Navigating the world of student loans can feel overwhelming, especially when faced with terms like “subsidized” and “unsubsidized.” These seemingly minor distinctions can significantly impact your borrowing experience, from interest rates and eligibility to repayment options and long-term financial health. Understanding these differences is crucial for making informed decisions about financing your education and avoiding potential pitfalls down the road. This guide will dissect the key differences between subsidized and unsubsidized federal student loans, providing clarity and empowering you to make the best choices for your future.

This detailed comparison will cover interest rates, eligibility requirements, loan forgiveness programs, repayment options, credit score impact, and the consequences of default. By the end, you’ll have a comprehensive understanding of the nuances between these two loan types, enabling you to confidently manage your student loan debt.

Interest Rates

Subsidized and unsubsidized federal student loans differ significantly in how their interest rates are determined and how interest accrues over time. Understanding these differences is crucial for borrowers to make informed decisions about managing their student loan debt.

Interest rates for both subsidized and unsubsidized federal student loans are set annually by the government. They are influenced by several factors, including prevailing market interest rates and the overall economic climate. Unlike private loans, the rates are not determined by the borrower’s credit score or financial history. Instead, the government sets a fixed interest rate for each loan period, which remains consistent for the life of the loan. However, the specific rate will vary from year to year depending on the economic conditions at the time the loan is disbursed.

Interest Rate Determination and Accrual

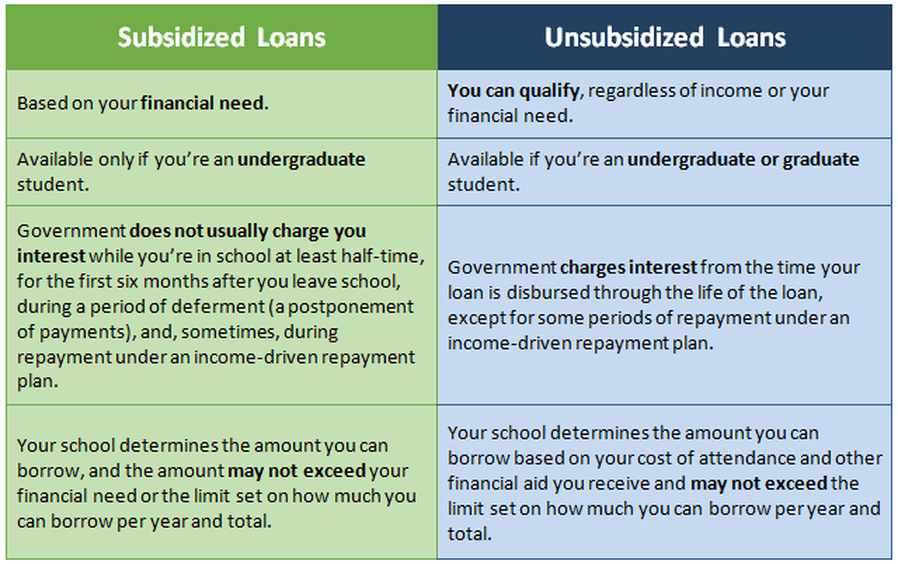

The interest rate for subsidized loans is generally lower than that for unsubsidized loans. This is because the government subsidizes the interest on subsidized loans while the borrower is in school at least half-time, during grace periods, and during certain deferment periods. Unsubsidized loans, on the other hand, accrue interest from the moment the loan is disbursed, regardless of the borrower’s enrollment status or repayment plan. This means that the total amount owed on an unsubsidized loan will be higher than that on a subsidized loan with the same principal amount, even if both loans have the same initial interest rate. The interest on unsubsidized loans compounds over time, meaning that interest accrues on both the principal and previously accrued interest. This compounding effect can significantly increase the total cost of the loan over its repayment period.

Interest Accrual During Deferment or Forbearance

A key difference lies in how interest accrues during periods of deferment or forbearance. For subsidized loans, the government pays the interest that accrues during eligible deferment periods (e.g., while the borrower is enrolled at least half-time in school). This prevents the interest from capitalizing (being added to the principal balance). However, interest still accrues on unsubsidized loans during deferment or forbearance periods, and this accrued interest is added to the principal balance at the end of the deferment or forbearance. This capitalization increases the total amount the borrower must repay. Forbearance, which is a temporary suspension of loan payments, works similarly for both loan types regarding interest accrual: interest continues to accrue on unsubsidized loans, while the government’s interest subsidy ceases on subsidized loans during forbearance.

