The cost of higher education in the United States has long been intertwined with the availability and terms of student loans. Understanding the historical trajectory of student loan interest rates is crucial for comprehending the current student debt crisis and the evolving relationship between government policy, economic conditions, and individual borrowers. This exploration delves into the fluctuating landscape of student loan interest rates, examining key legislative changes, economic influences, and the contrasting experiences of borrowers with federal and private loans.

From the initial establishment of federal student loan programs to the complexities of current interest rate calculations, we will trace the evolution of this critical aspect of financing higher education. We’ll analyze how economic factors, such as inflation and recession, have shaped interest rate trends, and we will consider the impact of significant government policies designed to manage student loan costs and accessibility.

Introduction to Historical Student Loan Interest Rates

The history of federal student loan programs in the United States is a complex tapestry woven with threads of expanding access to higher education and evolving economic realities. Since the initial programs’ inception, the landscape of student loan interest rates has undergone significant transformations, influenced by fluctuating economic conditions, legislative changes, and evolving government policies. Understanding this history is crucial to grasping the current state of student loan debt and the challenges facing borrowers today.

The calculation methods for student loan interest rates have also evolved considerably over time. Early programs often utilized fixed interest rates, determined by prevailing market conditions or set by Congress. However, more recent programs have incorporated variable interest rates, tied to indices like the Treasury bill rate, leading to fluctuating monthly payments for borrowers. This shift towards variable rates introduced a new level of uncertainty for students planning their finances.

Key Legislation Impacting Student Loan Interest Rates

Several key pieces of legislation have profoundly impacted student loan interest rates. The Higher Education Act of 1965 laid the groundwork for federal student loan programs, establishing the basic framework for government involvement. Subsequent amendments and reauthorizations throughout the years, such as the Higher Education Act of 1998 and various subsequent amendments, refined eligibility criteria, loan terms, and interest rate structures. The Health Care and Education Reconciliation Act of 2010, for instance, introduced significant changes to the calculation and application of interest rates, impacting millions of students. These legislative acts often reflected shifting political priorities and economic conditions, leading to both increases and decreases in interest rates over time. The impact of these legislative shifts was often felt immediately by borrowers, influencing their monthly payments and overall repayment burden. For example, the 2010 act resulted in a temporary decrease in interest rates for certain loan types, providing some relief to borrowers but also highlighting the inherent volatility of the system.

