Navigating the world of student loans can feel overwhelming, but understanding the nuances of subsidized loans is crucial for securing a brighter financial future. This comprehensive guide delves into the intricacies of subsidized federal student loans, offering clear explanations of eligibility, application processes, repayment options, and long-term financial planning strategies. We’ll demystify the complexities, empowering you to make informed decisions about your education and financial well-being.

From comparing subsidized and unsubsidized loans to exploring various repayment plans and addressing potential challenges, we aim to provide a holistic understanding of the entire student loan lifecycle. This guide serves as your roadmap to successfully managing subsidized student loans, ensuring a smoother path towards academic and financial success.

Understanding Subsidized Student Loans

Securing funding for higher education is a significant step, and understanding the nuances of student loan programs is crucial for responsible financial planning. Subsidized federal student loans, in particular, offer a valuable opportunity for eligible students to manage their educational expenses effectively. This section will delve into the key aspects of these loans, providing a clear understanding of their features, eligibility criteria, and comparison to unsubsidized loans.

Key Features of Subsidized Federal Student Loans

Subsidized federal student loans are a form of financial aid offered by the U.S. government to eligible undergraduate students demonstrating financial need. A key feature is that the government pays the interest on the loan while the student is enrolled at least half-time, during a grace period, and during periods of deferment. This means the loan balance doesn’t grow during these periods, unlike unsubsidized loans. This crucial difference significantly reduces the overall cost of borrowing. Another key aspect is that these loans are only available to undergraduate students, and the amount a student can borrow is determined by their financial need and year in school.

Eligibility Requirements for Subsidized Loans

Eligibility for subsidized federal student loans hinges on demonstrating financial need. The Free Application for Federal Student Aid (FAFSA) is the primary tool used to determine this need. Factors considered include family income, assets, and the number of family members attending college. Applicants must also be enrolled at least half-time in an eligible degree or certificate program at a participating institution. Maintaining satisfactory academic progress is another critical factor for continued eligibility. Finally, the applicant must be a U.S. citizen or eligible non-citizen.

