Navigating the complexities of student loan repayment can feel daunting, particularly understanding the often-overlooked yet crucial aspect: interest. This guide delves into the intricacies of student loan interest, offering practical strategies and insightful information to empower you to manage your debt effectively and minimize long-term costs. We’ll explore various repayment methods, interest calculation methodologies, and even refinancing options to help you develop a personalized repayment plan.

From understanding fixed versus variable interest rates and the implications of interest capitalization to exploring the benefits of extra principal payments and the consequences of missed payments, we aim to provide a clear and comprehensive understanding of how to effectively navigate the financial landscape of student loan interest. This guide will equip you with the knowledge to make informed decisions and take control of your student loan debt.

Understanding Student Loan Interest

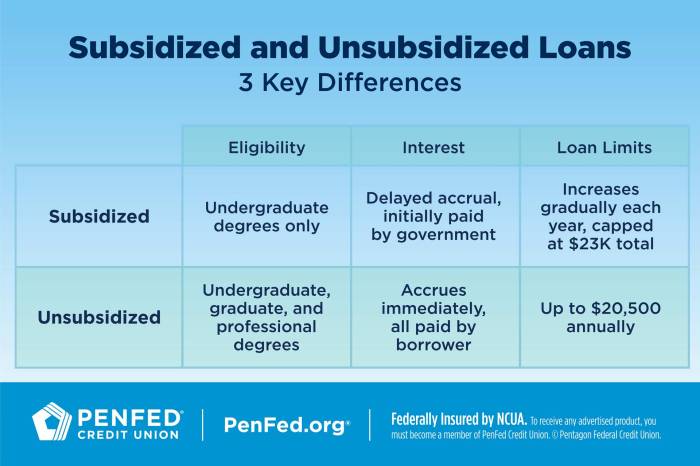

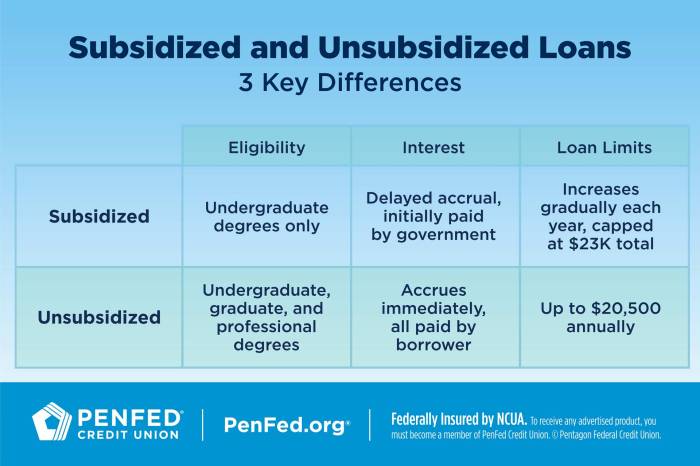

Understanding how student loan interest works is crucial for effective repayment planning. Interest accrues on your loan balance, increasing the total amount you owe over time. The type of loan and its interest rate significantly impact your overall repayment costs.

Fixed vs. Variable Interest Rates

Student loans can have either fixed or variable interest rates. A fixed interest rate remains constant throughout the loan’s life, providing predictable monthly payments. In contrast, a variable interest rate fluctuates based on market conditions, leading to potentially changing monthly payments. Borrowers should carefully consider their risk tolerance when choosing between these options. A fixed rate offers stability, while a variable rate could potentially lead to lower payments initially, but carries the risk of higher payments later if interest rates rise.

Interest Capitalization

Interest capitalization occurs when accrued but unpaid interest is added to your principal loan balance. This increases the principal amount on which future interest is calculated, resulting in a larger total loan amount and potentially higher overall repayment costs. For example, if you have a $10,000 loan with a 5% interest rate and don’t make payments for a year, the $500 interest accrued would be capitalized, increasing your principal to $10,500. Future interest calculations will be based on this higher amount. Understanding capitalization is essential for managing your loan effectively.

Student Loan Interest Calculation

Student loan interest is typically calculated daily on the outstanding principal balance. The daily interest is then added to the principal, compounding the interest over time. The formula for simple interest calculation is:

Interest = Principal x Rate x Time

. However, with daily compounding, the calculation is more complex and typically handled by the loan servicer. The annual interest rate is divided by 365 to determine the daily rate. This daily rate is then multiplied by the outstanding principal balance for each day to determine the daily interest accrued. This daily interest is added to the principal balance at the end of each day, and the process repeats.

