Navigating the world of private student loans can feel overwhelming, but understanding the process is crucial for securing the funding you need for higher education. This guide provides a clear and concise overview of how to take out a private student loan, covering everything from eligibility requirements and application procedures to interest rates, repayment options, and avoiding predatory lenders. We’ll demystify the process, empowering you to make informed decisions and secure your financial future.

From comparing fixed versus variable interest rates to understanding the role of co-signers and exploring loan consolidation strategies, we’ll equip you with the knowledge necessary to successfully navigate the complexities of private student loans. This guide emphasizes responsible borrowing and financial planning, helping you manage your debt effectively and achieve your educational goals.

Understanding Private Student Loans

Private student loans are a significant financial tool for students pursuing higher education, but understanding their intricacies is crucial before taking one out. They differ substantially from federal student loans, carrying varying interest rates, repayment terms, and eligibility requirements. Careful consideration of these factors is essential to make informed borrowing decisions.

Types of Private Student Loans

Several types of private student loans exist, each catering to specific needs and borrower profiles. These often include loans for undergraduate studies, graduate studies, and professional degrees like law or medicine. Some lenders offer loans specifically designed for parents to borrow on behalf of their children. Furthermore, some loans might require a co-signer, an individual who shares responsibility for repayment, while others might not. The specific loan types and features available will vary depending on the lender.

Eligibility Criteria for Private Student Loans

Lenders assess applicants based on several factors to determine eligibility for private student loans. Credit history plays a crucial role; a strong credit score often improves the chances of approval and secures more favorable terms. Income verification is also standard practice, as lenders need to ascertain the borrower’s ability to repay the loan. In some cases, a co-signer with a better credit history may be required to increase the likelihood of approval, especially for students with limited or no credit history. The lender will also typically review the applicant’s debt-to-income ratio and overall financial stability. Finally, the educational institution attended may also influence eligibility, with some lenders favoring accredited universities and colleges.

Interest Rates and Repayment Terms of Private Student Loans

Interest rates and repayment terms for private student loans are highly variable. They are largely influenced by the borrower’s creditworthiness, the loan amount, and the chosen repayment plan. Interest rates can be fixed or variable, with fixed rates remaining constant throughout the loan’s term, offering predictable monthly payments. Variable rates, on the other hand, fluctuate with market interest rates, leading to potentially higher or lower payments over time. Repayment terms also vary, ranging from several years to over a decade. Shorter repayment periods result in higher monthly payments but lower overall interest costs, while longer periods lead to lower monthly payments but higher overall interest costs.

Situations Requiring Private Student Loans

Private student loans can be necessary in various situations. For instance, they might be needed when federal student aid is insufficient to cover the full cost of education. This is particularly true for students attending expensive private universities or those pursuing graduate or professional degrees with high tuition costs. Private loans can also be a solution when a student doesn’t qualify for federal aid due to credit history or income issues, or when a student needs additional funds beyond the limits of federal loan programs. Lastly, private loans might be used to consolidate existing student loan debt into a single, more manageable payment.

Fixed vs. Variable Interest Rates

| Feature | Fixed Interest Rate | Variable Interest Rate |

|---|---|---|

| Rate | Stays the same throughout the loan term | Changes based on market fluctuations |

| Predictability | Highly predictable monthly payments | Monthly payments can fluctuate |

| Risk | Lower risk of significantly higher payments | Higher risk of significantly higher payments |

| Overall Cost | Potentially higher overall cost if rates are high initially | Potentially lower overall cost if rates remain low |

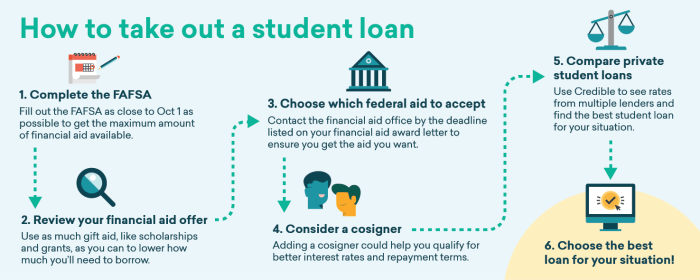

The Application Process

Applying for a private student loan involves several key steps, each requiring careful attention to detail. Understanding this process will help you navigate the application efficiently and increase your chances of approval. The overall process is generally straightforward, but the specifics can vary slightly between lenders.

