Navigating the world of student loans can feel overwhelming, but understanding the pre-qualification process is a crucial first step towards securing the financial support you need for your education. Pre-qualification allows you to explore your borrowing options without impacting your credit score, providing valuable insights into potential loan amounts and interest rates before committing to a formal application. This guide will equip you with the knowledge and tools to confidently navigate this process.

We’ll delve into the intricacies of pre-qualification, examining the factors lenders consider, the advantages and disadvantages, and ultimately, how to improve your chances of securing favorable loan terms. From understanding the required information to choosing the right lender, we’ll cover all aspects of pre-qualifying for student loans, empowering you to make informed decisions about your financial future.

Understanding Pre-qualification for Student Loans

Pre-qualifying for student loans is a crucial first step in the financial aid process. It allows you to explore your borrowing options without impacting your credit score and helps you understand how much you might be eligible to borrow. This process provides valuable insights into your financial preparedness for higher education.

The Pre-qualification Process

The pre-qualification process typically involves providing basic personal and financial information to a lender. This information is then used to generate an estimate of how much you might be able to borrow. The lender uses this information to assess your creditworthiness, income, and debt levels, providing a preliminary assessment of your eligibility. This is a quick and easy process, usually completed online or over the phone.

Information Required for Pre-qualification

Lenders generally require similar information for pre-qualification. This commonly includes your Social Security number, date of birth, current address, and information about your intended school and program of study. They will also ask about your anticipated graduation date and your estimated annual income (or your parents’ income, if you are a dependent applicant). Some lenders may also request details about your existing debt, such as credit card balances and other loans.

Pre-qualification vs. Formal Application

Pre-qualification provides a preliminary estimate of your borrowing power, whereas a formal application involves a much more thorough review of your financial history and creditworthiness. Pre-qualification doesn’t guarantee loan approval; it’s simply an indication of potential eligibility. A formal application, on the other hand, involves a comprehensive credit check and verification of your provided information. Pre-qualification is a soft inquiry and doesn’t affect your credit score, while a formal application is a hard inquiry and may slightly lower your credit score.

A Step-by-Step Guide to Pre-qualifying

1. Research Lenders: Explore various lenders offering student loans, comparing interest rates, fees, and repayment options.

2. Gather Necessary Information: Collect your Social Security number, date of birth, address, school information, and estimated income details.

3. Complete the Pre-qualification Form: Most lenders have online pre-qualification forms that you can complete quickly.

4. Review Your Results: Carefully review the pre-qualification results, which will provide an estimated loan amount and interest rate.

5. Compare Offers: Compare offers from different lenders to find the best terms.

Lender Comparison Table

| Lender | Pre-qualification Requirements | Benefits of Pre-qualification | Drawbacks of Pre-qualification |

|---|---|---|---|

| Sallie Mae | SSN, Date of Birth, Address, School Information, Estimated Income | Quick estimate of borrowing power, no impact on credit score | Not a guarantee of loan approval, may not reflect final loan terms |

| Discover | SSN, Date of Birth, Address, School Information, Estimated Income | Helps in planning, allows comparison shopping | May not be entirely accurate, requires further application |

| Wells Fargo | SSN, Date of Birth, Address, School Information, Estimated Income, Existing Debt | Provides a range of loan options, helps budget for college | Requires more information than other lenders, still not a guarantee |

Factors Affecting Pre-qualification

Pre-qualification for student loans isn’t a guarantee of approval, but it provides a valuable indication of your eligibility. Several key factors influence a lender’s decision during this preliminary assessment. Understanding these factors empowers you to improve your chances of securing a favorable loan offer.

