Navigating the world of student loans can feel like deciphering a complex code. Understanding the nuances between different loan types is crucial for responsible borrowing and financial planning. This guide focuses on unsubsidized student loans, explaining their core features, potential benefits, and crucial considerations to help you make informed decisions about your higher education financing.

Unsubsidized student loans offer a pathway to higher education, but they come with responsibilities. Unlike subsidized loans, interest begins accruing immediately. This guide will demystify the process, covering eligibility, application, repayment options, and potential risks, empowering you to make sound financial choices.

Definition of an Unsubsidized Student Loan

Unsubsidized student loans are a type of federal student loan offered to undergraduate, graduate, and professional students to help finance their education. Unlike subsidized loans, the government doesn’t pay the interest that accrues while you’re in school. This means your loan balance grows larger over time, even before you begin repayment. Understanding the nuances of unsubsidized loans is crucial for responsible financial planning during and after your studies.

Unsubsidized student loans offer a significant financial lifeline for students pursuing higher education. A key feature is that eligibility isn’t based on financial need. Any student who is accepted into a degree program at a participating institution and meets the other requirements can obtain an unsubsidized loan. The interest rate is fixed for the life of the loan, offering predictability in repayment calculations. However, it’s crucial to remember that interest begins accruing immediately, impacting the total amount you’ll ultimately repay. Borrowers should carefully consider the implications of this interest accumulation before accepting an unsubsidized loan.

