Navigating the world of student loans can feel like deciphering a complex financial code. One of the most crucial decisions you’ll make is understanding the difference between fixed and variable interest rates. This guide will illuminate the key distinctions between these two loan types, helping you make an informed choice that aligns with your financial goals and risk tolerance. We’ll explore the advantages and disadvantages of each, examining how they impact your monthly payments and overall loan repayment.

Choosing between a fixed and variable interest rate significantly impacts the long-term cost of your education. A fixed rate offers predictable monthly payments, shielding you from fluctuating interest rates. Conversely, a variable rate presents the potential for lower initial payments but carries the risk of higher costs if interest rates rise. This exploration will provide you with the knowledge necessary to make a confident and financially sound decision.

Types of Student Loans

Navigating the world of student loans can feel overwhelming, but understanding the different types available is crucial for making informed financial decisions. This section Artikels the key distinctions between federal and private student loans, highlighting their features and interest rate structures.

Federal Student Loans

Federal student loans are offered by the U.S. government through programs like the Federal Direct Loan Program. These loans are generally preferred due to their borrower protections and flexible repayment options. Several types of federal student loans exist, each with its own eligibility requirements and terms.

Subsidized Federal Direct Loans: These loans are available to undergraduate students who demonstrate financial need. The government pays the interest while the student is in school at least half-time, during grace periods, and during periods of deferment.

Unsubsidized Federal Direct Loans: These loans are available to both undergraduate and graduate students, regardless of financial need. Interest begins accruing immediately, even while the student is in school.

Federal Direct PLUS Loans: These loans are available to graduate students and parents of undergraduate students. Credit checks are performed, and approval isn’t guaranteed. Interest rates are generally higher than subsidized and unsubsidized loans.

Private Student Loans

Private student loans are offered by banks, credit unions, and other private lenders. Unlike federal loans, eligibility requirements and terms vary significantly among lenders. These loans often require a creditworthy co-signer, especially for students with limited or no credit history.

Features of Private Student Loans: Private student loans can offer various features, including variable or fixed interest rates, different repayment options, and potential discounts for automatic payments. However, they typically lack the borrower protections offered by federal loans. Interest rates can fluctuate based on market conditions for variable-rate loans, leading to unpredictable monthly payments.

Creditworthiness and Co-signers: Securing a private student loan often hinges on the applicant’s creditworthiness. A strong credit history can lead to lower interest rates. Students with limited or no credit history frequently need a creditworthy co-signer to qualify for a loan.

Comparison of Interest Rate Structures

Federal student loan interest rates are set by the government and are generally lower than those of private loans. Furthermore, federal loans often offer more flexible repayment options and protections for borrowers experiencing financial hardship. Private loan interest rates are influenced by market conditions and the borrower’s creditworthiness, resulting in potentially higher rates and less predictable repayment terms. The interest rate on a private loan can be fixed or variable, while federal loan interest rates are generally fixed for the life of the loan.

Student Loan Comparison Table

| Loan Type | Interest Rate Type | Repayment Options | Typical Lender |

|---|---|---|---|

| Subsidized Federal Direct Loan | Fixed | Standard, Income-Driven Repayment | U.S. Department of Education |

| Unsubsidized Federal Direct Loan | Fixed | Standard, Income-Driven Repayment | U.S. Department of Education |

| Federal Direct PLUS Loan | Fixed | Standard, Income-Driven Repayment | U.S. Department of Education |

| Private Student Loan | Fixed or Variable | Various options, lender-specific | Banks, Credit Unions, Online Lenders |

Fixed Interest Rates

Fixed interest rate student loans offer a predictable and stable repayment plan, unlike their variable-rate counterparts. Understanding the implications of a fixed rate is crucial for responsible financial planning during and after your education.

