Navigating the complexities of student loan repayment can feel overwhelming. Understanding interest rates is crucial for making informed financial decisions and avoiding long-term debt burdens. This guide provides a comprehensive overview of student loan interest rates, explaining how they’re calculated, the impact of different repayment plans, and how to effectively utilize an interest rate calculator to plan for your future.

We’ll explore the differences between fixed and variable interest rates, delve into the factors influencing these rates (like credit score and market conditions), and demonstrate how to use a calculator to compare various loan offers and repayment strategies. By understanding these concepts, you can gain a clearer picture of your total repayment costs and choose the most financially sound path for your circumstances.

Understanding Student Loan Interest Rates

Understanding student loan interest rates is crucial for planning your repayment strategy and minimizing the total cost of your education. The interest rate determines how much extra you’ll pay on top of your principal loan amount. Different types of loans and lending institutions have varying interest rate structures, impacting your overall borrowing experience.

Fixed vs. Variable Interest Rates

Student loans typically come with either fixed or variable interest rates. A fixed interest rate remains the same throughout the life of the loan, providing predictability in your monthly payments. A variable interest rate, on the other hand, fluctuates based on an underlying index, such as the prime rate or LIBOR (London Interbank Offered Rate). This means your monthly payment could increase or decrease over time, depending on market conditions. Choosing between a fixed and variable rate depends on your risk tolerance and predictions about future interest rate movements. A fixed rate offers stability, while a variable rate might offer lower initial payments but carries the risk of higher payments later.

Interest Rate Determination for Federal and Private Student Loans

Federal student loan interest rates are set by the government and generally tend to be lower than private loan rates. They are often tied to the 10-year Treasury note yield and adjusted annually. The specific rate depends on the loan type (e.g., subsidized or unsubsidized) and the student’s loan history. Private student loan interest rates, conversely, are determined by the lender based on several factors, including the borrower’s creditworthiness, credit score, loan amount, and the prevailing market interest rates. Lenders assess the risk of lending to you and adjust the interest rate accordingly. Generally, borrowers with higher credit scores and lower debt-to-income ratios qualify for lower interest rates.

Interest Capitalization and its Impact on Loan Repayment

Interest capitalization is the process of adding accrued interest to the principal balance of a loan. This typically occurs when a borrower is in deferment or forbearance, periods where payments are temporarily suspended. For example, imagine you have a $10,000 loan with a 5% interest rate. If you defer payments for a year, the interest accrued during that year ($500) is added to your principal balance, increasing it to $10,500. Future interest will then be calculated on this higher amount, leading to a larger overall repayment amount. Understanding how interest capitalization works is crucial, as it can significantly increase the total cost of your loan over time. It’s advisable to minimize periods of deferment or forbearance whenever possible.

Comparison of Student Loan Interest Rates

| Loan Type | Interest Rate Type | Rate Determination | Typical Rate Range |

|---|---|---|---|

| Federal Subsidized Loan | Fixed | Government-set, tied to Treasury note yield | 1-7% (varies yearly) |

| Federal Unsubsidized Loan | Fixed | Government-set, tied to Treasury note yield | 1-7% (varies yearly) |

| Private Student Loan | Fixed or Variable | Lender-determined, based on creditworthiness | 3-15% (varies widely) |

How Student Loan Interest Rate Calculators Work

Student loan interest rate calculators are valuable tools that simplify the complex process of understanding the financial implications of borrowing for education. They use straightforward mathematical principles to estimate monthly payments and total repayment costs, allowing borrowers to make informed decisions about their loan options. By inputting key variables, users can quickly see the potential long-term effects of different loan terms and interest rates.

Understanding how these calculators work involves grasping the fundamental mathematics behind compound interest and its application to loan amortization. The calculators process user inputs to project the future cost of borrowing, making the often-daunting task of loan planning more manageable.

Input Variables

A typical student loan calculator requires three primary input variables: the loan amount, the annual interest rate, and the repayment period (loan term). The loan amount represents the total principal borrowed. The annual interest rate reflects the cost of borrowing, expressed as a percentage. Finally, the repayment period specifies the length of time, usually in months or years, over which the loan will be repaid. These inputs are crucial, as they directly influence the calculated monthly payment and total interest paid. Accuracy in providing these values is paramount for receiving an accurate estimate.

