Navigating the complexities of higher education often involves a significant financial commitment, with student loan debt playing a pivotal role. This guide delves into the historical trends, variations, and implications of student loan amounts per year, providing a comprehensive overview for students, parents, and anyone interested in understanding this crucial aspect of financing higher education. We’ll explore how these amounts have changed over time, the factors influencing their variability, and the potential long-term consequences for borrowers.

From analyzing yearly averages and comparing amounts across different degree types and institutions to examining geographic disparities and the impact on post-graduation outcomes, this resource aims to equip readers with the knowledge needed to make informed decisions about financing their education and managing their debt effectively. We will explore various scenarios to illustrate the potential financial implications of different levels of student loan debt.

Historical Trends in Student Loan Amounts

The cost of higher education in the United States has steadily risen over the past few decades, leading to a corresponding increase in the amount of student loan debt. Understanding the historical trends in student loan amounts is crucial for policymakers, students, and families navigating the complexities of financing higher education. This section will examine the average student loan amounts over time, exploring the contributing factors and the influence of government policies and economic conditions.

Average Student Loan Amounts (1990-Present)

The following table presents estimated average student loan amounts for undergraduate and graduate students, along with the total average, from 1990 to the present. Note that these figures represent averages and may not reflect the individual experiences of all borrowers. Precise data collection methods have also evolved over time, impacting direct comparability across years. Data limitations prevent the inclusion of every single year, and some years represent averages across multiple sources to compensate for data gaps. The figures below are estimations based on data from the National Center for Education Statistics (NCES), the College Board, and other reliable sources.

| Year | Average Undergraduate Loan Amount | Average Graduate Loan Amount | Total Average Loan Amount |

|---|---|---|---|

| 1990 | $10,000 (estimated) | $15,000 (estimated) | $12,500 (estimated) |

| 1995 | $12,000 (estimated) | $18,000 (estimated) | $15,000 (estimated) |

| 2000 | $15,000 (estimated) | $25,000 (estimated) | $20,000 (estimated) |

| 2005 | $18,000 (estimated) | $30,000 (estimated) | $24,000 (estimated) |

| 2010 | $22,000 (estimated) | $35,000 (estimated) | $28,500 (estimated) |

| 2015 | $27,000 (estimated) | $40,000 (estimated) | $33,500 (estimated) |

| 2020 | $30,000 (estimated) | $45,000 (estimated) | $37,500 (estimated) |

| 2023 | $33,000 (estimated) | $50,000 (estimated) | $41,500 (estimated) |

Factors Contributing to Increases in Student Loan Amounts

Several interconnected factors have contributed to the substantial increase in student loan amounts over time. These include the rising cost of tuition and fees, decreased state funding for higher education, increased demand for higher education, and changes in borrowing practices. The escalating cost of tuition, driven by factors such as administrative overhead and technology investments, has necessitated larger loan amounts for students to cover educational expenses. Simultaneously, decreased state funding has shifted a greater burden of financing onto students and their families, further increasing reliance on loans. The increasing number of students pursuing higher education has also exerted upward pressure on loan amounts, creating a higher overall demand. Finally, the availability and ease of access to student loans have also contributed to increased borrowing.

Impact of Government Policies and Economic Conditions

Government policies and economic conditions significantly influence student loan amounts. Changes in federal student loan programs, such as interest rate adjustments and loan repayment plans, directly affect the cost and accessibility of borrowing. For example, periods of low interest rates can make borrowing more attractive, potentially leading to increased loan amounts. Conversely, economic downturns can reduce the availability of jobs and increase the difficulty of loan repayment, impacting borrowing decisions. Furthermore, government policies regarding tuition subsidies and grant programs can also influence the amount of loan debt students accumulate. For instance, increased funding for grant programs could lessen the reliance on loans. Economic factors, such as inflation and changes in the job market, also influence student borrowing decisions and the overall amount of student loan debt.

