Securing a favorable interest rate on student loans is crucial for minimizing long-term debt. Navigating the complexities of federal and private loan options, understanding APRs and fees, and employing effective repayment strategies can significantly impact your financial future. This guide explores how to find and secure the best interest rates for your student loan needs, empowering you to make informed decisions.

We’ll delve into the factors influencing interest rates, including your credit score, loan type, and market conditions. We’ll compare federal and private loan options, highlighting the benefits and drawbacks of each. Finally, we’ll provide practical tips for improving your chances of securing a low interest rate and managing your repayment effectively.

Defining “Good” Interest Rates

Securing a student loan with a favorable interest rate is crucial for minimizing long-term borrowing costs. What constitutes a “good” rate, however, is relative and depends on several factors. This section will explore the current landscape of student loan interest rates, highlighting key influences and providing a comparative analysis.

Generally, a “good” interest rate reflects the lowest possible cost of borrowing while considering your individual financial circumstances and the prevailing market conditions. Lower interest rates translate directly to lower monthly payments and less total interest paid over the life of the loan. However, the definition of “good” varies based on the type of loan and your creditworthiness.

Interest Rate Ranges for Student Loans

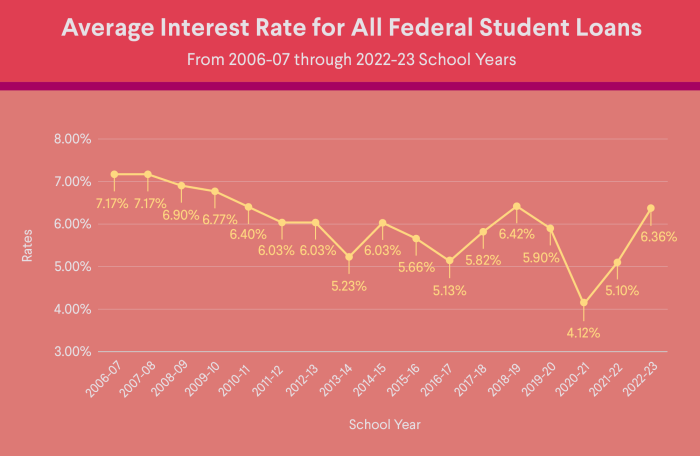

Favorable interest rates for student loans currently fall within a specific range, differing significantly between federal and private loans. Federal student loans typically offer lower rates due to government backing and subsidies. Private loans, on the other hand, are subject to market fluctuations and individual credit profiles, resulting in a wider range of rates. Currently, favorable rates for federal student loans might range from 4% to 7%, while competitive rates for private student loans could be anywhere from 6% to 12%, depending on creditworthiness and other factors. These ranges are subject to change based on market conditions.

Factors Influencing Interest Rate Perception

Several key factors significantly impact the perception of a “good” interest rate for student loans. These factors influence both the interest rate offered by lenders and a borrower’s ability to secure the most favorable terms.

Credit Score: A higher credit score demonstrates creditworthiness to lenders, resulting in lower interest rates. Individuals with excellent credit scores (750 and above) typically qualify for the most favorable rates. Conversely, those with poor credit may face significantly higher rates or even loan denials. For example, a borrower with a 780 credit score might secure a 6% interest rate on a private loan, whereas a borrower with a 650 credit score might receive an interest rate of 10% or more.

Loan Term: The length of the loan term also impacts the interest rate. Shorter loan terms generally come with lower interest rates but result in higher monthly payments. Longer loan terms typically mean lower monthly payments, but the total interest paid over the life of the loan will be higher due to the longer repayment period. For instance, a 10-year loan will likely have a lower interest rate than a 20-year loan, even from the same lender.

Market Conditions: Prevailing economic conditions and the overall interest rate environment significantly influence student loan interest rates. During periods of low interest rates, lenders offer more competitive rates. Conversely, periods of high interest rates typically result in higher loan costs for borrowers. This is because lenders adjust their rates to reflect the cost of borrowing money in the broader financial market.

