Navigating the complexities of student loan repayment can feel overwhelming, especially when understanding the nuances of interest rates. A crucial element in this process is determining whether your student loan carries a fixed or variable interest rate. This impacts not only your monthly payments but also the total amount you’ll ultimately repay. Understanding the implications of each is paramount to making informed financial decisions.

This exploration delves into the specifics of fixed-rate student loans, examining their advantages and disadvantages, outlining the process of securing such loans, and providing strategies for effective repayment. We’ll also consider how economic factors and government policies can influence the landscape of fixed-rate student loans, empowering you with the knowledge to make the best choices for your financial future.

Understanding Student Loan Interest Rates

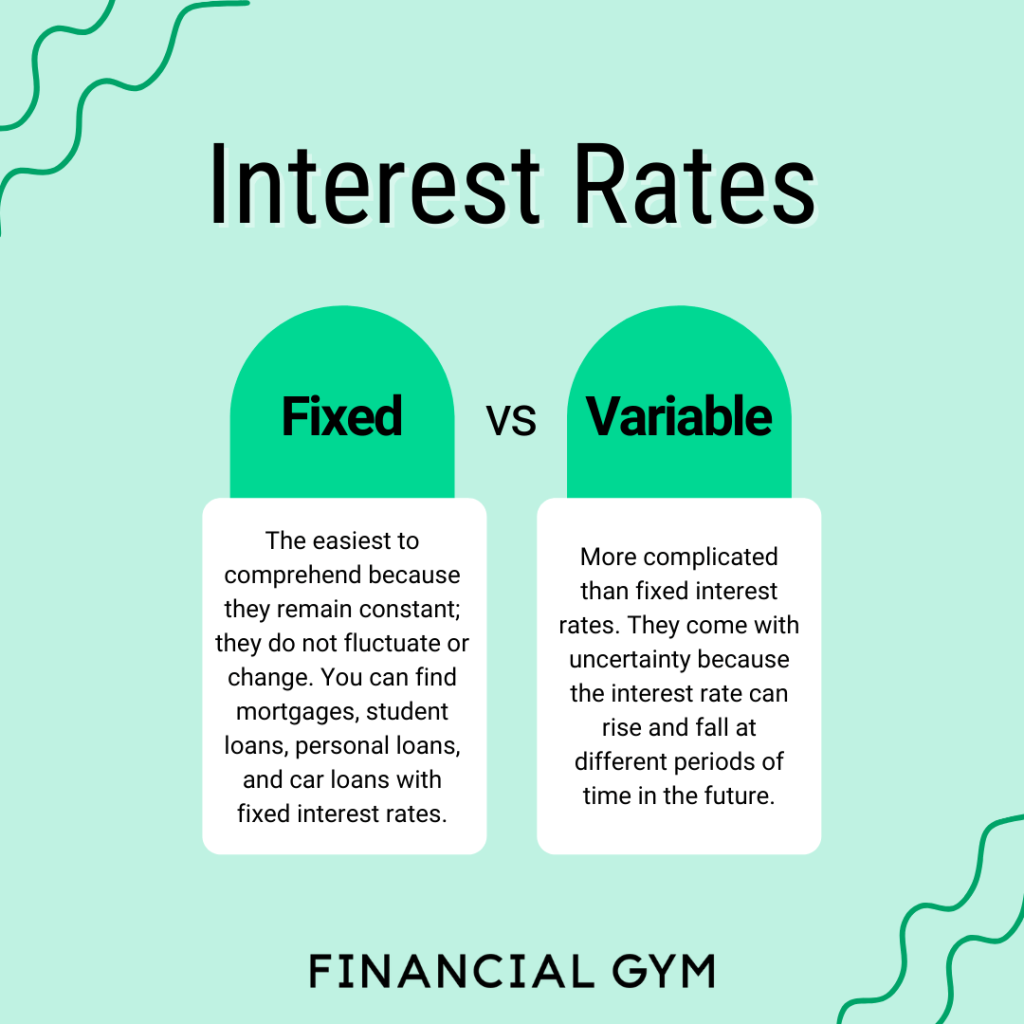

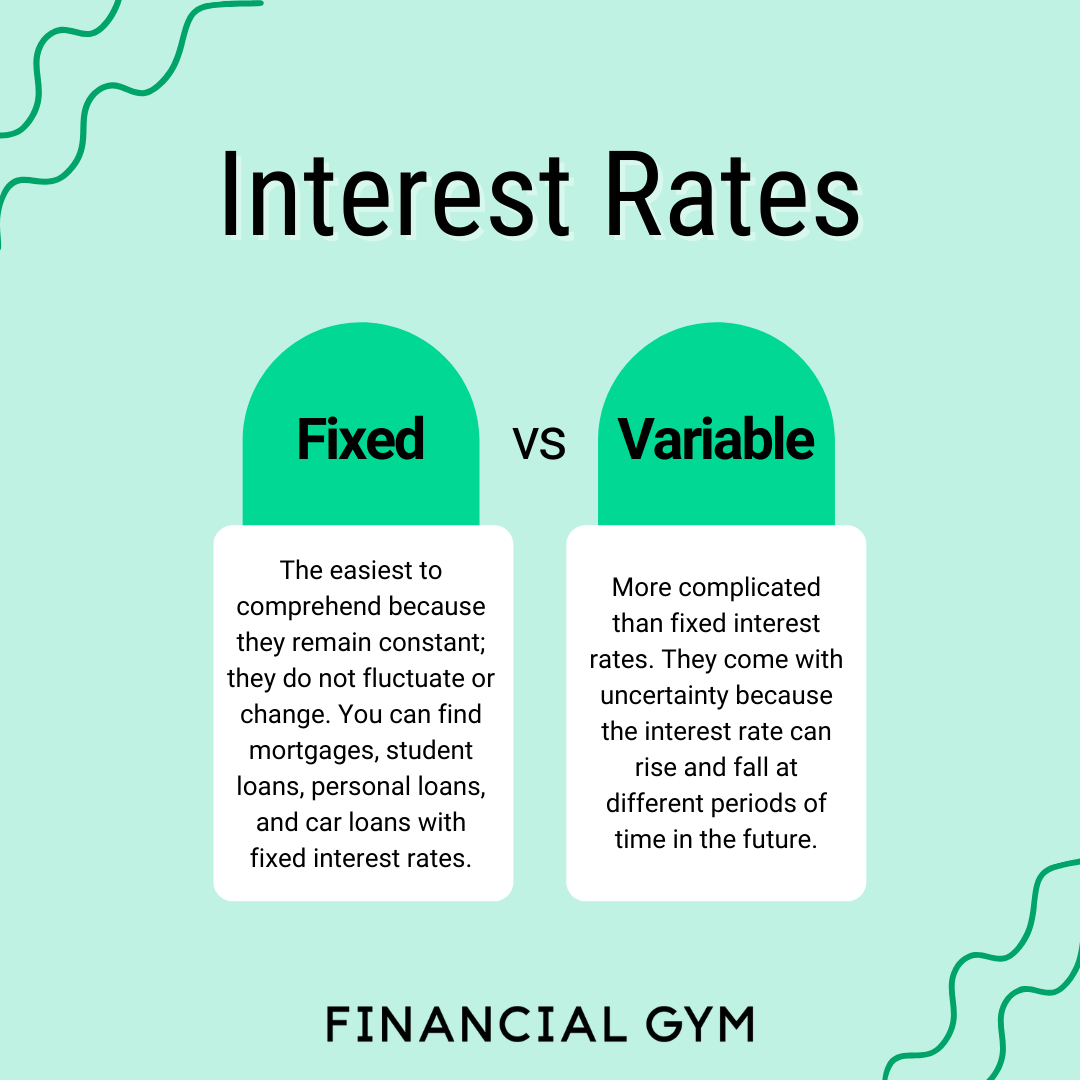

Choosing between a fixed or variable interest rate for your student loan is a crucial decision that significantly impacts your overall repayment costs. Understanding the nuances of each type is essential for making an informed financial choice. This section will clarify the differences between fixed and variable rates, explore the factors that determine these rates, and provide illustrative examples of how these rates affect your loan repayment.

