Navigating the complex world of student loans can feel overwhelming, especially when the goal is securing the lowest possible interest rate. Understanding the factors that influence these rates—from your credit score to the type of loan—is crucial for minimizing your long-term debt burden. This guide will equip you with the knowledge to make informed decisions and find the most affordable financing for your education.

From comparing federal and private loan options to exploring different repayment plans, we’ll break down the key aspects of securing the cheapest student loan interest rate. We’ll also address common misconceptions and hidden fees, empowering you to confidently navigate the loan application process and achieve your educational goals without unnecessary financial strain.

Understanding Student Loan Interest Rates

Securing student loans is a significant financial decision, and understanding the interest rates associated with them is crucial for responsible borrowing. Interest rates directly impact the total cost of your education, determining how much you’ll ultimately repay. This section will clarify the factors influencing these rates and help you navigate the complexities of fixed versus variable options offered by different lenders.

Factors Influencing Student Loan Interest Rates

Several factors contribute to the interest rate you’ll receive on your student loans. These factors vary depending on whether you’re borrowing from federal or private lenders. Generally, a higher credit score, a lower debt-to-income ratio, and a co-signer (for private loans) can all lead to lower interest rates. Conversely, a lower credit score or a higher debt burden may result in higher rates. The type of loan (subsidized vs. unsubsidized, for federal loans) also plays a significant role. Additionally, prevailing market interest rates influence the rates offered by both federal and private lenders. For example, during periods of economic uncertainty or high inflation, interest rates tend to rise.

Fixed Versus Variable Interest Rates for Student Loans

Student loans can come with either fixed or variable interest rates. A fixed interest rate remains constant throughout the loan’s repayment period, providing predictability and stability in your monthly payments. A variable interest rate, on the other hand, fluctuates based on an underlying benchmark rate, such as the prime rate or LIBOR. This means your monthly payments could increase or decrease over time depending on market conditions. While variable rates may initially be lower than fixed rates, the potential for increases makes them riskier for borrowers. Choosing between a fixed and variable rate depends on your risk tolerance and financial circumstances. For example, someone with a long repayment horizon might be more willing to accept the risk of a variable rate, hoping for lower overall costs, while someone seeking stability might prefer a fixed rate.

Comparison of Interest Rates Offered by Federal and Private Lenders

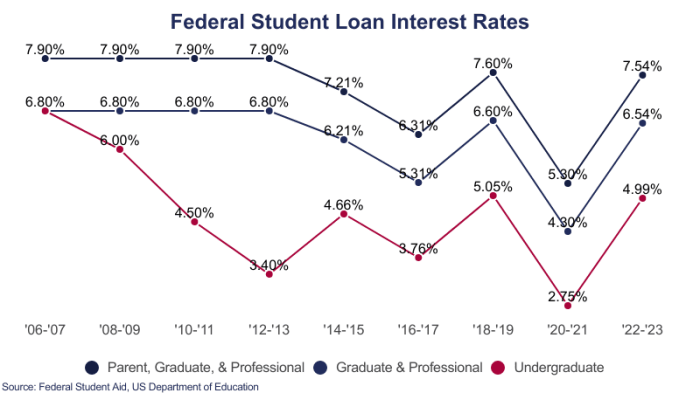

Federal student loans generally offer lower interest rates than private loans. This is because federal loans are backed by the government, which reduces the risk for lenders. However, the specific interest rate for federal loans varies based on the loan type (subsidized or unsubsidized), the borrower’s credit history, and the prevailing market rates. Private lenders, on the other hand, base their interest rates on the borrower’s creditworthiness, income, and other factors. They tend to offer higher rates than federal loans, particularly to borrowers with lower credit scores or limited income. It is important to shop around and compare offers from multiple private lenders before making a decision. For example, a borrower with excellent credit might find competitive rates from several private lenders, while a borrower with less-than-perfect credit might find fewer options and higher interest rates.

