Navigating the complexities of student loan repayment can feel daunting, especially when understanding how interest accrues and impacts your overall debt. This guide demystifies the process, providing a clear and concise explanation of how to calculate interest on your student loans, whether it’s the simple or more complex compound interest. We’ll explore different interest rate types, the effects of capitalization, and various repayment scenarios to empower you with the knowledge to effectively manage your student loan debt.

Understanding student loan interest is crucial for effective financial planning. By grasping the underlying principles of simple and compound interest calculations, you can accurately predict your future payments and make informed decisions about your repayment strategy. This knowledge empowers you to proactively manage your debt and avoid unexpected financial burdens.

Understanding Interest Accrual on Student Loans

Understanding how interest accrues on your student loans is crucial for effective repayment planning. Failing to grasp this can lead to significantly higher overall loan costs. This section will clarify the different types of interest rates, the process of capitalization, and the impact of various calculation methods.

Fixed vs. Variable Interest Rates

Student loans can have either fixed or variable interest rates. A fixed interest rate remains constant throughout the loan’s life, making repayment predictable. A variable interest rate, however, fluctuates based on an index, such as the prime rate or LIBOR. This means your monthly payments could change over time, potentially increasing or decreasing depending on market conditions. Choosing between a fixed and variable rate depends on your risk tolerance and predictions about future interest rate movements. Generally, fixed rates offer more predictability, while variable rates might offer lower initial payments if interest rates are low.

Interest Capitalization

Interest capitalization occurs when accumulated interest is added to the principal loan balance. This increases the total amount you owe. Capitalization typically happens when your loan enters a grace period (the period after graduation before repayment begins) or if you defer or forbear your payments. For example, if you have $10,000 in unpaid interest during a grace period, that $10,000 is added to your principal balance, and you now owe $20,000 (assuming a principal of $10,000). Future interest will then be calculated on this larger amount, leading to higher overall interest payments.

Simple vs. Compound Interest

Simple interest is calculated only on the principal loan amount. Compound interest, however, is calculated on both the principal and accumulated interest. This means compound interest grows exponentially over time.

Let’s illustrate with an example:

Suppose you have a $10,000 loan with a 5% annual interest rate.

* Simple Interest: After one year, the interest would be $10,000 * 0.05 = $500. After two years, it would be $1,000.

* Compound Interest: After one year, the interest is $500, making the new balance $10,500. The second year’s interest is calculated on $10,500, resulting in $525 interest. After two years, the total interest is $1,025.

As you can see, even with a relatively low interest rate, compound interest significantly increases the total amount owed over time.

Comparison of Student Loan Interest Calculation Methods

| Method | Formula | Example | Impact on Total Cost |

|---|---|---|---|

| Simple Interest | Interest = Principal x Rate x Time | $10,000 principal, 5% rate, 1 year: Interest = $10,000 x 0.05 x 1 = $500 | Lower total cost compared to compound interest |

| Compound Interest | A = P (1 + r/n)^(nt) where A = the future value of the investment/loan, including interest; P = the principal investment amount (the initial deposit or loan amount); r = the annual interest rate (decimal); n = the number of times that interest is compounded per year; and t = the number of years the money is invested or borrowed for. | $10,000 principal, 5% rate, compounded annually for 1 year: A = $10,000 (1 + 0.05/1)^(1*1) = $10,500 | Higher total cost due to interest accruing on interest |

| Interest Capitalization (with Compound Interest) | A = P (1 + r/n)^(nt) , with accrued interest added to P periodically | $10,000 principal, 5% rate, compounded annually, interest capitalized annually for 2 years: Year 1: $500 interest added to principal; Year 2: Interest calculated on $10,500. | Significantly increases total cost, especially over longer loan terms |

| Interest-Only Payments | Payment = Principal x Rate / Number of Payments per Year | $10,000 principal, 5% rate, monthly payments: Payment = $10,000 x 0.05 / 12 ≈ $41.67 (only interest is paid) | Principal remains unchanged until additional payments are made; may result in high total interest paid. |

