Navigating the complexities of private student loan debt can feel overwhelming, but understanding your options is the first step towards financial freedom. This guide provides a comprehensive overview of private student loan settlements, exploring the process from initial eligibility assessment to post-settlement implications. We’ll examine various negotiation strategies, potential pitfalls, and alternative debt management solutions, empowering you to make informed decisions about your financial future.

From identifying eligibility criteria and crafting effective negotiation tactics to understanding the long-term consequences of a settlement, we aim to equip you with the knowledge needed to approach this process with confidence. We’ll delve into the legal aspects, examine successful settlement strategies, and highlight the crucial role of professional guidance when necessary. This guide is designed to be your comprehensive resource for navigating the intricacies of private student loan settlements.

Understanding Private Student Loan Settlements

Negotiating a settlement on your private student loans can significantly reduce your debt burden, but it’s crucial to understand the process and potential implications. This section will Artikel the various types of settlements, the legal considerations involved, and provide a practical guide to help you navigate this complex process.

Types of Private Student Loan Settlements

Private student loan settlements generally involve negotiating a lower payoff amount than the outstanding balance. The specific terms can vary considerably. A common approach is a lump-sum settlement, where you pay a single, reduced amount to settle the entire debt. Alternatively, an installment agreement might be negotiated, allowing you to repay the reduced balance over a specified period. In some cases, a loan modification may be possible, adjusting the interest rate or repayment terms rather than reducing the principal. The availability of each type depends on the lender’s policies and your individual circumstances.

Legal Aspects of Private Student Loan Settlements

Private student loan settlements are governed by contract law. The original loan agreement Artikels the terms and conditions, and any settlement must adhere to these legally binding stipulations. It’s vital to understand that accepting a settlement usually results in a “settlement agreement,” a legally binding contract. This agreement typically includes a release of liability clause, meaning the lender releases you from further debt obligations once the agreed-upon amount is paid. Failure to adhere to the terms of the settlement agreement can lead to legal repercussions, potentially including lawsuits to recover the remaining balance. Seeking legal counsel is recommended before entering into any settlement agreement.

Initiating a Settlement Negotiation

Negotiating a private student loan settlement requires a strategic approach. First, gather all relevant documentation, including your loan agreements, payment history, and any supporting financial documentation. Next, contact your lender directly and formally request a settlement. Clearly articulate your financial hardship and propose a reasonable settlement amount, supported by evidence of your financial situation. Be prepared to negotiate. The lender may counter your initial offer, so be ready to compromise. Keep detailed records of all communication, including dates, times, and the substance of conversations. If direct negotiation fails, consider consulting with a credit counselor or debt settlement company. These professionals can assist with negotiation and provide expert advice.

Successful Private Student Loan Settlement Strategies

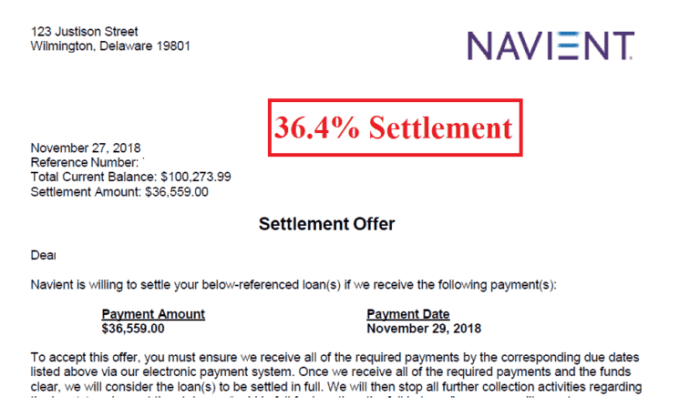

Successful settlements often involve demonstrating a genuine inability to repay the full loan amount. This may involve providing documentation such as proof of unemployment, medical bills, or other significant financial setbacks. Presenting a comprehensive budget that clearly illustrates your limited financial resources can strengthen your negotiation position. Furthermore, offering a lump-sum payment, even if it’s a smaller percentage of the total debt, can be more appealing to lenders than an installment plan. This demonstrates your commitment to resolving the debt and reduces their administrative burden. For example, offering 50% of the outstanding balance as a lump sum might be more successful than proposing a lower percentage over a longer repayment period.