Mathematical Principles

The core mathematical principle underlying student loan interest calculations is compound interest. This means that interest accrues not only on the principal loan amount but also on the accumulated interest from previous periods. The formula for calculating simple interest is relatively straightforward: Interest = Principal x Rate x Time. However, student loans typically utilize compound interest calculations, which are more complex and result in significantly higher total interest paid over the life of the loan. The exact formula used in calculators is iterative and involves calculating interest and principal payments for each period of the loan.

Calculation Process Flowchart

Imagine a flowchart with the following steps:

1. Start: The calculator receives the loan amount, interest rate, and loan term as input.

2. Calculate Monthly Interest Rate: The annual interest rate is divided by 12 to get the monthly rate.

3. Calculate Number of Payments: The loan term (in years) is multiplied by 12 to get the total number of monthly payments.

4. Amortization Calculation: A formula is applied repeatedly to determine the monthly payment amount. This formula considers the principal, monthly interest rate, and the number of payments. The formula accounts for both interest and principal repayment in each monthly payment.

5. Iterative Calculation: The calculator iterates through each month of the loan term. For each month, it calculates the interest accrued on the remaining principal balance, subtracts the principal portion of the monthly payment, and updates the remaining principal balance.

6. Total Interest Calculation: The calculator sums up the interest paid over all months.

7. Total Repayment Calculation: The total repayment is calculated by adding the principal loan amount and the total interest.

8. Output: The calculator displays the monthly payment, total interest paid, and total repayment amount.

9. End: The calculation is complete.

Example Calculation

Let’s consider two scenarios with a $20,000 loan:

Scenario 1: 5% Interest Rate, 10-Year Repayment

In this scenario, a student loan calculator would likely show a monthly payment around $212 and a total repayment cost of approximately $25,440, with around $5,440 in total interest paid.

Scenario 2: 7% Interest Rate, 10-Year Repayment

With a higher interest rate, the monthly payment would increase, perhaps to around $239, and the total repayment cost would rise to approximately $28,680, resulting in roughly $8,680 in total interest paid.

This example demonstrates how a seemingly small difference in interest rates can significantly impact the overall cost of the loan over time. The higher interest rate leads to a considerably larger total repayment amount. This highlights the importance of securing the lowest possible interest rate when borrowing for education.

Impact of Different Repayment Plans

Choosing the right student loan repayment plan significantly impacts your monthly budget and the total amount you’ll pay over the life of your loan. Understanding the differences between available plans is crucial for effective long-term financial planning. This section compares four common repayment plans: Standard, Extended, Graduated, and Income-Driven.

Comparison of Repayment Plans

The following table summarizes the key features of each repayment plan. Note that specific details may vary depending on your loan servicer and the type of federal student loan you have.

| Repayment Plan | Monthly Payment | Loan Term | Suitability |

|---|---|---|---|

| Standard | Fixed, typically higher | 10 years | Borrowers with stable income and a preference for paying off loans quickly. |

| Extended | Fixed, lower than standard | Up to 25 years | Borrowers who prefer lower monthly payments, even if it means paying more interest overall. |

| Graduated | Starts low, increases over time | 10 years | Borrowers anticipating income growth, allowing for lower initial payments that gradually increase. |

| Income-Driven (IBR, PAYE, REPAYE, ICR) | Based on income and family size | 20-25 years | Borrowers with low income relative to their loan amount, potentially leading to loan forgiveness after 20-25 years. |

Illustrative Examples of Repayment Plan Impact

Let’s consider a hypothetical scenario: A borrower has a $30,000 federal student loan with a 6% interest rate. The impact of different repayment plans on monthly payments and total interest paid is shown below. These are simplified examples and actual figures may vary based on specific loan terms and servicer calculations.