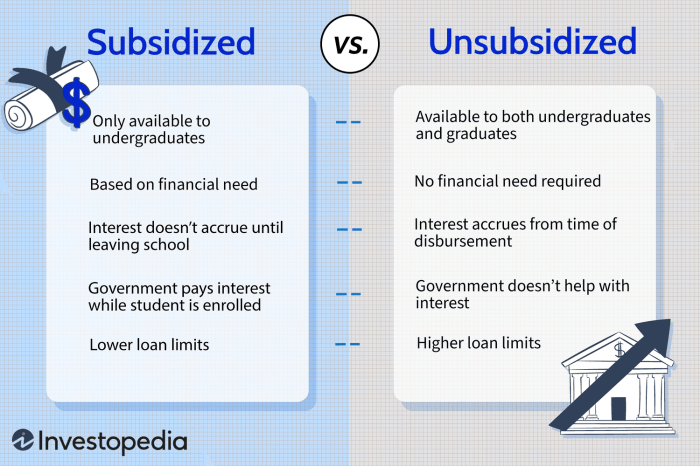

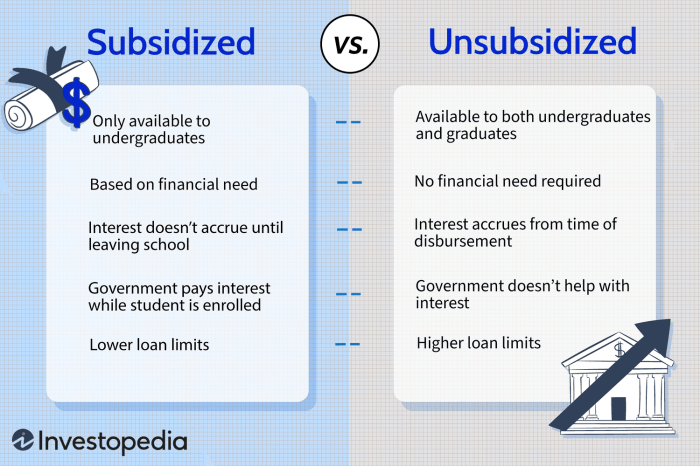

Comparison of Subsidized and Unsubsidized Loans

The primary difference between subsidized and unsubsidized federal student loans lies in interest accrual. As mentioned, the government pays the interest on subsidized loans during certain periods, whereas interest accrues on unsubsidized loans from the time the loan is disbursed. This means that the total amount owed at the end of the loan term is typically lower for subsidized loans. Unsubsidized loans are available to both undergraduate and graduate students, regardless of financial need, while subsidized loans are need-based and limited to undergraduates.

Interest Rates and Repayment Terms for Subsidized Loans

Interest rates for subsidized federal student loans are set annually by the government and are generally lower than unsubsidized loan rates. The specific interest rate will depend on the loan disbursement year. Repayment typically begins six months after the student graduates, leaves school, or drops below half-time enrollment (the grace period). Standard repayment plans offer a fixed monthly payment over a 10-year period, though other repayment plans are available to accommodate individual circumstances. Borrowers should explore the various repayment options to find the most suitable plan.

Advantages and Disadvantages of Subsidized Loans

| Advantage | Disadvantage |

|---|---|

| Government pays interest during certain periods, reducing overall cost. | Available only to undergraduate students with demonstrated financial need. |

| Generally lower interest rates compared to unsubsidized loans. | Borrowing limits are determined by financial need, potentially limiting the amount available. |

| Helps manage educational expenses more effectively. | Requires completion of the FAFSA application and meeting eligibility criteria. |

| Can significantly reduce the total interest paid over the life of the loan. | Failure to meet eligibility requirements or maintain satisfactory academic progress can lead to loan cancellation. |

Accessing Subsidized Student Loans

Securing federal subsidized student loans involves a straightforward process, but understanding the steps involved is crucial for a successful application. This section details the application process, highlighting key aspects such as the FAFSA, the role of your school’s financial aid office, and the disbursement of funds.

The application process for federal subsidized student loans begins with completing the Free Application for Federal Student Aid (FAFSA).

The Free Application for Federal Student Aid (FAFSA)

The FAFSA is a free application form used by the federal government to determine your eligibility for federal student aid, including subsidized loans. Completing the FAFSA accurately and on time is paramount. The form requires information about your family’s financial situation, including income, assets, and tax information. This information is used to calculate your Expected Family Contribution (EFC), which helps determine your eligibility for financial aid. Submitting the FAFSA early is recommended to avoid potential delays in receiving aid. The FAFSA data is used to determine your eligibility not only for federal subsidized loans, but also for grants and other forms of financial aid. The website, studentaid.gov, provides detailed instructions and allows for online submission of the FAFSA.

The Role of the School’s Financial Aid Office

Your school’s financial aid office plays a vital role in the loan process. After you submit your FAFSA, your information is sent to your chosen school(s). The financial aid office reviews your application, determines your eligibility for subsidized loans, and informs you of your award package. They also manage the disbursement of funds directly to your school account to cover tuition, fees, and other educational expenses. If you have questions about your financial aid package or the loan process, the financial aid office is your primary point of contact. They can provide personalized guidance and help you navigate any challenges you might encounter. Direct communication with your school’s financial aid office is essential throughout the entire process.

Disbursement of Loan Funds

Once you’ve accepted your financial aid offer, including your subsidized loan, the disbursement process begins. The funds are usually disbursed in two installments: one for the fall semester and another for the spring semester. The money is typically credited to your student account to cover tuition and fees. Any remaining funds might be disbursed to you directly, but this depends on your school’s policies. You will receive notification from your school’s financial aid office regarding the disbursement schedule and any remaining funds. It is important to monitor your student account regularly to track the disbursement of funds. Understanding your school’s disbursement policies is crucial for effective financial planning.

