The question of whether 529 funds can be used to pay off student loans is a complex one, touching upon crucial aspects of financial planning and education funding. While 529 plans are primarily designed for qualified education expenses, exploring the possibility of using them for student loan repayment reveals potential benefits and significant drawbacks. This guide delves into the intricacies of 529 plan regulations, student loan repayment options, and the tax implications of utilizing these funds for non-qualified expenses. We’ll examine alternative debt management strategies and offer a comprehensive overview to help you make informed financial decisions.

Understanding the rules surrounding 529 plans and the various types of student loans is paramount. We’ll analyze the potential financial advantages and disadvantages of diverting 529 funds from their intended purpose, considering both short-term and long-term consequences. By the end, you’ll have a clearer picture of whether using 529 funds for student loan repayment aligns with your overall financial goals.

Understanding 529 Plan Regulations

529 plans are a valuable tool for saving for higher education, offering significant tax advantages to families. Understanding the regulations surrounding these plans is crucial to maximizing their benefits and avoiding potential penalties. This section will Artikel the key aspects of 529 plan regulations.

Primary Purpose of 529 Plans

The primary purpose of a 529 plan is to provide a tax-advantaged savings vehicle for qualified education expenses. These plans allow contributions to grow tax-deferred, meaning that investment earnings are not taxed until withdrawn for qualified expenses. This feature makes them an attractive option for long-term education savings.

Tax Advantages of 529 Plans

The significant tax advantages of 529 plans are a key reason for their popularity. Contributions are made with after-tax dollars, but earnings grow tax-deferred. Furthermore, withdrawals used for qualified education expenses are generally tax-free at the federal level. This combination of tax-deferred growth and tax-free withdrawals can substantially reduce the overall cost of higher education. State tax benefits may also apply, varying by state of residence.