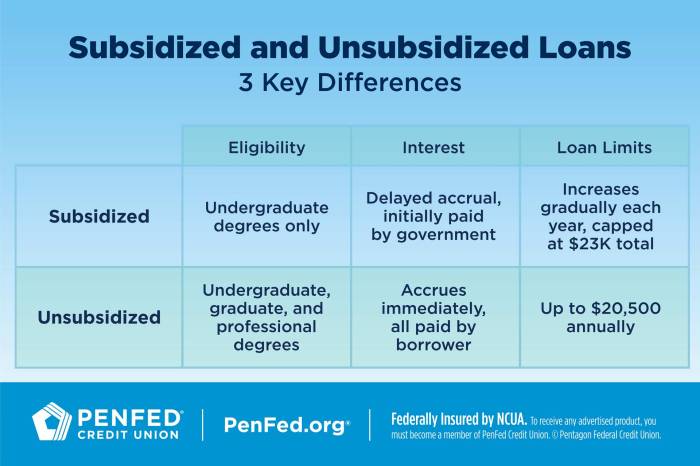

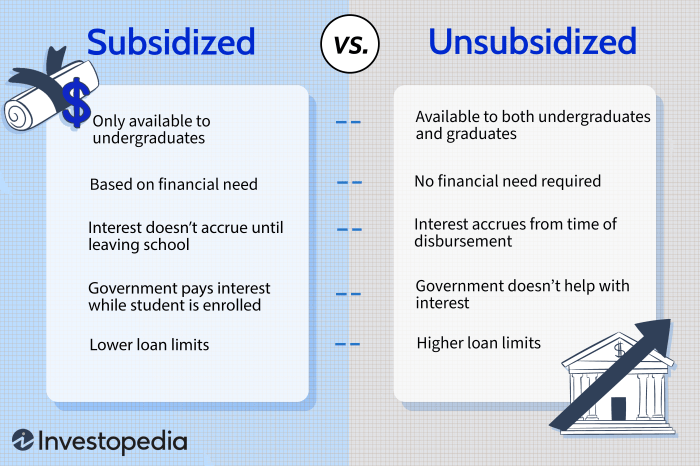

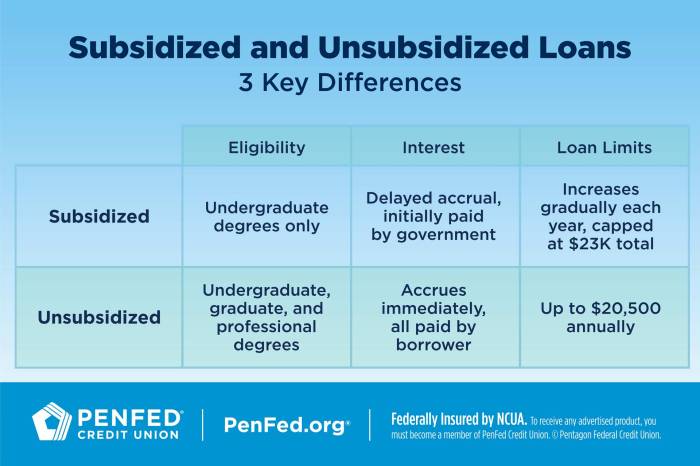

Key Differences Between Subsidized and Unsubsidized Loans

The primary difference lies in interest accrual. With subsidized loans, the government pays the interest while you’re in school (at least half-time) and during certain grace periods. Unsubsidized loans, however, accrue interest from the moment the loan is disbursed, regardless of your enrollment status. This difference significantly impacts the total cost of borrowing. Other differences may include eligibility requirements, though both loan types are generally available to students enrolled at least half-time in eligible degree programs. Repayment terms are largely similar, with standard repayment plans and options available for both.

Concise Definition of an Unsubsidized Student Loan

An unsubsidized student loan is a federal loan for education where interest begins accumulating from the time the loan is disbursed, regardless of enrollment status or financial need.

Comparison of Subsidized and Unsubsidized Loans

| Loan Type | Interest Accrual | Eligibility | Repayment |

|---|---|---|---|

| Subsidized | Interest is paid by the government while the student is enrolled at least half-time and during certain grace periods. | Based on demonstrated financial need. | Begins after a grace period (typically six months after graduation or leaving school). |

| Unsubsidized | Interest accrues from the time the loan is disbursed, regardless of enrollment status. | Generally available to all eligible students, regardless of financial need. | Begins after a grace period (typically six months after graduation or leaving school). |

Interest Accrual on Unsubsidized Loans

Unsubsidized student loans begin accruing interest from the moment the loan is disbursed, unlike subsidized loans, which defer interest accrual during certain periods. Understanding how this interest accumulates and the implications of interest capitalization is crucial for effective loan management.

Interest accrues daily on the principal balance of your unsubsidized loan. This means that every day, interest is calculated on the outstanding amount you owe, and added to your principal. The longer the loan remains unpaid, the more interest accumulates, significantly increasing the total amount you’ll eventually repay. This is unlike subsidized loans, where the government pays the interest during certain periods, such as while you’re enrolled at least half-time in school.

Interest Capitalization

Interest capitalization occurs when accrued but unpaid interest is added to the principal balance of your loan. This increases the principal amount on which future interest is calculated, leading to a snowball effect. The higher the principal, the more interest accrues, further increasing the principal, and so on. This process typically happens at the end of a grace period (a period after graduation before repayment begins) or when a deferment or forbearance ends. It’s a significant factor in increasing the overall cost of your loan.

Scenario: The Impact of Interest Capitalization

Let’s consider a scenario. Suppose a student borrows $10,000 in unsubsidized loans with a 5% annual interest rate. Over four years of college, if no payments are made, the interest accrued would be approximately $2,000. If this interest is capitalized at the end of the four years, the new principal balance becomes $12,000. Over the subsequent repayment period, interest will now be calculated on this larger amount, resulting in a higher total repayment amount than if the interest had not been capitalized. This difference compounds over the loan’s life, leading to a substantially larger total repayment. For instance, if the loan is repaid over 10 years after graduation, this capitalization can add hundreds, if not thousands, of dollars to the total cost.

Minimizing the Impact of Interest Accrual

There are several strategies to mitigate the impact of interest accrual on unsubsidized loans. Making interest-only payments while in school, even small ones, can significantly reduce the amount of interest that capitalizes. Another strategy is to explore loan consolidation options after graduation, which can potentially lower your overall interest rate. Furthermore, diligently paying down the loan as quickly as possible after graduation will minimize the total interest paid. Understanding your loan terms and repayment options is key to effectively managing your debt.

Eligibility and Application Process

Obtaining an unsubsidized student loan involves meeting specific eligibility requirements and navigating the application process. Understanding these aspects is crucial for prospective students seeking financial aid for their education. This section details the criteria for eligibility and provides a step-by-step guide to the application procedure.

Eligibility for unsubsidized federal student loans generally hinges on several key factors. Applicants must be U.S. citizens or eligible non-citizens, be enrolled or accepted for enrollment at least half-time in an eligible degree or certificate program at a participating institution, and maintain satisfactory academic progress. Furthermore, applicants must complete the Free Application for Federal Student Aid (FAFSA) and meet any additional requirements set by their chosen educational institution. Finally, they must demonstrate a need for financial aid as determined by their FAFSA information, although unsubsidized loans are not need-based in the same way as subsidized loans.

