Successfully managing student loan debt requires understanding your servicer. This guide delves into the intricacies of Nelnet Student Loan Servicer, providing a clear and concise overview of their services, repayment options, and troubleshooting common issues. We aim to empower you with the knowledge needed to confidently navigate your student loan journey with Nelnet.

From understanding Nelnet’s role in managing various loan types to mastering their online portal and exploring repayment plan options, this resource covers essential aspects of interacting with this major student loan servicer. We’ll also address potential challenges and offer solutions to help you maintain a healthy financial standing.

Nelnet Student Loan Servicer Overview

Nelnet is a significant player in the student loan servicing industry, managing billions of dollars in federal and private student loans for borrowers across the United States. Understanding their role, services, and contact methods is crucial for borrowers seeking efficient loan management.

Nelnet’s Role in Student Loan Servicing

Nelnet acts as an intermediary between student loan borrowers and the lenders. Their primary responsibilities include processing payments, managing accounts, providing customer service, and ensuring compliance with federal regulations regarding student loan repayment. They handle various aspects of the loan lifecycle, from initial disbursement to eventual repayment. This includes providing account statements, answering borrower inquiries, and assisting with repayment plan options.

Types of Student Loans Nelnet Manages

Nelnet services a wide range of student loans, including both federal and private loans. Federal loans are typically backed by the government, offering various repayment plans and protections. Private loans, on the other hand, are provided by private lenders and often have less flexible repayment options. The specific types of federal loans Nelnet handles may vary over time, depending on contracts with the government. They might service Federal Family Education Loans (FFEL), Direct Loans, and potentially other federal loan programs. Their private loan portfolio includes loans from various private lenders, each with its own terms and conditions.

Nelnet’s Customer Service Processes

Nelnet offers multiple avenues for borrowers to access customer service. These include online account access, phone support, and mail correspondence. Their online portal allows borrowers to view account details, make payments, and access important documents. Phone support provides direct assistance from customer service representatives, while mail correspondence is suitable for formal requests or document submissions. Nelnet aims to provide prompt and helpful service to address borrower inquiries and resolve issues effectively. They often utilize automated systems for initial contact, routing calls and inquiries to the appropriate departments for efficient handling.

Contacting Nelnet: A Step-by-Step Guide

1. Online Account Access: Log in to your Nelnet account online through their website. This often provides the quickest access to account information and allows for secure messaging.

2. Phone Support: Call Nelnet’s customer service number, which is readily available on their website. Be prepared to provide your account information for verification purposes.

3. Mail Correspondence: Send a written request to the address provided on your statement or Nelnet’s website. Ensure to include all necessary information, such as your account number and a clear description of your request.

Comparison of Nelnet to Other Major Student Loan Servicers

The following table provides a comparison of Nelnet with other major student loan servicers. Note that customer reviews can be subjective and vary widely.

| Servicer Name | Contact Information | Loan Types Serviced | Customer Reviews (Summary) |

|---|---|---|---|

| Nelnet | Website and Phone Number (available on their website) | Federal and Private Loans | Reviews vary widely; some praise their responsiveness, while others cite difficulties in communication. |

| Navient | Website and Phone Number (available on their website) | Federal and Private Loans | Similar to Nelnet, reviews are mixed, with some positive experiences and some negative ones. |

| Great Lakes | Website and Phone Number (available on their website) | Primarily Federal Loans | Generally considered to have better customer service than some competitors. |

Nelnet Loan Repayment Options

Choosing the right repayment plan for your Nelnet student loans is crucial for managing your debt effectively and minimizing long-term costs. Several options exist, each with its own set of advantages and disadvantages depending on your individual financial circumstances. Understanding these options empowers you to make informed decisions about your repayment strategy.

Nelnet offers a variety of repayment plans designed to accommodate different financial situations and repayment preferences. These plans range from standard repayment schedules to income-driven plans that adjust your monthly payments based on your income and family size. Careful consideration of your current income, expenses, and long-term financial goals is vital in selecting the most suitable plan.

Standard Repayment Plan

The Standard Repayment Plan is a fixed monthly payment plan spread over a 10-year period. This plan provides a predictable payment schedule, allowing for consistent budgeting. However, the fixed monthly payment might be higher than other plans, potentially resulting in faster loan payoff but potentially higher monthly payments initially.

Extended Repayment Plan

This plan extends the repayment period beyond 10 years, resulting in lower monthly payments. The benefit is reduced monthly financial burden, but the drawback is that you will pay significantly more in interest over the life of the loan. The extended repayment period is usually up to 25 years, depending on the loan type and balance.

