Navigating the complex world of student loan interest rates can feel overwhelming. Understanding these rates is crucial, impacting not only the initial cost of your education but also the long-term financial burden of repayment. This guide provides a clear and concise overview of current rates, historical trends, and strategies for managing your student loan debt effectively, empowering you to make informed decisions about your financial future.

From federal and private loan distinctions to the influence of government policies and your personal credit score, we’ll explore the multifaceted factors that shape your interest rate. We’ll also delve into practical strategies for minimizing repayment costs and optimizing your repayment plan, equipping you with the knowledge to navigate this critical aspect of higher education financing.

Current Student Loan Interest Rates

Understanding current student loan interest rates is crucial for prospective and current borrowers. These rates significantly impact the total cost of a higher education and the repayment burden following graduation. Variations in rates exist due to several factors, including loan type, lender, and borrower creditworthiness.

The interest rate applied to a student loan determines the cost of borrowing. A higher interest rate means you’ll pay more in interest over the life of the loan, increasing the overall cost of your education. Conversely, a lower interest rate will result in lower overall interest payments.

Federal vs. Private Student Loan Interest Rates

Federal and private student loans differ significantly in how their interest rates are determined and the rates themselves. Federal loan rates are generally set by the government and are often lower than private loan rates, which are influenced by market conditions and the borrower’s credit profile.

| Loan Type | Undergraduate | Graduate | Factors Influencing Rates |

|---|---|---|---|

| Federal Subsidized Loans | Variable; check the current federal government website for the most up-to-date information. | Variable; check the current federal government website for the most up-to-date information. | Set by Congress annually; generally lower than private loan rates. |

| Federal Unsubsidized Loans | Variable; check the current federal government website for the most up-to-date information. | Variable; check the current federal government website for the most up-to-date information. | Set by Congress annually; generally lower than private loan rates. |

| Private Student Loans | Variable, typically higher than federal loan rates. | Variable, typically higher than federal loan rates. | Credit score, credit history, loan amount, co-signer (if applicable), and market interest rates. |

Note: The interest rates shown above are examples and are subject to change. Always consult the official websites of federal student aid programs and private lenders for the most current information.

Factors Influencing Student Loan Interest Rate Variation

Several factors contribute to the differences in interest rates across various student loan types. Understanding these factors can help borrowers make informed decisions about their financing options.

For federal loans, the government sets the interest rate based on various economic indicators and legislative decisions. These rates are often fixed for the life of the loan, offering predictability for borrowers. For private loans, the lender considers several factors to assess risk. A borrower with a strong credit history and a high credit score will typically qualify for a lower interest rate than someone with a weaker credit profile. The loan amount also influences the rate; larger loans may carry higher rates due to increased risk for the lender. The presence of a co-signer can positively impact the interest rate, as the co-signer’s creditworthiness reduces the lender’s risk.

Determining an Individual Student’s Interest Rate

The process of determining a student’s interest rate varies depending on whether the loan is federal or private. For federal loans, the interest rate is generally determined by the type of loan (subsidized or unsubsidized), the borrower’s educational level (undergraduate or graduate), and the loan disbursement year. The government publishes these rates annually. For private loans, the lender uses a more complex process, assessing the borrower’s creditworthiness, loan amount, and market conditions. A credit check is usually required, and the lender will review the borrower’s credit history, including payment history, debt-to-income ratio, and credit score. The higher the credit score and the lower the debt-to-income ratio, the better the chances of obtaining a lower interest rate. A co-signer with good credit can also significantly influence the interest rate offered.

