Navigating the complexities of higher education often requires financial assistance, and for many students, small loans represent a crucial stepping stone towards achieving their academic goals. This guide delves into the multifaceted world of student loans, offering a clear and concise overview of the various options available, from federal programs to private lenders. We’ll explore eligibility criteria, application processes, repayment strategies, and potential risks, empowering you to make informed decisions about your financial future.

Understanding the landscape of student loans is vital for responsible financial planning. This guide aims to demystify the process, providing you with the knowledge and tools necessary to secure the funding you need while minimizing potential long-term financial burdens. Whether you’re considering federal or private loans, understanding the nuances of each is key to making a well-informed choice that aligns with your individual circumstances and financial goals.

Types of Small Student Loans

Securing funding for higher education can be a significant undertaking. Understanding the different types of student loans available is crucial for making informed financial decisions. This section will explore federal and private student loan options, highlighting their key features and helping you determine which might be the best fit for your needs.

Federal Student Loans

Federal student loans are offered by the U.S. government and generally offer more favorable terms than private loans. These loans are typically less expensive and provide various borrower protections. Two main types exist: subsidized and unsubsidized. Subsidized federal student loans don’t accrue interest while you’re in school at least half-time, during grace periods, and during periods of deferment. Unsubsidized loans, however, begin accruing interest from the moment they’re disbursed. Both types offer various repayment plans to help manage debt after graduation. Eligibility for federal loans is determined by financial need and enrollment status.

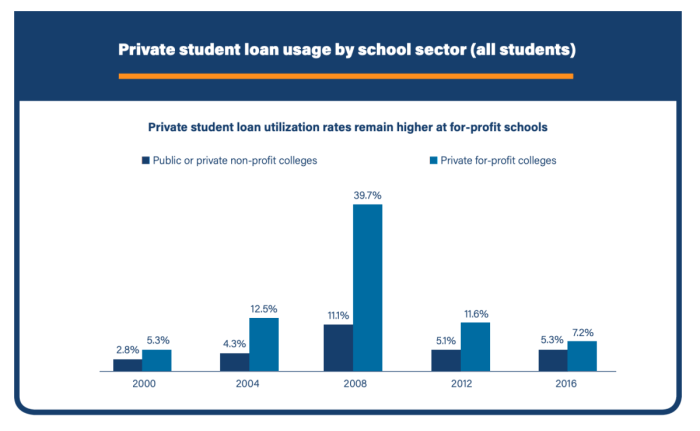

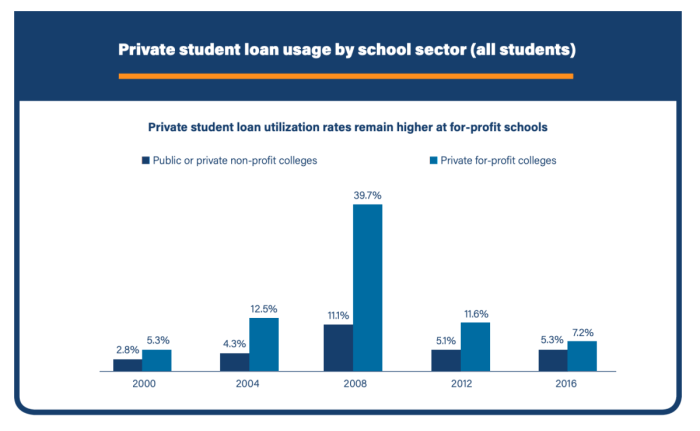

Private Student Loans

Private student loans are offered by banks, credit unions, and other financial institutions. Unlike federal loans, private loan terms and interest rates vary significantly depending on your creditworthiness, co-signer availability, and the lender’s policies. Interest rates on private loans tend to be higher than those on federal loans, and repayment options may be less flexible. It’s essential to compare offers from multiple lenders to secure the best possible terms. Borrowers should carefully review the terms and conditions before accepting a private student loan.

Comparison of Federal and Private Student Loans

Federal student loans generally offer lower interest rates, more flexible repayment options, and various borrower protections, such as deferment and forbearance programs in times of financial hardship. However, eligibility is based on financial need and may have loan amount limits. Private student loans offer greater flexibility in loan amounts but usually come with higher interest rates and less borrower protection. The decision of whether to choose federal or private loans often depends on individual financial circumstances and credit history. Students with strong credit and co-signers might find private loans attractive for larger loan amounts, while those with limited credit history or financial need might find federal loans a more suitable option.