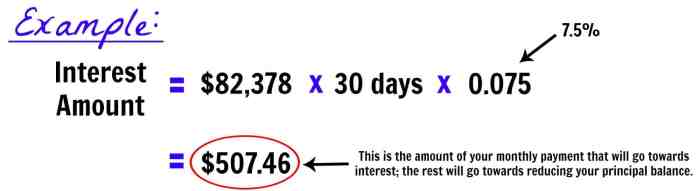

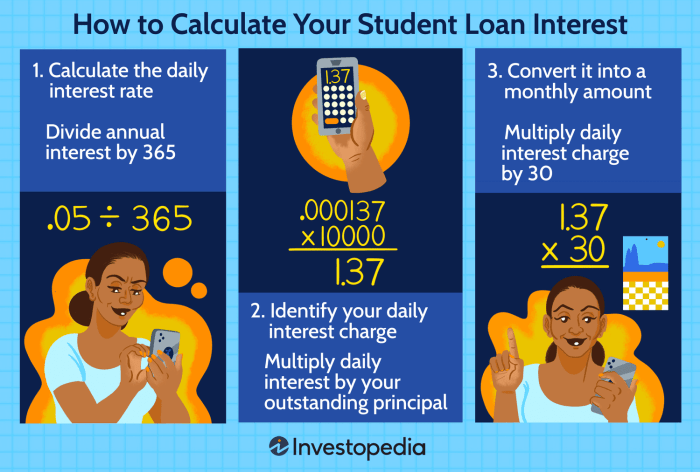

Calculating Simple Interest on Student Loans

Understanding how simple interest is calculated on student loans is crucial for budgeting and managing repayment effectively. While most student loans use compound interest, understanding simple interest provides a foundational knowledge for grasping the broader concept of interest accrual. This section will detail the calculation of simple interest and explore scenarios where this method might be relevant.

The Formula for Simple Interest

Simple interest is calculated using a straightforward formula. It represents the interest earned or charged on the principal amount only, without considering any accumulated interest. The formula is:

Simple Interest = (Principal × Rate × Time) / 100

Where:

* Principal is the initial loan amount.

* Rate is the annual interest rate (expressed as a percentage).

* Time is the loan term, expressed in years.

Calculating Simple Interest: A Numerical Example

Let’s assume a student loan of $10,000 with a 5% annual simple interest rate over a 2-year repayment period. Applying the formula:

Simple Interest = ($10,000 × 5 × 2) / 100 = $1,000

Therefore, the total simple interest accrued over two years would be $1,000. The total amount due at the end of the loan term would be $11,000 ($10,000 principal + $1,000 interest).

A Step-by-Step Guide to Calculating Simple Interest on a Student Loan

Calculating simple interest involves these sequential steps:

1. Identify the Principal: Determine the initial amount borrowed for your student loan.

2. Determine the Annual Interest Rate: Locate the interest rate stated in your loan agreement. This is usually expressed as a percentage.

3. Establish the Loan Term: Identify the length of the loan repayment period, expressed in years.

4. Apply the Formula: Substitute the values obtained in steps 1-3 into the simple interest formula: Simple Interest = (Principal × Rate × Time) / 100.

5. Calculate the Total Amount Due: Add the calculated simple interest to the principal amount to determine the total repayment amount.

Scenarios Where Simple Interest Might Apply to Student Loans

While uncommon for the entire loan term, simple interest calculations might be applicable in specific situations. For instance, some short-term student loan deferment plans or add-on interest arrangements might utilize simple interest for the duration of the deferment period. Additionally, some loan forgiveness programs or specific loan restructuring plans might involve simple interest calculations as part of their overall structure. It’s essential to review the fine print of your loan agreement and any associated documents to understand how interest is calculated in specific scenarios.

Calculating Compound Interest on Student Loans

Understanding compound interest is crucial for accurately assessing the total cost of your student loan. Unlike simple interest, which is calculated only on the principal amount, compound interest is calculated on the principal amount plus any accumulated interest. This means your debt grows faster over time.

Compound interest is calculated using the following formula:

A = P (1 + r/n)^(nt)

Where:

* A = the future value of the loan, including interest

* P = the principal loan amount

* r = the annual interest rate (as a decimal)

* n = the number of times that interest is compounded per year

* t = the number of years the loan is outstanding

Compound Interest Calculation Example

Let’s illustrate with an example. Suppose you have a $20,000 student loan with a 6% annual interest rate compounded monthly. We’ll calculate the loan balance after one year.