Interest Rate Trends Over Time

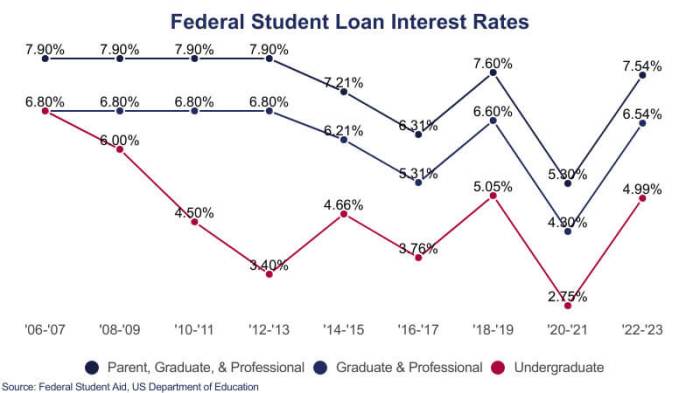

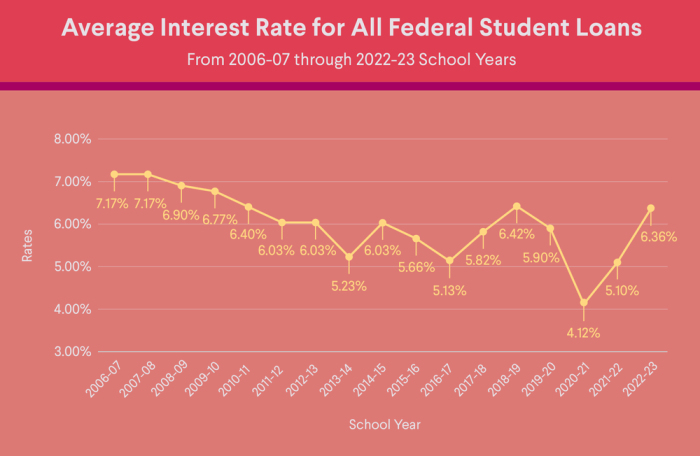

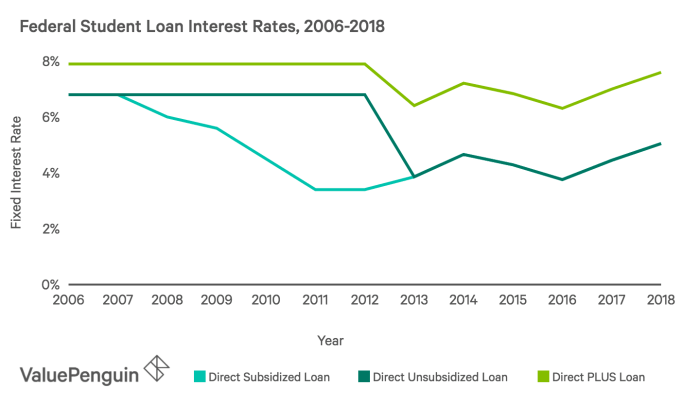

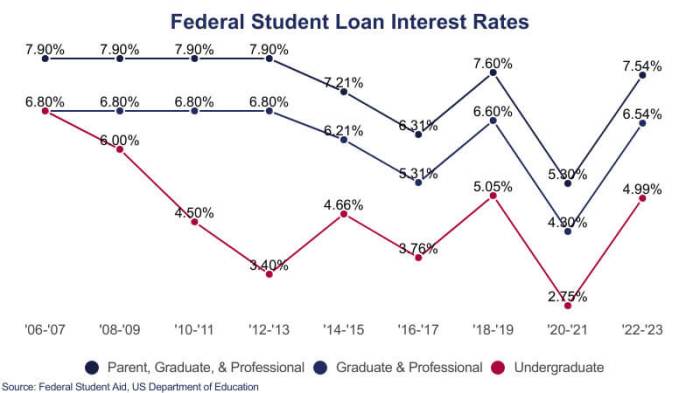

Student loan interest rates have fluctuated significantly over the past few decades, impacting borrowers’ repayment burdens and overall higher education affordability. Understanding these trends is crucial for prospective and current borrowers to make informed financial decisions. This section will analyze historical interest rate changes, exploring contributing factors and comparing rates across different loan types.

The following table provides a snapshot of student loan interest rates across several decades. Note that these are simplified examples and actual rates varied based on factors such as creditworthiness and the specific loan program. Furthermore, indexation methods also shifted over time, further complicating a direct comparison.

| Year | Loan Type | Interest Rate (Approximate) | Index Used (if applicable) |

|---|---|---|---|

| 1990 | Subsidized Stafford | 7% | Treasury Bill Rate |

| 1990 | Unsubsidized Stafford | 9% | Treasury Bill Rate |

| 1990 | Graduate PLUS | 10% | Treasury Bill Rate |

| 2000 | Subsidized Stafford | 4% | Treasury Bill Rate |

| 2000 | Unsubsidized Stafford | 7% | Treasury Bill Rate |

| 2000 | Graduate PLUS | 8.25% | Treasury Bill Rate |

| 2010 | Subsidized Stafford | 3.4% | Fixed Rate |

| 2010 | Unsubsidized Stafford | 6.8% | Fixed Rate |

| 2010 | Graduate PLUS | 7.6% | Fixed Rate |

| 2020 | Subsidized Stafford | 2.75% | Fixed Rate |

| 2020 | Unsubsidized Stafford | 4.5% | Fixed Rate |

| 2020 | Graduate PLUS | 7.08% | Fixed Rate |

Significant Interest Rate Fluctuations

Periods of significant interest rate changes were often influenced by broader economic conditions. For instance, the relatively low rates in the early 2000s coincided with a period of low inflation and accommodative monetary policy by the Federal Reserve. Conversely, increases in rates, particularly in the 1980s and early 1990s, mirrored periods of higher inflation and tighter monetary policy. Government policies, such as changes to loan programs and subsidies, also played a considerable role. The shift from index-based rates to fixed rates in the later years reflected a policy decision to provide more predictable borrowing costs for students.

Comparison of Interest Rates Across Loan Types

Historically, Graduate PLUS loans have consistently carried higher interest rates compared to undergraduate Stafford loans (both subsidized and unsubsidized). This difference reflects the higher perceived risk associated with lending to graduate students, who often have higher debt burdens and potentially less established credit histories. Unsubsidized Stafford loans generally had higher rates than subsidized loans because interest accrues on unsubsidized loans while the student is in school, whereas interest is not charged on subsidized loans during the in-school period. The difference in interest rates between subsidized and unsubsidized loans often reflects the government’s willingness to subsidize the interest for students who demonstrate financial need.

Impact of Economic Factors on Interest Rates

Student loan interest rates, while seemingly isolated, are deeply intertwined with broader economic conditions. Fluctuations in inflation, Federal Reserve policies, and the overall health of the economy significantly influence the cost of borrowing for students. Understanding these relationships is crucial for both borrowers and policymakers.