Private Student Loan Settlement Process Flowchart

A flowchart visually representing the settlement process could be designed as follows:

[Imagine a flowchart here. The flowchart would begin with “Contact Lender,” branching to “Negotiate Settlement Amount,” then to “Lender Accepts/Rejects Offer.” If accepted, it proceeds to “Sign Settlement Agreement” and “Make Payment.” If rejected, it branches to “Counter-Offer” or “Seek Alternative Solutions (e.g., Credit Counseling).” Finally, all paths lead to “Settlement Complete/Process Ends.”]

Eligibility and Qualification for Settlements

Securing a private student loan settlement requires careful consideration of eligibility criteria and the factors lenders weigh in their evaluation. Understanding these aspects is crucial for borrowers hoping to negotiate a reduced repayment amount. This section will Artikel the key elements involved in the qualification process.

Lenders assess several factors when reviewing settlement offers. These include the borrower’s current financial situation, the age and size of the loan, and the borrower’s repayment history. Demonstrating a genuine inability to repay the loan in full is often a key element in a successful settlement negotiation. The lender will also consider the potential benefits of a settlement compared to pursuing legal action or continuing with the existing repayment plan. A lower settlement amount is generally more attractive to lenders than the prolonged and uncertain process of attempting to collect the full balance.

Factors Lenders Consider

Lenders primarily focus on the borrower’s demonstrated financial hardship. This usually involves providing documentation of income, expenses, and assets. A consistent pattern of missed payments or delinquency is also a significant factor, signaling a higher likelihood of default. The age of the loan can also play a role, as older loans might be more likely to be settled due to increased collection costs. Finally, the overall balance of the loan influences the negotiation; larger balances may lead to more substantial settlement offers.

Borrower Eligibility Criteria

Borrowers must generally demonstrate financial hardship to be eligible for a settlement. This often involves providing proof of income below a certain threshold, significant medical expenses, job loss, or other unforeseen circumstances impacting their ability to repay the loan. Credit history, while not always a direct eligibility criterion, significantly influences the lender’s willingness to negotiate. A history of responsible financial behavior, even with the current hardship, may improve the chances of a successful settlement. Furthermore, proactively engaging with the lender and demonstrating a genuine desire to resolve the debt positively impacts the outcome.

Comparison of Lender Requirements

Eligibility requirements can vary slightly between lenders. Some may be more lenient with income requirements, while others may place greater emphasis on the length of delinquency. For instance, a lender with a large portfolio of distressed loans might be more willing to settle than a smaller lender with fewer resources for collection. Furthermore, the specific terms of the original loan agreement can also influence eligibility. However, the common thread across most lenders is the need to demonstrate a genuine financial hardship that makes full repayment impossible.

Key Eligibility Factors for Private Student Loan Settlements

| Lender | Requirement 1 | Requirement 2 | Requirement 3 |

|---|---|---|---|

| Example Lender A | Demonstrated financial hardship (proof of income, expenses) | Consistent payment delinquency (e.g., 6+ months) | Loan balance exceeding a certain threshold |

| Example Lender B | Documentation of significant life event (job loss, medical emergency) | Negotiable settlement offer (lump sum or installment plan) | Good faith effort to resolve the debt |

| Example Lender C | Debt-to-income ratio exceeding a specific limit | Detailed budget showing inability to repay | Willingness to accept a written settlement agreement |

Negotiating a Settlement

Negotiating a private student loan settlement requires a strategic approach. Success hinges on understanding your leverage, communicating effectively, and presenting a compelling proposal to your lender. Remember, the goal is to reach an agreement that’s mutually beneficial, reducing your debt burden while ensuring the lender recovers a portion of their investment.

Effective negotiation tactics involve a combination of preparation, assertive communication, and a willingness to compromise. It’s crucial to approach the negotiation with a realistic understanding of your financial situation and the lender’s objectives.

Effective Negotiation Tactics

Strong negotiation hinges on demonstrating a clear understanding of your financial situation and presenting a viable solution. This includes providing documentation to support your claims and maintaining a professional yet assertive tone throughout the process. Thoroughly researching your lender’s typical settlement practices can also give you a valuable advantage. For instance, some lenders are more willing to negotiate than others, and knowing this beforehand can inform your approach. Preparing multiple settlement proposals with varying terms allows for flexibility during the negotiation process.