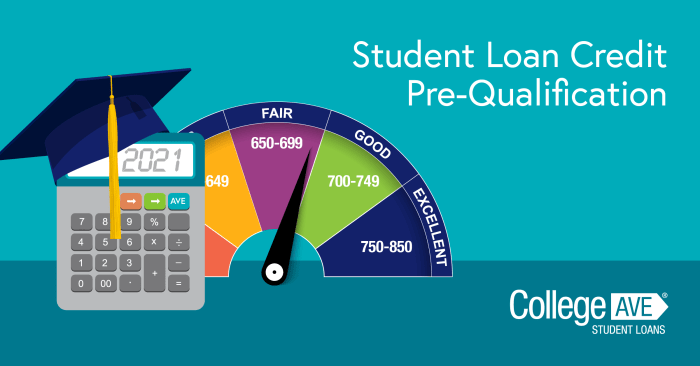

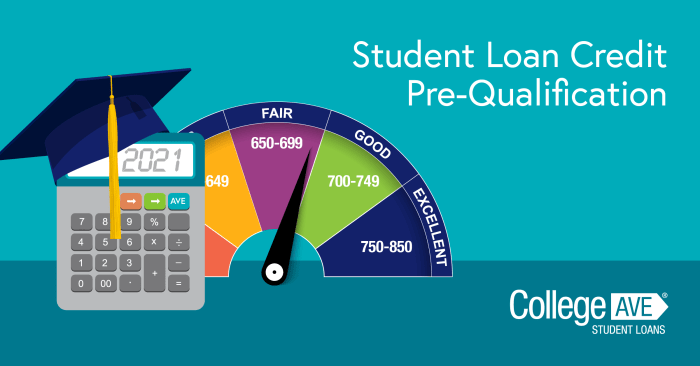

Credit Score’s Influence on Pre-qualification

Your credit score is a crucial element in the pre-qualification process. Lenders use it to assess your creditworthiness – your ability to repay borrowed funds responsibly. A higher credit score generally translates to better loan terms, including lower interest rates and potentially higher loan amounts. Conversely, a low credit score might lead to denial or less favorable offers. For instance, a score below 670 might trigger stricter scrutiny, resulting in higher interest rates or a smaller loan amount than someone with a score above 750. A credit score below 600 may significantly reduce the chances of pre-qualification or even lead to outright rejection.

Income and Debt-to-Income Ratio

Lenders also carefully evaluate your income and debt-to-income (DTI) ratio. Your income demonstrates your ability to make monthly loan payments. The DTI ratio, calculated by dividing your monthly debt payments by your gross monthly income, reveals how much of your income is already committed to debt repayment. A lower DTI ratio generally indicates a greater capacity to manage additional debt, making you a more attractive borrower. For example, a student with a high income and a low DTI ratio (e.g., below 36%) is likely to receive a more favorable pre-qualification compared to a student with a low income and a high DTI ratio (e.g., above 43%). Lenders prefer applicants with a manageable debt burden.

Examples of Pre-qualification Denial

Several scenarios could result in pre-qualification denial. One common reason is a poor credit history, marked by late payments, defaults, or bankruptcies. Insufficient income to support the loan repayment is another significant factor. A high DTI ratio, indicating a substantial existing debt load, could also lead to rejection. Furthermore, a lack of verifiable income or inconsistent employment history can negatively impact pre-qualification outcomes. For example, a student with multiple past-due accounts and a history of missed payments would likely face rejection. Similarly, a student with limited income and high existing debt obligations might not pre-qualify for a substantial loan amount.

Lender’s Decision-Making Flowchart

The following flowchart illustrates a simplified version of a lender’s decision-making process during pre-qualification:

[Diagram Description: The flowchart begins with “Applicant Submits Pre-qualification Request.” This leads to two branches: “Meets Minimum Requirements?” Yes leads to “Credit Check and Income Verification.” This then branches to “Favorable Results?” Yes leads to “Pre-qualification Approved.” No leads to “Pre-qualification Denied.” No (from “Meets Minimum Requirements?”) leads directly to “Pre-qualification Denied.”]

Benefits and Drawbacks of Pre-qualification

Pre-qualifying for student loans offers a valuable opportunity to understand your borrowing power before formally applying. This process allows you to explore different loan options and potentially avoid the pitfalls of applying for loans you may not qualify for. However, it’s crucial to weigh the advantages against any potential drawbacks to make an informed decision.