Fixed versus Variable Interest Rates

Fixed interest rates remain constant throughout the life of your student loan. This predictability allows for easier budgeting and repayment planning, as your monthly payment will not fluctuate. In contrast, variable interest rates are subject to change based on market conditions, typically tied to an underlying benchmark interest rate like the prime rate or LIBOR (although LIBOR is being phased out). This means your monthly payment could increase or decrease over time, making long-term financial planning more challenging. The stability of a fixed rate provides a level of certainty, while the potential for lower initial payments with a variable rate can be attractive to some borrowers. However, this potential for lower payments comes with the risk of significantly higher payments later.

Factors Influencing Student Loan Interest Rates

Several factors contribute to the interest rate you’ll receive on your student loan. These include your credit history (or lack thereof, in the case of many undergraduate loans), the type of loan (federal or private), the loan’s repayment term, and the prevailing economic conditions. A strong credit history typically qualifies you for lower interest rates. Federal student loans often have lower interest rates than private loans, due to government subsidies and risk mitigation. Longer repayment terms generally lead to higher overall interest costs, even if monthly payments are lower. Finally, broader economic trends and the federal funds rate influence interest rate movements, affecting both fixed and variable rates, although fixed rates are less sensitive to these fluctuations.

Examples of Fixed Interest Rates Over the Life of a Loan

Let’s consider a $20,000 student loan with a 5% fixed annual interest rate and a 10-year repayment term. The monthly payment would remain constant throughout the loan’s duration. In this example, the borrower would pay approximately $212.47 per month for 10 years. The total interest paid over the life of the loan would be approximately $5,496.60. If the interest rate were 7%, the monthly payment would increase to approximately $229.87, resulting in a total interest paid of approximately $7,792.20. This illustrates the significant impact that even a small change in the fixed interest rate can have on the total cost of the loan.

Comparison of Fixed and Variable Rate Student Loans

| Interest Rate Type | Interest Rate Calculation | Repayment Amount Over Time | Total Interest Paid |

|---|---|---|---|

| Fixed | Set at loan origination and remains constant. | Consistent monthly payments. | Predictable and calculable upfront. |

| Variable | Fluctuates based on an index rate (e.g., prime rate). | Monthly payments change with interest rate fluctuations. | Unpredictable; can be significantly higher or lower than initially projected. |

Fixed Rate Loan Benefits and Drawbacks

Choosing a fixed-rate student loan involves understanding its advantages and disadvantages. While offering predictability, it also limits potential savings compared to variable-rate options. This section will explore these aspects in detail, providing a comprehensive overview to aid your decision-making process.

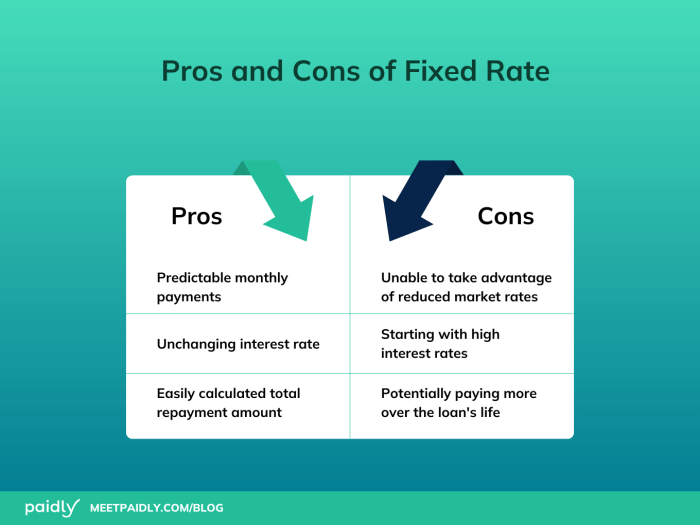

Fixed-rate student loans offer the significant advantage of predictable monthly payments. Knowing exactly how much you’ll owe each month simplifies budgeting and financial planning. This stability can reduce financial stress, especially during the often uncertain post-graduation period. The consistent payment amount eliminates the worry of fluctuating interest rates impacting your monthly budget. Furthermore, a fixed rate provides certainty regarding the total cost of the loan over its lifespan, allowing for accurate long-term financial projections.

Advantages of Fixed-Rate Student Loans

The primary benefit is the predictable monthly payment amount throughout the loan’s term. This predictability is invaluable for budgeting and financial planning, allowing borrowers to confidently allocate funds and avoid unexpected increases in monthly payments. Knowing the total interest paid over the life of the loan also simplifies long-term financial planning, enabling borrowers to make informed decisions about other financial goals.