Strong Negotiation Points for Borrowers

Several factors can strengthen your negotiating position. A documented history of consistent, albeit partial, payments demonstrates your commitment to resolving the debt. Significant hardship, such as job loss or a medical emergency, can be powerful arguments for a reduced settlement amount. Presenting a detailed budget that showcases your limited financial resources helps the lender understand your constraints and the feasibility of your proposed repayment plan. For example, a borrower who experienced a prolonged period of unemployment due to a documented illness could use this as a compelling reason for a settlement. Similarly, a borrower with a consistently low income, supported by pay stubs, could negotiate a lower monthly payment.

Communicating Effectively with Lenders

Clear, concise, and professional communication is paramount. Maintain a respectful tone, even if you’re frustrated. Document all communication, including emails, phone calls, and letters. Be prepared to answer questions about your financial situation honestly and thoroughly. If you need additional time to gather information, request it politely. For example, a borrower might say, “I understand your need for this information quickly, however, I require a few days to collect my bank statements to accurately reflect my current financial situation.” This demonstrates cooperation while maintaining your position.

Presenting a Compelling Settlement Proposal

A compelling proposal presents a realistic and achievable solution for both parties. It should include a proposed settlement amount, a detailed payment plan, and documentation supporting your financial situation. Clearly Artikel the benefits of the settlement for the lender, such as avoiding costly litigation or reducing the risk of default. A well-structured proposal, free from grammatical errors and presented professionally, will demonstrate your seriousness and commitment. For example, a borrower might propose a lump-sum payment within a specific timeframe, supported by evidence of recent savings or an inheritance. Alternatively, they might suggest a series of smaller payments spread over a longer period.

Potential Borrower Concessions

Borrowers might consider several concessions to strengthen their negotiation. Offering a higher initial payment, even if it strains their budget, can signal good faith. Agreeing to a longer repayment period, while increasing the total amount paid, could be acceptable if the monthly payments are manageable. Providing collateral, such as a vehicle or other asset, could increase the lender’s willingness to negotiate a more favorable settlement. However, it is crucial to weigh the potential benefits against the risks involved before offering such concessions. A borrower should carefully consider the long-term implications of any concession offered before committing.

Settlement Terms and Agreements

Reaching a settlement on your private student loans involves carefully considering the terms and conditions Artikeld in a formal agreement. Understanding these terms is crucial to making an informed decision that aligns with your financial situation and long-term goals. A poorly understood agreement can have significant consequences.

Common Terms in Private Student Loan Settlement Agreements

Private student loan settlement agreements typically include several key components. These commonly involve a reduced payoff amount, representing a percentage of the original debt. The agreement will specify the exact amount due, the payment schedule (lump sum or installments), and any associated fees. Crucially, the agreement will clearly state that upon full payment, the remaining balance of the loan is forgiven, and the lender agrees not to pursue further collection actions. Furthermore, the agreement often includes a detailed description of the consequences of defaulting on the agreed-upon payment plan, which may include reinstatement of the original debt or negative impacts on credit scores. Finally, the agreement should include a clear and unambiguous statement regarding the tax implications of the settlement.

Implications of Accepting a Settlement Offer

Accepting a private student loan settlement has several important implications. Primarily, it results in a reduction of the overall debt owed, providing immediate financial relief. However, it also negatively impacts your credit score, as settlements are typically reported to credit bureaus. The extent of the negative impact depends on various factors, including your existing credit history and the terms of the settlement. Furthermore, accepting a settlement means you relinquish your right to dispute the debt further. This is a critical consideration, as it represents a final resolution of the loan obligation. Finally, the settlement amount may be considered taxable income by the IRS, leading to potential tax liabilities.

Examples of Settlement Structures

Settlement structures can vary depending on the negotiation between the borrower and the lender. A common approach is a lump sum payment, where the borrower pays the agreed-upon reduced amount in a single payment. This offers the borrower the benefit of resolving the debt quickly and avoiding further monthly payments. Alternatively, a settlement may involve installment payments, where the borrower pays the reduced amount in smaller, regular installments over a specified period. This option provides more flexibility for borrowers with limited immediate funds but requires consistent payments to avoid default. For instance, a $20,000 debt might be settled for $10,000 in a lump sum, or $2,500 per year for four years.