Typical Interest Rates for Subsidized and Unsubsidized Loans

The following table presents typical interest rate ranges for subsidized and unsubsidized federal student loans. Keep in mind that these are examples and actual rates may vary depending on the year the loan was disbursed and other factors.

| Loan Type | Interest Rate Range (Example) | Accrual During Deferment | Repayment Period Examples |

|---|---|---|---|

| Subsidized | 2.75% – 5.5% | Interest not accrued during eligible deferment | 10-20 years (depending on repayment plan) |

| Unsubsidized | 3.75% – 6.5% | Interest accrues during deferment, capitalizes at the end | 10-20 years (depending on repayment plan) |

Eligibility Requirements

Both subsidized and unsubsidized federal student loans have specific eligibility requirements that students must meet to receive funding. These requirements are designed to ensure that federal loan funds are distributed to those who demonstrate a genuine need and are pursuing eligible educational programs. Understanding these criteria is crucial for students planning to finance their education through federal student loans.

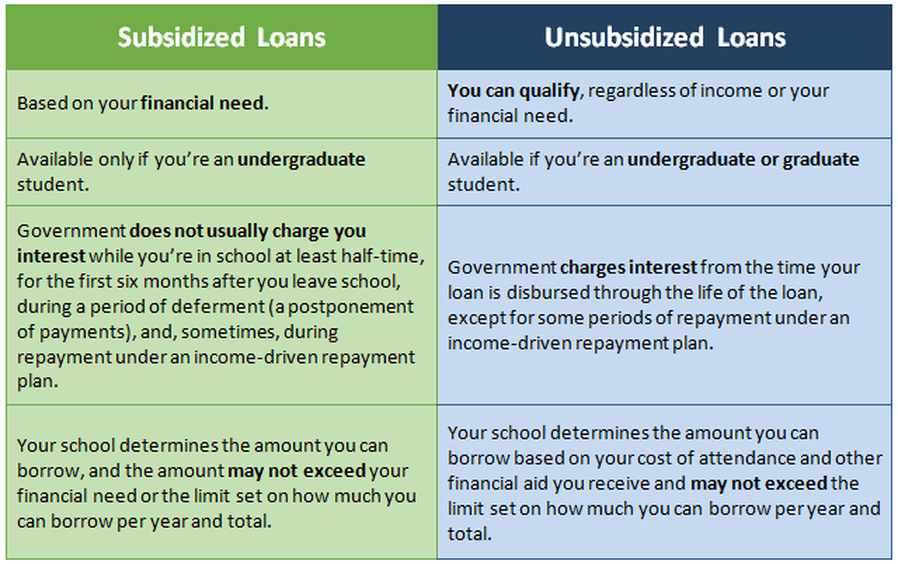

Eligibility for both subsidized and unsubsidized federal student loans hinges on several key factors. The most important are the student’s enrollment status, financial need (for subsidized loans), credit history (generally not a factor for federal loans), and citizenship or residency status. These factors interact to determine a student’s loan eligibility and the amount they can borrow.

Subsidized Loan Eligibility

To qualify for a subsidized federal student loan, a student must demonstrate financial need. This is determined through the Free Application for Federal Student Aid (FAFSA). The FAFSA calculates the Expected Family Contribution (EFC), which is then compared to the student’s cost of attendance to determine their financial need. A lower EFC generally indicates greater financial need and a higher likelihood of qualifying for subsidized loans. The government directly subsidizes the interest on these loans while the student is in school at least half-time, during grace periods, and during deferment periods.

- Be enrolled at least half-time in an eligible degree or certificate program at a participating institution.

- Be a U.S. citizen or eligible non-citizen.

- Maintain satisfactory academic progress as defined by the institution.

- Demonstrate financial need as determined by the FAFSA.

- Not have an existing default on a federal student loan.