Disadvantages of Fixed-Rate Student Loans Compared to Variable-Rate Loans

Fixed-rate loans may have higher initial interest rates compared to variable-rate loans, particularly if interest rates are low at the time of borrowing. This higher initial rate can result in paying more interest overall compared to a variable-rate loan if interest rates decrease significantly during the repayment period. While a variable rate offers the potential for lower payments, it also carries the risk of significantly higher payments should interest rates rise.

Comparison of Fixed-Rate Student Loans to Other Loan Types

Fixed-rate structures are common across various loan types, including home mortgages and auto loans. However, the interest rates and terms vary significantly depending on the type of loan and the borrower’s creditworthiness. For example, home loans often have longer repayment periods than student loans, resulting in higher overall interest paid despite potentially lower initial interest rates. Auto loans, conversely, usually have shorter terms, leading to quicker repayment but potentially higher monthly payments. The specific interest rate offered depends on factors like credit score, loan amount, and prevailing market conditions.

Hypothetical Scenario Illustrating Interest Rate Fluctuations

Let’s imagine two students, Alex and Ben, each borrowing $20,000 for their education. Alex chooses a fixed-rate loan with a 6% annual interest rate, while Ben opts for a variable-rate loan with an initial interest rate of 4%, subject to annual adjustments. In the first year, Ben enjoys lower monthly payments. However, if interest rates rise to 8% in subsequent years, Ben’s monthly payments will increase substantially. Alex’s payments remain consistent throughout the loan term. Conversely, if interest rates fall, Ben could see lower payments than Alex, but this is not guaranteed. This illustrates the trade-off between the predictability of a fixed rate and the potential for savings with a variable rate. The best choice depends on individual risk tolerance and predictions about future interest rate movements. Note that this is a simplified scenario; actual interest rate fluctuations and loan terms can be more complex.

Finding Fixed-Rate Student Loans

Securing a fixed-rate student loan involves understanding the landscape of lenders and navigating the application process. This section will guide you through identifying potential lenders, understanding the application process, comparing loan offers, and ultimately, securing your loan. Remember, careful comparison and planning are crucial to finding the best loan for your needs.

Finding the right fixed-rate student loan requires research and careful consideration of several factors. This process involves identifying potential lenders, completing applications, and comparing offers to find the most suitable option.

Lenders Offering Fixed-Rate Student Loans

Several institutions offer fixed-rate student loans. These include federal loan programs (administered through the U.S. Department of Education), private lenders (banks, credit unions, and online lenders), and potentially state-sponsored loan programs. Federal loans generally offer more favorable terms and protections, but private loans might be necessary if federal options are insufficient to cover educational costs. It’s important to investigate all available options.

The Application Process for Fixed-Rate Student Loans

The application process varies depending on the lender. Federal loan applications generally involve completing the Free Application for Federal Student Aid (FAFSA), while private loan applications typically require providing personal and financial information, including credit history (if applicable), and details about your education and intended program. Expect to provide documentation such as tax returns, bank statements, and proof of enrollment. Pre-qualification may be available to assess your eligibility without impacting your credit score.

Factors to Consider When Comparing Fixed-Rate Loan Offers

Before accepting a fixed-rate student loan offer, carefully compare several key factors across different lenders.

- Interest Rate: The annual percentage rate (APR) is a crucial factor. A lower APR will result in lower overall interest payments over the life of the loan.

- Fees: Many lenders charge origination fees, late payment fees, and other charges. These fees can significantly impact the overall cost of the loan.

- Loan Term: Longer loan terms result in lower monthly payments but higher overall interest payments. Shorter loan terms mean higher monthly payments but lower overall interest paid.

- Repayment Options: Explore different repayment plans offered, such as standard repayment, graduated repayment, or income-driven repayment plans. Understand the implications of each option.

- Deferment and Forbearance Options: In case of financial hardship, check the lender’s policies on deferment (temporary suspension of payments) and forbearance (temporary reduction in payments).

- Customer Service and Reputation: Research the lender’s reputation and customer service. Look for reviews and ratings from other borrowers.

Securing a Fixed-Rate Student Loan: A Step-by-Step Guide

Securing a fixed-rate student loan involves a systematic approach.