Comparison of Key Features of Different Student Loan Interest Rate Types

| Feature | Fixed Interest Rate | Variable Interest Rate | Subsidized Federal Loan | Unsubsidized Federal Loan |

|---|---|---|---|---|

| Interest Rate | Constant throughout the loan term | Fluctuates based on a benchmark rate | Lower than unsubsidized loans; interest does not accrue while in school | Higher than subsidized loans; interest accrues while in school |

| Predictability | High; payments remain consistent | Low; payments may increase or decrease | High; predictable interest and payment amounts | Moderate; interest accrues, impacting total repayment |

| Risk | Low; consistent payments | High; potential for increased payments | Low; government-backed | Moderate; interest accrues, increasing total cost |

| Loan Availability | Widely available from both federal and private lenders | Available from some private lenders | Available from the federal government | Available from the federal government |

Eligibility and Qualification for Lowest Rates

Securing the lowest interest rates on student loans hinges on several key factors that lenders carefully assess. Understanding these criteria and actively working to improve your standing in these areas can significantly reduce the overall cost of your education. This section will explore the crucial elements that influence your eligibility for the most favorable loan terms.

Lenders use a variety of criteria to determine student loan interest rates. These criteria are designed to assess the borrower’s risk of defaulting on the loan. A lower perceived risk translates to a lower interest rate.

Credit Score’s Impact on Interest Rates

A strong credit history is paramount in securing favorable student loan interest rates. Lenders view a high credit score as an indicator of responsible financial behavior, reducing their perceived risk. For instance, a borrower with a credit score above 750 might qualify for a significantly lower interest rate compared to someone with a score below 600. The difference can be substantial, potentially amounting to thousands of dollars in saved interest over the life of the loan. A higher credit score demonstrates a proven track record of managing debt effectively, making you a more attractive borrower.

Income’s Influence on Interest Rates

Your income level also plays a role in determining your eligibility for lower interest rates. Lenders consider your income as a measure of your ability to repay the loan. A higher income typically indicates a greater capacity to make consistent monthly payments, leading to a lower interest rate. For example, a borrower with a stable, high income is more likely to secure a lower rate than someone with a low or inconsistent income. This is because lenders see less risk in lending to individuals with higher earning potential.

Co-Signer’s Role in Securing Lower Rates

A co-signer, who agrees to share responsibility for repayment, can significantly improve your chances of obtaining a lower interest rate, particularly if your credit history is limited or weak. The co-signer’s strong credit score and income are considered by the lender, mitigating the risk associated with lending to you. If a borrower lacks a sufficient credit history, a co-signer with excellent credit can act as a guarantor, effectively reducing the lender’s risk and resulting in a lower interest rate. The co-signer’s financial stability helps secure more favorable terms.

Strategies for Improving Eligibility for Lower Interest Rates

Several strategies can enhance your eligibility for the lowest interest rates. These strategies focus on improving your credit score, managing your income, and potentially seeking a co-signer.

Importance of a Strong Credit History

Building and maintaining a strong credit history is a crucial long-term investment. It impacts not only student loans but also mortgages, auto loans, and credit card interest rates. Consistent on-time payments, keeping credit utilization low, and avoiding excessive applications for new credit are all vital steps in cultivating a positive credit history. Regularly monitoring your credit report and addressing any errors is also essential. A strong credit history demonstrates responsible financial management, making you a less risky borrower and thus more likely to qualify for the most favorable loan terms.

Federal vs. Private Student Loans

Choosing between federal and private student loans is a crucial decision impacting your repayment journey. Understanding the differences in interest rate structures and associated benefits and drawbacks is essential for making an informed choice. Both loan types offer access to funds for higher education, but their interest rate mechanisms differ significantly.