Unsubsidized Loan Eligibility

Unsubsidized federal student loans do not require a demonstration of financial need. Students are eligible based on their enrollment status, credit history (generally not a factor for federal loans), and citizenship or residency status. Interest accrues on these loans from the time the loan is disbursed, regardless of the student’s enrollment status. This means the borrower is responsible for paying the accumulated interest.

- Be enrolled at least half-time in an eligible degree or certificate program at a participating institution.

- Be a U.S. citizen or eligible non-citizen.

- Maintain satisfactory academic progress as defined by the institution.

- Not have an existing default on a federal student loan.

Examples of Differing Eligibility

A student from a high-income family might be eligible for unsubsidized loans but not subsidized loans because they do not demonstrate financial need according to the FAFSA. Conversely, a student from a low-income family might qualify for both subsidized and unsubsidized loans, but the subsidized loans would offer them a significant advantage by covering interest during periods of non-payment. A student who is not enrolled at least half-time would not be eligible for either type of loan.

Loan Forgiveness Programs

Loan forgiveness programs offer the possibility of eliminating your student loan debt under specific circumstances. The availability of these programs, and the eligibility requirements, can vary depending on whether you have subsidized or unsubsidized loans. While both loan types can be eligible for some programs, certain programs may favor one type over the other. Understanding these differences is crucial for borrowers seeking loan forgiveness.

Applicability of Loan Forgiveness Programs

Several federal loan forgiveness programs exist, each with its own set of eligibility criteria. These programs generally focus on public service, specific professions, or income-based repayment plans. The key difference in applicability between subsidized and unsubsidized loans often lies in the type of repayment plan a borrower is enrolled in and their employment. For example, the Public Service Loan Forgiveness (PSLF) program requires borrowers to make 120 qualifying monthly payments under an income-driven repayment plan. Both subsidized and unsubsidized loans can be included in PSLF, provided they meet the program’s other requirements. However, the amount of forgiveness received will depend on the total amount borrowed, regardless of the loan type.

Eligibility Differences Based on Loan Type

While most federal loan forgiveness programs don’t explicitly differentiate between subsidized and unsubsidized loans in terms of *eligibility*, the type of loan can indirectly influence eligibility. This is primarily because subsidized loans typically have lower interest rates and do not accrue interest while the borrower is in school (under certain conditions). This can affect the overall loan balance and, consequently, the amount of forgiveness a borrower receives. For instance, a borrower with primarily subsidized loans might have a smaller loan balance to forgive compared to a borrower with a similar repayment history but a larger proportion of unsubsidized loans. This difference, however, is not a matter of eligibility but rather of the total debt eligible for forgiveness.

Loan Forgiveness Program Comparison

The following table compares the applicability of several key loan forgiveness programs to subsidized and unsubsidized federal student loans. Note that meeting all eligibility requirements is crucial for loan forgiveness under any program.

| Program Name | Eligibility Criteria | Subsidized Loan Applicability | Unsubsidized Loan Applicability |

|---|---|---|---|

| Public Service Loan Forgiveness (PSLF) | 120 qualifying payments under an income-driven repayment plan while working full-time for a qualifying government or non-profit organization. | Yes | Yes |

| Teacher Loan Forgiveness | Five years of full-time teaching in a low-income school or educational service agency. | Yes | Yes |

| Income-Driven Repayment (IDR) Plans (e.g., IBR, PAYE, REPAYE) | Meeting income requirements and making timely payments for a specified period (often 20-25 years). Leads to loan forgiveness of remaining balance after the payment period. | Yes | Yes |

| Perkins Loan Cancellation (Discontinued) | Working in specific public service fields (e.g., teaching, healthcare) for a set number of years. This program is no longer available for new borrowers. | Yes (if originally a Perkins loan) | No (Perkins loans were a separate loan program) |

Repayment Options

Both subsidized and unsubsidized federal student loans offer a variety of repayment plans to help borrowers manage their debt. Understanding these options is crucial for effective debt management and minimizing long-term interest costs. The key difference lies in how interest accrues during certain periods, influencing the total amount repaid.

Standard Repayment Plan

The standard repayment plan is a fixed monthly payment spread over 10 years. This is often the simplest option but may result in higher monthly payments compared to income-driven plans. For subsidized loans, the government pays the interest during periods of deferment (e.g., while in school or during grace periods). For unsubsidized loans, interest accrues during these periods and is capitalized (added to the principal balance), leading to a larger loan amount and higher total payments over time.