Comparison of Student Loan Interest Rates from Different Lenders

The following table compares interest rates from hypothetical lenders, illustrating the variations based on loan type and borrower profile. Remember that these are examples and actual rates will vary.

| Lender | Loan Type | Interest Rate Range (%) | Key Features | Potential Drawbacks |

|---|---|---|---|---|

| Federal Direct Loan Program | Federal Subsidized/Unsubsidized | 4-7 | Government-backed, fixed rates, income-driven repayment plans available | Rate is determined by the government, may not be the lowest rate available |

| Private Lender A | Private | 6-10 | Variable or fixed rates, potential for lower rates with excellent credit | Higher rates for borrowers with lower credit scores, potential for additional fees |

| Private Lender B | Private | 7-12 | Flexible repayment options, potential for co-signer assistance | Higher rates compared to Lender A, stricter eligibility requirements |

| Private Lender C | Private | 8-14 | Specialized programs for certain professions | Potentially higher rates and fees, specific eligibility criteria |

Federal Student Loan Programs

Understanding the intricacies of federal student loan programs is crucial for prospective and current students aiming to manage their educational debt effectively. Different loan types come with varying interest rate structures, directly impacting the total cost of repayment. This section details the key features of several federal student loan programs, highlighting the implications of their interest rate structures.

Federal student loans offer several advantages over private loans, including generally lower interest rates and flexible repayment options. However, it’s vital to understand the nuances of each program to make informed borrowing decisions. The interest rates are not fixed and change periodically based on market conditions, so it’s essential to check the current rates on the official government website before applying.

Subsidized and Unsubsidized Federal Stafford Loans

Subsidized and unsubsidized Stafford loans are the most common types of federal student loans for undergraduates. The key difference lies in how interest accrues. With subsidized loans, the government pays the interest while the student is enrolled at least half-time and during grace periods. Unsubsidized loans accrue interest from the moment the loan is disbursed, regardless of enrollment status. The interest rate for both is set annually by the government and is the same for both loan types. For example, let’s consider a student borrowing $10,000 in unsubsidized loans at a 5% annual interest rate. If they take 10 years to repay, the total interest paid would be significantly higher than if they repaid it in 5 years. Conversely, a subsidized loan with the same amount and interest rate would accumulate less total interest if the student maintained half-time enrollment during their studies and the grace period. The impact of interest rate and repayment period on total cost is substantial.

Federal PLUS Loans

Federal PLUS loans are available to graduate students and parents of dependent undergraduate students. These loans typically have higher interest rates compared to Stafford loans. The interest rate is fixed for the life of the loan, but it is also subject to annual changes set by the government. Let’s imagine a parent borrowing $20,000 in PLUS loans at a 7% interest rate. If repaid over 10 years, the total interest paid would be considerably more than if the loan were repaid over 5 years. A longer repayment period increases the total interest paid.

Interest Rate Impact on Total Repayment Costs

The following table illustrates the impact of interest rates and repayment periods on total loan repayment costs. These are illustrative examples, and actual interest rates will vary.

| Loan Amount | Interest Rate | Repayment Period (Years) | Total Interest Paid | Total Repayment Cost |

|---|---|---|---|---|

| $10,000 | 5% | 5 | $1,280 | $11,280 |

| $10,000 | 5% | 10 | $2,760 | $12,760 |

| $20,000 | 7% | 5 | $4,270 | $24,270 |

| $20,000 | 7% | 10 | $9,820 | $29,820 |

It is crucial to note that these figures are simplified and do not account for potential fees or changes in interest rates.

Benefits and Drawbacks of Federal Student Loan Programs

Understanding the advantages and disadvantages of each program is vital for informed decision-making.

Below is a summary of the benefits and drawbacks related to interest rates for each program.

