Navigating the world of student loans can feel overwhelming, especially when faced with the seemingly similar yet distinctly different options of subsidized and unsubsidized loans. Understanding the nuances between these two loan types is crucial for responsible borrowing and long-term financial well-being. This guide will illuminate the key differences, helping you make informed decisions about financing your education.

From interest rates and accrual to eligibility requirements and repayment plans, we’ll explore the critical aspects that differentiate subsidized and unsubsidized federal student loans. We’ll also delve into the impact these loans can have on your credit score, overall financial aid package, and long-term financial goals, providing you with the knowledge to confidently manage your student loan debt.

Interest Rates and Accrual

Understanding the differences in interest rates and accrual between subsidized and unsubsidized federal student loans is crucial for effective financial planning during and after your education. Both loan types have varying interest rates and accrual periods, significantly impacting the total repayment amount.

Subsidized and unsubsidized loans differ primarily in how interest accrues. The interest rate itself is determined by the federal government and varies yearly depending on the loan disbursement date. While both loan types will have a fixed interest rate for the life of the loan, the timing of interest accrual creates significant differences in the overall cost.

Interest Rate Comparison

The interest rate for both subsidized and unsubsidized federal student loans is set by the government each year and is fixed for the life of the loan. However, the interest rate for unsubsidized loans is typically slightly higher than that of subsidized loans. This difference reflects the added risk to the lender as the borrower is responsible for all accrued interest. The exact difference will depend on the specific loan year.

Interest Accrual During Different Periods

The key distinction lies in how interest accrues during different loan phases. This impacts the total amount owed upon entering repayment.

| Loan Type | Interest Rate Type | Accrual During School | Accrual During Grace Period |

|---|---|---|---|

| Subsidized | Fixed (set annually) | No interest accrues | No interest accrues |

| Unsubsidized | Fixed (set annually) | Interest accrues | Interest accrues |

Hypothetical Interest Paid Example

Let’s consider a hypothetical example to illustrate the difference. Suppose a student borrows $10,000 in both subsidized and unsubsidized loans. The fixed interest rate for both loans is 5% per year. The student attends school for four years. During the four years of school, interest on the unsubsidized loan will accrue. Let’s assume, for simplicity, that the interest is compounded annually. After four years, the unsubsidized loan balance will be significantly higher than the initial $10,000 due to accrued interest. The subsidized loan will still be $10,000 because no interest accrued during this time. Once the grace period ends, interest begins to accrue on both loan types, further increasing the total repayment amount for the unsubsidized loan.

In this scenario, the total interest paid over the life of the loan will be substantially higher for the unsubsidized loan compared to the subsidized loan, even with the same initial principal and interest rate, solely due to the interest accrual during the in-school and grace periods.

Eligibility Requirements

Understanding the eligibility criteria for subsidized and unsubsidized federal student loans is crucial for prospective students. These loans differ significantly based on financial need and the student’s dependency status. This section clarifies these differences and provides examples to illustrate the eligibility process.