Steps Involved in Applying for a Private Student Loan

The application process typically unfolds in a series of steps. Careful completion of each step is crucial for a smooth and successful application.

- Pre-qualification: Many lenders offer a pre-qualification process that allows you to check your eligibility without impacting your credit score. This provides a good starting point and helps you compare loan offers from different lenders.

- Application Submission: Once you’ve chosen a lender, you’ll complete their online application. This typically involves providing personal information, educational details, and financial information.

- Credit Check: The lender will perform a credit check to assess your creditworthiness. A strong credit history significantly increases your chances of approval and may result in a lower interest rate.

- Verification of Information: The lender may request additional documentation to verify the information you provided in your application. This is a standard procedure to ensure the accuracy of the information.

- Loan Approval/Denial: After reviewing your application and supporting documents, the lender will notify you of their decision. If approved, you’ll receive loan terms and conditions.

- Loan Disbursement: Once you accept the loan terms, the funds will be disbursed according to the lender’s procedures, typically directly to your educational institution or, in some cases, to you.

Required Documents for a Private Student Loan Application

Gathering the necessary documentation beforehand streamlines the application process. Having these documents readily available saves time and prevents delays.

- Government-issued photo ID: This verifies your identity.

- Social Security number: Used for credit checks and loan processing.

- Proof of enrollment: Acceptance letter or enrollment confirmation from your educational institution.

- Financial information: Bank statements, tax returns, and pay stubs to demonstrate your ability to repay the loan.

- Co-signer information (if applicable): If you require a co-signer, their personal information and financial documentation will be needed.

The Credit Check Process and its Impact on Loan Approval

A credit check is a standard part of the private student loan application process. Your credit score and history directly influence the lender’s decision.

Lenders use credit reports to assess your creditworthiness. A higher credit score generally indicates a lower risk to the lender, resulting in a higher likelihood of approval and potentially more favorable loan terms, such as a lower interest rate. Conversely, a low credit score may lead to loan denial or higher interest rates. Factors considered include payment history, debt levels, and length of credit history.

Methods of Receiving Loan Funds

Loan disbursement methods vary among lenders, but the most common methods include:

- Direct Deposit: Funds are electronically transferred directly to your bank account.

- Check: A physical check is mailed to you or your educational institution.

Interest Rates and Fees

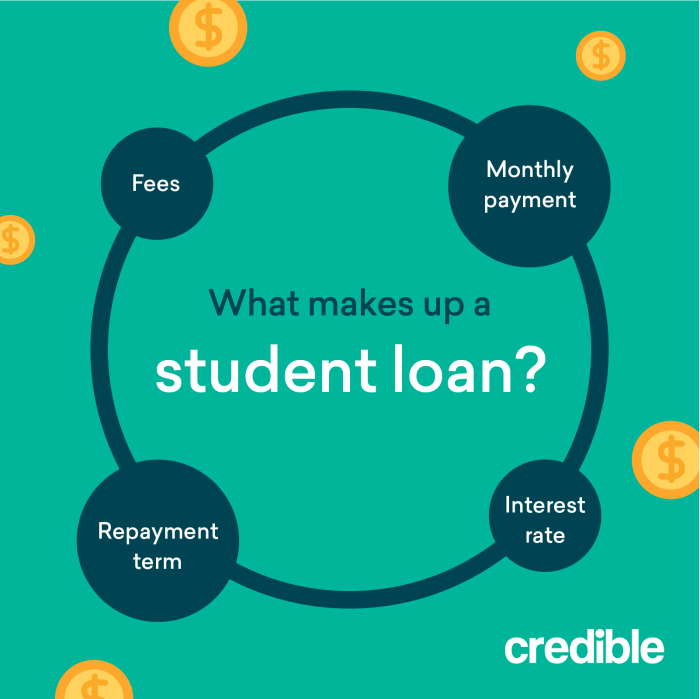

Understanding the interest rates and fees associated with private student loans is crucial for making informed borrowing decisions. These factors significantly impact the overall cost of your education and your long-term financial health. Careful consideration of these elements will allow you to choose the most suitable loan and repayment plan.

