Securing higher education often hinges on successfully navigating the often-complex world of student loan applications. This guide delves into the intricacies of the student loan application form, providing a clear and concise roadmap for prospective students. From understanding the various sections and required documentation to mastering the application process and addressing potential challenges, we aim to empower you with the knowledge and confidence to successfully obtain the financial aid you need.

We’ll explore different types of student loan applications, highlighting the key distinctions between federal and private options. Furthermore, we’ll address common pitfalls and offer practical solutions, ensuring a smoother application process and ultimately, a clearer path towards your academic goals. This guide serves as a comprehensive resource, combining practical advice with illustrative examples to demystify the complexities of securing student loans.

Understanding the Student Loan Application Form

Applying for student loans can seem daunting, but understanding the application process is key to securing the funding you need for your education. This section will break down the typical components of a student loan application, helping you navigate the process with confidence.

Student loan application forms, whether federal or private, generally require similar core information, though the specific details and verification methods may vary. Understanding the purpose of each section will streamline the application process and increase your chances of approval.

Typical Sections of a Student Loan Application Form

A typical student loan application form will contain several key sections designed to assess your eligibility and creditworthiness. These sections typically include personal information, educational details, financial information, and credit history.

The personal information section requests basic identifying details such as your full name, date of birth, social security number, address, and contact information. This information is used to verify your identity and track your application. The educational details section requires information about your chosen institution, intended degree program, and anticipated enrollment dates. This helps lenders understand the purpose of the loan and its potential impact on your future earnings. The financial information section collects details about your income, assets, and existing debts. This is crucial for assessing your ability to repay the loan. Finally, the credit history section, if applicable, involves a credit check to evaluate your creditworthiness and repayment history. This is particularly relevant for private loans.

Information Verification in Student Loan Applications

Verification of the information provided is a crucial step in the loan application process. Lenders employ various methods to verify the accuracy of the data submitted. This might involve checking your credit report, contacting your educational institution to confirm your enrollment, or requesting supporting documentation such as tax returns or bank statements. Providing accurate and complete information upfront will expedite the process and avoid delays. Inaccurate information can lead to application rejection.

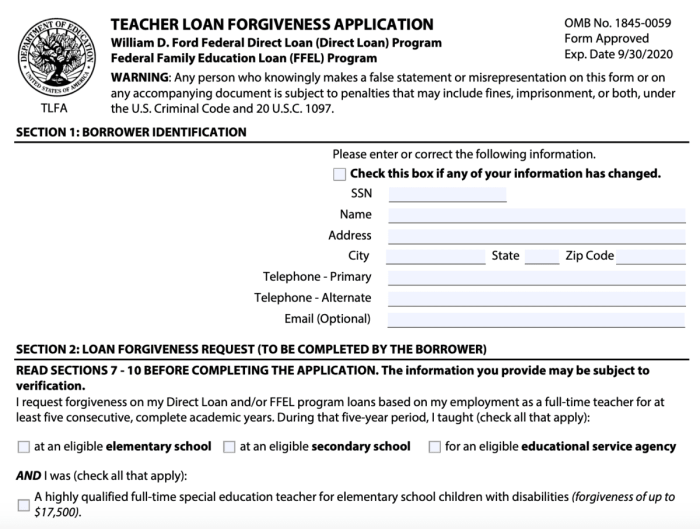

Examples of Student Loan Application Forms: Federal vs. Private

Federal student loan applications, such as those processed through the Free Application for Federal Student Aid (FAFSA), focus primarily on your financial need and educational status. They typically involve less stringent credit checks compared to private loans. Private student loan applications, on the other hand, often require a more comprehensive credit check and financial assessment, as these loans are not backed by the government. They may also require a co-signer if your credit history is insufficient.

Comparison of Student Loan Application Forms

The following table compares three different hypothetical student loan application forms, highlighting key differences in their requirements and processes.

| Feature | Federal Loan (FAFSA-like) | Private Loan (Bank A) | Private Loan (Bank B) |

|---|---|---|---|

| Credit Check Required | No (primarily need-based) | Yes | Yes |

| Co-signer Required | No | Possibly, depending on credit score | Possibly, depending on credit score and loan amount |

| Documentation Required | Tax returns, income verification | Tax returns, bank statements, pay stubs, credit report | Tax returns, bank statements, pay stubs, credit report, employment verification |

| Application Process | Online application, relatively straightforward | Online application, potentially more complex | Online application, potentially lengthy review process |

| Interest Rates | Fixed, generally lower | Variable or fixed, potentially higher | Variable or fixed, potentially higher |

The Application Process

Applying for a student loan can seem daunting, but breaking down the process into manageable steps makes it significantly easier. This section Artikels the application procedure, required documentation, and best practices for a smooth and successful application.

