Navigating the complexities of student loan repayment is a significant undertaking for many. Understanding the tax implications, however, can significantly ease the burden. This guide delves into the intricacies of Form 1098-e, specifically focusing on the student loan interest deduction, providing clarity on eligibility, claiming the deduction, and the impact on various loan types and filing statuses. We’ll explore the nuances of this deduction, offering practical examples and addressing common questions to empower you with the knowledge needed to maximize your tax benefits.

From deciphering the information presented on your 1098-e form to understanding the eligibility criteria and AGI limitations, we’ll provide a comprehensive overview. We’ll also examine how different loan types and repayment plans influence your deduction and address specific scenarios for married couples filing jointly. This guide aims to demystify the process, making tax season less daunting and more rewarding.

Understanding the 1098-E Form

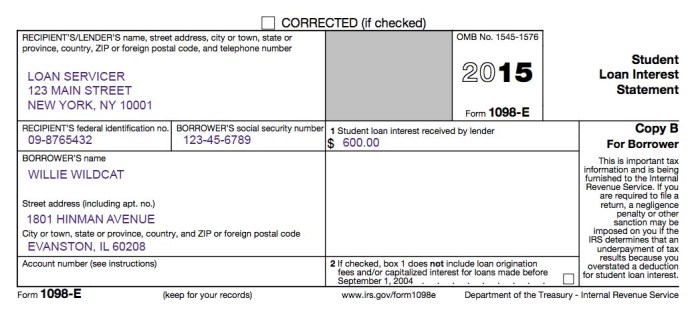

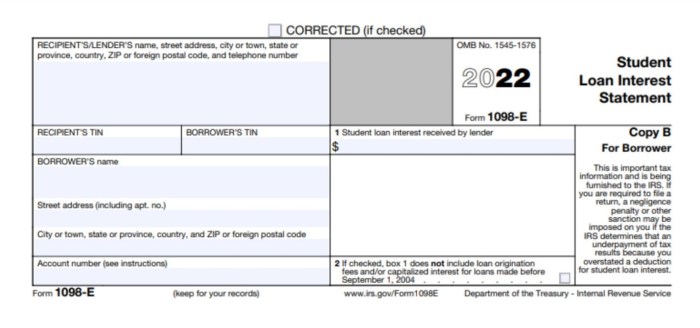

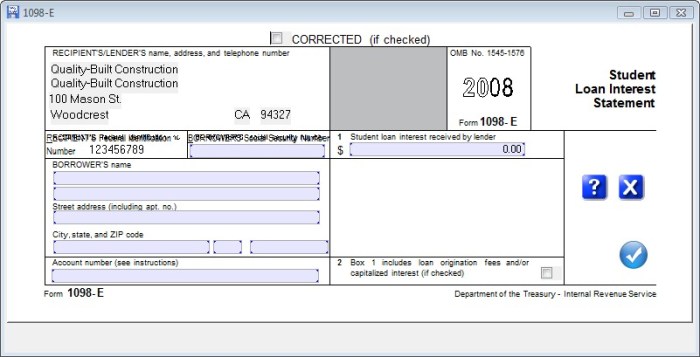

The 1098-E form is a crucial document for anyone who paid interest on student loans during the tax year. It serves as a record of these payments, allowing taxpayers to claim the student loan interest deduction on their federal income tax return. This deduction can significantly reduce your tax liability, making understanding the 1098-E form essential for proper tax filing.

The 1098-E form provides a summary of the student loan interest you paid during the tax year. It’s issued by your lender, and it’s important to note that not everyone who pays student loan interest will receive one. The information provided is used to help you accurately report your student loan interest payments when filing your taxes. Accurate reporting ensures you receive the appropriate tax benefits.

Information Typically Included on a 1098-E Form

The 1098-E form contains several key pieces of information. This information is vital for accurately completing your tax return and claiming the student loan interest deduction. Missing or incorrect information could delay your refund or result in penalties.

Examples of Situations Where a 1098-E Form Would Be Issued

A 1098-E form will be issued if you paid at least $600 in student loan interest during the tax year. This threshold ensures that the IRS only processes forms for significant payments. If your payments were less than this amount, you may still be able to deduct the interest, but you’ll need to keep your payment records for verification. Examples include situations where you made payments on Federal student loans, private student loans, or a combination of both. Refinancing your loans will also likely trigger a 1098-E if the total interest paid exceeds the $600 threshold.