Graduated Repayment Plan

This plan starts with lower monthly payments that gradually increase over time. This option might be attractive initially, but the payments can become significantly higher in later years. Similar to the standard plan, interest accrual differs between subsidized and unsubsidized loans; interest is covered by the government for subsidized loans during deferment, whereas it adds to the principal for unsubsidized loans.

Extended Repayment Plan

This plan extends the repayment period beyond 10 years, resulting in lower monthly payments. The maximum repayment period depends on the loan amount. However, it’s important to note that extending the repayment period will increase the total interest paid over the life of the loan. The interest accrual differences between subsidized and unsubsidized loans remain consistent with the other plans.

Income-Driven Repayment Plans

Income-driven repayment plans (IDR) base monthly payments on your income and family size. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). These plans are designed to make repayment more manageable, especially for borrowers with lower incomes. The significant difference is that with IDR plans, the government often covers a portion of the interest for both subsidized and unsubsidized loans while in the IDR plan. However, remaining unpaid interest still accrues for unsubsidized loans, even though the payment is lower. After a set period (often 20 or 25 years), any remaining loan balance may be forgiven under certain conditions. This forgiveness may be considered taxable income.

Repayment Process Differences

The repayment process itself is largely similar for both subsidized and unsubsidized loans. Borrowers make monthly payments to their loan servicer. However, the total amount repaid differs due to the interest accrual during deferment periods. Unsubsidized loans will generally have a higher total repayment amount due to capitalized interest.

Repayment Plan Comparison

| Repayment Plan | Monthly Payment Calculation | Subsidized Loan Impact | Unsubsidized Loan Impact |

|---|---|---|---|

| Standard | Fixed amount over 10 years | Interest covered during deferment | Interest accrues and capitalizes during deferment |

| Graduated | Starts low, increases over time | Interest covered during deferment | Interest accrues and capitalizes during deferment |

| Extended | Lower fixed amount over longer period | Interest covered during deferment | Interest accrues and capitalizes during deferment |

| Income-Driven (IBR, PAYE, REPAYE, ICR) | Based on income and family size | Partial interest subsidy possible during repayment | Partial interest subsidy possible during repayment, but remaining unpaid interest accrues |

Impact on Credit Score

Both subsidized and unsubsidized federal student loans can impact your credit score, but the effect differs based on how you manage your loan repayment. Understanding this impact is crucial for building a strong credit history. Responsible borrowing and timely payments are key to minimizing negative effects and maximizing the positive ones.

Subsidized and unsubsidized loans are both considered installment loans, and their timely repayment contributes positively to your credit score. However, the absence of interest accrual during the grace period for subsidized loans slightly alters the initial impact on your credit report. The key factors influencing the impact are your payment history, the amount of debt, and the length of your credit history.

Subsidized Loan Impact on Credit Score

Subsidized loans, while offering interest-free periods, still appear on your credit report once you begin repayment. Consistent on-time payments will build your credit history positively. Late payments or defaults, however, will significantly damage your credit score, just as they would with unsubsidized loans. The longer your repayment history shows consistent on-time payments, the better your credit score will be. For example, a student who consistently pays their subsidized loan for five years will see a more substantial positive impact on their credit score than a student who only makes payments for one year.

Unsubsidized Loan Impact on Credit Score

Unsubsidized loans accrue interest from the time the loan is disbursed. This interest adds to the total loan amount, potentially leading to a higher debt burden. However, the impact on your credit score is still primarily determined by your payment history. Making timely payments consistently is vital. A student who diligently pays their unsubsidized loan, even with a larger initial loan amount due to accrued interest, will see a positive impact on their credit score. Conversely, late payments or default on an unsubsidized loan will have a more severe negative impact due to the larger debt balance.

Responsible Borrowing and Credit Management

Responsible borrowing involves carefully considering your financial capacity to repay the loan before taking it out. It also includes understanding the terms and conditions of the loan, such as the interest rate, repayment period, and any associated fees. Credit management involves consistently monitoring your credit report and score, making on-time payments, and keeping your debt-to-income ratio low.

