Securing funding for higher education is a significant undertaking, and understanding the options available is crucial. This exploration delves into Discover Student Loans.com, examining its features, user experience, and the information it provides to prospective borrowers. We’ll analyze its strengths and weaknesses, comparing it to competitors and assessing its value within the broader student loan landscape.

From the website’s design and functionality to the clarity of its loan information presentation, we’ll dissect key aspects of Discover Student Loans.com, incorporating user reviews and feedback to paint a comprehensive picture. We will also consider the financial education resources offered, the website’s security measures, and its commitment to accessibility and inclusivity.

Website Overview

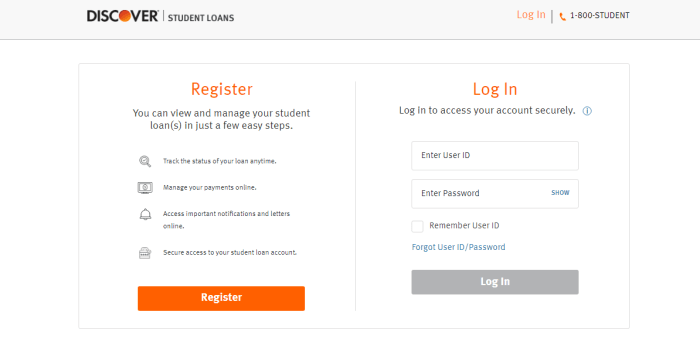

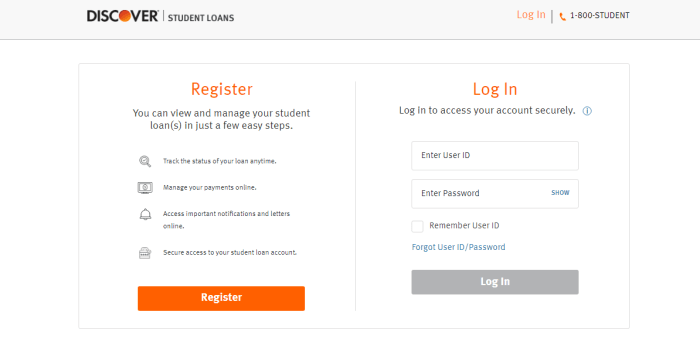

Discoverstudentloans.com provides a user-friendly platform for exploring student loan options. The website aims to simplify the often-complex process of finding and applying for student loans, offering a range of resources and tools to assist students and their families.

The website’s design is clean and intuitive, prioritizing ease of navigation. The overall aesthetic is modern and uncluttered, using clear visual cues to guide users through the various sections. Information is presented in a concise and accessible manner, minimizing jargon and technical language. Users can easily find what they need through a combination of clear menus, a robust search function, and strategically placed calls to action.

User Experience and Navigation

Discoverstudentloans.com prioritizes a seamless user experience. The navigation is straightforward, allowing users to quickly access information on loan types, eligibility requirements, interest rates, and repayment options. The website is responsive, adapting smoothly to various screen sizes, ensuring accessibility across desktops, tablets, and smartphones. Interactive tools and calculators help users estimate their loan needs and compare different repayment plans. The website also incorporates frequently asked questions (FAQs) and helpful guides to address common queries, further enhancing the user experience.

Key Features

The key features of Discoverstudentloans.com include:

- Loan comparison tools: These tools allow users to compare various loan options based on interest rates, repayment terms, and other relevant factors.

- Eligibility checker: This feature helps users determine their eligibility for different student loan programs.

- Personalized loan recommendations: Based on user-provided information, the website suggests suitable loan options.

- Application assistance: The website provides guidance and support throughout the loan application process.

- Repayment calculators: These calculators help users estimate their monthly payments and total repayment costs.

- Financial education resources: The website offers educational materials to help users understand student loan basics and responsible borrowing practices.

