Navigating the complexities of private student loan repayment can be daunting, especially when unexpected life events arise. Understanding the options available, such as deferment, is crucial for responsible financial management. This guide explores the process of deferring private student loans, outlining eligibility criteria, application procedures, and the long-term financial implications. We’ll delve into the nuances of different lender policies, compare deferment to alternative repayment strategies, and address potential legal considerations to empower you with the knowledge needed to make informed decisions.

From exploring income-based deferment options to understanding the impact on your credit score and long-term financial health, we aim to provide a clear and comprehensive understanding of the deferment process. We’ll also examine the various alternative repayment plans available and guide you in choosing the best option for your specific circumstances. This guide serves as a valuable resource for borrowers seeking to navigate the complexities of private student loan management effectively.

Eligibility Criteria for Deferment

Securing a deferment on your private student loans can provide crucial financial relief during challenging times. Understanding the eligibility requirements is key to successfully applying for this assistance. The process and specific criteria can vary significantly depending on your lender, so careful review of your loan agreement and lender’s website is essential.

General Eligibility Requirements for Private Student Loan Deferment

Generally, private student loan deferments require borrowers to demonstrate a genuine hardship or extenuating circumstance preventing them from making timely payments. This usually involves providing documentation to support your claim. Lenders typically review applications on a case-by-case basis, considering the specifics of your situation. While some lenders may offer standardized deferment options, others may have more flexible approaches, depending on their policies and the type of loan.

Income-Based Deferment Criteria for Private Student Loans

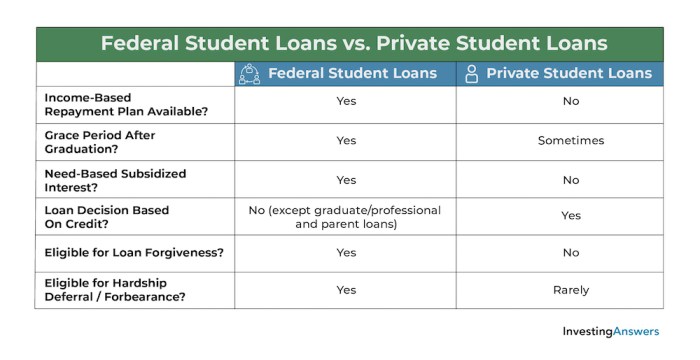

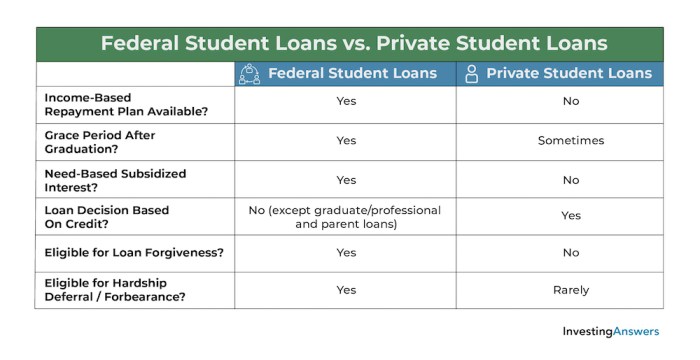

Income-based deferment for private student loans is less common than for federal student loans. While some private lenders may offer programs with income-based repayment plans, a formal “income-based deferment” specifically tied to income thresholds is less frequently found. It’s crucial to contact your lender directly to inquire about their specific income-related repayment or deferment options. They may have programs that consider your income relative to your loan payments, possibly allowing for temporary reductions or deferments under specific financial hardship circumstances.

Examples of Situations Qualifying for Deferment

Several situations commonly qualify borrowers for deferment. These include documented unemployment, where proof of job loss is required; serious illness or injury, often needing medical documentation; active military service, typically requiring proof of deployment; and natural disasters, requiring evidence of significant damage or displacement. It is important to note that the specific documentation required will vary depending on the lender and the nature of the hardship.

Comparison of Deferment Eligibility Across Different Private Lenders

Eligibility criteria for private student loan deferment vary significantly among lenders. Some lenders may have stricter requirements, while others may offer more flexible options. It is advisable to thoroughly review your loan agreement and contact your lender directly to understand their specific policies. Factors like the type of loan, your credit history, and the length of time you’ve been in repayment can also influence eligibility.