1098-E Form Information Breakdown

The following table details the key information fields found on a 1098-E form, their descriptions, example values, and tax implications:

| Information Field | Description | Example Value | Tax Implications |

|---|---|---|---|

| Borrower’s Name | The name of the individual who paid the student loan interest. | John Doe | Used to match the information with the taxpayer’s return. |

| Borrower’s Social Security Number (SSN) | The taxpayer’s Social Security Number. | 123-45-6789 | Used for identification and verification purposes. |

| Payer’s Name | The name of the lender who received the student loan interest payments. | Example Bank | Identifies the source of the loan and interest payments. |

| Payer’s Identification Number (TIN) | The lender’s tax identification number. | 12-3456789 | Used for IRS tracking and verification. |

| Total Student Loan Interest Paid | The total amount of student loan interest paid during the tax year. | $1,200 | This amount is used to calculate the student loan interest deduction. |

Eligibility for the Student Loan Interest Deduction

Claiming the student loan interest deduction can significantly reduce your tax burden, but eligibility hinges on several key factors. Understanding these requirements is crucial to ensure you accurately report your deduction and receive the appropriate tax benefit. This section details the criteria for eligibility, limitations on the deduction amount, and the impact of your adjusted gross income (AGI).

Criteria for Eligibility

To claim the student loan interest deduction, you must meet specific criteria. You must have paid interest on a qualified student loan during the tax year, and the loan must have been taken out by you (or your spouse) to pay for qualified education expenses. These expenses include tuition, fees, and room and board for yourself, your spouse, or a dependent. The student loan must be for yourself, your spouse, or your dependent, and you must be legally obligated to repay the loan. Furthermore, you must be able to itemize deductions on your tax return; the student loan interest deduction is an itemized deduction, not a deduction from your gross income.

Limitations and Restrictions on the Deduction Amount

The student loan interest deduction is limited to the actual amount of interest you paid during the tax year. However, the maximum deduction is capped at $2,500 per tax year, regardless of how much interest you actually paid. This limit applies to both single filers and those filing jointly. This means that even if you paid more than $2,500 in student loan interest, you can only deduct $2,500. It’s important to note that this deduction is for interest paid, not principal payments made on your student loan.

Adjusted Gross Income (AGI) Limits

The student loan interest deduction is subject to adjusted gross income (AGI) limitations. The deduction begins to phase out for single filers with an AGI exceeding $70,000 and for married couples filing jointly with an AGI exceeding $140,000. The phase-out is not a sudden cutoff; instead, it’s a gradual reduction of the deduction as your AGI increases beyond these thresholds. For example, a single filer with an AGI of $75,000 might see a reduced deduction, while someone with an AGI of $80,000 or more may not be able to claim the deduction at all. The exact amount of the deduction reduction within the phase-out range depends on the specific AGI. Consult the current IRS guidelines for the most up-to-date phase-out ranges and calculations.

Flowchart for Determining Eligibility

The following flowchart illustrates the steps involved in determining eligibility for the student loan interest deduction. Imagine a simple flowchart with boxes and arrows. The first box would ask: “Did you pay interest on a qualified student loan?” A “Yes” arrow would lead to the next box: “Is the loan for you, your spouse, or a dependent?” A “Yes” would lead to: “Is the loan for qualified education expenses?” A “Yes” would lead to: “Did you itemize deductions?” A “Yes” leads to: “Is your AGI below the phase-out limit?” A “Yes” leads to: “You are eligible for the deduction!” A “No” at any point would lead to: “You are not eligible for the deduction.” Each “No” would also have a box explaining the reason for ineligibility. This visual representation helps clarify the eligibility process.

Claiming the Deduction on Your Tax Return

Successfully claiming the student loan interest deduction requires understanding where to report it on your tax return and ensuring you have the necessary documentation. This section will guide you through the process, highlighting potential pitfalls to avoid.

The student loan interest deduction is claimed on Form 1040, Schedule 1 (Additional Income and Adjustments to Income). Specifically, it’s reported on line 21, “Student loan interest.” This schedule is used to report various adjustments to income, and the student loan interest deduction reduces your adjusted gross income (AGI), ultimately lowering your taxable income.

Location of the Student Loan Interest Deduction on Tax Form 1040

The student loan interest deduction is reported on Form 1040, Schedule 1, line 21. This is a crucial step because it’s not directly subtracted from your gross income; it’s an adjustment to income, impacting your AGI calculation. A lower AGI can potentially qualify you for other tax benefits or reduce your tax liability.

Step-by-Step Guide to Claiming the Deduction

- Gather your 1098-E form: This form, provided by your lender, details the amount of student loan interest you paid during the tax year. Carefully review this form for accuracy; discrepancies should be reported to your lender immediately.