Qualified Education Expenses

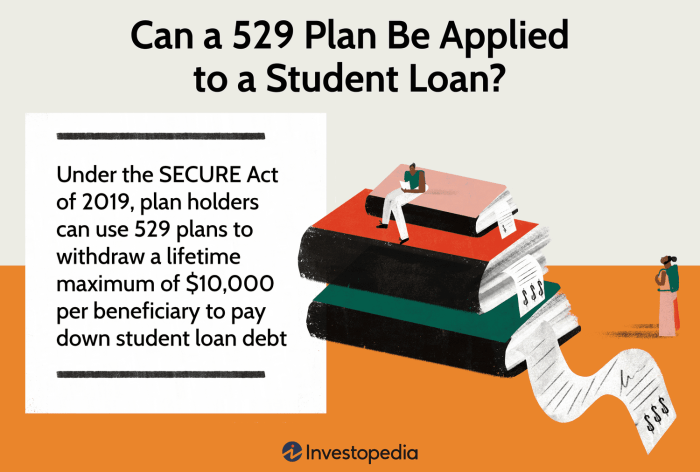

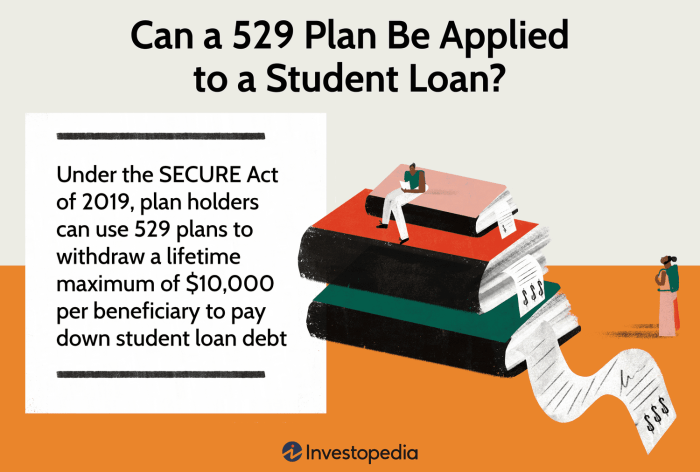

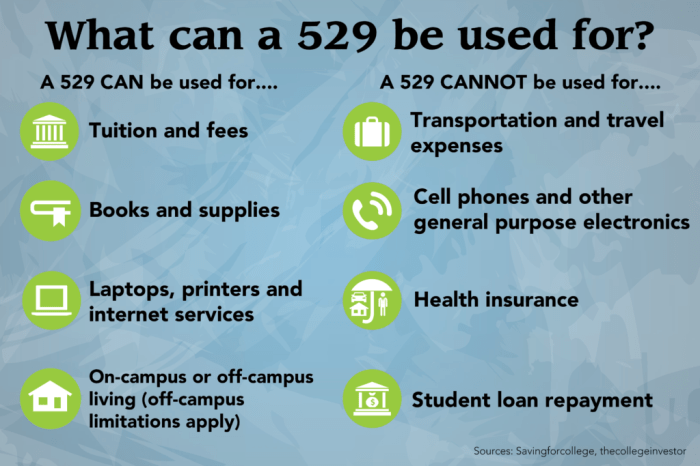

A range of expenses qualify for tax-free withdrawals from a 529 plan. These typically include tuition and fees, room and board, books, supplies, and even certain computer equipment. Specific requirements may vary slightly depending on the plan and the institution. It’s important to consult the plan’s specific guidelines and the institution’s financial aid policies to ensure expenses are eligible.

Penalties for Non-Qualified Withdrawals

While 529 plans offer substantial tax advantages, withdrawing funds for non-qualified expenses incurs penalties. The earnings portion of the withdrawal is subject to income tax at the recipient’s ordinary income tax rate, plus a 10% federal penalty. This penalty can significantly reduce the amount of money ultimately available for its intended purpose. There are limited exceptions, such as for certain disability expenses or death of the beneficiary.

Tax Implications of 529 Fund Usage

| Expense Type | Tax Treatment of Earnings | Federal Penalty | Example |

|---|---|---|---|

| Qualified Education Expenses (Tuition, Fees, etc.) | Tax-free | None | $10,000 withdrawn for tuition; no tax or penalty. |

| Non-Qualified Expenses (Personal Use) | Taxed at ordinary income rate | 10% | $10,000 withdrawn for a vacation; taxed at recipient’s rate + 10% penalty. |

Student Loan Repayment Options

Navigating the complexities of student loan repayment can feel daunting, but understanding the various options available is crucial for long-term financial well-being. This section will Artikel different types of student loans, their associated interest rates and repayment terms, and strategies for effective repayment. We will also explore the advantages of early repayment and the long-term financial implications of various repayment approaches.

Types of Student Loans

Student loans are broadly categorized into federal and private loans. Federal loans are offered by the U.S. government and generally offer more borrower protections, such as income-driven repayment plans and loan forgiveness programs. Private loans, on the other hand, are provided by banks, credit unions, and other private lenders. They often have less favorable terms and lack the same level of government protection. The specific terms and conditions of each loan type vary depending on the lender and the borrower’s creditworthiness.

Average Interest Rates and Repayment Terms

Interest rates and repayment terms for student loans vary significantly. Federal student loan interest rates are set by the government and are generally lower than private loan rates. For example, the interest rate for a Direct Subsidized Loan for undergraduate students in 2023 was fixed at a range of rates depending on the loan’s disbursement date. Private loan interest rates are variable and depend on factors such as credit score, loan amount, and the lender’s risk assessment. Repayment terms typically range from 10 to 20 years, but some loans may offer shorter or longer repayment periods. Longer repayment periods result in lower monthly payments but lead to higher total interest paid over the life of the loan.

Benefits of Early Student Loan Repayment

Early repayment of student loans offers several key advantages. The most significant is the reduction in total interest paid. The sooner you pay off your loans, the less interest accrues, saving you substantial money over the long term. Early repayment can also reduce financial stress and improve your credit score, making it easier to qualify for other types of credit in the future. Consider a scenario where you have a $30,000 loan with a 6% interest rate. Paying it off early, even by a few years, could save you thousands of dollars in interest.

Long-Term Financial Implications of Repayment Strategies

Different repayment strategies have significant long-term financial implications. For instance, aggressively paying down high-interest loans first (the avalanche method) minimizes the total interest paid over the life of the loans. Conversely, the snowball method, focusing on paying off the smallest loans first, can provide a psychological boost and motivation to continue repaying debts. Choosing a repayment plan that aligns with your financial goals and risk tolerance is critical. Failure to properly manage student loan debt can lead to significant financial hardship, impacting credit scores, purchasing power, and overall financial stability. A realistic budget and disciplined savings plan are essential for successful long-term repayment.

Steps Involved in Repaying Student Loans

Understanding the steps involved in repaying student loans is essential for efficient debt management.

- Consolidate Loans (if applicable): Combining multiple loans into a single loan can simplify repayment and potentially lower your monthly payment.