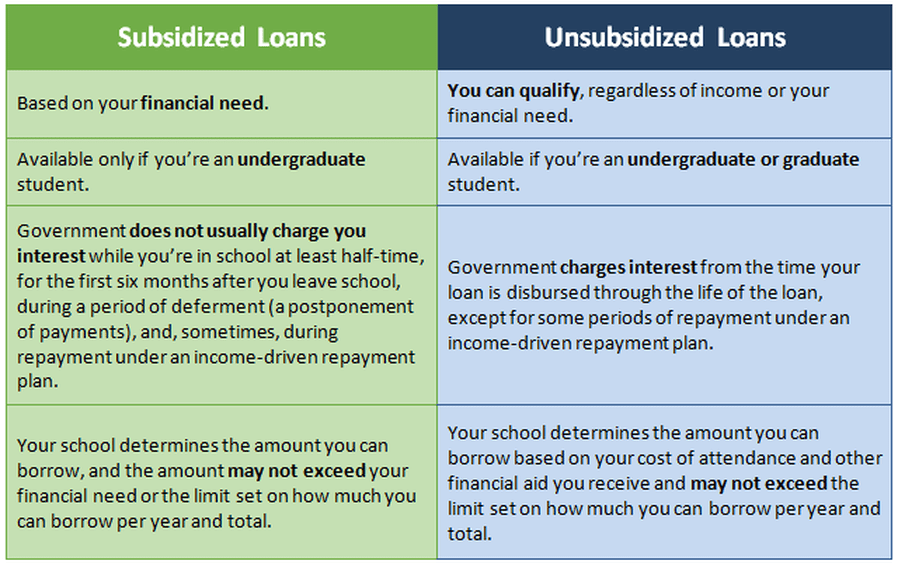

Both subsidized and unsubsidized federal student loans are offered by the U.S. Department of Education to help students finance their higher education. However, their eligibility requirements differ significantly, primarily revolving around demonstrated financial need and the student’s dependency status (whether they are considered dependent or independent by the Free Application for Federal Student Aid, or FAFSA).

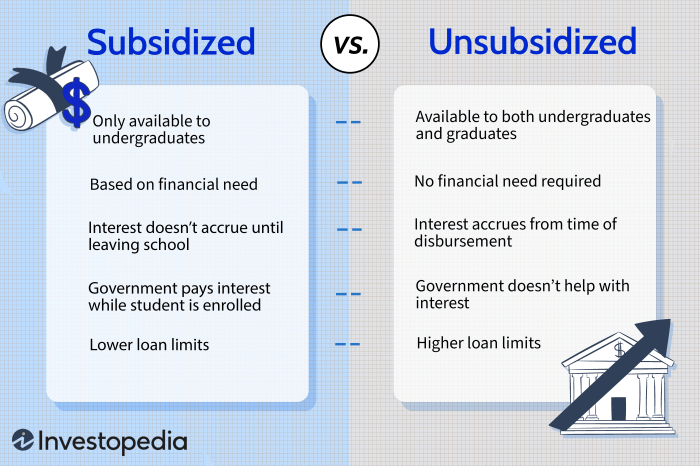

Subsidized Loan Eligibility

Eligibility for subsidized federal student loans hinges on demonstrating financial need. The Department of Education determines financial need based on information provided on the FAFSA, including family income, assets, and the number of family members. Students are generally considered to have financial need if their Expected Family Contribution (EFC) is less than the cost of attendance at their chosen institution. Only undergraduate students are eligible for subsidized loans, and the amount a student can borrow is dependent on their year in school and financial need, as determined by the FAFSA.

Unsubsidized Loan Eligibility

Unsubsidized federal student loans do not require a demonstration of financial need. Both undergraduate and graduate students are eligible. The maximum loan amount a student can borrow is determined by their year in school, and the aggregate loan limit across all loans will restrict the total amount of loan a student can receive. Interest begins accruing on unsubsidized loans immediately, unlike subsidized loans where interest accrual is deferred until after graduation.

Dependency Status and Loan Eligibility

A student’s dependency status significantly impacts their eligibility for federal student aid, including loans. Dependent students are those who are claimed as a dependent on their parents’ or guardians’ tax returns. Independent students are those who are not claimed as a dependent and meet certain criteria, such as being married, having children, or serving in the military. Dependent students’ eligibility for subsidized loans is largely based on their parents’ financial information. Independent students have their eligibility assessed based on their own financial situation.

Examples of Eligibility Scenarios

Let’s consider some scenarios to illustrate the differences:

- Scenario 1: A dependent undergraduate student with a low EFC, based on their family’s income, will likely qualify for both subsidized and unsubsidized loans. The subsidized loan amount will be determined by their financial need, while the unsubsidized loan amount will be based on their year in school and the maximum loan limit.

- Scenario 2: An independent graduate student will be eligible for unsubsidized loans but not subsidized loans, as subsidized loans are not available to graduate students. Their loan amount will be determined by their year in school and the maximum loan limit.

- Scenario 3: A dependent undergraduate student with a high EFC may qualify for unsubsidized loans but not subsidized loans, as they do not demonstrate sufficient financial need. The amount they can borrow will be limited by their year in school and the maximum loan limit.

