Navigating the complexities of student loan debt and overall financial obligations can feel overwhelming. Many find themselves burdened by multiple loans, high interest rates, and unclear repayment paths. Debt consolidation offers a potential solution, promising simplified repayment and potentially lower interest rates. However, it’s crucial to understand the various methods available, their advantages and disadvantages, and the long-term implications for your financial health before making any decisions. This guide will explore the intricacies of debt consolidation, specifically focusing on its application to student loans, to help you make informed choices.

We will delve into the mechanics of debt consolidation, examining different loan types, comparing secured and unsecured options, and providing a step-by-step application process. The unique challenges of consolidating student loan debt will be addressed, including the nuances of federal loan programs. Crucially, we’ll discuss factors to consider before consolidating, such as credit score impact, interest rates, and associated fees. Alternative debt management strategies will also be explored, providing a holistic perspective on managing your financial burdens.

Understanding Debt Consolidation

Debt consolidation simplifies your finances by combining multiple debts into a single, more manageable payment. This can lead to lower monthly payments, a simplified repayment schedule, and potentially a lower overall interest rate, although this isn’t always guaranteed. Understanding the mechanics and different options is crucial for making an informed decision.

Mechanics of Debt Consolidation

Debt consolidation works by taking out a new loan—a consolidation loan—to pay off existing debts. The new loan then replaces your previous debts, leaving you with just one monthly payment to the lender providing the consolidation loan. This lender pays off your old creditors, and you make your payments to them instead. The success of debt consolidation hinges on your ability to manage the new loan responsibly and make consistent payments. Careful budgeting and financial planning are essential for avoiding further debt accumulation.

Types of Debt Consolidation Loans

Several types of debt consolidation loans exist, each with its own set of features and requirements. These include personal loans, balance transfer credit cards, and home equity loans. Personal loans are unsecured or secured loans specifically designed for debt consolidation. Balance transfer credit cards allow you to transfer high-interest debt to a card with a lower introductory APR. Home equity loans utilize the equity in your home as collateral.

Secured vs. Unsecured Debt Consolidation Loans

Secured debt consolidation loans, such as home equity loans, use an asset (like your home) as collateral. This often results in lower interest rates because the lender has less risk. However, defaulting on a secured loan could lead to the loss of the collateral. Unsecured debt consolidation loans, like personal loans, don’t require collateral. This offers greater flexibility but typically comes with higher interest rates to compensate for the increased risk to the lender. Choosing between secured and unsecured depends heavily on your financial situation and risk tolerance. A thorough evaluation of your assets and creditworthiness is necessary before making this decision.

Applying for Debt Consolidation

Applying for debt consolidation typically involves these steps:

- Check your credit report and score. A good credit score significantly improves your chances of securing a favorable loan.

- Compare offers from multiple lenders. Shop around to find the best interest rates and terms.

- Gather necessary documentation. This includes proof of income, employment history, and details of your existing debts.

- Complete the loan application. Provide accurate and complete information.

- Wait for approval. The lender will review your application and notify you of their decision.

- Close the loan and pay off your existing debts. Once approved, the funds from the consolidation loan will be used to pay off your existing debts.

Comparison of Debt Consolidation Methods

| Method | Pros | Cons | Suitability |

|---|---|---|---|

| Personal Loan | Simplified payments, potentially lower interest rates | Higher interest rates than secured options, may require good credit | Individuals with good credit and manageable debt |

| Balance Transfer Credit Card | Low introductory APR, potential for 0% interest period | High interest rates after introductory period, balance transfer fees may apply | Individuals with good credit who can pay off the balance before the introductory period ends |

| Home Equity Loan | Lower interest rates, larger loan amounts | Risk of foreclosure if you default, may require significant home equity | Homeowners with substantial equity and good credit |