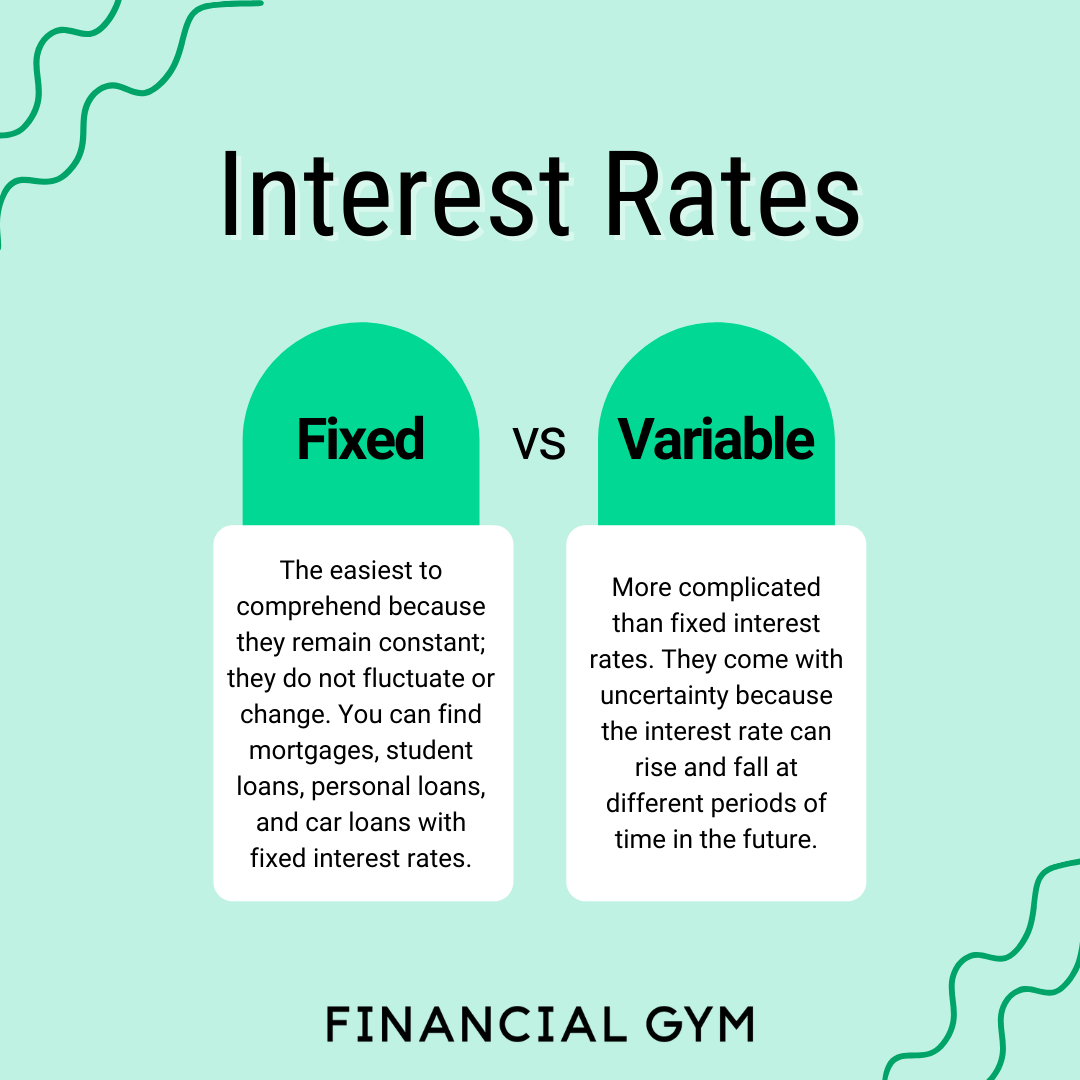

A fixed interest rate student loan means the interest rate on your loan remains constant throughout the entire repayment period. This rate is set when you borrow the money and doesn’t change, regardless of fluctuations in the overall market interest rates. This contrasts with variable-rate loans, where the interest rate can adjust periodically based on economic indicators.