Interest Rate Determination

Private student loan interest rates are not fixed; they are variable and depend on several factors. Lenders assess the borrower’s creditworthiness, considering credit history, credit score, debt-to-income ratio, and the presence of a co-signer. The prevailing market interest rates also play a significant role, as do the loan terms (length of the repayment period). Generally, borrowers with stronger credit profiles and shorter loan terms qualify for lower interest rates. A longer repayment period typically results in a higher overall interest payment, although monthly payments will be lower. For example, a borrower with excellent credit might receive an interest rate of 6%, while a borrower with a limited credit history might face a rate closer to 10%.

Common Fees Associated with Private Student Loans

Several fees are commonly associated with private student loans. Origination fees are one-time charges paid upfront, typically a percentage of the loan amount. These fees cover the lender’s administrative costs of processing the loan. Late payment fees are charged if a payment is not received by the due date. These fees can vary significantly among lenders. Other potential fees include prepayment penalties (though less common now), returned check fees, and potentially fees for specific services like loan consolidation. It’s vital to review the loan agreement carefully to understand all associated costs.

Strategies for Minimizing Interest Payments

Several strategies can help borrowers minimize interest payments on their private student loans. Choosing a shorter loan term reduces the total interest paid over the life of the loan, although monthly payments will be higher. Making extra payments beyond the minimum amount reduces the principal balance faster, leading to lower overall interest charges. Refinancing the loan to a lower interest rate, if possible, is another effective strategy. This involves securing a new loan from a different lender at a more favorable interest rate, thereby replacing the existing loan. Finally, diligent budgeting and responsible financial management are crucial to ensure timely payments and avoid incurring additional late payment fees.

Comparison of Total Borrowing Costs

The total cost of borrowing significantly varies depending on the interest rate and loan term. Consider two scenarios: Loan A has a $10,000 principal, a 7% interest rate, and a 10-year term; Loan B has the same principal, a 9% interest rate, and a 15-year term. While Loan B has lower monthly payments, the total interest paid over 15 years will be substantially higher than the total interest paid on Loan A over 10 years. This highlights the importance of comparing total repayment costs across different loan options before making a decision. A thorough analysis, potentially using online loan calculators, is essential to understand the long-term financial implications of each loan option.

Sample Amortization Schedule

The following table illustrates a sample amortization schedule for a $10,000 loan at 7% interest over 10 years. This is a simplified example, and actual schedules may vary based on specific loan terms and payment calculations.

| Month | Beginning Balance | Payment | Interest | Principal | Ending Balance |

|---|---|---|---|---|---|

| 1 | $10,000.00 | $116.11 | $58.33 | $57.78 | $9,942.22 |

| 2 | $9,942.22 | $116.11 | $58.08 | $58.03 | $9,884.19 |

| 3 | $9,884.19 | $116.11 | $57.83 | $58.28 | $9,825.91 |

| … | … | … | … | … | … |

| 120 | $116.11 | $116.11 | $0.81 | $115.30 | $0.00 |

Repayment Options

Choosing the right repayment plan for your private student loan is crucial for managing your debt effectively and avoiding financial hardship. Several options exist, each with its own advantages and disadvantages, depending on your individual financial circumstances and repayment goals. Understanding these options will empower you to make informed decisions and create a sustainable repayment strategy.