- Subsidized Stafford Loans:

- Benefit: Interest does not accrue while in school (at least half-time) and during grace periods.

- Drawback: Generally only available to undergraduate students who demonstrate financial need.

- Unsubsidized Stafford Loans:

- Benefit: Available to undergraduate and graduate students, regardless of financial need.

- Drawback: Interest accrues from disbursement, increasing the total loan cost.

- Federal PLUS Loans:

- Benefit: Provides access to funds for graduate students and parents of undergraduate students.

- Drawback: Typically higher interest rates than Stafford loans.

Private Student Loan Options

Securing a private student loan can be a crucial step in financing your education, especially if federal loans don’t cover the full cost. However, understanding the intricacies of private loan interest rates is vital to making informed financial decisions. Unlike federal loans, private loan interest rates are variable and depend on several factors, leading to a wider range of potential costs.

Private student loan interest rates vary significantly across different lenders. These lenders assess applicants based on creditworthiness, using various factors to determine the risk involved in lending. This section will explore the interest rate landscape of private student loans, highlighting key influencing factors and providing examples from several prominent lenders.

Factors Influencing Private Student Loan Interest Rates

Several factors significantly influence the interest rate a borrower receives on a private student loan. A strong credit history generally translates to lower rates, reflecting a reduced risk for the lender. The presence of a creditworthy co-signer can also substantially lower the interest rate, mitigating the risk associated with a borrower’s less-than-perfect credit. The loan amount itself plays a role; larger loan amounts might come with slightly higher interest rates due to the increased risk for the lender. Finally, the loan’s terms, such as the repayment period, can also affect the interest rate. Longer repayment periods may lead to higher interest rates to compensate the lender for the extended time value of money.

Interest Rate Comparison Across Lenders

The following table illustrates hypothetical interest rate ranges for different credit profiles and loan amounts from three hypothetical private lenders (Note: These are illustrative examples and do not reflect actual rates offered by specific lenders. Actual rates vary constantly and depend on many factors beyond those shown here). Always check directly with lenders for the most up-to-date information.

| Credit Profile | Loan Amount ($USD) | Lender A (APR Range) | Lender B (APR Range) | Lender C (APR Range) |

|---|---|---|---|---|

| Excellent (750+ FICO) | $10,000 | 6.00% – 7.00% | 6.50% – 7.50% | 7.00% – 8.00% |

| Good (700-749 FICO) | $10,000 | 7.00% – 8.00% | 7.50% – 8.50% | 8.00% – 9.00% |

| Fair (650-699 FICO) | $10,000 | 8.50% – 9.50% | 9.00% – 10.00% | 9.50% – 10.50% |

| Excellent (750+ FICO) | $50,000 | 6.50% – 7.50% | 7.00% – 8.00% | 7.50% – 8.50% |

| Good (700-749 FICO) | $50,000 | 7.50% – 8.50% | 8.00% – 9.00% | 8.50% – 9.50% |

| Fair (650-699 FICO) | $50,000 | 9.00% – 10.00% | 9.50% – 10.50% | 10.00% – 11.00% |

Repayment Strategies and Interest Rate Impact

Choosing the right repayment strategy significantly impacts the total cost of your student loans. Understanding the nuances of different repayment plans and their effect on interest accumulation is crucial for long-term financial health. The interest rate itself plays a major role, influencing both your monthly payments and the overall amount you pay back.

Different repayment plans offer varying levels of flexibility and impact the total interest paid over the loan’s lifetime. The standard repayment plan involves fixed monthly payments over a 10-year period, while graduated repayment plans start with lower payments that gradually increase over time. Income-driven repayment plans, on the other hand, base your monthly payment on your income and family size, potentially extending the repayment period significantly.

