Navigating the complexities of federal student loans can feel overwhelming, especially when understanding the interest rates involved. This guide aims to demystify the process, providing a clear and concise explanation of how interest rates for FAFSA loans are determined, how they accrue, and strategies for managing them effectively. From subsidized and unsubsidized loans to repayment plan options, we’ll cover the key aspects to help you make informed financial decisions.

Understanding your FAFSA loan interest rate is crucial for planning your repayment strategy and minimizing long-term costs. This guide will explore the various factors that influence these rates, including loan type, government policies, and even your repayment plan choice. We’ll delve into the mechanics of interest accrual and capitalization, offering practical examples to illustrate their impact on your total debt. Ultimately, the goal is to equip you with the knowledge to manage your student loan debt responsibly and effectively.

Understanding FAFSA Student Loan Interest Rates

Securing financial aid for higher education often involves navigating the complexities of federal student loans. Understanding the interest rates associated with these loans is crucial for responsible borrowing and long-term financial planning. This section will clarify the different loan types, how their interest rates are determined, and provide a historical perspective on rate fluctuations.

Federal Student Loan Types and Interest Rates

The federal government offers several types of student loans through the FAFSA (Free Application for Federal Student Aid) program. Each loan type carries a different interest rate, impacting the overall cost of borrowing. These rates are not fixed and can change annually.

Interest Rate Determination

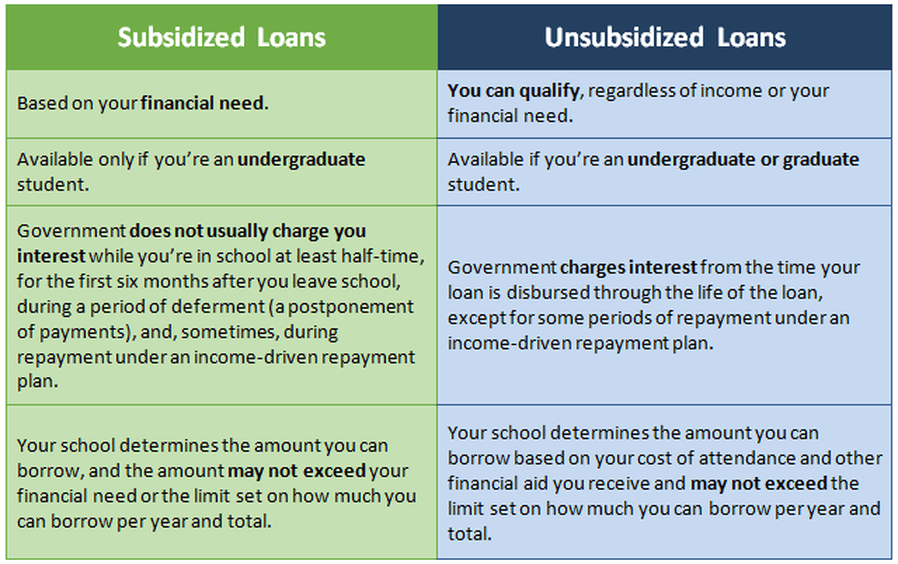

Several factors influence the interest rate assigned to a federal student loan. The loan type is a primary determinant, with subsidized loans generally having lower rates than unsubsidized loans. The interest rate for each loan type is set annually by Congress and can vary based on market conditions and prevailing interest rates in the economy. For example, during periods of economic uncertainty or high inflation, interest rates may rise, while during periods of economic stability, they may decrease. The borrower’s credit history does *not* affect the interest rate on federal student loans, unlike many private loans.