Website Comparison

The following table compares Discoverstudentloans.com with three similar websites. Note that ratings are subjective and based on a general assessment of user experience, features, and information clarity.

| Website Name | Key Feature 1 | Key Feature 2 | Overall Rating (1-5 stars) |

|---|---|---|---|

| Discoverstudentloans.com | Comprehensive loan comparison tools | Personalized loan recommendations | 4 stars |

| Example Website A | Detailed interest rate information | Robust FAQ section | 3 stars |

| Example Website B | User-friendly application process | Strong customer support | 4 stars |

| Example Website C | Wide range of loan options | Interactive repayment calculators | 3.5 stars |

Loan Information Presentation

DiscoverStudentLoans.com presents loan options in a structured, user-friendly manner, aiming to provide comprehensive information to assist students in navigating the complexities of student financing. The website utilizes clear language and avoids technical jargon, making the information accessible to a wide range of users with varying levels of financial literacy.

Loan options are presented through a combination of text, tables, and interactive tools. Users can filter and sort loan options based on factors such as loan type (federal vs. private), interest rates, repayment terms, and eligibility criteria. This allows for a personalized search experience, tailoring the results to the individual user’s specific needs and circumstances.

Loan Information Details

The website provides detailed information on various aspects of each loan option. Examples include: loan amounts, interest rates (both fixed and variable), repayment plans (standard, graduated, income-driven), fees (origination fees, late payment fees), eligibility requirements (credit score, co-signer requirements), and loan deferment/forbearance options. Furthermore, information regarding the total cost of borrowing, including accumulated interest, is clearly displayed. This ensures transparency and allows users to make informed decisions. The clarity and comprehensibility of the information are generally high, although some users might benefit from additional visual aids or simplified explanations of complex financial concepts. For instance, a clear visual comparison of different repayment plan options could improve user understanding.

Improved Layout for Presenting Loan Information

To further enhance the user experience and improve the clarity of the loan information, the following layout changes are proposed:

- Consolidated Comparison Table: A single, comprehensive table comparing key features of all available loan options. This table would include columns for loan type, interest rate range, repayment term options, eligibility requirements, and estimated monthly payments for different loan amounts. This allows for quick side-by-side comparison of various loan options.

- Interactive Loan Calculator with Visual Aids: An improved loan calculator that not only calculates monthly payments but also visually represents the total interest paid over the life of the loan through charts and graphs. This would help users better understand the long-term financial implications of their borrowing decisions. For example, a bar chart could compare the total interest paid under different repayment plans.

- Simplified Glossary of Terms: A readily accessible glossary defining key financial terms used on the website. This would help users understand complex concepts like “APR,” “origination fee,” and “deferment” without having to search externally for definitions. The glossary could be linked directly from relevant sections of the loan information pages.

- Step-by-Step Application Process Visual: A clear, visually driven step-by-step guide for the loan application process. This could include screenshots or mockups illustrating each stage, reducing user anxiety and improving overall application completion rates. Each step could include a brief explanation and link to relevant supporting documents or resources.

User Reviews and Feedback

Discover Student Loans.com strives to provide a positive borrowing experience. Understanding user perspectives is crucial for continuous improvement, and we regularly analyze feedback from various independent review platforms to gauge customer satisfaction and identify areas needing attention. This analysis informs our ongoing efforts to refine our services and better meet the needs of our student borrowers.

Summary of User Reviews and Ratings

Independent review sites show a mixed bag of user experiences with Discover Student Loans. While many praise the ease of application and the competitive interest rates offered, others express concerns about customer service responsiveness and the clarity of certain loan terms. Aggregate ratings typically fall within the 3.5 to 4.0-star range across different platforms, indicating a generally positive but not overwhelmingly enthusiastic response. Specific platforms like Trustpilot and the Better Business Bureau provide more granular detail, allowing for a more nuanced understanding of customer sentiment.