Types of Small Student Loans: A Comparison

| Lender | Interest Rate Range (Approximate) | Loan Amount Limits | Repayment Options |

|---|---|---|---|

| Federal Direct Subsidized Loan | Variable, set annually by the government | Varies depending on the student’s cost of attendance and financial need | Standard, graduated, extended, income-driven |

| Federal Direct Unsubsidized Loan | Variable, set annually by the government | Varies depending on the student’s cost of attendance | Standard, graduated, extended, income-driven |

| Sallie Mae Smart Option Student Loan | Variable, depends on creditworthiness | Varies depending on creditworthiness and co-signer | Standard, graduated |

| Discover Student Loan | Variable, depends on creditworthiness | Varies depending on creditworthiness and co-signer | Standard, graduated |

Eligibility Requirements for Small Student Loans

Securing a student loan, whether federal or private, hinges on meeting specific eligibility criteria. These requirements vary depending on the loan type and lender, impacting your access to funds for educational expenses. Understanding these requirements is crucial for a smooth application process.

Federal Student Loan Eligibility

Federal student loans, offered through programs like the Federal Direct Loan program, generally have broader eligibility criteria than private loans. These loans are designed to be accessible to a wider range of students, prioritizing need and educational goals.

- U.S. Citizenship or Eligible Non-Citizen Status: Applicants must be U.S. citizens or eligible non-citizens, such as permanent residents. Specific documentation will be required to verify this status.

- Enrollment Status: Applicants must be enrolled or accepted for enrollment at least half-time in a degree or certificate program at an eligible institution. This generally means attending classes for at least six credit hours per semester or equivalent.

- High School Diploma or GED: Most federal loan programs require applicants to possess a high school diploma or its equivalent, such as a GED.

- Financial Need (for some programs): Certain federal loan programs, like subsidized loans, consider financial need as a factor in eligibility. This is determined through the Free Application for Federal Student Aid (FAFSA).

- Satisfactory Academic Progress: Students must maintain satisfactory academic progress as defined by their institution to remain eligible for federal student loans. This typically involves maintaining a minimum GPA and completing a minimum number of credits per term.

Private Student Loan Eligibility

Private student loans, offered by banks and other financial institutions, typically have stricter eligibility requirements than federal loans. These loans often consider creditworthiness and financial stability as key factors in the approval process.

- Credit Score: Lenders often require a minimum credit score, which can vary depending on the lender and the loan terms. A higher credit score generally results in more favorable interest rates and loan terms. Students with limited or no credit history may find it challenging to qualify for a private loan without a co-signer.

- Income: Lenders typically assess the applicant’s income or the co-signer’s income to determine their ability to repay the loan. A stable income source demonstrates a higher likelihood of repayment.

- Co-signer: Many private lenders require a co-signer, typically a parent or other responsible adult with good credit, if the student lacks sufficient credit history or income. The co-signer assumes responsibility for the loan repayment if the student defaults.

- Enrollment Status: Similar to federal loans, private lenders usually require proof of enrollment at an eligible institution.

Eligibility for Students with Limited Credit History

Students with limited or no credit history face unique challenges when applying for private student loans. Lenders may be hesitant to approve loans without a demonstrated track record of responsible credit management. However, several options exist to overcome this hurdle.

- Co-signer: A co-signer with a strong credit history can significantly increase the chances of loan approval. The co-signer’s creditworthiness helps mitigate the lender’s risk.

- Federal Student Loans: Federal student loans are generally more accessible to students with limited credit history, as they primarily focus on enrollment status and financial need rather than credit score.

- Secured Loans: Some lenders may offer secured loans, which require collateral to guarantee repayment. This collateral could be a savings account or other asset.

Applying for Small Student Loans

Securing funding for your education often involves navigating the application processes for student loans. Understanding the steps involved, whether for federal or private loans, is crucial for a successful application. This section Artikels the procedures for applying for both types of loans and emphasizes the importance of comparing loan offers.