First, we identify our variables:

* P = $20,000

* r = 0.06 (6% expressed as a decimal)

* n = 12 (compounded monthly)

* t = 1 (one year)

Now, let’s plug these values into the formula:

A = 20000 (1 + 0.06/12)^(12*1) = 20000 (1 + 0.005)^12 = 20000 (1.005)^12 ≈ $21,233.60

After one year, the loan balance, including interest, is approximately $21,233.60. The interest accrued in the first year is $21,233.60 – $20,000 = $1,233.60. To illustrate further compounding, we could repeat this calculation for subsequent years, using the new balance as the principal for each calculation. Each year, the interest accrued will be higher than the previous year due to the compounding effect.

Steps in Calculating Compound Interest

Calculating compound interest involves these steps:

- Identify the principal loan amount (P).

- Determine the annual interest rate (r) and convert it to a decimal.

- Identify the compounding frequency (n) – this is how many times interest is calculated per year (e.g., monthly (12), quarterly (4), annually (1)).

- Determine the loan term (t) in years.

- Substitute the values into the compound interest formula: A = P (1 + r/n)^(nt).

- Calculate the future value (A).

- Subtract the principal amount (P) from the future value (A) to find the total interest paid.

Simple Interest vs. Compound Interest Comparison

Let’s compare the total interest paid over 10 years on a $20,000 loan with a 6% annual interest rate, using both simple and compound interest (compounded annually for simplicity of comparison).

- Simple Interest: Total interest paid = Principal x Rate x Time = $20,000 x 0.06 x 10 = $12,000

- Compound Interest (Annual Compounding): Using the compound interest formula with n=1 and t=10, the future value (A) would be approximately $35,816.90. The total interest paid would be $35,816.90 – $20,000 = $15,816.90

As this comparison shows, compound interest results in significantly higher total interest paid over the life of the loan compared to simple interest.

Factors Affecting Student Loan Interest Calculations

Understanding the intricacies of student loan interest is crucial for responsible financial planning. Several key factors significantly influence the interest rate you’ll pay and the overall cost of your loan. These factors interact to determine your total repayment amount, making it essential to understand their impact.

Key Factors Influencing Student Loan Interest Rates

Several factors determine the interest rate applied to your student loan. These factors are often considered independently but work together to determine the final rate. The most significant factors include your credit history (or lack thereof for federal loans), the type of loan (federal vs. private), the loan’s terms and conditions, and prevailing market interest rates. Federal student loans generally offer lower, fixed interest rates than private loans, which often have variable rates that fluctuate with market conditions. A strong credit history may result in a lower interest rate on private loans.

Impact of Loan Deferment or Forbearance on Interest Accrual

Deferment and forbearance are temporary pauses in your loan repayment schedule. While they offer relief from making payments, it’s crucial to understand that interest typically continues to accrue during these periods, particularly for subsidized loans. Unsubsidized loans always accrue interest, regardless of repayment status. This means that the principal loan amount increases, potentially leading to a larger overall repayment burden when payments resume. For example, if a borrower defers a $10,000 loan with a 5% interest rate for one year, they would owe approximately $500 in additional interest at the end of that deferment period.

Loan Repayment Plan’s Effect on Total Interest Paid

The repayment plan you choose significantly affects the total interest paid over the life of the loan. Shorter repayment plans, while requiring higher monthly payments, generally lead to lower overall interest payments due to the shorter accrual period. Conversely, longer repayment plans, such as extended repayment or income-driven repayment plans, result in lower monthly payments but significantly higher total interest paid over time. For instance, a 10-year repayment plan will likely have substantially less total interest than a 25-year plan for the same loan amount and interest rate.