Comparison Table of Deferment Eligibility Requirements

| Lender | Required Documentation | Maximum Deferment Period | Income-Based Options |

|---|---|---|---|

| Lender A (Example) | Proof of unemployment, medical documentation, military orders | Up to 12 months | No |

| Lender B (Example) | Documentation of hardship, financial statements | Up to 6 months, potentially renewable | May offer reduced payment plans based on income |

| Lender C (Example) | Proof of unemployment, medical documentation, etc. Specific requirements detailed on their website | Varies depending on situation; case-by-case review | Contact lender for details |

The Deferment Application Process

Applying for a deferment on your private student loans involves several steps and requires careful attention to detail. Understanding the process beforehand can significantly streamline the application and improve your chances of a successful outcome. This section details the typical steps, required documentation, potential challenges, and timelines involved.

Required Documentation for Deferment Applications

Lenders typically require specific documentation to verify your eligibility for a deferment. This varies depending on the reason for your deferment request. Common documents include proof of enrollment in school (for in-school deferments), documentation of unemployment (for unemployment deferments), and medical documentation (for deferments due to illness or disability). Providing complete and accurate documentation is crucial for a swift processing of your application. Incomplete applications often lead to delays. For example, an application for an unemployment deferment might require a copy of your unemployment benefits statement, while a deferment due to medical reasons might need a doctor’s note outlining the nature of your condition and its impact on your ability to repay your loans.

Potential Challenges and Roadblocks in the Application Process

While the process is generally straightforward, certain challenges can arise. One common challenge is providing sufficient documentation to support your claim. For instance, if you are applying for a deferment due to economic hardship, you might need to provide proof of income and expenses. Another potential roadblock is processing delays caused by lender backlogs or incomplete applications. Finally, some lenders may have stricter requirements or less flexible deferment options than others. It’s advisable to contact your lender directly if you anticipate any difficulties.

Timelines Involved in Deferment Request Processing

The time it takes to process a deferment request varies significantly depending on the lender and the complexity of your application. While some lenders may process requests within a few days, others may take several weeks or even months. It is advisable to apply well in advance of when you need the deferment to take effect. For example, if you are applying for an in-school deferment, submitting your application before the start of the semester is highly recommended. Always check your lender’s website or contact them directly to inquire about their typical processing times.

Step-by-Step Guide to the Deferment Application Process

Applying for a deferment can be broken down into these key steps:

- Review your lender’s deferment policy: Understand the eligibility criteria, required documentation, and the application process specific to your lender.

- Gather necessary documentation: Compile all required documents, ensuring they are complete and accurate. This may include proof of enrollment, employment status, or medical documentation, as applicable.

- Complete the deferment application form: Carefully fill out the application form provided by your lender, ensuring all information is accurate and up-to-date.

- Submit your application: Submit your completed application form and all supporting documentation according to your lender’s instructions. This may be done online, by mail, or through fax.

- Follow up on your application: After submitting your application, track its progress and contact your lender if you haven’t heard back within a reasonable timeframe.

Impact of Deferment on Loan Terms

Deferring your private student loans can offer temporary relief, but it’s crucial to understand the long-term financial implications. While pausing payments provides short-term breathing room, it significantly impacts your loan’s overall cost and repayment schedule. This section details how deferment affects your loan terms, highlighting the importance of careful consideration before applying.

Total Interest Accrued During Deferment

During a deferment period, your loan payments are suspended, but interest usually continues to accrue. This means the total amount you owe increases even though you’re not making payments. The longer the deferment, the more interest will accumulate, ultimately leading to a larger total loan balance at the end of the deferment period. For example, a $10,000 loan with a 7% interest rate could accrue $700 in interest over a year of deferment. This accrued interest is typically capitalized, meaning it’s added to your principal loan balance, increasing the amount you’ll need to repay later.