Federal Student Loan Application Process

Applying for federal student loans primarily involves completing the Free Application for Federal Student Aid (FAFSA). This application gathers information about your financial situation to determine your eligibility for federal aid, including grants, work-study, and loans. The FAFSA data is then sent to your chosen colleges and your state’s higher education agency. They will use this information to determine your financial aid package.

- Complete the FAFSA: Visit the official FAFSA website (studentaid.gov) and create an account. You’ll need your Social Security number, federal tax information (yours and your parents’ if you are a dependent student), and your high school and college information.

- Submit the FAFSA: Once you’ve completed the application, review it carefully for accuracy and submit it electronically. You’ll receive a Student Aid Report (SAR) confirming your submission.

- Receive your Student Aid Report (SAR): The SAR summarizes the information you provided on the FAFSA. Review it for any errors and correct them if necessary.

- Accept your Financial Aid Offer: Your college will send you a financial aid offer outlining the types and amounts of aid you’ve been awarded. You’ll need to accept the loan portion of your offer.

- Loan Disbursement: Once you’ve accepted your loan, the funds will be disbursed directly to your college to cover tuition and fees. Some loans may be disbursed in multiple installments.

Private Student Loan Application Process

Private student loans are offered by banks, credit unions, and other financial institutions. The application process typically involves completing an online application, providing documentation, and undergoing a credit check (if you’re an independent student). Your creditworthiness plays a significant role in determining your eligibility and interest rate.

- Find a Lender: Research different private lenders to compare interest rates, fees, and repayment terms. Consider lenders that offer student loan programs.

- Complete the Application: Each lender will have its own application process. You’ll generally need to provide personal information, educational details, and financial information.

- Provide Required Documents: Lenders typically require documents such as proof of enrollment, transcripts, and tax returns. You may also need to provide a co-signer if you don’t have a strong credit history.

- Credit Check and Approval: The lender will review your application and conduct a credit check. Approval depends on your creditworthiness and the lender’s criteria.

- Loan Disbursement: Upon approval, the funds will be disbursed according to the lender’s terms, often directly to your college.

Comparing Loan Offers

Before accepting any student loan, it’s crucial to compare offers from multiple lenders. This allows you to find the loan with the most favorable terms, including the lowest interest rate, lowest fees, and most manageable repayment plan. Consider factors like the loan’s interest rate (fixed vs. variable), repayment period, and any associated fees. A lower interest rate will save you money over the life of the loan.

Student Loan Application Flowchart

A flowchart illustrating the application process for both federal and private student loans would show two parallel paths. The federal loan path would begin with completing the FAFSA, followed by receiving a financial aid award, accepting the loan offer, and finally, loan disbursement. The private loan path would start with researching and selecting a lender, completing the application and providing documentation, undergoing a credit check and receiving approval, and concluding with loan disbursement. Both paths would converge at the point of loan disbursement to the educational institution. The flowchart would use standard flowchart symbols like ovals (start/end), rectangles (processes), and diamonds (decisions).

Repaying Small Student Loans

Repaying your student loans is a crucial step after graduation. Understanding your repayment options and planning strategically can significantly impact your long-term financial health. Choosing the right repayment plan depends on several factors, including your loan type (federal or private), loan amount, interest rate, and your post-graduation income.

Federal Student Loan Repayment Plans

The federal government offers several repayment plans designed to accommodate varying financial situations. These plans differ in monthly payment amounts and loan repayment periods. Selecting the most appropriate plan is crucial for managing debt effectively and avoiding default.

- Standard Repayment Plan: This plan involves fixed monthly payments over a 10-year period. It’s generally the shortest repayment term and results in the lowest total interest paid, but monthly payments can be higher.

- Graduated Repayment Plan: Payments start low and gradually increase over time, typically every two years. This can be helpful in the early stages of your career when income may be lower, but it leads to higher total interest payments over the life of the loan.

- Income-Driven Repayment Plans (IDR): These plans, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR), base your monthly payment on your income and family size. Payments are typically lower than under standard plans, but the repayment period is longer (often 20 or 25 years), resulting in higher total interest paid. After a set period (usually 20 or 25 years), any remaining balance may be forgiven, but this forgiven amount is considered taxable income.