Examples of Credit Score Impact

Let’s consider two students, Sarah and John. Sarah takes out a subsidized loan and makes every payment on time. Her credit score gradually increases reflecting her responsible borrowing and repayment behavior. John, on the other hand, takes out an unsubsidized loan and misses several payments. This negatively impacts his credit score more significantly than Sarah’s because of the compounding interest and the negative payment history. This illustrates how even with different loan types, responsible financial management leads to better credit outcomes. Conversely, irresponsible financial practices will lead to negative consequences, regardless of whether the loan is subsidized or unsubsidized.

Default and its Consequences

Defaulting on student loans, whether subsidized or unsubsidized, carries significant and long-lasting negative consequences. The repercussions are similar in nature but can vary in severity depending on the loan type and the borrower’s individual circumstances. Understanding these consequences is crucial for responsible loan management and avoiding potentially devastating financial setbacks.

Defaulting on a student loan means failing to make payments for a specified period (typically 270 days). This triggers a series of actions by the loan servicer and the government, ultimately impacting your credit score and financial well-being. The process for both subsidized and unsubsidized loans is largely the same, involving initial delinquency notices, followed by attempts to contact the borrower for repayment arrangements. If these efforts are unsuccessful, the loan is referred to collections agencies, and further legal action may ensue.

Consequences of Default

Defaulting on either subsidized or unsubsidized loans results in several severe consequences. These include damage to credit scores, wage garnishment, tax refund offset, and difficulty obtaining future loans or credit. The impact on credit scores can be particularly damaging, making it difficult to secure mortgages, auto loans, or even rent an apartment. Wage garnishment involves a portion of your paycheck being directly seized to repay the debt, and tax refund offset means the government can withhold your tax refund to apply it towards your loan debt. These consequences apply equally to both subsidized and unsubsidized loans. However, the total debt amount may differ, leading to variations in the severity of the consequences.

Hypothetical Scenarios Illustrating Long-Term Financial Implications

Let’s consider two hypothetical scenarios to illustrate the long-term financial impact of default.

Scenario 1: Maria defaulted on a $30,000 unsubsidized loan. Due to the default, her credit score plummeted, preventing her from securing a mortgage to buy a house. She also faced wage garnishment, significantly reducing her disposable income. The default remained on her credit report for seven years, impacting her ability to obtain credit cards and other loans during that period. The long-term impact resulted in lost opportunities for homeownership and financial growth.

Scenario 2: David defaulted on a $20,000 subsidized loan. While the initial debt was smaller than Maria’s, the default still resulted in a severely damaged credit score. This made it challenging for him to rent an apartment, as many landlords conduct credit checks. He also faced difficulty securing a car loan, forcing him to rely on unreliable public transportation, impacting his ability to maintain employment. The default impacted his chances of career advancement, creating a cycle of financial hardship.

Closing Summary

Choosing between subsidized and unsubsidized student loans is a pivotal decision in your educational journey. While both offer avenues to finance your studies, their distinct characteristics significantly influence your financial obligations and long-term outlook. By carefully considering the factors Artikeld – interest accrual, eligibility criteria, repayment plans, and potential impact on your credit score – you can make an informed choice that aligns with your financial goals and ensures a smoother path toward debt management and financial success. Remember to explore all available resources and seek professional advice when needed to navigate this crucial aspect of higher education funding.

FAQ Resource

What happens if I don’t repay my student loans?

Failure to repay your student loans can lead to serious consequences, including damage to your credit score, wage garnishment, and difficulty obtaining future loans or credit. The specific repercussions vary depending on the loan type and the severity of the default.

Can I refinance my subsidized and unsubsidized loans together?

Yes, you can often refinance both subsidized and unsubsidized federal student loans together into a private loan. However, be aware that refinancing federal loans into private loans may mean losing access to federal repayment programs and protections.

Are there any penalties for paying off my student loans early?

Generally, there are no penalties for paying off your student loans early. In fact, it can save you money on interest in the long run.

How do I apply for subsidized and unsubsidized loans?

You apply for federal student loans through the Free Application for Federal Student Aid (FAFSA). Your eligibility for subsidized and unsubsidized loans will be determined based on your FAFSA information.