Navigating the complexities of student loan financing can feel overwhelming, particularly when understanding the nuances of subsidized loans. This guide provides a comprehensive overview of subsidized student loan interest rates, exploring how they’re determined, the factors influencing them, and how they compare to other loan types. We’ll delve into the historical context, examine current rates, and offer practical strategies for managing your debt effectively. Understanding these rates is crucial for making informed financial decisions and ensuring a smoother path towards repaying your student loans.

From the interplay of economic indicators and government policies to the impact on individual borrowers, we will illuminate the key aspects of subsidized student loan interest rates. We’ll explore various repayment plans, the benefits of consolidation, and offer illustrative scenarios to provide a clearer picture of the financial implications involved. Ultimately, our aim is to empower you with the knowledge necessary to confidently manage your subsidized student loan debt.

Understanding Subsidized Student Loan Interest Rates

Subsidized and unsubsidized federal student loans are both designed to help students finance their education, but they differ significantly in how interest accrues. Understanding these differences is crucial for responsible financial planning during and after college.

The key distinction lies in interest accrual. With subsidized loans, the government pays the interest while you’re in school at least half-time, during grace periods, and during certain deferment periods. Unsubsidized loans, however, begin accruing interest from the moment the loan is disbursed, regardless of your enrollment status. This means you’ll owe more upon graduation with an unsubsidized loan than a subsidized loan of the same amount.

Subsidized Loan Interest Rate Determination

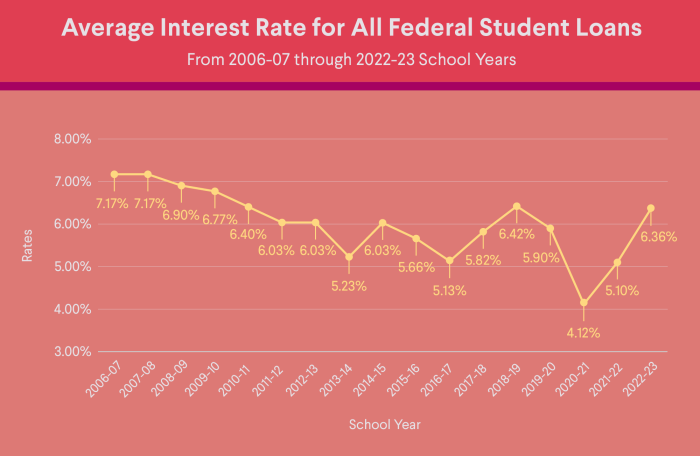

The interest rate for subsidized federal student loans is determined annually by Congress and is fixed for the life of the loan. This rate is usually set based on the 10-year Treasury note auction held in May of the previous year. Several factors influence the final rate, including economic conditions and government budget priorities. It’s important to note that the rate is not directly tied to market fluctuations, ensuring some level of predictability for borrowers. The rate remains consistent throughout the loan’s repayment period.