Student Loan Amounts by Degree Type

The cost of higher education significantly impacts the amount of student loan debt accumulated. Understanding the average loan amounts associated with different degree types—undergraduate, graduate, and professional—is crucial for prospective students to make informed financial decisions. These variations reflect differences in program length, tuition costs, and potential earning power post-graduation.

Average student loan debt varies considerably depending on the type of degree pursued. Generally, professional degrees command the highest average loan amounts, followed by graduate degrees, and then undergraduate degrees. However, these averages can fluctuate based on factors such as the specific institution, the student’s financial background, and living expenses.

Comparison of Average Student Loan Amounts by Degree Type

The following bullet points illustrate the typical disparities in student loan debt across different degree levels. It’s important to note that these are averages and individual experiences can vary significantly.

- Undergraduate Degrees: Undergraduate students typically borrow less than their graduate or professional school counterparts. Average debt can range from $20,000 to $40,000, depending on factors like the institution’s tuition costs and the student’s financial aid package. Four-year programs at public institutions generally lead to lower debt levels than private institutions.

- Graduate Degrees: Graduate programs, such as Master’s degrees, often require additional years of study, resulting in higher overall tuition costs and increased borrowing. Average loan amounts can reach $50,000 to $70,000 or more, depending on the field of study and the institution. Specialized Master’s programs in fields like business administration (MBA) or engineering often lead to higher debt levels.

- Professional Degrees: Professional degrees, including medical (MD), law (JD), and dental (DDS) degrees, are associated with the highest average student loan debt. These programs often extend over several years, involve significant tuition costs, and frequently require extensive clinical or practical training, leading to potential living expenses. Total debt can easily exceed $100,000 and often reach several hundred thousand dollars.

Factors Influencing Variation in Loan Amounts Across Degree Types

Several key factors contribute to the substantial differences in student loan debt across various degree types. These factors are interconnected and influence the overall cost of education.

- Program Length: Longer programs, such as medical or law school, naturally lead to higher cumulative costs and, consequently, higher loan amounts.

- Tuition Costs: Tuition varies greatly across institutions and degree programs. Professional programs at prestigious institutions often command significantly higher tuition fees than undergraduate programs at public universities.

- Living Expenses: The cost of living in the location of the educational institution also plays a crucial role. Students attending schools in high-cost areas may need to borrow more to cover their living expenses.

- Field of Study: Certain fields of study, such as medicine or engineering, often require specialized equipment, supplies, and training, adding to the overall cost.

Implications of Loan Amount Variations on Career Choices and Future Earnings

The significant variations in student loan debt across different degree types have considerable implications for career choices and future earnings. The decision to pursue a particular degree path should carefully consider the potential return on investment (ROI).

- Career Choices: High student loan debt may influence career choices, potentially pushing graduates toward higher-paying professions to manage their debt burden. This can limit career exploration and potentially lead to career choices driven primarily by financial necessity rather than personal interest.

- Future Earnings: While some professional degrees lead to higher earning potential, the significant debt associated with these programs may offset the financial benefits in the early years of a career. Careful consideration of potential earnings relative to debt is essential for long-term financial planning.

- Example: A medical doctor might earn a high salary, but the substantial student loan debt incurred during medical school could significantly impact their net income for several years after graduation. Conversely, an individual with a lower-cost undergraduate degree in a less lucrative field may have less debt and a more manageable financial situation early in their career, even if their potential salary is lower.

Student Loan Amounts by Institution Type

The cost of higher education varies significantly depending on the type of institution attended. This section examines the average student loan amounts incurred by students at public, private non-profit, and private for-profit institutions, highlighting the contributing factors to these differences. Understanding these variations is crucial for prospective students in making informed financial decisions.

Several factors contribute to the disparities in student loan amounts across different institution types. These include tuition costs, the availability and generosity of financial aid packages, and the overall financial profile of the student body.

