Navigating the world of student loans can feel overwhelming, but understanding your options is key to financial success. This Ascent student loans review delves into the various loan products, application processes, customer service experiences, and repayment options offered by Ascent. We’ll compare Ascent to other major lenders, analyze its financial stability, and provide illustrative examples to help you determine if Ascent is the right choice for your educational financing needs. We aim to provide a clear and comprehensive assessment, empowering you to make informed decisions about your student loan journey.

This review covers everything from the specifics of Ascent’s loan offerings and their eligibility criteria to practical advice on navigating the application process and managing repayments. We’ll examine customer feedback, analyze repayment plans, and assess Ascent’s overall financial health to provide a well-rounded perspective. By the end, you’ll have a clearer understanding of whether Ascent’s student loans align with your individual circumstances and financial goals.

Ascent Student Loan Products Overview

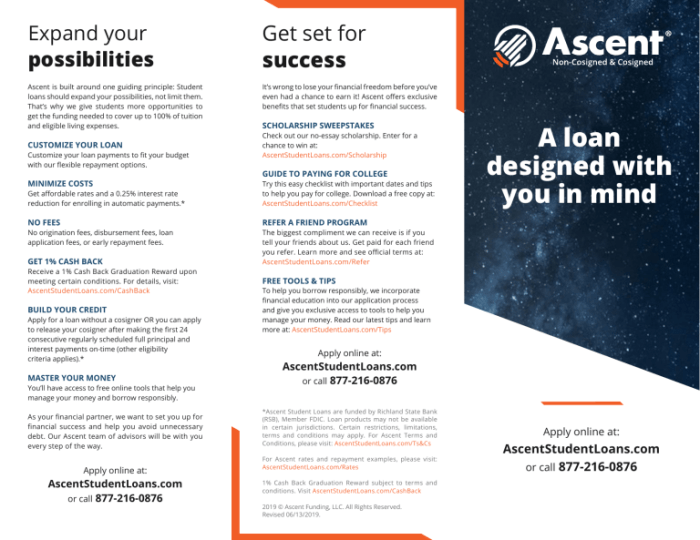

Ascent offers a range of student loan products designed to cater to various financial needs and borrower profiles. Unlike some federal loan programs, Ascent focuses on private student loans, offering competitive interest rates and flexible repayment options. Understanding the nuances of their offerings is crucial for prospective borrowers to make informed decisions.

Ascent’s primary student loan products are geared towards undergraduate and graduate students, and they differ slightly in terms of eligibility and repayment plans. The company also offers parent loans, allowing parents to borrow on behalf of their children. The key differentiator for Ascent lies in its credit-based underwriting process, meaning that borrowers with strong credit profiles may qualify for more favorable interest rates. This contrasts with some federal loan programs that prioritize need-based assessments.

Ascent Student Loan Product Details

Ascent provides several distinct loan products, each with specific features. Their undergraduate and graduate loans cater to students pursuing higher education. Parent loans provide financial support for students whose parents need to borrow funds. These loans are all private loans and thus require a credit check and typically have variable interest rates which can fluctuate over the life of the loan. Eligibility criteria usually involve being enrolled at least half-time in an eligible program, having a U.S. address, and demonstrating a reasonable credit history (or having a co-signer with a good credit history).

Comparison with Other Major Student Loan Providers

Ascent competes with established players like Sallie Mae, Discover, and private banks offering student loans. While all these lenders provide private student loans, Ascent distinguishes itself through its focus on credit-based underwriting and its use of technology for a streamlined application process. Other lenders may offer a broader range of loan types or have different eligibility criteria, including those that prioritize need-based assessments over credit scores. Direct comparison requires reviewing individual offers as interest rates and terms vary based on creditworthiness, the borrower’s chosen repayment plan, and other factors.