The application process generally involves several key stages, from initial information gathering to final submission and approval. Careful planning and attention to detail at each stage will significantly improve your chances of a quick and positive outcome.

Step-by-Step Application Procedure

Completing a student loan application typically follows a sequential process. Each step requires careful attention to ensure accuracy and completeness.

- Gather Required Information: Before starting the application, collect all necessary personal and financial information, including social security number, date of birth, address history, and income details. This preliminary step saves considerable time and prevents delays.

- Complete the Application Form: Carefully read all instructions and fill out the form accurately and completely. Double-check all entries for accuracy before proceeding.

- Compile Supporting Documentation: Gather all supporting documents as specified in the application guidelines. This may include tax returns, proof of income, transcripts, and other relevant materials. Organize these documents for easy access during the submission process.

- Review and Submit the Application: Thoroughly review the completed application and supporting documents for accuracy and completeness before submission. Submit the application according to the instructions provided, whether electronically or via mail.

- Follow Up: After submission, follow up on the status of your application as needed. Most lenders provide online portals or contact information for tracking application progress.

Required Supporting Documentation

The specific documents required may vary depending on the lender and the type of loan. However, some common supporting documents include:

- Proof of Identity: A government-issued ID such as a driver’s license or passport.

- Tax Returns: Recent tax returns to verify income and financial status.

- Proof of Income: Pay stubs or employment verification letters.

- Academic Transcripts: Official transcripts from your educational institution.

- Bank Statements: Bank statements showing account activity.

Best Practices for Accurate and Efficient Completion

Following best practices can significantly improve the efficiency and accuracy of your application. These practices ensure a smoother application process and reduce the likelihood of delays or rejections.

- Read Instructions Carefully: Thoroughly read all instructions and guidelines before starting the application.

- Double-Check for Errors: Carefully review all entries for accuracy before submitting the application. Typos and inconsistencies can lead to delays.

- Organize Documents: Organize all supporting documents neatly and clearly label them for easy access.

- Keep Copies: Retain copies of all submitted documents for your records.

- Seek Assistance if Needed: If you have questions or encounter difficulties, seek assistance from the lender or a financial advisor.

Application Process Flowchart

The following describes a flowchart illustrating the student loan application process. Imagine a simple diagram with boxes and arrows. The first box would be “Gather Required Information,” connected by an arrow to “Complete Application Form.” Another arrow leads to “Compile Supporting Documents,” followed by “Review and Submit Application.” Finally, an arrow points to “Follow Up/Approval.” This visual representation clarifies the sequential nature of the process.

Financial Aid and Eligibility

Securing funding for your education is a crucial step in the application process. Understanding the different types of financial aid available and the eligibility requirements is essential for a successful application. This section will clarify the various aid options and the role of your application in determining your eligibility.

Types of Financial Aid

Several types of financial aid can help fund your education. These include federal grants, scholarships, federal student loans (subsidized and unsubsidized), and private student loans. Each type has specific eligibility criteria, and the application form plays a vital role in determining your suitability for each.

Federal Grant Eligibility

Federal grants, unlike loans, do not need to be repaid. Eligibility is primarily determined by financial need, as assessed through the Free Application for Federal Student Aid (FAFSA). The FAFSA requires detailed information about your family’s income, assets, and household size. Your application form, specifically the sections related to your financial information, directly feeds into the FAFSA calculations, ultimately influencing your eligibility for federal grants. Higher need generally translates to a greater chance of receiving a grant.

Scholarship Eligibility

Scholarships are awarded based on various criteria, including academic merit, athletic ability, community involvement, or demonstrated financial need. While some scholarships require a separate application, many institutions use information from your student loan application to assess your eligibility. For example, your GPA and extracurricular activities listed on your application might be considered when evaluating scholarship applications.

Federal Student Loan Eligibility

Federal student loans are available to students who demonstrate financial need (subsidized loans) or regardless of financial need (unsubsidized loans). The application form provides the necessary financial information to determine need-based eligibility. Credit history is generally not a factor for federal student loans, although satisfactory academic progress is usually required to continue receiving funds.

Private Student Loan Eligibility

Private student loans are offered by banks and other financial institutions. Unlike federal loans, eligibility for private loans often depends significantly on your credit history and may require a co-signer. A strong credit history increases your chances of approval and potentially secures you a lower interest rate. If you lack a sufficient credit history, a co-signer with good credit can significantly improve your chances of loan approval. The information provided in your application, while not directly impacting the private lender’s decision in the same way as the FAFSA, can still indirectly influence the lender’s assessment of your financial responsibility.

