

- Compare multiple offers: Use the calculator to compare offers from different lenders to find the best terms for your situation.

Flowchart Illustrating the Refinancing Calculator Process

Imagine a flowchart with the following steps:

1. Start: A rounded rectangle indicating the beginning of the process.

2. Input Loan Data: A parallelogram representing the input of loan details (loan amount, interest rate, term).

3. Input Refinancing Terms: Another parallelogram for inputting proposed interest rate and loan term.

4. Calculate Monthly Payment: A rectangle showing the calculation of the monthly payment using the formula above.

5. Calculate Total Interest: A rectangle showing the calculation of total interest paid.

6. Compare to Current Loans: A rectangle comparing the new monthly payment and total interest to the existing loan details.

7. Display Results: A parallelogram displaying the results (monthly payment, total interest, potential savings).

8. End: A rounded rectangle indicating the end of the process. The arrows connecting these shapes show the flow of the process.

Factors Affecting Refinancing Decisions

Refinancing student loans is a significant financial decision that requires careful consideration of several key factors. Understanding these factors will help you determine if refinancing is the right choice for your specific circumstances and ultimately, whether it will lead to long-term financial benefits or potential drawbacks. The decision hinges on a complex interplay of your financial situation and the current market conditions.

Your eligibility for refinancing and the terms you’ll receive depend heavily on your creditworthiness and financial stability. Lenders assess your application based on various metrics, evaluating your risk as a borrower. A strong credit score, consistent income, and a manageable debt-to-income ratio are crucial elements in securing favorable refinancing terms, such as a lower interest rate.

Credit Score and Income Influence on Refinancing

A higher credit score typically translates to more attractive interest rates and better loan terms. Lenders view individuals with excellent credit as lower-risk borrowers, making them more willing to offer competitive rates. Similarly, a stable and substantial income demonstrates your ability to repay the loan, influencing the lender’s decision. Conversely, a low credit score or inconsistent income can lead to higher interest rates, less favorable terms, or even loan rejection. For example, someone with a 750 credit score is likely to qualify for a significantly lower interest rate than someone with a 600 credit score. Similarly, a consistent annual income of $80,000 demonstrates greater repayment capacity than an inconsistent income of $40,000.

Benefits and Drawbacks of Refinancing Student Loans

Refinancing can offer several advantages, but it’s essential to weigh these against potential disadvantages. The primary benefit is often a lower interest rate, leading to reduced monthly payments and lower overall interest paid over the life of the loan. However, refinancing might result in the loss of federal student loan protections, such as income-driven repayment plans or loan forgiveness programs. Furthermore, refinancing locks you into a new repayment term, potentially extending the repayment period.

Scenarios Where Refinancing Might Be Beneficial or Detrimental

Understanding the potential benefits and drawbacks is crucial before making a decision. Let’s consider some scenarios:

The following examples illustrate situations where refinancing could be advantageous or disadvantageous:

- Beneficial: A borrower with excellent credit (750+), a stable high income, and multiple federal student loans at high interest rates (above 6%) could significantly benefit from refinancing into a lower interest rate private loan, reducing their monthly payments and overall interest paid.

- Beneficial: A borrower consolidating multiple loans with varying interest rates into a single loan with a lower, fixed interest rate simplifies repayment and potentially saves money.

- Detrimental: A borrower with a low credit score (below 650) and a high debt-to-income ratio might find it difficult to qualify for refinancing or receive favorable terms, potentially resulting in higher interest rates or less favorable repayment options.

- Detrimental: A borrower relying on federal student loan forgiveness programs should carefully consider the implications of refinancing, as private loans generally do not offer these protections. For example, a teacher relying on the Public Service Loan Forgiveness program might lose this benefit if they refinance their federal loans into a private loan.

Impact of Credit Score and Income

Your credit score and income are pivotal factors determining your eligibility for student loan refinancing and the interest rate you’ll secure. Lenders assess these factors to gauge your creditworthiness and repayment ability. A higher credit score generally translates to a lower interest rate, while a higher income demonstrates a greater capacity to manage debt.

Lenders use a complex algorithm considering various factors beyond just your credit score and income, but these two remain the most significant. A strong credit history and sufficient income significantly increase your chances of approval and securing favorable terms. Conversely, a low credit score or insufficient income can lead to rejection or higher interest rates, potentially making refinancing less beneficial.

Credit Score’s Influence on Interest Rates

The impact of your credit score on the interest rate offered is substantial. A higher credit score signifies lower risk to the lender, resulting in a more favorable interest rate. Conversely, a lower credit score suggests higher risk, leading to a higher interest rate or even loan denial.

The following examples illustrate the potential impact of different credit scores on the interest rate for a hypothetical $50,000 student loan refinance:

- Credit Score: 750+ (Excellent): Interest rate offered might be around 5.0% – 6.0%.