Understanding the benefits and drawbacks of pre-qualification helps you navigate the student loan process more effectively, ultimately leading to a more informed borrowing strategy. By carefully considering both sides, you can make a decision that best aligns with your financial situation and long-term goals.

Advantages of Pre-qualification

Pre-qualification provides several key advantages that can significantly simplify and improve the student loan application process. These advantages help you plan effectively and potentially secure better loan terms.

- Improved Planning: Pre-qualification gives you a clear picture of how much you can borrow, allowing you to better budget for your education and related expenses. This avoids the risk of underestimating your funding needs or over-borrowing.

- Comparison Shopping: Knowing your pre-qualification amount allows you to compare loan offers from different lenders, ensuring you secure the most favorable interest rates and repayment terms. This competitive analysis can save you significant money over the life of the loan.

- Faster Application Process: Because some information is already gathered during pre-qualification, the formal application process is often streamlined, saving you time and effort. This can be particularly helpful during the often-stressful college application period.

- Reduced Application Fees: While some lenders may charge fees, many don’t for pre-qualification. This contrasts with the potential costs associated with applying for multiple loans without knowing your eligibility beforehand. You avoid unnecessary application fees by focusing on lenders where you are likely to be approved.

- Avoids Hard Credit Inquiries: Many pre-qualification processes only use a soft credit inquiry, which doesn’t impact your credit score. This is a significant advantage compared to applying for multiple loans, each of which typically involves a hard credit inquiry that can temporarily lower your score.

Disadvantages of Pre-qualification

While pre-qualification offers several benefits, it’s important to acknowledge potential drawbacks. Understanding these limitations allows you to manage expectations and avoid disappointment.

- Not a Guarantee of Approval: Pre-qualification is an estimate, not a guarantee. Your final loan amount and terms may differ after a formal application and credit check. While it provides a good indication, it’s not a definitive offer.

- Potential for Multiple Inquiries (depending on the lender): Some lenders might perform a hard credit inquiry even during the pre-qualification process, negatively impacting your credit score. It is vital to understand each lender’s specific process.

- Time Commitment: While generally faster than a full application, pre-qualification still requires providing some personal and financial information. This may be a minor inconvenience for some but a significant factor for others.

Comparison: Pre-qualification Benefits vs. Multiple Loan Applications

The cost of applying for multiple loans without pre-qualifying can be substantial, encompassing both financial and time costs. Multiple hard credit inquiries can lower your credit score, potentially affecting your ability to secure favorable terms on other loans in the future. The time spent completing multiple applications is also a considerable factor, especially when dealing with several lenders and complex forms. Pre-qualification offers a more efficient and potentially less costly alternative, helping to mitigate these risks. For example, applying for five loans without pre-qualification could result in five hard credit inquiries and significant time spent on paperwork, whereas pre-qualification could streamline the process to one or two formal applications.

Finding and Choosing Lenders

Securing student loans involves careful consideration of various lenders, each offering different terms and conditions. Understanding the landscape of available lenders and their offerings is crucial for making an informed decision that aligns with your financial situation and long-term goals. This section will guide you through the process of finding and selecting the most suitable lender for your student loan needs.

Types of Student Loan Lenders

Several types of lenders provide student loans. These include federal government agencies, private banks and credit unions, and online lenders. Federal loans generally offer more favorable terms and repayment options, including income-driven repayment plans and potential loan forgiveness programs. Private lenders, while offering potentially higher interest rates, may provide loan amounts exceeding federal loan limits. Online lenders offer convenience and streamlined application processes, often targeting specific borrower demographics. Careful comparison across these lender types is essential.

Researching and Comparing Lenders

Thorough research is vital before committing to a student loan. Start by comparing interest rates, which represent the cost of borrowing. Lower interest rates translate to lower overall loan costs. Next, examine loan fees, including origination fees, late payment fees, and prepayment penalties. Understand the repayment options offered, such as fixed or variable interest rates, and the repayment period’s length. Consider the lender’s customer service reputation, checking online reviews and ratings from independent sources. Finally, evaluate the lender’s financial stability and track record.

