Navigating the world of student loans can feel overwhelming, a labyrinth of eligibility criteria, paperwork, and repayment plans. Understanding the requirements is crucial for securing the funding you need for higher education and avoiding future financial strain. This guide unravels the complexities, offering a clear path through the process.

From determining your eligibility for federal student loans and gathering the necessary documentation to understanding loan amounts, repayment options, and the potential consequences of default, we’ll equip you with the knowledge to make informed decisions about your educational financing.

Eligibility Criteria for Student Loans

Securing federal student loans in the United States involves meeting several key eligibility requirements. These criteria ensure that the loan program effectively supports students pursuing higher education while maintaining responsible lending practices. Understanding these requirements is crucial for prospective borrowers to determine their eligibility and plan their financial aid strategy.

General Eligibility Requirements for Federal Student Loans

To be eligible for federal student loans, applicants generally must be a U.S. citizen or eligible non-citizen, be enrolled or accepted for enrollment at least half-time in an eligible degree or certificate program at a participating institution, maintain satisfactory academic progress, and complete the Free Application for Federal Student Aid (FAFSA). Additional requirements may apply depending on the specific loan program. For example, some programs may require a demonstration of financial need.

Undergraduate vs. Graduate Student Loan Requirements

While the core eligibility requirements remain largely consistent, some differences exist between undergraduate and graduate student loan programs. Undergraduate students typically have access to a broader range of loan programs, including subsidized loans, which do not accrue interest while the student is enrolled at least half-time. Graduate students generally have access to unsubsidized loans and may have higher loan limits. The specific requirements regarding enrollment status, degree program, and academic progress remain consistent across both levels.

Comparison of Eligibility Criteria Across Loan Programs

Federal student loan programs, such as subsidized and unsubsidized loans, differ primarily in how interest accrues. Subsidized loans do not accrue interest while the student is enrolled at least half-time and during certain grace periods. Unsubsidized loans, on the other hand, accrue interest from the time the loan is disbursed, regardless of enrollment status. Both subsidized and unsubsidized loans require the same basic eligibility criteria, including U.S. citizenship or eligible non-citizen status, enrollment in an eligible program, and satisfactory academic progress. The primary difference lies in the interest accrual and, consequently, the overall cost of the loan. Parent PLUS loans, available to parents of dependent students, have separate eligibility requirements, typically involving a credit check.

Key Eligibility Factors for Federal Student Loans

| Factor | Undergraduate Loans | Graduate Loans | Parent PLUS Loans |

|---|---|---|---|

| Citizenship/Residency | U.S. citizen or eligible non-citizen | U.S. citizen or eligible non-citizen | U.S. citizen or eligible non-citizen |

| Enrollment Status | At least half-time | At least half-time | Dependent student enrolled at least half-time |

| Credit History | Not required for most programs | Not required for most programs | Credit check required |

| Degree Program | Eligible undergraduate program | Eligible graduate program | Dependent student enrolled in an eligible program |

Required Documentation for Student Loan Applications

Applying for a student loan requires submitting various documents to verify your identity, enrollment, and financial situation. This process ensures that the lending institution can assess your eligibility and make an informed decision regarding your loan application. Providing accurate and complete documentation will streamline the application process and increase your chances of approval.

The specific documents required may vary slightly depending on the lender and the type of loan, but generally, you’ll need to provide several key pieces of information. Failure to provide all necessary documentation can lead to delays or rejection of your application.

Types of Required Documents

The following documents are commonly requested by student loan providers. It is crucial to carefully review the specific requirements of your chosen lender, as variations may exist.

- Completed Application Form: This is the foundational document initiating the loan process. It gathers essential personal and financial information necessary for assessment.

- Government-Issued Photo Identification: This verifies your identity and prevents fraud. Acceptable forms include a driver’s license, passport, or state-issued ID card. The ID must be current and clearly display your photograph and identifying information.

- Proof of Enrollment: This confirms your current student status at an eligible educational institution. Acceptable forms include an official acceptance letter, enrollment verification form from the registrar’s office, or a current student ID card with your name, photo, and institution’s details clearly visible. The document should show the current academic year or term.