Graduated Repayment Plan

The Graduated Repayment Plan starts with lower monthly payments that gradually increase over time. This plan can be beneficial in the early stages of your career when your income might be lower. However, the increasing payments can become challenging to manage as they rise.

Income-Driven Repayment Plans

Income-driven repayment plans adjust your monthly payment based on your income and family size. This ensures your payments are manageable, even during periods of financial hardship. However, because payments are lower, the loan repayment period is typically longer, leading to increased interest payments over the life of the loan.

Examples of Nelnet Income-Driven Repayment Plans

Nelnet offers several income-driven repayment plans, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE). These plans typically base your monthly payment on a percentage of your discretionary income (income above a certain poverty guideline). For example, under IBR, your monthly payment could be as low as 10% or 15% of your discretionary income, depending on when you entered repayment. The specific percentage and calculation method vary by plan.

Choosing a Repayment Plan: A Flowchart

[Imagine a flowchart here. The flowchart would begin with a question like “What is your current financial situation?”, branching to options like “Stable Income” or “Variable Income.” Each branch would lead to a further question, such as “Do you prioritize faster repayment or lower monthly payments?”, eventually leading to recommendations for Standard, Extended, Graduated, or Income-Driven repayment plans. The flowchart would visually represent the decision-making process.]

Summary of Repayment Plan Options

- Standard Repayment Plan: Fixed monthly payment, 10-year repayment period, higher monthly payments but faster payoff.

- Extended Repayment Plan: Lower monthly payments, longer repayment period (up to 25 years), significantly higher total interest paid.

- Graduated Repayment Plan: Payments start low and gradually increase, potentially challenging to manage as payments rise.

- Income-Driven Repayment Plans (IBR, PAYE, REPAYE): Payments based on income and family size, lower monthly payments, longer repayment period, potentially resulting in loan forgiveness after 20-25 years depending on the plan and eligibility.

Managing Your Nelnet Student Loans

Effectively managing your Nelnet student loans involves understanding and utilizing the available online tools and resources. This section details how to navigate the online portal, make payments, update personal information, and manage your loan repayment plan.

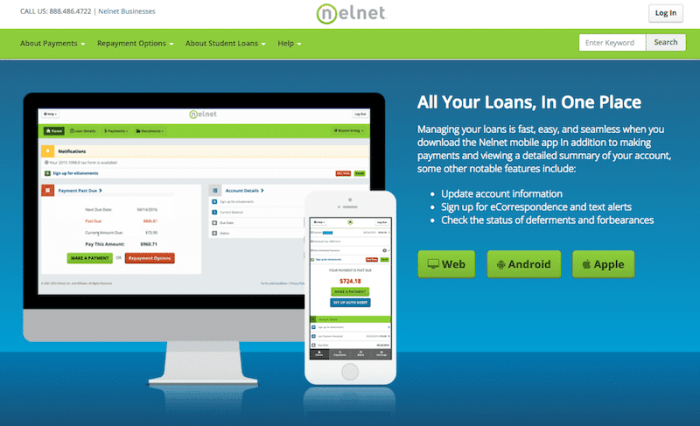

Accessing and Using the Nelnet Online Portal

The Nelnet online portal provides a centralized location to manage all aspects of your student loan accounts. Features include viewing your loan balance, payment history, upcoming payments, and accessing your monthly statements. You can also update your contact information, enroll in autopay, and explore repayment options directly through the portal. Navigation is generally intuitive, with clear menus and readily accessible information. The portal is designed for easy access from desktop computers, tablets, and smartphones.

Making Payments Through the Nelnet System

Nelnet offers several convenient ways to make payments on your student loans. You can make online payments directly through the online portal using a debit card, credit card, or electronic bank transfer. Alternatively, you can mail a check or money order to the address provided on your monthly statement. For those who prefer automated payments, Nelnet offers an autopay option, which automatically deducts your payment from your chosen bank account each month. Setting up autopay can help you avoid late payments and maintain a positive payment history. Remember to always include your loan identification number when making payments to ensure accurate processing.

Updating Personal Information with Nelnet

Keeping your contact information up-to-date is crucial for receiving important notifications from Nelnet regarding your student loans. You can update your address, phone number, and email address through the online portal. The process typically involves logging into your account, navigating to the personal information section, and making the necessary changes. After updating your information, it’s recommended to verify the changes by checking your account details. Providing accurate information ensures Nelnet can communicate with you effectively about your loans.

