Navigating the complexities of student loan repayment can feel overwhelming, especially when unexpected life events arise. Understanding your options, such as deferment, is crucial for managing your finances effectively and avoiding potential negative impacts on your credit. This guide provides a comprehensive overview of the Discover student loan deferment process, empowering you to make informed decisions about your repayment strategy.

We’ll walk you through locating the necessary forms, completing them accurately, submitting your application, and understanding what happens afterward. We’ll also explore the potential long-term consequences of deferment and compare it to alternative repayment options. By the end, you’ll have the knowledge and confidence to navigate this crucial aspect of student loan management.

Understanding Student Loan Deferment

Student loan deferment allows you to temporarily postpone your student loan payments without penalty. This can be a valuable tool during periods of financial hardship or significant life changes. Understanding the different types of deferment and their eligibility requirements is crucial for making informed decisions about your student loan repayment.

Types of Student Loan Deferment Programs

Several types of deferment programs exist, each with its own specific criteria. The availability of these programs may vary depending on your loan type (federal or private) and lender. It’s essential to check with your loan servicer for the most up-to-date information.

- Economic Hardship Deferment: This type of deferment is typically available for federal student loans and is granted to borrowers experiencing temporary financial difficulties, such as unemployment or reduced income. Documentation supporting the hardship is usually required.

- Unemployment Deferment: Similar to economic hardship deferment, unemployment deferment is specifically for borrowers who have become unemployed. Proof of unemployment, such as a layoff notice or unemployment benefits documentation, is needed.

- In-School Deferment: This deferment applies to students who are enrolled at least half-time in an eligible educational program. It typically covers the period of enrollment, and proof of enrollment is necessary.

- Deferment for Graduate Fellowship or Residency: Borrowers pursuing graduate studies supported by a fellowship or engaged in medical residency programs may qualify for this type of deferment. Evidence of enrollment and fellowship/residency is required.

- Military Deferment: Active-duty military personnel may be eligible for deferment while serving. Proof of active-duty status is required.

Eligibility Criteria for Deferment

Eligibility for student loan deferment varies depending on the type of deferment and the lender. Generally, you will need to demonstrate that you meet the specific requirements for a particular program. This often involves providing documentation to support your claim. For example, for unemployment deferment, you’ll likely need to provide proof of unemployment from your state’s unemployment office. For in-school deferment, you’ll need to provide proof of enrollment from your educational institution. Private loan deferments often have stricter requirements and may not offer the same options as federal loans.

Determining the Most Suitable Deferment Option

Choosing the right deferment option requires careful consideration of your individual circumstances. First, identify the reason you need a deferment (e.g., unemployment, return to school). Then, determine if you meet the eligibility requirements for the corresponding deferment type. If you meet the requirements for multiple deferment options, consider which one best aligns with your long-term financial goals. Contact your loan servicer to discuss your options and obtain the necessary application forms.

Examples of Scenarios Where Deferment Might Be Beneficial

Several situations may benefit from a student loan deferment.

- Unexpected Job Loss: If you lose your job and are struggling to make loan payments, an unemployment deferment can provide temporary relief.

- Return to School: Going back to school to further your education or pursue a higher degree may necessitate an in-school deferment.

- Serious Illness or Injury: A prolonged illness or injury that prevents you from working may qualify you for an economic hardship deferment.

- Military Service: Active duty in the military may allow for a deferment during your service period.

Locating the Deferment Form

Finding the correct deferment application form is crucial for successfully postponing your student loan payments. The process varies depending on your loan servicer, the type of deferment you’re seeking, and your specific circumstances. Understanding where to find this form and how to navigate the application process will significantly streamline the procedure.

Securing the appropriate deferment application form requires accessing official sources provided by your loan servicer. Avoid using unofficial websites or third-party platforms, as these may contain outdated or inaccurate information, leading to delays or rejection of your application. Always prioritize direct communication with your loan servicer for the most reliable information.