- Choose a Repayment Plan: Select a repayment plan that aligns with your income and financial goals. Federal loans offer various income-driven repayment options.

- Create a Budget: Develop a realistic budget that prioritizes student loan payments.

- Make Timely Payments: Consistent and timely payments are crucial for avoiding late fees and maintaining a good credit score.

- Explore Additional Repayment Options: Consider strategies like refinancing, making extra payments, or seeking assistance programs.

529 Plan Usage for Non-Qualified Expenses

While 529 plans are primarily designed for qualified education expenses, there are circumstances where using the funds for non-qualified expenses might be considered, albeit with significant tax implications. Understanding these implications is crucial before making such a decision. This section details the potential tax consequences, the withdrawal process, and scenarios where using 529 funds for non-qualified expenses might be financially advantageous or disadvantageous.

Tax Consequences of Non-Qualified Withdrawals

Withdrawing funds from a 529 plan for non-qualified expenses results in the earnings portion being subject to income tax at the beneficiary’s tax rate, plus a 10% additional tax penalty. This means only the original contributions are tax-free. For example, if $10,000 is withdrawn, and $2,000 represents the original contribution, the remaining $8,000 will be taxed as ordinary income and subject to the 10% penalty. Exceptions to the penalty exist, such as the beneficiary’s death or disability. It is vital to consult a tax advisor before proceeding with a non-qualified withdrawal.

Withdrawal Process for Non-Qualified Expenses

The process for withdrawing funds for non-qualified expenses is generally straightforward. The account owner typically initiates the withdrawal request through the 529 plan provider’s online portal or by contacting their customer service department. The provider will then process the withdrawal, distributing the funds to the designated account. The tax implications, as described above, will need to be reported on the beneficiary’s tax return. Accurate record-keeping is essential to track contributions and earnings to properly calculate the taxable portion.

Examples of Financially Beneficial and Detrimental Uses

Using 529 funds for non-qualified expenses can be financially beneficial in certain limited situations. For instance, if faced with an unexpected medical emergency and the family has exhausted other financial resources, using 529 funds might alleviate immediate financial stress, even with the tax consequences. However, this decision must be weighed carefully against alternative options, such as loans or other emergency funds. Conversely, using 529 funds for non-essential expenses like a vacation is almost always financially detrimental due to the significant tax burden. The tax and penalty will often outweigh any perceived benefit. A thorough cost-benefit analysis is crucial before making this decision. For example, withdrawing $10,000 for a vacation, with $2,000 in contributions, would result in an $8,000 tax liability, plus an additional $800 penalty (10% of $8,000). This makes the effective cost of the vacation significantly higher than the initial withdrawal amount.

Alternative Strategies for Managing Student Loan Debt

Managing student loan debt effectively requires a strategic approach tailored to individual circumstances. Several options exist beyond standard repayment plans, each with its own advantages and disadvantages. Careful consideration of your financial situation, risk tolerance, and long-term goals is crucial in selecting the most appropriate strategy.

Refinancing Student Loans

Refinancing involves replacing your existing student loans with a new loan from a private lender, often at a lower interest rate. This can significantly reduce the total interest paid over the life of the loan and shorten the repayment period. However, refinancing typically requires a good credit score and may not be suitable for everyone. For instance, borrowers with federal loans might lose access to income-driven repayment plans or loan forgiveness programs if they refinance into a private loan.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans adjust your monthly payments based on your income and family size. Several IDR plans exist, including the Revised Pay As You Earn (REPAYE), Income-Based Repayment (IBR), and Income-Contingent Repayment (ICR) plans. These plans can make monthly payments more manageable, particularly during periods of lower income. However, IDR plans often extend the repayment period, resulting in higher total interest paid over the life of the loan. Furthermore, the remaining balance after a specified period might be forgiven, but this forgiven amount is considered taxable income.