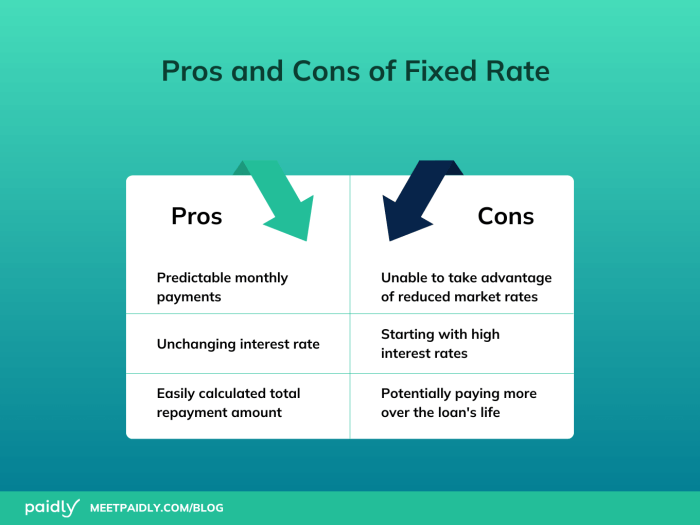

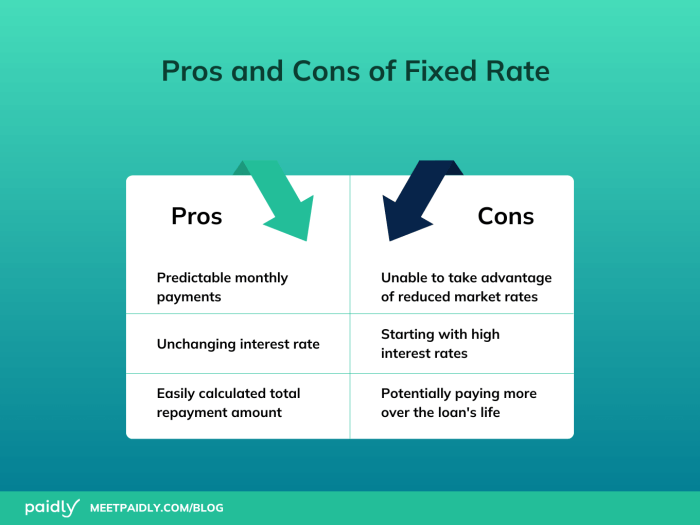

Advantages of Fixed Interest Rate Student Loans

Choosing a fixed interest rate offers several key benefits. The most significant advantage lies in the predictability and stability it provides for your budget.

Predictability of Monthly Payments with a Fixed Interest Rate

With a fixed interest rate, your monthly payment remains consistent for the life of the loan. This allows for easier budgeting and financial planning. You can accurately forecast your expenses and avoid the uncertainty of fluctuating payments that can occur with variable-rate loans. For example, if your monthly payment is $300, you can reliably budget that amount each month, unlike variable rates where it might increase unexpectedly. This predictability is especially valuable for recent graduates entering the workforce and establishing their financial footing.

Protection Against Rising Interest Rates

Fixed interest rates offer significant protection against increases in market interest rates. If interest rates rise after you’ve secured a fixed-rate loan, your payments will not increase. This shields you from the potential financial strain of higher interest costs. For instance, if market rates jump significantly, your monthly payment will stay the same, unlike variable-rate loans which could see a substantial increase, potentially impacting your ability to manage your finances effectively. This stability is particularly beneficial in uncertain economic climates.

Variable Interest Rates

Variable interest rate student loans, unlike their fixed-rate counterparts, have interest rates that fluctuate over the life of the loan. This means your monthly payment amount can change, potentially increasing or decreasing, depending on market conditions. Understanding how these rates work and their associated risks is crucial before committing to this type of loan.

Variable interest rates are tied to an underlying benchmark index, such as the prime rate or the London Interbank Offered Rate (LIBOR), often with a margin added by the lender. This margin represents the lender’s profit. The index rate changes periodically, typically monthly, causing the interest rate on your loan to adjust accordingly.

Factors Influencing Variable Interest Rates

Several economic factors influence the benchmark index and, consequently, your variable interest rate. These include inflation rates, central bank monetary policy decisions (such as changes in the federal funds rate), and overall market conditions. For example, if inflation rises significantly, central banks might increase interest rates to curb inflation, leading to a higher variable interest rate on your student loan. Conversely, during periods of economic slowdown, interest rates may decrease, resulting in lower payments.

Potential Risks of Variable Interest Rates

The primary risk of a variable interest rate student loan is the uncertainty surrounding future payments. An unexpected increase in the benchmark index can lead to significantly higher monthly payments, potentially straining your budget. If the interest rate rises substantially, you might find yourself struggling to make your payments, potentially leading to delinquency or default. This is particularly risky for borrowers with already tight budgets or those anticipating lower income in the future. Consider, for example, a borrower with a loan whose interest rate increases by 2 percentage points. This seemingly small increase can significantly impact the total repayment amount and monthly payments over the life of the loan.

Comparison of Variable and Fixed Interest Rates

While variable interest rates can offer lower initial interest rates compared to fixed rates, particularly in periods of low interest rates, this advantage can quickly disappear if market conditions change. Fixed-rate loans provide predictability and stability, offering a consistent monthly payment amount throughout the loan term. This predictability is highly valuable for budgeting and financial planning. The trade-off is that the initial interest rate on a fixed-rate loan might be higher than a variable rate loan at the time of origination. The best choice depends on your individual risk tolerance and financial circumstances. A borrower comfortable with risk and expecting lower interest rates in the future might consider a variable rate, while those prioritizing predictability and stability would likely prefer a fixed rate.