Historical Overview of Subsidized Student Loan Interest Rates

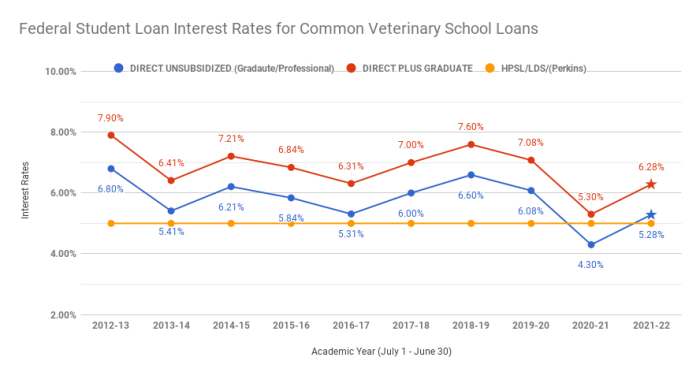

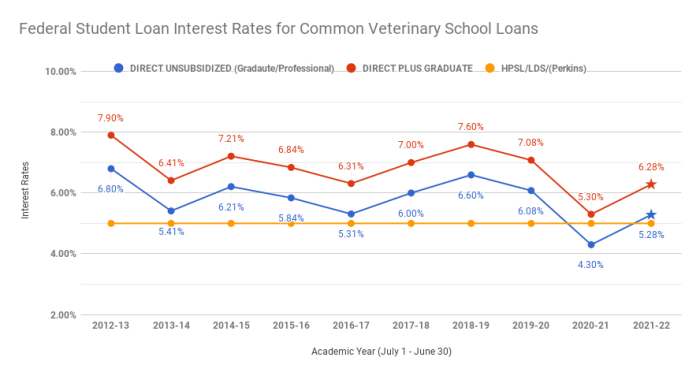

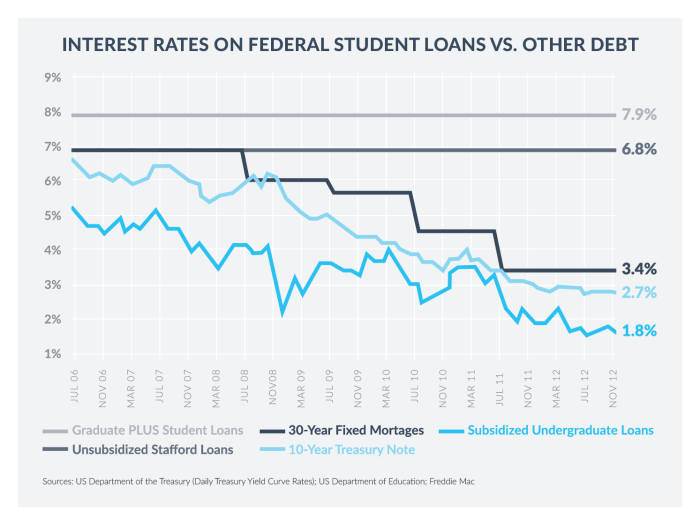

Subsidized student loan interest rates have fluctuated over time, reflecting broader economic trends. For instance, rates were generally lower in the early 2000s and then increased significantly during the late 2000s and early 2010s, influenced by factors like the 2008 financial crisis. More recently, rates have been relatively stable, though they can still vary slightly from year to year depending on the prevailing economic climate and Congressional decisions. Access to historical data from the U.S. Department of Education’s website provides a more complete picture of these fluctuations.

Comparison of Subsidized Loan Interest Rates Across Programs

The following table compares interest rates for subsidized loans across different federal student loan programs. Note that these rates are subject to change and may vary slightly depending on the loan disbursement year. It’s essential to consult the official federal student aid website for the most up-to-date information.

| Loan Program | Interest Rate (Example – subject to change) | Repayment Period (Example) | Subsidy Details |

|---|---|---|---|

| Direct Subsidized Loan (Undergraduate) | 4.99% | 10-20 years | Interest subsidized during in-school, grace, and deferment periods. |

| Direct Subsidized Loan (Graduate) | 6.54% | 10-20 years | Interest subsidized during in-school, grace, and deferment periods. |

| Federal Perkins Loan (Limited Availability) | 5% (Fixed) | 9-10 years | Interest subsidized during in-school, grace, and deferment periods. |

Factors Influencing Subsidized Loan Interest Rates

The interest rate on subsidized student loans isn’t set arbitrarily; it’s a dynamic figure influenced by a complex interplay of economic factors and government policies. Understanding these influences is crucial for borrowers to anticipate potential rate fluctuations and make informed financial decisions. These rates directly impact the total cost of a student’s education and their ability to manage repayment.

Economic Factors Influencing Interest Rates

Several key economic indicators significantly affect subsidized student loan interest rates. These rates often move in tandem with broader economic trends, reflecting the overall cost of borrowing money in the economy. The government, when setting these rates, considers the prevailing market conditions to ensure a sustainable and equitable system.

Government Policy Changes and Interest Rates

Government policy plays a dominant role in shaping subsidized student loan interest rates. Congressional action directly sets or influences the interest rate, often through annual appropriations bills or dedicated legislation addressing student financial aid. Changes in government priorities, such as increased focus on affordability or budget constraints, can lead to immediate or gradual adjustments in the rates. For example, a decision to prioritize affordability might result in lower interest rates, while budgetary concerns could lead to increases.