Federal Student Loan Program Interest Rates

The following table compares the approximate interest rates for different federal student loan programs. Note that these rates can change annually and are subject to market fluctuations, especially for variable rate loans. Always refer to the official government website for the most up-to-date information.

| Loan Program | Interest Rate Type | Approximate Interest Rate Range (%) | Notes |

|---|---|---|---|

| Direct Subsidized Loan | Fixed | 4.99 – 7.54 | Interest accrues while the student is in school at least half-time. |

| Direct Unsubsidized Loan | Fixed | 4.99 – 7.54 | Interest accrues from disbursement. |

| Direct PLUS Loan (Graduate/Parent) | Fixed | 7.54 – 10.5 | Higher interest rate compared to subsidized and unsubsidized loans. |

| Direct Consolidation Loan | Fixed | Variable, based on weighted average of consolidated loans | Interest rate is a weighted average of the rates of the loans being consolidated. |

Methods of Paying Student Loan Interest

Understanding how to pay your student loan interest is crucial for managing your debt effectively and minimizing long-term costs. Different repayment plans and payment strategies significantly impact the total interest you pay. This section Artikels various approaches to managing your student loan interest payments.

Student Loan Repayment Plans and Their Impact on Interest

Choosing the right repayment plan can substantially affect the amount of interest you accrue over the life of your loan. Federal student loans offer several repayment options, each with its own implications for interest payments. For instance, the Standard Repayment Plan involves fixed monthly payments over a 10-year period. While this plan leads to higher monthly payments, it minimizes the total interest paid compared to longer repayment plans. Conversely, Income-Driven Repayment (IDR) plans, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE), base your monthly payments on your income and family size. These plans typically result in lower monthly payments but often extend the repayment period, potentially leading to higher overall interest costs. It’s important to carefully weigh the advantages of lower monthly payments against the increased total interest paid over the life of the loan. A longer repayment period also means you’ll be paying off your debt for a longer time.

Benefits and Drawbacks of Making Extra Principal Payments

Making extra principal payments on your student loans can significantly reduce the total interest you pay and shorten the repayment period. The benefit is straightforward: by paying down the principal balance faster, you reduce the amount of principal on which interest accrues each month. This can translate to substantial savings over the life of the loan. However, a drawback is that making extra payments requires additional financial resources, which may not always be readily available. It’s crucial to balance the benefits of accelerated repayment with your overall financial situation and other financial goals, such as saving for a down payment on a house or building an emergency fund. For example, an extra $100 per month on a $20,000 loan could save thousands of dollars in interest and shave years off the repayment schedule.

Interest-Only Payments Versus Principal and Interest Payments

Interest-only payments only cover the interest that accrues each month, leaving the principal balance untouched. This approach can provide temporary relief from high monthly payments, particularly during periods of financial hardship. However, the principal balance remains unchanged, meaning the loan will take significantly longer to repay, and the total interest paid will be much higher. Principal and interest payments, on the other hand, cover both the interest and a portion of the principal balance each month. This approach leads to faster loan repayment and significantly lower total interest costs. The choice between these payment methods depends on individual financial circumstances and long-term goals. Choosing interest-only payments should be a carefully considered short-term strategy, as it delays the payoff and ultimately increases the total cost of borrowing.

Setting Up Automatic Payments for Student Loan Interest

Setting up automatic payments is a simple yet effective way to ensure consistent and timely interest payments. The steps typically involve logging into your student loan servicer’s online portal. First, locate the “payments” or “autopay” section. Second, select the “automatic payments” option. Third, provide your bank account information and authorize the automatic debit of your payments. Fourth, confirm your payment amount and frequency (monthly, bi-weekly, etc.). Fifth, review the confirmation details and save the settings. This automated process removes the burden of remembering due dates and helps avoid late payment fees. Many servicers offer incentives, such as a small interest rate reduction, for enrolling in automatic payments. It’s always a good idea to verify your payment information regularly to ensure accuracy and avoid any potential issues.

Managing Student Loan Interest Effectively

Effectively managing student loan interest is crucial for minimizing long-term debt and achieving financial stability. Understanding budgeting strategies, available resources, and the consequences of missed payments are key to successful repayment.

Budgeting and Prioritizing Student Loan Interest Payments

Creating a realistic budget is paramount to successful interest payment. This involves tracking income and expenses to identify areas where savings can be allocated towards loan payments. Prioritizing student loan payments, particularly those with higher interest rates, can significantly reduce the overall interest paid over the life of the loan. Consider using budgeting apps or spreadsheets to monitor your progress and make informed financial decisions. For example, if you have two loans, one with a 7% interest rate and another with a 4% interest rate, focusing on the 7% loan first will save you money in the long run, even if the principal balance is lower.

Resources for Borrowers Struggling to Pay Interest

Several resources are available for borrowers facing difficulties in paying their student loan interest. Deferment or forbearance options may temporarily postpone payments, though interest may still accrue during these periods. Income-driven repayment plans adjust monthly payments based on income and family size, making them more manageable for borrowers with lower incomes. Contacting your loan servicer directly to discuss your situation is crucial; they can provide information on available hardship programs and explore options tailored to your circumstances. For instance, the National Foundation for Credit Counseling offers free financial counseling services to help borrowers create a budget and explore repayment options.

Consequences of Missing Student Loan Interest Payments

Missing student loan interest payments can have significant negative consequences. The most immediate effect is the accumulation of additional interest, increasing the overall loan balance. This can lead to a larger total repayment amount and potentially extend the repayment period. Furthermore, missed payments can negatively impact your credit score, making it more difficult to obtain loans or credit in the future. In severe cases, your loan could go into default, resulting in wage garnishment, tax refund offset, and damage to your creditworthiness. For example, a missed payment can result in a late fee, and repeated missed payments can lead to the loan being sent to collections.