Eligibility Criteria for Unsubsidized Federal Student Loans

To be eligible for an unsubsidized federal student loan, an applicant must meet several criteria. These include:

- U.S. citizenship or eligible non-citizen status.

- Acceptance or enrollment at least half-time in a degree or certificate program at a title IV eligible institution.

- Maintenance of satisfactory academic progress as defined by the institution.

- Completion of the Free Application for Federal Student Aid (FAFSA).

- Meeting any additional requirements set by the educational institution.

The Application Process for Unsubsidized Student Loans

The application process for unsubsidized federal student loans is primarily centered around completing the FAFSA. While the specific steps may vary slightly depending on the institution, the overall process remains consistent.

- Gather Necessary Information: Before starting the FAFSA, collect essential information, including Social Security numbers, federal tax returns (yours and your parents’, if applicable), and your driver’s license or state identification.

- Create an FSA ID: You and your parent(s) (if you are a dependent student) will need an FSA ID to access and sign the FAFSA. This is a username and password combination that allows you to securely access your FAFSA information online.

- Complete the FAFSA Form: Access the FAFSA form online at studentaid.gov. Carefully answer all questions accurately and completely. Be aware of deadlines for submission as they vary by state and institution.

- Submit the FAFSA: Once completed, review your information carefully before submitting the FAFSA. You will receive a confirmation number after successful submission.

- Review Your Student Aid Report (SAR): After submission, you will receive a Student Aid Report (SAR). Review this document carefully for any errors or discrepancies. Contact the Federal Student Aid office if you need to make corrections.

- Accept Your Loan Offer: Your school will notify you of your loan eligibility and the amount offered. You will need to accept the loan offer through your school’s financial aid portal.

- Loan Counseling: Before receiving your loan funds, you will be required to complete entrance counseling. This session covers important information about loan repayment, rights, and responsibilities.

- Loan Disbursement: The funds will be disbursed to your school according to the school’s disbursement schedule, usually in installments corresponding to the academic terms.

Repayment Options and Plans

Choosing the right repayment plan for your unsubsidized student loans is crucial for managing your debt effectively and minimizing long-term interest costs. Several plans are available, each with its own advantages and disadvantages depending on your financial situation and repayment goals. Understanding these options allows you to make an informed decision that best suits your circumstances.

Understanding the nuances of different repayment plans is essential for responsible debt management. The standard repayment plan is often the default, but other options, such as income-driven plans, can significantly impact your monthly payments and overall repayment timeline. The choice will influence your budget, long-term financial planning, and the total amount of interest paid.

Repayment Plan Comparison

Several repayment plans are available for unsubsidized federal student loans. The most common include Standard, Graduated, Extended, and Income-Driven Repayment (IDR) plans. Each plan offers a different approach to repayment, affecting monthly payment amounts, loan repayment duration, and total interest paid.

| Plan Name | Payment Type | Duration | Interest Implications |

|---|---|---|---|

| Standard Repayment Plan | Fixed monthly payment | 10 years | Generally lower total interest paid due to shorter repayment period. |

| Graduated Repayment Plan | Payments start low and gradually increase | 10 years | May result in higher total interest paid compared to standard due to lower initial payments. |

| Extended Repayment Plan | Fixed or graduated monthly payments | Up to 25 years | Significantly higher total interest paid due to longer repayment period. |

| Income-Driven Repayment (IDR) Plans (e.g., ICR, PAYE, REPAYE,IBR) | Payments based on income and family size | 20-25 years; potential for loan forgiveness after 20-25 years | Potentially lower monthly payments but higher total interest paid over the life of the loan; possibility of loan forgiveness after a set period. |

Strategies for Effective Repayment

Effective management of unsubsidized student loans involves proactive planning and consistent effort. Several strategies can help borrowers navigate repayment successfully. These strategies are crucial for minimizing interest accumulation and achieving timely loan repayment.

Creating a realistic budget that prioritizes loan repayment is paramount. This involves tracking income and expenses meticulously to identify areas for potential savings. Automating loan payments ensures consistent and timely repayments, avoiding late payment fees and negative impacts on credit scores. Exploring options like loan refinancing can potentially lower interest rates, resulting in significant savings over the long term. Finally, maintaining open communication with your loan servicer allows for addressing any issues or challenges promptly and efficiently.