Fixed Repayment Plans

Fixed repayment plans involve consistent monthly payments over a set period, typically 5 to 15 years. The monthly payment remains the same throughout the loan’s life, making budgeting easier. However, the fixed payment might be higher initially compared to other options. For example, a $30,000 loan at 7% interest over 10 years would result in a monthly payment of approximately $347. A shorter repayment term will result in higher monthly payments but less interest paid overall. Conversely, a longer term will result in lower monthly payments but significantly more interest paid over the life of the loan.

Graduated Repayment Plans

Graduated repayment plans offer lower monthly payments initially, gradually increasing over time. This can be beneficial for recent graduates who often have lower incomes at the start of their careers. The increase in payments is usually tied to a pre-determined schedule. However, it’s essential to anticipate the rising payments and adjust your budget accordingly. For instance, a $30,000 loan at 7% interest over 10 years with a graduated plan might start at $250 per month, increasing to over $400 per month by year 10. The total interest paid will likely be higher compared to a fixed plan.

Interest-Only Repayment Plans

Some lenders offer interest-only repayment plans, where borrowers pay only the accruing interest during a specified period. This option can provide short-term relief from higher monthly payments, but the principal loan amount remains unchanged. It’s important to note that the principal will still need to be repaid after the interest-only period ends, often leading to a higher payment burden at that time. This option should be considered carefully and only as a temporary measure, as it delays the repayment of the principal and increases the total interest paid.

Deferment and Forbearance

Deferment and forbearance are temporary pauses or reductions in your monthly loan payments. Deferment typically requires meeting specific criteria, such as returning to school or experiencing unemployment. During deferment, interest may or may not accrue, depending on the loan terms. Forbearance is generally granted at the lender’s discretion and may involve reduced payments or a temporary suspension of payments. Both options provide temporary financial relief but can lead to increased long-term interest costs.

Consequences of Default

Defaulting on a private student loan has severe consequences. It can damage your credit score significantly, making it difficult to obtain loans, credit cards, or even rent an apartment in the future. Collection agencies may pursue legal action, including wage garnishment or bank levy. Your lender may also sell your debt to a collection agency, further complicating the situation. In short, avoiding default is paramount.

Comparison of Repayment Plans

| Repayment Plan | Monthly Payment | Pros | Cons |

|---|---|---|---|

| Fixed | Consistent | Predictable budgeting, lower total interest (compared to graduated plans with same term) | Potentially higher initial payments |

| Graduated | Increasing over time | Lower initial payments | Payments increase significantly over time, higher total interest (compared to fixed plans with same term) |

| Interest-Only | Interest only for a period | Lower initial payments | Principal remains unpaid, total interest paid is much higher, potential for large payment increase at end of term |

Co-signers and Loan Consolidation

Securing a private student loan can sometimes require additional support, particularly if your credit history is limited or your income isn’t substantial. This is where co-signers and loan consolidation strategies become important considerations in managing your student loan debt. Understanding their roles and implications is crucial for making informed financial decisions.

The Role of a Co-signer in a Private Student Loan

A co-signer is an individual with established credit who agrees to share responsibility for repaying your private student loan. Lenders often require a co-signer for borrowers with limited or poor credit history, increasing the likelihood of loan approval and potentially securing a more favorable interest rate. Essentially, the co-signer acts as a guarantor, promising to repay the loan if the primary borrower defaults.

Benefits and Drawbacks of Using a Co-signer

Using a co-signer offers several advantages. It significantly improves the chances of loan approval, especially for students with limited credit history. It may also result in a lower interest rate, reducing the overall cost of borrowing. However, it also carries significant drawbacks. The co-signer assumes equal responsibility for repayment, impacting their credit score if payments are missed. This shared responsibility can significantly affect the co-signer’s financial future and borrowing capacity. The co-signer’s creditworthiness is directly linked to the borrower’s loan performance.

The Process of Consolidating Multiple Private Student Loans

Consolidating private student loans involves combining multiple loans into a single, new loan with a potentially simplified repayment schedule. The process typically begins by researching potential lenders offering consolidation services. Borrowers then need to gather documentation, including details of their existing loans and personal financial information. Once a lender is selected, an application is submitted and reviewed, followed by loan approval (or denial) and disbursement of the new consolidated loan. Existing loans are then paid off with the funds from the consolidated loan.