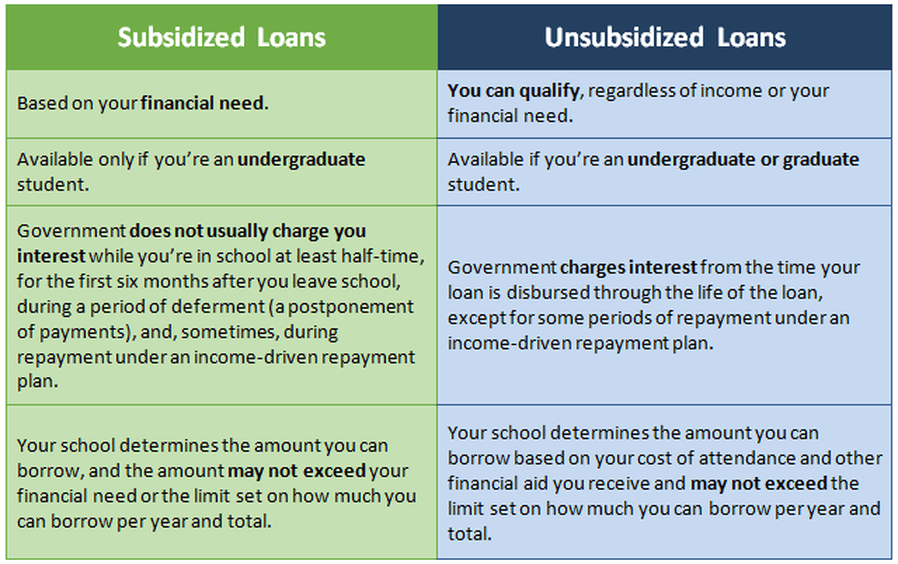

Historical Overview of FAFSA Student Loan Interest Rate Changes

Over the past decade, FAFSA student loan interest rates have experienced fluctuations. For instance, rates were relatively low in the years following the 2008 financial crisis, reflecting the Federal Reserve’s efforts to stimulate economic growth through low interest rates. However, in subsequent years, rates have increased, reflecting shifts in broader economic conditions. Specific historical data can be found on the official websites of the Department of Education and the Federal Student Aid office. Analyzing these historical trends can help prospective borrowers better anticipate potential rate changes.

Comparison of Subsidized and Unsubsidized Loan Interest Rates

The following table compares the interest rates for subsidized and unsubsidized federal student loans for undergraduate and graduate students. Note that these rates are subject to change and represent a snapshot in time. It is crucial to consult official government sources for the most up-to-date information before applying for loans.

| Loan Type | Undergraduate Rate (Example) | Graduate Rate (Example) | Subsidized/Unsubsidized |

|---|---|---|---|

| Direct Subsidized Loan | 4.99% | 6.54% | Subsidized |

| Direct Unsubsidized Loan | 6.54% | 7.54% | Unsubsidized |

Interest Rate Accrual and Capitalization

Understanding how interest accrues on your FAFSA loans and the concept of capitalization is crucial for effectively managing your student loan debt. This section will clarify these processes and their impact on your overall repayment.

Interest accrues on FAFSA loans differently depending on the loan’s life cycle stage: in-school, grace, and repayment. The total amount you ultimately repay is significantly affected by how and when interest is added to your principal balance.

Interest Accrual During Different Loan Periods

During the in-school period, interest may or may not accrue depending on the loan type and your lender’s policies. Some subsidized loans do not accrue interest while you are enrolled at least half-time, while unsubsidized loans accrue interest from the moment the loan is disbursed. During the grace period, which typically follows graduation or leaving school, interest almost always accrues on both subsidized and unsubsidized loans. Once the repayment period begins, interest continues to accrue until the loan is paid in full. The longer the interest accrues without payments, the larger the total amount you owe becomes.

Interest Capitalization

Interest capitalization is the process of adding accumulated interest to the principal loan balance. This essentially transforms unpaid interest into part of the principal amount, increasing the total loan amount and subsequently the total interest paid over the life of the loan. Capitalization typically occurs at the end of the grace period or if payments are significantly behind schedule.

Examples of Interest Capitalization’s Impact

Let’s consider two scenarios with a $10,000 unsubsidized loan with a 5% annual interest rate.

Scenario 1: No Capitalization. Assume a four-year grace period, during which $2,000 in interest accrues. At the start of repayment, the principal remains $10,000.

Scenario 2: Capitalization. The same $2,000 in interest from the grace period is capitalized. At the start of repayment, the principal is now $12,000. This larger principal will lead to higher monthly payments and a substantially larger total repayment amount over the life of the loan.

