The crushing weight of student loan debt is a reality for millions, often hindering financial freedom and future planning. Understanding how student loan interest accrues is the first step towards tackling this significant challenge. This guide delves into effective strategies to minimize or even eliminate the interest burden, empowering you to regain control of your finances and achieve your financial goals sooner.

From exploring various repayment plans and refinancing options to understanding government programs and forgiveness initiatives, we’ll equip you with the knowledge and tools to navigate the complexities of student loan repayment. We’ll also cover crucial aspects of financial planning and budgeting, emphasizing the importance of seeking professional advice when needed.

Understanding Student Loan Interest

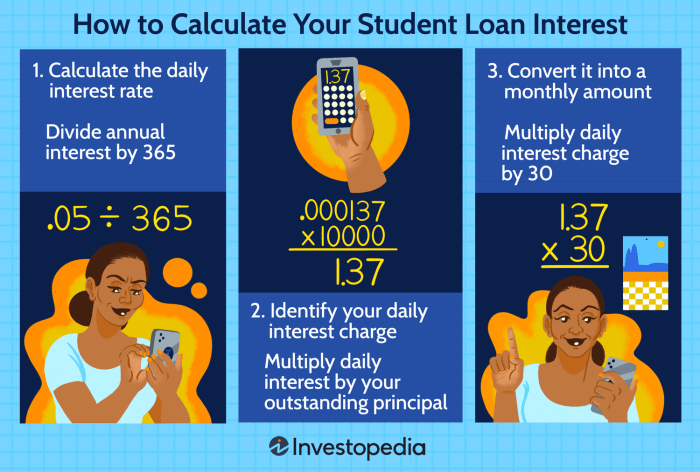

Understanding student loan interest is crucial for effective financial planning. The interest accrued on your loans significantly impacts the total amount you’ll repay. This section will clarify the various types of interest, how it compounds, and the factors influencing its rate.

Types of Student Loan Interest

Student loans typically accrue either fixed or variable interest rates. Fixed interest rates remain constant throughout the loan’s life, providing predictability in monthly payments. Variable interest rates, on the other hand, fluctuate based on market indexes, potentially leading to changes in your monthly payment amount. Understanding this difference is essential for budgeting and long-term financial planning.

Interest Capitalization

Interest capitalization occurs when accumulated interest is added to the principal loan balance. This effectively increases the principal amount on which future interest is calculated, leading to a larger total repayment amount over the life of the loan. For example, if you defer your payments, the unpaid interest capitalizes, increasing your principal and leading to higher payments when you begin repayment. This process can significantly increase the overall cost of your loan if not carefully managed.

Factors Influencing Interest Rates

Several factors influence student loan interest rates. These include the type of loan (federal or private), your credit history (for private loans), the loan’s repayment term, and prevailing market interest rates. Federal loans generally offer lower interest rates than private loans, reflecting the lower risk associated with government-backed lending. A strong credit history can also lead to more favorable interest rates on private loans. Longer repayment terms generally result in higher total interest paid, though monthly payments are lower. Finally, economic conditions significantly impact interest rates; higher market interest rates usually translate to higher loan interest rates.

Fixed vs. Variable Interest Rates

| Feature | Fixed Interest Rate | Variable Interest Rate |

|---|---|---|

| Rate | Stays the same throughout the loan term | Fluctuates based on a market index |

| Predictability | Highly predictable monthly payments | Monthly payments can change |

| Risk | Lower risk of unexpected payment increases | Higher risk of unexpected payment increases or decreases |

| Long-term cost | Generally higher total interest paid over the life of the loan compared to a variable rate during periods of low interest rates. | Potentially lower total interest paid over the life of the loan compared to a fixed rate during periods of low interest rates, but higher during periods of high interest rates. |

Strategies to Reduce or Eliminate Interest

Managing student loan interest effectively is crucial for minimizing your overall debt burden. Several strategies can significantly reduce or even eliminate the accumulation of interest, ultimately saving you considerable money over the life of your loans. These strategies involve leveraging government programs and exploring refinancing options to achieve more favorable repayment terms.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans are designed to make student loan repayment more manageable by basing your monthly payments on your income and family size. The lower monthly payments often result in less interest accruing over the life of the loan, compared to standard repayment plans. This is because a smaller portion of your payment goes towards principal, leaving a larger portion to be covered by accruing interest. However, it’s important to note that IDR plans typically extend the repayment period, meaning you’ll pay off your loans over a longer time frame.