- Assess Your Needs: Determine the total amount of funding required for your education, considering tuition, fees, living expenses, and other costs.

- Explore Federal Loan Options: Complete the FAFSA to determine your eligibility for federal student loans. Federal loans often have more favorable terms than private loans.

- Research Private Lenders: If federal loans are insufficient, research private lenders and compare their offers based on the factors discussed above.

- Pre-qualify (if available): Use pre-qualification tools to check your eligibility without affecting your credit score.

- Complete the Application: Once you’ve chosen a lender, complete the loan application accurately and thoroughly, providing all required documentation.

- Review and Accept the Loan Offer: Carefully review the loan terms and conditions before accepting the offer. Understand all fees and repayment options.

- Understand Your Rights and Responsibilities: Familiarize yourself with your rights as a borrower and your responsibilities regarding loan repayment.

Repaying Fixed-Rate Student Loans

Repaying student loans can seem daunting, but understanding your options and employing effective strategies can significantly ease the process. The repayment plan you choose will directly impact the total amount you pay over the life of your loan, influencing both your monthly payments and the overall interest accrued. Choosing wisely is crucial to minimizing your long-term financial burden.

Successfully navigating student loan repayment requires a proactive approach. This involves careful consideration of different repayment plans, proactive budgeting, and a commitment to consistent payments. Failing to do so can lead to serious financial consequences.

Available Repayment Plans

Several repayment plans are available for fixed-rate student loans, each with its own advantages and disadvantages. The best plan for you will depend on your individual financial circumstances and income. Common plans include Standard Repayment, Extended Repayment, Graduated Repayment, and Income-Driven Repayment (IDR) plans. Standard Repayment involves fixed monthly payments over a 10-year period. Extended Repayment stretches payments over a longer period (up to 25 years), reducing monthly payments but increasing total interest paid. Graduated Repayment starts with lower monthly payments that gradually increase over time. IDR plans, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE), base your monthly payments on your income and family size. These plans often result in lower monthly payments but can extend the repayment period significantly, leading to higher total interest costs.

Impact of Repayment Options on Total Interest Paid

The choice of repayment plan significantly impacts the total interest paid over the life of the loan. Shorter repayment plans, like the Standard Repayment plan, minimize the total interest paid but result in higher monthly payments. Conversely, longer repayment plans, such as Extended Repayment or IDR plans, reduce monthly payments but increase the total interest paid due to the extended repayment period. For example, a $30,000 loan with a 5% interest rate repaid over 10 years (Standard Repayment) might accrue $4,000 in interest, while the same loan repaid over 25 years (Extended Repayment) could accrue $15,000 or more in interest. The specific amounts will vary based on the interest rate and the loan amount.

Strategies for Effective Repayment

Effective repayment strategies are key to minimizing debt and avoiding financial hardship.

- Budgeting and Prioritization: Create a detailed budget that includes your student loan payments as a top priority. Track your income and expenses carefully to ensure you can afford your monthly payments.

- Automatic Payments: Set up automatic payments to avoid missed payments and late fees. This ensures consistent payments and helps you stay on track.

- Extra Payments: Whenever possible, make extra payments towards your principal loan balance. This will reduce the total interest paid and shorten the repayment period. Even small extra payments can make a significant difference over time.

- Refinancing: Consider refinancing your loans if interest rates fall. This could lower your monthly payments and reduce the total interest paid. However, carefully compare offers before refinancing.

- Consolidation: Consolidating multiple loans into a single loan can simplify repayment and potentially lower your monthly payment. This however might not always reduce the total interest paid.

Consequences of Defaulting on a Fixed-Rate Student Loan

Defaulting on your student loans has severe consequences. These can include damage to your credit score, wage garnishment, tax refund offset, and difficulty obtaining future loans or credit. Furthermore, the government may pursue legal action to recover the debt. In some cases, default can lead to significant financial penalties and even legal action. It is crucial to contact your loan servicer immediately if you are struggling to make your payments to explore available options for avoiding default.

Impact of Economic Factors on Fixed-Rate Student Loans

The seemingly fixed nature of a student loan’s interest rate doesn’t entirely shield it from the fluctuating landscape of the economy. Several macroeconomic factors significantly influence both the initial interest rate offered and the loan’s overall cost over time, impacting the borrower’s long-term financial well-being. Understanding these influences is crucial for prospective and current student loan borrowers.