Flowchart Illustrating the Subsidized Loan Process

A flowchart illustrating the process would show a series of boxes and arrows. Starting with “Complete the FAFSA,” an arrow would lead to “Submit the FAFSA to the Federal Processor.” The next box would be “School Receives FAFSA Data,” followed by “Financial Aid Office Reviews Application.” This would lead to “Award Notification,” then “Acceptance of Award,” followed by “Loan Funds Disbursed to Student Account.” Finally, an arrow would point to “Funds Used for Tuition and Fees (and potentially disbursed to student).” This visual representation clearly Artikels the steps involved in obtaining subsidized student loans.

Repayment of Subsidized Student Loans

Successfully navigating the repayment of your subsidized student loans is crucial to your financial well-being after graduation. Understanding the various repayment options available and planning strategically can significantly impact your long-term financial health. This section will Artikel the different repayment plans, potential consequences of default, and strategies for effective loan management.

Available Repayment Plans

Several repayment plans cater to different financial situations and income levels. Choosing the right plan depends on your individual circumstances and financial goals. Careful consideration of your post-graduation income and expenses is vital in making this decision.

Standard Repayment Plan

This is the most common plan, requiring fixed monthly payments over a 10-year period. The monthly payment amount is calculated based on your total loan amount and interest rate. For example, a $20,000 loan at a 5% interest rate would result in an approximate monthly payment of $212, leading to a total repayment of approximately $25,440 over 10 years. This plan offers predictability but might result in higher monthly payments compared to other options.

Extended Repayment Plan

This plan stretches repayments over a longer period, typically 25 years. This lowers the monthly payment amount but increases the total interest paid over the life of the loan. Using the same $20,000 loan example at 5% interest, the monthly payment would be approximately $106, leading to a total repayment of roughly $25,440, although the total amount paid is higher than the Standard plan. This is suitable for borrowers with lower post-graduation incomes.

Graduated Repayment Plan

This plan features lower payments initially, gradually increasing over time. This option can be helpful for borrowers anticipating income growth after graduation. The initial lower payments may ease the financial burden in the early years of repayment, but the payments will increase significantly as the repayment progresses.

Income-Driven Repayment Plans

These plans, such as the Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE) plans, base monthly payments on your discretionary income and family size. Payments are typically lower and may even be $0 in some cases. However, remaining loan balances may be forgiven after 20 or 25 years, depending on the plan, but this forgiven amount is considered taxable income. These plans offer flexibility but can lead to higher total interest paid over the loan’s lifetime.

Consequences of Loan Default

Failing to make timely loan payments can result in serious consequences. These include damage to your credit score, wage garnishment, tax refund offset, and difficulty obtaining future loans or credit. Furthermore, your ability to secure employment might be negatively impacted.

Strategies for Avoiding Default

Proactive steps can significantly reduce the risk of default. These include creating a realistic budget, exploring available repayment plans, contacting your loan servicer if you anticipate difficulties, and seeking professional financial guidance if needed.

Loan Consolidation and Refinancing

Loan consolidation combines multiple federal student loans into a single loan with a new interest rate and repayment terms. Refinancing involves replacing your existing federal student loans with a private loan, potentially at a lower interest rate. Both options can simplify repayment but should be carefully considered, especially refinancing, as it might involve the loss of federal loan benefits.

Repayment Plan Comparison

| Repayment Plan | Payment Duration | Payment Amount | Total Interest Paid |

|---|---|---|---|

| Standard | 10 years | Fixed, higher | Lower |

| Extended | 25 years | Fixed, lower | Higher |

| Graduated | 10 years | Increases over time | Moderate |

| Income-Driven | 20-25 years | Based on income | Potentially High |

Subsidized Loans and Financial Planning

Incorporating subsidized student loans effectively into a comprehensive financial plan is crucial for long-term financial health. Understanding the implications of loan repayment, alongside other financial obligations, allows for proactive budgeting and minimizes potential financial stress during and after your studies. This section will guide you through the process of integrating subsidized loans into your financial strategy, providing practical tips for management and highlighting potential challenges and solutions.