Loan Eligibility Flowchart

The following flowchart illustrates the decision-making process for determining student loan eligibility:

[Diagram Description]: The flowchart would begin with a box asking “Are you an undergraduate student?”. A “Yes” branch leads to a box asking “Do you have financial need (low EFC)?”. A “Yes” response leads to a “Qualifies for Subsidized and Unsubsidized Loans” box. A “No” response leads to a “Qualifies for Unsubsidized Loans Only” box. A “No” response to the first question (“Are you an undergraduate student?”) leads to a box asking “Are you a graduate student?”. A “Yes” response leads to a “Qualifies for Unsubsidized Loans Only” box. A “No” response leads to a “Ineligible for Federal Student Loans” box. Each box would have clear arrows indicating the flow of the decision-making process.

Loan Forgiveness and Repayment Plans

Navigating student loan repayment can be complex, particularly understanding the nuances of loan forgiveness programs and the various repayment plan options available for subsidized and unsubsidized loans. This section clarifies the key differences and provides practical examples to help you make informed decisions.

Loan Forgiveness Programs

Several federal loan forgiveness programs exist, but eligibility requirements vary significantly. These programs generally target specific professions (like teaching or public service) or borrowers facing economic hardship. While both subsidized and unsubsidized loans may be eligible for some programs, the specifics depend on the program itself and the borrower’s individual circumstances. For example, the Public Service Loan Forgiveness (PSLF) program can forgive the remaining balance on Direct Loans after 120 qualifying monthly payments, but this requires consistent employment in a qualifying public service job. Teacher Loan Forgiveness programs offer partial loan forgiveness to teachers who meet specific requirements, and are available for both subsidized and unsubsidized loans. It’s crucial to thoroughly research specific programs to determine eligibility.

Repayment Plan Options

Borrowers have several repayment plan options to choose from, each with different implications for monthly payments, total interest paid, and loan repayment timeline. The best option depends on individual financial circumstances and long-term goals.

Standard Repayment Plan

This plan involves fixed monthly payments over a 10-year period. Both subsidized and unsubsidized loans are eligible. While it leads to the quickest repayment, monthly payments can be high. For example, a $30,000 loan at a 5% interest rate would result in approximately $330 monthly payments and a total repayment of approximately $39,600.

Extended Repayment Plan

This plan extends the repayment period to up to 25 years, lowering monthly payments but increasing the total interest paid over the life of the loan. Both subsidized and unsubsidized loans qualify. Using the same $30,000 loan example, a 25-year repayment plan would result in significantly lower monthly payments, around $165, but the total repayment would be considerably higher, potentially exceeding $50,000 due to accumulated interest.

Income-Driven Repayment Plans

These plans (such as ICR, PAYE, REPAYE, and IBR) base monthly payments on income and family size. Both subsidized and unsubsidized loans are eligible. Payments are typically lower than under standard repayment, but the repayment period is often longer, potentially up to 20 or 25 years, leading to higher overall interest costs. For instance, a borrower with a low income might have a monthly payment as low as $50 under an income-driven plan, but this could extend repayment well beyond the standard 10 years. The remaining balance might be forgiven after a certain number of qualifying payments, depending on the specific plan.

Comparison of Repayment Plan Options

| Repayment Plan | Subsidized Loan Applicability | Unsubsidized Loan Applicability | Key Features |

|---|---|---|---|

| Standard Repayment | Yes | Yes | 10-year repayment, fixed monthly payments, higher monthly payments, lower total interest paid |

| Extended Repayment | Yes | Yes | Up to 25-year repayment, lower monthly payments, higher total interest paid |

| Income-Driven Repayment (ICR, PAYE, REPAYE, IBR) | Yes | Yes | Monthly payments based on income, lower monthly payments, longer repayment period, potential for loan forgiveness |

Impact on Credit Score and Financial Aid

Understanding the nuances of subsidized and unsubsidized student loans is crucial for navigating your financial future. Both loan types affect your credit score and eligibility for future financial aid, albeit in different ways. This section will clarify these impacts and offer guidance on budgeting effectively to manage student loan debt.

Subsidized and Unsubsidized Loans’ Effect on Credit Score

Your credit score is a numerical representation of your creditworthiness, impacting your ability to secure loans, rent an apartment, or even get a job in some cases. Both subsidized and unsubsidized loans can affect your credit score, but the timing and manner differ. Unsubsidized loans begin accruing interest immediately, and this interest is added to your principal balance. Once you start making payments on either loan type (after the grace period), this repayment activity is reported to credit bureaus, positively impacting your credit score, provided you make timely payments. Consistent on-time payments demonstrate responsible credit management, building a positive credit history. Conversely, late or missed payments will negatively impact your credit score, potentially hindering future financial opportunities. The impact of a single missed payment may be relatively small, but consistent negative activity can significantly lower your score.