Ascent Loan Comparison Table

The following table provides a simplified comparison of Ascent’s loan types. Note that these are illustrative examples and actual rates and fees may vary depending on individual creditworthiness and market conditions. It is crucial to check Ascent’s website for the most up-to-date information.

| Loan Type | Interest Rate (Example) | Repayment Terms (Example) | Fees (Example) |

|---|---|---|---|

| Undergraduate Loan | 6.0% – 12.0% Variable | 5-15 years | Origination fee (may vary) |

| Graduate Loan | 7.0% – 13.0% Variable | 5-15 years | Origination fee (may vary) |

| Parent Loan | 7.5% – 13.5% Variable | 5-15 years | Origination fee (may vary) |

Ascent Student Loan Application Process

Applying for an Ascent student loan involves a straightforward process designed for ease of use. The application itself is completed online, and the entire process, from initial application to loan disbursement, is generally efficient. However, understanding the steps involved and the necessary documentation will ensure a smooth and timely experience.

The Ascent student loan application process is primarily online, requiring applicants to provide personal and financial information. This information is then used to assess creditworthiness and determine loan eligibility. The verification process involves confirming the provided details through various methods, such as accessing credit reports and verifying academic enrollment.

Required Documentation

Applicants should gather the necessary documents before starting the application to streamline the process. Generally, this includes personal identification (such as a driver’s license or passport), proof of enrollment (an acceptance letter or current enrollment verification from your educational institution), and information regarding your income and financial resources. Ascent may request additional documentation depending on individual circumstances. Providing accurate and complete information upfront will minimize delays.

Step-by-Step Application Guide

- Create an Account: Begin by creating an account on the Ascent website. This involves providing basic personal information such as your name, email address, and date of birth.

- Complete the Application: Fill out the online application form completely and accurately. This will include details about your educational institution, program of study, loan amount requested, and financial information.

- Upload Supporting Documents: Upload the required supporting documents, such as proof of enrollment and identification, as prompted by the application system.

- Review and Submit: Carefully review your application for accuracy before submitting it. Once submitted, you cannot make changes without contacting Ascent directly.

- Verification and Processing: Ascent will verify the information provided in your application. This may involve contacting your educational institution or checking your credit report. This step can take several business days.

- Loan Approval or Denial: Once the verification process is complete, Ascent will notify you of their decision regarding your loan application. If approved, you will receive details about the loan terms and disbursement schedule.

- Loan Disbursement: If approved, the loan funds will be disbursed according to the terms Artikeld in your loan agreement. Disbursement is typically made directly to your educational institution to cover tuition and fees.

Verification Process

The verification process is crucial to ensure the accuracy and validity of the information provided in the application. Ascent utilizes various methods, including automated systems and manual reviews, to verify applicant details. This includes confirming enrollment status with the educational institution, verifying income information through third-party sources, and accessing credit reports to assess creditworthiness. This thorough process helps to mitigate risk and protect both the borrower and the lender.

Ascent Customer Service and Support

Ascent’s customer service is a crucial aspect of the overall borrowing experience. Positive interactions can significantly alleviate stress during the loan process, while negative experiences can create unnecessary complications. Understanding the various support channels and the common feedback from borrowers will help prospective students make informed decisions.

Ascent offers several avenues for borrowers to seek assistance, allowing for flexibility depending on individual preferences and the urgency of the issue. The effectiveness of these channels, however, varies based on user reviews and reported experiences. This section analyzes Ascent’s customer service based on user feedback, categorized by the type of support sought.

Ascent Customer Support Channels

Ascent provides customer support through multiple channels, aiming to cater to diverse communication styles. These include phone support, email, and online chat. Phone support is generally considered the quickest method for urgent issues, allowing for immediate interaction with a representative. Email provides a written record of the interaction, which can be beneficial for complex issues requiring documentation. The online chat function offers a convenient option for quick questions or less urgent matters. The availability and responsiveness of each channel can vary depending on factors like time of day and demand.