For instance, a standard 10-year repayment plan for the first scenario (no capitalization) might result in a total repayment of approximately $15,000, while the same plan with capitalization (Scenario 2) could result in a total repayment exceeding $18,000. The exact figures will vary depending on the repayment plan chosen and the interest rate.

Visual Representation of Loan Growth

Imagine two graphs, both showing the growth of the loan balance over time. The x-axis represents time (in years), and the y-axis represents the loan balance.

Graph 1 (No Capitalization): This graph shows a relatively slow upward curve. The initial increase is due to interest accruing during the in-school period (if applicable) and grace period. The curve steepens during repayment, as interest is added to the principal and payments are made.

Graph 2 (Capitalization): This graph shows a steeper upward curve, especially after the grace period. There’s a visible jump in the loan balance at the point of capitalization, representing the addition of the accrued interest to the principal. The steeper curve reflects the higher principal amount and therefore higher interest accruing during repayment. The overall increase in the loan balance is significantly greater than in Graph 1, clearly illustrating the impact of capitalization. The difference between the final loan balance in both graphs represents the additional cost due to capitalization.

Repayment Plans and Interest Rates

Choosing the right repayment plan for your federal student loans is crucial, as it significantly impacts your monthly payments and the total amount of interest you’ll pay over the life of the loan. Understanding the differences between the available plans is key to making an informed financial decision. This section will Artikel the key features of several common repayment options.

The interest rate on your federal student loans is fixed, meaning it doesn’t change over the life of the loan. However, the repayment plan you select directly affects how much you pay each month and, consequently, the total interest accrued. A shorter repayment period means higher monthly payments but lower overall interest costs, while longer repayment periods result in lower monthly payments but higher total interest.

Standard Repayment Plan

The Standard Repayment Plan is the default option for most federal student loans. It involves fixed monthly payments over a 10-year period. This plan offers predictable payments but can result in higher monthly payments compared to income-driven plans. The benefit is that you pay off your loans faster and pay less interest in total.

- Fixed monthly payments over 10 years.

- Higher monthly payments than income-driven plans.

- Lower total interest paid compared to longer repayment plans.

Extended Repayment Plan

The Extended Repayment Plan provides a longer repayment term, typically up to 25 years, resulting in lower monthly payments. However, this longer repayment period means you will pay significantly more in interest over the life of the loan. This option is suitable for borrowers who need lower monthly payments to manage their budget effectively.

- Fixed monthly payments over up to 25 years.

- Lower monthly payments than the Standard Repayment Plan.

- Higher total interest paid compared to the Standard Repayment Plan.

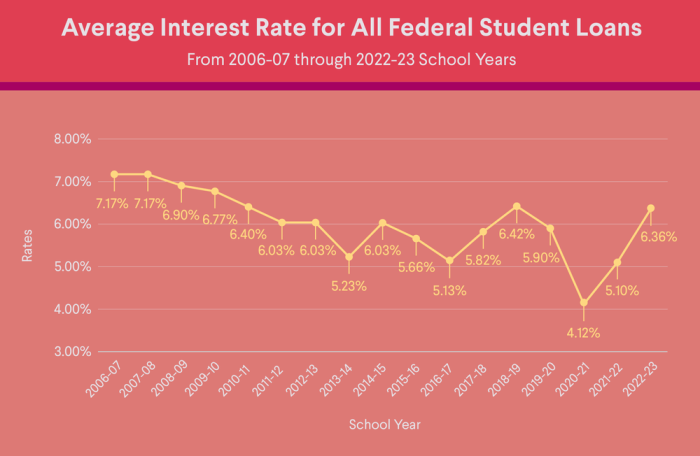

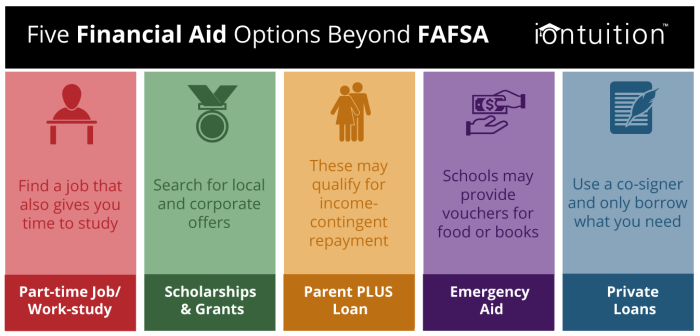

Income-Driven Repayment Plans

Income-driven repayment plans (IDR) adjust your monthly payment based on your income and family size. Several types of IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). These plans generally result in lower monthly payments, especially during periods of lower income. However, they often extend the repayment period beyond the standard 10 years, leading to higher total interest paid over the loan’s lifetime. Forgiveness may be possible after 20 or 25 years, depending on the plan and income.