Importance of Reading the Fine Print and Understanding Loan Terms

Before signing any loan agreement, meticulously review the terms and conditions. Pay close attention to the interest rate type (fixed or variable), the repayment schedule, any potential fees, and the consequences of late or missed payments. Understanding the loan’s amortization schedule—a detailed breakdown of your monthly payments and how they are applied to principal and interest—is crucial for budgeting and long-term financial planning. Don’t hesitate to ask questions if anything is unclear; a reputable lender will be happy to explain the terms in detail.

Comparison of Hypothetical Lenders

The following table compares three hypothetical lenders to illustrate the variations in interest rates, fees, and repayment options. Remember that these are examples, and actual rates and fees will vary depending on individual creditworthiness and market conditions.

| Lender | Interest Rate (Fixed) | Origination Fee | Repayment Options |

|---|---|---|---|

| Lender A | 6.5% | 1% of loan amount | Standard 10-year plan, Income-driven repayment available |

| Lender B | 7.0% | 0% | Standard 10-year and 15-year plans |

| Lender C | 6.0% | 0.5% of loan amount | Standard 10-year plan, Accelerated repayment option |

Improving Your Chances of Pre-qualification

Securing student loan pre-qualification hinges on presenting a strong financial profile to lenders. By proactively addressing several key areas, you can significantly improve your likelihood of a positive pre-qualification outcome and access favorable loan terms. This involves improving your credit score, managing your debt effectively, and meticulously gathering the necessary documentation.

Credit Score Improvement Strategies

A higher credit score is a significant factor in loan pre-qualification. Lenders view a strong credit history as an indicator of responsible financial behavior. Improving your credit score involves consistent, positive actions over time. Addressing any negative marks on your report is crucial.

Several strategies can contribute to a higher credit score:

- Pay bills on time: This is the single most important factor influencing your credit score. Consistent on-time payments demonstrate responsible financial management.

- Keep credit utilization low: Aim to keep your credit card balances below 30% of your total credit limit. Higher utilization ratios suggest higher risk to lenders.

- Maintain a diverse credit mix: A mix of credit accounts (credit cards, installment loans) can positively impact your credit score, demonstrating responsible management of various credit types.

- Dispute errors on your credit report: Incorrect information on your credit report can negatively affect your score. Review your report regularly and dispute any inaccuracies with the relevant credit bureaus.

- Avoid opening multiple new accounts in a short period: Numerous new credit applications can temporarily lower your credit score.

Debt Management and Debt-to-Income Ratio Improvement

Managing existing debt is critical for a successful pre-qualification. Lenders assess your debt-to-income ratio (DTI), which compares your monthly debt payments to your gross monthly income. A lower DTI indicates a greater ability to manage additional debt, increasing your chances of pre-qualification.

Effective debt management strategies include:

- Create a budget: Track your income and expenses to identify areas where you can reduce spending and allocate funds towards debt repayment.

- Prioritize high-interest debt: Focus on paying down debts with the highest interest rates first to minimize overall interest payments.

- Consider debt consolidation: Combining multiple debts into a single loan with a lower interest rate can simplify repayment and potentially lower your DTI.

- Negotiate with creditors: If you’re struggling to make payments, contact your creditors to explore options such as payment plans or reduced interest rates.

Gathering Necessary Documentation

Providing complete and accurate documentation is essential for a smooth pre-qualification process. Lenders require specific information to assess your financial situation and eligibility.

Typically, you will need to provide:

- Proof of identity: Such as a driver’s license or passport.

- Social Security number: To verify your identity and credit history.

- Proof of income: Such as pay stubs, tax returns, or bank statements.

- Information about existing debts: Including loan balances and monthly payments.

- Bank statements: To demonstrate your financial stability.

Presenting a Strong Financial Profile

Presenting a comprehensive and well-organized financial profile demonstrates your financial responsibility and increases your chances of pre-qualification.

Key elements of a strong financial profile include:

- A high credit score: Demonstrates responsible credit management.