Examples of Income-Driven Repayment Plans and Eligibility Criteria

Several IDR plans exist, each with specific eligibility criteria. For example, the Income-Based Repayment (IBR) plan, the Pay As You Earn (PAYE) plan, and the Revised Pay As You Earn (REPAYE) plan all offer different payment calculation methods and income thresholds. Eligibility generally depends on factors like loan type, income, and family size. Specific details on eligibility and calculations can be found on the Federal Student Aid website. For instance, the REPAYE plan generally offers lower monthly payments than IBR, but may result in a higher total amount paid over the life of the loan due to its longer repayment period.

Refinancing Student Loans to Lower Interest Rates

Refinancing your student loans involves taking out a new loan from a private lender to pay off your existing federal or private student loans. The primary benefit is often a lower interest rate, potentially saving you a substantial amount of money over the life of the loan. However, refinancing federal student loans can result in the loss of certain federal protections, such as income-driven repayment plans and loan forgiveness programs. Carefully weighing the pros and cons is essential before making this decision.

Pros and Cons of Refinancing Options

Refinancing can offer lower monthly payments and a shorter repayment period, but it’s crucial to understand the potential drawbacks. Lower interest rates are the main advantage, leading to reduced overall interest payments. However, refinancing federal loans eliminates access to federal repayment assistance programs and potential loan forgiveness options. Additionally, the terms offered by private lenders can vary significantly, so it’s vital to compare multiple offers before making a decision. For instance, some lenders may offer attractive initial rates but increase them after a certain period, or have higher fees associated with the refinancing process.

Government Programs and Forgiveness Options

Navigating the complexities of student loan repayment can be daunting, but several government programs offer pathways to loan forgiveness or interest reduction. Understanding these programs and their eligibility requirements is crucial for borrowers seeking relief. This section details key federal programs designed to alleviate the burden of student loan debt.

Public Service Loan Forgiveness (PSLF) Program

The Public Service Loan Forgiveness (PSLF) Program forgives the remaining balance on your Direct Loans after you have made 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer.

- Eligibility Requirements: Borrowers must have Direct Loans, work full-time for a qualifying government or non-profit organization, and make 120 qualifying monthly payments under an income-driven repayment plan. Qualifying employment includes government jobs at the federal, state, local, or tribal level, as well as employment with certain non-profit organizations.

- Application Process: Borrowers must consolidate their federal student loans into a Direct Consolidation Loan if they have other types of federal student loans. Then, they must apply for PSLF through the Federal Student Aid website, certifying their employment and payment history. Regular monitoring of the application’s progress is essential.

Teacher Loan Forgiveness Program

This program provides forgiveness for qualified teachers who have completed five years of full-time teaching in low-income schools or educational service agencies.

- Eligibility Requirements: Borrowers must teach full-time for five consecutive academic years in a low-income school or educational service agency. They must have received a qualifying federal student loan, and their teaching must meet specific requirements defined by the program.

- Application Process: Applications are submitted to the Federal Student Aid website. Documentation of teaching experience and employment at a qualifying institution is required. The application process requires careful attention to detail and accurate record-keeping.

Income-Driven Repayment (IDR) Plans

IDR plans are not loan forgiveness programs, but they significantly reduce monthly payments based on income and family size, potentially leading to loan forgiveness after a set period (typically 20 or 25 years).

- Eligibility Requirements: Eligibility varies by plan but generally includes having federal student loans and providing income and family size information annually.

- Application Process: Borrowers apply through their student loan servicer. Annual recertification of income and family size is required to maintain eligibility. Different IDR plans offer varying repayment periods and forgiveness timelines.

Financial Planning and Budgeting for Loan Repayment

Successfully managing student loan debt requires careful financial planning and budgeting. Creating a realistic budget that incorporates loan payments is crucial for avoiding delinquency and minimizing long-term financial stress. This section Artikels strategies for integrating loan repayments into your budget and prioritizing them effectively.

Sample Budget Incorporating Student Loan Payments

A comprehensive budget should account for all income and expenses. Consider this example: Assume a monthly net income of $3,000. Allocate funds as follows: Rent ($1,000), Groceries ($500), Transportation ($300), Utilities ($200), Student Loan Payment ($500), Savings ($200), Entertainment ($300). This example demonstrates how a significant portion of income can be dedicated to loan repayment while still maintaining essential living expenses and savings. Adjust these figures based on your individual circumstances and income.

Prioritizing Loan Repayment Within a Budget

Prioritizing loan repayment often involves making trade-offs. Consider the interest rates on your loans. Aggressively paying down high-interest loans first minimizes the total amount paid over the life of the loan. For example, if you have a loan with a 7% interest rate and another with a 3% interest rate, focusing on the 7% loan first will save you money in the long run. Explore strategies like the debt avalanche (highest interest first) or debt snowball (smallest debt first) methods. Careful tracking of payments and interest accrued is vital.