Integrating Subsidized Loans into a Financial Plan

A successful financial plan should explicitly account for student loan repayment. This involves estimating total loan amounts, understanding interest accrual (or lack thereof for subsidized loans during certain periods), and projecting monthly payments. This information should then be integrated into a broader budget that considers other expenses such as housing, food, transportation, and personal savings goals. Failing to account for loan repayments can lead to unexpected financial strain and difficulty meeting other financial obligations. A realistic projection of loan repayment should be a cornerstone of your financial plan, influencing decisions about career choices, savings targets, and other major life decisions.

Budgeting and Managing Finances During Loan Repayment

Effective budgeting is paramount during and after loan repayment. Creating a detailed budget that meticulously tracks income and expenses is the first step. This budget should clearly allocate funds for loan payments, ensuring these payments are prioritized alongside essential living expenses. Utilizing budgeting apps or spreadsheets can significantly aid in tracking spending habits and identifying areas for potential savings. Furthermore, exploring options for loan consolidation or refinancing might provide opportunities to reduce monthly payments or shorten the repayment period, improving your long-term financial outlook. Regularly reviewing and adjusting your budget based on changing circumstances is also crucial for maintaining financial stability.

Challenges in Loan Repayment and Solutions

Several challenges can arise during student loan repayment. Unexpected job loss or reduced income can severely impact the ability to make timely payments. Similarly, unforeseen medical expenses or other emergencies can create financial strain. To mitigate these risks, establishing an emergency fund is vital. This fund should ideally cover several months’ worth of living expenses, providing a financial buffer during unforeseen circumstances. Additionally, exploring options like deferment or forbearance, if available, can offer temporary relief from loan payments during periods of financial hardship. Open communication with your loan servicer is crucial to exploring these options and potentially negotiating repayment plans tailored to your specific situation.

Long-Term Financial Impact of Subsidized Loans

While subsidized loans offer significant advantages during education, their long-term impact requires careful consideration. The interest saved during the grace period and in-school deferment can positively influence the overall cost of the loan, but significant debt can still affect long-term financial goals. High levels of student loan debt can delay major life decisions such as homeownership, starting a family, or investing for retirement. Careful financial planning, responsible spending habits, and proactive management of loan repayment are crucial for minimizing the long-term financial consequences of student loan debt. Early and consistent repayment strategies can substantially reduce the total interest paid over the life of the loan, freeing up more financial resources for future investments and aspirations.

Sample Budget Illustrating Loan Repayment

Monthly Income: $3,000

Housing: $1,000

Food: $500

Transportation: $200

Student Loan Payment: $400

Utilities: $150

Savings: $250

Other Expenses: $500

This sample budget illustrates how loan repayment can be incorporated into a broader financial plan. The allocation of $400 towards student loan repayment demonstrates the prioritization of this essential expense. The inclusion of savings highlights the importance of maintaining financial security alongside loan repayment. Remember that this is a sample budget, and individual budgets should be tailored to reflect personal income and expenses.

Ending Remarks

Securing the best subsidized student loans is a significant step towards achieving your educational goals without undue financial strain. By carefully considering eligibility requirements, understanding the application process, and diligently planning for repayment, you can leverage these valuable resources to build a strong financial foundation. Remember, proactive planning and informed decision-making are key to navigating the complexities of student loan repayment and achieving long-term financial success. This guide provides a solid framework; consult with financial aid professionals for personalized guidance.

Question & Answer Hub

What is the difference between subsidized and unsubsidized loans?

With subsidized loans, the government pays the interest while you’re in school (under certain conditions). Unsubsidized loans accrue interest from the time the loan is disbursed.

What happens if I default on my subsidized student loan?

Defaulting can severely damage your credit score, leading to difficulty obtaining loans, credit cards, and even employment. Wage garnishment and tax refund offset are also potential consequences.

Can I refinance my subsidized student loan?

Yes, refinancing options exist, potentially lowering your interest rate. However, be aware that refinancing federal loans into private loans may eliminate federal protections.

How long do I have to repay subsidized student loans?

Repayment terms vary depending on the loan and repayment plan chosen. Standard plans typically span 10 years, but income-driven repayment plans can extend the repayment period.