Customer Review Analysis: Loan Application Support

Reviews regarding support during the loan application process are mixed. Some borrowers report positive experiences, praising the representatives’ knowledge and helpfulness in navigating the application steps and addressing their specific questions. Others, however, cite difficulties in reaching a representative or experiencing long wait times. A common complaint involves unclear communication regarding application status updates, leading to frustration and uncertainty. For example, one borrower reported waiting over a week for a response to an email inquiry about their application status. Another borrower described a positive experience, highlighting the representative’s patience in explaining the various loan options and answering complex financial questions.

Customer Review Analysis: Repayment Support

Regarding repayment support, reviews generally indicate a higher level of satisfaction. Many borrowers praise the clarity of repayment information provided by Ascent and the availability of representatives to answer questions about payment plans, interest rates, and other financial aspects of repayment. However, some users report challenges in modifying their repayment plans or resolving billing discrepancies. Specific examples include difficulties in contacting representatives during peak hours and inconsistent responses to requests for repayment plan adjustments.

Customer Review Analysis: Troubleshooting Technical Issues

Customer reviews related to troubleshooting technical issues with the Ascent platform are less frequent but often reveal significant challenges. Many users report difficulties in accessing their accounts or navigating the online portal. The lack of readily available troubleshooting resources, such as FAQs or comprehensive online guides, is a recurring criticism. When contacting support for technical assistance, some borrowers experienced long wait times and difficulty in clearly explaining their technical issues to representatives. In some instances, users reported that representatives lacked the technical expertise to effectively resolve their problems.

Ascent Loan Repayment Options and Features

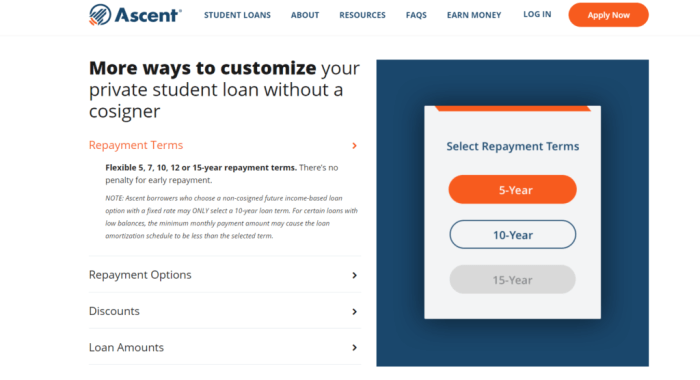

Ascent offers several repayment options designed to accommodate borrowers’ varying financial situations and preferences. Understanding these options and any accompanying features is crucial for effective loan management and minimizing long-term costs. Choosing the right plan depends on your post-graduation income and financial goals.

Ascent’s repayment plans aim to provide flexibility without compromising on responsible borrowing. They offer a range of choices, including options that adjust payments based on income, allowing borrowers to navigate potential financial uncertainties after graduation. This contrasts with some lenders who offer only a standard repayment plan.

Standard Repayment

The standard repayment plan involves fixed monthly payments over a set period (typically 10 years). This provides predictability in budgeting, as the payment amount remains consistent throughout the loan term. This predictability is attractive to borrowers who prefer a consistent monthly expense. However, the fixed monthly payment might be higher than other repayment options in the initial years.

Graduated Repayment

The graduated repayment plan starts with lower monthly payments that gradually increase over time. This option can be beneficial for borrowers who anticipate higher income in the later years of their repayment period. The lower initial payments may ease the transition into repayment after graduation, but it’s important to note that the total amount paid over the loan term remains the same, only the timing of payments changes.

Income-Driven Repayment (IDR) Plans

Ascent may offer income-driven repayment plans, though the specific plans and eligibility criteria should be confirmed directly with Ascent. These plans typically tie monthly payments to a percentage of your discretionary income. If your income is low, your monthly payments may be lower or even $0. However, it is important to understand that any unpaid interest may be capitalized, leading to a higher overall loan balance.