| Repayment Plan | Approximate Monthly Payment | Approximate Total Interest Paid | Total Repaid |

|---|---|---|---|

| Standard (10 years) | $330 | $11,700 | $41,700 |

| Extended (25 years) | $165 | $24,000 | $54,000 |

| Graduated (10 years, starting low) | Variable, starting around $200, increasing annually | $13,000 (estimate) | $43,000 (estimate) |

| Income-Driven (20 years, assuming consistent income) | Variable, dependent on income | $18,000 (estimate) | $48,000 (estimate) |

Long-Term Financial Implications

Choosing a repayment plan is a long-term commitment. The standard plan, while resulting in higher monthly payments, significantly reduces total interest paid and shortens the repayment period. Conversely, income-driven repayment plans offer lower monthly payments but often extend the repayment period and lead to higher total interest paid. However, they may also offer loan forgiveness after a specified period, which can be a significant advantage for borrowers with consistently low incomes. Extended repayment plans provide lower monthly payments but significantly increase total interest paid over the life of the loan. Graduated repayment plans offer a compromise, starting with lower payments and gradually increasing them, but total interest may still be substantial. Careful consideration of your current financial situation, income projections, and long-term goals is vital for making the most informed decision.

Factors Influencing Student Loan Interest Rates

Securing a student loan involves understanding the various factors that determine the interest rate you’ll be charged. These rates directly impact the total cost of your education, so it’s crucial to be informed. Several key elements play a role, ranging from your personal creditworthiness to broader economic conditions.

Several interconnected factors determine the interest rate you’ll receive on your student loan. These factors are not always equally weighted, and their relative importance can vary depending on the type of loan and the lender. Understanding these influences empowers you to make informed decisions and potentially secure a more favorable rate.

Credit Score’s Influence on Interest Rates

Your credit score is a significant factor in determining your student loan interest rate, particularly for private student loans. Lenders use credit scores to assess your creditworthiness – your ability to repay the loan. A higher credit score generally indicates a lower risk to the lender, leading to a lower interest rate. Conversely, a lower credit score suggests a higher risk, resulting in a higher interest rate or even loan denial. For example, a borrower with an excellent credit score (750 or above) might qualify for a significantly lower interest rate compared to a borrower with a fair credit score (650-699). This difference can translate to thousands of dollars in interest paid over the life of the loan.

Loan Type and Interest Rate Correlation

The type of student loan you obtain – federal or private – significantly impacts the interest rate. Federal student loans generally offer fixed interest rates determined by Congress, which are typically lower than private loan rates. These rates are often subsidized (meaning the government pays the interest during certain periods, like deferment) or unsubsidized (interest accrues while you’re in school). Private student loans, on the other hand, have variable or fixed interest rates set by the lender based on factors like your credit score, income, and the loan’s terms. The interest rates on private loans are usually higher and more susceptible to market fluctuations.

Economic Factors and Their Impact

Broader economic conditions, such as inflation and Federal Reserve policies, also influence student loan interest rates, primarily impacting private loans and the rates offered on variable-rate federal loans. Inflation, which is a general increase in prices, can lead to higher interest rates as lenders adjust their rates to compensate for the decreased purchasing power of money. Similarly, Federal Reserve policies, such as changes in the federal funds rate (the target rate banks charge each other for overnight loans), influence the overall cost of borrowing, which then affects student loan interest rates. For instance, if the Federal Reserve raises the federal funds rate to combat inflation, this generally leads to higher interest rates across the board, including student loans.

Strategies for Securing Lower Interest Rates

Improving your creditworthiness is key to securing lower interest rates. Here are some strategies borrowers can employ:

- Maintain a good credit history: Pay all bills on time and keep credit utilization low.

- Improve your credit score: Address any negative marks on your credit report and avoid opening multiple new accounts.

- Explore federal student loan options: Federal loans often have lower interest rates than private loans.

- Consider a co-signer: A co-signer with good credit can help you qualify for a lower interest rate.

- Shop around for the best rates: Compare offers from multiple lenders to find the most favorable terms.

