Navigating the complexities of higher education financing often leaves students and families grappling with significant student loan debt. While 529 plans are widely known for their role in funding college tuition, many wonder if these savings vehicles can also be utilized to alleviate the burden of student loan repayments. This guide delves into the intricacies of using a 529 plan for student loan payoff, exploring the legal parameters, financial implications, and practical considerations to help you make an informed decision.

We will examine the IRS regulations governing 529 plan withdrawals, compare the potential benefits of using 529 funds against alternative student loan repayment strategies, and provide illustrative examples to clarify the financial calculations involved. Understanding these factors is crucial for determining whether leveraging your 529 plan for student loan repayment aligns with your overall financial goals.

529 Plan Basics

529 plans are tax-advantaged savings plans designed to encourage saving for future education costs. They offer significant benefits for families aiming to fund higher education, and understanding their mechanics is crucial for maximizing their potential. These plans provide a powerful tool to help families meet the rising costs of college and other qualifying educational expenses.

529 plans are sponsored by states, state agencies, or educational institutions, and each plan offers various investment options to suit different risk tolerances and time horizons. The primary advantage lies in the tax benefits, allowing contributions to grow tax-deferred and withdrawals used for qualified education expenses to be tax-free.

Qualified Education Expenses

Qualified education expenses encompass a broad range of costs associated with post-secondary education. These expenses are specifically defined by the IRS to ensure that the tax benefits are applied correctly. Understanding these expenses is critical for effectively utilizing 529 plan funds. These include tuition and fees, room and board, books, supplies, and even some computer equipment. Specific examples include tuition at a four-year university, community college fees, and room and board costs in a university dormitory. However, it’s important to note that expenses such as personal expenses or luxury items are not considered qualified expenses.

Institutions Accepting 529 Plan Funds

A wide variety of educational institutions accept 529 plan funds for tuition payments. This includes most public and private colleges and universities, as well as community colleges and vocational schools. The acceptance of 529 funds is generally standard practice, simplifying the payment process for families. Examples include prestigious institutions like Harvard University, state universities such as the University of California system, and community colleges across the country. Generally, the institution’s financial aid office will provide guidance on using 529 funds for payment.

Comparison of 529 Plan Features

Different 529 plans offer varying features, making it essential to compare options before selecting a plan. Factors to consider include investment choices, fees, and state residency requirements. Choosing a plan that aligns with your financial goals and risk tolerance is crucial for maximizing the benefits.

| Feature | Plan A (Example) | Plan B (Example) | Plan C (Example) |

|---|---|---|---|

| State Residency Requirement | None | Resident of State X | Resident of State Y |

| Investment Options | Age-based, Index Funds, Target-date funds | Age-based, Individual Stocks, Bonds | Index Funds, Mutual Funds |

| Annual Fees | 0.15% | 0.20% | 0.10% |

| Maximum Contribution | $500,000 | $500,000 | $500,000 |

Student Loan Repayment

Successfully navigating student loan repayment requires understanding the various loan types, the challenges borrowers face, and the available repayment options. This section provides a comprehensive overview to help you manage your student loan debt effectively.

Types of Student Loans

Student loans are broadly categorized into federal and private loans. Federal loans are offered by the U.S. government and generally offer more borrower protections and flexible repayment options than private loans. Private loans, on the other hand, are offered by banks, credit unions, and other private lenders. They often have higher interest rates and fewer repayment options.

Federal student loans include subsidized and unsubsidized Stafford Loans (for undergraduates and graduate students), PLUS Loans (for parents and graduate students), and Perkins Loans (a need-based loan program). Each loan type has specific eligibility requirements, interest rates, and repayment terms. Private student loans are less standardized, with varying interest rates, fees, and repayment plans depending on the lender and the borrower’s creditworthiness.