- Social Security Number (SSN): This is essential for verifying your identity and tracking your loan information. You will typically provide this number on the application form.

- Financial Information: This often includes tax returns, bank statements, and pay stubs to demonstrate your financial capability to manage loan repayments. The lender will use this to assess your creditworthiness and repayment capacity.

- Parent(s) or Guardian’s Financial Information (for Dependent Students): If you are a dependent student, your parents’ or guardians’ financial information may be required to determine their contribution towards your education costs and to assess the overall family’s financial capacity to repay the loan. This typically involves tax returns and bank statements.

Examples of Acceptable Identification and Proof of Enrollment

Acceptable forms of government-issued photo identification include a driver’s license from any US state, a US passport, or a state-issued identification card. These documents must be current and valid. For proof of enrollment, an official acceptance letter from the institution, a current student ID card, or an enrollment verification form directly from the registrar’s office are generally accepted. These documents should clearly state your name, the institution’s name, your student status, and the current academic term.

Step-by-Step Process for Gathering and Organizing Documentation

A systematic approach to gathering and organizing your documents will ensure a smooth application process.

- Create a Checklist: Start by creating a comprehensive checklist of all the required documents based on the lender’s specific requirements.

- Gather Documents: Systematically collect each document from the appropriate sources. This might involve contacting your educational institution for enrollment verification, requesting copies of tax returns, or obtaining bank statements.

- Organize Documents: Organize your documents logically, perhaps using a folder or binder, to ensure easy access and submission. Maintain copies for your records.

- Verify Completeness and Accuracy: Carefully review each document to ensure it is complete, accurate, and legible. Correct any errors or omissions before submission.

- Submit Application: Submit your completed application form and all supporting documents according to the lender’s instructions. Retain copies of all submitted materials.

Understanding Loan Amounts and Repayment Plans

Securing a student loan involves understanding not only eligibility but also the financial implications, specifically the loan amount you can receive and the various repayment options available. This section clarifies these crucial aspects to help you make informed decisions.

Factors Influencing Maximum Loan Amount

Several factors determine the maximum student loan amount a student can borrow. These include the student’s cost of attendance (tuition, fees, room, and board), their financial need (as determined by the Free Application for Federal Student Aid, or FAFSA), their enrollment status (full-time versus part-time), and their educational program (undergraduate versus graduate). Additionally, lenders may consider the student’s credit history (if applicable) and co-signer’s creditworthiness (if a co-signer is involved). The maximum loan amount is often capped by federal or institutional guidelines, preventing students from accumulating excessive debt. For example, federal student loan programs have annual and aggregate borrowing limits.

Types of Repayment Plans

Several repayment plan options exist to accommodate different financial situations and repayment preferences. Choosing the right plan is crucial for managing debt effectively and avoiding delinquency.

Comparison of Repayment Plan Advantages and Disadvantages

Each repayment plan offers unique benefits and drawbacks. Understanding these differences is essential for selecting the plan that best aligns with your financial circumstances and post-graduation prospects.

| Repayment Plan | Description | Advantages | Disadvantages |

|---|---|---|---|

| Standard Repayment Plan | Fixed monthly payments over 10 years. | Predictable payments, shorter repayment period. | Higher monthly payments compared to other plans. |

| Graduated Repayment Plan | Payments start low and gradually increase over time. | Lower initial payments, manageable in early career stages. | Payments significantly increase over time, potentially becoming unaffordable later. |

| Extended Repayment Plan | Fixed monthly payments over a longer period (up to 25 years). | Lower monthly payments compared to standard plan. | Higher total interest paid due to the longer repayment period. |

| Income-Driven Repayment Plan (IDR) | Monthly payments are based on your income and family size. | Payments are affordable based on your current financial situation. | Repayment period can be extended significantly (potentially up to 20-25 years), leading to higher total interest paid. Forgiveness may be subject to certain conditions and tax implications. |

Interest Rates and Fees Associated with Student Loans

Understanding the interest rates and fees associated with student loans is crucial for responsible borrowing and effective financial planning. These costs significantly impact the total amount you’ll repay over the life of your loan. Failing to account for these factors can lead to unexpected debt burdens.

