The escalating cost of higher education in the United States has left many graduates grappling with substantial student loan debt. Understanding the current landscape of average student loan debt in 2024 is crucial for both prospective students and policymakers. This analysis delves into the key factors contributing to the rising debt burden, explores geographical variations, and examines the long-term implications for graduates’ financial well-being. We will also consider potential solutions and policy implications to mitigate this growing concern.

This report provides a detailed examination of average student loan debt in 2024, offering insights into the trends, contributing factors, and potential consequences. By analyzing data from reputable sources and considering various perspectives, we aim to provide a comprehensive understanding of this pressing issue and its implications for individuals and society.

Current Average Student Loan Debt in 2024

Determining the precise average student loan debt for 2024 requires careful consideration of data collection methodologies and reporting lags. Official statistics often lag behind the calendar year, and various reporting agencies use slightly different methodologies, leading to variations in reported figures. Therefore, the following analysis presents the most readily available and reliable data as of late 2024, acknowledging that final, precise figures may be slightly different upon official release.

The average student loan debt in the United States continues to be a significant concern for recent graduates and the national economy. Understanding the trends and contributing factors is crucial for informed policy discussions and personal financial planning.

Average Student Loan Debt Figures for 2024

While precise, finalized figures for the average student loan debt in 2024 are not yet fully available from official sources like the Federal Reserve or the Department of Education as of this writing, estimates from various financial institutions and data aggregators suggest a continued upward trend. Several factors, including inflation and rising tuition costs, contribute to this increase. Data from reputable sources like the Education Data Initiative (EDI) and the National Center for Education Statistics (NCES) will be essential for obtaining the most accurate figures once they are released. For now, estimates place the average debt for undergraduate borrowers somewhere between $37,000 and $40,000, with graduate borrowers facing considerably higher average debt levels, potentially exceeding $70,000. These are broad estimates and will vary significantly based on the specific program of study, the institution attended, and the borrower’s individual borrowing habits.

Comparison of Average Student Loan Debt Across Years

The following table provides a comparison of average student loan debt across several recent years. Note that these figures are based on available estimates and may be subject to revision as more comprehensive data becomes available. It is important to understand that these are averages and individual experiences can vary widely.

| Year | Average Student Loan Debt | Percentage Change from Previous Year | Explanation of Shift |

|---|---|---|---|

| 2022 | $38,000 (Estimate) | – | Baseline year for comparison; this figure is an estimate based on available data at the time. |

| 2023 | $39,500 (Estimate) | +4% | Increase likely driven by inflation and continued rising tuition costs. |

| 2024 (Estimate) | $40,000 – $42,000 | +1.3% – +6.3% | Continued upward trend reflecting persistent economic pressures. The range reflects the uncertainty in precise figures at this time. |

Methodologies for Calculating Average Student Loan Debt

Several methodologies exist for calculating average student loan debt, each with potential limitations and biases. Common approaches involve surveying borrowers, analyzing federal student loan data, or using a combination of these methods. Surveys may suffer from sampling bias, potentially under- or over-representing certain demographic groups. Analysis of federal loan data might exclude private loans, leading to an underestimation of the overall average debt. Furthermore, averages can mask significant variations in debt levels across different student populations, obscuring the experiences of individuals with exceptionally high or low debt burdens. Finally, the methodology used to calculate the average (mean, median, or mode) can significantly affect the result. The choice of methodology needs to be transparent and carefully considered when interpreting the results.

Factors Influencing Student Loan Debt Levels in 2024

Several interconnected factors contribute to the current level of student loan debt in 2024. These factors range from the rising cost of higher education to the availability and accessibility of financial aid. Understanding these influences is crucial for developing effective strategies to manage and reduce student loan burdens.