Private Student Loan Repayment Options

Private student loans, unlike federal loans, don’t offer income-driven repayment plans. Repayment terms and options are determined by the lender.

- Fixed Interest Rate: Your monthly payment remains consistent throughout the loan’s life. This offers predictability in budgeting.

- Variable Interest Rate: Your monthly payment fluctuates based on market interest rate changes. This can lead to unpredictable payments and potentially higher total interest paid if rates rise.

Long-Term Financial Implications of Repayment Strategies

Choosing a repayment plan is a significant financial decision. A shorter repayment period, such as the standard 10-year plan for federal loans, minimizes total interest paid but requires higher monthly payments. Conversely, longer repayment periods like those offered by IDR plans reduce monthly payments but result in substantially higher overall interest costs. Borrowers should carefully weigh the trade-off between lower monthly payments and increased long-term interest expenses. For private loans, the choice between fixed and variable interest rates also influences long-term costs. A fixed rate provides stability, while a variable rate introduces uncertainty.

Sample Loan Repayment Calculation

Let’s assume a $5,000 student loan with a 5% annual interest rate and a 5-year repayment term.

- Annual Interest Rate: 5%

- Monthly Interest Rate: 5% / 12 months = 0.4167%

- Loan Term in Months: 5 years * 12 months/year = 60 months

- Using a loan amortization calculator (easily found online), the approximate monthly payment is $92.72. Note that the exact calculation is complex and involves the use of a formula that accounts for compound interest.

The formula for calculating monthly payments is: M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1] where M = Monthly Payment, P = Principal Loan Amount, i = Monthly Interest Rate, and n = Number of Months.

Potential Risks and Considerations

Taking out student loans can be a crucial step towards achieving higher education, but it’s vital to understand the potential financial implications before signing on the dotted line. Borrowing responsibly requires careful planning and a realistic assessment of your future earning potential. Failing to do so can lead to significant financial strain long after graduation.

Borrowing money for education involves inherent risks, primarily revolving around the accumulation of debt and the potential for high interest rates. These risks can significantly impact your financial well-being for years to come, potentially delaying major life decisions like buying a home or starting a family. Understanding these risks and implementing effective strategies for managing debt is paramount to ensuring a positive outcome.

High Interest Rates and Debt Accumulation

Student loan interest rates can vary significantly depending on the loan type, lender, and your creditworthiness. High interest rates can dramatically increase the total cost of your education over time, leading to a much larger debt burden than the initial loan amount. For example, a $10,000 loan with a 7% interest rate will cost significantly more than the same loan with a 4% interest rate over the repayment period. Careful comparison shopping and exploring options like federal loans with potentially lower interest rates is crucial. The longer it takes to repay the loan, the more interest will accrue, further compounding the debt.

Strategies for Responsible Borrowing and Budgeting

Responsible borrowing starts with careful planning. Before applying for any loans, create a realistic budget that accounts for tuition fees, living expenses, and other educational costs. Determine the minimum amount you need to borrow and avoid taking out more than necessary. Prioritize scholarships, grants, and part-time work to reduce your reliance on loans. Explore different repayment plans and understand the implications of each option. Tracking your spending and income regularly using budgeting apps or spreadsheets can help you stay on track and avoid overspending. Consider setting up automatic payments to avoid late fees and maintain a good credit history.

Resources and Tools for Loan Payment Tracking and Financial Management

Several resources and tools are available to help students track their loan payments and manage their finances effectively. Many lenders provide online portals where you can monitor your loan balance, payment history, and interest accrual. Budgeting apps, such as Mint or YNAB (You Need A Budget), can help you track your income and expenses, create a budget, and set financial goals. Credit monitoring services can help you track your credit score and identify potential issues. Finally, many universities and colleges offer financial aid offices and counseling services that can provide guidance and support in managing student loan debt.

Potential Long-Term Costs of Student Loans

The following table illustrates the potential long-term costs of different loan amounts and interest rates over a 10-year repayment period. Note that these are simplified examples and actual costs may vary depending on the specific loan terms and repayment plan.

| Loan Amount | Interest Rate | Monthly Payment (approx.) | Total Repaid (approx.) |

|---|---|---|---|

| $5,000 | 5% | $50 | $6,000 |

| $10,000 | 7% | $110 | $13,200 |

| $20,000 | 9% | $230 | $27,600 |

| $30,000 | 11% | $350 | $42,000 |

Alternatives to Small Student Loans

Securing funding for higher education shouldn’t solely rely on borrowing. Exploring alternative financing options can significantly reduce your reliance on student loans and potentially alleviate future financial burdens. These alternatives offer various advantages, including avoiding interest accumulation and fostering financial responsibility.