Interest Rate Calculation Methods

Understanding how interest is calculated on your student loans is crucial for effective financial planning. Different methods exist, and the specifics depend on your loan type and lender. This section will clarify common calculation methods and illustrate the impact of interest capitalization.

The most common method for calculating interest on student loans is simple interest. This means interest is calculated only on the principal balance of the loan. The formula is: Interest = Principal x Rate x Time. Where ‘Principal’ is the original loan amount, ‘Rate’ is the annual interest rate (expressed as a decimal), and ‘Time’ is the time period (usually in years). However, for student loans, interest is usually calculated daily and then added to the principal balance. This daily compounding means that the interest accrued each day is added to the principal, and the next day’s interest calculation includes that added interest. This subtly increases the amount of interest paid over the life of the loan compared to a simple interest calculation.

Interest Capitalization

Interest capitalization occurs when accumulated interest is added to the principal loan balance. This increases the principal amount on which future interest is calculated, leading to a larger overall loan repayment amount. This process typically happens when payments are not made or during periods of deferment or forbearance.

For example, imagine you have a $10,000 loan with a 5% interest rate. If you defer payments for one year, the interest accrued during that year ($500) will be capitalized. Your new principal balance becomes $10,500, and subsequent interest calculations will be based on this higher amount. This process can significantly increase the total cost of your loan over time.

Calculating Monthly Payments (Fixed Interest Rate)

Calculating the exact monthly payment on a student loan requires a slightly more complex formula, often using an amortization schedule. However, a simplified approach offers a reasonable estimate. We can use a formula that approximates the monthly payment:

Monthly Payment ≈ (Loan Amount x Monthly Interest Rate) / (1 – (1 + Monthly Interest Rate)^-Number of Months)

Where:

- Loan Amount: The original principal amount of the loan.

- Monthly Interest Rate: The annual interest rate divided by 12.

- Number of Months: The total repayment period in months (loan term in years multiplied by 12).

Let’s illustrate with an example: A $20,000 loan with a 6% annual interest rate over 10 years (120 months).

- Monthly Interest Rate: 0.06 / 12 = 0.005

- Number of Months: 10 years * 12 months/year = 120 months

- Monthly Payment ≈ ($20,000 x 0.005) / (1 – (1 + 0.005)^-120) ≈ $222.04

Note: This is an approximation. Actual monthly payments might vary slightly due to rounding and the precise amortization schedule used by the lender.

Fixed vs. Variable Rate Loan Comparison

This hypothetical scenario demonstrates the difference in total interest paid between a fixed and variable rate loan over a 10-year repayment period.

- Scenario: A $20,000 student loan.

- Fixed Rate Loan: 6% annual interest rate. Using an online loan calculator or amortization schedule, the total interest paid over 10 years would be approximately $7,442. This is assuming consistent monthly payments over the entire loan term.

- Variable Rate Loan: Starts at 4% annual interest rate, but increases to 7% in year 5, and remains there until loan maturity. Using a loan calculator or amortization schedule that accommodates variable rates, and assuming the increase occurs precisely at year 5, the total interest paid over 10 years would likely be higher than the fixed-rate loan, potentially between $7,500 and $8,000, due to the interest rate increase midway through the loan term. The exact amount depends on the timing and magnitude of interest rate fluctuations. This illustrates that while a variable rate might start lower, the total cost can exceed a fixed rate loan if interest rates rise.

Impact of Interest Rate on Repayment

The choice between a fixed and variable interest rate for your student loan significantly impacts your long-term repayment costs. Understanding this impact is crucial for making an informed decision that aligns with your financial situation and repayment goals. The type of interest rate you choose directly affects the total amount you’ll pay over the life of the loan.

The total cost of a student loan is determined by the principal amount borrowed plus the accumulated interest. Fixed-rate loans offer predictable monthly payments and a known total repayment amount. Variable-rate loans, on the other hand, present more uncertainty, as interest rates fluctuate based on market conditions. This fluctuation can lead to lower payments initially, but potentially much higher payments later, or a longer repayment period.

Impact of Variable Interest Rates on Borrowers with Limited Income

Choosing a variable-rate student loan when income is limited presents significant financial risks. While lower initial payments might seem appealing, unexpected increases in interest rates can strain a borrower’s budget. This could lead to difficulty making payments, potential delinquency, and damage to credit scores. The unpredictable nature of variable rates makes budgeting and financial planning significantly more challenging for those with already constrained financial resources. A sudden spike in interest rates could force borrowers to make difficult choices, potentially impacting their ability to meet other essential expenses.