Key Eligibility Factors for Different Loan Types

Understanding the key eligibility factors is crucial for a successful application. Here’s a summary:

- Federal Grants: Financial need (demonstrated through the FAFSA, informed by your application); Enrollment status.

- Scholarships: Academic merit, extracurricular activities, financial need (depending on the scholarship), demonstrated talent (e.g., athletic ability); Information often drawn from your application form.

- Federal Student Loans (Subsidized): Financial need (demonstrated through the FAFSA); Enrollment status; Satisfactory Academic Progress.

- Federal Student Loans (Unsubsidized): Enrollment status; Satisfactory Academic Progress.

- Private Student Loans: Credit history; Income; Co-signer (often required for students with limited or no credit history); Enrollment status.

Impact of Credit History and Co-signers

A strong credit history significantly improves your chances of securing a private student loan and obtaining favorable interest rates. A poor credit history may result in loan denial or higher interest rates. If you lack a credit history, a co-signer with good credit can act as a guarantor, increasing your likelihood of approval. The co-signer assumes responsibility for repayment if you default on the loan. This demonstrates a level of trust and financial responsibility to the lender.

Potential Challenges and Solutions

Applying for student loans can be a complex process, and even minor errors can lead to delays or rejection. Understanding potential pitfalls and how to avoid them is crucial for a smooth application process. This section Artikels common challenges students face and provides practical solutions to overcome them.

Common Application Errors

Many students make mistakes when completing their student loan applications. These errors often stem from a lack of attention to detail, misunderstanding of specific requirements, or insufficient preparation. Failing to accurately report income, providing incomplete documentation, or omitting crucial information are common issues. These mistakes can lead to delays in processing or, in some cases, outright rejection of the application.

Solutions to Common Application Errors

Careful preparation is key to avoiding errors. Begin by thoroughly reviewing the application instructions and required documentation. Double-check all information for accuracy before submitting the application. If unsure about any aspect of the application, contact the financial aid office for clarification. Utilize checklists and templates to ensure all necessary information is included. For example, creating a spreadsheet to track all required documents and their submission status can prevent overlooking crucial pieces of information. Seeking assistance from a trusted advisor or mentor can also prove beneficial.

Application Processing Delays and Mitigation Strategies

Delays in processing student loan applications can occur due to various factors, including incomplete applications, missing documentation, and system processing times. However, proactive measures can significantly reduce the risk of delays. Submitting a complete and accurate application well in advance of deadlines is essential. Ensure all supporting documents are readily available and attached to the application. Regularly check the application status online and follow up with the financial aid office if there are any concerns or if the processing time seems excessive. For instance, if you know you will be traveling, submit your application well in advance of your departure date.

Common Application Problems, Causes, and Solutions

| Problem | Cause | Solution | Example |

|---|---|---|---|

| Incomplete Application | Missing information or supporting documents | Thoroughly review application instructions and ensure all fields are completed accurately. Gather all necessary documents before starting the application. | Forgetting to include tax returns, leading to a request for additional information and a processing delay. |

| Inaccurate Information | Errors in reported income, GPA, or other details. | Double-check all information for accuracy. Use official documents as references. | Incorrectly reporting income, leading to an inaccurate assessment of financial need. |

| Missing Documentation | Failure to submit required transcripts, tax returns, or other supporting documents. | Maintain organized records and submit all required documents along with the application. | Not submitting official transcripts, resulting in a delay while the institution requests them. |

| Late Submission | Submitting the application after the deadline. | Submit the application well in advance of the deadline to account for potential technical issues or unforeseen delays. | Submitting the application one day late, resulting in ineligibility for the loan. |

Post-Application Procedures

Submitting your student loan application marks a significant step towards your educational goals. Understanding the post-application process is crucial to ensure a smooth transition from application to receiving your funds. This section details the steps involved in tracking your application, receiving your loan, and understanding your repayment obligations.

After submitting your application, you’ll typically receive a confirmation email or notification within a few business days. This confirmation will include a unique application ID, allowing you to track its progress. Most lenders provide online portals or dedicated phone lines for checking the status of your application. Regularly checking for updates ensures you are aware of any required actions or delays.

Application Status Tracking

The application status tracking process varies depending on the lender. Many lenders offer online portals where you can log in using your application ID and other identifying information to view the current status of your application. These portals typically provide updates on each stage of the process, such as application received, verification in progress, approval/denial, and disbursement. Some lenders may also provide email or SMS notifications at key stages of the process. If you encounter any difficulty tracking your application, contacting the lender’s customer service department directly is recommended.

Post-Approval Procedures

Once your application is approved, the lender will notify you via email or mail. This notification will usually include details about the loan amount approved, the disbursement schedule, and the terms of the loan agreement. The disbursement of funds typically occurs in installments, often aligned with academic terms or semesters. The exact disbursement schedule will depend on your institution’s policies and the lender’s procedures. For example, a student might receive half the funds at the beginning of the fall semester and the remaining half at the beginning of the spring semester.