Impact of Deferment on the Loan Repayment Schedule

Deferment extends your loan’s repayment period. Because interest continues to accrue, the principal loan balance increases. This necessitates a longer repayment timeline to cover the original principal plus accumulated interest. A longer repayment period means you’ll be paying off your student loan debt for a longer time and potentially paying more in interest overall. For instance, a 10-year loan could become a 12-year loan after a two-year deferment, increasing the total interest paid over the life of the loan.

Consequences of Multiple Deferment Requests

Repeated deferments significantly exacerbate the negative financial impacts. Each deferment adds to the accumulated interest, lengthening the repayment period and increasing the total cost of borrowing. Multiple deferments can lead to a substantially higher total repayment amount compared to consistently making payments on schedule. Lenders may also have limitations on the number of deferments allowed, and exceeding those limits could have negative repercussions.

Long-Term Financial Implications of Deferment Versus Other Repayment Options

Deferment should be viewed as a short-term solution, not a long-term strategy. Compared to other repayment options like income-driven repayment plans or loan refinancing, deferment often results in the highest overall cost. Income-driven plans adjust payments based on your income, while refinancing can lower your interest rate and potentially shorten your repayment period. Carefully evaluating these alternatives is crucial to minimizing the long-term financial burden.

Comparison of Deferment Effects on Different Loan Types

| Loan Type | Effect of Deferment on Interest | Effect on Repayment Schedule | Long-Term Financial Impact |

|---|---|---|---|

| Fixed-Rate Loan | Interest accrues at a consistent rate throughout the deferment period. | Repayment schedule is extended, with higher total payments due to capitalized interest. | Predictable but potentially high total cost due to prolonged repayment. |

| Variable-Rate Loan | Interest accrues at a fluctuating rate, potentially increasing or decreasing during the deferment. | Repayment schedule is extended, with total payments influenced by interest rate fluctuations and capitalization. | Less predictable total cost due to variable interest rates; potential for higher or lower overall cost compared to a fixed-rate loan. |

Alternatives to Deferment

Choosing to defer your private student loan payments can offer temporary relief, but it’s crucial to understand that it’s not always the best long-term solution. Interest may continue to accrue, potentially increasing your overall loan balance. Exploring alternative repayment options can lead to more financially sound outcomes depending on your individual circumstances. Several alternatives exist, each with its own set of advantages and disadvantages.

Understanding the nuances of these alternatives is key to making an informed decision. This section will compare and contrast deferment with forbearance and income-driven repayment plans, highlighting their respective pros and cons and guiding you toward selecting the most suitable option for your specific financial situation.

Alternative Repayment Options for Private Student Loans

Private student loan lenders typically offer a range of repayment options beyond deferment. These may include graduated repayment plans (where payments increase over time), extended repayment plans (spreading payments over a longer period), and, in some cases, options tailored to specific financial hardships. Always check directly with your lender to see what options are available for your specific loan. Some lenders might also offer short-term payment reductions or hardship programs.

Comparison of Deferment, Forbearance, and Income-Driven Repayment

While deferment, forbearance, and income-driven repayment plans all offer temporary relief from student loan payments, they differ significantly in their mechanics and long-term implications. Income-driven repayment plans are generally only available for federal student loans, not private ones. However, understanding the differences can still help you frame your expectations and questions for your private lender.

Pros and Cons of Alternative Repayment Options

Each alternative repayment option carries its own set of advantages and disadvantages. Carefully weighing these factors is crucial before making a decision.

| Feature | Deferment | Forbearance | Income-Driven Repayment (Federal Loans Only – Illustrative Comparison) |

|---|---|---|---|

| Payment Status | Temporarily suspended | Temporarily suspended | Payments based on income |

| Interest Accrual | Usually accrues (private loans) | Usually accrues (private loans) | May accrue (depends on plan) |

| Credit Score Impact | Potentially negative | Potentially negative | Potentially less negative than deferment or forbearance |

| Loan Term | Extended | Extended | Potentially extended (up to 20-25 years) |

| Eligibility | Specific criteria from lender | Specific criteria from lender, often requires documentation of hardship | Based on income and family size |

| Application Process | Generally straightforward | May require documentation | Requires application and documentation |

Choosing the Most Suitable Option

The best repayment option depends heavily on your individual financial situation, risk tolerance, and long-term goals. If you anticipate a short-term financial hardship, forbearance might be a suitable option, but remember that interest will likely continue to accrue. If you have a longer-term need for lower payments, an extended repayment plan (if offered by your lender) could be more appropriate. However, this will extend the loan term and increase the total interest paid. Before making any decision, it is strongly recommended to contact your lender and explore all available options.