Interest Rate Determination

Several factors influence the interest rate you’ll receive on your student loan. The most significant factor is the type of loan. Federal student loans generally offer lower interest rates than private loans. Creditworthiness also plays a role, with borrowers demonstrating strong credit histories often securing more favorable rates. The prevailing market interest rates at the time of loan disbursement also influence the final rate. Finally, the loan’s repayment term can affect the interest rate; longer repayment periods may come with slightly higher rates. For example, a federal subsidized loan might have a fixed rate determined annually by the government, while a private loan’s rate could fluctuate based on market conditions and your credit score.

Fees Associated with Student Loans

Student loans often come with various fees that add to the overall cost. Origination fees are charges levied by the lender to process your loan application. These fees can vary depending on the lender and loan type. Late payment fees are charged if you miss a payment or make a payment that is late. These fees can range from a small percentage of the missed payment to a fixed dollar amount. Some lenders may also charge prepayment penalties if you pay off your loan early, though this is less common with federal student loans. Finally, returned payment fees can be incurred if your payment is rejected due to insufficient funds.

Interest Capitalization

Interest capitalization is the process of adding accumulated interest to the principal loan balance. This means that unpaid interest is added to the loan’s principal amount, increasing the total amount you owe. This can significantly increase the overall cost of your loan over time. For instance, imagine a $10,000 loan with a 5% interest rate. If interest is not paid during the grace period after graduation, that unpaid interest will be added to the principal. After one year, the principal might grow to $10,500, and future interest calculations will be based on this larger amount. This snowball effect can substantially increase your total repayment amount.

Illustrative Scenarios of Interest Rates and Fees

Understanding how different interest rates and fees impact total loan repayment is essential. The following scenarios illustrate the potential effects:

- Scenario 1: A $20,000 loan with a 4% interest rate and no fees results in a lower total repayment cost compared to a loan with a 7% interest rate and a $200 origination fee.

- Scenario 2: A loan with on-time payments will have significantly lower total costs than a loan with several late payments, which incur late fees.

- Scenario 3: A shorter repayment term (e.g., 10 years) will generally lead to a lower total interest paid than a longer term (e.g., 20 years), even if the interest rate is the same, due to less time for interest to accrue.

- Scenario 4: A $10,000 loan with interest capitalization will result in a higher total repayment amount than a similar loan without interest capitalization, particularly if interest is not paid during periods of deferment or forbearance.

Financial Aid and Student Loan Alternatives

Securing funding for higher education involves exploring options beyond federal student loans. A well-rounded financial strategy considers a diverse range of funding sources to minimize reliance on loans and potentially reduce overall debt. This section Artikels alternative funding options and compares them to student loans.

Many students successfully finance their education without solely relying on loans. By proactively researching and applying for various aid options, students can significantly reduce their financial burden and graduate with less debt.

Alternative Funding Options for Higher Education

Beyond federal student loans, several avenues exist to finance higher education. These include scholarships, grants, and work-study programs. Scholarships are typically merit-based awards, recognizing academic achievement, talent, or community involvement. Grants, on the other hand, are usually need-based, providing financial assistance to students demonstrating financial hardship. Work-study programs offer part-time employment opportunities on campus, allowing students to earn money while pursuing their studies. Each option has its own application process and eligibility criteria.

Comparison of Student Loans and Other Financial Aid Options

Student loans, while offering immediate funding, come with the obligation of repayment, including interest. This contrasts with scholarships and grants, which are generally considered “free money” as they do not require repayment. Work-study programs provide income, but the earnings are typically lower than what a full-time job might offer. The best option depends on individual financial circumstances and academic goals. A balanced approach, combining several funding sources, often proves most effective.

Exploring and Applying for Scholarships and Grants

Numerous organizations offer scholarships and grants. These include government agencies, private foundations, colleges and universities, and professional associations. The application processes vary, often requiring essays, transcripts, and letters of recommendation. Online scholarship databases, such as Fastweb and Scholarships.com, can assist in identifying potential opportunities. Careful research and timely application are crucial for maximizing the chances of securing funding. It’s also important to be aware of deadlines and eligibility requirements for each scholarship or grant.