Finding the Deferment Form Based on Loan Servicer

The location of the deferment application form will depend on your loan servicer. Most servicers provide access to these forms through their online portals. Others may require you to contact them directly via phone or mail to request the form. It’s important to note that the process may differ based on the type of loan you have (federal or private).

Comparison of Application Processes Across Loan Servicers

The following table compares the application processes for several common student loan servicers. Note that this information is for illustrative purposes and may not be entirely comprehensive. Always check your servicer’s official website for the most up-to-date instructions.

| Loan Servicer | Form Location | Application Method | Additional Requirements |

|---|---|---|---|

| Example Servicer A | Online portal, under “Deferment/Forbearance” | Online submission | Supporting documentation may be required (e.g., proof of unemployment) |

| Example Servicer B | Downloadable PDF from website’s FAQs section | Mail or fax | Completed form, supporting documentation |

| Example Servicer C | Accessible through account dashboard | Online submission or mail | Digital signature or wet signature |

| Example Servicer D | Requires a phone call to request the form | May require verification of eligibility |

Potential Obstacles and Solutions

Successfully obtaining the deferment form can sometimes be challenging. Here are some potential obstacles and their solutions:

Finding the correct section on the servicer’s website can be difficult due to the complex navigation of many websites. To solve this, utilize the website’s search function using s like “deferment,” “forbearance,” or “payment postponement.” If that doesn’t work, contact customer support directly.

Inaccurate or outdated information found on unofficial websites can lead to the submission of the wrong form or incomplete application. Always refer to your loan servicer’s official website for the most accurate information.

Difficulty contacting customer support can result in delays in obtaining the form. Try contacting customer service during off-peak hours, or utilize their online chat feature if available.

Completing the Deferment Form

Accurately completing your student loan deferment form is crucial to ensure your request is processed efficiently. Inaccurate or incomplete information can lead to delays or even rejection of your application. Take your time, gather all necessary documentation, and carefully review each section before submitting.

Student Information Section

This section requires your personal details, ensuring the lender can correctly identify you and your loan(s). Fields typically include your full legal name, date of birth, social security number, current mailing address, phone number, and email address. Double-check each entry for accuracy. For example, ensure your name matches exactly as it appears on your loan documents. Providing an incorrect social security number will undoubtedly delay processing. Using a current and reliable email address is vital for receiving updates on your application status.

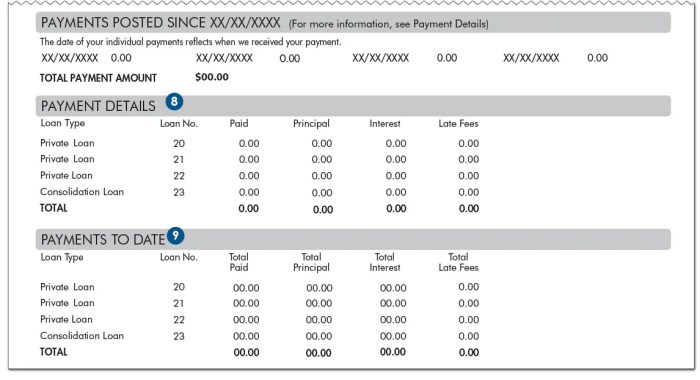

Loan Information Section

This section focuses on the specific loan(s) you wish to defer. You’ll need to provide your loan servicer’s name, your loan ID numbers, and the total amount of each loan. If you have multiple loans with different servicers, you may need separate deferment forms for each. For instance, if you have a loan with Sallie Mae and another with Navient, you’ll need to complete a form for each servicer. Ensure that the loan information you provide exactly matches the details on your loan statements to avoid processing errors.

Reason for Deferment Section

This section requires you to state your reason for requesting a deferment. Common reasons include unemployment, economic hardship, or enrollment in a qualifying graduate program. Clearly and concisely explain your situation, providing any supporting documentation as requested. For example, if claiming unemployment, you would provide proof of unemployment benefits. If claiming economic hardship, you might include pay stubs demonstrating a significant decrease in income. The more detailed and verifiable the information provided, the smoother the deferment process will be.