Advantages and Disadvantages of Loan Consolidation

Consolidating loans can simplify repayment by reducing the number of monthly payments and potentially lowering the monthly payment amount (though the total interest paid might increase). It can also streamline the repayment process by having a single monthly payment and point of contact. However, consolidation may result in a higher total interest paid over the life of the loan if the new loan carries a higher interest rate than some of the original loans. It’s crucial to carefully compare the terms of the new consolidated loan with the existing loans before making a decision.

Examples of Situations Where Co-signing Might Be Beneficial or Detrimental

Co-signing can be beneficial for a student with no credit history who needs a loan to attend college and has a financially stable parent or family member willing to co-sign. It can be detrimental if a borrower consistently misses payments, damaging both their own and the co-signer’s credit. For instance, a co-signer who is already carrying significant debt might find their financial situation severely strained if the borrower defaults. Similarly, if the borrower unexpectedly faces job loss or other financial hardship, the co-signer could be held responsible for the full loan amount.

Avoiding Predatory Lending Practices

Navigating the world of private student loans requires vigilance against predatory lending practices. These practices can significantly increase the overall cost of your education and leave you burdened with debt for years to come. Understanding the red flags and employing due diligence can protect you from exploitative loan terms.

Predatory lenders often target students due to their financial inexperience and urgent need for funding. They may use deceptive marketing tactics and complex loan agreements to obscure unfavorable terms. It’s crucial to approach the loan application process with informed awareness and a healthy dose of skepticism.

Identifying Red Flags

Several warning signs indicate potentially predatory lending practices. High interest rates significantly exceeding market averages, excessive fees, and unclear or confusing loan terms are major red flags. Aggressive sales tactics, pressure to borrow more than needed, and a lack of transparency regarding repayment options also signal potential problems. For example, a lender offering a loan with an interest rate of 20% or more should raise immediate concern, as this is far above typical market rates for student loans. Similarly, hidden fees or fees that are disproportionately large compared to the loan amount should be a cause for concern.

Choosing a Reputable Lender

Selecting a trustworthy lender is paramount. Researching lenders’ reputations through online reviews and independent rating agencies can provide valuable insights. Check if the lender is licensed and accredited by relevant authorities. Look for lenders with a history of fair lending practices and transparent fee structures. Consider lenders who offer clear and easily understandable loan agreements. Comparing lenders based on these factors helps in selecting a reputable institution. For example, checking the Better Business Bureau (BBB) ratings of different lenders can help assess their trustworthiness and track record.

The Importance of Reading the Loan Agreement

Carefully reading the loan agreement is non-negotiable. This document Artikels all the terms and conditions of your loan, including interest rates, fees, repayment schedules, and default penalties. Don’t hesitate to seek clarification on any confusing terms or clauses. Understanding the details will empower you to make informed decisions and avoid unforeseen financial burdens. For instance, thoroughly review sections detailing the interest capitalization process and any prepayment penalties to understand the full cost of the loan.

Comparing Loan Offers

Comparing loan offers from multiple lenders is essential for securing the most favorable terms. Use a standardized comparison sheet to organize information on interest rates, fees, repayment options, and other key aspects of each loan. This will enable a clear and objective comparison of different lenders and their respective offers. For example, comparing a loan with a 7% fixed interest rate and a 1% origination fee to a loan with a 6.5% variable interest rate and a 2% origination fee requires careful consideration of the total cost over the loan term.

Questions to Ask Potential Lenders

Before signing a loan agreement, ask the lender specific questions. Inquire about the annual percentage rate (APR), including all fees, and the total cost of the loan over its lifespan. Ask about the repayment options, including the length of the repayment period and the potential impact of deferment or forbearance. Understand the lender’s policies on late payments and default. Clarify the process for disputing errors or billing issues. Asking these questions ensures you are fully aware of your financial obligations.