Potential Risks and Considerations

Unsubsidized student loans, while offering flexibility, carry inherent risks that borrowers must carefully consider before accepting them. Understanding these risks and their potential consequences is crucial for responsible financial planning and avoiding long-term financial hardship. Failure to do so can lead to significant financial burdens and negatively impact credit scores.

Risks Associated with Unsubsidized Loans

The primary risk associated with unsubsidized loans is the accumulation of interest. Unlike subsidized loans, interest begins accruing from the moment the loan is disbursed, even while the borrower is still in school. This can significantly increase the total amount owed by graduation, leading to higher monthly payments and a longer repayment period. Another risk involves the potential for high debt burdens, especially if borrowers take out larger loans than they can realistically repay. This can lead to financial stress and limit future financial opportunities. Finally, a lack of understanding of repayment options and the consequences of default can also pose a significant risk.

Consequences of Defaulting on an Unsubsidized Loan

Defaulting on a student loan, including an unsubsidized loan, has severe consequences. This includes damage to credit scores, making it difficult to obtain loans, credit cards, or even rent an apartment in the future. Wage garnishment is another possibility, where a portion of your paycheck is automatically deducted to repay the debt. The government may also seize tax refunds or other assets to recover the outstanding loan amount. Furthermore, default can negatively impact future opportunities, such as obtaining professional licenses or securing employment in certain fields. In short, defaulting on a student loan can have far-reaching and long-lasting negative consequences.

Responsible Borrowing and Budgeting

Responsible borrowing and budgeting are paramount to avoiding the risks associated with unsubsidized loans. This involves carefully assessing your financial situation, including current income, expenses, and future earning potential. Borrow only what you absolutely need for education, and create a realistic budget that accounts for loan repayments. Explore all available financial aid options, including scholarships and grants, to minimize the amount you need to borrow. Regularly monitor your loan balance and interest accrual, and proactively communicate with your loan servicer if you anticipate any difficulties in repayment. Consider seeking financial counseling to help develop a comprehensive financial plan.

Decision-Making Process for Considering an Unsubsidized Loan

The following flowchart illustrates a step-by-step process for determining whether an unsubsidized loan is the right choice:

[Flowchart Description: The flowchart would begin with a decision box: “Need additional funding for education?”. A “Yes” branch leads to a box: “Explore all other financial aid options (scholarships, grants, etc.)?”. A “Yes” branch leads to a box: “Estimate total cost of education and potential post-graduation income?”. A “Yes” branch leads to a box: “Can you realistically afford monthly loan repayments?”. A “Yes” branch leads to a box: “Understand loan terms and repayment options?”. A “Yes” branch leads to a box: “Proceed with unsubsidized loan application.” A “No” branch at any point in the flowchart leads to a box: “Re-evaluate financial situation and explore alternative options.” A “No” branch from the initial question leads directly to “Re-evaluate financial situation and explore alternative options.”]

Alternatives to Unsubsidized Loans

Securing funding for higher education involves exploring various options beyond unsubsidized loans. Understanding the strengths and weaknesses of each alternative is crucial for making informed financial decisions. A well-rounded approach often combines several funding sources to minimize reliance on loans and reduce long-term debt.

Scholarships and Grants

Scholarships and grants represent forms of financial aid that don’t require repayment. They are awarded based on merit, need, or specific criteria set by the awarding institution or organization. Scholarships often recognize academic achievement, athletic prowess, or community involvement, while grants are typically based on demonstrated financial need. A thorough search of available scholarships and grants is a crucial first step in financing higher education.

- Merit-Based Scholarships: These are awarded based on academic performance, talents, or achievements. Examples include athletic scholarships, academic scholarships, and scholarships based on specific skills (e.g., music, art).

- Need-Based Grants: These are awarded based on a student’s and family’s financial situation, as determined by the Free Application for Federal Student Aid (FAFSA). Examples include Pell Grants and state-sponsored grants.

- Institutional Grants: These are grants offered directly by colleges and universities to students based on merit or need. The amount varies significantly by institution.