Comparative Illustration of Fixed and Variable Rate Repayment Schedules

The following illustration compares two repayment schedules: one with a fixed interest rate of 5% and another with a variable interest rate starting at 4% and fluctuating over the loan term. Both loans assume a principal amount of $20,000 and a 10-year repayment period.

Imagine a graph with two lines. The horizontal axis represents the time in years (0-10), and the vertical axis represents the cumulative amount repaid (in dollars). The line representing the fixed-rate loan is a straight, upward-sloping line, reflecting consistent monthly payments. The line representing the variable-rate loan starts below the fixed-rate line, reflecting lower initial payments due to the lower starting interest rate. However, this line shows periods of steeper slopes, indicating higher payments during times of increased interest rates. The line might also show periods of gentler slopes reflecting lower payments when interest rates decrease. Importantly, by the end of the 10-year period, the variable-rate loan line will likely be significantly higher than the fixed-rate loan line, illustrating the potential for a much larger total repayment amount with a variable rate. A legend would clearly label each line as “Fixed Rate (5%)” and “Variable Rate (Starting at 4%)”. The graph visually demonstrates the potential for higher total repayment costs with a variable rate loan, despite the lower initial payments. The difference in total repayment between the two loans over the 10-year period would be clearly visible, highlighting the long-term financial implications of choosing a variable rate loan.

Factors Affecting Interest Rates

Several key factors interplay to determine the interest rate you’ll receive on your student loans. Understanding these factors can help you navigate the borrowing process and potentially secure a more favorable rate. These factors range from your personal financial history to broader economic trends.

The interest rate isn’t simply a random number; it’s a reflection of the lender’s assessment of your creditworthiness and the prevailing economic climate. A lower interest rate translates to lower overall borrowing costs, making repayment significantly easier. Conversely, a higher rate increases the total amount you’ll pay back over the loan’s lifetime.

Credit History’s Influence on Interest Rates

Your credit history is a cornerstone in determining your student loan interest rate. Lenders use your credit score – a numerical representation of your creditworthiness – to gauge the risk of lending to you. A higher credit score, indicating responsible borrowing and repayment behavior in the past, typically results in a lower interest rate. Conversely, a lower credit score suggests a higher risk of default, leading lenders to offer higher interest rates to compensate for that increased risk. For example, a borrower with an excellent credit score (750 or above) might qualify for a significantly lower interest rate compared to someone with a poor credit score (below 600). Lenders often use established credit scoring models like FICO to assess risk.

Loan Amount’s Impact on Interest Rates

While not always a direct correlation, the amount you borrow can indirectly influence your interest rate. Larger loan amounts might be perceived as higher risk by some lenders, potentially leading to slightly higher interest rates. This isn’t a universal rule, as other factors heavily influence the rate, but it’s a consideration. Lenders may also offer different interest rate tiers based on loan amounts, with smaller loans sometimes receiving slightly better rates due to lower perceived risk.

Prevailing Economic Conditions and Interest Rates

Broader economic conditions significantly impact student loan interest rates. Factors such as inflation, interest rate hikes by the Federal Reserve, and overall economic growth all play a role. During periods of high inflation, lenders might increase interest rates to protect their returns against the erosion of purchasing power. Similarly, if the Federal Reserve raises its benchmark interest rate, this often leads to higher interest rates across various loan types, including student loans. Conversely, during periods of economic downturn, interest rates may be lower as lenders try to stimulate borrowing. For instance, during the 2008 financial crisis, we saw a significant drop in interest rates across various loan products.

Closure

Ultimately, the decision of whether to choose a fixed or variable interest rate student loan hinges on your individual financial circumstances, risk tolerance, and long-term financial projections. While variable rates might offer lower initial payments, the inherent uncertainty of fluctuating interest rates poses a significant risk. A fixed rate provides the stability and predictability crucial for responsible financial planning. By carefully weighing the pros and cons presented in this guide, you can confidently select the loan type that best supports your academic and financial future.

General Inquiries

What is interest capitalization?

Interest capitalization is the process of adding unpaid interest to the principal balance of your loan. This increases the total amount you owe and can significantly impact your overall loan cost.

How often do variable interest rates adjust?

The frequency of adjustment varies depending on the lender and the specific loan terms. It could be monthly, quarterly, or annually.

Can I refinance my student loan to change the interest rate type?

Yes, refinancing allows you to potentially secure a lower interest rate or switch from a variable to a fixed rate (or vice versa), but it depends on your creditworthiness and market conditions.

What factors besides credit score influence interest rates?

Besides credit score, factors like loan amount, loan type (federal vs. private), and prevailing economic conditions all influence interest rates.