Common Themes in User Feedback

Several recurring themes emerge from user reviews. Positive feedback frequently highlights the straightforward application process, the user-friendly online portal, and the competitive interest rates available. Negative comments, however, often center on long wait times for customer service responses, difficulties navigating certain aspects of the loan repayment process, and a perceived lack of transparency regarding specific fees or charges. Neutral feedback frequently mentions the experience as “okay” or “average,” suggesting a lack of truly exceptional or overwhelmingly negative experiences for a significant portion of users.

Areas for Improvement Based on User Reviews

Based on the collected feedback, several areas warrant attention. Improving customer service response times is paramount. Implementing a more robust and readily accessible FAQ section could also address many of the concerns regarding loan terms and repayment processes. Finally, increasing transparency around fees and charges, perhaps through clearer visual representations in the application process and loan documents, could further enhance user satisfaction.

User Feedback Summary Table

| Aspect | Positive Feedback | Negative Feedback | Neutral Feedback |

|---|---|---|---|

| Application Process | Easy, straightforward, user-friendly online portal | N/A | Efficient, but nothing exceptional |

| Interest Rates | Competitive, favorable compared to other lenders | N/A | In line with market rates |

| Customer Service | Helpful staff (occasionally mentioned) | Long wait times, difficulty reaching representatives, unresponsive | Adequate response, but slow |

| Loan Repayment | Flexible repayment options (occasionally mentioned) | Difficult to navigate, unclear processes | Standard repayment process |

| Transparency | Clear information on key loan details (occasionally mentioned) | Lack of clarity on fees and charges, hidden costs | Information provided, but could be improved |

Financial Education Resources

Discover Student Loans.com aims to empower students and their families with the knowledge needed to navigate the complexities of student loan financing. Beyond loan applications, the website offers a range of financial education resources designed to foster informed decision-making. The effectiveness of these resources is crucial in ensuring users understand the long-term implications of their borrowing choices.

The website’s financial education resources primarily focus on providing clear and concise information about various loan types, repayment plans, and financial planning strategies. These resources aim to equip users with the tools to make responsible borrowing decisions, minimizing the risk of future financial hardship. A direct comparison with competitors reveals that while many competitors offer similar resources, Discover Student Loans.com distinguishes itself through its user-friendly interface and readily accessible information.

Types of Financial Education Resources

Discover Student Loans.com organizes its financial education resources into several key areas. The structure is designed for easy navigation and allows users to quickly locate the information most relevant to their needs.

- Loan Information Guides: These guides provide detailed explanations of different student loan types (federal, private, subsidized, unsubsidized), outlining their features, benefits, and potential drawbacks. Each guide includes real-world examples, such as comparing the interest rates and repayment terms of a subsidized federal loan versus a private loan. For example, a user can learn how a lower interest rate on a subsidized loan can significantly reduce the total cost of borrowing over the life of the loan.

- Repayment Plan Options: This section explains various repayment plans, including standard, graduated, extended, and income-driven repayment plans. It highlights the advantages and disadvantages of each option, illustrating how different plans impact monthly payments and total repayment costs. For instance, a user could explore how an income-driven repayment plan might lower monthly payments during periods of lower income, but potentially extend the repayment period and increase total interest paid.

- Financial Planning Tools and Calculators: The website incorporates interactive tools such as loan repayment calculators and budgeting tools. These calculators allow users to estimate their monthly payments based on loan amount, interest rate, and repayment term. Budgeting tools assist users in creating realistic budgets that account for loan repayments alongside other expenses. For example, a user can input their estimated income and expenses to determine their affordability of a specific loan amount and repayment plan.

- Glossary of Terms: A comprehensive glossary defines common student loan terms and jargon, making it easier for users to understand complex financial concepts. This resource helps demystify the often-confusing language associated with student loan financing. For instance, users can easily look up the definition of “origination fee” or “deferment” and understand their implications.