Sample Settlement Agreement

This is a sample agreement and should be adapted with legal counsel for your specific situation.

| Term | Description |

|---|---|

| Original Loan Balance | $30,000 |

| Settlement Amount | $15,000 |

| Payment Method | Lump Sum |

| Payment Due Date | October 26, 2024 |

| Release of Debt | Upon full payment, the lender agrees to release the borrower from further debt obligations. |

| Credit Reporting | The settlement will be reported to credit bureaus. |

| Tax Implications | The borrower is responsible for understanding and reporting any tax implications related to the settlement. |

Potential Pitfalls to Avoid in Settlement Agreements

Before signing a settlement agreement, carefully review all terms and conditions. It is highly advisable to seek legal counsel.

- Hidden Fees: Be wary of unexpected fees or charges that could increase the total cost of the settlement.

- Unclear Terms: Ensure all terms are clearly defined and easily understood. Ambiguous language can lead to disputes later.

- Lack of Written Agreement: Always obtain a written agreement that Artikels all aspects of the settlement.

- Failure to Consider Tax Implications: Understand the potential tax consequences of the settlement before agreeing to the terms.

- Ignoring Credit Reporting: Be aware that the settlement will likely be reported to credit bureaus, potentially impacting your credit score.

Post-Settlement Implications

Successfully settling a private student loan can bring relief, but it’s crucial to understand the lasting effects on your finances. A settlement isn’t a simple erasure of debt; it has significant consequences for your credit score, taxes, and long-term financial health. Careful consideration of these implications is essential before agreeing to any settlement terms.

Impact on Credit Scores

A private student loan settlement will negatively impact your credit score. The settlement will be reported to the credit bureaus as a “settled account,” which is generally viewed less favorably than a fully paid account. The severity of the impact depends on several factors, including your existing credit history, the amount of debt settled, and your overall credit utilization. While the exact drop in your score is unpredictable, it’s generally significant and can make obtaining future credit more challenging or expensive. For example, settling a $10,000 loan might result in a score drop of 50-100 points, making it harder to qualify for a mortgage or auto loan at favorable interest rates. The negative mark on your credit report will typically remain for seven years.

Tax Implications of a Private Student Loan Settlement

The amount forgiven in a student loan settlement is generally considered taxable income by the IRS. This means you’ll need to report the forgiven amount on your tax return for the year the settlement occurs. For example, if you settled a $5,000 loan and the lender forgave $2,000, you would need to report $2,000 as income. The tax implications can be substantial, especially if the forgiven amount is large. It’s highly recommended to consult a tax professional to understand your specific tax liability and explore potential strategies to mitigate the tax burden. Failing to report the forgiven debt can lead to penalties and interest from the IRS.

Long-Term Financial Consequences

Settling a private student loan can have long-term financial consequences beyond the immediate impact on your credit score and taxes. The lower credit score can make it more difficult to secure loans, rent an apartment, or even get certain jobs. Higher interest rates on future loans can significantly increase the cost of borrowing. Moreover, the settlement itself may not resolve the underlying financial issues that led to the debt. Addressing these issues, such as budgeting and financial planning, is crucial to prevent future debt accumulation. Without a solid financial plan, a settled loan could be just a temporary fix, leading to further financial difficulties down the line.

Obtaining Settlement Documentation

After reaching a settlement agreement, ensure you receive official documentation confirming the terms. This documentation should clearly state the amount of debt settled, the amount paid, the date of settlement, and a confirmation that the loan has been closed. This documentation is crucial for your credit report and tax purposes. Request multiple copies of the agreement, keeping one for your records and submitting the necessary copies to credit bureaus and tax authorities. Without proper documentation, you may face difficulties in resolving future disputes or proving the settlement to relevant parties.

Post-Settlement Actions Checklist

After successfully settling your private student loan, a proactive approach is crucial. This checklist Artikels essential steps:

- Obtain and review all settlement documentation thoroughly.

- Report the forgiven debt to the IRS on your tax return.

- Monitor your credit report for accuracy and report any discrepancies.

- Develop a comprehensive budget and financial plan to avoid future debt.

- Consider seeking financial counseling to improve your financial management skills.