- Monthly payments based on income and family size.

- Lower monthly payments, especially during periods of lower income.

- Longer repayment periods (potentially 20-25 years).

- Higher total interest paid compared to the Standard Repayment Plan.

- Potential for loan forgiveness after a specified period (20 or 25 years, depending on the plan).

Factors Affecting Interest Rates and Repayment

Understanding the factors influencing your FAFSA student loan interest rate and subsequent repayment is crucial for effective financial planning. Several interconnected elements contribute to the final interest rate you’ll face, impacting the total cost of your education. These factors range from broader economic trends to your individual financial profile.

Several external factors significantly influence FAFSA loan interest rates. These are largely outside of your direct control, but understanding them can help you better anticipate potential changes.

External Factors Influencing FAFSA Loan Interest Rates

Government fiscal policy and prevailing economic conditions are primary drivers of FAFSA loan interest rates. For instance, periods of high inflation often lead to increased interest rates as the government attempts to curb spending and control rising prices. Conversely, during economic downturns, interest rates may be lowered to stimulate borrowing and economic activity. Changes in the federal budget, particularly allocations towards student aid programs, also impact the interest rates offered on FAFSA loans. A decrease in funding might necessitate higher interest rates to maintain the solvency of the program. These fluctuations are generally announced well in advance, allowing students and families to prepare for potential changes in borrowing costs.

Credit History and Private Student Loan Interest Rates

While FAFSA loans are federal loans and don’t directly consider individual credit history, private student loans often do. Your credit score and history significantly influence the interest rate offered on private student loans. A strong credit history, reflected in a high credit score, typically translates to lower interest rates. Conversely, a poor credit history or a low credit score may result in higher interest rates, or even loan rejection. Lenders assess your creditworthiness to gauge the risk of default. A history of responsible credit management demonstrates lower risk, leading to more favorable interest rates. This is why building a positive credit history before applying for private student loans is highly recommended.

Calculating Total Interest Paid on a FAFSA Loan

Accurately calculating the total interest paid over the life of a FAFSA loan requires a methodical approach. The calculation depends on the loan’s principal amount, interest rate, and repayment plan. The following steps provide a general illustration. Note that the actual calculation may be more complex depending on the specific repayment plan and any capitalization of interest.

- Determine the principal loan amount: This is the initial amount borrowed.

- Identify the annual interest rate: This is the percentage charged annually on the outstanding loan balance.

- Select the repayment plan: Different plans (e.g., standard, graduated, income-driven) have varying repayment periods and monthly payments, influencing the total interest paid.

- Calculate monthly interest: Divide the annual interest rate by 12 to get the monthly interest rate. Then, multiply the monthly interest rate by the outstanding loan balance at the beginning of each month.

- Calculate monthly principal repayment: Subtract the monthly interest from the monthly payment to determine the amount applied towards reducing the principal balance.

- Repeat steps 4 and 5 for each month of the repayment period: This will show the interest paid and principal reduction each month.

- Sum the total interest paid over the entire repayment period: This represents the total interest cost of the loan.

For example: A $10,000 loan at 5% annual interest, repaid over 10 years with a standard repayment plan, will result in a significantly higher total interest paid compared to a shorter repayment period or a lower interest rate. Detailed amortization schedules are available online or from your loan servicer to show the breakdown of interest and principal for each payment.

Managing Interest and Minimizing Costs

Successfully navigating student loan debt requires a proactive approach to managing interest. High interest can significantly increase the total cost of your education, extending repayment periods and impacting your long-term financial health. Fortunately, several strategies can help minimize these costs and accelerate your path to becoming debt-free.