Comparison of Various Financial Aid Sources

| Financial Aid Source | Eligibility Criteria | Pros | Cons |

|---|---|---|---|

| Federal Student Loans | Enrollment in an eligible program, US citizenship or eligible non-citizen status, FAFSA completion | Accessibility, flexible repayment options | Accumulation of debt, interest charges |

| Scholarships | Academic achievement, extracurricular activities, demonstrated need (depending on the scholarship) | Free money, no repayment required | Competitive application process, limited availability |

| Grants | Demonstrated financial need, FAFSA completion | Free money, no repayment required | Limited funding, strict eligibility requirements |

| Work-Study | Financial need, enrollment in an eligible program, FAFSA completion | Earned income, on-campus employment | Limited hours, may not cover all expenses |

Understanding the Loan Application Process

Securing federal student loans involves a multi-step process, primarily centered around the Free Application for Federal Student Aid (FAFSA). Understanding this process is crucial for students aiming to finance their education effectively. This section details the steps involved in applying for federal student loans, including completing the FAFSA and managing your loan account.

The federal student loan application process begins with completing the Free Application for Federal Student Aid (FAFSA). This form is used by the federal government to determine your eligibility for various types of financial aid, including federal student loans, grants, and work-study programs. Your FAFSA information is sent to your chosen schools, allowing them to determine your financial need and offer you aid packages.

Completing the FAFSA Form

The FAFSA is an online application requiring accurate and complete information. Gathering necessary documents beforehand significantly streamlines the process. These documents typically include your Social Security number, federal tax returns, W-2s, and bank statements.

- Create an FSA ID: Before starting the FAFSA, you and at least one parent (if you are a dependent student) must create an FSA ID. This acts as your digital signature and allows you to access and manage your FAFSA information online.

- Gather Required Information: Collect all necessary tax information, including your tax returns, W-2s, and any other relevant financial documents. This includes information about your income, assets, and family size.

- Complete the Application: Carefully fill out the online FAFSA form, ensuring accuracy in all fields. The form asks for details about your family’s financial situation, your educational goals, and your intended school. Double-check all information before submitting.

- Submit the Application: Once you have reviewed your completed application, submit it electronically. You will receive a confirmation number, which you should keep for your records.

- Review Your Student Aid Report (SAR): After submission, you will receive a Student Aid Report (SAR). This report summarizes the information you provided and indicates your eligibility for federal student aid. Review this carefully for any errors or discrepancies.

Receiving Loan Disbursement and Managing Student Loan Accounts

Once your FAFSA is processed and your school determines your financial aid package, your loan disbursement will be sent directly to your school. The school then applies the funds to your tuition, fees, and other eligible expenses. Any remaining funds may be disbursed to you directly.

Managing your student loan accounts involves staying organized and informed. You should receive information from your loan servicer regarding your loan terms, repayment schedule, and contact information. Regularly reviewing your account statements is crucial to ensure accurate payment and avoid late fees. Understanding your repayment options and exploring potential repayment plans is also important to manage your debt effectively. Contacting your loan servicer with any questions or concerns is recommended.

Default and its Consequences

Defaulting on your student loans can have serious and long-lasting financial repercussions. Understanding what constitutes default and the potential consequences is crucial for responsible loan management. This section will Artikel the definition of default, detail the ramifications, and provide strategies for avoiding this outcome.