Alternatives to Settlement

Private student loan settlement isn’t the only path to managing overwhelming student loan debt. Several alternatives exist, each with its own set of advantages and disadvantages. Understanding these options is crucial for making an informed decision about your financial future. Careful consideration of your individual circumstances and financial goals is paramount.

Choosing the best option depends heavily on your specific financial situation, your relationship with your lender, and your long-term financial goals. Factors such as your income, employment stability, and the overall amount of your debt will influence the suitability of each alternative. It’s often beneficial to consult with a financial advisor before making a decision.

Loan Modification

Loan modification involves negotiating with your lender to change the terms of your loan agreement. This could include lowering your monthly payment, extending the repayment period, or switching to a different repayment plan. The goal is to make your payments more manageable without necessarily reducing the total amount owed.

Forbearance

Forbearance is a temporary pause on your loan payments. During a forbearance period, interest may still accrue, depending on the type of loan and the terms of the forbearance agreement. This means that while you’re not making payments, the total amount you owe could increase. Forbearance is often used as a short-term solution to address temporary financial hardship.

Repayment Plans

Several repayment plans are available through federal student loan programs, offering different payment amounts and repayment timelines. These plans, such as Income-Driven Repayment (IDR) plans, tie your monthly payments to your income and family size, potentially lowering your monthly payments. However, they may extend the repayment period, leading to a higher total interest paid over the life of the loan. Note that these plans generally apply to federal student loans, not private ones.

Comparison of Options

| Option | Advantages | Disadvantages | Eligibility |

|---|---|---|---|

| Private Student Loan Settlement | Potentially reduces the total amount owed; eliminates future payments; improves credit score after successful settlement. | Negotiation can be difficult; may negatively impact credit score initially; lender may not agree to a settlement; potential tax implications. | Typically requires significant financial hardship and demonstrated inability to repay the loan. |

| Loan Modification | Reduces monthly payments; extends repayment period; may avoid default. | May not reduce the total amount owed; interest may still accrue; requires negotiation with the lender. | Generally requires demonstrating financial hardship; lender approval is necessary. |

| Forbearance | Provides temporary relief from payments; can help avoid default. | Interest usually continues to accrue; does not reduce the total amount owed; may not be a long-term solution; can negatively impact credit score if not managed carefully. | Typically requires demonstrating financial hardship; lender approval is necessary. |

| Federal Repayment Plans (e.g., IDR) | Lower monthly payments based on income; avoids default; various plans available. | Longer repayment periods; potentially higher total interest paid; eligibility requirements vary by plan. | Applies only to federal student loans; income verification is required. |

Seeking Professional Help

Navigating the complex world of private student loan settlements can be daunting. Many borrowers find themselves overwhelmed by the legal jargon, negotiation tactics, and potential consequences. Seeking professional assistance can significantly improve your chances of a successful and fair settlement. This section explores the roles of debt counselors and attorneys, when their expertise is most valuable, and how to find reputable professionals.

Debt counselors and attorneys offer distinct yet complementary services in the context of private student loan settlements. Debt counselors provide guidance on managing your overall debt, including student loans, and may assist in negotiations with your lender. Attorneys, on the other hand, specialize in legal matters and can represent you in more complex situations, potentially leading to better settlement outcomes. They can also help ensure your rights are protected throughout the process.

The Benefits of Professional Assistance

Professional assistance is particularly beneficial in several situations. Individuals facing significant financial hardship, those struggling to communicate effectively with their lenders, or those dealing with complex legal issues surrounding their loans would benefit greatly from professional guidance. Borrowers with multiple loans or those who have already missed several payments may also find professional help invaluable in navigating the complexities of loan settlement. Moreover, if a lender is employing aggressive collection tactics, professional intervention can protect your rights and ensure fair treatment.

Finding Reputable Professionals

Locating a trustworthy debt counselor or attorney requires careful research. Start by checking online directories and review sites such as the National Foundation for Credit Counseling (NFCC) for certified credit counselors and your state bar association for licensed attorneys. Look for professionals with experience in student loan debt resolution and positive client testimonials. Verify their credentials and licenses to ensure they are legitimate and qualified to handle your specific situation.