Historical Trends in Student Loan Interest Rates

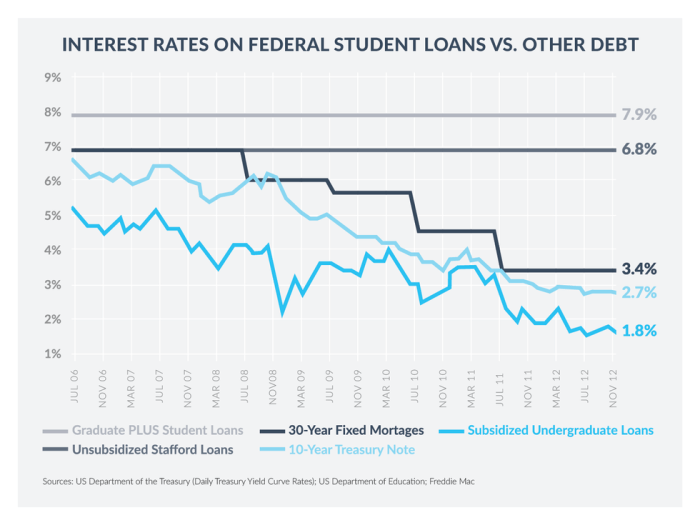

Understanding the historical trends in student loan interest rates provides valuable context for current borrowing conditions. Fluctuations in these rates reflect broader economic shifts and government policies, impacting both borrowers and the overall financial landscape. Analyzing these trends allows for a more informed understanding of the cost of higher education and its implications for future generations.

A graph depicting the fluctuation of federal student loan interest rates over the past 20 years would show a generally upward trend, albeit with significant year-to-year variations. The graph’s vertical axis would represent the interest rate (percentage), while the horizontal axis would represent the year (2004-2024). The line graph would illustrate periods of relatively stable rates interspersed with sharp increases and decreases. The visual representation would likely show peaks and troughs corresponding to major economic events and policy changes. For instance, periods of economic recession might be associated with lower rates as the Federal Reserve attempts to stimulate the economy, while periods of economic expansion might show higher rates. The overall upward trend would likely be less steep than the rate increases observed in the private loan market.

Major Economic Events Impacting Student Loan Interest Rates

Several key economic events have significantly influenced student loan interest rates. The 2008 financial crisis, for example, led to a decrease in interest rates across the board, including student loans, as the Federal Reserve implemented expansionary monetary policies to combat the recession. Conversely, periods of economic growth often see an increase in interest rates as the Federal Reserve attempts to control inflation. Government policies, such as changes to the federal budget or adjustments to student loan programs, also have a substantial impact. For example, legislative changes affecting subsidized and unsubsidized loan programs can directly influence the rates offered to students. The COVID-19 pandemic resulted in a temporary suspension of student loan payments and interest accrual, followed by a period of low interest rates before a gradual return to more typical levels.

Comparison of Federal and Private Student Loan Interest Rate Trends

Historically, federal student loan interest rates have been significantly lower than those of private student loans. This is primarily due to the government’s role in subsidizing these loans and the lower risk associated with them. Federal loan rates are often tied to broader economic indicators, such as the 10-year Treasury note yield, leading to predictable fluctuations based on market conditions. In contrast, private student loan rates are influenced by a wider array of factors, including the borrower’s creditworthiness, the lender’s risk assessment, and prevailing market conditions. Consequently, private loan interest rates have exhibited greater volatility and a generally steeper upward trend compared to federal loans over the past 20 years. Borrowers with poor credit or limited financial history may face substantially higher interest rates on private loans than those with strong credit profiles. This disparity highlights the importance of understanding the differences between federal and private loan options when planning for higher education financing.

Impact of Interest Rates on Student Loan Repayment

Understanding the impact of interest rates on student loan repayment is crucial for effective financial planning. Higher interest rates significantly increase the total cost of borrowing, extending repayment timelines and potentially impacting future financial goals. This section will explore the effects of varying interest rates on repayment amounts and discuss strategies to mitigate the burden of high interest.

The total amount repaid on a student loan is directly influenced by the interest rate applied. A higher interest rate leads to a larger portion of your monthly payments going towards interest, leaving less to reduce the principal balance. This results in a longer repayment period and a significantly higher total repayment amount. Conversely, lower interest rates reduce the overall cost and shorten the repayment timeline.

Hypothetical Repayment Plan

The following example illustrates the impact of different interest rates on a $30,000 student loan repaid over 10 years with a fixed monthly payment. These calculations assume simple interest for ease of understanding and do not include fees or other potential charges.

- Scenario 1: 5% Interest Rate: A 5% interest rate would result in a monthly payment of approximately $311 and a total repayment of approximately $37,320. The total interest paid would be approximately $7,320.