Inflation’s effect on the real cost of a fixed-rate student loan is a prime example. While the nominal interest rate remains constant, inflation erodes the purchasing power of both the loan payments and the principal amount over time. This means that while the dollar amount of your monthly payment stays the same, what those dollars can buy decreases with rising inflation. For instance, a $500 monthly payment might represent a significant portion of a borrower’s income in a low-inflation environment, but the same payment might represent a smaller portion if inflation significantly increases the cost of living. Consequently, the real burden of the loan increases, despite the fixed interest rate.

Inflation’s Impact on Real Loan Cost

Inflation directly reduces the real value of money. A fixed-rate loan, while seemingly protecting against interest rate fluctuations, doesn’t protect against inflation. Consider a scenario where a student takes out a $10,000 loan at a 5% fixed interest rate. If inflation averages 3% annually, the real interest rate is only 2% (5% – 3%). However, if inflation unexpectedly jumps to 6%, the real interest rate becomes negative (-1%), making the loan effectively cheaper in real terms. Conversely, if inflation remains low or is lower than the interest rate, the real cost of the loan is higher. This illustrates the dynamic interplay between inflation and the true cost of a fixed-rate student loan.

Interest Rates and Loan Availability

Prevailing interest rates in the broader financial market strongly influence the availability of fixed-rate student loans and the rates offered. When general interest rates are low, lending institutions are more willing to offer fixed-rate student loans at competitive rates, increasing their availability. Conversely, during periods of high interest rates, lenders might be less inclined to offer fixed-rate loans, or they may offer them at higher rates, potentially reducing the number of available options and increasing borrowing costs for students. The Federal Reserve’s monetary policy plays a pivotal role in this dynamic, as its actions directly influence the overall interest rate environment.

Government Policy Influence on Interest Rates

Government policies and regulations significantly impact fixed-rate student loan interest rates. Government subsidies, loan guarantee programs, and direct lending initiatives can directly influence the interest rates charged on federal student loans. Changes in government spending priorities or shifts in economic policy can affect the overall cost of these loans. For example, government decisions to increase or decrease subsidies can directly translate to lower or higher interest rates for borrowers. Additionally, regulatory changes concerning lending practices can also affect the rates and terms offered by both private and government lenders.

Macroeconomic Conditions and Loan Affordability

Macroeconomic conditions, encompassing factors like unemployment rates, economic growth, and overall consumer confidence, significantly affect the affordability of fixed-rate student loans. High unemployment rates can reduce borrowers’ ability to repay loans, leading to potential defaults and increased risk for lenders. This, in turn, can lead to higher interest rates or reduced availability of loans. Conversely, periods of strong economic growth and low unemployment often lead to lower interest rates and increased loan availability due to reduced risk and increased lender confidence. The 2008 financial crisis serves as a stark example, where the economic downturn led to a tightening of credit markets, making student loans harder to obtain and more expensive.

Final Summary

Ultimately, the decision between a fixed-rate and variable-rate student loan hinges on individual circumstances and risk tolerance. While fixed-rate loans offer predictability and stability, they may not always represent the lowest initial interest rate. By carefully weighing the pros and cons, understanding the application process, and employing effective repayment strategies, borrowers can navigate the student loan system confidently and responsibly, paving the way for a secure financial future. Remember to thoroughly research lenders and compare loan offers before making a commitment.

Essential Questionnaire

What are the common types of student loans?

Common types include federal subsidized and unsubsidized loans, federal PLUS loans (for parents and graduate students), and private student loans. Each has different eligibility requirements and interest rate structures.

Can I refinance my student loans to a fixed rate?

Yes, refinancing is an option, allowing you to potentially secure a lower interest rate or switch from a variable to a fixed rate. However, refinancing often involves private lenders and may impact your eligibility for federal loan repayment programs.

What happens if I default on a fixed-rate student loan?

Defaulting on a student loan has serious consequences, including damage to your credit score, wage garnishment, and potential legal action. It’s crucial to explore repayment options if you’re struggling to make payments.

How do I find the best fixed-rate student loan?

Compare offers from multiple lenders, considering factors like interest rates, fees, repayment terms, and lender reputation. Use online comparison tools and consult with a financial advisor.