Requesting a Deferment or Forbearance

A deferment or forbearance may be options if you are experiencing temporary financial hardship and are unable to make your scheduled loan payments. A deferment temporarily postpones your payments, and interest may or may not accrue depending on your loan type. A forbearance also temporarily postpones your payments, but interest typically continues to accrue. To request a deferment or forbearance, you’ll need to log into your Nelnet account and submit an application. You’ll need to provide documentation supporting your need for a deferment or forbearance, such as proof of unemployment or medical expenses. The approval process varies depending on the circumstances.

Accessing and Interpreting Your Monthly Statements

Your monthly statement provides a summary of your loan account activity. It includes your current loan balance, payment due date, minimum payment amount, and a detailed breakdown of payments made and interest accrued. Understanding your statement is essential for tracking your loan repayment progress. The statement clearly Artikels the amount you owe and the actions you need to take to stay current on your payments. If you have multiple loans, the statement will provide individual details for each loan. Contact Nelnet customer service if you have any questions or difficulty understanding your statement.

Understanding Nelnet’s Fees and Charges

It’s crucial to understand the potential fees associated with your Nelnet student loans to effectively manage your repayment and avoid unexpected costs. This section details the various fees Nelnet may charge, the circumstances under which they apply, and how these compare to industry averages. Accurate information about fees allows for better financial planning and budgeting.

Nelnet, like other student loan servicers, may assess fees for specific actions or situations related to your loan account. These fees are generally disclosed in your loan documents and are subject to change, so it’s always advisable to check your account statements and Nelnet’s website for the most up-to-date information. Understanding these fees allows for proactive management of your loan and avoids potential penalties.

Nelnet Fee Types and Circumstances

Nelnet’s fee structure is generally in line with industry standards, although specific fees and amounts can vary. While some fees are standard across most servicers, others might be specific to Nelnet or depend on your individual loan terms and repayment plan. It’s important to compare offers from different servicers before committing to a loan, to ensure that you understand the terms and conditions.

Summary of Nelnet Fees

The following table summarizes potential fees associated with Nelnet student loans. Note that the amounts listed are examples and may not reflect current fees. Always refer to your loan documents and Nelnet’s official website for the most accurate and updated fee information.

| Fee Type | Description | Amount (Example) | Circumstances |

|---|---|---|---|

| Late Payment Fee | Charged when a payment is received after the due date. | $25-$35 | Applies if payment is not received by the due date, as specified in the loan agreement. |

| Returned Payment Fee | Charged when a payment is returned due to insufficient funds or incorrect account information. | $25-$35 | Applies if a payment is rejected by the bank due to insufficient funds or incorrect account information. |

| Check Processing Fee (Potentially) | Some servicers may charge a fee for processing paper checks. Nelnet’s policy on this should be verified directly. | $5-$10 (if applicable) | Applies only if paying by check and Nelnet charges for this service. Many servicers now prefer electronic payments. |

| Early Pay-Off Fee (Generally Not Applicable) | Generally, federal student loans do not have prepayment penalties. However, always verify with your loan documents. | $0 (Typically) | This fee is rarely applied to federal student loans. Private loans may have different terms. |

Troubleshooting Common Nelnet Issues

Navigating student loan repayment can be complex, and even with a reputable servicer like Nelnet, borrowers occasionally encounter issues. This section addresses common problems and provides solutions to help you resolve them efficiently. Understanding these potential challenges and their solutions can empower you to manage your student loans effectively.

Payment Processing Errors

Payment processing errors can be frustrating, but they are often easily resolved. These errors typically stem from incorrect account information, insufficient funds, or technical glitches.

- Problem: Payment Declined. Solution: Verify sufficient funds in your account and ensure the correct account number and routing number are used. Contact your bank if the issue persists.

- Problem: Payment Not Recorded. Solution: Check your Nelnet account online for confirmation. If the payment isn’t reflected, contact Nelnet customer service with your payment confirmation (e.g., bank statement showing the transaction).

- Problem: Incorrect Payment Amount Applied. Solution: Contact Nelnet customer service immediately to report the discrepancy and provide supporting documentation, such as your payment confirmation. They will adjust your account accordingly.

Incorrect Account Information

Inaccurate account information can lead to missed payments, inaccurate billing, and other complications. It’s crucial to keep your contact information and other details updated.

- Problem: Incorrect Address on File. Solution: Log into your Nelnet account online and update your address. You can usually do this through the account settings section. Alternatively, contact Nelnet customer service to request the update.

- Problem: Incorrect Contact Information. Solution: Similar to updating your address, you can update your phone number and email address through your online account or by contacting Nelnet directly. Ensure all information is accurate to avoid missed communications.