Student Loan Debt and Consolidation

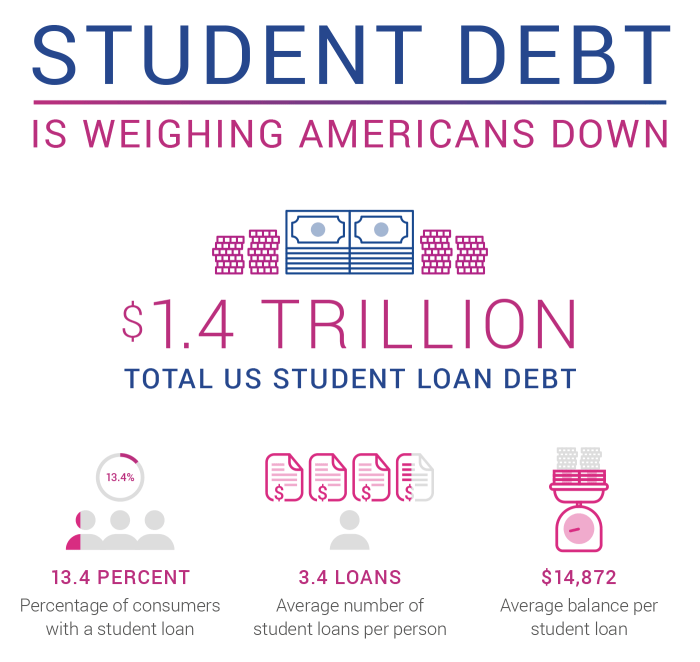

Student loan debt can be a significant financial burden for many, impacting their ability to save, invest, and achieve other financial goals. Consolidating these loans offers a potential pathway to simplify repayment and potentially reduce monthly payments. However, it’s crucial to understand the nuances of student loan consolidation before making a decision. This section will explore the complexities of consolidating student loans, focusing specifically on federal loans.

Unique Challenges of Consolidating Student Loan Debt

Consolidating student loans, particularly federal loans, presents unique challenges. One major consideration is the potential loss of benefits associated with specific loan types, such as income-driven repayment plans or loan forgiveness programs. Furthermore, the interest rate on the consolidated loan is typically a weighted average of the interest rates on the individual loans being consolidated, which may result in a higher overall interest rate than some of the original loans, especially if you had loans with lower interest rates. Finally, the consolidation process itself can be time-consuming and require careful planning to avoid unforeseen complications.

Types of Federal Student Loans and Consolidation Eligibility

Several types of federal student loans exist, each with its own terms and conditions. These include Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans (for parents and graduate students), and Direct Consolidation Loans. All federal student loans are eligible for consolidation through the Direct Consolidation Loan program. This program allows borrowers to combine multiple federal student loans into a single, new loan with a single monthly payment. It’s important to note that private student loans cannot be consolidated with federal loans through this program.

Benefits and Drawbacks of Consolidating Federal Student Loans

Consolidating federal student loans offers several potential benefits, including simplified repayment with a single monthly payment and potentially a lower monthly payment amount (although the total interest paid may be higher over the life of the loan). However, drawbacks include the potential for a higher total interest paid over the life of the loan due to a longer repayment period or a higher interest rate, and the potential loss of benefits associated with specific loan types, such as income-driven repayment plans or loan forgiveness programs. Careful consideration of these factors is crucial before making a decision.

Scenarios Where Student Loan Consolidation is Beneficial

Student loan consolidation can be particularly beneficial in certain scenarios. For example, a borrower with multiple federal student loans with varying interest rates and repayment schedules might find consolidation simplifies their repayment process. Similarly, borrowers struggling to manage multiple loan payments may benefit from the streamlined approach offered by consolidation. Another scenario where consolidation might be advantageous is when a borrower is facing financial hardship and seeks to lower their monthly payment amount, although it’s crucial to understand that this may lead to paying more interest overall. It’s crucial to weigh the long-term implications against short-term relief.

Federal Student Loan Consolidation Process

The following flowchart illustrates the steps involved in federal student loan consolidation:

[Descriptive Flowchart]

Imagine a flowchart with rectangular boxes representing steps. The first box would be “Determine Eligibility.” This would lead to a diamond-shaped decision box asking, “Eligible for Consolidation?” A “Yes” branch leads to “Complete Application,” which in turn leads to “Submit Application.” A “No” branch from the decision box would lead to “Explore Alternative Options.” The “Submit Application” box leads to another decision box, “Application Approved?” A “Yes” branch leads to “Loan Consolidation Complete,” while a “No” branch leads to “Address Application Issues.”

Factors to Consider Before Consolidating

Debt consolidation, while potentially beneficial, requires careful consideration. Rushing into it without a thorough understanding of your financial situation and the implications of different consolidation options can lead to unforeseen consequences. Taking the time to assess several key factors will help you make an informed decision that aligns with your long-term financial goals.

Credit Score Impact on Debt Consolidation Options

Your credit score significantly influences the terms and availability of debt consolidation options. A higher credit score generally translates to more favorable interest rates, lower fees, and a wider range of lenders willing to work with you. Conversely, a lower credit score may limit your options, resulting in higher interest rates and potentially less attractive loan terms. For example, someone with a credit score above 750 might qualify for a low-interest rate personal loan, while someone with a score below 600 might only qualify for a secured loan with a significantly higher interest rate or even be denied altogether. Lenders use your credit score as an indicator of your creditworthiness and repayment ability.