Inflation’s Effect on Student Loan Interest Rates

Inflation, the rate at which the general level of prices for goods and services is rising, and student loan interest rates share a close relationship. High inflation typically leads to higher interest rates. This is because lenders demand a higher return on their investment to compensate for the decreased purchasing power of their future repayments. Conversely, low inflation may allow for lower interest rates. For example, during periods of low inflation in the early 2010s, some student loan interest rates were relatively low. However, the relationship isn’t always perfectly linear; other economic factors can also play a role.

Federal Reserve Policy’s Influence on Student Loan Interest Rates

The Federal Reserve (also known as the Fed), the central bank of the United States, plays a pivotal role in shaping interest rates across the economy, including those for student loans. The Fed uses monetary policy tools, primarily the federal funds rate (the target rate banks charge each other for overnight loans), to influence borrowing costs. When the Fed raises the federal funds rate to combat inflation, this generally leads to higher interest rates across the board, including for student loans. Conversely, lowering the federal funds rate, often done during economic downturns to stimulate borrowing and spending, can lead to lower student loan interest rates. The impact, however, is often indirect; the Fed’s actions influence the broader market, which in turn affects the rates offered by lenders for student loans.

Economic Recessions and Student Loan Interest Rate Trends

Economic recessions significantly impact student loan interest rate trends. During recessions, the demand for loans may decrease as fewer students enroll in higher education due to economic hardship, and lenders may become more risk-averse. This decreased demand and increased risk aversion can lead to initially lower interest rates as lenders compete for borrowers. However, as governments often increase borrowing during recessions to stimulate the economy, this can increase overall interest rates over time, potentially affecting student loan rates. The 2008 financial crisis, for instance, saw initial decreases in student loan demand, followed by a more complex pattern of interest rate adjustments as government intervention and economic recovery played out.

Impact of Government Policies on Interest Rates

Government policies play a pivotal role in shaping the landscape of student loan interest rates, significantly impacting borrowers’ financial burdens and repayment strategies. These policies, primarily enacted by Congress, influence not only the rates themselves but also the accessibility and overall affordability of higher education. Understanding the interplay between government action and interest rates is crucial to comprehending the student loan system’s complexities.

Congress’s role is multifaceted, encompassing the setting of interest rate caps, the implementation of subsidy programs, and the overall structure of the student loan system. Through legislative acts, Congress directly influences the cost of borrowing for students and, consequently, their long-term financial well-being. This influence is exerted through various mechanisms, including direct rate setting, the creation of income-driven repayment plans, and the availability of loan forgiveness programs.

Congressional Role in Setting Interest Rates and Subsidies

Congress directly influences student loan interest rates through legislation. For example, the Higher Education Act of 1965 established the federal student loan program, laying the groundwork for government involvement in setting interest rates and providing subsidies. Subsequent amendments and new legislation have repeatedly adjusted these rates, often reflecting prevailing economic conditions and political priorities. Congress can set fixed interest rates for specific loan types or allow rates to fluctuate based on market indices, such as the Treasury bill rate. Additionally, Congress can provide subsidies, effectively lowering the interest rate paid by borrowers. These subsidies are typically funded through federal appropriations and reduce the overall cost of borrowing for students. The amount of the subsidy can vary depending on the type of loan and the borrower’s financial circumstances.

Impact of Policy Changes on Student Loan Borrowers

Changes in government policies have significantly affected student loan borrowers. For instance, periods of fluctuating interest rates, particularly during periods of economic uncertainty, have created challenges for borrowers. A sudden increase in interest rates can dramatically increase the total cost of a loan, potentially leading to increased debt burdens and longer repayment periods. Conversely, periods of low or subsidized interest rates can make borrowing more accessible and affordable, potentially encouraging higher enrollment in higher education. The implementation of income-driven repayment plans, designed to make repayment more manageable based on borrowers’ income, has also significantly impacted borrowers, offering more flexibility and potentially reducing the risk of default.

Timeline of Significant Legislative Changes

Several key legislative changes have significantly altered the student loan interest rate landscape. A detailed timeline illustrating these changes would provide a comprehensive overview. For example, the 2007-2008 financial crisis prompted significant changes to the student loan system, including the shift from variable to fixed interest rates for certain loan types. Subsequent legislation has further modified these rates, reflecting ongoing policy debates and economic conditions. A table summarizing these key legislative changes, including the year of enactment, the specific changes implemented, and their impact on borrowers, would offer valuable context. This timeline would demonstrate the dynamic nature of government involvement in student loan interest rates and highlight the continuous evolution of the system.

The Role of Private Student Loans

Private student loans represent a significant, albeit often more risky, segment of the student loan market. Unlike federal loans, which are backed by the government and offer various borrower protections, private loans are offered by banks, credit unions, and other financial institutions. Understanding the historical differences and inherent risks is crucial for prospective borrowers.

Private student loan interest rates have historically been higher than those of federal student loans. This disparity stems from several factors, including the lender’s assessment of risk, market conditions, and the borrower’s creditworthiness. The lack of government backing necessitates higher interest rates to compensate for the increased risk of default.