- Scenario 2: 7% Interest Rate: With a 7% interest rate, the monthly payment increases to approximately $339, and the total repayment rises to approximately $40,680. The total interest paid increases to approximately $10,680.

- Scenario 3: 10% Interest Rate: A 10% interest rate would lead to a monthly payment of approximately $380 and a total repayment of approximately $45,600. The total interest paid would be approximately $15,600.

As demonstrated, even a small increase in the interest rate can substantially increase the total amount repaid over the life of the loan.

Interest Capitalization’s Effect on Repayment Cost

Interest capitalization occurs when accrued interest is added to the principal loan balance. This effectively increases the principal amount on which future interest is calculated, leading to a snowball effect that significantly amplifies the total repayment cost. For example, if a borrower defers payments or enters into a forbearance period, the unpaid interest is capitalized, increasing the loan’s overall balance and future monthly payments. This can make repayment significantly more challenging.

Repayment Strategies to Minimize High-Interest Impact

Several strategies can help borrowers minimize the impact of high interest rates on their student loan repayment. These strategies require proactive planning and commitment.

- Income-Driven Repayment Plans: These plans adjust monthly payments based on income and family size, making repayment more manageable, particularly during periods of lower income. However, they often extend the repayment period, leading to higher total interest paid over time.

- Refinancing: Refinancing allows borrowers to secure a new loan with a lower interest rate, reducing monthly payments and the total amount repaid. This option is typically available to borrowers with good credit scores.

- Making Extra Payments: Paying more than the minimum monthly payment can significantly reduce the loan’s principal balance and shorten the repayment period. Even small extra payments can accumulate substantial savings over time.

- Consolidation: Combining multiple student loans into a single loan can simplify repayment and potentially secure a lower interest rate, depending on creditworthiness and market conditions.

Government Policies and Student Loan Interest Rates

Government policies play a significant role in shaping the student loan interest rate landscape, impacting both borrowers and lenders. These policies often aim to balance the need for accessible higher education with the financial stability of the lending system. The effectiveness of these interventions varies depending on the economic climate and the specific design of the policy.

Numerous government programs and policies directly or indirectly influence student loan interest rates. These interventions can range from direct subsidies to influence interest rates offered by lenders to regulatory changes impacting the lending market. The overall goal is often to make higher education more affordable and accessible, but the consequences can be complex and far-reaching.

Direct Subsidization of Student Loans

The government directly subsidizes a portion of student loans, effectively lowering the interest rate borrowers pay. This subsidy reduces the lender’s risk and, consequently, the interest rate they charge. The impact on borrowers is a lower monthly payment and a reduced overall loan burden. For lenders, while profitability per loan might be lower due to the subsidy, the increased volume of loans can compensate for this. The effectiveness of this approach depends on the level of subsidy provided and the overall demand for student loans. A higher subsidy leads to lower rates for borrowers but increases the government’s financial commitment.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans modify monthly payments based on a borrower’s income and family size. While not directly impacting the initial interest rate, IDR plans significantly influence the total repayment amount and the overall cost of the loan. Lower monthly payments can help borrowers manage their debt, but it often leads to a longer repayment period and increased interest accumulation over the life of the loan. The impact on lenders is a potential increase in the risk of loan default, although the government often insulates lenders from this risk through loan guarantees. The effectiveness of IDR plans depends on their design and the ability of borrowers to consistently meet their modified payment obligations.

Changes in Federal Lending Regulations

Government regulations concerning student loan lending can significantly affect interest rates. For instance, stricter regulations on lending practices, such as increased oversight of predatory lending, can lead to higher borrowing costs for students as lenders adjust to comply with the new rules. Conversely, deregulation could potentially lower borrowing costs but might also increase the risk of financial hardship for borrowers. The impact on lenders depends on their ability to adapt to the regulatory environment and maintain profitability. The effectiveness of these regulations depends on their ability to balance the need for consumer protection with maintaining access to credit for students. A balance is needed to avoid stifling the market while preventing predatory lending practices.

Private Student Loan Interest Rates and Lender Practices

Private student loans offer an alternative funding source for higher education, but understanding their interest rates and lender practices is crucial for responsible borrowing. These loans typically come with higher interest rates than federal loans and are subject to varying lender terms and conditions. Careful comparison shopping and a thorough understanding of your creditworthiness are essential before committing to a private student loan.