Financial Implications and Long-Term Planning

Deferring your private student loans can offer temporary relief, but it’s crucial to understand the long-term financial implications and plan accordingly. Making informed decisions about deferment requires a clear understanding of its impact on your credit score, overall financial health, and long-term debt management strategies. Failing to do so can lead to significant financial setbacks.

Impact of Deferment on Credit Scores

Deferring your student loans typically reports to the credit bureaus as an account that is not being paid as agreed. While this doesn’t automatically result in a significant drop, it can negatively affect your credit score. The length of the deferment and your overall credit history will influence the severity of the impact. For example, a short deferment period for a borrower with an otherwise excellent credit history might result in a minor, temporary dip, whereas a prolonged deferment for someone with a less robust credit history could lead to a more substantial and lasting decrease. This can make it harder to secure loans, rent an apartment, or even get a job in the future, as many employers perform credit checks. It’s vital to carefully weigh the short-term benefits against the potential long-term consequences to your creditworthiness.

Potential Long-Term Financial Consequences of Deferment

The most significant long-term consequence of deferment is the accumulation of interest. While payments are paused during the deferment period, interest typically continues to accrue on the principal loan amount. This means that the total amount you owe will increase, potentially significantly, by the end of the deferment period. This increased debt can lead to higher monthly payments once the deferment ends, making it harder to manage your finances. For example, a $20,000 loan with a 7% interest rate deferred for two years could result in several thousand dollars of added interest, increasing the overall loan burden. Furthermore, extending the repayment period due to deferment increases the total interest paid over the life of the loan. This can significantly impact your financial stability and long-term savings goals.

Strategies for Managing Debt During and After a Deferment Period

Effective debt management during and after a deferment requires proactive planning. Before initiating a deferment, create a detailed budget to identify areas where you can cut expenses and allocate more funds towards debt repayment once the deferment ends. During the deferment, consider making interest-only payments if allowed to minimize the overall interest accrued. Explore options like refinancing to lower your interest rate after the deferment, making repayment more manageable. Once the deferment ends, prioritize higher-interest debt and consider debt consolidation to simplify payments and potentially reduce interest costs. Regularly monitoring your credit report and score is essential to track the impact of deferment and address any issues promptly.

Importance of Financial Planning in Conjunction with Loan Deferment

Financial planning is paramount when considering loan deferment. Before applying, carefully assess your short-term and long-term financial goals. Determine if deferment is truly necessary or if alternative solutions, such as income-driven repayment plans, could be more beneficial. Develop a comprehensive budget that incorporates the potential increase in your debt after the deferment period. This plan should Artikel strategies for managing your finances during the deferment and for accelerating debt repayment once it ends. Regularly reviewing and adjusting your financial plan is crucial to adapt to changing circumstances and ensure you stay on track. Consider seeking professional financial advice to create a personalized plan that aligns with your specific situation and financial goals.

Checklist of Steps to Take Before, During, and After a Deferment Period

Before applying for a deferment, thoroughly research all available options and their potential consequences. Compare the costs and benefits of deferment with other repayment options. Create a detailed budget to manage expenses during and after the deferment. Understand the terms and conditions of the deferment, including the impact on interest accrual and credit reporting.

During the deferment period, actively monitor your credit report. Explore opportunities to make interest-only payments to reduce the overall interest burden. Regularly review your financial plan and make adjustments as needed.

After the deferment, immediately resume regular payments. Consider refinancing or consolidating your loans to reduce interest rates and monthly payments. Continue to monitor your credit report and actively manage your debt. Re-evaluate your financial plan and adjust it as needed based on your current financial situation.

Legal Aspects and Consumer Protections

Navigating the legal landscape of private student loan deferment requires understanding both potential pitfalls and available protections. Borrowers should be aware of their rights and responsibilities to avoid complications and ensure fair treatment throughout the deferment process. This section Artikels key legal considerations and resources for borrowers.