- Credit Score: 700-749 (Good): Interest rate offered might be around 6.0% – 7.0%.

- Credit Score: 660-699 (Fair): Interest rate offered might be around 7.0% – 8.5%.

- Credit Score: Below 660 (Poor): Interest rate offered might be significantly higher (9%+), or refinancing may be denied altogether.

Note: These are illustrative examples and actual interest rates will vary depending on several factors, including the lender, loan term, and market conditions.

Improving Credit Score for Better Refinancing Options

Improving your credit score before applying for refinancing can significantly improve your chances of securing a lower interest rate. Several strategies can help elevate your credit score:

- Pay all bills on time: Consistent on-time payments are crucial. Even a single missed payment can negatively impact your score.

- Keep credit utilization low: Aim to use less than 30% of your available credit. High utilization suggests financial strain.

- Maintain a diverse credit mix: A healthy mix of credit accounts (e.g., credit cards, installment loans) can positively influence your score.

- Check your credit report for errors: Errors on your credit report can lower your score. Dispute any inaccuracies with the credit bureaus.

- Avoid opening multiple new credit accounts in a short period: Numerous applications within a short time can negatively impact your score.

Potential Risks and Considerations

Refinancing student loans can offer significant financial advantages, but it’s crucial to understand the potential drawbacks before making a decision. While refinancing can lower your monthly payments and interest rate, it also involves risks that could negatively impact your financial situation. Carefully weighing these risks against the potential benefits is essential for informed decision-making.

Refinancing student loans carries several inherent risks. One major concern is the loss of federal loan benefits. Federal student loans often come with protections like income-driven repayment plans, deferment options during periods of financial hardship, and forgiveness programs based on employment in public service. These benefits disappear once your federal loans are refinanced into a private loan. This means you lose the safety net provided by the federal government should your circumstances change unexpectedly.

Loss of Federal Loan Benefits

The loss of federal student loan benefits is a significant risk. For example, imagine a borrower who qualifies for the Public Service Loan Forgiveness (PSLF) program. This program forgives the remaining balance of federal student loans after 120 qualifying payments. If this borrower refinances their federal loans into a private loan, they lose eligibility for PSLF, potentially resulting in thousands of dollars in additional debt. Similarly, income-driven repayment plans, which adjust monthly payments based on income, are unavailable for private loans. A sudden job loss or decrease in income could lead to significantly higher monthly payments without the flexibility offered by federal loan programs.

Impact of Changing Interest Rates

A change in interest rates after refinancing can significantly affect your loan payments. When you refinance, you lock in a fixed interest rate for the loan’s term. However, if interest rates rise after refinancing, you’ll be unaffected because your rate is fixed. Conversely, if interest rates fall after you refinance, you’ll miss out on the opportunity to secure a lower rate on your existing loan. Consider, for instance, a borrower who refinances at a 6% interest rate. If interest rates subsequently drop to 4%, they will continue paying at the higher rate. Conversely, if rates rise to 8%, they remain protected by their fixed 6% rate. Therefore, careful consideration of prevailing interest rate trends and predictions is essential before refinancing.

Credit Score Impact

A hard credit inquiry, conducted during the refinancing application process, can slightly lower your credit score. While this impact is typically temporary, it’s a factor to consider, especially if you plan to apply for other credit products in the near future. The extent of the score decrease varies depending on individual credit reports and scoring models. Furthermore, a lower credit score might result in less favorable refinancing terms. A borrower with a poor credit history may receive a higher interest rate or be denied refinancing altogether. Maintaining a good credit score is therefore crucial for securing the best possible refinancing terms.

Epilogue

Refinancing student loans can be a powerful tool for achieving financial stability, but it’s essential to approach the process with careful consideration. By utilizing a student loan refinancing calculator and understanding the factors influencing your eligibility and interest rates, you can make an informed decision that aligns with your financial goals. Remember to weigh the potential benefits against the risks and always explore all available options before making a commitment.

FAQ Corner

What is the difference between federal and private student loans?

Federal student loans are offered by the government and typically have more borrower protections, while private student loans are offered by banks and credit unions and often have variable interest rates and less stringent eligibility requirements.

Can I refinance multiple student loans together?

Yes, many lenders allow you to refinance multiple student loans into a single, consolidated loan, simplifying repayment.

What happens if my credit score changes after refinancing?

Your interest rate is generally fixed once your loan is refinanced, so a change in credit score will not directly impact your rate. However, your eligibility for future loans might be affected.

How often should I check my credit score before refinancing?

It’s advisable to check your credit score regularly, ideally a few months before you plan to refinance, to identify any potential issues and improve your score if needed.