The Federal Budget and Subsidized Loan Interest Rates

The federal budget has a direct impact on the availability of funds for subsidized student loan programs and, consequently, on interest rates. If the government allocates more funds to student aid, it may be able to offer lower interest rates, reflecting a lower cost of borrowing for the government itself. Conversely, budgetary constraints might necessitate higher interest rates to ensure the long-term solvency of the program. This relationship is complex and involves considerations of overall fiscal policy, debt levels, and competing demands for government spending.

Inflation’s Impact on Subsidized Loan Interest Rates

Inflation, a general increase in the prices of goods and services, significantly impacts interest rates across the board, including those on subsidized student loans. When inflation rises, the purchasing power of money decreases. To compensate for this erosion of value, lenders, including the government in this case, often increase interest rates to maintain the real return on their investment. For example, if inflation increases by 3%, the government might adjust the subsidized loan interest rate upward to ensure the loan’s real value isn’t diminished over time. This ensures that the government receives a sufficient return on its investment, accounting for the impact of inflation. A hypothetical scenario: Let’s say the subsidized loan interest rate is 4% and inflation unexpectedly jumps to 6%. To offset the loss of purchasing power, the government might raise the interest rate to, say, 7% or higher, ensuring the real return on the loan remains positive.

Subsidized Loan Interest Rate vs. Other Loan Types

Understanding the interest rate on your subsidized federal student loan is crucial, but it’s equally important to compare it to other loan options to make informed borrowing decisions. This section will contrast subsidized federal student loan interest rates with those of private student loans, highlighting scenarios where subsidized loans prove advantageous and outlining the key advantages and disadvantages of each.

Subsidized federal student loans, offered by the government, typically have lower interest rates than private student loans. This difference stems from the lower risk associated with government-backed loans. Private lenders, on the other hand, assess risk based on individual creditworthiness and other factors, leading to potentially higher interest rates for borrowers with less favorable credit profiles.

Comparison of Interest Rates: Subsidized vs. Private Student Loans

The interest rate on a subsidized federal student loan is determined by Congress and can vary from year to year. Private student loan interest rates are set by the lender and depend on factors like credit score, loan amount, and the borrower’s co-signer (if applicable). Generally, subsidized federal loans will offer a more favorable interest rate, particularly for students with limited or no credit history. However, the total cost of borrowing can still be significant, depending on the loan amount and repayment period. For example, a subsidized federal loan might have a fixed interest rate of 5%, while a private loan for the same borrower could have a variable interest rate ranging from 7% to 12% depending on market conditions and the borrower’s creditworthiness. This significant difference in interest rates can lead to substantial savings over the life of the loan.

Situations Where Subsidized Loans Offer a Better Rate

Several scenarios highlight the benefits of subsidized federal student loans compared to private options. For instance, students with limited or no credit history will often find it difficult to secure a private student loan with a competitive interest rate. In such cases, a subsidized federal loan, which doesn’t require a credit check, presents a much more attractive option. Furthermore, students attending low-income schools or those from disadvantaged backgrounds may benefit significantly from the lower interest rates and greater accessibility of subsidized federal loans. Lastly, the fixed interest rate of a subsidized loan provides certainty and avoids the risk of fluctuating interest rates associated with some private loans. A predictable repayment schedule makes budgeting easier.

Advantages and Disadvantages of Subsidized Loans Compared to Other Loan Types

It’s beneficial to weigh the pros and cons of subsidized federal loans against other loan options.

- Advantage: Lower Interest Rates: Subsidized federal loans generally offer lower interest rates than private student loans, leading to significant long-term savings.

- Advantage: No Credit Check Required: Eligibility for subsidized federal loans doesn’t depend on credit history, making them accessible to students with limited or no credit.

- Advantage: Fixed Interest Rates: Subsidized federal loans usually have fixed interest rates, eliminating the risk of fluctuating payments.

- Disadvantage: Loan Limits: There are limits on how much you can borrow through subsidized federal loans. You may need to supplement with unsubsidized federal loans or private loans to cover all your educational expenses.