Challenges Faced by Student Loan Borrowers

Many student loan borrowers encounter significant challenges throughout the repayment process. High interest rates can quickly accumulate debt, making repayment a long and arduous process. Unexpected life events, such as job loss or illness, can disrupt repayment plans and lead to delinquency or default. Understanding the complexities of different repayment plans and available options can also be overwhelming for borrowers. Furthermore, the sheer volume of debt can be psychologically burdensome, impacting mental health and overall well-being. For example, a borrower with a high debt-to-income ratio might struggle to afford basic necessities while also making loan payments.

Student Loan Repayment Options

Several repayment options are available to help borrowers manage their student loan debt. Federal student loans offer various repayment plans, including standard repayment, graduated repayment, extended repayment, and income-driven repayment plans. Standard repayment involves fixed monthly payments over a 10-year period. Graduated repayment starts with lower payments that gradually increase over time. Extended repayment offers longer repayment periods, resulting in lower monthly payments but higher overall interest costs. Income-driven repayment plans base monthly payments on a borrower’s income and family size. Private loan repayment options are typically less flexible and may only offer standard repayment plans.

Steps Involved in Student Loan Repayment

Before beginning repayment, understanding the process is crucial. Here’s a step-by-step guide:

- Understand your loans: Identify the types of loans you have, their interest rates, and repayment terms. This includes both federal and private loans.

- Choose a repayment plan: Select a repayment plan that aligns with your financial situation and long-term goals. Consider the pros and cons of each option, including the total interest paid and the length of the repayment period.

- Create a budget: Develop a realistic budget that includes your student loan payments. Track your income and expenses to ensure you can afford your monthly payments.

- Make timely payments: Pay your student loans on time each month to avoid late fees and negative impacts on your credit score. Set up automatic payments to ensure you never miss a payment.

- Monitor your loan progress: Regularly check your loan balance and interest accrued. This helps you stay on track and make informed decisions about your repayment strategy.

- Explore options for financial assistance: If you’re struggling to make payments, explore options such as deferment, forbearance, or income-driven repayment plans. Contact your loan servicer to discuss your options.

529 Plans and Student Loan Repayment

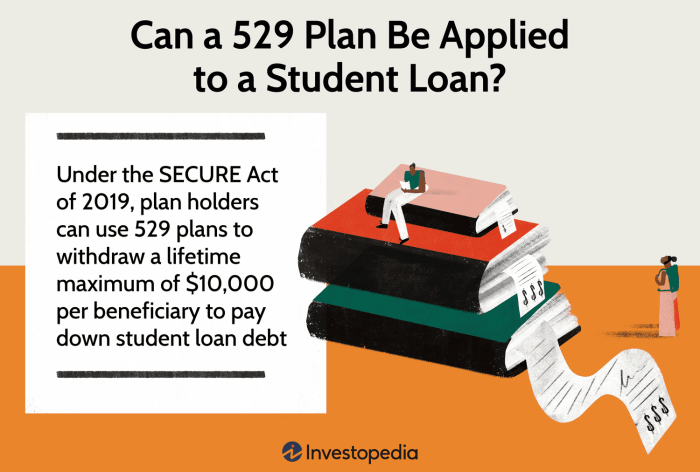

The use of 529 plans, designed to encourage saving for higher education expenses, has sparked debate regarding their applicability to student loan repayment. While primarily intended for qualified education expenses, the IRS regulations governing 529 plans offer limited flexibility, creating a complex landscape for those considering this option. Understanding these regulations is crucial for navigating the potential tax implications and making informed financial decisions.

IRS Regulations Governing 529 Plan Funds

The Internal Revenue Code Section 529 Artikels the rules for 529 plans. Crucially, these plans primarily allow tax-advantaged withdrawals for qualified education expenses. These expenses typically include tuition, fees, books, supplies, and room and board. However, the IRS does not explicitly permit the use of 529 funds for student loan repayment as a qualified expense. Any attempt to use 529 funds for this purpose would therefore fall under the category of non-qualified withdrawals.