Questions to Ask Potential Professionals

Before engaging a professional, ask clarifying questions to gauge their expertise and suitability. Inquire about their experience with private student loan settlements, their fees and payment structures, and their approach to negotiation. It’s crucial to understand their communication style and whether they will provide regular updates throughout the process. Finally, ask about their success rate in achieving favorable settlements for clients with similar situations.

Resources for Borrowers

Several organizations provide resources and support to borrowers seeking assistance with student loan debt. The National Foundation for Credit Counseling (NFCC) offers free financial counseling and debt management services. The Student Loan Borrower Assistance Project (SLBAP) provides free legal assistance to borrowers in certain states. Additionally, the Consumer Financial Protection Bureau (CFPB) offers valuable information and resources on managing student loan debt and resolving disputes with lenders. These organizations can provide guidance, support, and potentially direct assistance in navigating the complexities of student loan settlement.

Illustrative Case Studies

Understanding the complexities of private student loan settlements is best achieved through examining real-world examples. The following case studies illustrate both successful and unsuccessful negotiations, highlighting key strategies and potential pitfalls. These examples are not exhaustive but serve to illuminate the diverse range of scenarios borrowers may encounter.

Successful Private Student Loan Settlement: Case Study 1

This case study details the successful negotiation of a private student loan settlement for Sarah, a 32-year-old teacher with $40,000 in outstanding debt. Sarah experienced a period of unemployment after a family emergency, impacting her ability to make consistent loan payments. She contacted her lender directly and presented a detailed hardship letter outlining her financial situation, including documentation of her unemployment and reduced income. She proposed a lump-sum payment of $25,000, representing 62.5% of the original debt, in exchange for a full settlement. After several weeks of negotiation, the lender agreed to the terms, eliminating the remaining balance and preventing further negative impacts on her credit score.

- Borrower’s Situation: $40,000 in outstanding private student loan debt, period of unemployment.

- Negotiation Process: Direct communication with lender, presentation of hardship letter with supporting documentation, proposed lump-sum payment of $25,000.

- Outcome: Successful settlement at 62.5% of the original debt, removal of remaining balance.

- Lessons Learned: Proactive communication, strong documentation of financial hardship, a well-structured proposal significantly increased the chances of a favorable outcome.

Unsuccessful Private Student Loan Settlement: Case Study 2

Mark, a 40-year-old software engineer, faced $60,000 in private student loan debt. He attempted to negotiate a settlement without providing any documentation of financial hardship, simply stating that he found the payments burdensome. He proposed a significantly reduced payment plan without offering any concrete evidence of his inability to meet his current obligations. The lender rejected his proposal, citing a lack of sufficient evidence to justify a settlement. Mark’s credit score subsequently suffered due to missed payments.

- Borrower’s Situation: $60,000 in outstanding private student loan debt, no documented financial hardship.

- Negotiation Process: Informal communication with lender, proposal of a reduced payment plan without supporting documentation.

- Outcome: Unsuccessful negotiation, continued debt burden, negative impact on credit score.

- Lessons Learned: Insufficient documentation and a poorly structured proposal led to the failure of the negotiation. A strong case, supported by verifiable evidence, is crucial for a successful settlement.

Ending Remarks

Successfully negotiating a private student loan settlement requires careful planning, strategic communication, and a thorough understanding of your rights and options. By understanding the eligibility criteria, employing effective negotiation techniques, and being aware of potential pitfalls, borrowers can significantly improve their chances of reaching a favorable agreement. Remember to weigh the long-term financial consequences and consider seeking professional advice when necessary. Ultimately, a well-informed approach empowers you to take control of your student loan debt and pave the way for a more secure financial future.

Frequently Asked Questions

What happens to my credit score after a student loan settlement?

A settlement will likely negatively impact your credit score, but the severity depends on factors like the amount settled and your overall credit history. It’s generally better than defaulting, however.

Can I negotiate a settlement if I’m not currently in default?

Yes, you can attempt to negotiate a settlement even if you’re not in default. However, lenders may be less willing to negotiate unless you demonstrate financial hardship.

Are there tax implications for a private student loan settlement?

The forgiven portion of your debt may be considered taxable income. Consult a tax professional for personalized advice.

What if I can’t afford the settlement terms?

Explore alternative options like loan modification, forbearance, or seeking professional debt counseling before defaulting on your loans.