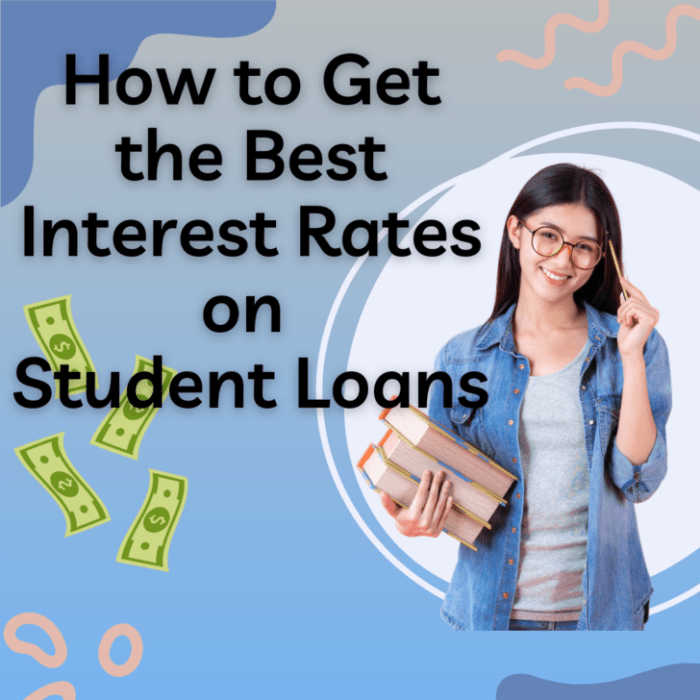

Federal and private student loans operate under distinct interest rate models. Federal student loan interest rates are set by the government and tend to be fixed, meaning they remain constant throughout the loan’s life. In contrast, private student loan interest rates are determined by the lender and are often variable, meaning they can fluctuate based on market conditions. This variability introduces an element of uncertainty into repayment planning.

Interest Rate Structures: Federal vs. Private Loans

Federal student loans typically offer fixed interest rates, providing borrowers with predictability. The specific rate depends on the loan type (e.g., subsidized, unsubsidized, PLUS loans) and the loan’s disbursement year. These rates are generally lower than those offered by private lenders. Private student loans, on the other hand, usually have variable interest rates, which can be advantageous if market interest rates decline, but pose a risk if they rise. The interest rate a borrower receives depends on their creditworthiness, the loan amount, and the lender’s current lending practices.

Benefits and Drawbacks of Each Loan Type Regarding Interest Rates

Federal student loans offer several advantages regarding interest rates. Their fixed rates eliminate the uncertainty of fluctuating interest payments, making budgeting and repayment planning simpler. Moreover, federal loans often come with lower interest rates compared to private loans, resulting in lower overall borrowing costs. However, federal loans may have stricter eligibility requirements and might not cover the full cost of education.

Private student loans can sometimes offer competitive interest rates, particularly for borrowers with excellent credit. Furthermore, private lenders may offer more flexible repayment options than federal loan programs. However, the variable interest rates associated with many private loans create uncertainty regarding the total repayment amount. Additionally, private loans usually come with higher interest rates compared to federal loans, especially for borrowers with less-than-perfect credit scores. Defaulting on a private loan can severely damage your credit rating.

Comparison Table: Federal vs. Private Student Loans (Interest Rates)

| Feature | Federal Student Loans | Private Student Loans |

|---|---|---|

| Interest Rate Type | Generally Fixed | Often Variable |

| Interest Rate Level | Generally Lower | Generally Higher |

| Rate Predictability | High | Low |

| Credit Check Requirement | Generally No Credit Check (for subsidized and unsubsidized loans; PLUS loans require a credit check) | Credit Check Required |

Scenarios Illustrating Interest Rate Differences

A borrower with excellent credit might secure a private student loan with a lower interest rate than a federal unsubsidized loan. This is more likely to occur when market interest rates are exceptionally low. Conversely, a borrower with a poor credit history would likely face a significantly higher interest rate on a private loan compared to a federal loan, even a subsidized one, because federal loans do not always require a credit check. For example, a student with a strong credit history might get a 5% interest rate on a private loan during a period of low interest rates, while a comparable federal unsubsidized loan might be at 6%. However, if the same student had poor credit, they could face a 12% interest rate on a private loan, while the federal loan remains at 6%.