Autopay Discount and Deferment Options

Ascent typically offers an autopay discount, reducing the monthly payment amount for borrowers who enroll in automatic payments. This incentive encourages timely payments and can result in significant savings over the life of the loan. Deferment options may also be available under certain circumstances, such as unemployment or enrollment in graduate school, temporarily suspending payments. However, interest may still accrue during deferment periods, potentially increasing the total loan amount owed.

Comparison with Other Lenders

Compared to other student loan providers, Ascent’s repayment options generally align with industry standards. Many lenders offer standard, graduated, and income-driven repayment plans. However, the specific features and eligibility criteria can vary significantly between lenders. Some lenders may offer more flexible deferment options or different autopay discounts. It is crucial to compare offers from multiple lenders to find the repayment plan that best suits your individual circumstances and financial goals. A thorough comparison should include not only the repayment options but also interest rates, fees, and other loan terms.

Ascent’s Financial Health and Stability

Ascent, a relatively newer player in the student loan market compared to established giants, has demonstrated a commitment to financial stability and responsible growth. Understanding their financial health is crucial for prospective borrowers seeking assurance about the long-term viability of their loan provider. This section examines Ascent’s financial performance, highlighting key factors contributing to its stability and providing a brief overview of its trajectory.

Ascent’s financial performance is not publicly available in the same detail as publicly traded companies. As a privately held company, Ascent is not obligated to release detailed financial statements. However, information gleaned from press releases, investor reports (when available), and industry analyses paints a picture of a company experiencing significant growth and focused on responsible lending practices. This focus on responsible lending, coupled with strategic partnerships and technological innovation, are key factors in its ongoing stability.

Ascent’s Growth and Development Timeline

Ascent’s history, while shorter than some competitors, shows a rapid expansion in the student loan market. While precise financial data is limited, a general timeline can be constructed based on publicly available information. This timeline reflects key milestones in Ascent’s development, showcasing its progress and market penetration.

While specific revenue figures and profit margins are not publicly disclosed, press releases often highlight significant milestones such as loan volume increases and partnerships formed with educational institutions. This information, while not a complete financial picture, provides valuable context for understanding Ascent’s growth.

Factors Contributing to Ascent’s Financial Health

Several factors contribute to Ascent’s financial health and stability. These include a focus on responsible lending practices, strategic partnerships with educational institutions, and a technology-driven approach to loan origination and management. Responsible lending practices minimize default rates, while strategic partnerships expand their reach and brand recognition. Technological advancements streamline operations, increasing efficiency and reducing operational costs. The interplay of these factors is vital for maintaining a strong financial position.

For example, Ascent’s focus on providing loans to students with strong academic records and co-signers mitigates risk and helps maintain a healthy loan portfolio. Furthermore, their use of technology for automated underwriting and customer service reduces operational costs and improves efficiency. These strategic choices directly impact Ascent’s bottom line and contribute to its overall financial stability.

Credit Ratings and Investor Reports

Because Ascent is a privately held company, it does not have publicly available credit ratings from agencies like Moody’s or S&P. The lack of public credit ratings is common for privately held companies and doesn’t necessarily indicate a negative financial situation. Similarly, detailed investor reports are not publicly accessible. However, the company’s continued operation and expansion suggest a positive reception from investors, though the specifics of their investment strategies remain confidential.

The absence of publicly available credit ratings and investor reports should be considered within the context of Ascent’s private ownership structure. While a lack of this information may raise some concerns for potential borrowers, the company’s continued growth and expansion suggest a positive outlook from private investors who have access to more detailed financial information.

Illustrative Examples of Ascent Loan Scenarios

Understanding the true cost of a student loan requires careful consideration of repayment plans and available features. The following examples illustrate how different choices can significantly impact the overall cost and repayment timeline. We will examine scenarios using hypothetical but realistic loan amounts and interest rates.

Ascent offers various repayment plans, each with its own implications for total interest paid and monthly payments. Choosing the right plan depends on your individual financial circumstances and repayment goals. The examples below demonstrate the financial impact of different choices.