- Disadvantage: Government Regulations: Federal loans are subject to government regulations, which may include specific repayment plans and restrictions.

- Disadvantage: Potential for Higher Overall Cost (in certain scenarios): While generally offering lower interest rates, if a student qualifies for an exceptionally low rate private loan (e.g., through a parent’s excellent credit), the total cost of borrowing might be slightly lower than a subsidized loan if the loan amounts are similar.

Managing Subsidized Student Loan Debt

Successfully navigating subsidized student loan debt requires a proactive approach and a thorough understanding of available repayment options. Effective management minimizes long-term costs and ensures timely repayment, ultimately contributing to improved financial health. This section will explore strategies and tools to help borrowers effectively manage their loans.

Strategies for Effective Debt Management

Developing a robust strategy is crucial for managing subsidized student loan debt. This involves understanding your loan terms, creating a realistic budget, and exploring various repayment options. Prioritizing loan repayment alongside other financial goals, such as saving and investing, is also essential. Consistent and diligent monitoring of loan balances and interest accrual is key to staying on track. Consider budgeting tools and financial planning resources to assist in this process. For example, creating a detailed monthly budget that allocates a specific amount towards loan repayment can significantly improve repayment efficiency. Furthermore, exploring options for income-driven repayment plans can alleviate immediate financial strain.

Federal Student Loan Repayment Plans

Several repayment plans are available for federal subsidized student loans, each with its own characteristics and implications. The choice of plan significantly impacts the monthly payment amount and the total interest paid over the life of the loan.

- Standard Repayment Plan: This plan involves fixed monthly payments over a 10-year period. It offers the shortest repayment timeline, minimizing total interest paid but potentially resulting in higher monthly payments.

- Graduated Repayment Plan: Payments start low and gradually increase over a 10-year period. This option may be more manageable initially but leads to higher total interest payments due to the longer period of lower payments.

- Extended Repayment Plan: This plan stretches payments over a longer period (up to 25 years), resulting in lower monthly payments but significantly higher total interest paid.

- Income-Driven Repayment (IDR) Plans: These plans (such as ICR, PAYE, REPAYE, and IBR) base monthly payments on your income and family size. Payments are typically lower, but the repayment period can be extended to 20 or 25 years, potentially increasing total interest paid. However, remaining balances may be forgiven after 20 or 25 years, depending on the plan and your income.

Impact of Repayment Plans on Total Interest Paid

The choice of repayment plan directly influences the total interest paid over the loan’s lifetime. For instance, a standard repayment plan, with its shorter repayment period, typically results in the lowest total interest. Conversely, extended repayment plans and IDR plans, while offering lower monthly payments, significantly increase the total interest paid due to the extended repayment periods.

| Repayment Plan | Repayment Period | Monthly Payment (Example) | Total Interest Paid (Example) |

|---|---|---|---|

| Standard | 10 years | $300 | $5,000 |

| Graduated | 10 years | Starts at $200 | $7,000 |

| Extended | 25 years | $150 | $15,000 |

| Income-Driven (Example) | 20 years | $100 | $12,000 |

*Note: These are example figures and actual amounts will vary based on loan amount, interest rate, and individual circumstances.*

Consolidating Subsidized Student Loans: A Step-by-Step Guide

Consolidating multiple subsidized student loans into a single loan can simplify repayment. However, it’s crucial to weigh the potential benefits against potential drawbacks, such as potentially losing certain borrower benefits associated with specific loan types.

- Gather Necessary Information: Collect details about your existing loans, including loan amounts, interest rates, and loan servicers.

- Check Eligibility: Ensure you meet the eligibility criteria for federal student loan consolidation.

- Choose a Consolidation Loan Program: Select a federal Direct Consolidation Loan program.

- Complete the Application: Submit the application through the appropriate channels, usually online.

- Review and Accept the Terms: Carefully review the terms of the consolidated loan before accepting.

- Begin Repayment: Once approved, begin making payments according to the new loan terms.