Private student loan interest rates are highly variable, influenced by several factors including the borrower’s creditworthiness, the loan’s terms, and the prevailing market conditions. Lenders use a range of criteria to assess risk and set interest rates, resulting in a diverse landscape of options for borrowers.

Private Student Loan Interest Rate Comparison

The following table provides a hypothetical comparison of interest rates offered by different private student loan lenders. Note that these rates are illustrative and can change frequently. Actual rates will depend on individual borrower circumstances and the specific loan product.

| Lender | Fixed APR (Undergraduate) | Variable APR (Undergraduate) | Fixed APR (Graduate) |

|---|---|---|---|

| Lender A | 7.00% – 13.00% | 6.50% – 12.50% | 8.00% – 14.00% |

| Lender B | 7.50% – 13.50% | 7.00% – 13.00% | 8.50% – 14.50% |

| Lender C | 6.50% – 12.50% | 6.00% – 12.00% | 7.50% – 13.50% |

| Lender D | 8.00% – 14.00% | 7.50% – 13.50% | 9.00% – 15.00% |

Creditworthiness Assessment and Interest Rate Determination

Private lenders employ a rigorous process to assess the creditworthiness of applicants. Factors considered include credit score, credit history, debt-to-income ratio, income verification, and co-signer availability. A higher credit score and a strong credit history generally lead to lower interest rates, reflecting a lower perceived risk for the lender. The absence of a strong credit history might necessitate a co-signer to secure a loan or result in a higher interest rate. Applicants with higher debt-to-income ratios may also face higher rates.

Terms and Conditions of Private Student Loans

Private student loans typically involve various fees and repayment options. Common fees include origination fees, which are charged at the loan’s inception, and late payment fees, levied for missed or delayed payments. Repayment options may include fixed-rate or variable-rate loans, with varying repayment periods. Some lenders offer deferment or forbearance options in case of financial hardship, but these options should be carefully considered as they can increase the overall cost of borrowing. Borrowers should carefully review the loan agreement to fully understand all terms and conditions before signing.

Strategies for Managing Student Loan Debt with High Interest Rates

Managing high-interest student loan debt requires a proactive and strategic approach. Failing to address high interest rates effectively can significantly increase the total cost of repayment over the loan’s lifetime. This section Artikels actionable strategies to help borrowers navigate this challenge.

Addressing high-interest student loans necessitates a multi-pronged approach encompassing both immediate actions and long-term planning. Prioritizing repayment, exploring refinancing options, and creating a robust budget are crucial steps towards minimizing the financial burden of student loan debt.

Strategies for Reducing High-Interest Student Loan Debt

Several strategies can be employed to effectively manage high-interest student loans. These strategies focus on minimizing interest accrual and accelerating repayment.

- Prioritize High-Interest Loans: Focus extra payments on loans with the highest interest rates. This minimizes the total interest paid over the life of the loans. For example, if you have a loan with a 7% interest rate and another with a 4% interest rate, make extra payments on the 7% loan first.

- Explore Loan Refinancing: Refinancing can consolidate multiple loans into a single loan with a lower interest rate, potentially saving significant money over time. However, careful consideration of the terms and conditions is crucial.

- Income-Driven Repayment Plans: Explore income-driven repayment plans offered by the government. These plans adjust your monthly payments based on your income and family size, making them more manageable, although they may extend the repayment period.

- Make Extra Payments: Even small extra payments can significantly reduce the total interest paid and shorten the repayment period. Consider making bi-weekly payments instead of monthly payments; this is equivalent to making an extra monthly payment each year.

- Debt Avalanche vs. Debt Snowball: The debt avalanche method prioritizes paying off the loan with the highest interest rate first, while the debt snowball method prioritizes paying off the smallest loan first for motivational purposes. Choose the method that best suits your personality and financial goals.

Refinancing Student Loans: Benefits and Drawbacks

Refinancing student loans can be a powerful tool for managing high-interest debt, but it’s essential to weigh the potential benefits against the drawbacks.

- Benefits: Lower interest rates, simplification of repayment (consolidation of multiple loans), potentially lower monthly payments.