Supporting Documentation Section

Many deferment applications require supporting documentation to substantiate your reason for deferment. This might include proof of enrollment in school, unemployment verification, or medical documentation. Carefully review the application instructions to determine what documents are required. Organize your documents clearly and ensure they are legible. Failure to provide necessary documentation may result in the rejection of your deferment request.

Checklist for Completing the Deferment Form

Before submitting your form, use this checklist to ensure all necessary information is included:

- All personal information is accurate and complete.

- All loan information is accurate and complete, including loan servicer(s) and loan ID(s).

- The reason for deferment is clearly stated.

- All required supporting documentation is attached.

- The form is signed and dated.

Submitting the Deferment Form

Submitting your completed student loan deferment application is the final step in the process. Choosing the right submission method and effectively tracking your application can significantly impact the timeline for your deferment approval. Consider the following options and best practices to ensure a smooth process.

Deferment Form Submission Methods

Several methods exist for submitting your completed deferment application, each with its own set of advantages and disadvantages. Selecting the most appropriate method depends on your personal preferences and circumstances.

- Mail: Submitting your application via mail involves printing the completed form and sending it to the designated address provided by your loan servicer. This method offers a tangible record of your submission, but it is the slowest option and requires careful attention to ensure accurate and complete mailing.

- Online Portal: Many loan servicers offer online portals where you can securely upload your completed deferment application. This method is generally faster and more convenient than mailing, providing immediate confirmation of submission. However, it requires access to the internet and a working knowledge of the online portal.

Advantages and Disadvantages of Submission Methods

A comparison of the pros and cons of each method helps in making an informed decision.

| Method | Advantages | Disadvantages |

|---|---|---|

| Provides a physical record of submission; simple to understand for those less comfortable with technology. | Slowest method; risk of lost mail; requires postage and potentially tracking; no immediate confirmation. | |

| Online Portal | Fast and convenient; immediate confirmation of submission; often allows for easy tracking; no postage costs. | Requires internet access and familiarity with online portals; potential for technical issues; reliance on the portal’s functionality. |

Tracking Application Status

After submitting your application, actively tracking its status is crucial. Most loan servicers provide online portals or phone numbers to check the progress of your deferment request. For mailed applications, retaining a copy of the submitted form and tracking number (if applicable) is essential. Expect a response time of several weeks, though this can vary depending on the servicer and the volume of applications they receive. For example, a large servicer during peak deferment periods might take longer to process an application than a smaller servicer during a less busy time. Regularly checking your online account or contacting your servicer directly if you haven’t received an update within a reasonable timeframe is advisable.

Deferment Application Submission Flowchart

The following illustrates a typical deferment application submission process and expected timelines:

[Imagine a flowchart here. The flowchart would begin with “Complete Deferment Form,” leading to a decision point: “Mail or Online Portal?”. Each branch would then show the respective submission method (Mail: Send form via mail, Online Portal: Upload form via online portal). Both branches would then lead to “Application Received by Servicer,” followed by “Servicer Processes Application (2-4 weeks),” and finally, “Deferment Approved/Denied”. The “Denied” branch would ideally lead to “Reason for Denial Provided” and an opportunity to appeal.]

Understanding the Deferment Process After Submission

After submitting your student loan deferment application, the process moves into the hands of your loan servicer. The time it takes to process your request varies depending on the servicer and the volume of applications they’re currently handling. Generally, you can expect a response within a few weeks, but it could take longer in some cases. During this period, it’s crucial to keep an eye on your email and online account for updates.

Processing Times and Servicer Communication

Expect to receive some form of communication from your loan servicer, whether it’s an email confirmation of receipt, a notification of the decision, or an update on the status of your application. This communication will usually Artikel the next steps, if any, and may include a timeline for when you can expect a final decision. For example, some servicers might send an automated email acknowledging receipt of your application, followed by a separate email once the review is complete. Others may update your online account with the status, allowing you to track the progress. Remember to check both your email and your online loan account regularly.