- A low debt-to-income ratio: Shows your ability to manage additional debt.

- Consistent income: Indicates financial stability.

- Complete and accurate documentation: Ensures a smooth and efficient pre-qualification process.

- A clear understanding of your loan needs: Demonstrates preparedness and planning.

Next Steps After Pre-qualification

Pre-qualification for a student loan provides a valuable snapshot of your borrowing power. However, it’s merely the first step in securing funding for your education. The formal application process involves significantly more detail and documentation. Understanding this process will help you navigate it efficiently and increase your chances of loan approval.

The formal application process for a student loan begins after you’ve received your pre-qualification. This involves completing a comprehensive application form provided by the lender. This form will request detailed information about your financial situation, academic history, and the intended use of the loan funds. Be prepared to provide documentation to support your claims, such as tax returns, pay stubs, and acceptance letters from your chosen educational institution. The lender will then verify the information you’ve provided, which may involve contacting your school or employer. This verification process can take several weeks.

Formal Application Process Details

The formal application process usually includes providing detailed personal information, including Social Security number, date of birth, and contact information. You will also need to provide information about your educational institution, including the program you’re enrolled in and the expected cost of attendance. Finally, you’ll need to declare the loan amount you’re requesting, which should align with your pre-qualification estimate but might be adjusted based on your finalized financial aid package. Remember to carefully review all documents before submitting them. Inaccurate or incomplete information can delay the process significantly.

Loan Acceptance and Disbursement

Once your application is approved, you’ll receive a loan agreement outlining the terms and conditions of your loan, including the interest rate, repayment schedule, and any associated fees. Carefully review this document and ask questions if anything is unclear. After signing and returning the loan agreement, the lender will process the disbursement of the funds. The disbursement process can take several weeks, depending on the lender and the school’s procedures. Funds are often disbursed directly to the educational institution to cover tuition and fees. In some cases, a portion of the loan may be disbursed directly to the student for living expenses.

Timeline: Pre-qualification to Loan Disbursement

A realistic timeline from pre-qualification to loan disbursement can vary, but a general example might look like this:

| Stage | Timeline (Estimated) | Description |

|---|---|---|

| Pre-qualification | 1-3 days | Online application and receiving a pre-qualification offer. |

| Formal Application | 1-2 weeks | Completing and submitting the full loan application with supporting documents. |

| Verification | 2-4 weeks | Lender verifies information provided in the application. |

| Loan Approval | 1-2 weeks | Receiving notification of loan approval and reviewing the loan agreement. |

| Loan Disbursement | 2-4 weeks | Funds are released to the educational institution or the student, depending on the lender and school’s policies. |

Outcome Summary

Successfully pre-qualifying for student loans is a significant achievement, marking a pivotal point in your educational journey. By understanding the process, factors influencing eligibility, and the steps involved, you’ve taken control of your financial planning. Remember to carefully compare lenders, understand the terms, and leverage the information gained to make the best choices for your specific circumstances. With diligent preparation and informed decision-making, you can confidently proceed towards securing the funding you need to achieve your academic goals.

Question Bank

What is the difference between pre-qualification and a formal application?

Pre-qualification is a preliminary assessment of your eligibility, providing an estimate of potential loan amounts and interest rates. A formal application involves a more thorough review of your financial information and results in a firm loan offer.

How long does the pre-qualification process typically take?

The pre-qualification process usually takes just a few minutes to a few days, depending on the lender and the information provided.

Will pre-qualifying affect my credit score?

No, most lenders perform a “soft inquiry” during pre-qualification, which doesn’t impact your credit score.

What happens if I’m denied pre-qualification?

Denial may indicate areas for improvement, such as credit score or debt-to-income ratio. Review the lender’s feedback and work on strengthening your financial profile before reapplying or exploring alternative options.

Can I pre-qualify with multiple lenders simultaneously?

Yes, comparing offers from multiple lenders is recommended to find the most favorable terms. Remember that multiple soft inquiries within a short period won’t negatively affect your credit score.