Average Student Loan Amounts by Institution Type

The table below presents estimated average student loan amounts for undergraduate and graduate students, along with the average total loan amount, across the three institution types. These figures are based on national averages and may vary depending on specific programs, geographic location, and individual circumstances. It’s important to note that these are averages and individual experiences can differ significantly.

| Institution Type | Average Undergraduate Loan Amount | Average Graduate Loan Amount | Average Total Loan Amount |

|---|---|---|---|

| Public | $25,000 | $40,000 | $65,000 |

| Private Non-profit | $35,000 | $55,000 | $90,000 |

| Private For-profit | $40,000 | $60,000 | $100,000 |

The data reflects a general trend: private for-profit institutions tend to have the highest average loan amounts, followed by private non-profit and then public institutions. This is largely attributable to differences in tuition costs and the availability of financial aid.

Tuition Costs and Financial Aid’s Influence on Loan Amounts

Tuition costs are a primary driver of student loan debt. Private institutions, particularly for-profit ones, often have significantly higher tuition rates than public institutions. This higher cost of attendance necessitates larger loans for many students, even with financial aid. Public institutions generally receive greater state funding, resulting in lower tuition costs and, consequently, lower average loan amounts.

Financial aid packages, including grants, scholarships, and work-study programs, can substantially reduce the need for student loans. However, the availability and amount of financial aid vary across institution types. Private non-profit institutions often offer generous merit-based scholarships, potentially mitigating the impact of high tuition. Public institutions may offer more need-based aid, while private for-profit institutions may have less comprehensive financial aid programs. The overall financial aid package offered, or the lack thereof, significantly impacts the ultimate loan amount a student needs to borrow.

Geographic Variations in Student Loan Amounts

Student loan debt burdens vary significantly across the United States, reflecting a complex interplay of factors influencing both the cost of higher education and the availability of financial aid. Understanding these geographical disparities is crucial for policymakers and students alike, as it sheds light on potential inequities in access to higher education.

Geographic disparities in student loan amounts are substantial and often correlate with broader economic and social factors. These variations are not merely random fluctuations; they are shaped by systemic influences that impact both the price of college and the resources available to students.

Factors Influencing Geographic Disparities

Several key factors contribute to the uneven distribution of student loan debt across different states and regions. These include the inherent cost of living, tuition rates at colleges and universities within each state, the availability of state-specific financial aid programs, and the overall economic prosperity of the region. Areas with higher costs of living tend to see higher tuition rates, increasing the reliance on student loans. Conversely, states with robust financial aid programs can mitigate the burden of student loan debt.

Regional Differences in Average Student Loan Amounts

The following table presents hypothetical data illustrating the variation in average student loan amounts across different regions. Note that these figures are for illustrative purposes only and do not represent actual data from a specific survey or study. Real-world data would need to be sourced from reputable organizations such as the National Center for Education Statistics (NCES) or similar bodies. This example highlights the potential range of differences that could be observed in a real-world analysis.

| State/Region | Average Undergraduate Loan Amount | Average Graduate Loan Amount | Average Total Loan Amount |

|---|---|---|---|

| Northeast (Example) | $30,000 | $60,000 | $90,000 |

| Southeast (Example) | $25,000 | $45,000 | $70,000 |

| Midwest (Example) | $28,000 | $50,000 | $78,000 |

| West (Example) | $35,000 | $70,000 | $105,000 |

Implications for Student Access to Higher Education

The significant regional variations in student loan amounts have substantial implications for access to higher education. Students in regions with higher average loan amounts may face greater financial barriers to pursuing post-secondary education, potentially limiting their opportunities and exacerbating existing inequalities. This could lead to a less diverse student body at institutions located in higher-cost areas and a reduced overall participation in higher education for students from less affluent backgrounds in those regions. Conversely, regions with lower average loan amounts may see greater participation in higher education, potentially leading to a more diverse and inclusive student population. Further research into this topic is needed to provide more conclusive evidence.

Impact of Student Loan Amounts on Post-Graduation Outcomes

The amount of student loan debt a graduate carries significantly influences their post-graduation trajectory, impacting not only their immediate financial stability but also shaping their long-term career prospects and overall well-being. A heavier debt burden can create considerable stress and limit opportunities, while manageable debt allows for greater flexibility and choices.