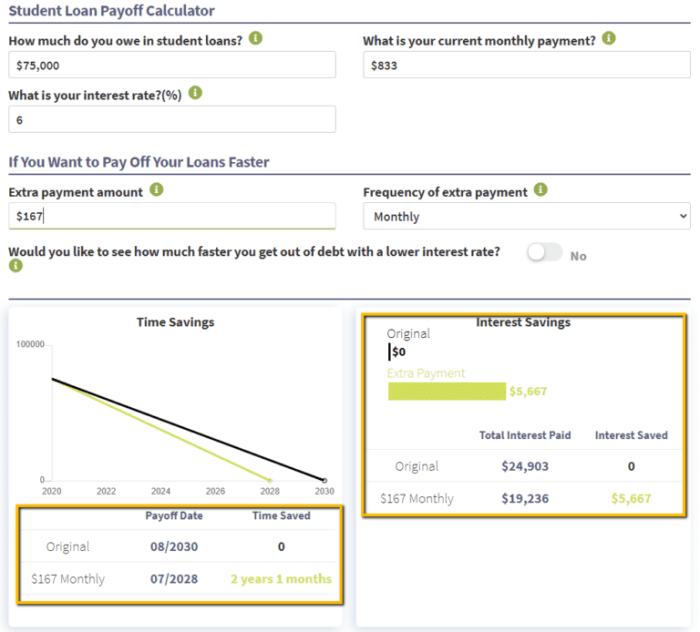

Using a Student Loan Interest Rate Calculator Effectively

Student loan interest rate calculators are invaluable tools for understanding the true cost of your education and for making informed borrowing decisions. By accurately inputting your information and carefully interpreting the results, you can significantly improve your financial planning and avoid unexpected debt burdens. This section will guide you through the process of effectively utilizing these calculators.

Accurate inputting of information is paramount for receiving reliable results from a student loan interest rate calculator. The accuracy of the output is directly dependent on the accuracy of the input. Most calculators will require you to input the principal loan amount, the interest rate (typically expressed as a percentage), the loan term (length of the loan in years or months), and any additional fees. Be meticulous in entering these figures; a small error in any one of these values can significantly alter the calculated total interest paid and the monthly payment amount.

Accurate Information Input

To ensure accurate results, begin by gathering all necessary information about your student loans. This includes the principal loan amount (the original amount borrowed), the annual interest rate (expressed as a percentage), and the loan term (the length of the repayment period, usually in months or years). You’ll also need to account for any additional fees associated with the loan, such as origination fees or late payment penalties. Inputting these figures precisely is crucial; even minor discrepancies can lead to significant variations in the calculated total cost.

The Importance of Including All Fees and Charges

Many student loan calculators allow for the input of additional fees. It is crucial to include all associated fees when using the calculator, as these fees can significantly increase the overall cost of your loan. These fees can include origination fees (charged by the lender at the time the loan is disbursed), late payment fees, and prepayment penalties (fees charged if you pay off your loan early). Failing to account for these fees will result in an underestimation of your total repayment cost, potentially leading to inaccurate financial planning.

Interpreting Calculator Results

Once you’ve entered all the necessary information, the calculator will typically provide several key outputs. These usually include the total interest paid over the life of the loan, the monthly payment amount, and an amortization schedule (a table showing the breakdown of principal and interest payments for each payment period). Carefully review each of these outputs to gain a complete understanding of the financial implications of your loan. For example, a result showing a high total interest paid may indicate the need to explore alternative loan options or repayment plans.

Comparing Loan Offers and Repayment Options

Student loan interest rate calculators are invaluable tools for comparing different loan offers and repayment options. By inputting the details of each loan offer into the calculator, you can directly compare the total cost, monthly payments, and overall repayment duration. This allows you to make an informed decision by choosing the loan option that best aligns with your financial capabilities and long-term goals. For instance, you might compare a loan with a lower interest rate but a longer repayment term to a loan with a higher interest rate but a shorter repayment term, considering the trade-offs between total interest paid and monthly payment amounts.