Work-Study Programs

Federal Work-Study programs provide part-time employment opportunities for students who demonstrate financial need. Earnings from these jobs can directly contribute to educational expenses, reducing the reliance on loans. Work-study programs can offer valuable professional experience and help students build their resumes while earning money for college.

Savings and Investments

Utilizing personal savings and investments can significantly reduce the need for borrowing. Parents and students can contribute to dedicated college savings plans, such as 529 plans, which offer tax advantages. These plans can help families accumulate funds over time to cover educational costs. However, reliance on savings alone might not be sufficient to cover the entire cost of higher education for many families.

Family Contributions

Family contributions represent a significant source of funding for many students. This can include direct financial support from parents, relatives, or family trusts. The amount of family contribution varies significantly depending on family income and resources. While this is a significant potential source of funding, it’s important to acknowledge that not all families have the resources to fully fund their children’s education.

Private Loans

Private loans offer an alternative to federal student loans, but they often come with higher interest rates and less favorable repayment terms. It’s crucial to compare interest rates and fees carefully before opting for a private loan. Private loans should be considered only after exploring all other available options. Borrowers should be cautious of predatory lending practices.

Comparison of Alternatives

Unsubsidized loans differ significantly from other funding options. Unlike scholarships and grants, loans require repayment with interest, potentially increasing the overall cost of education. While work-study and family contributions reduce reliance on loans, they may not fully cover tuition and expenses. Private loans provide an additional source of funding, but they often carry higher risks due to potentially higher interest rates and less flexible repayment options. Careful consideration of all alternatives is crucial to create a sustainable and affordable plan for financing higher education.

Illustrative Example: Impact of Interest

Understanding the long-term effects of interest on an unsubsidized student loan is crucial for responsible financial planning. This example demonstrates how different interest rates can significantly impact the total repayment amount over a 10-year period on a $10,000 loan.

This section will analyze the total cost of a $10,000 unsubsidized student loan over 10 years, considering various interest rates. We will then visualize this data using a chart to highlight the substantial impact of even small interest rate variations.

Loan Repayment Breakdown at Different Interest Rates

The following table shows the total repayment amount for a $10,000 unsubsidized student loan over 10 years with different annual interest rates. These calculations assume a standard amortization schedule, where payments are made monthly. Note that these are simplified examples and do not account for potential fees or changes in interest rates.

| Annual Interest Rate | Monthly Payment (approx.) | Total Repaid (approx.) |

|---|---|---|

| 3% | $84.89 | $10,186.80 |

| 5% | $96.66 | $11,600.00 |

| 7% | $108.43 | $13,011.60 |

| 9% | $120.20 | $14,424.00 |

Visual Representation of Interest Impact

A line graph would effectively illustrate the impact of interest rates on the total repayment amount.

The x-axis would represent the annual interest rate (3%, 5%, 7%, 9%), and the y-axis would represent the total amount repaid over 10 years. Each data point would represent the total repayment amount at a specific interest rate, as calculated in the table above. The graph would clearly show an upward trend, demonstrating how a higher interest rate leads to a significantly higher total repayment amount. For instance, a 9% interest rate results in a total repayment approximately 42% higher than a 3% interest rate, even though the initial loan amount is the same. This visual representation would powerfully demonstrate the compounding effect of interest over time.

Final Wrap-Up

Securing higher education funding requires careful planning and a thorough understanding of available options. Unsubsidized student loans, while offering access to crucial funds, demand responsible management. By carefully weighing the benefits and drawbacks, understanding the interest accrual implications, and exploring alternative financing options, you can navigate the process effectively and make informed decisions that align with your financial goals. Remember to always borrow responsibly and budget wisely.

FAQ Resource

What happens if I don’t repay my unsubsidized student loan?

Failure to repay your unsubsidized student loan can lead to serious consequences, including damage to your credit score, wage garnishment, and potential legal action.

Can I refinance my unsubsidized student loan?

Yes, refinancing your unsubsidized student loan is possible through private lenders. This might offer a lower interest rate, but it’s essential to compare offers carefully.

Are there any penalties for early repayment of an unsubsidized student loan?

Generally, there are no penalties for early repayment of federal unsubsidized student loans. However, always check your loan terms.

How does my credit score affect my unsubsidized student loan application?

While a good credit score isn’t strictly required for federal unsubsidized loans, a poor credit history might affect your eligibility for private student loans or influence the interest rate offered.