Illustrative Examples of Subsidized Loan Interest Rate Scenarios

Understanding how subsidized loan interest rates impact borrowers requires looking at real-world scenarios. These examples illustrate the potential benefits and challenges associated with these rates, emphasizing the importance of understanding loan terms.

Beneficial Low Interest Rate Scenario

Imagine Sarah, a diligent student pursuing a medical degree. She secures a subsidized federal student loan with a remarkably low interest rate of 2.75% for the entire duration of her studies and the grace period. This significantly reduces her overall borrowing costs compared to unsubsidized loans or private loans with potentially higher interest rates. Upon graduation, she has a manageable debt burden, allowing her to focus on her career without the crushing weight of excessive interest accumulation. The low interest rate allowed her to prioritize her studies and avoid taking on additional part-time work to cover interest payments, thus leading to a more successful academic career. This scenario demonstrates the significant advantage a low subsidized interest rate can offer ambitious students.

Challenges Due to Interest Rate Changes

Consider David, who borrowed heavily for his undergraduate education using subsidized federal loans. During his repayment period, interest rates unexpectedly rose due to shifts in the national economic climate. This increase significantly impacted his monthly payments, making it challenging to manage his budget and potentially delaying his ability to achieve financial goals such as purchasing a home or starting a family. This illustrates the vulnerability borrowers face when interest rates fluctuate. The unforeseen increase in interest payments underscored the need for careful budgeting and proactive financial planning to navigate such unpredictable changes.

Importance of Understanding Loan Terms and Conditions

Maria secured a subsidized student loan, but failed to fully understand the terms regarding the grace period and repayment options. After graduation, she missed several payments during her grace period, leading to the capitalization of interest, thereby increasing her principal loan amount. This resulted in higher overall repayment costs and extended her repayment period. This example highlights the crucial role of carefully reviewing and understanding all aspects of a loan agreement before signing, including repayment schedules, interest rate calculations, and the implications of missed payments. Thorough understanding of the terms could have prevented a substantial increase in her total debt.

Infographic: Loan Amount, Interest Rate, and Total Repayment Cost

The infographic would visually represent the relationship between loan amount, interest rate, and total repayment cost using a combination of charts and text. The main visual element would be a three-dimensional bar chart. The x-axis would represent the loan amount ($10,000, $20,000, $30,000), the y-axis would represent the annual interest rate (3%, 5%, 7%), and the z-axis would represent the total repayment cost over a ten-year period. Each bar would be color-coded according to the interest rate, with a legend clearly identifying the color-rate correspondence. A smaller pie chart would show the breakdown of total repayment cost into principal and interest for a selected scenario (e.g., $20,000 loan at 5% interest). Accompanying text would explain the concepts illustrated in the chart and provide a clear and concise interpretation of the data, emphasizing how even small differences in interest rates can significantly affect the total cost of repayment over time. For instance, it might show that a 2% difference in interest rate on a $20,000 loan could translate to thousands of dollars in additional repayment costs over 10 years.

Closing Notes

Securing a subsidized student loan can be a significant step towards achieving higher education, but understanding the associated interest rates is paramount. This guide has provided a framework for navigating the intricacies of these rates, highlighting the influence of economic factors, government policies, and available repayment options. By carefully considering the information presented, borrowers can make informed decisions, effectively manage their debt, and plan for a financially sound future. Remember to proactively engage with your loan servicer and explore all available resources to optimize your repayment strategy.

Top FAQs

What is the difference between subsidized and unsubsidized federal student loans?

Subsidized loans offer interest rate subsidies from the government while you’re in school, deferment, or grace periods. Unsubsidized loans accrue interest from the day the loan is disbursed.

Can my subsidized loan interest rate change?

Yes, the interest rate is fixed for the life of the loan but the rate itself is set annually by the government and varies based on the loan disbursement year.

What happens if I don’t repay my subsidized student loans?

Failure to repay can lead to negative credit impacts, wage garnishment, and potential tax refund offset. Contact your loan servicer immediately if you anticipate difficulties.

How can I find my subsidized student loan interest rate?

Your loan servicer’s website or your federal student aid account (NSLDS) will display your current interest rate and loan details.