Impact of Loan Types on Financial Aid Packages

The amount of federal student aid you receive (grants, scholarships, etc.) is based on your demonstrated financial need. While neither subsidized nor unsubsidized loans directly reduce your financial aid, the overall amount of your loan debt can indirectly influence your eligibility for future aid. A student with a large amount of unsubsidized loan debt may appear less financially needy than a student with a smaller loan amount, potentially impacting the amount of future grants or scholarships they receive. This is because financial aid packages are often calculated based on a student’s total debt and their family’s contribution. Therefore, managing your loan debt responsibly and minimizing the total amount you borrow is crucial for maximizing future financial aid opportunities.

Incorporating Student Loan Debt into a Personal Budget

Successfully managing student loan debt requires careful budgeting. Start by creating a realistic budget that Artikels all your monthly income and expenses. Include your student loan payments as a fixed expense, ensuring you allocate sufficient funds for timely payments. Explore various budgeting methods, such as the 50/30/20 rule (50% needs, 30% wants, 20% savings and debt repayment), to prioritize your loan payments while maintaining a healthy financial balance. Track your spending diligently to ensure you remain within your budget and make consistent progress on loan repayment. Utilize budgeting apps or spreadsheets to simplify the process and gain a clear understanding of your financial situation. Consider exploring loan refinancing options if you qualify for a lower interest rate to reduce your monthly payments and accelerate debt repayment.

Hypothetical Scenario: Combined Effect of Loan Types on Financial Health

Imagine Sarah, a college student who takes out $20,000 in subsidized loans and $10,000 in unsubsidized loans. Her subsidized loans won’t accrue interest while she’s in school, but her unsubsidized loans will. By graduation, her unsubsidized loan balance will be slightly higher due to accrued interest. After graduation, she secures a job and starts making timely payments on both loans. Her consistent on-time payments positively impact her credit score. However, if Sarah had only taken unsubsidized loans, the higher interest accrued during her studies would result in a larger total debt and higher monthly payments, potentially straining her budget. If she had difficulty making timely payments on a larger loan amount, it would negatively impact her credit score, making it harder to secure loans or other financial products in the future. Conversely, her responsible management of both subsidized and unsubsidized loans allows her to build a strong credit history, opening doors to better financial opportunities.

Federal vs. Private Loans

Choosing between federal and private student loans is a crucial decision impacting your financial future. Understanding the key differences between these loan types is essential for making an informed choice that aligns with your individual circumstances and financial goals. This section will compare and contrast federal subsidized and unsubsidized loans with private student loans, highlighting their respective advantages and disadvantages, and providing examples of when one type might be preferable over the other.

Comparison of Federal and Private Student Loans

Federal student loans, encompassing both subsidized and unsubsidized options, are offered by the U.S. government. Private student loans, conversely, are provided by banks, credit unions, and other private lending institutions. A key distinction lies in the eligibility criteria and the terms offered. Federal loans typically have more lenient eligibility requirements, often based solely on enrollment status and financial need (for subsidized loans), while private loans often require a credit check and a co-signer, particularly for students with limited or no credit history.

Advantages and Disadvantages of Federal Student Loans

Federal student loans offer several advantages. They often come with lower interest rates than private loans, and they offer various repayment plans and forgiveness programs, such as income-driven repayment and Public Service Loan Forgiveness. However, the maximum loan amounts available through federal programs may not always cover the full cost of tuition and other educational expenses. Furthermore, eligibility is subject to government regulations and may change over time.

Advantages and Disadvantages of Private Student Loans

Private student loans can sometimes offer higher loan amounts than federal loans, potentially bridging the gap between financial aid and educational costs. However, they typically come with higher interest rates and less flexible repayment options. Moreover, private lenders may require a creditworthy co-signer, placing an additional burden on the borrower’s family or friends. Defaulting on a private loan can severely damage your credit score.