Ascent Repayment Plan Comparison: Impact on Total Loan Cost

Let’s compare two borrowers, both receiving a $20,000 Ascent loan with a 7% interest rate. Borrower A chooses a standard 10-year repayment plan, while Borrower B opts for a 15-year repayment plan.

| Borrower | Repayment Plan | Monthly Payment (approx.) | Total Interest Paid (approx.) | Total Repayment (approx.) |

|---|---|---|---|---|

| A | 10-year | $220 | $6,400 | $26,400 |

| B | 15-year | $160 | $10,400 | $30,400 |

This table illustrates that while Borrower B enjoys lower monthly payments, they ultimately pay significantly more in interest over the life of the loan. Borrower A, despite higher monthly payments, saves approximately $4,000 in interest.

Effective Debt Management Using Ascent Features: A Hypothetical Scenario

This scenario demonstrates how a borrower, Sarah, can leverage Ascent’s features to effectively manage her $30,000 loan.

- Strategic Repayment Plan Selection: Sarah chooses a 10-year repayment plan to minimize total interest paid, despite slightly higher monthly payments.

- Autopay Enrollment: Sarah enrolls in autopay, securing a small interest rate reduction, saving her money over the life of the loan.

- Income-Driven Repayment Exploration: Anticipating potential income fluctuations, Sarah explores Ascent’s income-driven repayment options, providing a safety net should her financial situation change.

- Financial Health Resources Utilization: Sarah actively uses Ascent’s financial health resources, including budgeting tools and financial literacy materials, to enhance her financial management skills and improve her overall financial well-being.

- Proactive Communication: Should any unforeseen circumstances arise, Sarah proactively communicates with Ascent’s customer service team to explore potential repayment adjustments or hardship options.

Ascent Loan Savings Infographic Description

The infographic visually represents the potential long-term savings associated with choosing Ascent’s loan products, specifically highlighting the benefits of choosing shorter repayment plans and utilizing features like autopay. The infographic would use a bar chart comparing the total interest paid over the loan’s lifetime for different repayment plans (e.g., 5-year, 10-year, 15-year). A second section would illustrate the cumulative savings achieved through autopay discounts over the loan term, represented by a visually appealing graph showing the difference between total repayment with and without autopay. Finally, a concise summary would highlight the key takeaways, emphasizing the long-term financial benefits of proactive loan management with Ascent. The overall design would be clean, modern, and easy to understand, using clear labels and a consistent color scheme. The infographic would clearly show that while shorter-term loans may have higher monthly payments, the significant reduction in overall interest paid leads to substantial long-term savings. Real-world examples of savings amounts, based on various loan amounts and interest rates, would be included to further enhance the infographic’s impact and credibility.

Conclusive Thoughts

Ultimately, choosing the right student loan provider is a deeply personal decision. This Ascent student loans review provides a thorough examination of the company’s offerings, aiming to equip you with the knowledge needed to make an informed choice. By carefully considering the information presented—from loan features and repayment options to customer service experiences and financial stability—you can confidently assess whether Ascent aligns with your needs and long-term financial objectives. Remember to explore all available options and compare them based on your individual circumstances before making a final decision.

FAQ Compilation

What are the interest rates for Ascent student loans?

Interest rates vary depending on the loan type, creditworthiness, and other factors. Check Ascent’s website for current rates.

Does Ascent offer loan forgiveness programs?

Ascent doesn’t directly offer loan forgiveness programs, but borrowers may qualify for government programs depending on their career path and other factors.

What happens if I miss a loan payment?

Late payments can result in late fees and negatively impact your credit score. Contact Ascent immediately if you anticipate difficulty making a payment to explore options like deferment or forbearance.

Can I refinance my existing student loans with Ascent?

Ascent primarily offers new student loans, not refinancing for existing loans from other lenders. Check their website for the most up-to-date information.