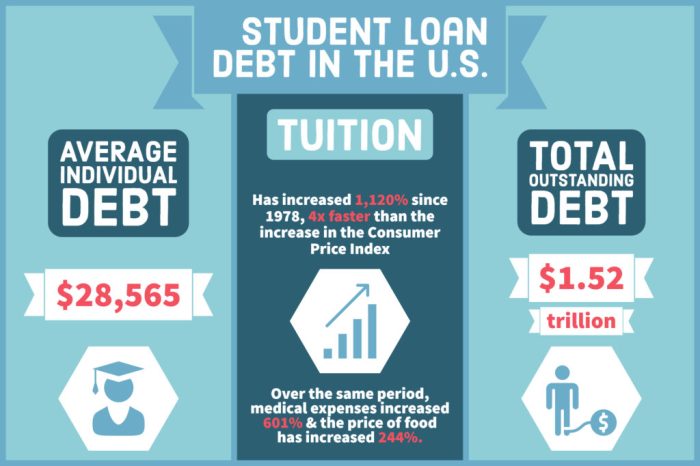

Tuition Inflation’s Impact on Student Loan Debt

Tuition inflation significantly impacts student loan debt levels. The cost of higher education has consistently outpaced inflation for many years, forcing students to borrow more to cover expenses. For example, the average annual tuition increase at private four-year colleges has historically been higher than the rate of inflation, meaning that the cost of attending college increases faster than the overall growth of the economy. This widening gap necessitates increased borrowing to meet tuition costs, leading to higher overall debt upon graduation. A student who attended a private university in 2004 might have faced significantly lower tuition compared to a student attending the same university in 2024, necessitating a much larger loan amount for the latter.

Average Debt Levels Across Different Educational Institutions

The average student loan debt varies considerably depending on the type of institution attended.

- Public Universities: Generally, students attending public universities incur lower average debt compared to those at private institutions. This is often attributed to lower tuition costs, particularly for in-state residents, and potentially greater access to state-based financial aid programs.

- Private Universities: Private universities typically have significantly higher tuition costs, resulting in substantially higher average student loan debt for graduates. The lack of state subsidies and reliance on tuition revenue often contribute to these higher costs and greater reliance on student loans.

- For-Profit Colleges: Students attending for-profit colleges often accumulate the highest levels of debt relative to their earnings potential. This is partly due to higher tuition rates and potentially less robust financial aid options compared to public and private non-profit institutions.

The Role of Financial Aid and Scholarships in Mitigating Student Loan Debt

Financial aid and scholarships play a vital role in mitigating student loan debt. Grants, scholarships, and federal student aid programs, such as Pell Grants, can significantly reduce the amount students need to borrow. However, the availability and accessibility of these resources vary widely depending on factors such as family income, academic merit, and the type of institution attended. For instance, a student with a high GPA and strong extracurricular activities might secure a merit-based scholarship, reducing their need for loans. Similarly, students from low-income families may qualify for need-based grants that significantly lessen their debt burden. The effectiveness of these programs in mitigating debt is dependent on both the amount of aid available and the student’s ability to access and utilize these resources.

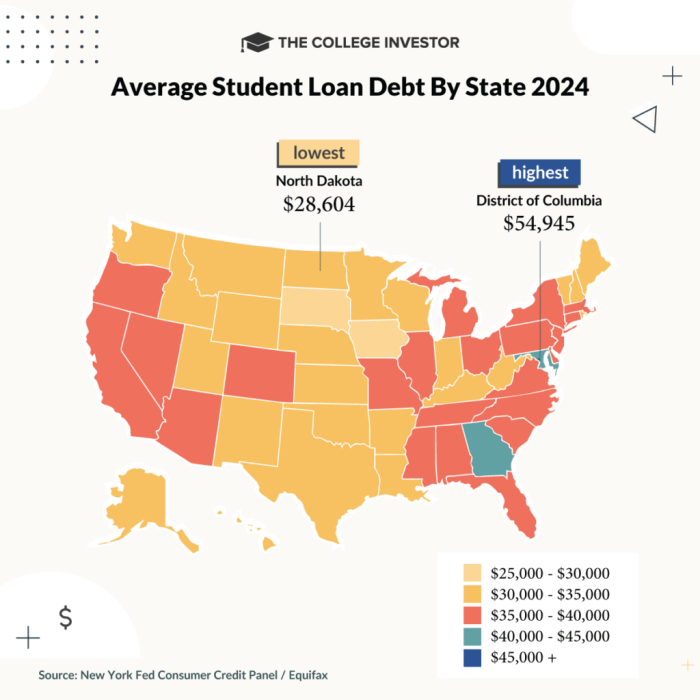

Geographic Variations in Student Loan Debt

A significant disparity exists in the average student loan debt burden across the United States, with certain regions consistently shouldering a heavier financial load than others. This uneven distribution is not simply a matter of chance; it reflects a complex interplay of socioeconomic factors, educational opportunities, and regional economic conditions.