- Problem: Discrepancies in Loan Details. Solution: Contact Nelnet customer service to verify the accuracy of your loan details. Provide them with any supporting documentation you may have, such as your loan disbursement information.

Appealing a Nelnet Decision

Nelnet’s decisions regarding your account are generally based on established policies and procedures. However, if you believe a decision is incorrect or unfair, you have the right to appeal.

- Problem: Disagreement with a Fee or Charge. Solution: Gather all relevant documentation supporting your case (e.g., contracts, communication records). Submit a formal written appeal to Nelnet, clearly outlining the reasons for your disagreement and the desired resolution. Keep a copy of your appeal for your records.

- Problem: Incorrect Calculation of Interest or Principal. Solution: Provide Nelnet with detailed calculations showing the discrepancy and supporting evidence. Clearly state your request for a review and correction of the error.

- Problem: Denial of a Deferment or Forbearance. Solution: If your request for a deferment or forbearance was denied, review the reasons provided by Nelnet. If you believe you meet the eligibility requirements, submit a new request with additional supporting documentation to strengthen your case.

Nelnet’s Role in Loan Forgiveness Programs

Nelnet, as a student loan servicer, plays a crucial role in the administration of federal student loan forgiveness programs. While Nelnet doesn’t determine eligibility or create these programs, they manage the accounts of borrowers who apply and are potentially eligible, processing applications and communicating updates throughout the process. Their involvement is primarily focused on the logistical aspects of managing borrowers’ accounts within the framework established by the federal government.

Nelnet’s involvement in federal loan forgiveness programs is primarily administrative. They handle the processing of applications, maintain borrower account information, and communicate program updates to eligible borrowers. It’s important to understand that Nelnet does not make the final decision on loan forgiveness; that authority rests with the relevant federal agencies.

Eligibility Criteria for Federal Loan Forgiveness Programs

Eligibility requirements vary significantly depending on the specific loan forgiveness program. For instance, the Public Service Loan Forgiveness (PSLF) program requires 120 qualifying monthly payments under an income-driven repayment plan while working full-time for a qualifying government or non-profit organization. The Teacher Loan Forgiveness program, conversely, has different requirements, focusing on teaching in low-income schools or educational service agencies. Each program has specific criteria related to loan type, employment history, and payment history, and it is crucial for borrowers to thoroughly research the specific program’s requirements before applying.

The Application Process for Loan Forgiveness

The application process for loan forgiveness programs generally involves several steps. First, borrowers must confirm their eligibility based on the program’s specific criteria. Next, they need to complete the appropriate application form, providing documentation to support their eligibility claims. This often includes employment verification, tax returns, and payment history information. After submitting the application, borrowers must regularly monitor their account for updates and respond to any requests for additional information from Nelnet or the relevant federal agency. The processing time can vary significantly depending on the program and the volume of applications.

Visual Representation of the Loan Forgiveness Application Process

Imagine a flowchart. The first box is “Determine Eligibility for Specific Program.” This leads to a “yes” or “no” path. The “no” path ends with “Ineligible – Review Program Requirements.” The “yes” path leads to “Gather Required Documentation” (e.g., employment verification, tax returns). This leads to “Complete and Submit Application Through Nelnet.” This then flows into “Nelnet Processes Application,” followed by “Agency Review and Decision.” Finally, the process ends with two branches: “Loan Forgiveness Granted” and “Loan Forgiveness Denied (with reason).” This visual illustrates the sequential nature of the application, highlighting the key decision points and the roles of both Nelnet and the federal agency.

Final Review

Successfully managing your Nelnet student loans hinges on proactive engagement and a thorough understanding of the available resources. By utilizing the online portal effectively, exploring diverse repayment plans, and addressing any issues promptly, you can take control of your student loan debt and pave the way for a secure financial future. Remember to regularly review your account information and utilize Nelnet’s customer service channels when needed.

Query Resolution

What types of student loans does Nelnet service?

Nelnet services various federal student loans, including Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans, and often private student loans as well. The specific types they manage can vary.

How do I update my contact information with Nelnet?

You can typically update your contact information through Nelnet’s online account portal. Look for a section dedicated to personal information or account settings. Instructions are usually provided within the portal itself.

What happens if I miss a student loan payment?

Missing a payment can result in late fees and negatively impact your credit score. Contact Nelnet immediately if you anticipate difficulty making a payment to explore options like deferment or forbearance.

Does Nelnet offer hardship programs?

Yes, Nelnet typically offers various hardship programs, including deferment and forbearance, which temporarily suspend or reduce your monthly payments. Eligibility criteria and application processes vary; check their website or contact customer service for details.