Standard, Graduated, and Income-Driven Repayment Plans

The choice of repayment plan directly affects the total interest paid. A standard repayment plan, with its shorter repayment period, minimizes the total interest accrued because the principal is paid down more quickly. However, the fixed monthly payments might be higher, posing a challenge for some borrowers. Graduated repayment plans offer lower initial payments, making them more manageable initially, but the longer repayment period results in higher overall interest payments. Income-driven repayment plans offer the lowest monthly payments, but they often extend the repayment term considerably, leading to the highest total interest paid over the life of the loan. For example, a $50,000 loan at 5% interest could cost an additional $15,000 to $20,000 in interest depending on the chosen plan.

The Impact of Extra Principal Payments

Making extra principal payments significantly reduces the total interest paid over the life of the loan. Every extra dollar paid towards the principal reduces the loan balance, thus lessening the amount of interest calculated on the remaining balance. This snowball effect accelerates the loan payoff and can save thousands of dollars in interest. For instance, paying an extra $100 per month on a $30,000 loan at 6% interest could save you several thousand dollars and shorten the repayment period by several years. The effect is most pronounced in the early years of the loan when the interest portion of the payment is higher.

Long-Term Financial Implications of Interest Rates

The interest rate on your student loan has a profound impact on your long-term financial health. A higher interest rate results in significantly higher total interest paid over the life of the loan, increasing the overall cost. This means a larger portion of your monthly payment goes towards interest rather than principal. Conversely, a lower interest rate reduces the total interest paid and lowers your monthly payments, freeing up more of your income for other financial goals. For example, a 1% difference in interest rate on a $40,000 loan can add thousands of dollars to the total cost over the loan term. This difference can significantly affect your ability to save for a down payment on a house, invest in retirement, or tackle other financial responsibilities.

Understanding APR and Fees

Securing a student loan involves more than just understanding the stated interest rate. A crucial factor in determining the true cost of borrowing is the Annual Percentage Rate (APR), which encompasses the interest rate and other associated fees. Understanding the components of the APR and the various fees involved is essential for making informed borrowing decisions.

The Annual Percentage Rate (APR) represents the total annual cost of borrowing, expressed as a percentage. Unlike the stated interest rate, which only reflects the cost of the loan’s interest, the APR includes all fees charged by the lender. This provides a more comprehensive picture of the loan’s overall expense. A higher APR signifies a more expensive loan, even if the stated interest rate appears low. For example, a loan with a 5% interest rate and high origination fees could have a significantly higher APR than a loan with a 6% interest rate and low fees.

APR Components

The APR is calculated by taking the stated interest rate and adding all other loan fees, then annualizing the total cost. This means it reflects the total cost of borrowing over the entire loan term, expressed as a yearly percentage. A lender must clearly disclose the APR, which helps borrowers compare the true cost of different loan options.

Common Student Loan Fees

Several fees can significantly impact the overall cost of a student loan. Understanding these fees is vital to making a sound financial decision.

Origination fees are charges levied by the lender to process the loan application and fund the loan. These fees are typically a percentage of the loan amount and are added to the principal balance, increasing the total amount borrowed. For instance, a 1% origination fee on a $10,000 loan adds $100 to the principal, increasing the total amount to be repaid.

Late payment fees are penalties charged when a payment is not made by the due date. These fees can vary depending on the lender but often range from $15 to $30 or more per late payment. Consistent late payments can substantially increase the overall cost of the loan over time.

Other fees may include prepayment penalties (though less common in federal student loans), returned payment fees (for bounced checks), and potentially other administrative fees. Always carefully review the loan documents to understand all associated fees.

Illustrative APR Breakdown

Let’s consider a sample student loan with a $10,000 principal amount.

| Component | Amount |

|———————-|————|

| Principal Amount | $10,000.00 |

| Stated Interest Rate | 7% |

| Origination Fee | $100.00 |

| Total Fees | $100.00 |

In this example, the origination fee is added to the principal amount, resulting in a total loan amount of $10,100.00. The 7% interest rate is then applied to this total amount over the loan term to calculate the total interest paid. The APR will be higher than 7% due to the inclusion of the origination fee in the calculation. The exact APR will depend on the loan’s repayment terms. A longer repayment period will generally result in a higher total interest paid and thus a potentially higher APR, even with the same interest rate and fees. Conversely, a shorter repayment period, while requiring larger monthly payments, will generally result in less interest paid over the loan’s lifetime.