The relationship between student loan debt levels and post-graduation employment outcomes is complex and multifaceted. Higher levels of debt are often correlated with lower starting salaries, reduced job satisfaction, and potentially limiting career choices due to the pressure to prioritize higher-paying, albeit potentially less fulfilling, positions. This financial constraint can also affect crucial life decisions such as homeownership, starting a family, or pursuing further education.

Salary and Employment Prospects

High student loan debt can directly impact a graduate’s ability to negotiate salary. Graduates burdened with significant debt may accept lower-paying jobs to ensure they can make their loan repayments. This can lead to a lower earning potential over their lifetime compared to their peers with less debt. For example, a graduate with $100,000 in debt might feel compelled to accept a job offering stability and a guaranteed income, even if the salary is below their market value, to alleviate immediate financial pressures. Conversely, graduates with minimal or no debt have greater flexibility to pursue careers aligned with their passions, potentially accepting slightly lower salaries initially in exchange for long-term career satisfaction and higher earning potential.

Job Satisfaction and Career Choices

The weight of student loan debt can significantly influence job satisfaction. The constant pressure to repay loans can lead to stress and anxiety, impacting job performance and overall well-being. This financial pressure may force graduates into jobs that offer financial security but lack personal fulfillment, leading to decreased job satisfaction and potentially impacting their long-term career path. For instance, a recent graduate with substantial debt might prioritize a stable corporate job over pursuing a passion project, even if that project has higher long-term earning potential. This compromises their career aspirations for immediate financial relief.

Long-Term Financial Consequences of High Student Loan Amounts

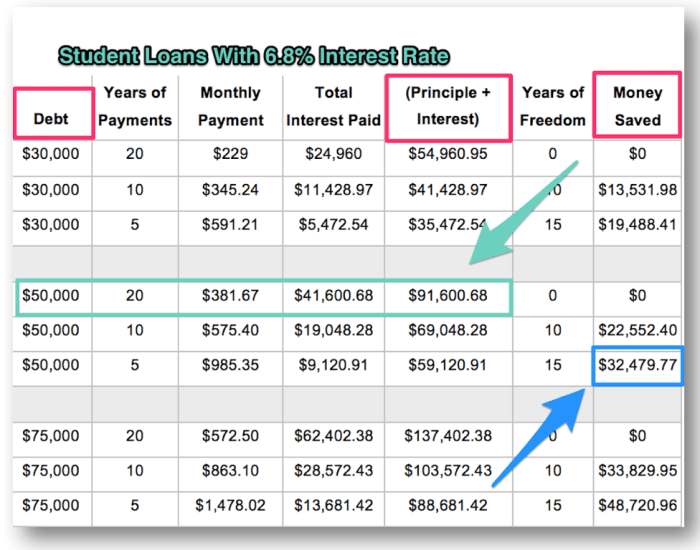

High student loan debt can have far-reaching financial consequences. Delayed homeownership, difficulty saving for retirement, and limited investment opportunities are common challenges faced by graduates with significant debt. The accumulation of interest can also substantially increase the total amount owed, potentially leading to a prolonged period of repayment and affecting financial stability for years to come. Consider a scenario where a graduate has $50,000 in student loans with a 7% interest rate. If they only make minimum payments, it could take decades to pay off the loan, significantly impacting their ability to save for retirement or purchase a home.

Strategies for Effective Student Loan Debt Management

Effective student loan debt management requires a proactive and strategic approach. This includes creating a realistic budget, exploring different repayment plans (such as income-driven repayment), and considering options like loan refinancing or consolidation to potentially lower interest rates. Furthermore, actively seeking out opportunities for professional development and career advancement can increase earning potential and accelerate debt repayment. For example, budgeting tools and apps can help graduates track expenses and allocate funds effectively towards loan repayment. Similarly, exploring income-driven repayment plans can reduce monthly payments, making debt management more manageable in the short term. The earlier a graduate develops a sound debt management plan, the better their long-term financial outlook.