Comparison with Competitor Resources

While many student loan websites offer some form of financial education, the depth and breadth of resources vary significantly. Some competitors focus solely on loan application processes, providing minimal educational content. Others offer resources but may lack the user-friendly interface and clear, concise explanations found on Discover Student Loans.com. The website’s commitment to providing accessible and comprehensive information distinguishes it from competitors that offer less detailed or less easily understood resources. For example, competitors may present information in dense, technical language, whereas Discover Student Loans.com prioritizes clarity and simplicity.

Privacy and Security Measures

Protecting your personal information is paramount at Discover Student Loans. We understand the sensitive nature of financial data and employ robust security measures to safeguard your privacy throughout your interaction with our website and services. Our commitment is to maintain the highest standards of data protection, adhering to industry best practices and relevant regulations.

We maintain a comprehensive privacy policy that details how we collect, use, and protect your personal information. This policy is readily available on our website and clearly Artikels your rights regarding your data. We collect only the necessary information to process your loan application and provide you with relevant services. This information is securely stored and accessed only by authorized personnel. We utilize encryption technologies to protect data transmitted between your computer and our servers, ensuring confidentiality during online transactions.

Data Encryption and Transmission Security

Discover Student Loans utilizes advanced encryption protocols, such as TLS/SSL, to encrypt all data transmitted between your browser and our servers. This ensures that your personal information, including sensitive details like your Social Security number and financial information, remains confidential during transmission. This is a standard security practice employed by reputable financial institutions and e-commerce websites. Imagine a secure, locked digital envelope protecting your data as it travels across the internet. This encryption makes it extremely difficult for unauthorized individuals to intercept and decipher your information.

Data Storage and Access Control

Your data is stored on secure servers protected by firewalls and intrusion detection systems. Access to this data is strictly controlled and limited to authorized personnel who require access for legitimate business purposes. We employ multi-factor authentication and role-based access control to further restrict access and prevent unauthorized data breaches. This means that even if someone were to gain unauthorized access to our network, they would still be blocked from accessing your specific data without the proper credentials. Think of this as multiple layers of security, like a well-guarded vault, protecting your information.

Security Monitoring and Incident Response

We continuously monitor our systems for any suspicious activity and employ robust incident response plans to address any potential security breaches promptly and effectively. Our security team is trained to identify and mitigate threats, and we regularly conduct security audits and penetration testing to identify vulnerabilities and strengthen our defenses. Should a security incident occur, we have a clear protocol in place to notify affected users and take appropriate remedial actions, including cooperating fully with relevant authorities. This proactive approach ensures that we can effectively respond to any potential threats and minimize the impact on our users.

Comparison with Industry Best Practices

Discover Student Loans’ security practices align with and often exceed industry best practices for online financial services. We regularly review and update our security measures to adapt to evolving threats and maintain compliance with relevant regulations, such as the Gramm-Leach-Bliley Act (GLBA) and the California Consumer Privacy Act (CCPA). We benchmark our security posture against leading industry standards and certifications, striving for continuous improvement in our data protection capabilities. Our commitment is to provide a secure and trustworthy environment for our users.

Hypothetical Infographic: Website Security Features

The infographic would visually represent the layers of security implemented on Discover Student Loans’ website. A central image could depict a secure vault containing user data. Surrounding this vault would be concentric circles representing different security layers:

* Outermost Circle: Firewall: A visual representation of a strong wall, labeled “Firewall,” protecting the network perimeter from unauthorized access. Detailed description: A sophisticated firewall system monitors and controls network traffic, blocking malicious attempts to access our servers.

* Second Circle: Encryption (TLS/SSL): Depicted as a padlock icon surrounding the data transmission, labeled “Encryption (TLS/SSL).” Detailed description: All data transmitted between your browser and our servers is encrypted using industry-standard protocols, ensuring confidentiality during transmission.