Historical Interest Rate Comparison

Historically, the interest rate spread between private and federal student loans has varied, but private loans have generally carried a higher cost. For example, during periods of low interest rates (like the early 2010s), the difference might have been only a few percentage points. However, during times of economic uncertainty or rising interest rates, this gap has widened significantly. The specific rates are influenced by various factors, including the credit history of the borrower, the loan terms, and prevailing market conditions. Data from the National Center for Education Statistics and the Consumer Financial Protection Bureau would reveal the specific historical fluctuations.

Factors Influencing Private Student Loan Interest Rates

Several factors contribute to the interest rates applied to private student loans. The borrower’s credit score is a primary determinant; individuals with higher credit scores generally qualify for lower rates. The loan amount, repayment term, and the presence of a co-signer also impact interest rates. Furthermore, prevailing economic conditions, such as the federal funds rate and inflation, influence the overall cost of borrowing. Finally, the lender’s own risk assessment and profit margins play a significant role. A lender might offer a higher interest rate if they perceive a greater risk of default.

Risks Associated with Private Student Loans

Private student loans carry several risks compared to their federal counterparts. The most significant risk is the lack of borrower protections. Federal loans often provide options for income-driven repayment plans, deferment, and forbearance, which can help borrowers manage their debt during financial hardship. Private loans typically lack these safeguards. Additionally, private loans may have more stringent eligibility requirements, making them inaccessible to borrowers with less-than-perfect credit. Defaulting on a private student loan can severely damage a borrower’s credit score, making it difficult to obtain loans or credit in the future. The absence of government intervention in the event of default also places a greater burden on the borrower.

Visual Representation of Data

Understanding historical student loan interest rate trends requires effective visualization. Graphs and charts offer a clear and concise way to interpret complex data, revealing patterns and comparisons that might be missed in raw numerical form. The following sections detail visual representations of student loan interest rate data.

Line Graph of Average Student Loan Interest Rates Over Time

A line graph is ideal for showing the fluctuation of average student loan interest rates over an extended period. The horizontal (x) axis represents time, typically in years, spanning a relevant historical period, such as the last 20 years or more. The vertical (y) axis represents the average annual interest rate, expressed as a percentage. Data points would be plotted for each year, connecting them with a line to illustrate the trend. The graph’s title could be “Average Student Loan Interest Rates (Year X – Year Y),” clearly indicating the time period covered. The axes would be labeled clearly, with the units (years and percentage) specified. For instance, a data point at (2010, 6.8%) would indicate that the average student loan interest rate in 2010 was 6.8%. The line connecting the data points would reveal whether rates generally increased, decreased, or remained relatively stable over the period. Significant fluctuations or specific events (like economic recessions) could be highlighted with annotations.

Bar Chart Comparing Average Interest Rates for Different Loan Types in a Selected Year

A bar chart effectively compares average interest rates across different types of student loans for a specific year. The horizontal (x) axis would list the various loan types, such as subsidized federal loans, unsubsidized federal loans, and private student loans. The vertical (y) axis represents the average interest rate for each loan type, expressed as a percentage. Each loan type would have a corresponding bar, with the height of the bar representing its average interest rate. The chart title could be “Average Student Loan Interest Rates by Loan Type (Year Z),” specifying the year. The axes would be clearly labeled with units. For example, a bar for “Subsidized Federal Loans” might reach a height representing 4.5%, indicating the average interest rate for that loan type in the selected year. The visual comparison allows for easy identification of which loan type had the highest and lowest interest rates during that year. This provides a snapshot of the interest rate landscape for different loan options at a particular point in time.

Outcome Summary

The history of student loan interest rates reveals a complex interplay of economic forces, government policy, and the ever-increasing cost of higher education. While periods of low interest rates have offered some relief to borrowers, significant increases have contributed to the substantial growth of student loan debt. Analyzing these historical trends provides valuable insights into the challenges faced by current and future generations of students and highlights the need for continued discussion and reform in the realm of student financial aid.

FAQ Guide

What is the difference between subsidized and unsubsidized student loans?

Subsidized loans don’t accrue interest while the borrower is in school (or during grace periods), whereas unsubsidized loans do.

How often do student loan interest rates change?

The frequency of changes depends on the loan type and whether the rate is fixed or variable. Federal loan rates are often set annually, while private loan rates can fluctuate more frequently.

What is the impact of inflation on student loan interest rates?

High inflation can lead to higher interest rates as lenders seek to protect the real value of their loans. Conversely, low inflation might correlate with lower rates.

Are there resources available to help borrowers understand their loan terms and interest rates?

Yes, the National Student Loan Data System (NSLDS) and the Federal Student Aid website offer tools and information to help borrowers understand their loans.