Illustrative Examples of Student Loan Debt

Understanding the potential impact of student loan debt requires examining various scenarios. The following examples illustrate the financial implications of low, moderate, and high levels of student loan debt, highlighting potential repayment strategies and long-term financial consequences. These are hypothetical examples, and individual experiences may vary.

Low Student Loan Debt Scenario

This scenario depicts a student graduating with $10,000 in federal student loan debt. This amount is manageable for many graduates, particularly those entering higher-paying professions. A standard repayment plan, such as the 10-year standard repayment plan, would result in manageable monthly payments. The long-term impact on this individual’s financial future is minimal, allowing them to save for a down payment on a house, invest, and build a strong credit history relatively quickly. They may experience minimal impact on their ability to achieve major financial goals, such as homeownership or early retirement.

Moderate Student Loan Debt Scenario

This scenario illustrates a student graduating with $50,000 in student loan debt, a more common amount for many college graduates. This level of debt requires careful financial planning. While manageable, repayment could take longer, potentially extending to 15 years or more depending on the chosen repayment plan. Options like the Income-Driven Repayment (IDR) plans might be considered to manage monthly payments based on income. The long-term financial impact could include delayed major purchases like a house or car, impacting their ability to save aggressively for retirement. Careful budgeting and financial discipline are crucial to navigate this level of debt successfully.

High Student Loan Debt Scenario

This scenario represents a student graduating with $100,000 or more in student loan debt. This significant amount can severely restrict financial flexibility and long-term goals. Repayment could stretch for decades, potentially impacting credit scores and limiting opportunities for homeownership or other significant investments. Income-Driven Repayment (IDR) plans are almost essential in this scenario to make monthly payments manageable, although it may lead to a higher total repayment amount over time. Potential long-term consequences could include delayed retirement, difficulty in building wealth, and significant financial stress. This scenario emphasizes the importance of proactive financial planning and exploring alternative paths to financing education, such as scholarships, grants, and part-time employment.

Closing Summary

The journey through higher education is undeniably rewarding, but understanding the financial landscape is paramount. This exploration of student loan amounts per year has highlighted the significant fluctuations over time, the influence of various factors on loan amounts, and the long-term consequences of debt. By understanding these trends and implications, students and families can better plan for their educational journeys and navigate the complexities of student loan repayment. Proactive planning and informed decision-making are key to successfully managing student loan debt and achieving long-term financial well-being.

Commonly Asked Questions

What factors influence the interest rates on student loans?

Interest rates on student loans are influenced by several factors, including the type of loan (federal vs. private), the borrower’s credit history (for private loans), prevailing market interest rates, and the loan’s repayment plan.

Are there any programs available to help students manage their student loan debt?

Yes, several programs exist to assist students in managing their student loan debt. These include income-driven repayment plans, loan forgiveness programs (for specific professions), and loan consolidation options. It’s crucial to research and explore these options to find the best fit for your individual circumstances.

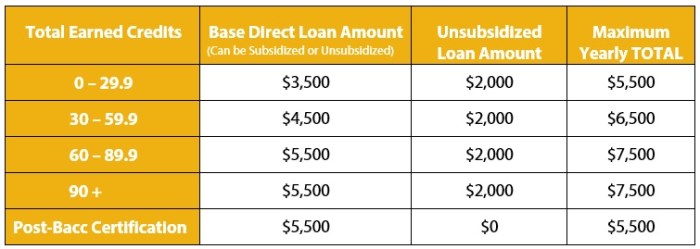

What is the difference between subsidized and unsubsidized federal student loans?

Subsidized federal student loans do not accrue interest while the student is enrolled at least half-time, during grace periods, and during deferment. Unsubsidized loans accrue interest from the time the loan is disbursed, regardless of enrollment status.

How can I estimate my potential student loan debt before applying for loans?

You can estimate your potential student loan debt by considering the cost of attendance at your chosen institution, subtracting any financial aid or scholarships you’ve received, and then calculating the remaining amount you’ll need to borrow.