Potential Legal Issues Related to Private Student Loan Deferment

Private student loan deferments are governed by the terms of the individual loan agreements, which can vary significantly between lenders. Potential legal issues may arise from disputes over eligibility criteria, the application process, or the lender’s handling of the deferment request. For example, a lender might incorrectly deny a deferment request based on a misinterpretation of the borrower’s financial circumstances or fail to properly document the deferment agreement. These situations could lead to legal action, requiring borrowers to potentially engage in negotiations or litigation to protect their rights. Another potential issue is the lender’s failure to accurately reflect the deferment on the borrower’s credit report, which could negatively impact their credit score.

Consumer Protections Available to Borrowers Seeking Deferment

While the protections afforded to borrowers of federal student loans are more robust, some consumer protections exist for those with private student loans. These protections often stem from state laws governing consumer lending practices and contract law. These laws might prohibit unfair or deceptive practices by lenders, such as imposing excessive fees or failing to provide clear and accurate information about the deferment process. Additionally, the Fair Credit Reporting Act protects borrowers’ credit information accuracy, requiring lenders to report deferment statuses accurately. However, the specific protections available can vary widely by state and the terms of the individual loan agreement.

Rights and Responsibilities of Borrowers During a Deferment Period

During a deferment period, borrowers have the right to receive clear and concise information regarding their loan status, including any accruing interest and the terms of their repayment plan upon deferment’s end. They also have the right to challenge any decisions made by the lender regarding their deferment application or the terms of the deferment itself. On the other hand, borrowers have the responsibility to adhere to the terms of the deferment agreement, including providing necessary documentation to the lender and keeping them informed of any changes in their circumstances that might affect their eligibility for the deferment. Failure to meet these responsibilities could lead to the termination of the deferment and potential negative consequences.

Situations Requiring Legal Assistance

Legal assistance might be necessary when a lender denies a deferment request without justification, fails to accurately reflect the deferment on the borrower’s credit report, or imposes unfair fees or penalties related to the deferment. It may also be required if the lender fails to provide clear and accurate information about the deferment process, or if the borrower believes the lender is violating state or federal consumer protection laws. Furthermore, legal assistance can be crucial in negotiating with lenders to resolve disputes and protect the borrower’s rights.

Resources for Borrowers Facing Difficulties with Private Student Loans

Borrowers facing difficulties with their private student loans can access several resources. These include non-profit consumer credit counseling agencies that can provide advice and assistance with negotiating repayment plans. State attorneys general offices often handle consumer complaints against lenders, and the Consumer Financial Protection Bureau (CFPB) offers resources and tools for navigating financial issues. Additionally, legal aid organizations may provide free or low-cost legal assistance to borrowers who qualify based on income and other factors. Finally, seeking advice from a qualified attorney specializing in consumer finance or student loan debt can be highly beneficial in resolving complex legal issues.

Closure

Successfully managing private student loan debt requires careful planning and a thorough understanding of available options. Deferment can provide temporary relief, but it’s essential to weigh its long-term financial implications against alternative repayment strategies. By carefully considering your individual circumstances, understanding the application process, and proactively managing your finances, you can navigate the challenges of student loan repayment and achieve your long-term financial goals. Remember to always explore all available resources and seek professional advice when needed to ensure you make the most informed decisions.

FAQ Section

What happens to interest during a deferment period?

Interest typically continues to accrue on your loan during a deferment period, increasing your overall loan balance. The lender’s specific policy on interest capitalization (adding accrued interest to the principal) should be reviewed.

Can I defer my private student loans multiple times?

The number of times you can defer your loans depends on your lender’s policies. Multiple deferments may have longer-term financial implications, potentially increasing your total repayment amount. Check your loan agreement for details.

How does deferment affect my credit score?

While not as negative as delinquency, deferment can still negatively impact your credit score, as it indicates a temporary inability to make payments. The impact varies depending on your credit history and other factors.

What if my deferment request is denied?

If your request is denied, understand the reasons provided by your lender. You may need to reapply with additional documentation or explore alternative repayment options like forbearance.