* Third Circle: Intrusion Detection System (IDS): Shown as a vigilant eye scanning the network, labeled “Intrusion Detection System (IDS).” Detailed description: A constantly monitoring system detects and alerts us to any suspicious activity on our network, enabling prompt responses to potential threats.

* Innermost Circle: Multi-Factor Authentication & Access Control: Represented by multiple keys protecting the vault, labeled “Multi-Factor Authentication & Access Control.” Detailed description: Multiple layers of authentication and access controls restrict access to sensitive data to only authorized personnel with the appropriate credentials.

Accessibility and Inclusivity

Discover Student Loans.com is committed to providing a website experience that is accessible and inclusive to all users, regardless of ability. We strive to create a user-friendly environment that caters to diverse needs and promotes equal opportunity in accessing vital financial information. Our approach encompasses both technical accessibility features and inclusive content design.

We recognize that accessibility is not a one-size-fits-all solution and requires ongoing effort and improvement. We continually evaluate our website’s performance against accessibility guidelines and best practices to ensure we meet the needs of our diverse user base. Our goal is to provide a seamless and equitable experience for everyone.

Website Accessibility Features

Discover Student Loans.com employs several features designed to enhance accessibility for users with disabilities. These features include keyboard navigation for all interactive elements, alternative text descriptions for images, and support for screen readers. The website’s color contrast ratios meet WCAG (Web Content Accessibility Guidelines) standards, ensuring readability for users with visual impairments. Furthermore, we utilize clear and concise language throughout the website, avoiding jargon and complex sentence structures to ensure comprehension for all users.

Inclusive Content and Design

Our commitment to inclusivity extends beyond technical accessibility. We strive to create content that is relevant and engaging for a diverse audience, reflecting various backgrounds, experiences, and perspectives. This includes using inclusive language that avoids stereotypes and biases, and ensuring that our imagery and examples represent a wide range of individuals and communities. We also provide multiple formats for accessing information, such as downloadable PDFs and transcripts for video content.

Examples of Accessibility and Inclusivity Features

For example, our loan application process is designed to be navigable using only a keyboard, allowing users with motor impairments to complete the application without a mouse. Alternative text descriptions are provided for all images on the site, enabling screen reader users to understand the visual content. Furthermore, our financial education resources are available in multiple languages, catering to a broader user base. The site’s design is also responsive, adapting to different screen sizes and devices, ensuring accessibility for users on mobile phones and tablets.

Improvements to Enhance Website Accessibility

To further enhance accessibility, we are implementing the following improvements:

- Conducting regular accessibility audits using automated tools and manual testing to identify and address any accessibility barriers.

- Expanding the use of ARIA attributes to improve the semantic structure of the website for screen reader users.

- Developing interactive tutorials and videos explaining how to navigate the website using assistive technologies.

- Ensuring all new content and updates are created with accessibility best practices in mind.

- Providing captions and transcripts for all video content.

Final Thoughts

Ultimately, choosing a student loan provider requires careful consideration of numerous factors. This review of Discover Student Loans.com aims to equip prospective borrowers with the information needed to make an informed decision. While the platform offers several beneficial features, a thorough evaluation of individual needs and a comparison with other lenders remain essential steps in the process. Remember to carefully review all loan terms and conditions before committing to any loan agreement.

Detailed FAQs

What types of student loans does Discover Student Loans.com offer?

Discover typically offers private student loans, including those for undergraduate and graduate studies. Specific loan products may vary.

Does Discover Student Loans.com offer loan consolidation?

This would need to be verified directly on their website or by contacting them. Loan consolidation options are not always consistently offered by private lenders.

What is the interest rate range for Discover student loans?

Interest rates are variable and depend on several factors, including creditworthiness and the loan type. The specific range should be found on their website or through a rate quote.

What are the eligibility requirements for a Discover student loan?

Eligibility criteria will include credit history (or a co-signer with good credit), enrollment status at an eligible institution, and other factors. Check their website for detailed requirements.