- Drawbacks: Loss of federal loan benefits (e.g., income-driven repayment plans, deferment options), potential for higher fees, risk of locking into a longer repayment term if not carefully considered.

Before refinancing, carefully compare offers from multiple lenders and ensure the new interest rate is significantly lower than your current rates. Consider the total cost of the loan, including any fees, and the length of the repayment term.

Budgeting and Prioritizing Loan Repayment

Effective budgeting is critical for managing student loan debt. A well-structured budget helps allocate funds for loan repayment while covering essential living expenses.

Creating a detailed budget involves tracking all income and expenses. Categorize expenses to identify areas where savings can be made. Prioritize loan repayment within the budget, allocating as much as possible towards high-interest loans. Regularly review and adjust the budget as needed to ensure it remains aligned with your financial goals and repayment plan.

For example, a borrower could track their monthly income, allocate funds for rent, groceries, transportation, and other necessities, and then dedicate a specific amount towards student loan repayment. By carefully tracking expenses and identifying areas for potential savings, the borrower can maximize the amount available for loan repayment.

The Role of Credit Scores in Determining Interest Rates

Your credit score plays a significant role in determining the interest rate you’ll receive on private student loans. Unlike federal student loans, which primarily base interest rates on factors like the loan type and the year the loan was disbursed, private lenders heavily consider your creditworthiness when setting interest rates. A higher credit score generally translates to a lower interest rate, while a lower score can result in significantly higher rates or even loan denial.

Lenders use your credit score as an indicator of your ability and willingness to repay debt. A strong credit history demonstrates responsible financial behavior, reducing the lender’s perceived risk. Conversely, a poor credit history suggests a higher risk of default, leading lenders to charge higher interest rates to compensate for this increased risk. This relationship is not always linear, but the general trend is clear: better credit, better rates.

Credit Score Impact on Interest Rates

The impact of credit scores on interest rates can be substantial. For instance, a borrower with an excellent credit score (750 or higher) might qualify for a private student loan with an interest rate of 6%, while a borrower with a fair credit score (650-699) might face an interest rate of 10% or more on the same loan. This difference in interest rates can lead to thousands of dollars in additional interest payments over the life of the loan. Consider a $20,000 loan: a 4% difference in interest rate can easily add $2,000-$4,000 or more to the total repayment cost. This demonstrates the importance of maintaining a good credit score when applying for private student loans.

Strategies for Improving Credit Scores

Improving your credit score before applying for private student loans can significantly reduce your interest rate and save you money in the long run. Several strategies can help improve your creditworthiness.

Improving your credit score involves consistent and responsible financial behavior. This includes paying all bills on time, consistently, maintaining low credit utilization (the percentage of available credit you’re using), and avoiding opening multiple new credit accounts within a short period. Regularly monitoring your credit report for errors and addressing any inaccuracies is also crucial. Building a positive credit history takes time, but the long-term benefits are substantial, particularly when it comes to securing favorable loan terms. Credit repair services can be helpful, but it’s important to be cautious and choose reputable providers to avoid scams.

Epilogue

Successfully managing student loan debt requires a proactive and informed approach. By understanding the intricacies of interest rates, historical trends, and available repayment strategies, you can significantly reduce the long-term financial impact of your student loans. This guide has provided a foundational understanding, empowering you to make well-informed decisions and build a secure financial future. Remember to regularly review your loan terms and explore options to minimize your overall repayment costs.

Key Questions Answered

What is the difference between fixed and variable interest rates for student loans?

Fixed interest rates remain constant throughout the loan’s life, providing predictability. Variable rates fluctuate based on market conditions, potentially leading to lower initial payments but higher overall costs if rates rise.

Can I refinance my student loans to lower my interest rate?

Yes, refinancing can lower your interest rate, but it typically involves a new loan from a private lender, potentially altering your repayment terms. Carefully compare offers before refinancing.

What happens if I don’t make my student loan payments?

Failure to make payments can result in delinquency, negatively impacting your credit score and potentially leading to wage garnishment or tax refund offset.

How does my credit score affect my student loan interest rate?

A higher credit score generally qualifies you for lower interest rates, as lenders perceive you as a lower risk. Improving your credit score can significantly impact your loan terms.