Strategies for Securing Favorable Rates

Securing a favorable interest rate on your student loans is crucial, as it directly impacts the total cost of your education. By proactively managing your credit and strategically shopping for loans, you can significantly reduce the amount you’ll pay over the life of your loan. This section Artikels practical strategies to achieve this goal.

Improving Credit Scores for Lower Interest Rates

A higher credit score significantly improves your chances of qualifying for lower interest rates on both federal and private student loans. Lenders view a strong credit history as an indicator of responsible financial behavior, making you a less risky borrower. Improving your credit score involves several key steps. First, pay all your bills on time, consistently. Late payments severely damage your credit score. Second, keep your credit utilization low; aim to use less than 30% of your available credit. Third, maintain a diverse mix of credit accounts, demonstrating responsible management of different credit types. Finally, avoid opening multiple new credit accounts in a short period, as this can negatively impact your score. Consistent and responsible credit management over several months or even years can lead to a noticeable improvement in your credit score, resulting in better loan offers. For example, a jump from a 650 to a 750 credit score could translate to a reduction of several percentage points in your interest rate.

Loan Comparison Shopping and Selection

Before committing to a student loan, thoroughly compare offers from multiple lenders. This involves examining not only the interest rate but also fees, repayment terms, and any other associated costs. Several online comparison tools can help simplify this process by allowing you to input your financial information and receive personalized loan offers. Don’t solely focus on the advertised interest rate; consider the Annual Percentage Rate (APR), which includes fees and other charges, to get a more accurate representation of the total cost. For instance, one lender might advertise a lower interest rate but charge higher origination fees, ultimately making another lender’s offer more cost-effective. Comparing loan terms, such as repayment periods and grace periods, is also essential, as these can significantly impact your monthly payments and overall loan cost.

Using a Co-Signer for Lower Interest Rates on Private Student Loans

A co-signer, typically a parent or other responsible adult with a strong credit history, can significantly improve your chances of securing a lower interest rate on a private student loan, especially if your own credit history is limited or less than ideal. The co-signer essentially guarantees the loan, reducing the lender’s risk. However, this comes with responsibilities for the co-signer, as they become legally obligated to repay the loan if you default. Therefore, thoroughly discuss the implications with your potential co-signer before using this strategy. It’s crucial to weigh the benefits of a lower interest rate against the potential burden on your co-signer. For example, a lower interest rate could save thousands of dollars over the life of the loan, but the co-signer assumes the financial responsibility if you are unable to repay.

Final Thoughts

Ultimately, securing a good interest rate on student loans requires careful planning and research. By understanding the various loan options available, comparing interest rates from different lenders, and employing smart repayment strategies, you can significantly reduce your overall borrowing costs and pave the way for a more financially secure future. Remember to proactively manage your credit and explore all available options to find the best fit for your individual circumstances.

Q&A

What is the difference between subsidized and unsubsidized federal student loans?

Subsidized loans don’t accrue interest while you’re in school, during grace periods, or while in deferment. Unsubsidized loans accrue interest from the time the loan is disbursed.

Can I refinance my student loans to get a lower interest rate?

Yes, refinancing can lower your interest rate, but it often involves switching from a federal loan to a private loan, potentially losing federal protections.

How does a co-signer affect my private student loan interest rate?

A co-signer with good credit can significantly improve your chances of getting a lower interest rate on a private student loan, as they share the responsibility of repayment.

What is an origination fee?

An origination fee is a one-time charge paid to the lender for processing your loan application. It’s usually a percentage of the loan amount.