Repayment Plans and Their Impact on Costs

Choosing the right repayment plan for your student loans significantly impacts the total cost you’ll pay over the loan’s lifetime. Understanding the differences between various plans is crucial for minimizing your overall debt burden. Different plans offer varying repayment periods and monthly payments, directly influencing the amount of interest accrued.

The length of your repayment period is the primary factor determining the total interest paid. Shorter repayment periods mean higher monthly payments but significantly reduce the total interest accumulated over time. Conversely, longer repayment periods result in lower monthly payments but lead to substantially higher interest costs. This is because you’re paying interest on the principal balance for a longer duration.

Standard Repayment Plans

Standard repayment plans typically involve fixed monthly payments over a 10-year period. This is often the quickest way to repay your loans and minimize the total interest paid. However, the monthly payments can be substantial, potentially impacting your budget. For a $30,000 loan at 5% interest, the total interest paid under a standard 10-year plan would be approximately $5,300.

Extended Repayment Plans

Extended repayment plans offer longer repayment periods, usually up to 25 years. This lowers monthly payments, making them more manageable for borrowers with limited income. However, the trade-off is a significantly higher total interest paid. Using the same $30,000 loan example at 5% interest, an extended 25-year plan could result in approximately $16,000 in total interest – more than triple the amount paid under a standard plan.

Income-Driven Repayment Plans

Income-driven repayment plans (IDR) adjust your monthly payments based on your income and family size. These plans are designed to make repayment more affordable, especially during periods of lower income. However, IDR plans often extend the repayment period to 20 or 25 years, resulting in higher overall interest costs compared to standard plans. The exact interest paid will vary greatly depending on income fluctuations over the repayment period. For instance, a borrower with a fluctuating income might end up paying more interest than initially anticipated, even with the lower monthly payments.

Comparison of Repayment Plans: Estimated Total Interest Paid

| Repayment Plan | Loan Amount | Interest Rate | Total Interest Paid (Estimate) |

|---|---|---|---|

| Standard (10-year) | $30,000 | 5% | $5,300 |

| Extended (25-year) | $30,000 | 5% | $16,000 |

| Income-Driven (20-year) | $30,000 | 5% (Variable based on income) | $10,000 – $15,000 (Estimate range) |

Impact of Extra Payments

Making extra payments on your student loans, even small amounts, can significantly reduce the total interest paid and shorten the loan’s repayment period. For example, adding an extra $100 per month to a $30,000 loan at 5% interest could save thousands of dollars in interest and potentially pay off the loan years ahead of schedule. The exact savings depend on the loan amount, interest rate, and the amount of extra payments made. This strategy is highly effective for minimizing the overall cost of borrowing.

Finding the Best Rates and Resources

Securing the lowest possible interest rate on your student loans is crucial for minimizing your overall borrowing costs. This involves diligent research, careful comparison, and a strategic application process. Understanding the available resources and employing effective strategies will significantly improve your chances of obtaining favorable loan terms.

Finding the best student loan interest rates requires a proactive approach and the utilization of reliable resources. This section details reputable sources for comparing rates, a step-by-step guide to researching loan offers, and the application process itself, all aimed at securing the most advantageous terms.

Reputable Resources for Comparing Student Loan Interest Rates

Several trustworthy sources can assist in comparing student loan interest rates. These include government websites offering federal loan information, independent financial aid websites that aggregate loan offers, and individual lender websites. It’s crucial to consult multiple sources to obtain a comprehensive view of available options. Direct comparison between lenders and loan types is essential to make an informed decision.

A Step-by-Step Guide to Researching and Comparing Loan Offers

- Identify Your Needs: Determine the total amount you need to borrow and your preferred repayment timeline.

- Check Federal Loan Options First: Explore federal student loan programs, as they often offer lower interest rates and more flexible repayment plans than private loans.