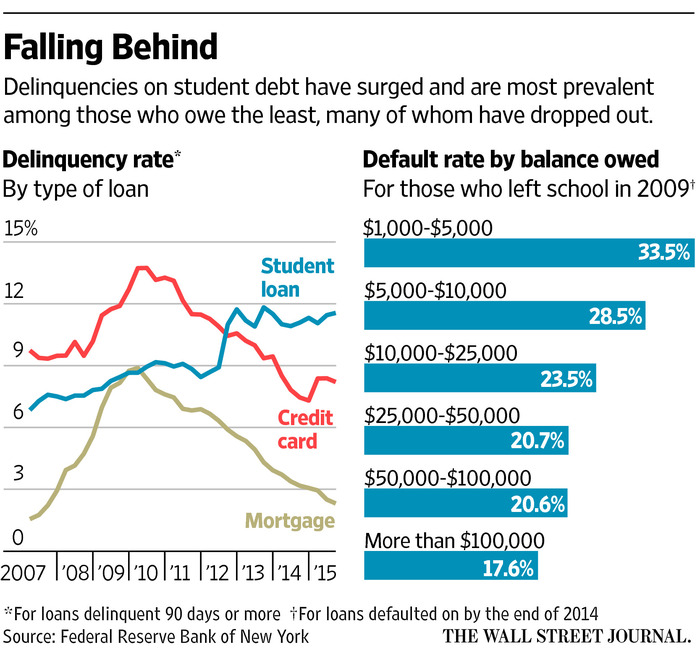

Student loan default occurs when you fail to make your scheduled loan payments for a specific period, typically 270 days or nine months, depending on your loan type and servicer. This isn’t simply missing a payment; it’s a persistent failure to meet your repayment obligations. Once in default, your loan’s status changes significantly, triggering a range of negative consequences.

Consequences of Student Loan Default

Defaulting on student loans triggers a cascade of negative effects that can severely impact your financial well-being. These consequences can extend far beyond the initial debt and significantly hinder your future financial prospects. The severity of these consequences can vary depending on the loan type and the lender.

The most common consequences include wage garnishment, where a portion of your paycheck is automatically withheld to repay the debt; tax refund offset, where your federal tax refund is used to pay down your delinquent loans; and damage to your credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future. In some cases, the defaulted debt can be referred to collections agencies, leading to further fees and aggressive collection efforts. Legal action, including lawsuits, is also a possibility. These actions can create significant financial strain and emotional stress. Furthermore, certain federal benefits and professional licenses may be jeopardized.

Avoiding Student Loan Default

Proactive planning and responsible financial management are key to avoiding student loan default. Creating a realistic budget that prioritizes loan repayment is crucial. This involves understanding your monthly income and expenses, and allocating sufficient funds for your loan payments. Exploring options such as income-driven repayment plans can adjust your monthly payment based on your income and family size, making repayment more manageable. Regular communication with your loan servicer is essential; they can offer guidance and assistance if you anticipate difficulties. Seeking professional financial advice from a credit counselor or financial advisor can also provide valuable insights and strategies for managing your debt effectively. Keeping track of your loan details and due dates is crucial for avoiding missed payments.

Steps to Take When Facing Repayment Difficulties

Facing difficulty in making loan repayments can be stressful, but proactive steps can mitigate the negative consequences.

- Contact your loan servicer immediately: Don’t wait until you’re in default. Explain your situation and explore available options.

- Explore income-driven repayment plans: These plans adjust your monthly payment based on your income and family size.

- Consider deferment or forbearance: These options temporarily postpone your payments, but interest may still accrue.

- Seek professional financial counseling: A credit counselor can help you create a budget and explore debt management strategies.

- Consolidate your loans: Combining multiple loans into one can simplify repayment and potentially lower your monthly payment.

Final Thoughts

Securing student loans requires careful planning and a thorough understanding of the process. By understanding the eligibility requirements, gathering necessary documentation, and choosing a suitable repayment plan, you can effectively manage your student loan debt and focus on your academic pursuits. Remember to explore all available financial aid options to minimize your reliance on loans and build a solid financial foundation for your future.

Commonly Asked Questions

What is the FAFSA and why is it important?

The Free Application for Federal Student Aid (FAFSA) is a form used to determine your eligibility for federal student aid, including grants, loans, and work-study programs. It’s crucial for accessing most federal student financial aid.

Can I get a student loan with bad credit?

While good credit isn’t always required, a poor credit history may limit your loan options or require a co-signer. Federal student loans generally have more lenient credit requirements than private loans.

What happens if I miss a student loan payment?

Missing payments can lead to late fees, damage your credit score, and ultimately, default. Contact your loan servicer immediately if you anticipate difficulties making payments to explore options like deferment or forbearance.

How long does it take to receive loan disbursement?

The disbursement timeline varies depending on the lender and your school’s processing time, but it generally takes several weeks after approval.