- Complete Form 1040, Schedule 1: Enter the amount of student loan interest reported on your 1098-E on line 21. Ensure this amount accurately reflects the interest you paid during the tax year. Do not include any principal payments.

- Attach your 1098-E form: Keep a copy of your 1098-E for your records. The IRS may request this documentation during an audit.

- Review your return: Before filing, double-check all entries on Schedule 1 and the rest of your tax return to ensure accuracy.

- File your tax return: Submit your completed tax return according to the IRS deadlines.

Required Documentation

The primary document required to support your student loan interest deduction is Form 1098-E. This form, issued by your lender, reports the total amount of student loan interest you paid during the tax year. It’s essential to keep this form securely for your records, as it serves as crucial evidence to support your deduction claim. If you did not receive a 1098-E, you should contact your lender to obtain a copy. In the absence of a 1098-E, you may still be able to claim the deduction with other supporting documentation like bank statements showing loan interest payments.

Common Errors and How to Avoid Them

- Claiming more than the actual interest paid: Only deduct the amount of student loan interest actually paid during the tax year. Do not inflate the amount or include principal payments.

- Failing to attach Form 1098-E: Always attach your 1098-E to your tax return. The IRS may reject your return without it.

- Incorrectly reporting the deduction on the wrong line: The deduction goes on Schedule 1, line 21, not directly on Form 1040. Carefully review the instructions for Schedule 1.

- Exceeding the maximum deduction limit: The student loan interest deduction is capped at a certain amount, currently $2,500. If you paid more than this, you can only deduct up to the limit.

- Failing to meet the eligibility requirements: Ensure you meet all eligibility requirements before claiming the deduction. This includes being the student or co-signer responsible for the loan payments, and having the loan used for qualified education expenses.

Impact of Different Loan Types

The student loan interest deduction, while beneficial, interacts differently with various loan types and repayment strategies. Understanding these nuances is crucial for maximizing tax savings. This section will explore how federal versus private loans, repayment plans, and refinancing affect your eligibility and the potential deduction amount.

The primary difference in tax implications stems from the source of the loan. Federal student loans are generally more straightforward when it comes to the deduction, while private loans may present additional complexities.

Federal vs. Private Student Loans

Federal student loans are generally easier to track for deduction purposes because the interest paid is often reported directly to the IRS on Form 1098-E. Private loans, however, may require more diligent record-keeping, as the lender might not always report the interest paid. You will need to maintain accurate records of your payments to claim the deduction for interest paid on private loans. The eligibility criteria for the deduction remain the same regardless of loan type; however, the ease of claiming the deduction differs significantly.

Impact of Income-Driven Repayment Plans

Income-driven repayment (IDR) plans, such as ICR, PAYE, REPAYE, and IBR, adjust your monthly payments based on your income and family size. While these plans can lower your monthly payments, they often extend the repayment period. This extended repayment period means you’ll pay more interest over the life of the loan. However, the amount of interest paid in any given year that qualifies for the deduction remains unaffected by the chosen repayment plan. The deduction is based on the interest paid, not the total loan amount or repayment schedule.

Tax Implications of Refinancing Student Loans

Refinancing student loans can have significant tax implications. When you refinance, you essentially consolidate your existing loans into a new loan with a potentially different interest rate and lender. This may change the type of loan (from federal to private, for example), impacting how the interest is reported and the ease of claiming the deduction. Furthermore, refinancing might erase the ability to utilize income-driven repayment plans or other federal loan forgiveness programs that are tied to specific loan types. Careful consideration of these trade-offs is essential before refinancing.

Potential Tax Advantages and Disadvantages of Different Student Loan Repayment Strategies

Choosing a repayment strategy involves weighing the short-term cost of higher monthly payments against the long-term savings from reduced interest payments and potential tax benefits.

- Standard Repayment: Higher monthly payments, leading to faster loan payoff and less overall interest paid. This translates to lower interest paid over the loan’s lifetime, potentially resulting in a smaller deduction in any given year but a greater overall tax savings over the loan’s life due to less interest paid.

- Income-Driven Repayment (IDR): Lower monthly payments, potentially leading to a larger deduction in any given year as you pay interest for a longer period, but more interest paid overall. The trade-off here is affordability versus total interest paid over the life of the loan.

- Refinancing: Potentially lower interest rates, leading to lower monthly payments and less overall interest paid. However, this could shift the loan from federal to private, making claiming the deduction more challenging and potentially eliminating access to federal loan forgiveness programs. The tax benefits are dependent on the new interest rate and whether the interest is still deductible after refinancing.