- Compare Interest Rates: Use online comparison tools and individual lender websites to compare interest rates from different lenders. Pay close attention to the Annual Percentage Rate (APR), which includes fees and other charges.

- Review Fees and Charges: Carefully examine all associated fees, including origination fees, late payment fees, and prepayment penalties.

- Consider Repayment Options: Compare repayment plans offered by different lenders and choose one that aligns with your financial situation and repayment capabilities.

- Read the Fine Print: Thoroughly review the loan terms and conditions before signing any loan agreement.

Applying for Student Loans and Securing the Best Possible Rate

The application process typically involves completing a FAFSA (Free Application for Federal Student Aid) for federal loans and submitting applications to private lenders for private loans. Maintaining a strong credit history (if applying for private loans), demonstrating financial responsibility, and having a co-signer (if needed) can positively influence your chances of securing a lower interest rate. Shopping around and comparing offers from multiple lenders is crucial to finding the best possible rate. It is important to note that pre-qualification does not guarantee approval and does not impact your credit score.

Checklist of Factors to Consider When Choosing a Student Loan

Before selecting a student loan, consider the following factors:

- Interest Rate: The annual interest rate directly impacts the total cost of the loan.

- Fees: Origination fees, late payment fees, and prepayment penalties can significantly increase the overall cost.

- Repayment Terms: Choose a repayment plan that aligns with your budget and financial goals.

- Loan Type: Federal loans often offer more borrower protections and flexible repayment options than private loans.

- Lender Reputation: Research the lender’s reputation and customer service before borrowing.

- Credit Score Impact: Understand how the loan application and repayment will impact your credit score.

Potential Hidden Costs and Fees

Securing the lowest interest rate on your student loans is a crucial step, but it’s equally important to understand the potential for hidden costs and fees that can significantly impact your overall borrowing experience. These unexpected expenses can quickly add up, increasing your total debt and making repayment more challenging. Failing to account for these fees can lead to financial strain after graduation.

Understanding all fees and charges before signing any loan documents is paramount. A thorough review prevents unpleasant surprises and allows you to make informed decisions about your borrowing. It’s essential to compare loan offers not only based on interest rates but also on the associated fees.

Common Student Loan Fees and Charges

Several fees can be associated with student loans, some more common than others. Carefully reviewing the loan terms and conditions is crucial to identifying and budgeting for these potential expenses. Failing to do so could lead to unexpected debt accumulation.

- Origination Fees: These are fees charged by the lender to process your loan application. They are typically a percentage of the loan amount and are deducted from the loan proceeds before you receive the funds. For example, a 1% origination fee on a $10,000 loan would result in a $100 reduction.

- Late Payment Fees: Missed or late payments result in penalties, typically a fixed dollar amount or a percentage of the missed payment. These fees can quickly escalate, significantly increasing the total cost of your loan. Consistent on-time payments are vital to avoid these charges.

- Returned Payment Fees: If a payment is returned due to insufficient funds, you’ll likely incur a fee. This fee can range from a few dollars to a substantial amount, depending on the lender. Maintaining sufficient funds in your account is critical to prevent this.

- Prepayment Penalties: While less common with federal student loans, some private lenders may charge a fee if you pay off your loan early. This penalty is usually a percentage of the outstanding loan balance. It’s important to check the loan agreement to determine if this applies.

- Default Fees: If your loan enters default (meaning you haven’t made payments in a specified period), significant fees and penalties are applied. These can include collection costs, damaged credit scores, and wage garnishment. Avoiding default is crucial for long-term financial health.

Strategies for Minimizing or Avoiding Unnecessary Fees

Proactive steps can help minimize or even eliminate many of these fees. Careful planning and diligent attention to detail are key to managing student loan costs effectively.

- Read the Fine Print: Before signing any loan documents, thoroughly review all terms and conditions, paying close attention to fees and charges. Don’t hesitate to ask questions if anything is unclear.

- Shop Around: Compare loan offers from multiple lenders, considering not only interest rates but also all associated fees. This allows for a comprehensive cost comparison.