Examining a hypothetical map of average student loan debt by state in 2024 would reveal a striking pattern. Imagine a gradient, with the darkest shading concentrated in the Northeast and along the coasts, particularly in states like New York, Massachusetts, and California. These areas would show the highest average student loan debt. Conversely, states in the Midwest and South, such as Arkansas, Mississippi, and West Virginia, would be represented by lighter shades, indicating lower average debt levels. The Rocky Mountain and Plains states would likely fall somewhere in between, displaying a moderate level of student loan debt. This visual representation would highlight the considerable regional differences in the financial burden faced by recent graduates.

Regional Disparities in Student Loan Debt

The observed geographical variations in student loan debt are a consequence of several interacting factors. Higher costs of living in states with major metropolitan areas and prestigious universities, such as those in the Northeast and on the West Coast, directly contribute to higher tuition fees and consequently, greater borrowing. These states also tend to have a higher concentration of private institutions, which often charge significantly more than public universities. Conversely, states with a larger number of affordable public universities and lower living expenses naturally see lower average student loan debt. Furthermore, access to financial aid and grant opportunities varies considerably by state, impacting the amount students need to borrow. States with robust state-funded grant programs might show lower average debt levels compared to states with less generous aid systems.

Correlation Between Student Loan Debt and Socioeconomic Factors

A strong correlation exists between average student loan debt and various socioeconomic indicators at the state level. States with higher average student loan debt tend to have higher average incomes, reflecting the higher cost of education and living in these areas. However, this higher income often does not fully offset the increased cost of tuition, leading to substantial borrowing. Conversely, states with lower average student loan debt often have lower average incomes and higher unemployment rates. This suggests that limited economic opportunities and reduced access to higher-paying jobs can contribute to lower levels of educational attainment and, consequently, lower student loan debt. The relationship is not necessarily linear; a state might have a relatively high income but still have high student loan debt if the cost of higher education is disproportionately high. For example, a state with a high concentration of highly-paid professionals but also high-cost private universities could see high average student loan debt despite high average incomes. Conversely, a state with a low average income might have lower student loan debt if it offers highly subsidized public education.

Impact of Student Loan Debt on Graduates

The weight of student loan debt significantly impacts graduates’ financial well-being, extending far beyond the immediate post-graduation period. The long-term consequences can shape major life decisions and influence overall financial security for years to come. Understanding these effects is crucial for both graduates and policymakers aiming to mitigate the burden of student loans.

The sheer magnitude of student loan debt can create considerable financial strain. Many graduates find themselves juggling monthly payments with the demands of establishing a career and independent living. This can lead to delayed or forgone opportunities that would otherwise contribute to long-term financial stability.

Challenges Faced by Graduates with Significant Student Loan Debt

High levels of student loan debt present numerous obstacles for graduates. The burden of repayment can significantly delay major life milestones. For instance, purchasing a home becomes considerably more difficult when a substantial portion of income is allocated to loan repayments. Similarly, starting a family might be postponed due to the financial constraints imposed by debt. Furthermore, saving for retirement often takes a backseat, potentially jeopardizing long-term financial security. Many graduates find themselves struggling to balance immediate financial needs with long-term planning, creating a cycle of debt that can be challenging to break. This is particularly true for those in lower-paying professions, where the monthly loan payments can represent a disproportionately large percentage of their income.

Career Paths and Earning Potential of Graduates with Varying Debt Levels

The relationship between student loan debt and career choices is complex. While higher education often leads to higher earning potential, the level of debt incurred can influence the types of jobs graduates pursue. Graduates with substantial debt may feel compelled to prioritize higher-paying jobs, even if those jobs don’t align with their passions or long-term career goals. This can lead to career dissatisfaction and a sense of being trapped in a financially driven career path. Conversely, graduates with lower debt levels might have more flexibility to explore diverse career options, even if they involve lower initial salaries, potentially leading to greater job satisfaction and a more fulfilling career trajectory in the long run. For example, a graduate with minimal debt might be more inclined to pursue a career in the non-profit sector, while a graduate burdened by significant debt may feel pressured to pursue a higher-paying, albeit less fulfilling, corporate role. The impact on overall well-being, therefore, extends beyond mere financial considerations.