Illustrative Example of Interest Rate Changes and Total Repayment

Imagine two identical $20,000 student loans with a 10-year repayment term. Loan A has a fixed interest rate of 5%, while Loan B has a fixed interest rate of 7%. Over the 10-year period, Loan A would accrue significantly less interest than Loan B, resulting in a lower total repayment amount. A simple illustration could be a table showing the yearly interest accrued and total amount due for each loan, clearly showing the cumulative effect of even a small interest rate difference over the life of the loan. This would demonstrate how a seemingly small increase in the interest rate can lead to a substantially higher total repayment cost over time. The difference could be visualized as two diverging lines on a graph, with Loan A’s line representing a lower total repayment and Loan B’s line representing a higher total repayment, clearly demonstrating the impact of a higher interest rate.

Using Loan Calculators and Resources

Navigating the complexities of student loan interest can be daunting, but thankfully, numerous online tools and resources are available to assist in the calculation process. Understanding how to effectively utilize these resources is crucial for accurate financial planning and responsible debt management. This section will explore the benefits and limitations of online loan calculators, and highlight alternative avenues for obtaining reliable interest calculations.

Online student loan calculators offer a convenient and readily accessible method for estimating interest accrual and future loan balances. These calculators typically employ pre-programmed formulas to compute simple and compound interest, providing users with a projected repayment schedule and total interest paid. However, it’s essential to understand both their strengths and limitations to ensure accurate financial projections.

Information Required for Accurate Student Loan Calculator Use

To obtain reliable results from a student loan calculator, accurate input data is paramount. This typically includes the loan principal amount (the initial loan amount borrowed), the annual interest rate (expressed as a percentage), the loan term (the length of the repayment period, usually in years or months), and the repayment frequency (monthly, quarterly, or annually). Additional factors, such as deferment or forbearance periods (times when payments are temporarily suspended), can also significantly impact the calculations and should be factored in if applicable. For example, a calculator might require you to input a $20,000 loan principal, a 6% annual interest rate, a 10-year repayment term, and monthly payments to accurately project your total interest paid over the life of the loan. Omitting or misrepresenting any of this information will result in inaccurate projections.

Limitations of Online Loan Calculators and Independent Verification

While online loan calculators provide a helpful estimate, it’s crucial to remember their inherent limitations. Many calculators simplify the calculations by assuming a consistent interest rate throughout the loan term, which might not reflect the reality of variable interest rates. Furthermore, they may not account for all potential fees or changes in repayment plans that could influence the final interest paid. Therefore, it’s strongly recommended to independently verify the results provided by these calculators. This can involve reviewing the loan terms and conditions provided by your loan servicer or consulting with a financial advisor for a personalized assessment. For instance, a calculator might not accurately reflect the impact of an early repayment strategy on your total interest costs.

Alternative Resources for Student Loan Interest Calculations

Beyond online calculators, several alternative resources can assist in calculating student loan interest. Loan servicers, the companies responsible for managing your student loans, typically provide detailed statements and online portals that display your loan balance, interest accrued, and repayment schedule. These statements offer a reliable source of information specific to your individual loan. Moreover, consulting a financial advisor can offer a personalized approach to managing your student loans. A financial advisor can consider your overall financial situation, help you understand the implications of different repayment strategies, and offer guidance on managing your debt effectively. Their expertise can provide a deeper level of understanding beyond the limitations of a simple online calculator.

Ultimate Conclusion

Mastering the calculation of student loan interest is a significant step toward responsible debt management. By understanding the nuances of simple and compound interest, the impact of various factors like interest rates and repayment plans, and by utilizing available resources like online calculators, you gain control over your financial future. Remember, proactive planning and informed decision-making are key to successfully navigating the repayment process and achieving financial freedom.

Common Queries

What is interest capitalization?

Interest capitalization is when unpaid interest is added to your principal loan balance, increasing the amount you owe. This results in paying interest on previously accrued interest.

How does a variable interest rate affect my payments?

A variable interest rate fluctuates based on market conditions. Your monthly payments may increase or decrease depending on these changes, making budgeting more challenging.

Can I pay off my loan faster than scheduled?

Yes, paying extra towards your principal balance each month will reduce your total interest paid and shorten the loan’s repayment period.

What happens if I defer or forbear my loan?

Deferment or forbearance temporarily suspends or reduces your payments, but interest usually still accrues (unless specified otherwise in your loan terms), increasing your total loan amount.