Examples of Permitted Uses of 529 Funds

While direct repayment of student loans is prohibited, there are limited situations where 529 funds might indirectly support loan repayment. For instance, if a student uses 529 funds to pay for qualified education expenses (like tuition), this could free up other funds that would have otherwise been used for tuition, allowing those funds to be applied toward student loan repayment. Another example could be using 529 funds to cover room and board, reducing the overall financial burden and freeing up resources for loan repayment. However, these are indirect applications and don’t represent a direct use of 529 funds for loan repayment.

Tax Implications of Non-Qualified Withdrawals

Using 529 plan funds for non-qualified expenses, such as student loan repayment, results in the earnings portion of the withdrawal being subject to income tax at the beneficiary’s tax rate, plus a 10% penalty. For example, if a 529 plan had accumulated $10,000 in earnings and $5,000 in contributions, and the beneficiary withdrew the entire amount for non-qualified expenses, they would owe income tax on the $10,000 in earnings, plus a $1,000 penalty (10% of $10,000). The contribution portion ($5,000) would be returned tax-free. This makes using 529 funds for non-qualified expenses a significantly less advantageous option than using them for qualified expenses.

Financial Benefits Comparison: 529 Funds vs. Other Repayment Methods

Directly using 529 funds for student loan repayment is generally less financially beneficial than other methods due to the aforementioned tax penalties. Methods such as income-driven repayment plans, refinancing, or consolidation often offer more favorable terms and avoid the tax penalties associated with non-qualified 529 withdrawals. The tax advantages of 529 plans are maximized when used for their intended purpose: qualified education expenses. Therefore, while indirectly freeing up funds for loan repayment by covering other expenses is possible, it’s crucial to weigh the tax implications against other, more efficient student loan repayment strategies.

Practical Considerations and Alternatives

Using a 529 plan to pay off student loans is a nuanced strategy with potential benefits and drawbacks. While not a typical use, certain scenarios might make it financially advantageous. Careful consideration of tax implications, potential penalties, and alternative debt management strategies is crucial before making a decision.

Hypothetical Scenario Illustrating Potential Advantages

Imagine Sarah, a recent graduate with $30,000 in student loans at a 7% interest rate. She also has a $30,000 529 plan, originally intended for her education, that has accumulated earnings over the years. If she were to withdraw the funds from her 529 plan to pay off her loans, she would incur a 10% penalty on the earnings, but this penalty could still be less than the total interest she would pay over the life of her loan. Let’s assume her 529 plan has earned $5,000. The penalty would be $500 ($5,000 x 0.10). However, if her loan repayment would have cost her $6,000 or more in interest over the loan’s lifetime, using the 529 funds would still be financially beneficial. This scenario highlights the importance of comparing the potential penalty to the projected interest cost.

Calculations for Determining Potential Financial Savings

To determine the potential savings, one must calculate the total interest payable on the student loan over its repayment period. This calculation depends on the loan amount, interest rate, and repayment plan. Next, compare this total interest cost to the 10% penalty on the 529 plan earnings. If the interest cost exceeds the penalty plus the earnings, using the 529 funds might be advantageous. For example:

Total Interest on Loan = Loan Amount x (Interest Rate/Number of Payments per Year) x Loan Term in Years

Potential Savings = Total Interest – (529 Earnings x 0.10 + 529 Earnings)

In Sarah’s case, if her total interest would be $6,000, and the 529 plan has $35,000 (including earnings), her potential savings would be $6,000 – ($5,000 x 0.10 + $5,000) = $500.

Alternative Strategies for Managing Student Loan Debt

Several alternatives exist for managing student loan debt. These include:

* Income-Driven Repayment Plans: These plans adjust monthly payments based on income and family size, potentially lowering monthly expenses.

* Student Loan Refinancing: Refinancing can lower the interest rate, reducing the overall cost of the loan. However, it might eliminate federal protections.

* Consolidation: Combining multiple loans into one simplifies repayment.

* Debt Management Plans: These plans involve working with a credit counseling agency to negotiate lower payments with creditors.

Factors to Consider When Deciding Whether to Use a 529 Plan for Student Loan Repayment

Several factors should be considered before using a 529 plan for student loan repayment. These include:

* The amount of 529 plan earnings: A high amount of earnings makes it more likely that the penalty will be outweighed by the interest savings.