Potential Solutions and Policy Implications

The escalating burden of student loan debt necessitates a multifaceted approach involving both immediate and long-term strategies, addressing individual responsibility alongside systemic issues within the higher education financing system. Solutions must consider the economic implications for borrowers, the federal budget, and the overall health of the economy.

The following Artikels potential solutions, categorized for clarity, acknowledging the complex interplay of economic and social factors involved.

Short-Term Solutions: Immediate Relief and Mitigation

Addressing the immediate crisis requires strategies that provide rapid relief to struggling borrowers. These solutions often involve direct government intervention and are typically more politically contentious due to their fiscal implications.

- Targeted Loan Forgiveness Programs: These programs, while politically charged, offer immediate relief to specific groups of borrowers (e.g., those in public service, those facing economic hardship). However, they can be expensive and may not address the root causes of rising debt. For example, the Public Service Loan Forgiveness program, while well-intentioned, has faced significant implementation challenges.

- Income-Driven Repayment (IDR) Plan Improvements: Expanding eligibility and simplifying the application process for IDR plans can offer immediate relief to borrowers struggling to make payments. Improving the transparency and effectiveness of these plans would help borrowers manage their debt more effectively. For instance, making the calculation of monthly payments more straightforward and easily accessible would benefit many.

- Increased Funding for Student Loan Counseling Services: Providing readily available and effective counseling services can help borrowers navigate the complexities of repayment options and avoid default. This approach addresses the individual’s need for informed decision-making and is a relatively cost-effective solution.

Long-Term Solutions: Systemic Reform and Prevention

Long-term solutions focus on preventing future debt crises through structural changes to the higher education system and financing mechanisms. These solutions require more time to implement but have the potential for more sustainable impact.

- Tuition Reform and Increased Affordability: Addressing the root cause of high student loan debt requires making college more affordable. This could involve increased state funding for public universities, tuition freezes or reductions, and incentivizing institutions to control costs. Examples of successful tuition control measures can be found in certain states that have implemented targeted funding increases for public institutions.

- Expansion of Need-Based Financial Aid: Increasing grant aid and scholarships based on financial need can reduce reliance on loans. This would require significant investment in federal and state aid programs. The Pell Grant program is a prime example of a need-based aid program, though its funding levels could be significantly increased to better address the needs of low-income students.

- Increased Transparency in College Costs and Outcomes: Requiring colleges to provide clearer information on tuition costs, graduation rates, and post-graduation employment outcomes can empower students to make informed decisions about their educational investments. This would promote greater accountability within the higher education sector.

Economic and Social Consequences of Policy Approaches

The economic and social consequences of different policy approaches are substantial and varied. Loan forgiveness programs, for example, have significant budgetary implications and may impact future borrowing behavior. Increased financial aid could stimulate economic activity by increasing consumer spending and boosting enrollment in higher education. Conversely, policies that fail to address affordability may exacerbate existing inequalities and limit social mobility. The overall impact depends on the specific policy implemented and its interaction with other economic and social factors. A comprehensive cost-benefit analysis is essential before implementing any large-scale policy intervention.

Final Summary

In conclusion, the average student loan debt in 2024 reflects a complex interplay of factors, including rising tuition costs, limited financial aid, and regional economic disparities. The long-term impact on graduates’ financial health is significant, underscoring the need for comprehensive solutions. Addressing this issue requires a multifaceted approach involving tuition reform, increased financial aid accessibility, and potentially, targeted loan forgiveness programs. Only through a concerted effort can we hope to alleviate the burden of student loan debt and ensure a brighter financial future for generations to come.

FAQ

What are the common repayment plans for student loans?

Common repayment plans include standard, graduated, extended, and income-driven repayment plans. Each plan offers different payment schedules and terms, and the best option depends on individual circumstances.

Can I consolidate my student loans?

Yes, loan consolidation combines multiple federal student loans into a single loan with a new interest rate and repayment schedule. This can simplify repayment but may not always lower the overall cost.

What happens if I default on my student loans?

Defaulting on student loans can have severe consequences, including wage garnishment, tax refund offset, and damage to credit score. It is crucial to contact your loan servicer to explore repayment options before defaulting.

Are there any resources available to help manage student loan debt?

Yes, several resources are available, including the National Foundation for Credit Counseling (NFCC), the Student Loan Borrower Assistance website, and individual loan servicers. These resources can provide guidance on repayment options and debt management strategies.