Tips for Reducing Total Interest Paid

Making extra payments, even small amounts, can significantly reduce the total interest paid over the loan’s lifetime. Refinancing your loans to a lower interest rate can also result in substantial savings. Exploring options such as loan consolidation can simplify repayment by combining multiple loans into a single payment with potentially a lower interest rate. Finally, consistently making on-time payments demonstrates responsible borrowing behavior and maintains a positive credit history. For example, paying an extra $50 per month on a $20,000 loan could save you thousands of dollars in interest over the loan term.

Exploring Loan Refinancing Options

Refinancing your student loans can be a strategic move to potentially reduce your monthly payments and overall interest costs. However, it’s crucial to carefully weigh the pros and cons before making a decision. This section will explore the intricacies of refinancing, helping you determine if it’s the right choice for your financial situation.

Refinancing involves replacing your existing student loans with a new loan from a different lender, typically at a lower interest rate. This can lead to significant savings over the life of the loan. However, it’s not always the best option, and there are potential drawbacks to consider.

Pros and Cons of Student Loan Refinancing

Refinancing student loans offers several potential benefits, but also carries certain risks. Understanding these aspects is key to making an informed decision.

- Lower Interest Rates: A primary advantage is the potential for a significantly lower interest rate, leading to reduced monthly payments and lower total interest paid over the loan term. For example, refinancing from a 7% interest rate to a 4% interest rate can save thousands of dollars over the life of a substantial loan.

- Simplified Payments: If you have multiple student loans with varying interest rates and repayment schedules, refinancing can consolidate them into a single loan with a simplified payment plan, making budgeting easier.

- Longer Repayment Term (Potential Drawback): While a longer repayment term can lower monthly payments, it also means paying more interest overall. This trade-off needs careful consideration.

- Loss of Federal Loan Benefits: Refinancing federal student loans into private loans means losing access to federal protections like income-driven repayment plans and potential loan forgiveness programs. This is a crucial factor to consider.

Qualifications and Application Process for Student Loan Refinancing

Eligibility for student loan refinancing varies depending on the lender. Generally, lenders assess creditworthiness, income stability, and debt-to-income ratio.

The application process typically involves providing personal information, employment history, income documentation, and details about your existing student loans. Lenders will then review your application and provide a loan offer, outlining the terms and conditions. It’s essential to compare offers from multiple lenders to secure the best possible rate.

Comparison of Interest Rates Offered by Different Student Loan Refinancing Lenders

Interest rates for student loan refinancing vary considerably among lenders, influenced by factors such as credit score, loan amount, and the type of loan being refinanced. It’s advisable to obtain quotes from several lenders to compare rates and terms before making a decision. For example, Lender A might offer a 4.5% interest rate, while Lender B offers 5%, and Lender C might offer 3.75%, depending on the borrower’s profile. These rates are illustrative and will change based on market conditions and individual circumstances.

Decision-Making Process for Refinancing Student Loans

A flowchart illustrating the decision-making process for refinancing student loans could look like this:

[Diagram Description: The flowchart would begin with a “Start” node. The first decision point would be “Do you have multiple student loans with high interest rates?”. A “Yes” branch leads to “Consider refinancing”. A “No” branch leads to “Refinancing may not be beneficial”. The “Consider refinancing” branch leads to “Compare offers from multiple lenders”. This leads to a decision point: “Is the offered interest rate significantly lower than your current rate and are the terms favorable?”. A “Yes” branch leads to “Refinance your loans”. A “No” branch leads to “Do not refinance”. Finally, both “Refinance your loans” and “Do not refinance” branches lead to an “End” node.]

Summary

Successfully managing student loan interest requires proactive planning and a thorough understanding of your loan terms and available options. By implementing the strategies Artikeld in this guide—from budgeting effectively and exploring refinancing opportunities to understanding the impact of different repayment plans—you can significantly reduce your overall repayment burden and achieve financial freedom sooner. Remember, taking control of your student loan interest is a crucial step towards securing your financial future.

Question Bank

What happens if I only pay the interest on my student loans?

Making interest-only payments prevents your principal balance from increasing, but it doesn’t reduce the loan’s overall amount. You’ll likely be paying off interest for a much longer period, resulting in higher overall costs.

Can I negotiate my student loan interest rate?

Generally, you cannot negotiate the interest rate on federal student loans. However, refinancing your loans through a private lender might offer a lower rate, depending on your creditworthiness.

What are the tax implications of paying student loan interest?

In some cases, you may be able to deduct the interest you paid on student loans from your federal income taxes. Consult a tax professional or the IRS website for the most up-to-date information and eligibility requirements.

How often is interest calculated on my student loans?

Interest on federal student loans is typically calculated daily and capitalized (added to the principal) periodically, depending on the loan type and repayment plan. Check your loan servicer’s website for specifics.