Many students successfully fund their education without significant loans by combining several strategies. A well-rounded approach often involves a mix of merit-based and need-based awards, alongside part-time employment. Understanding the nuances of each funding source is crucial for effective financial planning.

Scholarships

Scholarships are merit-based awards that don’t require repayment. They are often granted based on academic achievement, athletic ability, artistic talent, or demonstrated leadership qualities. The application process varies depending on the awarding institution, ranging from simple online forms to extensive essays and portfolios. Many scholarships are highly competitive, requiring meticulous preparation and strong applications. Securing multiple scholarships can substantially reduce the overall cost of education.

Grants

Unlike scholarships, grants are typically need-based awards. They are offered by government agencies, colleges, and private organizations to students who demonstrate financial need. The application process usually involves completing the Free Application for Federal Student Aid (FAFSA), which assesses your family’s financial situation. Federal grants, such as Pell Grants, are a significant source of need-based aid for eligible students. State and institutional grants also exist, with varying eligibility criteria.

Work-Study Programs

Work-study programs provide part-time employment opportunities for students with financial need. These programs are often administered through the college or university and allow students to earn money while attending school. The work is typically related to the institution’s operations or community service. While the wages may not fully cover tuition costs, they can significantly contribute to living expenses and reduce the need for borrowing. Eligibility is determined by financial need as assessed through the FAFSA.

Comparison of Funding Sources

| Funding Source | Benefits | Drawbacks |

|---|---|---|

| Scholarships | No repayment required, can significantly reduce tuition costs | Highly competitive, requires strong applications |

| Grants | No repayment required, available to students with financial need | Limited funding, may not cover all expenses |

| Work-Study | Earn money while studying, reduces reliance on loans | Limited hours, may not provide sufficient income |

| Small Student Loans | Covers educational expenses, flexible repayment options | Accumulates interest, potential for debt burden |

Finding Scholarships and Grants

Finding suitable scholarships and grants requires proactive research. Numerous websites and organizations specialize in providing information on financial aid opportunities. It’s essential to begin searching early in the application process, as deadlines vary significantly. Thoroughly researching each opportunity is crucial to ensure eligibility and maximize your chances of success.

Reputable Websites and Organizations

- Federal Student Aid (FSA): The official U.S. government website for federal student aid.

- Fastweb: A popular website that lists thousands of scholarships and grants.

- Scholarships.com: Another comprehensive resource for scholarship searches.

- Sallie Mae: A well-known lender that also provides information on scholarships and financial aid.

- Your College’s Financial Aid Office: Your college’s financial aid office is an invaluable resource for information on scholarships, grants, and other forms of financial assistance specific to your institution.

Closure

Securing a small loan for your education can be a significant step towards achieving your academic aspirations. By carefully considering the various options available – federal versus private loans, repayment plans, and alternative funding sources – you can navigate the process effectively and responsibly. Remember that thorough research and careful planning are essential to minimizing financial risk and ensuring a successful path to graduation. This guide provides a solid foundation for understanding your options; however, seeking personalized financial advice is always recommended.

Answers to Common Questions

What is the difference between subsidized and unsubsidized federal loans?

Subsidized loans don’t accrue interest while you’re in school, whereas unsubsidized loans do.

What credit score is needed for a private student loan?

Requirements vary by lender, but generally, a higher credit score improves your chances of approval and secures better interest rates. Co-signers can help if your credit is limited.

Can I refinance my student loans?

Yes, refinancing can potentially lower your interest rate and monthly payments, but it often involves switching from federal to private loans, potentially losing federal protections.

What happens if I default on my student loans?

Defaulting can severely damage your credit score, lead to wage garnishment, and impact your ability to obtain future loans or credit.

How long does it take to repay student loans?

Repayment terms vary depending on the loan type and lender, ranging from several years to over a decade. Repayment plans also influence the duration.