Financial Planning and Budgeting

Taking out private student loans is a significant financial commitment that requires careful planning and budgeting. Failing to adequately budget can lead to overwhelming debt and financial hardship. A well-structured budget is crucial for successfully managing your loan repayments and achieving your long-term financial goals.

Budgeting Strategies for Managing Student Loan Debt

Creating a realistic budget involves tracking your income and expenses to understand where your money goes. This allows you to identify areas where you can cut back and allocate funds towards your student loan repayments. Several strategies can help. The 50/30/20 rule suggests allocating 50% of your after-tax income to needs (housing, food, transportation), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment. Zero-based budgeting involves starting with zero and allocating every dollar to a specific category, ensuring all expenses are accounted for. The envelope system involves assigning cash to different spending categories in physical envelopes, helping to visually track spending and prevent overspending.

Long-Term Financial Implications of Student Loan Debt

Student loan debt can significantly impact your long-term financial well-being. High monthly payments can limit your ability to save for retirement, buy a home, or invest in other opportunities. Interest accrual can substantially increase the total amount you repay, extending the repayment period and increasing the overall cost. Furthermore, a poor credit score resulting from missed payments can affect your ability to secure loans, credit cards, or even rent an apartment in the future. For example, a $50,000 loan with a 7% interest rate over 10 years could cost you significantly more than $50,000 due to accumulated interest.

Tips for Minimizing Student Loan Debt

Minimizing student loan debt requires proactive measures throughout your education and beyond. Borrow only what you absolutely need, explore scholarships and grants to reduce your reliance on loans, choose a cost-effective education path, and consider part-time employment during your studies to reduce the need for borrowing. After graduation, prioritize high-interest loans for repayment to save on overall interest payments. Exploring loan refinancing options could potentially lower your interest rate and monthly payments. Consider consolidating multiple loans into a single loan with a more favorable interest rate.

Sample Budget Allocating Funds for Loan Repayment

The following is a sample budget illustrating how to allocate funds for loan repayment. Remember to adjust this based on your individual income and expenses.

| Category | Amount | Percentage | Notes |

|---|---|---|---|

| Housing | $1000 | 30% | Rent or mortgage payment |

| Food | $400 | 12% | Groceries, eating out |

| Transportation | $200 | 6% | Car payment, gas, public transport |

| Student Loan Payment | $500 | 15% | Prioritize high-interest loans first |

| Utilities | $150 | 4.5% | Electricity, water, internet |

| Savings | $250 | 7.5% | Emergency fund, retirement |

| Other Expenses | $500 | 15% | Entertainment, clothing, personal care |

Final Conclusion

Securing a private student loan requires careful planning and a thorough understanding of the associated terms and conditions. By carefully considering your eligibility, comparing loan offers, and developing a robust repayment strategy, you can leverage private student loans to fund your education while minimizing long-term financial risk. Remember to always borrow responsibly and prioritize financial literacy throughout the process. This guide serves as a starting point; further research and consultation with financial advisors are encouraged to ensure you make the best decisions for your individual circumstances.

FAQ Explained

What is the difference between a private student loan and a federal student loan?

Federal student loans are offered by the government and typically have more favorable terms and repayment options, including income-driven repayment plans. Private student loans are offered by banks and credit unions and often have higher interest rates and stricter eligibility requirements.

What is a co-signer, and why would I need one?

A co-signer is someone who agrees to repay your loan if you default. Lenders often require co-signers for applicants with limited or poor credit history, as it mitigates their risk.

How can I improve my chances of loan approval?

Maintain a good credit score, demonstrate a stable income, and provide all required documentation accurately and completely. A co-signer can also significantly improve your chances.

What happens if I default on my private student loan?

Defaulting can severely damage your credit score, leading to difficulty obtaining future loans or credit cards. Wage garnishment and legal action are also possible consequences.

Can I refinance my private student loan?

Yes, refinancing can allow you to secure a lower interest rate or change your repayment terms. However, carefully compare offers from multiple lenders before refinancing.