Minimizing interest payments on your FAFSA loans involves strategic planning and consistent effort. Understanding your repayment options and employing effective strategies can lead to substantial savings over the life of your loans.

Making Extra Payments

Making extra payments on your federal student loans is one of the most effective ways to reduce your overall interest costs and shorten your repayment period. Even small additional payments, made regularly, can accumulate significant savings over time. For example, if you have a $30,000 loan at a 5% interest rate with a 10-year repayment plan, an extra $100 per month could save you thousands of dollars in interest and pay off the loan several years early. This is because extra payments reduce the principal balance faster, meaning less interest accrues on the remaining amount. Consider setting up automatic payments to ensure consistency.

Refinancing Federal Student Loans

Refinancing federal student loans into private loans can be a complex decision with potential advantages and disadvantages. Refinancing might offer a lower interest rate, resulting in lower monthly payments and quicker loan repayment. However, it’s crucial to carefully weigh the potential benefits against the risks. Federal loans typically offer borrower protections such as income-driven repayment plans and deferment options, which are often lost when refinancing into a private loan. Private loan terms and conditions can vary significantly, so thorough research and comparison shopping are essential before making a decision.

Advantages and Disadvantages of Refinancing Federal Student Loans

| Feature | Refinancing (Private Loan) | Federal Loan |

|---|---|---|

| Interest Rate | Potentially lower, depending on credit score and market conditions. | Fixed or variable, generally higher than private loan rates for borrowers with excellent credit. |

| Monthly Payment | Potentially lower due to lower interest rate and potentially longer repayment term. | Varies depending on repayment plan; potentially higher than private loan payments. |

| Borrower Protections | Typically fewer protections; income-driven repayment plans and deferment options usually unavailable. | Offers various borrower protections, including income-driven repayment plans and deferment/forbearance options. |

| Loan Forgiveness Programs | Generally ineligible for federal loan forgiveness programs (e.g., Public Service Loan Forgiveness). | Eligible for certain federal loan forgiveness programs, depending on the type of loan and employment. |

Tips for Managing Student Loan Debt and Keeping Interest Costs Low

The following table summarizes key strategies for managing student loan debt effectively and minimizing interest expenses.

| Strategy | Description | Benefit | Caution |

|---|---|---|---|

| Prioritize High-Interest Loans | Focus extra payments on loans with the highest interest rates first. | Maximizes interest savings. | Requires careful tracking of loan details. |

| Automate Payments | Set up automatic payments to ensure consistent and timely payments. | Avoids late fees and maintains a good payment history. | Requires sufficient funds in the account. |

| Explore Repayment Plans | Investigate different repayment plans (e.g., extended repayment, income-driven repayment) to find one that suits your budget. | Provides flexibility and potentially lower monthly payments. | May extend the repayment period and increase total interest paid. |

| Budgeting and Financial Planning | Create a detailed budget to track income and expenses, prioritizing loan payments. | Ensures consistent loan payments and reduces financial stress. | Requires discipline and consistent monitoring. |

Epilogue

Successfully managing your FAFSA student loans requires a proactive approach to understanding the intricacies of interest rates and repayment options. By carefully considering the information presented here – from the different loan types and their associated rates to the various repayment plans and strategies for minimizing costs – you can develop a personalized plan that aligns with your financial goals. Remember, informed decision-making is key to navigating the student loan landscape and achieving long-term financial well-being.

General Inquiries

What is the difference between subsidized and unsubsidized student loans?

Subsidized loans don’t accrue interest while you’re in school, during grace periods, or during deferment. Unsubsidized loans accrue interest during these periods.

Can I refinance my federal student loans?

Yes, but refinancing federal loans into private loans means losing federal protections like income-driven repayment plans. Carefully weigh the pros and cons before refinancing.

What happens if I don’t make my loan payments?

Defaulting on your student loans can severely damage your credit score, lead to wage garnishment, and negatively impact your future financial opportunities.

How often are FAFSA interest rates adjusted?

Interest rates for federal student loans are typically set annually by Congress and can change based on economic conditions and government policies.