Interest Rates and Loan Terms’ Long-Term Impact on Repayment

The interest rate and loan term directly impact your total repayment cost. A lower interest rate will reduce the overall amount you pay over the life of the loan. Similarly, a shorter loan term will lead to higher monthly payments but will result in less interest paid overall. For instance, a $20,000 loan at 6% interest over 5 years will have higher monthly payments than the same loan over 10 years, but the total interest paid will be substantially less. Carefully compare offers from different lenders to find the best balance between manageable monthly payments and minimizing total interest paid.

Fees and Charges Associated with Different Debt Consolidation Methods

Various debt consolidation methods come with different fees and charges. These can include origination fees, application fees, prepayment penalties, and annual fees. Personal loans typically have origination fees, while balance transfer credit cards may charge balance transfer fees. Debt management plans (DMPs) usually involve monthly fees charged by credit counseling agencies. Before choosing a method, thoroughly research and compare the associated fees to ensure they align with your budget and overall savings. For example, a personal loan with a 3% origination fee on a $15,000 loan will cost you an upfront $450.

Checklist of Factors to Consider Before Debt Consolidation

Before pursuing debt consolidation, it’s crucial to carefully weigh several factors. This checklist can help guide your decision-making process:

- Current Debt Situation: List all your debts, including balances, interest rates, and minimum payments.

- Credit Score: Check your credit report and score to understand your eligibility for various options.

- Interest Rates and Loan Terms: Compare offers from multiple lenders to find the most favorable terms.

- Fees and Charges: Account for all associated fees and charges to determine the true cost of consolidation.

- Monthly Budget: Ensure your monthly payments are affordable and fit within your budget.

- Long-Term Financial Goals: Assess how debt consolidation aligns with your long-term financial plans.

- Alternatives: Explore alternative debt management strategies, such as debt management plans or snowball/avalanche methods.

Alternatives to Debt Consolidation

Debt consolidation, while a viable option for many, isn’t the only path to financial freedom. Several alternative strategies can effectively manage student loan debt and other financial obligations, depending on individual circumstances and risk tolerance. Understanding these alternatives allows for a more informed decision-making process, leading to a tailored debt management plan.

Alternative strategies focus on addressing the root causes of debt and implementing sustainable changes in spending habits and financial planning. These methods often involve a combination of techniques, and their effectiveness depends heavily on individual commitment and discipline. While some offer quicker results, others prioritize long-term financial health and stability.

Debt Management Plans

Debt management plans (DMPs) are structured programs offered by credit counseling agencies. These plans typically involve negotiating lower interest rates with creditors and creating a single, manageable monthly payment. The agency acts as an intermediary, coordinating payments and providing financial education to help clients improve their financial literacy and avoid future debt accumulation. The effectiveness of DMPs varies depending on the individual’s adherence to the plan and the agency’s negotiation skills. Successful implementation often results in improved credit scores over time, although it may take several years to eliminate debt completely. A common drawback is that DMPs usually require closing existing credit accounts, limiting access to credit during the plan’s duration.

The Importance of Budgeting and Financial Planning

Budgeting and financial planning are crucial components of any successful debt reduction strategy, regardless of whether debt consolidation is involved. A detailed budget identifies income sources and expenses, revealing areas where spending can be reduced. Financial planning involves setting realistic financial goals, such as becoming debt-free within a specific timeframe, and developing a strategy to achieve those goals. This might include increasing income through a second job or side hustle, or aggressively cutting non-essential expenses. Effective budgeting and financial planning empower individuals to take control of their finances and make informed decisions about their debt. For example, a family might track expenses for a month, identifying areas like dining out or entertainment that could be reduced, reallocating those funds towards debt repayment.

Comparing Debt Consolidation with Other Strategies

Debt consolidation simplifies debt management by combining multiple debts into a single payment, often with a lower interest rate. However, this approach might not be suitable for everyone. Alternatives like DMPs offer structured support and negotiation with creditors, while budgeting and financial planning provide a more holistic approach to debt management. A visual representation would show these three approaches as overlapping circles. The center where all three overlap represents the ideal debt management approach – a combination of consolidation (if appropriate), a DMP for guidance and negotiation, and a strong foundation of budgeting and financial planning. The individual areas of each circle represent instances where one approach might be more suitable than the others. For example, someone with excellent credit might find debt consolidation the most effective, while someone with multiple high-interest debts and poor credit might benefit most from a DMP coupled with rigorous budgeting.