Situations Favoring Private or Federal Loans

A private loan might be a better option when a student’s financial need exceeds the maximum amount available through federal loans. Conversely, a federal loan is generally the preferred choice when a student qualifies for subsidized loans, benefiting from interest-free periods and potentially lower interest rates overall. Students with limited or no credit history would find federal loans more accessible, as they typically do not require a credit check.

Applying for Federal and Private Student Loans

Applying for federal student loans involves completing the Free Application for Federal Student Aid (FAFSA). This application gathers information about your financial situation and determines your eligibility for federal student aid, including subsidized and unsubsidized loans. The process for private student loans usually involves applying directly to a private lender, often requiring a credit check and potentially a co-signer. Lenders will assess your creditworthiness and financial history to determine your eligibility and loan terms. Detailed information regarding interest rates, fees, and repayment options will be provided in the loan agreement.

Long-Term Financial Implications

The choice between subsidized and unsubsidized federal student loans significantly impacts your long-term financial health. Understanding these implications is crucial for making informed borrowing decisions and achieving your future financial goals. While both loan types offer access to education funding, their differing interest accrual mechanisms lead to varying levels of debt burden over time.

The primary difference lies in interest accrual. Unsubsidized loans accrue interest from the moment the loan is disbursed, increasing the total amount owed. Subsidized loans, conversely, do not accrue interest while you are enrolled at least half-time or during a grace period. This seemingly small difference can lead to substantial variations in the total amount repaid, especially with larger loan amounts and longer repayment periods. Failing to consider this difference can severely impact your ability to meet long-term financial goals.

Impact on Major Financial Goals

The accumulation of student loan debt can significantly influence your ability to achieve major life milestones. For instance, a larger loan balance resulting from unsubsidized loans may delay homeownership. The higher monthly payments associated with a larger principal balance might reduce the amount available for a down payment or make it difficult to qualify for a mortgage. Similarly, substantial student loan debt can impact retirement savings. Monthly payments dedicated to loan repayment could reduce the amount available for contributions to retirement accounts, potentially diminishing the nest egg available in later life. Consider this example: Two individuals graduate with similar incomes, but one has a significantly larger unsubsidized loan balance. Over 20 years, the individual with the larger debt may have contributed considerably less to retirement due to higher loan payments, leading to a substantial difference in their retirement savings.

Strategies for Minimizing Long-Term Financial Burden

Careful planning can significantly mitigate the long-term impact of student loan debt.

- Borrow only what you need: Carefully estimate your educational expenses and only borrow the minimum amount necessary to cover those costs. Avoid unnecessary borrowing.

- Prioritize subsidized loans: Explore and maximize your eligibility for subsidized loans to minimize the accumulation of interest.

- Explore scholarships and grants: Actively seek out scholarships and grants to reduce your reliance on loans.

- Choose a repayment plan that aligns with your budget: Consider income-driven repayment plans to manage monthly payments and prevent default.

- Make extra payments when possible: Any extra payments, even small ones, can significantly reduce the principal and shorten the repayment period, ultimately saving you money on interest.

- Budget effectively: Create a detailed budget that incorporates loan repayment as a priority expense to ensure timely payments and avoid late fees.

Last Point

Choosing between subsidized and unsubsidized student loans is a significant financial decision impacting your future. By carefully considering factors like interest rates, eligibility criteria, repayment options, and long-term financial implications, you can create a responsible borrowing strategy aligned with your individual circumstances. Remember to thoroughly research your options and seek professional financial advice when needed to ensure a path towards financial success.

Essential FAQs

What happens if I don’t repay my student loans?

Failure to repay your student loans can lead to serious consequences, including damage to your credit score, wage garnishment, and potential legal action. Contact your loan servicer immediately if you are struggling to make payments to explore options like deferment or forbearance.

Can I consolidate my subsidized and unsubsidized loans?

Yes, you can consolidate your federal student loans, including both subsidized and unsubsidized loans, into a single Direct Consolidation Loan. This simplifies repayment but may result in a higher overall interest rate over the life of the loan.

Are there any tax benefits associated with student loan interest?

Yes, you may be able to deduct the interest you paid on your student loans on your federal income tax return, subject to certain income limitations. Consult a tax professional or the IRS website for the most up-to-date information.