* The interest rate on the student loan: A high interest rate increases the likelihood of financial benefit from using the 529 funds.

* The length of the loan repayment period: A longer repayment period means more interest accrues, potentially making the 529 option more attractive.

* The availability of other resources: If other resources are available to pay off the loan, using the 529 plan might not be necessary.

* Future educational expenses: Using the 529 plan for student loans eliminates its use for future educational expenses.

Illustrative Examples

Let’s clarify the benefits and drawbacks of using 529 plan funds for college expenses through concrete examples. These examples will highlight the financial implications of using 529 funds for tuition versus student loan repayment, as well as the tax consequences of non-qualified withdrawals.

We will use two scenarios to illustrate the differences. Both scenarios assume a $20,000 annual college tuition cost.

529 Funds for Tuition vs. Student Loan Repayment

Imagine two students, Alex and Ben, both attending the same university. Alex’s parents diligently saved $80,000 in a 529 plan for his four years of college. Ben’s family did not save in a 529 plan and he took out student loans to cover his tuition.

A visual representation comparing their situations would be a bar graph. The horizontal axis would represent the four years of college. The vertical axis would represent the cost. Two bars would be displayed for each year: one representing Alex’s expenses (showing $20,000 in 529 withdrawals per year, totaling $80,000 over four years), and the other representing Ben’s expenses ($20,000 in student loan debt incurred each year, totaling $80,000 over four years). The graph would clearly show that both students incurred the same total cost of $80,000, but Alex’s expenses are tax-advantaged, while Ben will face interest accumulation on his loans. A supplementary section could depict Ben’s loan repayment schedule, including interest, showcasing a significantly higher total cost compared to Alex’s 529 plan utilization.

Tax Implications of Non-Qualified Withdrawals

This example illustrates the tax penalties associated with using 529 funds for non-qualified expenses. Suppose Sarah withdraws $10,000 from her 529 plan to pay for a down payment on a car, rather than qualified education expenses.

A visual representation could be a pie chart. The largest segment of the pie would represent the $10,000 withdrawn. A smaller segment would show the 10% federal tax penalty applied to the earnings portion of the withdrawal (assuming earnings represent a significant portion). Another segment would show the income tax on the earnings, which would vary depending on Sarah’s tax bracket. A small remaining segment could show the remaining principal, which is tax-free. The chart would visually emphasize the significant reduction in the actual amount received after taxes and penalties. For example, if the earnings portion was $4,000, the 10% penalty would be $400, and if Sarah’s tax bracket resulted in a 25% income tax on the earnings, that would be an additional $1000. Sarah would only receive $10,000 – $400 – $1000 = $8600 after taxes and penalties. The chart would clearly demonstrate how a seemingly small withdrawal can result in a substantial loss due to the penalties.

Closure

Ultimately, the decision of whether to use a 529 plan to pay off student loans is a highly personal one, contingent upon individual circumstances and financial objectives. While the IRS regulations restrict direct application for this purpose, exploring creative strategies and understanding the potential tax consequences is paramount. By carefully weighing the advantages and disadvantages, and considering alternative debt management approaches, you can formulate a comprehensive strategy that best suits your needs and minimizes your financial risk.

Quick FAQs

Can I use 529 funds for interest payments on student loans?

No, 529 funds can only be used for qualified education expenses, which generally do not include interest payments on student loans.

What happens if I withdraw 529 funds for non-qualified expenses?

Withdrawals for non-qualified expenses are subject to income tax on the earnings portion, plus a 10% penalty. There may be exceptions for certain disabilities.

Are there any situations where using 529 funds for student loan repayment might be indirectly beneficial?

Yes, if you have excess 529 funds after covering qualified education expenses, you could potentially use those funds to pay down student loans and reduce your overall debt, although the earnings would be subject to taxes and penalties.

What are some alternative strategies for managing student loan debt?

Alternatives include income-driven repayment plans, loan refinancing, and consolidation. Consulting a financial advisor can help determine the best approach.