Navigating the complexities of student loan repayment can feel daunting, especially when understanding how interest accrues and impacts your total debt. This guide demystifies the process, providing clear explanations and practical examples to help you confidently calculate the interest on your student loans. Whether you’re grappling with fixed or variable interest rates, understanding the mechanics of interest calculation is crucial for effective financial planning and responsible debt management.

We’ll explore both simple and compound interest calculations, highlighting the significant differences between them and their respective effects on your overall loan repayment. We’ll also delve into the influence of various repayment plans and other factors that affect your total interest paid, empowering you to make informed decisions about your financial future.

Understanding Interest Accrual on Student Loans

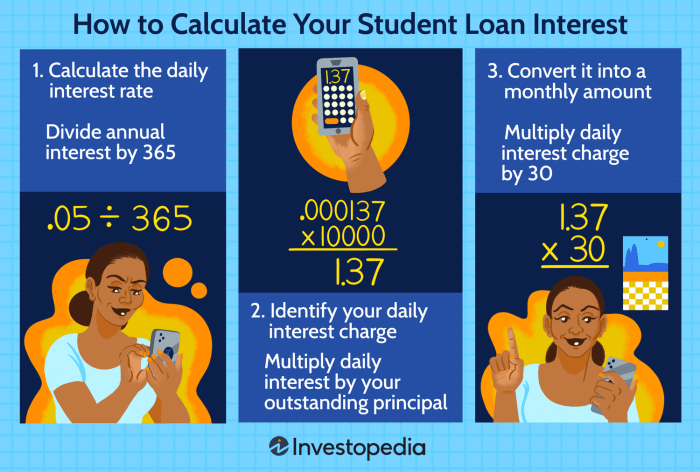

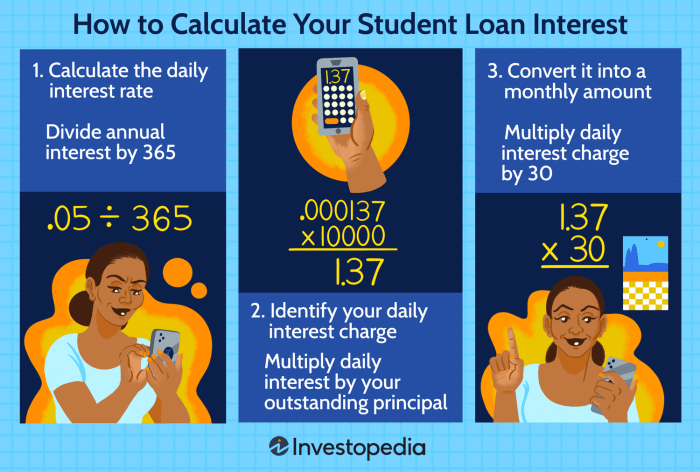

Understanding how interest accrues on your student loans is crucial for effective repayment planning. Failing to grasp this can lead to significantly higher overall costs. This section will clarify different interest types, capitalization, and the impact of various calculation methods on your total loan burden.

Fixed Versus Variable Interest Rates

Student loans typically come with either fixed or variable interest rates. A fixed interest rate remains constant throughout the loan’s life, providing predictability in your monthly payments. A variable interest rate, however, fluctuates based on market indices, meaning your monthly payments could change over time. This variability introduces uncertainty into your repayment budget. For example, a fixed-rate loan might offer a 5% interest rate for the entire loan term, while a variable-rate loan might start at 4% but increase or decrease depending on economic conditions. Choosing between fixed and variable rates depends on your risk tolerance and financial outlook. Generally, fixed rates provide more stability, while variable rates could potentially offer lower initial interest costs if rates remain low.

Interest Capitalization

Interest capitalization is the process of adding accumulated unpaid interest to your principal loan balance. This occurs when you are not making payments, such as during grace periods or deferments. The capitalized interest then begins accruing interest itself, leading to a larger overall debt. For example, imagine you have a $10,000 loan with a 6% interest rate and a six-month grace period. After six months, the accrued interest might be $300. Upon capitalization, your new principal balance becomes $10,300, and future interest calculations are based on this higher amount. This compounding effect can substantially increase the total cost of your loan over time.

Simple Versus Compound Interest

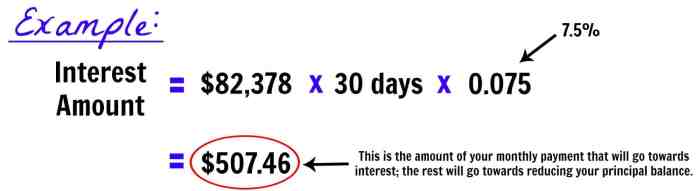

Simple interest is calculated only on the original principal loan amount. Compound interest, on the other hand, is calculated on the principal plus any accumulated interest. This means compound interest grows exponentially over time. Consider a $10,000 loan with a 5% annual interest rate. After one year, simple interest would be $500 ($10,000 x 0.05), resulting in a balance of $10,500. However, with compound interest, the interest earned in the first year is added to the principal, and the next year’s interest is calculated on the new balance of $10,500. This results in a slightly higher interest amount for the second year and a larger overall balance. The difference might seem small initially but becomes more significant over longer loan terms.

Comparison of Interest Calculation Methods

The following table illustrates the differences in total interest paid under various scenarios. These are simplified examples and do not account for all factors influencing actual loan repayment.

| Loan Amount | Interest Rate | Repayment Period (Years) | Total Interest Paid (Approximate) |

|---|---|---|---|

| $10,000 | 5% Fixed | 10 | $3,000 (Simple Interest – illustrative only, not realistic) |

| $10,000 | 5% Fixed | 10 | $3,600 (Compound Interest – approximate) |

| $20,000 | 7% Variable (average 7% over 10 years) | 10 | $7,000 (Compound Interest – approximate) |

| $15,000 | 6% Fixed | 5 | $2,250 (Compound Interest – approximate) |

Ending Remarks

Mastering the art of student loan interest calculation is a crucial step towards responsible debt management. By understanding the intricacies of simple and compound interest, the impact of different repayment plans, and the role of various influencing factors, you can effectively budget for repayment and minimize the overall cost of your education. Remember to utilize available online resources and calculators to aid in your calculations, always verifying the results against your individual loan terms. Taking control of your understanding empowers you to make sound financial decisions and navigate your student loan journey with confidence.

FAQ Explained

What is interest capitalization?

Interest capitalization is the process of adding accumulated unpaid interest to your principal loan balance. This increases the principal amount on which future interest is calculated, leading to higher overall interest payments.

How often is interest calculated on student loans?

Interest calculation frequency varies depending on your loan servicer and loan type. It’s typically daily or monthly, but you should check your loan documents for specifics.

What if I can’t afford my student loan payments?

Contact your loan servicer immediately. They can explain options like deferment, forbearance, or income-driven repayment plans which may temporarily reduce or adjust your payments.

Are there penalties for early repayment of student loans?

Generally, there are no penalties for early repayment of federal student loans. However, some private loans may have prepayment penalties, so check your loan agreement.