- Automatic Payments: Setting up automatic payments can help avoid late payment fees. This ensures timely payments without the need for manual intervention.

- Budgeting and Financial Planning: Create a realistic budget that accounts for loan repayments and associated fees. This prevents missed payments and associated penalties.

- Maintain Adequate Funds: Ensure sufficient funds are available in your account to cover loan payments and avoid returned payment fees.

Illustrative Examples of Loan Scenarios

Understanding the impact of different interest rates and repayment plans on your total student loan cost is crucial for making informed financial decisions. The following examples illustrate how these factors interact to determine your overall repayment burden. We’ll explore scenarios with varying loan amounts, interest rates, and repayment periods to highlight the significance of these variables.

Loan Scenario Comparisons

Let’s consider three distinct scenarios involving federal student loans, assuming a simple interest calculation for clarity. The actual calculation might be slightly more complex depending on the loan type and lender.

| Scenario | Loan Amount | Interest Rate | Repayment Period (Years) | Total Interest Paid | Total Repayment Amount |

|---|---|---|---|---|---|

| Scenario 1: Low Interest, Short Repayment | $20,000 | 4% | 5 | $2,168.20 (approx.) | $22,168.20 (approx.) |

| Scenario 2: Moderate Interest, Standard Repayment | $40,000 | 6% | 10 | $15,146.00 (approx.) | $55,146.00 (approx.) |

| Scenario 3: High Interest, Long Repayment | $60,000 | 8% | 15 | $46,862.50 (approx.) | $106,862.50 (approx.) |

These figures are approximate and do not include any potential fees. Actual interest calculations can vary depending on the loan servicer and amortization schedule.

Calculating Total Loan Cost

The total cost of a student loan is the sum of the principal loan amount and the accumulated interest. A simple formula to illustrate this is:

Total Loan Cost = Principal Loan Amount + Total Interest Paid

For example, in Scenario 1, the total loan cost is $20,000 (principal) + $2,168.20 (interest) = $22,168.20. This demonstrates how even a seemingly small interest rate can significantly impact the overall repayment amount over time. Longer repayment periods generally result in higher total interest payments, but smaller monthly payments. Conversely, shorter repayment periods mean higher monthly payments but significantly less interest paid over the life of the loan. Borrowers should carefully weigh these factors when selecting a repayment plan.

Impact of Interest Rates and Repayment Plans

The examples above highlight the substantial influence of interest rates and repayment periods on the final cost. A higher interest rate dramatically increases the total interest paid, even with a shorter repayment term. Similarly, extending the repayment period, while lowering monthly payments, ultimately leads to a greater total repayment amount due to the accumulation of interest over a longer duration. Careful consideration of these variables is essential to make informed decisions about student loan borrowing and repayment strategies. For instance, consolidating high-interest loans into a lower-interest loan can substantially reduce the total interest paid over the life of the loan.

Closure

Securing the cheapest student loan interest rate requires careful planning and research. By understanding the factors influencing rates, comparing different loan options, and strategically managing your repayment, you can significantly reduce your overall borrowing costs. Remember to leverage the resources available, ask questions, and prioritize a loan that aligns with your financial capabilities and long-term goals. A well-informed approach will set you on the path to financial success after graduation.

FAQ Summary

What is the difference between subsidized and unsubsidized federal student loans?

Subsidized loans don’t accrue interest while you’re in school, during grace periods, or during deferment. Unsubsidized loans accrue interest from the time the loan is disbursed.

Can I refinance my student loans to get a lower interest rate?

Yes, refinancing can potentially lower your interest rate, but it often involves switching from a federal to a private loan, which may eliminate certain borrower protections.

How does my credit history affect my interest rate?

A strong credit history typically leads to lower interest rates. Lenders view a good credit score as an indication of responsible borrowing behavior.

What are income-driven repayment plans?

Income-driven repayment plans base your monthly payments on your income and family size. They often result in higher total interest paid but lower monthly payments.