Implications of a Denied Deferment Application

If your deferment application is denied, your loan servicer will typically explain the reason for the denial in their communication. This could involve a lack of supporting documentation, an incomplete application, or failure to meet the eligibility criteria. Don’t despair; a denial doesn’t necessarily mean you’re out of options. You can typically appeal the decision by providing additional documentation or addressing the reasons for the denial. Review the denial letter carefully, identify the issues, and resubmit your application with the necessary corrections or supporting information. Contacting your loan servicer directly to discuss the denial and explore alternative options is also a proactive step.

Common Reasons for Deferment Application Rejection

Several common reasons lead to deferment application rejections. These include providing incomplete or inaccurate information on the application, failing to submit the required supporting documentation (like proof of unemployment or enrollment in a qualifying program), or not meeting the eligibility criteria for the type of deferment you applied for. For instance, submitting an application without the necessary income verification documents for an income-driven repayment plan deferment will likely lead to rejection. Similarly, applying for an unemployment deferment without providing proof of unemployment from the appropriate agency would result in denial. Addressing these issues involves carefully reviewing the application requirements, gathering all necessary documentation, and ensuring accuracy in the information provided.

Interpreting Servicer Communication

Loan servicer communication regarding your deferment application can vary in format and detail. However, key elements to look for include confirmation of receipt, a status update (e.g., “processing,” “approved,” “denied”), and the reason for approval or denial, if applicable. A typical approval notification will clearly state that your deferment has been granted, outlining the effective dates and any related terms or conditions. Conversely, a denial notification will specify the reason for rejection and often provide guidance on how to address the issue and potentially reapply. Always carefully review the communication to understand its meaning completely. If anything is unclear, contacting the servicer directly to clarify is essential.

Potential Impacts of Deferment

Deferring your student loans can offer temporary relief, but it’s crucial to understand the potential long-term financial consequences. While pausing payments provides immediate breathing room, it doesn’t eliminate the debt; instead, it often leads to increased overall costs. Understanding these impacts is key to making an informed decision.

Deferment’s effect on your credit score and future borrowing capacity is a significant consideration.

Impact on Credit Score and Future Borrowing

Deferment, while not always reported as negatively as a default, can still impact your credit score. Lenders view deferred loans as a potential risk, as it indicates a period where you were unable to meet your financial obligations. This can lower your credit score, making it more difficult to secure loans or credit cards in the future, potentially at higher interest rates. The impact varies depending on the length of the deferment and your overall credit history. A shorter deferment period with a strong credit history may have a minimal effect, while a longer deferment combined with other negative credit factors could significantly impact your score.

Long-Term Financial Consequences of Deferment

The most significant long-term consequence of deferment is the accumulation of interest. During a deferment period, interest typically continues to accrue on your loan balance. This means that your loan balance will grow even though you aren’t making payments. This added interest can substantially increase the total amount you owe, potentially extending the repayment period and ultimately costing you significantly more over the life of the loan. For example, a $20,000 loan with a 6% interest rate deferred for two years could accumulate thousands of dollars in additional interest, leading to a much larger debt burden once payments resume.

Comparison with Forbearance and Income-Driven Repayment Plans

Deferment isn’t the only option for managing student loan payments. Forbearance and income-driven repayment plans offer alternative solutions, each with its own advantages and disadvantages. Understanding these differences is essential for choosing the best approach for your individual financial situation.

| Feature | Deferment | Forbearance | Income-Driven Repayment |

|---|---|---|---|

| Payment Status | Payments temporarily suspended | Payments temporarily suspended | Payments based on income and family size |

| Interest Accrual | Interest usually accrues (subsidized loans are an exception) | Interest usually accrues | Interest may accrue, depending on the plan |

| Credit Score Impact | Potential negative impact | Potential negative impact | Generally less negative impact than deferment or forbearance |

| Length | Limited periods, often with specific qualifying circumstances | Limited periods, often with specific qualifying circumstances | Potentially longer term, up to 20 or 25 years |

Visual Guide to Deferment Application Process

This section provides a step-by-step visual representation of the student loan deferment application process. The visual aids described below aim to clarify each stage, from locating the necessary forms to submitting the completed application. Understanding these visuals will help you navigate the process efficiently.