Loan Disbursement and Repayment Options

The funds are usually electronically transferred directly to your educational institution to cover tuition and fees. Any remaining funds, if applicable, may be disbursed to you directly, but this is subject to the lender’s and institution’s policies. Repayment options vary widely depending on the type of loan (federal or private), the lender, and the loan terms. Common repayment options include standard repayment plans (fixed monthly payments over a set period), graduated repayment plans (payments start low and increase over time), extended repayment plans (longer repayment periods with lower monthly payments), and income-driven repayment plans (payments are based on your income and family size). It’s crucial to review the loan agreement carefully to understand your repayment options and choose the plan that best suits your financial situation.

Accessing and Understanding Loan Agreement Documents

The loan agreement is a legally binding contract outlining the terms and conditions of your loan. It details the loan amount, interest rate, repayment schedule, fees, and other important information. You will typically receive a copy of the loan agreement electronically or via mail after your application is approved. It is imperative to read this document thoroughly before signing it. If any terms are unclear or you have questions, contact the lender’s customer service department for clarification before signing. Understanding the terms of your loan agreement is vital for responsible financial management and avoiding potential issues down the line. For example, understanding the interest rate and repayment schedule allows you to accurately budget for your monthly payments.

Illustrative Examples

To further clarify the student loan application process, let’s examine two hypothetical scenarios. These examples illustrate the application process for different student profiles and highlight potential challenges and solutions.

Undergraduate Student Loan Application

This scenario follows Sarah, a 19-year-old undergraduate student applying for a federal student loan to cover tuition, fees, and living expenses at State University. Sarah is a US citizen, maintains a 3.5 GPA, and works part-time. Her parents are unable to contribute financially to her education. Her application process begins with completing the FAFSA (Free Application for Federal Student Aid). She accurately reports her income and assets, and those of her parents. She then selects her preferred loan type and amount, ensuring it aligns with her estimated educational costs.

Supporting documents submitted include her acceptance letter from State University, her transcript demonstrating academic standing, and her tax returns (or her parents’ tax returns, as she is considered a dependent student). The application process is straightforward for Sarah due to her eligibility and accurate documentation. The process is completed online through the designated student aid portal. She receives her loan disbursement within a few weeks of the approval notification.

Graduate Student Loan Application: International Student

This scenario focuses on David, a 28-year-old international student from Canada pursuing a Master’s degree in Computer Science at a private university. David faces unique challenges. He needs to demonstrate financial responsibility and sufficient funds to cover the high tuition fees and living expenses in the United States. His application involves more complex steps. In addition to the FAFSA, he may need to complete a CSS Profile (College Scholarship Services Profile), which is a more detailed financial aid application required by many private universities.

He must provide proof of his financial resources, including bank statements demonstrating sufficient funds to cover his educational expenses for the duration of his studies. He also needs to submit evidence of his health insurance coverage. His visa status and immigration documentation are crucial parts of the application. Because of his international status, processing times might be longer, and he may need to navigate additional bureaucratic hurdles. David also needs to consider the implications of different loan types and repayment options, factoring in the exchange rate between the US dollar and the Canadian dollar. He might seek assistance from the university’s international student office to navigate the complexities of the application process. He will need to ensure all documents are translated into English if they were originally in another language.

Outcome Summary

Successfully completing a student loan application requires careful planning, attention to detail, and a proactive approach. By understanding the process, gathering necessary documentation, and addressing potential challenges proactively, students can significantly increase their chances of securing the financial aid they need. Remember to utilize the resources available, seek assistance when necessary, and remain organized throughout the application process. This comprehensive guide aims to provide the foundation for a successful application, paving the way for a fulfilling educational journey.

FAQ Corner

What happens if I make a mistake on my application form?

Most applications allow for corrections. Contact the lender or institution immediately to explain the error and request guidance on how to rectify it. Don’t panic; many minor errors can be easily fixed.

How long does it typically take to process a student loan application?

Processing times vary depending on the lender and the complexity of the application. Federal loans generally have a more predictable timeline, while private loan processing times can fluctuate. Check with your lender for estimated processing times.

Can I appeal a loan application denial?

Yes, you usually can. Understand the reasons for denial and provide additional documentation or address concerns raised by the lender in a formal appeal letter.

What if I don’t have a co-signer?

While a co-signer can improve your chances of approval, it’s not always required, especially for federal loans. Lenders will assess your creditworthiness and financial history. A strong credit history or demonstrating sufficient income can increase your chances of approval without a co-signer.