Tax Implications for Married Couples Filing Jointly

Filing jointly significantly impacts how the student loan interest deduction is applied. Married couples can combine their student loan interest payments to potentially claim a larger deduction than if they filed separately. However, understanding the interaction between their combined income and the adjusted gross income (AGI) limits is crucial.

Married couples filing jointly use a combined adjusted gross income (AGI) to determine their eligibility for the student loan interest deduction. The deduction is phased out for higher AGIs, and this phase-out threshold is higher for married couples filing jointly than for single filers. This means a married couple can have a higher combined income and still qualify for the deduction, but exceeding the limit results in a partial or complete loss of the deduction.

Student Loan Interest Deduction for Married Couples with Separate Loans

When both spouses have student loan interest, they combine their total eligible interest paid during the tax year. This combined amount is then used to calculate the deduction. For example, if one spouse paid $1,500 in student loan interest and the other paid $1,000, they would report a total of $2,500 in student loan interest paid. This combined amount is then subject to the AGI limitations.

AGI Limits and Their Impact on Married Couples

The student loan interest deduction is subject to an AGI limit. This limit varies depending on the filing status and the tax year. For married couples filing jointly, the AGI limit is higher than for single filers. However, if their combined AGI exceeds this limit, the deduction is gradually reduced or eliminated. The exact phase-out range is determined by the IRS annually and should be checked for the specific tax year.

Examples Illustrating Different Scenarios

Let’s consider two scenarios:

Scenario 1: A married couple, John and Mary, have a combined AGI of $100,000 and paid a total of $2,500 in student loan interest. Assuming the AGI limit for married couples filing jointly is $150,000 for that tax year, they would be able to claim the full $2,500 deduction.

Scenario 2: Another married couple, David and Sarah, have a combined AGI of $180,000 and paid a total of $3,000 in student loan interest. Again, assuming the AGI limit is $150,000, they would likely have a reduced or no deduction because their AGI exceeds the limit. The exact reduction would depend on the specific phase-out rules for that tax year as defined by the IRS. They might be able to deduct a portion of their $3,000, or none at all. It is crucial to consult the IRS guidelines for the applicable tax year to determine the precise impact.

Illustrative Examples

Understanding the student loan interest deduction can be challenging. Let’s clarify this with some real-world examples, demonstrating how the deduction works in different scenarios. These examples are for illustrative purposes only and do not constitute tax advice. Consult a tax professional for personalized guidance.

Example 1: A Successful Deduction

Sarah, a single filer, paid $1,500 in student loan interest during the tax year. Her adjusted gross income (AGI) was $60,000. Sarah is eligible for the full student loan interest deduction because her AGI is below the phaseout limits. Assuming a 22% marginal tax bracket, the deduction will reduce her tax liability by $330 ($1,500 x 0.22). This means she will owe $330 less in taxes. This example showcases a straightforward application of the deduction where the taxpayer meets all the requirements.

Example 2: Deduction Limitations Due to High Income

John and Mary are married filing jointly. They paid $2,000 in student loan interest during the tax year. However, their combined AGI is $200,000. This exceeds the AGI phaseout limits for married couples filing jointly. As a result, they will not be able to claim the full student loan interest deduction. The exact amount of the deduction, if any, would depend on the specific phaseout rules for their income level in that tax year. This illustrates a scenario where high income prevents a full or any deduction.

Summary

Successfully navigating the student loan interest deduction requires a thorough understanding of Form 1098-e and the associated regulations. By carefully reviewing your eligibility, accurately completing your tax return, and understanding the potential impact of different loan types and filing statuses, you can effectively utilize this valuable tax benefit. Remember to keep detailed records of your student loan payments and consult with a tax professional if you have complex situations or require personalized advice. Claiming this deduction can significantly reduce your tax liability, making the process of student loan repayment slightly less burdensome.

Essential FAQs

What happens if I don’t receive a 1098-e form?

If you paid student loan interest but didn’t receive a 1098-e, you can still claim the deduction. You’ll need to gather documentation from your lender confirming the interest paid.

Can I claim the student loan interest deduction if I’m a dependent?

Yes, but you must meet all other eligibility requirements and itemize your deductions on your tax return. Your parents may also claim you as a dependent.

What if I only paid interest on part of my student loans?

You can deduct the amount of interest you actually paid, up to the maximum deduction limit.

Is there a deadline for claiming the student loan interest deduction?

The deadline is the same as the regular tax filing deadline, typically April 15th (or an extension date).