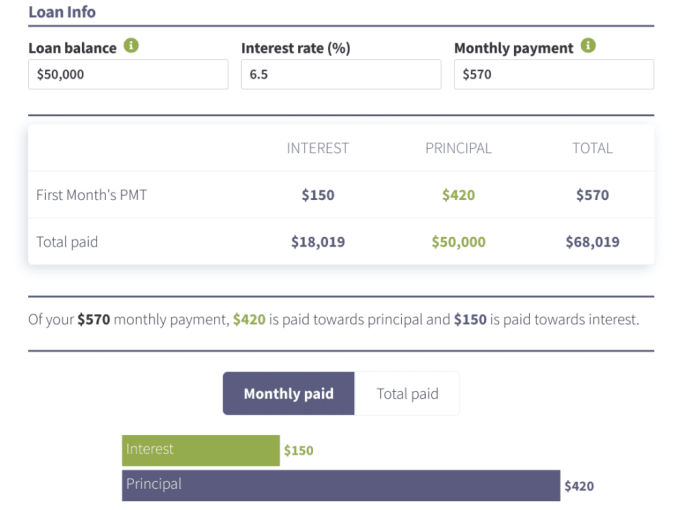

Visual Representation of Loan Repayment

Understanding the repayment process for student loans is crucial for effective financial planning. Visual aids can significantly enhance this understanding by clearly illustrating the complex interplay between loan amount, interest rate, and total repayment cost. The following sections will present visual representations to clarify these relationships.

Loan Amount, Interest Rate, and Total Repayment Cost

A three-dimensional graph provides the most effective visual representation of the relationship between loan amount, interest rate, and total repayment cost. The X-axis would represent the loan amount (e.g., $10,000 to $100,000), the Y-axis the interest rate (e.g., 2% to 10%), and the Z-axis the total repayment cost. The graph would show a surface rising steeply as both loan amount and interest rate increase. For instance, a $50,000 loan at 5% interest would have a significantly lower total repayment cost compared to a $100,000 loan at 10% interest. This visual would immediately demonstrate the exponential effect of higher loan amounts and interest rates on the final cost. The surface’s slope would also visually represent the sensitivity of total repayment cost to changes in interest rates and loan amounts.

Principal and Interest Payment Breakdown Over Loan Term

This visual uses a bar chart to show the distribution of principal and interest payments over the life of the loan. The X-axis represents the time period (e.g., year 1, year 2, etc., up to the loan term). The Y-axis represents the dollar amount. Two bars for each time period illustrate the principal and interest payments for that period. In the early years, a larger portion of the payment goes towards interest, while in later years, a larger portion goes towards the principal. This is represented visually by the relative heights of the bars.

| Year | Principal Payment | Interest Payment | Total Payment |

|---|---|---|---|

| 1 | $1,000 | $3,000 | $4,000 |

| 2 | $1,500 | $2,500 | $4,000 |

| 3 | $2,000 | $2,000 | $4,000 |

| 4 | $2,500 | $1,500 | $4,000 |

For example, a 10-year loan with a fixed monthly payment might show a gradual decrease in the interest portion and a corresponding increase in the principal portion over time. This visual clearly shows how the proportion of each payment changes throughout the repayment period, highlighting the importance of early repayment to minimize overall interest paid. The table above provides a sample breakdown; actual values would vary based on loan amount, interest rate, and repayment plan.

Final Review

Successfully managing student loan debt requires careful planning and a thorough understanding of interest rates and repayment options. By utilizing the information and tools presented in this guide, you can confidently navigate the complexities of student loan repayment, make informed decisions, and achieve long-term financial stability. Remember to always factor in all fees and charges when using a loan calculator for accurate projections. Proactive planning empowers you to take control of your financial future.

Key Questions Answered

What is the difference between fixed and variable interest rates?

Fixed interest rates remain constant throughout the loan term, while variable rates fluctuate based on market conditions. Fixed rates offer predictability, while variable rates could potentially lead to lower initial payments but higher costs overall if rates rise.

How does my credit score affect my interest rate?

A higher credit score generally qualifies you for lower interest rates. Lenders perceive borrowers with good credit as less risky.

Can I refinance my student loans to get a lower interest rate?

Yes, refinancing may be an option to secure a lower interest rate, but carefully compare offers and fees before making a decision. Consider the impact on your overall loan term.

What happens if I miss a student loan payment?

Missing payments can negatively impact your credit score and may result in late fees and increased interest charges. It can also lead to loan default.