Comparison of Debt Management Strategies

The choice between refinancing and IDR plans, or other strategies, depends heavily on individual financial circumstances. The table below provides a comparison:

| Strategy | Pros | Cons | Suitable For |

|---|---|---|---|

| Refinancing | Lower interest rates, shorter repayment period, potentially lower monthly payments | Loss of federal loan benefits, requires good credit, may not be available to all borrowers | Borrowers with good credit, seeking to lower interest costs and shorten repayment |

| Income-Driven Repayment (IDR) | Lower monthly payments, more manageable during periods of low income | Longer repayment period, higher total interest paid, potential tax implications on forgiven balance | Borrowers with low income or inconsistent income, prioritizing affordability over speed of repayment |

| Debt Consolidation | Simplifies repayment by combining multiple loans into one | May not lower interest rates, requires careful consideration of terms | Borrowers with multiple loans seeking simplified repayment, but not necessarily lower interest |

| Deferment/Forbearance | Temporary suspension of payments | Interest continues to accrue (usually), can negatively impact credit score | Borrowers facing temporary financial hardship, but should be used cautiously |

Impact of Credit Score on Student Loan Repayment Options

Your credit score significantly impacts your eligibility for various student loan repayment options, particularly refinancing. A higher credit score generally qualifies you for lower interest rates and more favorable loan terms. Conversely, a lower credit score might limit your refinancing options or result in higher interest rates. Additionally, a poor credit history can impact your eligibility for income-driven repayment plans, although it’s less of a direct factor than for refinancing. For example, a borrower with a credit score above 700 might qualify for a significantly lower interest rate on refinancing than a borrower with a score below 650, potentially saving thousands of dollars over the life of the loan.

Financial Planning Considerations

Integrating 529 plan usage and student loan repayment effectively requires a holistic approach to financial planning. This involves considering your overall financial goals, risk tolerance, and the potential tax implications of various strategies. Failing to do so could lead to suboptimal outcomes, either leaving you with unnecessary debt or forfeiting potential tax advantages.

Successfully navigating student loan repayment and 529 plan utilization demands a well-structured financial plan. This plan should encompass short-term goals like immediate debt reduction and long-term objectives such as retirement savings and wealth accumulation. By viewing these elements as interconnected components, you can make informed decisions that optimize your financial resources.

A Hypothetical Scenario: 529 Funds and Student Loan Repayment

Let’s consider Sarah, a recent graduate with $30,000 in student loan debt at a 6% interest rate and a $20,000 balance in her 529 plan. She’s facing a monthly payment of approximately $300. If she uses the 529 funds to pay off her loans, she’ll incur a 10% penalty on the withdrawn amount ($2,000) plus the taxes on the earnings. Assuming a 15% tax bracket and $5,000 in earnings, the total cost of using the 529 funds would be approximately $3,750 ($2,000 + $1,500 + $250). This means her net gain is $16,250 ($20,000 – $3,750). However, eliminating her debt would save her significantly on interest payments over the life of the loan, which could amount to several thousand dollars depending on her repayment schedule. The optimal decision hinges on a careful analysis of her financial situation, risk tolerance, and long-term goals. This calculation does not account for potential tax deductions on student loan interest, which could further impact the decision.

Seeking Professional Financial Guidance

A Certified Financial Planner (CFP) can provide personalized advice tailored to your specific circumstances. They can help you analyze your financial situation, considering factors such as your income, assets, debts, and risk tolerance, to create a comprehensive financial plan. A CFP can also help you understand the tax implications of using 529 funds for non-qualified expenses and explore alternative strategies for managing student loan debt. Moreover, they can assist in developing a plan that balances immediate debt reduction with long-term savings goals, ensuring you make informed decisions aligned with your financial objectives. Their expertise can be invaluable in navigating the complexities of financial planning and maximizing your financial resources.

Wrap-Up

Navigating the complexities of 529 plans and student loan repayment requires careful consideration of individual circumstances and financial goals. While using 529 funds for non-qualified expenses like student loan repayment is possible, it’s crucial to weigh the potential tax penalties against the benefits of accelerated debt reduction. Ultimately, a well-informed decision hinges on a thorough understanding of the regulations, available options, and a comprehensive financial plan. Consulting with a financial advisor can provide personalized guidance tailored to your unique situation.

Expert Answers

Can I use 529 funds for graduate school?

Yes, 529 funds can generally be used for graduate school expenses, as long as they meet the definition of qualified education expenses.

What happens if I withdraw more from my 529 plan than I need?

Any excess funds can remain in the 529 plan for future education expenses or be rolled over to a beneficiary’s sibling. However, withdrawing more than needed will likely incur taxes and penalties on the excess.

Are there income limits for using 529 funds?

No, there are no income limits for contributing to or withdrawing from a 529 plan. However, eligibility for certain state tax deductions or credits may have income limitations.

Can I change the beneficiary of my 529 plan?

Yes, you can generally change the beneficiary of your 529 plan to another family member, such as a sibling or cousin. Consult the plan’s rules for specific guidelines.