Overview Flowchart

A flowchart would visually represent the entire deferment application process. It would begin with a rectangular box labeled “Determine Eligibility.” This would branch into two paths: “Eligible” leading to the next step, and “Ineligible” ending the process. The “Eligible” path would continue with subsequent boxes representing each stage: “Locate Deferment Form,” “Complete Deferment Form,” “Gather Supporting Documentation,” “Submit Deferment Form,” and finally, “Confirmation/Acknowledgement.” Arrows connect each box, indicating the flow of the process. The flowchart’s clear visual structure helps users understand the sequential nature of the application.

Locating the Deferment Form: Screenshot Simulation

A simulated screenshot of the lender’s website would show the location of the deferment form. The image would highlight the relevant link or button, clearly labeled “Deferment Application” or a similar phrase. The screenshot would also display a portion of the website’s navigation menu to show the context within the website’s overall structure. This visual aids in quickly finding the correct form.

Completing the Deferment Form: Sample Form Representation

A visual representation of the deferment form itself would be beneficial. This could be a simplified mock-up showing key fields like applicant name, student ID number, loan details, reason for deferment, and signature area. The image would highlight mandatory fields, clearly indicating which information is required. This helps users understand what information to gather before beginning the application. Example fields with placeholder text like “Full Name,” “Loan ID Number,” and “Reason for Deferment (e.g., unemployment, medical reasons)” would be displayed.

Gathering Supporting Documentation: Checklist

A checklist would visually represent the necessary supporting documents. Each item on the checklist, such as proof of income, medical documentation, or employment verification, would be clearly listed with a checkbox next to it. Once a document is gathered, the corresponding checkbox could be marked, providing a clear visual confirmation of completion. This ensures that all required documents are collected before submission. Examples of supporting documents would be listed, such as pay stubs, doctor’s notes, or a letter from an employer.

Submitting the Deferment Form: Confirmation Page Simulation

A simulated screenshot of the confirmation page after successful submission would display a confirmation number and a summary of the submitted information. This visual would reassure the applicant that their form was successfully submitted. The screenshot would include a prominent confirmation message and the unique reference number generated by the system.

Post-Submission Process: Timeline Diagram

A timeline diagram would illustrate the expected processing time for the deferment request. It would show a timeline with key milestones, such as the submission date, expected processing time (e.g., “2-4 weeks”), and the date the applicant should expect a response. This visual provides realistic expectations regarding the application’s processing time. This would help manage expectations and avoid unnecessary anxiety.

Outcome Summary

Successfully navigating the Discover student loan deferment process requires careful planning and attention to detail. By understanding the eligibility criteria, completing the application accurately, and tracking its progress, you can effectively manage your student loan repayment during challenging times. Remember to weigh the long-term financial implications of deferment against other repayment options to ensure you choose the best strategy for your individual circumstances. Proactive planning and informed decision-making are key to long-term financial success.

Clarifying Questions

What happens if my deferment application is denied?

If your application is denied, Discover will typically notify you in writing, explaining the reason for the denial. You can then reapply if the circumstances that led to the denial have changed, or explore alternative repayment options.

How long does the deferment process take?

Processing times vary, but typically range from a few weeks to a couple of months. You should receive communication from Discover once a decision has been made.

Can I defer my student loans more than once?

The number of times you can defer your loans depends on your loan terms and the specific reasons for deferment. It’s best to check your loan agreement or contact Discover directly for clarification.

Will deferring my loans affect my credit score?

While deferment itself doesn’t directly impact your credit score, failing to make payments during the deferment period could negatively affect it if your servicer reports the missed payments. It’s crucial to understand the terms and conditions of your deferment.