Effective Budgeting Techniques for Managing Debt

Several techniques can improve your budgeting effectiveness. The 50/30/20 rule suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. Zero-based budgeting involves starting each month with a clean slate and allocating every dollar to a specific category. Budgeting apps and spreadsheets can help track expenses and visualize your financial progress. Regularly reviewing and adjusting your budget based on your spending patterns is essential for staying on track.

Visual Representation of a Debt Repayment Plan

Imagine a bar graph. Each bar represents a different loan, with the height corresponding to the loan’s balance. As you make payments, the height of the bars gradually decreases. A second graph could track the total interest paid over time, illustrating the savings achieved by prioritizing high-interest loans. This visual representation provides a clear picture of progress towards debt freedom and motivates continued effort. Color-coding the bars could further enhance understanding, for example, using a darker shade for high-interest loans and a lighter shade for lower-interest loans.

Seeking Professional Advice

Navigating the complexities of student loan debt can be overwhelming. Seeking professional guidance can significantly improve your understanding of your options and streamline the repayment process, potentially saving you time and money. A multifaceted approach, incorporating various professional resources, is often the most effective strategy.

The Role of Financial Advisors in Student Loan Debt Management

Financial advisors offer a holistic perspective on your financial situation, considering student loan debt alongside other financial goals such as saving for retirement or purchasing a home. They can help you create a comprehensive financial plan that incorporates a realistic student loan repayment strategy. This might involve exploring different repayment plans, consolidating loans, or even incorporating debt management into broader investment strategies. A financial advisor can also provide unbiased advice, helping you avoid predatory lending practices or scams. For example, they can help you evaluate the pros and cons of refinancing your loans based on your current financial standing and future projections.

Benefits of Consulting with a Student Loan Counselor

Student loan counselors specialize in student loan debt management. They possess in-depth knowledge of various repayment plans, income-driven repayment options, and potential forgiveness programs. Unlike financial advisors who take a broader view, student loan counselors focus specifically on your student loan debt, providing tailored advice and support throughout the repayment process. They can assist with applications for income-driven repayment plans, forbearance, or deferment, and help you navigate the often-complex paperwork involved. They can also offer valuable emotional support, helping you cope with the stress associated with significant debt.

Available Resources for Financial Literacy and Debt Management

Numerous resources are available to improve your financial literacy and enhance your ability to manage debt effectively. Many non-profit organizations offer free or low-cost financial counseling services. These organizations often provide workshops, webinars, and one-on-one counseling sessions covering budgeting, debt management, and credit repair. Additionally, many universities and colleges offer financial literacy programs for their students and alumni. Online resources, including government websites and reputable financial websites, provide valuable information on student loan repayment and debt management strategies. For example, the National Foundation for Credit Counseling (NFCC) offers certified credit counselors who can provide personalized guidance.

Understanding Your Rights and Options

Knowing your rights as a student loan borrower is crucial. The Consumer Financial Protection Bureau (CFPB) website provides comprehensive information on your rights and protections under federal law. Understanding your options, including different repayment plans, forbearance, deferment, and potential loan forgiveness programs, empowers you to make informed decisions about your debt. It’s vital to be aware of predatory lending practices and scams targeting student loan borrowers. Familiarizing yourself with relevant legislation and regulations, such as the Fair Credit Reporting Act (FCRA), protects you from unfair or deceptive practices. For instance, understanding your right to dispute inaccurate information on your credit report can significantly impact your ability to secure favorable loan terms in the future.

Ultimate Conclusion

Successfully managing student loan debt requires a proactive and informed approach. By understanding the nuances of interest calculation, exploring available repayment options, and leveraging government programs, you can significantly reduce your overall debt burden. Remember that seeking professional guidance from financial advisors or student loan counselors can provide invaluable support and personalized strategies. Take control of your financial future—start planning your path to debt freedom today.

Essential Questionnaire

What is interest capitalization?

Interest capitalization is when unpaid interest on your student loans is added to your principal loan balance, increasing the amount you owe. This results in paying interest on interest, ultimately increasing the total cost of your loan.

Can I deduct student loan interest from my taxes?

Possibly. The Student Loan Interest Deduction allows you to deduct the amount you paid in student loan interest during the tax year, up to a certain limit. Eligibility requirements and the maximum deduction amount may vary, so check the IRS website for the most up-to-date information.

What happens if I miss a student loan payment?

Missing payments can lead to late fees, damage your credit score, and potentially push your loan into default. Contact your loan servicer immediately if you anticipate difficulties making a payment to explore options like forbearance or deferment.

Are there any penalties for paying off student loans early?

Generally, there are no penalties for paying off student loans early. In fact, it can save you money on interest in the long run.