The Impact of Consolidation on Credit

Debt consolidation can significantly impact your credit score, both positively and negatively. The outcome depends largely on your pre-consolidation credit habits and how responsibly you manage your finances afterward. While it offers the potential for improved credit health, it’s crucial to understand the mechanics involved to avoid unintended consequences.

Debt consolidation affects your credit score primarily through several key factors: changes in credit utilization, the addition of a new account, and the potential impact on your payment history. Understanding these factors is crucial to navigating the process successfully.

Credit Score Changes After Consolidation

Consolidating debt can initially lower your credit score, particularly if you close existing accounts as part of the process. Closing older accounts, even those with high balances, can shorten your credit history, which negatively impacts your credit score. Conversely, if you successfully manage the consolidated debt and lower your credit utilization ratio, your score can improve over time. For example, if you had multiple credit cards with high balances, each contributing to a high utilization ratio, consolidating those balances onto a single loan with a lower interest rate can significantly reduce your utilization ratio, resulting in a potential credit score increase. This improvement is due to the fact that credit utilization is a significant factor in credit scoring models. Conversely, failing to make payments on your consolidated loan will severely damage your credit score, possibly resulting in a significant drop.

Responsible Credit Management After Consolidation

Maintaining a good credit score after debt consolidation requires diligent and responsible financial management. This involves consistent on-time payments, keeping credit utilization low (ideally under 30%), and avoiding the opening of numerous new credit accounts in a short period. Budgeting and financial planning are crucial tools to ensure you can comfortably afford your monthly payments. For instance, creating a detailed budget that accounts for all income and expenses can prevent missed payments and maintain a positive payment history.

Maintaining a Good Credit Score Post-Consolidation

Several strategies can help maintain a good credit score after consolidating debt. These include setting up automatic payments to avoid late fees and missed payments, monitoring your credit report regularly for errors, and keeping your credit utilization low by paying down your debt consistently. Using budgeting apps or working with a financial advisor can also provide additional support in managing your finances effectively. For example, regularly reviewing your credit report through annualcreditreport.com helps detect and address any errors that could negatively impact your score.

Long-Term Effects of Debt Consolidation on Credit History

The long-term effects of debt consolidation on your credit history depend entirely on your financial behavior after the consolidation. Successful management of the consolidated debt can lead to a gradual improvement in your credit score over time, potentially resulting in better interest rates on future loans and credit cards. However, failure to manage the debt effectively can lead to prolonged negative impacts on your credit history, including late payments, collections, and potentially even bankruptcy. For instance, a consistent record of on-time payments on the consolidated loan for several years will demonstrate responsible credit management to lenders, leading to improved creditworthiness.

Tips for Improving Credit Score After Debt Consolidation

To improve your credit score after debt consolidation, prioritize timely payments, maintain low credit utilization, and keep a diverse credit mix. Consider paying more than the minimum payment each month to reduce your debt faster. Regularly checking your credit report can also help identify and address any potential issues. For example, paying 10-15% above the minimum payment each month can significantly reduce the time it takes to pay off your debt and improve your credit score more quickly.

Last Recap

Effectively managing debt, particularly student loan debt, requires careful consideration and a strategic approach. While debt consolidation can be a powerful tool for simplification and potential cost savings, it’s not a one-size-fits-all solution. Understanding the various methods, their implications for your credit score, and the availability of alternative strategies is essential. By carefully weighing the pros and cons and considering your individual financial circumstances, you can make informed decisions that pave the way towards a more secure and debt-free future. Remember to seek professional financial advice if needed to tailor a plan to your specific situation.

Key Questions Answered

What is the impact of debt consolidation on my credit utilization ratio?

Debt consolidation can initially lower your credit utilization ratio (credit used versus available credit) if you pay down high-balance accounts. However, a new consolidated loan will appear on your credit report, potentially affecting your score depending on your credit history and the terms of the new loan.

Can I consolidate private and federal student loans together?

Generally, you cannot consolidate federal and private student loans into a single federal loan. You may be able to consolidate private loans with other private loans through a private lender, or refinance them into a single loan.

What happens if I default on my consolidated student loan?

Defaulting on a consolidated student loan has serious consequences, including damage to your credit score, wage garnishment, and potential tax refund offset. The terms and consequences of default may vary based on whether the loan is federal or private.

How long does the debt consolidation process typically take?

The timeframe for debt consolidation varies depending on the lender and the complexity of your situation. It can range from a few weeks to several months.